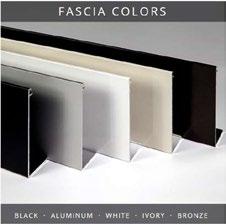

Demountable Walls & Structures areconsidered movable furniture and fixtures, allowing it to depreciate much faster—usually within 5 to 7 years—offering tax advantages and flexibility for businesses.

Millwork and modular casework differ significantly in depreciation. Millwork, which is custom-built and permanently installed, is classified as a fixture and depreciates over a longer period—typically 39 years for commercial spaces under IRS guidelines. In contrast, modular casework is considered movable furniture and fixtures, allowing it to depreciate much faster—usually within 5 to 7 years—offering tax advantages and flexibility for businesses.