3 minute read

6 NEW YEAR’S RESOLUTIONS TO INCREASE YOUR SUCCESS

6 NEW YEAR’S RESOLUTIONS TO INCREASE YOUR SUCCESS

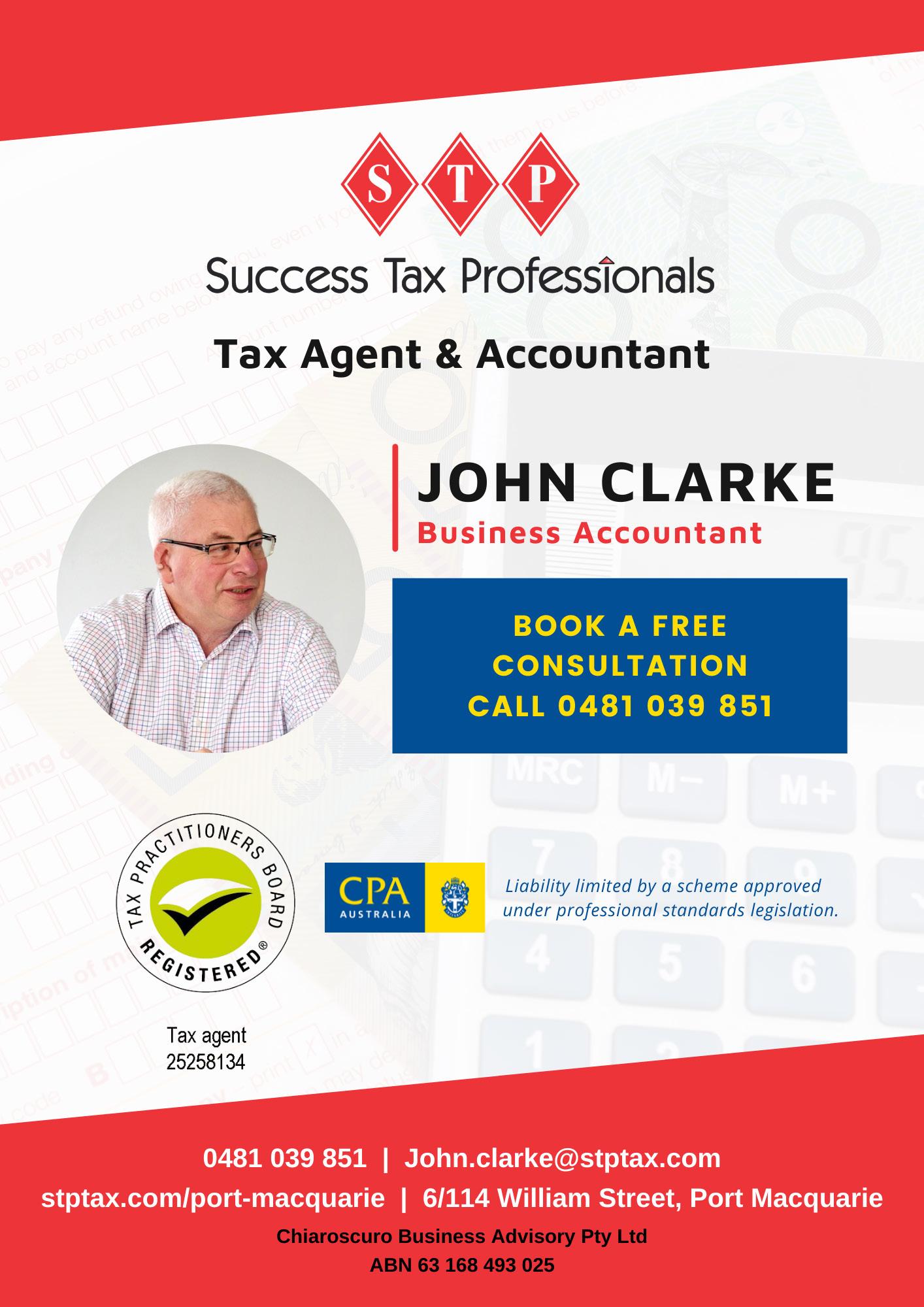

✦ Advice from John Clarke, Success Tax Professionals.

I t’s often a standing joke how ineffective many New Year’s Resolutions are. In the past mine have included losing weight, exercising, and giving up smoking. The problem with these kinds of resolutions is they are general. Any resolution needs to be more specific eg I will only eat take out twice a week, I will walk for half an hour 4 times a week. These goals are measurable.

After the COVID disruption to our lives over the past two years there is a risk that our personal and business tax might need to be looked at. It’s too late on July 1 2022 to start tax planning for the 2022 financial year.

Here are my suggestions for goals we can set as business owners.

1. Keep good records

If there’s one thing tax agents love it is going through shoe boxes full of receipts. But worse yet is the person who has spent money on items they could have claimed deductions on if they had kept the receipts or if the receipts had not faded to blankness in the hot glovebox. A simple solution could be to take photos on your phone of petrol receipts etc.

2. Motor Vehicle Logbook

If you use your vehicle for work or business purposes you may be able to claim a deduction. There are 2 options: 1. Keep a logbook and claim the work/business percentage 2. Claim on a kilometre basis. Maximum claim is for 5000 km.

If you haven’t kept a logbook the only method you can use is the kilometre method and you can only claim up to 5000 km. Keep a logbook or use an app on your phone. The logbook needs to be kept for 12 consecutive weeks and should reflect your typical use.

At the end of June if you’ve kept a logbook you can then make a decision to claim based on which method gives you the highest deduction. The logbook needs to be done a minimum of every 4 years, so if it’s a few years since you’ve kept a logbook start keeping one now.

3. My business structure

If you’re a sole trader this is the simplest way to carry on a business but it might not be the best way if your business has grown or for protecting your assets. Your accountant can give you advice about the tax consequences of different structures eg partnerships, companies, trusts.

4. Look at your business expenses

Each $ you save is a $ towards your bottom line. Have you got subscriptions you are not using? Talk to your insurance broker and check you are insured for the right risks.

Is your advertising effective (talk to Chrissy at Brilliant-Online)?

5. Business Income

Have you checked your prices in the last 6 months? Often in business we lack confidence to increase prices.

Are we giving discounts as a matter of course? Discounts can cost you money.

6. Take Action Within The Next 72 Hours

Research shows people need to commit to doing something within 72 hours of making the decision. The commitment could be as simple as downloading an app on your phone or ringing your accountant to make an appointment for the New Year.

As always, this article provides general taxation advice only, and you should consult a tax agent or accountant for advice that is specific to your circumstances.