1 minute read

POSEIDON NICKEL LIMITED SHARES CHALLENGES TO RESTART BLACK SWAN MINING PRODUCTION

✦ Peter Harold, Managing Director of Poseidon Nickel Limited (ASX:POS) has been steadily working towards restarting the Black Swan mining production. He shares recent setbacks and discusses the company's ASX announcement.

The journey of POS has been a mix of highs and lows. However, consider the long-term positive outlook for nickel and positive project development environment in 2024.

Factors for Black Swan Delay

The decision to restart Black Swan has been delayed despite the solid progress made since the delivery of the November 2022 Black Swan BFS. This delay is due to a combination of factors including:

• The later availability of grid power;

• The need to complete additional metallurgical testwork;

• The continuing tightness of the WA labour market;

• Ability to secure accommodation in Kalgoorlie for FIFO workers; and

• The volatility in global commodity and equity markets.

Poseidon Nickel is looking forward to a positive project development environment in 2024. The main objective is to relaunch Black Swan after addressing the mentioned issues and gaining a more favourable perspective on nickel prices and equity markets.

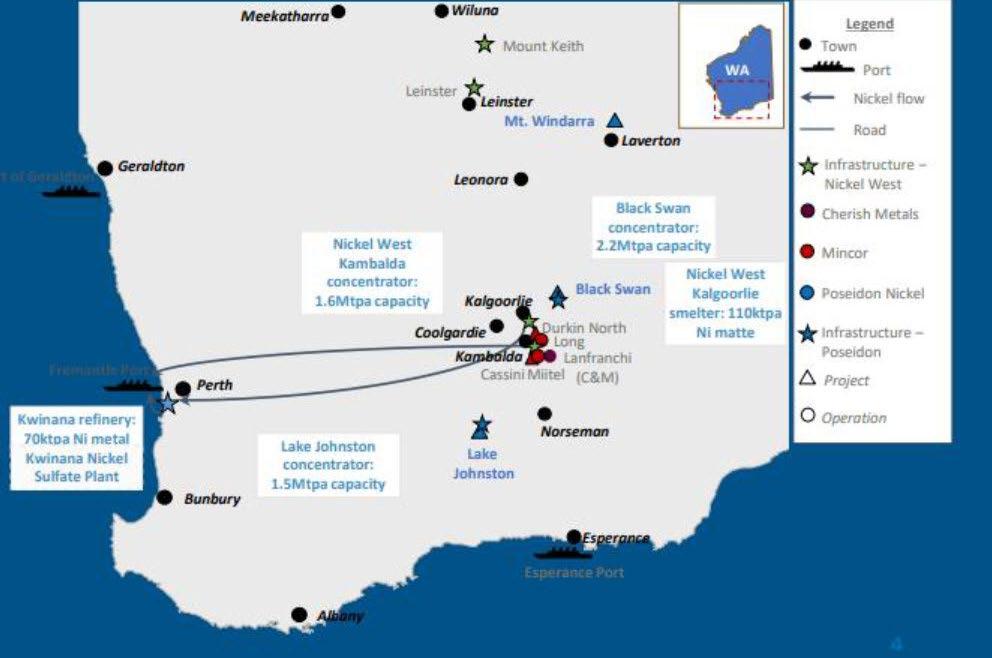

Samso, Tony Goode's take on the Poseidon story

The journey of POS has been a mix of highs and lows. While there have been challenges and unfulfilled promises, it's important to assess the company's potential as a nickel producer before making judgments. POS is actively addressing the identified issues and we believe they will transition from an explorer to a miner soon. Looking at the long-term outlook for nickel, it remains positive, and POS stands out globally among prospective and near-term producers. They have multiple existing nickel assets with varying grades and strong exploration targets. Their infrastructure is valued at over $600 million replacement value. cAs a result, we anticipate that POS will experience a substantial rerating in the future, presenting trading opportunities for investors.

Nevertheless, the delay doesn't change our overall expectations. POS is actively working with partners for offtake and funding. They are also addressing the metallurgical and other issues outlined in their recent announcement. Once resolved, the company will be able to announce a Final Investment Decision, Project Funding, and Offtake Agreements.

Currently, the share price is low due to the project delay announcement. However, we believe there is a significant disparity between the market cap of around $90 million and a more reasonable valuation based on the progress towards production, which could potentially reach a market cap of $300 million or more. The low price may make POS an attractive takeover target.

For a breakdown of Poseidon's business strategy and a deeper analysis of the Poseidon story, join Peter Harold in his Coffee with Samso below.