1 minute read

[New] About Poseidon Nickel Limited (ASX: POS)

Poseidon owns three significant nickel assets with a combined resource of close to 400kt of nickel and processing capacity of up to 3.7Mtpa of ore to produce nickel concentrate. The Company’s business strategy remains focussed on leveraging its existing asset base to grow Poseidon into a significant nickel producer over a period of expected significant growth in nickel demand largely driven by growth in the electric vehicle market.

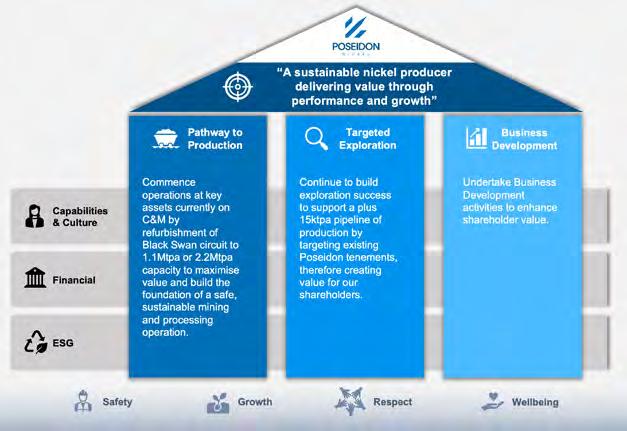

Poseidon’s strategic pillars are developing a pathway to production, targeted exploration across its nickel asset portfolio and considering proximal business development opportunities. The key enablers for the Company’s strategy to be successfully executed are ensuring key capabilities are resourced and the business is sufficiently funded for growth underpinned by a strong ESG framework.

Poseidon Business Strategy

The Company’s pathway to production was significantly progressed during FY22 with two metallurgical breakthroughs which could significantly improve the economics of the Black Swan project. The first involves incorporating a rougher concentrate regrind into its process flowsheet to significantly improve the quality of the smelter grade concentrate, which is expected to result in improved nickel payability. The second was testwork on a combined serpentinite and talc carbonate ore blend to produce a rougher concentrate which is amenable to both pressure oxidation and high-pressure acid leach to produce a mixed hydroxide precipitate.

Level 1, 3 Ord Street West Perth WA 6005

Contact: Poseidon Nickel Limited (ASX: POS) poseidon-nickel.com.au admin@poseidon-nickel.com.au

With the assistance of Poseidon’s geological consultants, Newexco, the Company completed an exploration targeting report for Lake Johnston during FY22, with follow up reports for Black Swan and Windarra to be delivered in FY23.

The Lake Johnston report identified the Western Ultramafic Unit as a priority, with a program of works approved to undertake 15,000 metres of RC drilling which is planned for FY23.

The Company’s business development efforts over FY22 focused on delivering value from the Windarra/Lancefield gold tailings project. Partnering with Green Gold and determining whether their proprietary gold recovery technology is suitable for Windarra/Lancefield is considered the optimal path to unlocking value from this project.

![[New] ADULTS ARE TAKING FLIGHT WITH BALLET!](https://assets.isu.pub/document-structure/230115041436-d7f9067096cb91d1a8fb10c5b61a0598/v1/2cc6d97e885c3275be67624b3aacc36b.jpeg)