7 minute read

giving

Generosity Changing World in a T The COVID-19 pandemic has upended the lives of millions – both medically and economically. Typically, when a natural disaster hits, the world watches as one community is affected and offers support to that area through donations and aid. It’s different this time, as people everywhere are struggling with the devastating effects of the pandemic. Many non-profits have been challenged through COVID-19, as well, as donors have become more focused in their giving by pivoting to provide aid when and where it is most urgently needed. These organizations will value your generosity as we emerge from by or serve on the board of the foundation. The private foundation retains full control over the grantmaking. If you closely follow IRS procedures, donors can make grants to charitable programs undertaken by individuals, scholarship programs and other entities, making the foundation a very flexible charitable vehicle. The flexibility of the private foundation does come with some administrative limitations that are not imposed on donor-advised funds. Private foundations are legal entities and will require assistance from your attorney and/or CPA to help set it up and get it qualified by the IRS. by John D. Eadie – Covenant CPA, CFA, CFP ® , PFS, CLU ® , CIMA, CKA ® the pandemic in what is hopefully the near future. But, how do you as Private foundations also require that 5% of the value of the foundation a donor best implement your philanthropic plan? Most people will conassets be distributed to a charitable organization each year, whereas tinue to simply give cash directly to their passions, and the non-profits as donor-advised funds have no requirement to make annual distribuwill highly value these gifts. However, if you would like to be more tions. Private foundations are not totally “private” either because they targeted or long-term focused in your giving, there are other strategies are required to file an information return each year, and that return is to consider. part of the public records. Donor-advised funds do not have the same

Two of the better methods to make a gift today and get an filing requirements and provide more privacy for donors who prefer to income tax deduction in the year of the gift, but retain the ability to remain anonymous in their giving. Finally, earnings on the investments designate the ultimate charitable recipient some time in the future are held inside of a private foundation are subject to an annual excise tax. donor-advised funds and private foundations. Earnings on the investments inside the donor-advised fund are fully

A donor-advised fund is like a charitable investment account for tax-exempt. the sole purpose of supporting charitable organizations you care about. Speaking of the investments inside a private foundation or a donor

When you contribute cash, securities or other assets to a donor-advised advised fund, contributors to these entities generally are passionate fund, you are generally eligible to take an immediate tax deduction. about doing good in the world and doing so with a purpose. As a result,

Those funds can then be invested for tax-free growth and you can impact investing has become a popular way to implement portfolios recommend grants to any qualified public charity when you are ready. ultimately directed towards charity. By definition, impact investing is

A private foundation is like a donor-advised fund where you can the act of purposefully making investments that help achieve certain give assets to the foundation and receive an immediate tax deducsocial and environmental benefits while generating financial returns. tion for the gift. Private foundations can offer more flexibility to the Impact investing can be a confusing and broad term, but generally giving family due to the fact that family members can be employed refers to investing in companies with an explicit mission aligned with

your values while avoiding investing in companies that do not meet those criteria. Combining impact investing with your philanthropic gifts to a private foundation or donor-advised fund can be a great way to align your values and passions with your family legacy.

For those of you older than 70 ½, you may be able to leverage your generosity by making a qualified charitable distribution from your taxable IRA. In effect, you simply transfer assets directly from your IRA to the charity of your choice. If you are over 72, these charitable transfers can be used to fulfill all or a part of your required minimum distribution. You are limited to charitable transfers of up to $100,000. The primary benefit of the direct transfer is that the IRA distribution is not included in your taxable income, which may keep you in a lower tax bracket, and reduce other detriments caused by higher taxable income.

Finally, if you are looking for an income stream while also providing a gift to charity, you might consider a charitable remainder trust. A charitable remainder trust is a “split interest” giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the trust assets that will pass to charitable beneficiaries. You can name yourself or someone else to receive the income stream for a term of years up to 20, or for life; and then name one or more charities to receive the remainder of the donated assets.

COVID-19 has created a huge need for philanthropy, and while so many want to give, they simply don’t know the best way to go about it whether for impact or financial benefit. If you are looking to begin a journey of generosity, reach out to your advisor so he or she can begin to lead you down that road that meets your philanthropic intentions. BBM

JOHN D. EADIE

CPA, CFA, CFP ® , PFS, CLU ® , CIMA, CKA ®

Founder and Managing Director, Covenant John is the founder and a managing director of Covenant. In his several leadership roles with Covenant, John serves as the firm’s CEO, chief wealth advisor, and leads all client service efforts. John has lengthy experience assisting families with their investment, income tax, wealth transfer planning, family governance and philanthropic strategies. Throughout his career, John worked with Fortune 500 executives to assess and implement complex compensation strategies—including deferred compensation, restricted stock, stock option, and other employee benefit planning. John was named a Barron’s 2012 and 2013 Top 100 Independent Financial Advisor. He has also been recognized since 2012 as a Five Star Wealth Manager. Earlier in his career, John was named by Worth magazine as one of the Top 100 Wealth Advisors in the country. www.covenantmfo.com

Ideal Health BOERNE

Located Inside of Boerne Family Medicine 112 Herff Rd - Ste 110 (830) 331-8585 traci@idealhealthboerne.com ALL THE POWER YOU NEED TO LOSE WEIGHT EXISTS INSIDE YOU. Book Your Appointment TODAY to begin your journey!

IDEALHEALTHBOERNE.COM

PROFESSIONAL PROPERTY MANAGEMENT & FULL SERVICE REAL ESTATE CO. We Care About the Properties We Manage! • Single Family Homes • Commercial Property • Condominiums • Community HOA’s

Quality Maintenance | Competitive Rates | Proven Track Record Call for More Info: (210) 535-1355 ed@homesweethomeboerne.com www.homesweethomeboerne.com From Boerne to San Antonio

Performance isOurPriority ~ Locally Owned~ Nationally Recognized

Stephen V. Vallone CEO, Escrow Officer steve@texasinvestorstitle.com

Becky Edmiston, CESP President, Escrow Officer becky@texasinvestorstitle.com

Boerne Office: 116 W. Blanco Rd., Suite 101, Boerne, Texas 78006

Houston Branch: 10000 Memorial Dr. Suite 100-N Houston, Texas 77024

Representing Stewart Title Guaranty, First American Title Insurance and Chicago Title Insurance COMMERCIAL ~ RANCHES ~ RESIDENTIAL PROPERTIES

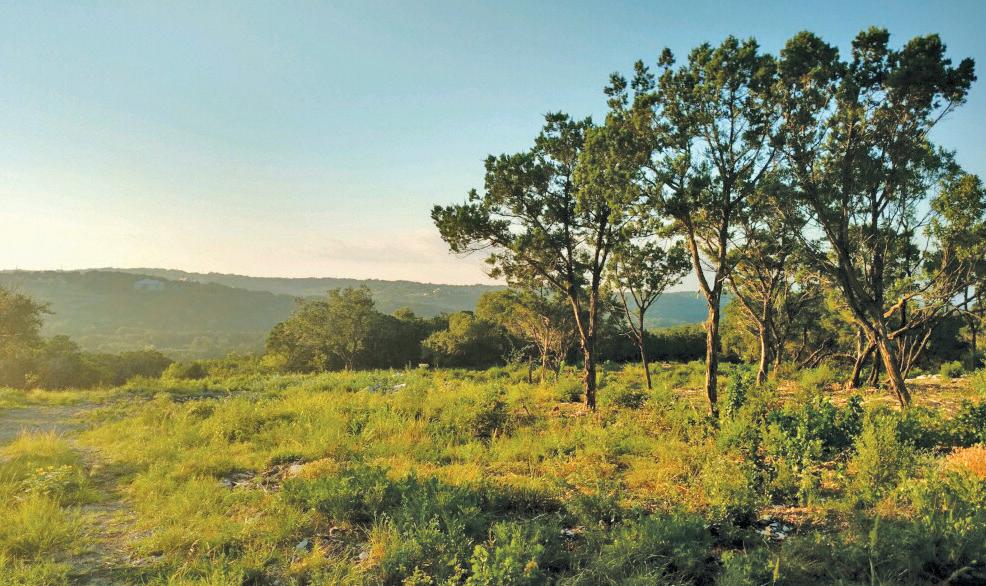

LIVE YOUR DREAM LONESTAR PROPERTIES’ HILL COUNTRY LOTS

Shannan Gleason

The Schultz Team

Missy Christian

Kacey Wells

Your Dream Lot? • Lake Access? • Plenty of Beautiful Trees? • On A River? • In A Subdivision with Amenities? • Close to Town? • Views? • Away from It All?

Nova Stephenson

Scarlett Wolter

LET OUR REAL ESTATE EXPERTS HELP YOU FIND YOUR HILL COUNTRY REALTY!

830.249.7979 222 S. Main – Boerne, Texas www.LoneStarBoerne.com

coming soon!

A CRYO Body Slimming and Skin Firming System

improve your skin with the Elaine Brennan Get-Glowing Micro Peel & coming this fall the Elaine Brennan Skin Renewal Peeling System

STYLE BY NOELLE IS NOW SHARING OUR SALON!

BOOK YOUR APPOINTMENT NOW FOR BLOWOUTS, BRAZILIAN BLOWOUTS, MAKEUP, HAIR, AIRBRUSH ORGANIC SPRAY TANS.