No Score Requirement for Element-to-Element serviced loans

CONVENTIONAL FINANCING

• Agency Fixed Rate Programs

○10-30 year Fixed and High Balance

○6- and 12-Month Extended Lock options

○2-1 Buydowns Available

○Lock And Shop 60 -and 90-day options

ADDITIONAL CREDIT FLEXIBILITIESCONVENTIONAL

• Direct Agency Seller-Servicer

• Manufactured Homes including Single-Wide

• Manual underwrites with extenuating circumstances considered

• Financed Properties follow Agency Guidelines

• HomeReady / HomePossible

• Homestyle Renovation Loans Referral Option

• In-house Reno Draws

• Reno Specialist handles the referrals

• Family First Mortgage Program

• Purchase a home for aging parents as Primary Residence

• Purchase a home for handicapped or disabled children as Primary Residence

FHA FINANCING

• Minimum credit score: 500

• Minimum credit score High Balance: 640

• Scorecard AUS “Approve/Eligible” or LP “Accept”

• Programs

○ Fixed Rate – 15-30 Year Fixed and High Balance Options

○ 6- and 12-Month Extended Lock options

○ 2/1 Buydowns Available

• FHA Streamline

○ Scores down to 600

○ No Score Requirement for Element-to-Element serviced loans

ADDITIONAL CREDIT FLEXIBILITIESFHA

• Manufactured and Modular Homes

• HUD REO

• HUD with Repair Escrows

• FHA 203K Renovation Loans (Full and Streamline)

VA FINANCING

• Minimum credit score: 580

• VA Jumbo: 640 to $1M ; 680 to $1.5M

• Scorecard AUS “Approve/Eligible” or LP “Accept”

• Cash out refinance max LTV 90%

• Programs:

○ 15-30 year Fixed and High Balance / Jumbo options

○ Extended Lock options available

○ 2/1 Buydowns available

• VA IRRRL

○ Scores down to 620

○ No Score requirement for Element-to-Element serviced loans

○ No AVM and unlimited LTV options

• Element Jumbo Program – Delegated – Very Aggressively priced

• LTV’s up to 90%

• Unlimited Cash Out options

• Jumbo Express – Automated Underwriting (AUS) options

• Jumbo Loan options up to $5M

• Non-Delegated options available

Agency and Non-Agency

ARM options

• 2nd Home ARM down to $50k

• Delegated – Very aggressively priced

• Agency ARM options – Pricing can vary depending on market

• Element Platinum

• Aggressively priced $400k to conforming loan limits

• Options available up to $5M

ADDITIONAL CREDIT FLEXIBILITIES - VA

• Manufactured Homes

• Vet/Non-Vet Joint transactions

• VA Renovation Loans

USDA FINANCING

• Minimum credit score: 580

• Purchase and Refinance

• Programs:

○ Fixed Rate

○ 30-year Fixed

○ 2/1 Buydowns available

• Alternative outlet for GSE eligible loans

• Lower LLPA’s compared to GSE’s

• Utilize Agency AUS for credit underwriting

• Great outlet for Second Homes and Investment Properties

Available

• In-house Underwriting Support and Scenario Desk

• Non-Warrantable Condos

• 12- and 24-month Bank Statement

• Investor DSCR Program (Professional Investor – LLC allowed)

• Agency “Just Miss” and Asset Based Alt-Doc programs

• Closes in our name

2 nd Mortgage Option

• Fixed Closed-end 2nds and Home Equity Lines available

• Delegated Underwriting

• Closes in our name

• 5th Street Capital

• Non-QM, Bank Statements, Complex Income, Foreign Income/Borrowers, Unique Properties, Non-Warrantable Condos

• ACC Mortgage

• ITIN, Foreign National, Non-QM, DSCR

• AAG Reverse

• Reverse Mortgages

• Angel Oak

• Non-QM Bank Statement, Asset Qualifier, DSCR, Jumbo 90%

• Carrington

• Government outlet for loans we cannot lend on

• Flagstar Bank

• Construction to Perm- Jumbo and Conventional options

• Lendsure

• Non-QM

• Luxury Mortgage

• Jumbo “Just Miss”

• Quontic Bank

• Non-QM

• Quorum Federal Credit Union

• Referral (not broker) of HELOC transactions

• Symmetry Lending

• HELOC Transactions

• We allow your Processors to clear underwriting conditions

• Title report

• Appraisal

• Submission of non-delegated loans

• Clearing invoice requirements

• UW conditions

• Specialist can make updates in the LOS prior to clear to close, including:

• Sales price

• Loan amount

• Appraised value

• Element has a dedicated condo desk with experienced staff to aid Loan Originators in facilitating condo reviews and approvals for a wide range of loan types including:

• Conventional (Limited, Full, Waiver and Fannie Mae PERS), Government (FHA, VA, USDA), and Bond/HFA

• Scenario Underwriters with 15+ years of experience

• Assists LOs with questions concerning everything from guidelines to information on the products offered

Loan Vision is a mortgage specific accounting software that allows us to report financial data by loan, LO, branch and department

• Loan Vision offers a web-based solution for Branch Managers to view the financial data for their branches

• Loan Vision allows users to drill down to the underlying source document, whether it be a loan settlement summary that shows revenue transactions or a vendor invoice that shows expenses

• Users can run P&L Statements, G/L Detail Reports and loan funding reports

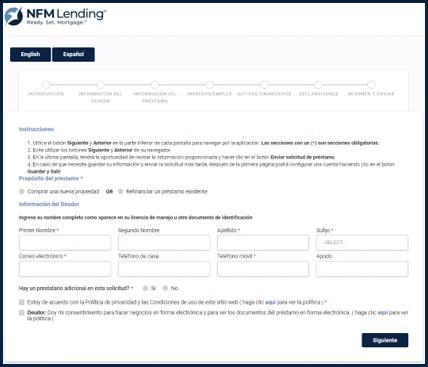

• Modern design and mobile optimized

• Prominent, one-click access to online

• Mobile responsive, interview style data gathering; can be completed in minutes

• Borrowers complete and submit loan apps without setting up accounts/passwords

• Originators have the option to include on their loan apps a prequalification/soft pull

• Available in Spanish for the convenience of Spanish speaking borrowers

• A new loan file is automatically created in Encompass

• No import is necessary. You will have access to abandoned, incomplete app

• Option for automatic credit run when borrowers submit application

• Automated text notification to LOs for new loan, if credit was run, or if the borrower indicated they have a signed a purchase contract

• Automated confirmation emails to borrowers and originator team

• Presents “Needs List” immediately

• Sends borrower a text with loan file number and SDU URL

• Sends email notifications to LO when borrower submits documents

• Simple, one time, one step process for borrower to identify all their accounts

• LOs are able to preview, refresh, and import asset report into the LOS when ready

• Borrowers enjoy simple, reliable, secure access from any device, any browser, any time

• Documents are placed automatically into the loan appropriate folders

• Loan Originators and borrowers have the ability to upload any document from their mobile phone, including pictures

• Real time updates with automated notifications – WOW factor!

Keeps your realtors informed

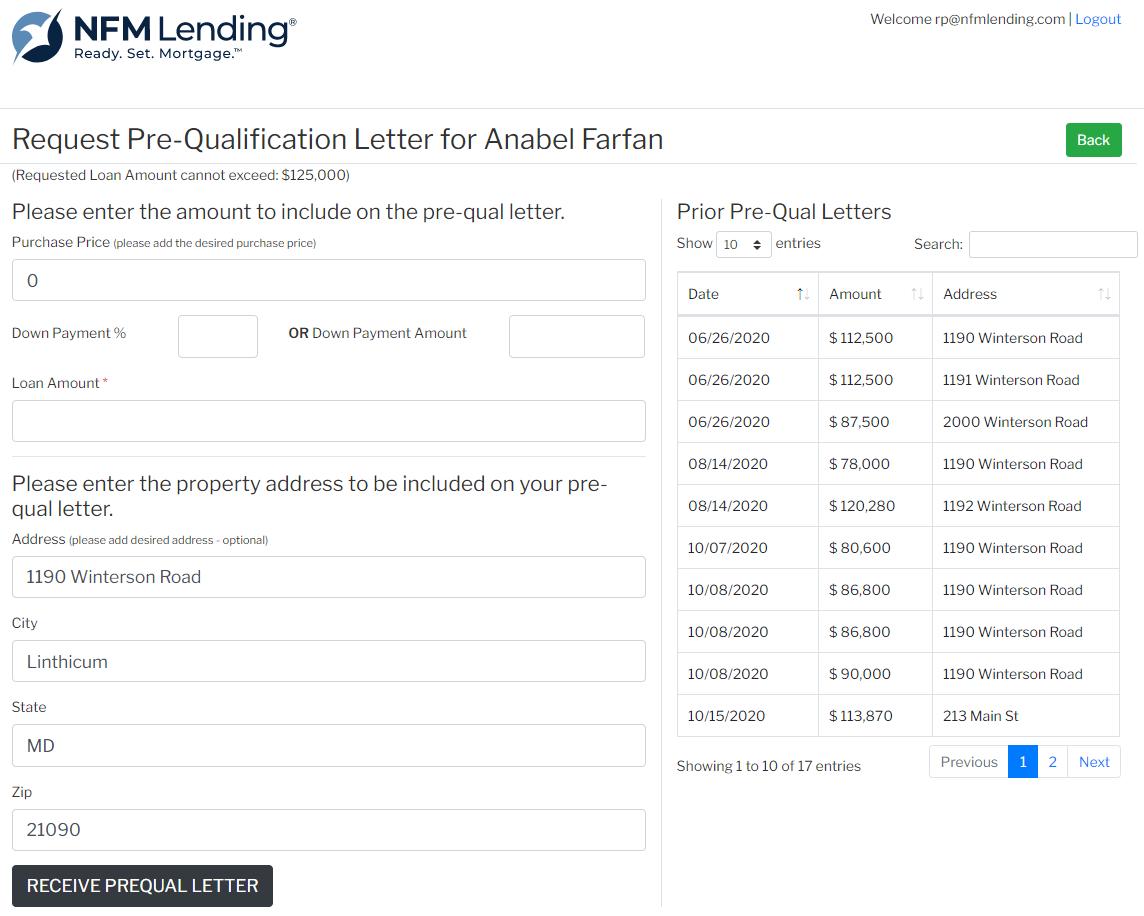

• Web portal for realtors to access and keep up-to-date with their pipeline

• Easily access loan-related contact information including telephone numbers and email addresses

• Request and receive prequalification letters with custom property address, sales price, and loan amounts

• Produce multiple scenario prequalification letters on-demand

• Keep builder partners up-to-date on their pipeline

• Provide real-time access and loan details, including dates and status

• Easily access loan-related contact information including telephone numbers and email addresses

• Ability to estimate monthly-equivalent cost of builder upgrades to offer more options to the home buyers

• Ability to export & print data from portal

• One Click Request for all Conventional Loans

• Obtains DU and LPA decisions

• Gathers Day1Certainty and findings

• Presents any PIW from both GSEs

• Checks which GSE may own the loan, and retrieves the Appraisal Risk Score if available

• Makes Intelligent Recommendations for:

• U/W Findings to use

• Investor to sell the loan to

• Type of Appraisal Ordering

• Type of Appraisal Review

• GSE ownership (for Refis)

• ALL IN ONE SCREEN, WITH ONE CLICK

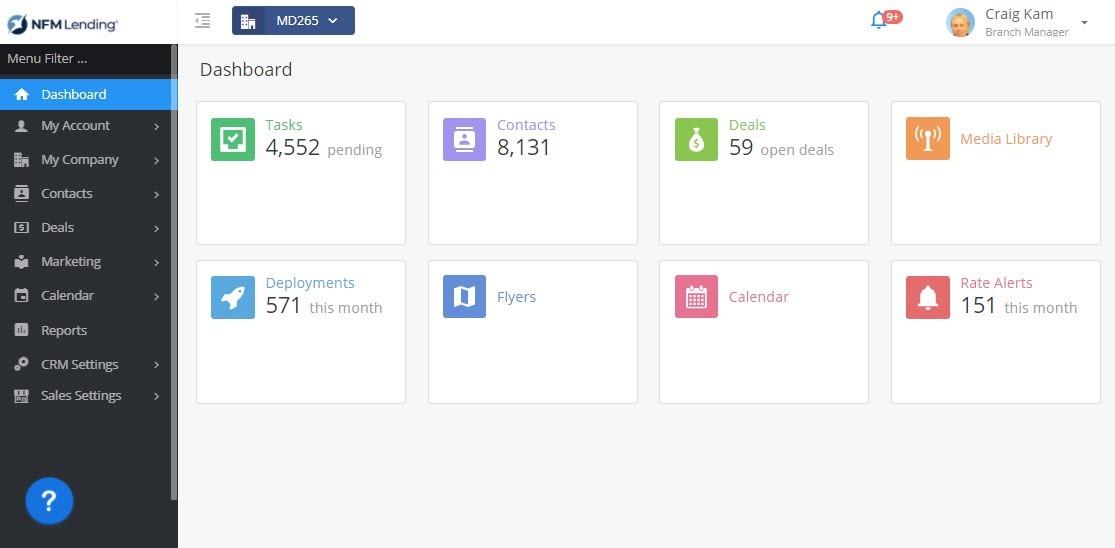

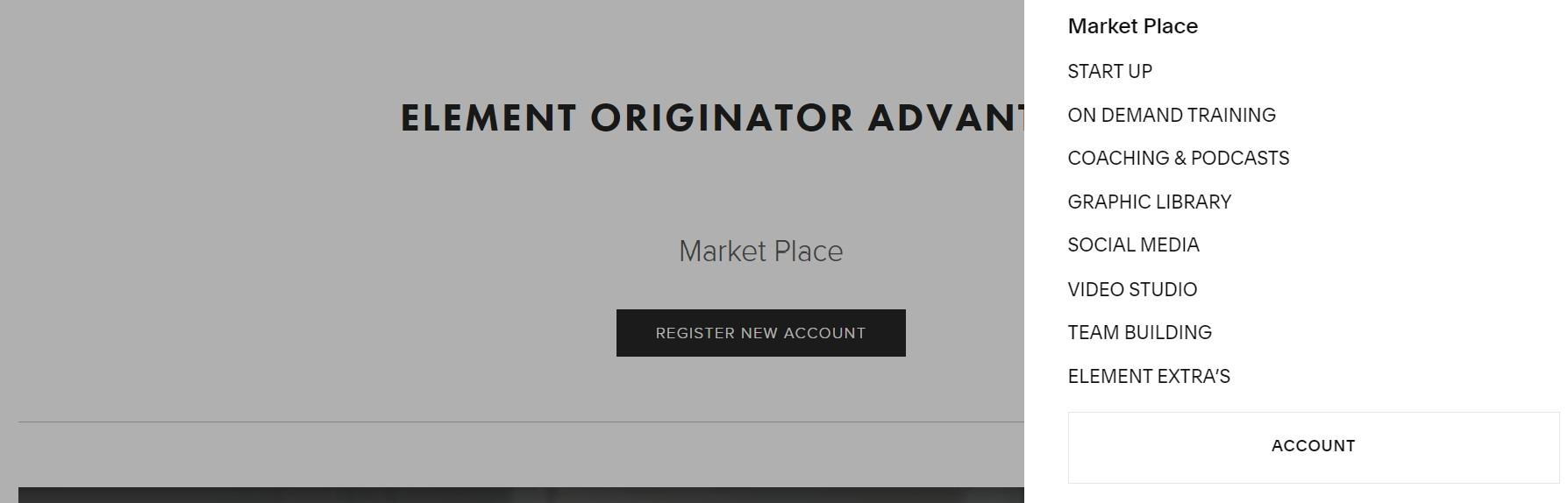

• All-in-one CRM platform created specifically for mortgage professionals

• Email, SMS, landing pages, lead forms, video, co-branding, and many more marketing outlets

• Custom in-process milestone emails (10) and texts, showing the borrower’s information and co-marketed with buyer’s agent

• Dynamic marketing automation to make workflows and drip campaigns

• Co-marketed single-property websites

• Power dialer, OB integration and bi-directional Encompass integration

• Available in English and Spanish

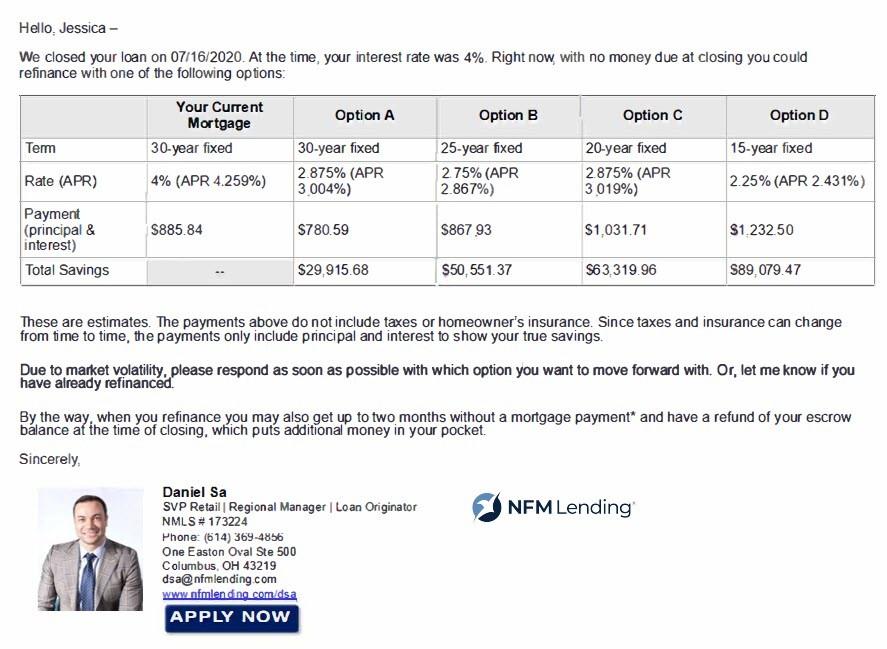

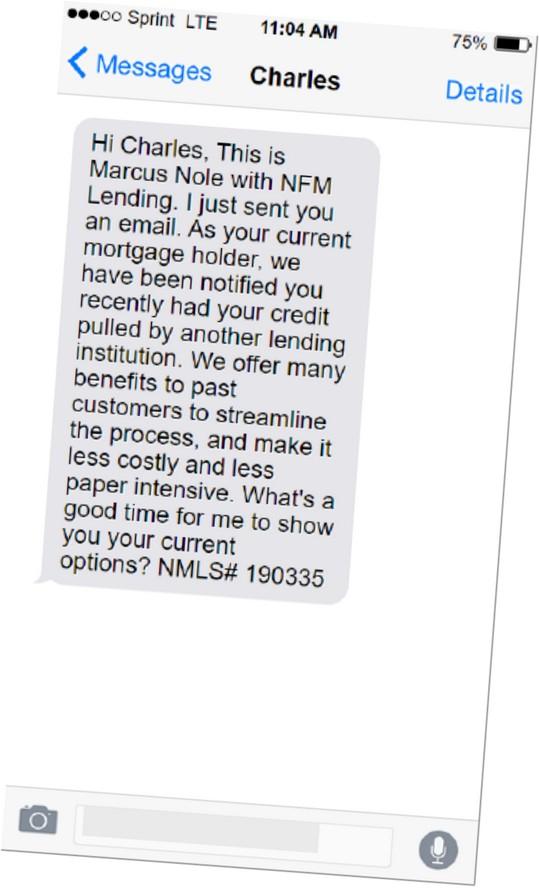

• Intelligent direct marketing refinance campaign

• Converts targeted past customers into refinances

• Personalized emails sent to customer from LO with new rate (pulled from Optimal Blue), payment, and total savings

• Campaign includes multiple touch points for max conversion

• All the customer has to do is respond with which refinance option they’ll take

Thank you for reaching out, can we do option B?

AutoQuote “Rate/Term” Results

12,951

Past clients reached

1,346 Applications

1,321 Funded Loans

8.61% Conversion Rate

6,548

75 Applications

Past clients reached $21 MM Volume Apps Received

1.2% Application Rate

April 2022 - July 2022

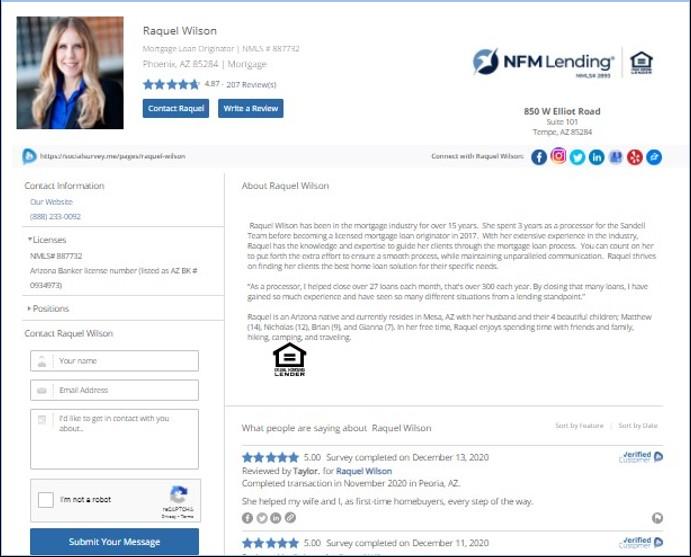

• Online reputation management platform

• Customers can easily leave reviews

• Generates positive social proof to help grow your business

• Automated social sharing

• Pulls in Zillow reviews automatically

• Pushes reviews to Facebook and LinkedIn automatically

• Improve the customer experience

• Improves Search Engine Optimization (SEO)

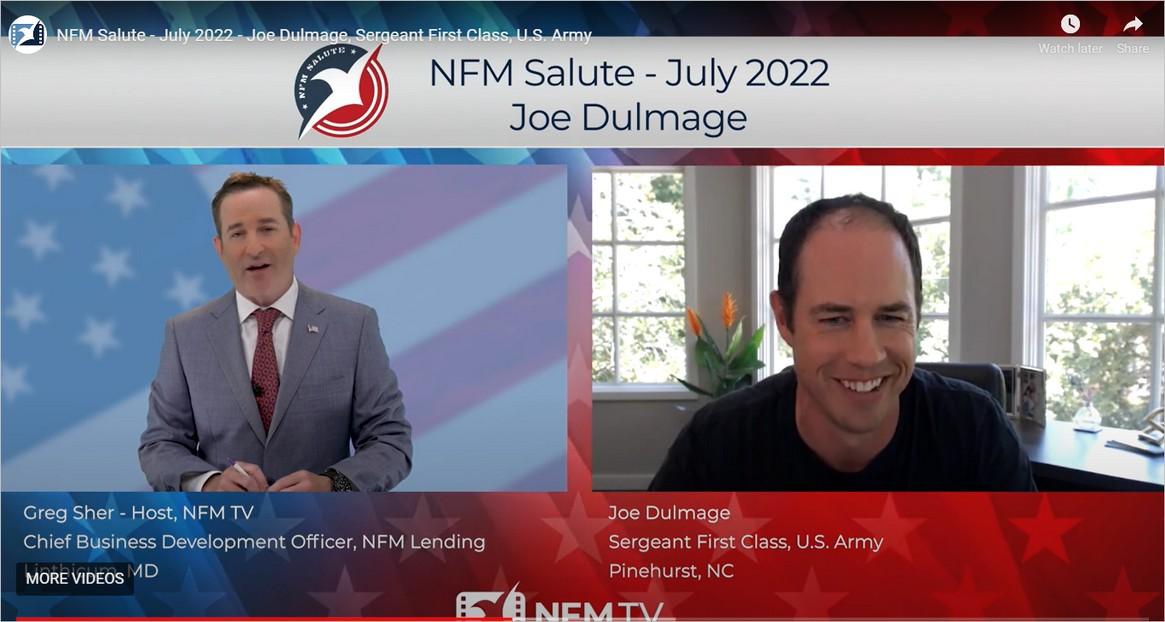

• Video production services are in-studio and in-field

• Studio production: in-house studio with multiple camera setups and live streaming capabilities. Available to you and your referral partners for use at any time and at no cost

• Field production: we come to you and your referral partners to produce high-quality marketing videos

• We help conceptualize, plan, script, produce, film, edit and distribute (market) video content

• Examples: Educational, Experience, Culture, Testimonial, PSA, Demonstration, Recruitment, Builders

• We can also help leverage videos through advertising, such as Facebook ads

• Branch marketing video: 2 to 3-minute marketing video featuring BM, LOs and other essential staff.

• Personal Branding: Raise the profile and recognition factor of essential staff with a :45 profile interview. Use on social media and personallybranded website.

• Headshots: New, professional headshots of all branch staff.

• Realtor promo videos: Each LO invites their top referral partner into the office for an hour to produce two short marketing videos. Give the referral partner the option of using our pre-written scripts or they can write their own (if the referral partner writes their own, we’ll also serve as script consultants).

• Mortgage Explainer videos – Access to our animated videos on a variety of mortgage topics that you can share to help educate your prospects.

• Top Producer: Your top producing LO is interviewed by our own Greg Sher. NFM will promote the video on our social media channels (up to 100,000 views). Use on your own social media outlets and branded web page as well

• Home Run: Great Client Experiences: Select a client that you hit it out of the ballpark for and we’ll feature them and the LO on our new podcast series. Invite the buyer’s agent as well!

• “I’ve Moved” video: :45 video telling referral partners and past clients that you’ve moved to NFM and all the cool, new things you now can offer. Send out via our CRM.

• Recruiting video: :45 video telling prospective LOs how you’ll help shoot their business to the moon.

• TV Studio Consultation: Consultation to discuss studio options depending on available space and budget. To include option of our coordination of complete planning and build out as well as equipment purchase if desired

• Being active on social media highly encouraged!

• We manage LO and branch Facebook social pages:

• Growing audience

• Posting content

• Regular updates to cover photos

• Facebook, LinkedIn

• Single-property websites

• Flyers

• Emails • Advertising

• Custom requests

• Experience

LEAD GENERATION THROUGH SOCIAL MEDIA AND SEARCH WEBSITES (I.E. GOOGLE)

RUN LOCALLY TARGETED AD CAMPAIGNS TO BRING IN NEW LEADS

TRACK WEBSITE VISITORS IN ORDER TO CONTINUALLY SHOW THEM ADS SO THEY THINK OF US WHEN THEY’RE READY TO MOVE FORWARD

12 hours or less

• WHO DOES NFM USE FOR HEALTH BENEFITS? – CIGNA & United Healthcare for FSA.

• WHAT DOCUMENT UPLOAD SYSTEM DOES NFM USE? – Our document upload system is built on own proprietary technology. NFM has one of the industry’s most sophisticated, dynamic document upload systems that make it simple for the borrower to use and it is fully integrated with our LOS bi-directionally. Documents are automatically uploaded into the right folders in the right loan file and the borrower can see in real time the documents that are still needed during both the loan application process and after the loan is submitted for processing and approval.

• DOES NFM PROMOTE A 401K MATCH? – Yes, we auto enroll all eligible employees at 6% and offer a discretionary 50% match up to $2,500 for employees after 1-year with a 5-year vesting schedule at 20% per year.

• WHAT PAYROLL SYSTEM DOES NFM USE? – We use Paycom as our HRIS, which includes payroll processing.

• DOES NFM HAVE A COMPANY INTRANET? – Yes. It's called InSITE and is used for all internal communication.

• WHAT KIND OF ONLINE FILE STORAGE DOES NFM USE? – Securely hosted, replicated with industry’s leading Amazon Web Services (AWS).

• DOES NFM HAVE SPANISH CAPABILITIES? – Our borrower communication portal for loan applications, our SMS/texting services, and our CRM all support both English and Spanish versions.

• IS NFM A FLAT ORGANIZATION? – YES. NFM has a Dynamic Leadership Structure, which means no regionals and C Level direct access.

• DOES NFM MARKETING ASSIST IN CREATING CONTENT? – Yes. We have a talented team of marketers, designers, social media coordinators and CRM experts to create all of your marketing materials.

• DO NFM LOS HAVE PERSONALIZED WEBSITES? – Yes. Each LO receives their own personally-branded website.

• WHAT OFFICE SUITE SOFTWARE DOES NFM USE? – NFM uses Office365 Business Applications

• WHAT CRM DOES NFM USE? – NFM’s primary CRM is Top of Mind’s Surefire CRM, the #1 most-used mortgage CRM for the second year in a row by STRATMOR Group’s Technology Insight Study.

• WHAT LOS DOES NFM USE? – Encompass.

• WHAT PRICING ENGINE DOES NFM USE? – Optimal Blue.

• DOES NFM HAVE MOBILE DOCUMENT UPLOAD CAPABILITIES? – Yes! Using our Secure Document Upload System, borrowers can easily upload their documents from their mobile device.

• WILL NFM ALLOW ME TO CUSTOMIZE MY FOLLOW UP PROCESS WITH BORROWERS AND REALTORS? – Yes! We have a recommended Lead to Loan Sales Process for branches to follow, however NFM encourage user creativity and has a Marketing team that will work with you to customize your sales process to your needs.

• CAN NFM HELP ME ENHANCE MY SOCIAL MEDIA PRESENCE? – The NFM Marketing Team can help you to setup your social media profiles as well as help you create custom Campaigns to target your audience. You can also use our state-of-the-art NFM Studio to create video content for your team.

• DOES NFM HAVE AN IT SUPPORT LINE? – Yes! NFM’s IT Support Team can be emailed or called at any time to fix your technical issues & get you back to work

• CAN NFM HELP ME CREATE FLYERS? – Using Surefire CRM, NFM can train you to create custom flyers for your open house events.