8 minute read

Risk cover and death pensions

The account from which risk insurance premiums are paid for cover held within an SMSF can have significant implications upon the death of a member. Anthony Cullen examines the different scenarios.

Superannuation Industry (Supervision) (SIS) Regulation 4.09 requires SMSF trustees to formulate, regularly review and give effect to an investment strategy that considers, among other things, whether they should hold a contract of insurance providing insurance cover for one or more members of the fund. This is not a requirement to hold insurance, but an obligation to consider and document the decision made. Such insurances may include life cover, as well as income protection (salary continuance) and total and permanent disability policies. In this article I will concentrate on life insurance and its interaction with receiving a superannuation death benefit pension.

It used to be the great Australian dream to own your own home and have the mortgage paid off and be close to, if not completely, debt free before retiring. Although this may still be the dream, many people are now faced with the prospect of heading into retirement with significant debt.

This predicament is likely to have a flow-on effect on people choosing to hold on to life insurance policies for longer. SMSFs often have members with multiple interests, such as an accumulation account, a transitionto-retirement income stream or even retirement-phase pensions, and a decision as to which interest the insurance policy will be attached will be necessary.

When considering SIS Regulations 5.02, determining and allocating costs, and 5.03, determining and allocating investment earnings, it is commonly accepted any payouts from an insurance policy should be allocated to the interest from which the premiums were deducted. This was also the view of the ATO when it addressed questions relating to the allocation of insurance proceeds in the June 2012 National Tax Liaison Group meeting.

So the question is to which interest the insurance policy should be attached and, more importantly, who should be making that decision? The second part of the question is relatively easy to answer – it should be the trustees or members making the decision. Whether that is in collaboration with and guidance from professionals is up to them. What we as professionals should be avoiding is making an arbitrary decision on behalf of our clients without explaining the potential consequences associated with them.

As to the first part of the question, if I may borrow a common catchphrase from the lawyers, “it depends”.

In many discussions I have had over the years, the default position is generally, where there are multiple interests, the accumulation account is the one from which insurance premiums should be deducted. On further investigation this appears to be primarily driven by the notion that to be able to claim a deduction for the premium, it must come from an accumulation-phase interest as it will be non-deductible when deducted from a pension interest that generates exempt current pension income (ECPI).

This is a myth and/or a misunderstanding of the rules associated with ECPI. With section 8-1 of the Income Tax Assessment Act 1997 (ITAA) limiting general, non-capital outgoings to being deductible against assessable income, it is accepted outgoings incurred in producing non-assessable income, including ECPI, will not be deductible. ATO Taxation Ruling (TR) 93/17 income tax deductions available to superannuation funds confirms this.

Certain insurance premiums, including for life cover, are considered a ‘specific type of deduction’ (refer to ITAA section 12-5) and therefore are claimable under ITAA section 295-465. Deductions under this section are not subject to the same proportioning requirements. Consequently, whether the member’s interest from which the insurance premium is deducted is in retirement phase or not does not affect the fund’s entitlement to claim a deduction in full without the need to apportion based on assessable and exempt income. However, where the deduction results in a current-year tax loss for the fund, any brought-forward losses will be reduced by the fund’s net ECPI.

Now we have established that ECPI shouldn’t be a deciding factor as to the interest from which premiums should be deducted, let’s look at the different implications for each interest in receiving the proceeds from a life insurance payout.

General considerations

Before we get into specifics, below are a couple of points that will be relevant in all situations.

As with the commencement of any pension, a death benefit pension should not be commenced before all the capital required to support the interest has been received. Further, SIS Regulation 1.06(1) (a)(ii) stipulates capital cannot be added to the interest once it has commenced.

Paragraph 138 of TR 2010/1 superannuation contributions confirms the ATO’s view insurance proceeds received under the terms and conditions of an insurance policy are to be treated as income, profits or gains from the use of the fund’s existing capital and not as a super contribution. However, when it comes to dealing with commencing death benefit pensions, there are other areas of tax law that will need to be considered. Not to suggest the amounts could be contributions, more so, there is a limitation on them being ‘investment earnings’. We’ll come back to this later.

In relation to a pension, section 307125 o the ITAA requires the tax-free/ taxable components to be determined at the time a pension commences.

Where insurance proceeds are to be allocated to a member’s accumulation interest, as with any allocation of earnings, they will increase the taxable component of the interest.

There are two options in relation to starting a death benefit pension. Firstly, to wait until the insurance proceeds have been received so as to determine the full value and tax components. Alternatively, if the death benefit pension is commenced prior to the proceeds being received, they cannot be allocated to the income stream unless it is commuted first and a new pension will need to be started. This is because the action would be seen as adding benefits to the pension interest after it has commenced and would be in breach of regulations.

As mentioned above, if the premiums are deducted from the accumulation interest, the proceeds must be allocated to that same interest. This does not extend to or include the death benefit pension commenced from the interest as this would be a new interest.

Where insurance proceeds are used to commence a death benefit pension, a credit will be recorded in the recipient’s transfer balance account (TBA).

Non-reversionary pension

Although a non-reversionary pension technically ceases on the date of death of the member, refer to paragraph 29 of TR 2013/5, it should be maintained as a separate interest and dealt with as a death benefit accordingly.

Changes to the definition of a superannuation income stream in the tax regulations, effective from the 2013 income year, ensure ECPI can continue to be claimed on the interest from the date of death until such time the death benefit has been dealt with, provided it is dealt with as soon as practicable as per Income Tax Assessment Regulation 307-70.02.

In addition, the tax components of the interest should be maintained and will determine the components for any new death benefit pension. This is on the proviso no amount, other than investment earnings, have been added to the interest after death. For the purposes of SIS Regulation 307-125.02, life insurance proceeds are considered investment earnings. However, adjustments need to be made to the tax components for the proceeds received. Effectively all of the insurance proceeds will be included in the taxable component.

Further, allowing for such amounts to be included as investment earnings is specific to this regulation. Generally, in the context of death benefits, they would not be considered investment earnings nor contributions as previously mentioned. This was confirmed under previous Income Tax Assessment Regulation 995-1.01(5).

Consequently, it is generally accepted the earnings generated from the insurance proceeds will not be eligible against which to claim ECPI. However, it would be expected in most instances the death benefit will be dealt with within a reasonable timeframe after receiving any insurance proceeds and any income generated from the proceeds is likely to be minimal.

As with accumulation interests, the timing of commencing a death benefit pension will need to consider the receipt of any insurance proceeds as they cannot be added to a new death benefit income stream after it has commenced. Further, insurance proceeds used to commence a death benefit pension will result in a credit to the recipient’s TBA.

Case study

Let’s wrap up with a short case study comparing the impact of life insurance proceeds being received by different interests.

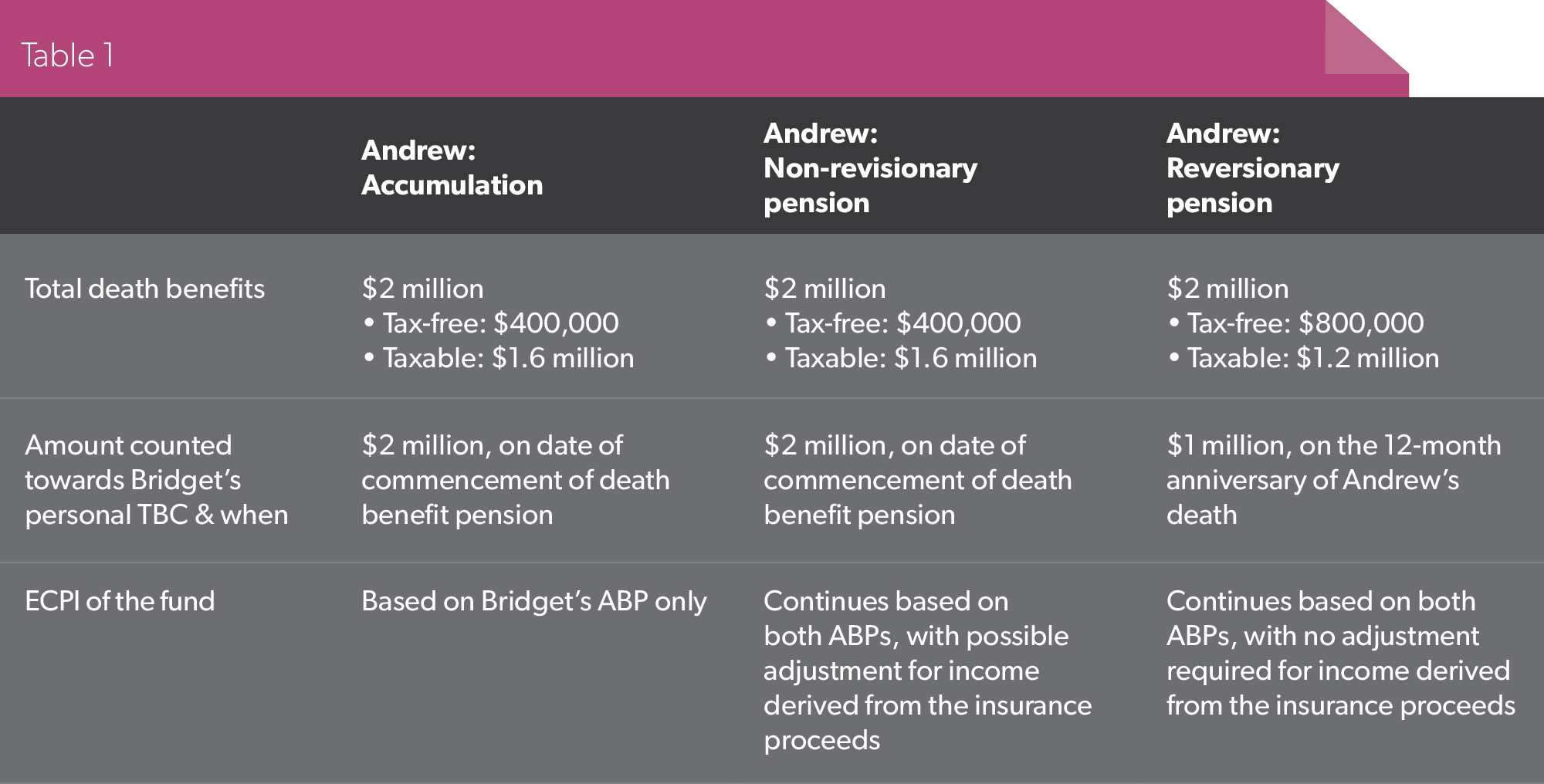

On the date of his death, Andrew had one superannuation interest worth $1 million (with 40 percent of it or $400,000 being tax-free) and the fund held a life insurance policy in relation to him worth $1 million. His spouse, Bridget, has an account-based pension

(ABP) worth $2 million. Her personal TBC is $1.9 million as is the balance of her TBA. Assume the fund has no investment earnings after Andrew’s death. The impact for Bridget and the fund will be based on how Andrew’s benefits were held when he died as outlined in Table 1.

As can be seen, where life insurance policies are held, the interest to which the policy is attached can impact how any proceeds may need to be dealt with. As with many things, tax and ECPI should not be the driving force behind decisions concerning which interest of a member’s insurance premiums and proceeds should be allocated.