9 minute read

Risk cover management

Risk insurance is often held within an SMSF for the associated tax breaks. Smarter SMSF technical and education manager Tim Miller looks at the different methods of maximising a tax benefit when a payment from life or disability cover is received.

It’s the time of year we now start to reconcile transactions that have occurred in the previous financial year for the purposes of preparing and lodging the annual return where, among other things, one objective is to reduce the tax liability of the SMSF. When a death or disability benefit is paid, and insurance is held within the fund, there are opportunities to help reduce the tax liability of the fund, both in the present and in the future too.

Transfer balance cap, ECPI and the $3m cap

Prior to 1 July 2017, the most common death benefit strategy for a spousal fund was for the surviving spouse to receive a pension from the deceased and to continue to receive a pension for themselves, if they were eligible. This maximised the tax effectiveness of the fund as the income on the assets was subject to the exempt current pension income (ECPI) deduction.

The nature of the transfer balance cap requires us to consider whether this strategy is appropriate as an individual can place no more than their personal transfer balance cap ($1.9 million for any pension commenced after 1 July 2023) within the retirement phase. As it is, in the instance where a member receives a death benefit pension from their spouse, their own pension may be required to be commuted back to accumulation, or alternatively they may choose to take money out of the superannuation system or if they hadn’t already commenced a pension, they may just leave the benefit in accumulation. Any action that results in more benefits being held in the accumulation phase means less of the fund income is considered ECPI.

Further, with the government’s announcement to impose a 15 per cent tax liability on the earnings attributable to a member’s total superannuation balance above $3 million from 1 July 2025, there is no doubt those impacted the most by this measure in the future will be individuals who never had $3 million until a life-changing event occurred, and not generally a good one.

In light of this announcement and as part of clients’ needs to undertake appropriate estate planning, we should once again be asking the question about the role insurance can play in an SMSF. It may be counterintuitive to consider something that will result in an increase in a member’s benefit, however, its presence in a fund does avail the fund to tax deductions, which can alleviate the fund’s tax liability, which could go some way towards minimising the impact of a higher personal tax liability if the new measure proceeds.

Regardless of future measures, in the event a fund has received and paid out insurance proceeds, we should be asking ourselves whether the SMSF should contemplate claiming a future service period deduction when a benefit is paid prior to age 65.

Disability too

As alluded to above, the deduction opportunities do not exist solely for funds paying death benefits but also for one paying a benefit when a member is incapacitated or terminally ill. While these deductions will provide a tax benefit for a fund, we still must ask whether a member will commence a disability income stream or consider taking a disability or terminal illness lump sum. Given commencing an income stream will affect their personal transfer balance cap, often at an earlier age, retaining insurance proceeds to pay an income stream may not be the go-to strategy and it could also push individuals above $3 million in the future.

Deductions available

Having crossed over from the end of the financial year, there is an opportunity, in a year a death or disability-based benefit is paid, to contemplate whether the fund claims the standard premium-based deduction or one under section 295-470 Complying funds – deduction for future liability to pay benefits of the Income Tax Assessment Act (ITAA).

Importantly, the ATO confirms via Interpretative Decision 2015/17 that the decision to claim under ITAA section 295-470 is not required prior to the event occurring, meaning a fund can claim the standard premium-based deduction in each year prior to the year the event triggering payment occurs and then make the election to claim against the benefit payment when appropriate. So how does the deduction work?

Future liability to pay benefits

ITAA section 295-470 allows a fund to claim a deduction on payment of:

a) a superannuation death benefit, or

b) a terminal illness benefit, or

c) a disability superannuation benefit, or

d) a temporary incapacity income stream.

The payment of a), b) or c) must be as a consequence of termination of a member’s employment and is eligible whether a benefit is paid as a lump sum or taken as a pension.

The formula for calculating the deductions as follows:

Benefit Amount x Future Service Days/ Total Service Days

The benefit amount is the lump sum or the purchase price of the pension or the total of the amounts paid during the income year in the instance of a temporary incapacity income stream.

Future service days is the number of days from the date of termination to the member’s last retirement day (age 65).

Total service days is the sum of future service days plus the member’s eligible service period to the day of termination.

Losses created by this deduction can be carried forward. This is the significance of the action for SMSFs as the deduction may not have a great impact in the year it is claimed, but may provide an ongoing benefit for the accumulation interests of the fund.

Election to claim future liability deduction

Section 295-465 of the ITAA allows an SMSF to claim a deduction for death and disability insurance premiums where the policy is held within the superannuation fund. To be entitled to claim a deduction under section 295-470, the fund must make an election under section 295-465(4) not to deduct amounts based on the premiums paid, but rather to claim on the future liability to pay benefits.

The election applies to all future years unless otherwise determined by the commissioner of taxation. Therefore, if a fund elects, in the year of paying a benefit, to claim for future liability and not for premiums paid, it cannot in future years claim insurance premiums for other members of the fund.

This requirement makes the future liability deduction more attractive to an SMSF as the deduction attributable to individual member premiums will in most instances be less significant.

Of course, with a deduction that provides the tax savings the way this one can, there are often drawbacks that need to be considered.

Untaxed element of a death benefit paid to a non-dependant

A superannuation death benefit paid to a non-dependant is taxable at 15 per cent plus the Medicare levy to the extent of the taxable component at the time of payment. If a deduction is claimed by a fund under either section 295-465 or 295-470, an untaxed element must be calculated as per the formula below. The untaxed element will be taxed at 30 per cent plus the Medicare levy.

Amount of Superannuation Lump Sum x Service Days/Service Days + Days to Retirement.

There are two other points worth pondering.

The taxed element in the fund is the amount derived from the above calculation less any tax-free component of the superannuation lump sum; the amount cannot be less than zero. The balance is the element untaxed.

It’s important to highlight the untaxed element will apply even when the fund claims the premium-based deduction, so where a benefit is paid to a non-dependant, there is no disadvantage by claiming the larger benefit-based deduction.

Case study – future liability to pay benefits deduction

These calculations highlight the potential of the deduction. It is important when undertaking these calculations to use actual days.

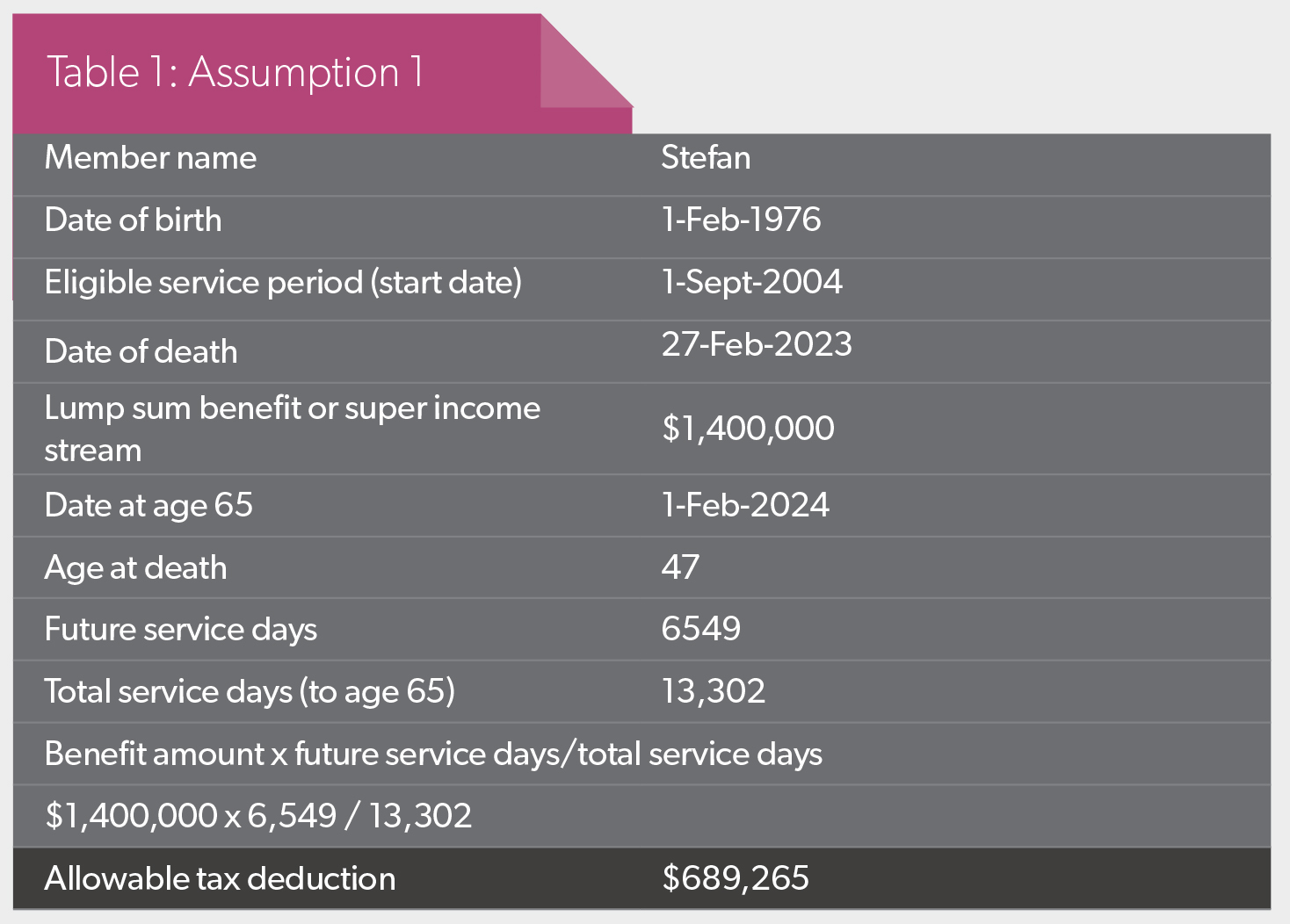

Assumption 1 – dependent beneficiary

Stefan is aged 47 and has an 18-year service period. He dies shortly after turning 47, leaving a wife and a 20-yearold non-dependent daughter. He has a superannuation fund balance of $500,000 comprising a $300,000 taxable and $200,000 tax-free component, and also holds an insurance policy valued at $900,000.

Stefan’s wife, Marie, is self-employed, makes deductible contributions to their SMSF and has a balance of $300,000.

The fund has previously claimed a deduction for the insurance premiums paid so elects not to do so, but rather to claim a deduction for the future liability to pay benefits.

The fund had taxable income of $50,000 consisting of contributions, realised capital gains and other income.

In the first year the SMSF creates a carried-forward loss of $639,265 that can be offset against future contributions, gains and income.

In this example the payment of $1.4 million to Marie is tax-free as she is a dependant. Ultimately she can take it as a lump sum or a death benefit income stream. If she elects to take it as an income stream, the SMSF would be entitled to an ECPI deduction on the income generated on the $1.4 million, which would lessen the appeal of the deduction, and is used prior to applying the ECPI percentage.

Assumption 2 – non-dependent beneficiary

Let’s assume Stefan and his wife have divorced so he wants to leave his superannuation proceeds to his daughter who is over 18 and not financially dependent. The same amount is calculated as above, $689,265.

In addition to this, the death benefit payment to the non-dependent daughter requires the calculation of the taxed and untaxed element:

Element taxed in the fund:

$1,400,000 x 6753 / 13,302

Element taxed:

$710,735 - $200,000 (tax free) = $510,735

Element taxed:

$510,735 x 17% = $86,825

Element untaxed:

$1,400,000 – $710,735 = $689,265

Element untaxed:

$689,265 x 32% = $220,565

Total tax on death benefit"

$220,565 + $86,825 = $307,390

Stefan’s daughter will receive an after-tax death benefit of $1,092,610, but will have the deduction of $689,265 to offset against the future income of the fund.

There is no doubt the deduction is more attractive for a death benefit payment to a dependant.

Conclusion

The nature of the transfer balance cap means the death or disablement of a member will not automatically result in a fund paying pension, but may lead to more lump sums being paid or more money being retained in accumulation.

Funds paying death or disability benefits to members and/or beneficiaries while continuing to generate a taxable income should consider the pros and cons of claiming a future liability to pay benefits deduction subject to meeting the applicable conditions. With the likelihood of a personal tax liability for those with high balances in the future, saving tax in the fund could provide some relief.