3 minute read

Comment

• TIM MOORE, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “May data highlighted a mixed picture across the UK construction sector as solid growth rates in commercial and civil engineering activity contrasted with a steeper downturn in house building. Rising demand among corporate clients and contract awards on infrastructure projects meanwhile underpinned the fastest rise in new orders since April 2022.

“However, cutbacks to new residential building projects in response to rising interest rates and subdued housing market conditions resulted in the sharpest drop in housing activity for three years. This meant that residential work underperformed the rest of the construction sector by the greatest margin since October 2008. Survey respondents also commented on concerns about the broader UK economic outlook, which contributed to an overall drop in output growth projections to the lowest for four months.

Advertisement

“Inflationary pressures meanwhile eased considerably May, with purchase prices increasing to the smallest extent since September 2020. Supply chain normalisation helped to moderate cost inflation, as signalled by the strongest improvement in delivery times for construction products and materials for almost 14 years.”

• DR JOHN GLEN, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “Though overall output in the construction sector showed an improvement for the fourth month in a row, the steepest drop in house building activity since April 2009, barring the initial pandemic lockdown in early 2020, will send a chill down the spine of the UK economy.

“The residential sub-sector is closely linked to consumer confidence and levels of spending. A further hike in interest rates this month, along with the relentless increase in the cost of living is making buyers hesitate about purchasing homes. As a result, builder confidence was pinched to remain below the survey average, as business costs remained high and firms expanded their workforce numbers at only a modest pace as they were cautious about their own affordability rates.

“Even with the strongest increase in new orders for just over a year, where commercial and civil engineering projects made up the shortfall, purchasing activity remained flat. Companies were de-stocking their builtup supplies because, with the fastest turnaround in supplier delivery times since August 2009, builders expected that demands for materials would be met should a longawaited sustainable upturn ever arrive.”

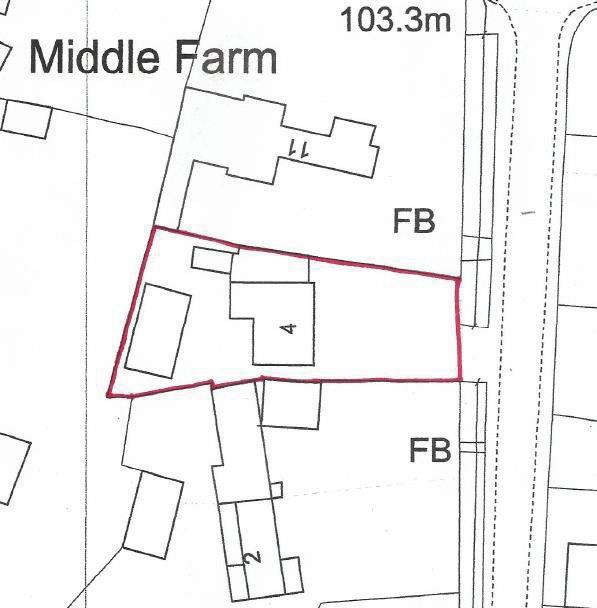

De73 8eh

An extraordinary development opportunity which benefits from Full Planning Permission for the erection of 7 dwellings with garages providing a total coverage of 10,400 sqft (approx. GIA, excl. garages). The site extends in all to 0.59 Acres (0.24 Ha) or thereabouts.

The site is being offered for sale as a whole by Informal Tender. Deadline for submission of tenders is by 12 noon on Wednesday 2 nd August 2023.

Offers are invited in excess of £1,500,000 (one million, five hundred thousand pounds)

A detailed information pack including Ground Investigation Report and Utilities searches is available.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Agents: Gary Kirk & Sam Tyler E-mail: gary.kirk@matherjamie.co.uk / sam.tyler@matherjamie.co.uk

Mather Jamie Ltd, 3 Bank Court, Weldon Road, Loughborough, Leicestershire LE11 5RF

MIDBROOK COMMERCIAL DEVELOPMENTS LIMITED (c/o

Agent: George Henshaw, Castle House, Friar Lane, Nottingham NG1 6DH) – Demolition of restaurant and erection of retail/commercial unit – at The Mandarin Chinese Restaurant, Egginton Road, Hilton, Derbyshire DE65 5FJ.

MELBOURNE HALL ESTATE

(c/o Agent: Phillip Tuckwell, TUK Rural, The Studio, 6A Market Place, Melbourne, Derby DE73 8DS) –Demolition of existing building and development of 5 new dwellings with associated amenity space and car parking – at Melbourne Community Centre, Church Street, Melbourne, Derbyshire DE73 8EJ.

MESSRS. JONATHAN, DAVID & PETER BABB (c/o: 1 The Hills, Warton, Warks. B79 0JF) –Demolition of existing residential properties (Nos. 19 & 20 Gorsey Leys) with the erection of 4 detached and semidetached twostorey dwellings, associated parking, garaging, landscaping and all enabling works – at 19 Gorsey Leys, Overseal, Swadlincote, Derbyshire DE12 6JE.

North Northants.

BARKER HOMES LIMITED (c/o Agent: Jon Sidey, Sidey Design Architecture, 10 Market Square, Higham Ferrers, Northants. NN10 8BT) – Change of use/conversion of the former public house to office use, and part conversion to 3 onebed residential units and erection of 3 one-bed two-storey dwellings with associated parking and amenity space (Resubmission) – at The Wheatsheaf, 1 High Street South, Northants. NN10 0QU.

BEST ASSET LIMITED (c/o: 12 Cottingham Way, Thrapston, Kettering, Northants. NN14 4PL) –Erection of 5 dwellings - at land adjacent to to Brook Farm Cottage, Brooks Road, Raunds, Northants. NN9 6NS.

MR B MCTAGGART (c/o Agent: Patrick Dooley, 2 Stanton Avenue, Spinney Hill, Northampton NN3 6BZ) – Proposed 2 detached single-storey dwellings with off road parking – at land adjacent to 31 Ashridge Close, Rushden, Northants. NN10 9HS.

GOLIATH PROPERTY LIMITED

(c/o Agent: Ryan Astill, Astill Planning Consultants Ltd, 144 New Walk, Leicester LE1 7JA) – Change of use from Commercial, Business and Service use to dwellinghouses –at 37-39 High Street, Rushden, Northants. NN10 0QE.