By Eugene

IMANI Veep urges gov’t to set up creditor committee to restructure debt MONDAY, SEPTEMBER 26, 2022 BUSINESS24.COM.GHNEWS FOR BUSINESS LEADERS IMF mission to visit Ghana from September 26 to October 7 Prince Adukwaw wins FBNBank’s Captain’s Prize Tournament 11 banks to support entrepreneurs gain access to capital under YouStart initiative Story on page 2 Story on page 3 Story on page 3 Story on page 4

Davis

Limited

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed.

We value your support and loyalty.

Contact: editor@business24.com.gh

Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

Horticulture fast becoming the new job-making machine

“When the last tree dies, the last man dies” they say and truly so because flora and fauna preserve the environment and hence human life, and at a time that economies are grossly feeling the harsh outcomes of climate change, the need to preserve our environment and green resources have become even more critical.

Aside the enviro-friendly outcomes, there is proven economic potential in the green economy, specifically the horticultural value chain.

Recent statistics put proportions of the youth (15 to 35) that are unemployed and seeking work at 34.2percent. Unemployment is therefore considered by many to be the most critical issue affecting the country.

It is trite to say that with the right national and individual orientation, policies, and drive, Ghana’s rich flora and fauna resources could provide millions of jobs to the country’s teeming youth.

Stratcomm Africa is leading the charge to green

Ghana for the varied purposes of beautification, wealth and job creation as well as a sustainable fight against climate change.

Now in is tenth year, the annual Garden and Flower Show challenges and motivates the youth and businesses in the sector to aspire to grow and reach their full potential, in order to improve their livelihoods and impact society.

This year’s theme “Growth Unleashed” preps the mind of young Ghanaians to burst forth and to grow beyond the norms to achieve a blooming environment.

The global horticulture market is estimated to be valued at USD 20.77 Billion as of 2021 and is projected to reach US$40.24bn by 2026 at a compound annual growth of 10.2percent whilst global flower and ornamental plants market was valued at US$475.6m in 2020 and is expected to reach US$725.4m by the end of 2027, growing annually at 6.3percent during 2021-2027.

IMANI Veep urges gov’t to set-up creditor committee to restructure debt

By Eugene Davis

Vice-President of IMANI-AFRICA Bright Simons has recommended that the government set up of a local creditor committee to help restructure the country’s debt and also expedite government’s engagement with the International Monetary Fund (IMF) over the aid package.

As Ghana awaits the IMF to continue further talks, Mr. Simons said that the creditor committee could be one route government could explore, he explains it as the assembling of all your creditors and some having representations of proxies -with decision being made by votes, so majority votes.

“In taking the creditor route, there are advantages and disadvantages, the first advantage is that without collective action clauses system this is the only way you increase efficiency of decision making, everybody comes to the committee and you deliberate on how to handle it.

Then there is the consultative method -where you literally call the investors [big ones] usually the majority action rules if you get the big guys to agree, then you leave the hold outs, most of them will not go to court but there is a risk, in fact there is evidence that suggests that over the last two decades the number of people that refuse to accept the determined rate when majority of big lenders, the number of people that go to court has been increasing exponentially.”

According to him, Ghana has to be careful how it approaches this route, for him the grey area has to

be the local banks – “most of them because of political exposure are going to be very careful, I don’t see any commercial banks taking the government to court but there still 12 to 15percent or so of our bonds that are held by non-resident investors [non-Ghanaian].”

He, however, warned that these non-Ghanaians that hold the country’s bond, some might go to court, “so government might decide it will prioritise in a consultative model and have a local creditor committee, it will enable them to apply a lot of political pressure. There will be factors that will help government on the local bank front.”

He also indicated that government has the advantage of local law stressing that “when you do an external debt restructuring you are confronted with the fact that, a lot of bonds are subject to English law and if that is the case, it is not as easy to make adjustments to local law to address it -because domestic debt is governed by local law, the government can go to parliament and make laws to affect a whole bunch of things, so it helps the government.”

He also revealed that some banks are already on the brink of capital distress, insolvency in the country.

As far as the debt restructuring is concerned, he proposed a law -which he says may make certain things easier, a creditor control but urged that government should be careful how it is structured, and also advised government to undertake an asset quality review before the attempt on bank side -banks owe about 50percent of the government debt, “that is a lot, but the households to my mind even if they suffer from a reprofiling I think they will bare it more easily than the banks but the vulnerable banks may not survive, so we have to be careful.”

Ghana turned to the IMF for help in July as its balance-of-payments deteriorated.

It is understood that an eventual agreement between Ghana and the IMF will likely consist of $3 billion in financing over a threeyear period, and contain elements of both Extended Credit Facility (ECF) and Extended Fund Facility (EFF) programmes.

2 | THEBUSINESS24ONLINE.COM News/Editorial

11 banks to support entrepreneurs gain access to capital under YouStart initiative

to create jobs.”

Mr. Ofori-Atta alluded to the immense role of the PFIs and disclosed that Government could not “move forward” without their support and revealed his administration’s desire for more of such partnerships from both the public and private sectors to ensure the creation of a culture and mindset that could leave the young generation unafraid to challenge themselves.

Government has signed a Memorandum of Understanding with eleven (11) banks for the YouStart Commercial Component, to support entrepreneurs gain access to capital to enhance their businesses.

The YouStart programme introduced by government and expected to create a million jobs for the Ghanaian youth in the next three years has three models: The Commercial Programme, District Entrepreneurship Programme, and the YouStart Grace Programme.

The Minister for Finance, Ken Ofori-Atta in his address said, the

commercial programme would offer a standardized loan product between GHS100,000 and GHc500,000.00 from Participating Financial Institution (PFIs) to cover working capital requirements, business expansion needs and the purchase of equipment or machinery by beneficiaries.

He added that, “Never in our history has there been a commitment of this size and scale toward strengthening the links between education and job market stakeholders, providing access to finance, skills, and markets for our young entrepreneurs and growing the capacity of the private sector

“Indeed, the expected consequence would be the realization of a WISER (Wealthy, Inclusive, Sustainable, Empowered, and Resilient) society, with our young people more confident about their place in the World”, the finance minister disclosed.

The financial institutions that signed the MoU with Government were GCB Bank Plc, ABSA Bank Ghana Limited, ARB Apex Bank, Access Bank (Ghana) PIc, Ecobank Ghana PIc, FBNBANK Ghana Ltd, Fidelity Bank Ghana Ltd, Universal Merchant Bank, Consolidated Bank Ghana Ltd, CalBank PIc, OmniBSIC Bank Ghana Limited, and the

Ghana Association of Banks signed as a witness.

Speaking on behalf of the Banks, the Chief Executive Officer of the Ghana Association of Banks, Mr. John Awuah pledged their commitment to assist entrepreneurs with substantial capital to develop and grow the SME sector.

He added that, the signing of the agreement with Government was a further proof that the private and public sectors could collaborate to the create value and entrepreneurship country that the country has been longing for.

“As a community of banks, we helped the Ministry of Finance to design a product that we believe will help propel businesses forward particularly younger and smaller businesses to move them to the next level. It is a positive development. We only must ensure that when it comes to the execution, we all come to the table in the manner in which the agreement had been signed,” he added.

Prince Adukwaw wins FBNBank’s Captain’s Prize Tournament

FBNBank’s Captain’s Golf Tournament held last Saturday at the Bok Nam Kim Golf Club ended with Prince Amo Adukwaw winning the Men’s title and Hajia Zenabu Akoto picking the Ladies’ award on a very competitive day of golf.

Good weather and a field of golfers numbering about 60 including others from Achimota, Celebrity and Obuasi Golf Clubs resulted in a very exciting competition at the Bok Nam Kim Golf Club under the sponsorship of FBNBank. To add to the excitement which went beyond the course, FBNBank’s Product Ambassador, Samini was present to cheer up the golfers and to try his hands at the sport.

Commenting on the competition, Colonel (Rtd) John A. Okai, Captain of the Bok Nam Kim Golf Club said, “It has been a very exciting and stupendous competition and we are very grateful to FBNBank for making all this possible. We are already looking forward to more collaboration in the future and I must say, I personally look forward to seeing them here next year. We need to strengthen our partnership and ensure that we continue to have a solid platform for the Bank

to be able to promote its business especially its engagement with its customers and other stakeholders. We have it all here already so we can confidently say that Bok Nam Kim Golf Club is ready to host an FBNBank-sponsored golf tournament the third consecutive time next year.”

The golf tournament also offered FBNBank a great opportunity to offer its Premium Banking proposition. The service which is founded on convenience and luxury was well received by the golfers and enthusiasts of the sport present. Staff of the Bank engaged in one-on-one sessions with players

and fans alike to explain the benefits of FBNBank’s Premium Banking.

Speaking after the event, Mr. Victor Yaw Asante, FBNBank’s Managing Director and Chief Executive Officer said, “our Premium Banking service has a lot in common with golf. Just as there is a particular type of club for each playing situation in golf, so does FBNBank’s Premium Banking offer a variety of services aimed at addressing each situation or need that a customer faces or has to address. All we offer is based on ensuring that our customers enjoy a great deal of convenience as they undertake finance-based actions.

The FBNBank’s Premium Banking proposition delivers a great lifestyle with priority service, comfort, security, luxury and access to financial advisory services as the benefits to customers. All these are offered through a unique relationship between the Bank and each customer.”

FBNBank’s Premium Banking is an invitation only banking experience that allows the Bank

to reward its discerning customers as they do business with the Bank. Once a customer is invited to Premium Banking, he or she is granted access to the Premium Banking Lounge in any of the Bank’s branches and is entitled to a host of banking privileges and the highest standards of quality service. The Premium Banking member is also assigned a dedicated Relationship Manager to cater to his or her banking needs.

FBNBank has been operating in Ghana for the past 26 years within which the bank has remained focused on putting its customers first. This, it has sought to do through the rich value and excellence of what the Bank contributes to the relationship with its stakeholders, particularly the customers. FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 128 years of operation. FBNBank Ghana has 22 branches and two agencies across the country with over 500 staff. FBNBank offers universal banking services to individuals and businesses in Ghana.

MONDAY, SEPTEMBER 26, 2022 | NEWS 3

IMF mission to visit Ghana from September 26 to October 7

An International Monetary Fund (IMF) staff team will be in Ghana from September 26 to October 7 to continue discussions with the government on policies and reforms that could be supported by a lending arrangement.

IMF staff will also further engage with other stakeholders during the visit.

The IMF team will be led by Stéphane Roudet, the Mission Chief for Ghana.

The last IMF mission to Ghana was between July 6 and July 13, 2022, to assess the economic situation and discuss the broad lines of the government’s Enhanced Domestic Program that could be supported by an IMF lending arrangement.

The IMF team met with Vice President Bawumia, Finance Minister Ofori-Atta, and the Governor of the Bank of Ghana.

The team also met with the Parliament’s Finance Committee, civil society organizations, and development partners, including UNICEF and the World Bank to engage on social spending.

Ghana is currently looking to secure a $3 billion loan from the IMF.

GRA rejects Auditor-General’s claim of GHS 3.26bn loss

The Ghana Revenue Authority (GRA) is refuting claim that the country has lost GHS3.26 billion as reported in the 2021 Auditor General’s report.

According to the GRA, the said amount, which was Energy Sector Levies, was not inculcated in the assessment conducted by the Audit Service in May 2022.

Florence Asante, Assistant Commissioner, Communication and Public Affairs, GRA, clarified the circumstances leading to the money being tagged “unaccounted”.

She explained further that the GRA furnished the Controller and Accountant General Department (CAGD) with provisional revenue figures for 2021 of GHS60.69 billion in March 2022, including Energy Sector Levies totaling GHS3.2 billion.

“In May 2022, the Audit Service conducted an audit of revenue collected by GRA in 2021 and arrived at a figure of GHS57.43 billion,” excerpts of the statement said, noting that but the aforementioned figure did

not take into consideration the Energy Sector Levies that GRA reports on such as Energy Debt Service, Energy Debt Recovery, Power Generation and Sanitation

figures were provided,” she mentioned.

Mrs. Asante stressed further that at GRA, no revenue was missing.

generated by different agencies did not necessarily show a loss of revenue to the Government.

Per the Auditor General in its 2021 report, the GRA and the Ministry of Finance reported a total tax revenue of GHS57.43 billion, the records of Controller and Accountant General Department showed a total tax revenue of GHS60 billion.

It, therefore, said that GHS3.26 billion was unaccounted for between the three institutions.

Providing details, the Auditor General noted that Direct and Indirect taxes reported by CAGD amounted to GHS27.7 billion (GHS27,709,806,120) and GHS32.9 billion (GHS32,979,232,570) respectively in the Government Accounts.

and Pollution levy.

“These levies totaling GHS3.2 billion were omitted from the Audit report even though the

Per an earlier explanation given by Dr John Kumah, the Deputy Minister of Finance, she indicated that the differences in data

It said that the amount, compared with GRA reported tax revenue of GHS27.6 billion and GHS29.8 billion for direct and indirect taxes respectively, resulted in an overstatement of tax revenue of GHS3.26 billion.

MONDAY, SEPTEMBER 26, 20224 | NEWS

Preparing for the next global catastrophe

By José Manuel Barroso

After two and a half years of lockdowns, quarantines, and mask mandates, billions of people around the world have returned to their normal lives. But in many ways, this newfound sense of post-pandemic normalcy is misleading. Beating COVID-19 will not mark the end of our current age of global instability, but rather the end of the beginning.

Of course, it is important to remember that the battle against COVID-19 is still far from over. More people have been infected in 2022 than in the previous two years combined, and while vaccines have brought down death rates, more than a million people worldwide have died this year after contracting the virus. And as governments begin to roll out updated booster shots, the world must brace itself for a major fall surge and the possible emergence of dangerous new variants.

But even if COVID-19 were to disappear soon, our goal must not be to return to the status quo ante. In the pre-pandemic world, governments and communities were woefully ill-prepared – not just for a deadly pathogen, but also for an explosive confluence of political and economic crises. If we continue to view the end of this pandemic as our only goal, the new normal will be just as fragile as the old one.

Global leaders should recognize that, far from being an outlier, the

pandemic might be a harbinger. Even as COVID-19 continues to spread, the likelihood of another pandemic increases by 2% each year. Moreover, the threat of new pandemics is just one of several looming catastrophes – including climate change, war, and food insecurity – that conspire to make social and economic stability a thing of the past. Simply put, the world is not prepared.

In any kind of crisis, the top priority should be to protect those who are most at risk. But as COVID-19 and climate change have demonstrated, the most vulnerable among us are often the first to be affected. And if adequate protection mechanisms are not introduced before a crisis strikes, the world’s poorest countries will most likely be the last to receive help.

The pandemic is a case in point. Instead of crafting an equitable global response in advance, leaders had to scramble to ensure that lower-income countries could get access to vaccines. Despite immense challenges, the COVID-19 Vaccine Global Access facility (COVAX) has been remarkably successful. So far, COVAX has delivered more than 1.75 billion vaccine doses to 146 countries. Of these, 1.5 billion went to 92 low-income countries. By January 2022, COVAX helped lower-income countries to achieve an average vaccination rate of 20%, enough to protect

the most at-risk groups.

But the next time we face a global crisis, we must act faster and more decisively. Crucially, any potential protection mechanism must be fully funded, or at least have pre-approved contingent funding in place, so that lowerincome countries have access to lifesaving countermeasures immediately. But developing an adequate global response also requires a change in mindset. Even now, as G20 leaders map out how to prepare for future pandemics, there are no detailed proposals that address how the world’s poorest economies will obtain vaccines.

Fortunately, COVAX itself provides a useful model for how to design future protection mechanisms. By treating the protection of the world’s most vulnerable as its primary objective, COVAX has helped ensure that 63% of older people and 75% of health-care workers in lower-income countries are fully vaccinated. Although the rollout could have been faster, the fact that 76% of the doses delivered to low-income countries have come through COVAX shows that hundreds of millions would have suffered without it.

But if COVAX had been created and fully funded before the pandemic, its impact could have been even greater. COVAX worked because it was built on global health networks that

were already in place and had the resources, expertise, and infrastructure to mount a rapid global effort. But that effort stretched these agencies to the limit. If these organizations had built-in surge capacity and contingency funding, the response could have been faster and more efficient.

The willingness to take risks is critical. With COVAX, officials secured billions of vaccine doses without knowing if those vaccines would work or how many doses would be needed. But the economic, social, and political repercussions of allowing millions of people to get sick or be displaced would have been far more costly.

Even though the COVAX model is not a one-size-fits-all solution for future calamities, it does offer useful lessons that could apply to crises beyond public health. For example, private-sector actors, led by Stripe, Alphabet, Shopify, Meta, and McKinsey, are exploring a Climate Advance Market Commitment that would promote and invest in climate solutions, based on COVAX’s innovative financing mechanism.

Whatever policies we put in place to prepare for future global crises, we must do so quickly.

Whether we like it or not, the next disaster is only a matter of time. Preparing for it must be our new normal.

MONDAY, SEPTEMBER 26, 2022 | AFRICAN BUSINESS 5

Latex Foam wins iconic brands award

High rated foam and mattress manufacturer, Latex Foam, has won again the iconic foam mattress brand award at the 9th Made-in-Ghana awards ceremony organised by the Entrepreneurs Foundation of Ghana.

The award is in recognition of the company’s continuous improvements in innovation and quality of its mattress and foamproducts as the best for the local market that meets international standards.

The award recognises and encourages the contributions of organisations to quality, excellence, and continuous improvements in products to meet customer satisfaction and promote Made-in-Ghana products to the wider Ghanaian public.

The Public Relations Officer of Latex Foam, Mrs Gifty E. Appiah in a post event interview on Friday evening, September

23, 2022, expressed happiness about the company’s recognition at the awards event, saying the award was in recognition of the company’s efforts to quality standards at all levels of the manufacturing processes.

“We are delighted at the recognition we have gained locally, especially coming at a time when customers want assurance of quality mattress and foam products on the local markets,” she stated.

In addition, she said, “This award will spur us on to deliver more quality products to our cherished customers.”

Going forward, Mrs Appiah disclosed, the company will continue to deliver optimum comfort and rest to buyers of “our products as the leading mattress and foam manufacturer in West Africa.”

In all, 25 organisations (brands) were rewarded at the event.

Some of the organisations that

received awards included Goil, Interplast, Ghacem Cement, Flora tissue, and GCB.

The annual awards ceremony is an initiative of Entrepreneurs Foundation of Ghana.

The mission of the Entrepreneurs Foundation of Ghana is to create and maintain an enabling entrepreneurship environment that promotes vibrant small and medium enterprises to enable them contribute to the growing of the Ghanaian economy.

Speaking at the ceremony, a Deputy Minister of Trade and Industries, Ms. Nana Dokua Asiamah Adjei reiterated that buying Made-in-Ghana products helps to grow the Ghanaian economy.

She therefore called on the Ghanaian manufacturing sector to help make Ghana, a manufacturing hub in the subregion.

She expressed the happiness that most of the companies

that received awards had gone the extra mile to improve upon their manufacturing processes, packaging and branding.

Ms Adjei said one of the major problems that confront many Ghanaian products in penetrating international markets was packaging and finishing.

She said government was aware of the challenges local manufacturing companies face and was working to resolve them in order to make the country the preferred business centre in Africa.

Some of the personalities that graced the occasion were the Maltese High Commissioner to Ghana, H.E. Jean Claude Galea Mallia; the Lebanese Ambassador to Ghana, H.E. Maher Kheir; Omanhene of Assin Owirenkyi Traditional Area, Ehunabobrim Prah Agyensaim VI; and the Chief Executive Officer of the Ghana Investment Promotion Centre (GIPC), Mr Ahomka Lindsay.

MONDAY, SEPTEMBER 26, 2022| NEWS6

Stanbic fostering SMEs’ growth in Volta Region

In Ghana, the private sector is dominated by Small and Mediumsized Enterprises (SMEs) with a little over 90% of the market share, according to the Registrar Generals Department. A research report by Ghanaweb, also shows that SMEs contribute an estimated 70% of Ghana’s GDP and make up approximately 85% of labour in the Ghanaian manufacturing industry.

Although SMEs have the potential to contribute greatly to national development, it is rather unfortunate that majority of them are saddled with numerous challenges that hinder them from expanding and growing as businesses, leading to their eventual collapse. Some of the major challenges faced by SMEs is lack of funding and inadequate infrastructure.

As part of the commitment to create value across the country, Stanbic continues to offer support to SMEs across the country. The Volta Region is one of the places with high potential for SME’s and business growth. In recent years, the region has launched initiatives to draw business and expose local business to the opportunities for

growth. Since Stanbic Bank began operating in the region in 2008, the bank has demonstrated its commitment to help SMEs in the region grow with tailor-made solutions.

A number of entrepreneurs in the region have attested to the immense support received from the bank and how it is helping transform their business outlook for the better. Mrs. Gloria Abio, the General Manager of Amenuveve Sogbor Company Limited, an SME which deals in the distribution of beverages in the region, shared how the bank had assisted them in scaling their businesses.

She said, “When Stanbic first came to the Volta region, we were one of the first people to partner with them. At the time our business began expanding, we noticed that our previous bank could not meet the services we needed. We needed working capital to continue to grow our business but we were not getting it. When we joined Stanbic, they received us warmly and gave us the capital we needed to continue our business and grow it as well.”

“Honestly, if Stanbic did not come through for us when they

did, I am certain that our business would have collapsed. We are still here today because of them. I am truly grateful to them for their support to us.” she added.

Ms. Linda Katsriku, Accountant for Rich Citi Mobile Enterprise in Ho, Volta Region, also shared how Stanbic helped them grow their business.

“When we started the business, we really needed financial support to grow. All the other banks we went to were not ready to help us but when we went to Stanbic they quickly provided us with the facilities we needed. With the help of Stanbic, we have continued to grow as a business and we are very grateful to them. Their loan facilities have really helped us to solve a lot of financial challenges which could have crippled the business. We are indeed grateful to them”, she noted Mrs. Malwine Amenu, the Branch Manager for Stanbic Bank Ho, discussed some of the challenges faced by SME’S in the region and shared the banks reason for lending a helping hand. She said, “The greatest problem SMEs in this part of the country face is funding. At Stanbic Bank

we always say, ‘Ghana is our home, we drive her growth.’ In driving Ghana’s growth, we realized that it was necessary to support local SMEs to grow. Stanbic has been in the Volta region since 2008 and during our time here we have contributed to the growth of a number of SMEs in the region. We have done this by granting facilities such as SME Loans, working capital and overdrafts to support their businesses. We also provide bancassurance services to provide the SMEs with insurance for their stores and goods. As a bank, we remain committed to providing these SME’s the necessary support they need to thrive as a business in any way we can.”

Creating value for all stakeholders remains an imperative objective for Stanbic bank as part of their mission to drive national growth. The bank continues to provide the necessary financial assistance and accessible loan facilities to businesses across the country in need to show that with Stanbic, it can be.

Fitch downgrades Ghana to CC from CCC

Fitch Ratings has downgraded Ghana’s Long-Term Local- and Foreign-Currency Issuer Default Ratings (IDRs) to ‘CC’, from ‘CCC’. The downgrade reflects the increased likelihood that Ghana will pursue a debt restructuring given mounting financing stress, with surging interest costs on domestic debt and a prolonged lack of access to Eurobond markets.

“There is a high likelihood that the IMF support programme currently being negotiated will require some form of debt treatment due to the climbing interest costs and structurally low revenue as a percentage of GDP,” Fitch said in the rating action commentary.

“We believe this will be in the form of a debt exchange and will qualify as a distressed debt exchange under our criteria. The government has not confirmed or denied press reports that Ghana is preparing to negotiate a restructuring. Interest costs on external debt are lower than for domestic debt and near-term external debt amortisations appear manageable. However, we believe there could be an incentive

to spread a debt restructuring burden across domestic and external creditors and therefore do not have a strong basis to differentiate between Foreignand Local-Currency ratings at this time”.

Fitch said there was “a high

likelihood that the IMF support program currently being negotiated will require some form of debt treatment due to the climbing interest costs and structurally low revenue as a percentage of GDP”.

“The most recent IMF debt

sustainability analysis, conducted in 2021, found Ghana at a high risk of debt distress and vulnerable to shock to market access and high debt servicing costs. Interest costs have risen substantially since then.”

MONDAY, SEPTEMBER 26, 2022 | NEWS 7

Zoomlion committed to offer tailor-made solutions to waste management – Dr Agyepong

The Executive Chairman of the Jospong Group of Companies, Dr Joseph Siaw Agyepong, has assured that Zoomlion Ghana Limited remains committed to deliver tailor-made solutions towards an integrated waste management system in the country.

In view of the above, he said plans were already underway by his company to expand its recycling and composting facilities across its areas of operations from 3,000 tons a day to 10,000 tons a day.

This, he maintained, will enable the country to effectively manage waste.

He pledged that the private sector will continue to support the government in its efforts to improve upon sanitation in the country.

According to Dr Agyepong, the government has been instrumental in the construction of the sixteen (16) state-of-theart integrated recycling compost plants (IRECoP) in the16 regions, all in an effort to deal with waste.

He, therefore, commended President Nana Addo Dankwa Akufo-Addo for encouraging the

private sector to be active players in his government and for them to contribute their quota to the development of Ghana.

Dr. Siaw Agyepong was delivering a presentation at a two-day stakeholder engagement workshop organised by the Ministry of Sanitation and Water Resources (MSWR) with support from UNICEF on Friday, September 23, 2022, in Accra.

In his presentation on Private Involvement in the Sanitation Subsector Performance 2018 -2021 and Outlook Performance for 2022-2025, he admitted that the 16 IRECoPs could not have been made possible without the “active involvement” of the Minister for Sanitation and Water Resources, Honourable Mrs. Cecilia Abena Dapaah,

He said the sanitation minister also played a crucial role in a 16-million Euro facility given to his group by Hungary which was used in the construction of waste management facilities in the 16 regions.

The minister of sanitation and water resources also helped in the country’s fight against the Covid-19 pandemic via disinfection and

distribution of one million bins, he added.

However, to achieve greater results and sustain the gains made in the sector, Dr. Siaw Agyepong reiterated the need for the involvement of all stakeholders in the sanitation space.

“I’ll urge each and everyone to help maintain a serene environment adding that you can’t do away with poverty if you don’t deal with water and sanitation,” he advised.

The Minister of Sanitation and Water Resources, Mrs. Cecilia Abena Dapaah, strongly called for the protection of the country’s water bodies.

She said this was crucial, especially in the light of the fact that these water bodies serve as sources of potable water for Ghanaians.

According to the minister, her ministry will build more public places of convenience across the country as part of measures to stop the practice of dislodging feaces into water bodies.

“…and it is my prayer that by 2030, Ghana would be where it’s supposed to be in terms of sanitation,” she optimistically

expressed.

She underscored that her ministry takes the issue of water and personal hygiene very seriously.

She went on to give a firm assurance that the MSWR was ready to upscale sanitation concerns nationwide, adding that measures had already been put in place to support good environmental practices in schools in the country.

Waste, she said, was wealth, and therefore, urged Ghanaians to engage in recycling of waste.

She also reiterated that her ministry will continue to collaborate with other sectors and institutions to make the President’s vision of making Accra the cleanest city in Africa come to fruition.

She disclosed that the water policy was ready to be validated, and thus pleaded with the Ghana Water Company Limited (GWCL) to extend pipe-borne water to rural dwellers.

On this score, Mrs. Dapaah heaped praises on donor partners such as UNICEF for supporting her ministry.

MONDAY, SEPTEMBER 26, 20228 | NEWS

MONDAY, SEPTEMBER 26, 2022 | FEATURE 9

The Giving Capsules: Let’s take the SDG pledge together. Part 2

By Baptista S. H.Gebu (Mrs.)

By Baptista S. H.Gebu (Mrs.)

Let’s take the Sustainable Development Goals pledge together. Pledge with me to make sustainability a priority personally. Pledge with me, “I understand that my actions, behaviors, and choices make an impact on the society, environment, and our economy. I pledge to make intentional choices that will benefit the quality of life for myself and advocate for choices that benefit the lives of others”. Don’t only be awesome in life, learn to #beHumane.

Every 21 September was Kwame Nkrumah Memorial Day in Ghana. This holiday commemorated the birthday of Ghana’s main independence leader, first prime minister, and first president, Osagyefo Dr. Kwame Nkrumah. He was one president that believed so much in Africa. To this end, it’s great to know of the African Unions agenda 2063 as visibility on it is low compared to the SDG. Look out for a special feature - the Africa we want is possible, lets form it together.

Ghana recently launched its 2022 Voluntary National Review (VNR) report on the Sustainable Development Goals (SDG’s). The 1992 constitution of the Republic of Ghana provides the expectations from government, citizens, and other entities on what should be accomplished by the state. These expectations make room for human rights, balanced development, environmental protection, international affairs, among others. According to the report, a total of 102 indicators were assessed in the 2022 VNR compared to 66 in the year 2019.

World leaders declared the period 2020 to 2030 as the Decade of Action for the Sustainable De¬velopment Goals (SDGs) in September 2019.

According to His Excellency Nana Addo Dankwa Akufo-Addo, President of the Republic of Ghana in his opening remarks read on his behalf; He cherished strongly the hope that this would trigger the rapid scaling-up of sustainable solutions needed to address the critical challenges facing our world. Unfortunately, few months after this historic declaration, our world was hit by the devastating COVID-19 pandemic, pushing us into “unchartered territory”, while fear and sheer terror gripped many.

The pandemic since have had a devastating effect on lives, livelihoods, global supply chains, businesses, and significantly eroded the development gains made over the last decade and the prospects of achieving the SDGs have become more daunting, but he dare say that giving up is not an option for Ghana. As the world re-opens up and begins to recover from the deleterious effects of the pandemic, the SDGs have, become even more relevant as they present us with a credible pathway for a prosperous, inclusive, resilient and peaceful world. Continuing from previous publication…

What then is the status of the indicators as reported in the 2022 VNR on the SDG’s?

SDG goal six is looking at ensuring availability and sustainable management of water and sanitation for all. According to the report, access to improved drinking water sources has improved from 87.7% to 92.2% an indication Ghana is on the path to achieving is national target of equitable access to basic drinking water services by 2025. Interestingly the two main sources of water are sachet water (51.5%) and pipe-borne (33.5%) for urban and borehole/tube well (33.6%) and pipe-borne water (28.8%) for rural. What will become of this progress with an increase in utilities seeing sachet water earmarked to be sold at GHC0.50 per sachet with immediate effect? Greater Accra, Bono, Upper West, Ashanti and Central regions are said to have almost achieved universal access whiles Northern, Oti, North East and Savannah still lacks access to improved water sources.

Sanitation is equally a great issue of interest, household toilet coverage according to the report also increased from 46% in 2010 to 59.3% in 2021 and for both periods access to toilets was higher among urban than rural households. Households using public toilets have declined by 12% to 23% from 35% in 2021 and same for open defecation from 19% to 17.7%. What then are the emerging issues for consideration; For Ghana to achieve the target of ending open defecation by 2030, it will require an average annual reduction of about 2% of population without toilet facilities. More than 45% of households are

still without toilet facilities and the progress towards ending open defecation is slow. Data from the 2021 population and housing census (PHC) revealed 70.6% of households still dispose-off waste water on the ground and on the street and outside. This practice is common in rural (88.9%) than urban (58.7%) areas with only 2.3% households relying on sewerage system for waste water disposal. With water systems, discharge of wastewater by soak away is common in Greater Accra region (17.8%) the practicing of throwing water on the ground is more common in Bono East region (89.3) by regional segregation. There is equally slow progress to achieving the very high scale of integrated water management. Our water basins and water quality are also affected with activities of illegal mining, uncontrolled pollution and dumping of refuse into river bodies.

SDG goal seven is to ensure access to affordable, reliable, sustainable and modern energy for all. Ghana is on track to achieving the universal access to electricity with 86.3% of the population said to be connected to the national grid in 2021. Urban population used about 95.2 % of electricity as main source of lighting in 2021 and 72.6% for rural areas for 2021. Greater Accra region continues to enjoy the highest electricity coverage (96.1%) whiles Upper East region has the least (57.0%).

The proposition of urban (51.3%) and rural (14.8%) households using gas (LPG) as their primary cooking fuel increased according to the report whiles the proposition of households using electricity as the main source of cooking declined from 0.5% in 2010 to 0.4% in 2021. Interestingly enough, the use of charcoal and wood has remained the main cooking fuel for more than half of the total population translating into a 54.3%.

The electricity generation mix in Ghana is approximately 34.1% for hydro as against 65.3% for thermal and a further 0.6% for renewables. Renewable energy share of the total final energy consumption has seen a decline from 42.7% in 2019 to 39.6% in 2021.

What then are the emerging issues for consideration; the increasing cost of Liquified Petroleum Gas (LPG) is a challenge. Media reports

on price hikes has it that; in January 2022 a kilogram of LPG sold at GHC8.93 totaling a GHC129.49 for a 14.5 kg then in May 2022 the same commodity sold for GHC11. 18 for a kilogram, this means GHC162.11 will be the total cost for the same 14.5kg. Its September 2022 now, can you imagine the cost as we approach the yelitude? Switch back to charcoal will affect the level of progress however the heightened economic situation could compel more people to opt for charcoal in a bit to managing the tough times.

The situation that more than half of household population depends still on wood fuel and charcoal means is of great concern. Further issues includes the gradual improvement in the share of renewables in energy generation mix, decreasing cost of solar panels, continuous disparity in access to electricity between the northern and southern parts.

Earlier publication reviewed progress made for SDG goals one to 6. Subsequent editions will review the other SDG goals to include; goal 8 - promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all. Goal 9 - build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation. Goal 10 - reduce inequality within and among countries. Goal 11 – make cities and human settlements inclusive, safe, resilient and sustainable. Goal 12ensures sustainable consumption and production patterns. Goal 13 - take urgent action to combat climate change and its impacts. Goals 14- conserve and sustainably use the oceans, seas and marine resources for sustainable development. Goal 15- protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss. Goal 16 –promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels.

Goals 17-strengthen the Means of Implementation and Revitalize the Global Partnership for Sustainable Development.

Baptista is a Hybrid Professional and the Executive Director of ProHumane Afrique International. ProHumane is a charitable, development & think thank organization working with communities & individuals to create sustainable solutions to transform communities through diverse pro-poor initiatives. Pro-poor initiatives are initiatives that help to alleviate poverty. Baptista is a realist, affable, simple and humane. You can reach us via e-mail on prohu maneafrique@gmail.com and follow this conversation on all our social media sites: Linked-In/ Twitter/ Facebook/ Instagram: ProHumane Afrique International. Call or WhatsApp: +233(0)262213313. Hashtag: #behumane #thegiv ingcapsules #prohumaneafriqueint #fowc

MONDAY, SEPTEMBER 26, 202210 | FEATURE

MONDAY, SEPTEMBER 26, 2022 11| NEWS Tel: +233 (0)302 21 6000 www cbg com gh cbgbankltd CBG Controller Loan • Eric Oppong-Johnson - 0596912267 • Samuel Asewe - 0556493505 • Get up to GH¢250,000 • Tenor - 72 Months • Fix rate throughout the loan tenor • No penalty for early pay off • Buy off other loans FEATURES • Mandate Pin • Competitive interest rate • Mandate Number • Settlement quotation (applicable to pay off) REQUIREMENTS (CONTROLLER)

Ursula touts business opportunities in Ghana to Canada investors

Minister of Communication and Digitalisation, Ursula OwusuEkuful, has told all diasporans, other nationals and Canadian organisations to take charge of the several business opportunities in Ghana and direct their investments into the country.

The Minister who described Ghana as the “land of golden opportunities” said, there are several opportunities available which makes a better investment destination of choice than its counterparts on the continent.

According to her, organisations in Canada should make it their priority to partner Ghanaian firms, some of whom she said already have footprints on the continent, to export goods and services across Africa and beyond.

The Ablekuma West lawmaker made this known when she was speaking at the Ghana-Canadian Investment Summit (GCIS) in

Toronto, Canada, organized by the Ghana Investment Promotion Center (GIPC) designed specifically to engage the Ghanaian Diaspora in order to attract long-term investments and partnerships for Ghana’s development.

“Ghana is the second most visited country on the African continent for African diasporans in Canada. This means that there are several investment opportunities in Ghana for the African diaspora, and as it stands, we have just scratched the surface. Ghana’s investment climate is favorable, provides for an enabling environment that is suitable for investment in ICT, especially with several companies around the world rushing in to set up their businesses in Ghana. I want to entreat you all diasporans, other nationals and Canadian organisations to come to Ghana

and invest in the land of golden opportunities” she said.

She reteritated the point for the Ghana-Canada relationship to develop to higher heights for progress and sustainable development to be sustained.

“Ghana has had cordial relations with Canada spanning over six decades. Over the years, the bond has been strengthened through our shared values, commonwealth and diplomatic camaraderie and bilateral trade.

As fate would have it, the two countries even share a common National Day of July 1. Ghana has been a strategic partner with a substantial number of Ghanaian professionals and businesses in Canada keenly contributing to developing Canada’s economy” she added.

The GCIS brought together delegates from the international investor community, especially

from Canada, venture capitalists, private equity fund managers, among others.

The participants discussed and explored viable investment opportunities within various sectors of the Ghanaian economy.

There were also collaborations with the Diaspora, Canadian investors and local entrepreneurs and the creation of awareness of the potential of Diaspora Direct Investment and the need to increase trade between Ghana and Canada.

Also present at the Summit were a number of state officials, including the Ministers of Foreign Affairs and Regional Integration, Shelly Ayorkor Botcwey, the Minister for Tourism and Culture, Dr Awal Ibrahim Mohammed, GIPC boss, Yofi Grant and other well-known dignitaries.

MONDAY, SEPTEMBER 26, 202212 | NEWS

MONDAY, SEPTEMBER 26, 2022 13| NEWS

Adom City Estate wins moreawards as leader in affordable housing in Ghana

By Daniel Kontie

By Daniel Kontie

“There is no place like home, home sweet home, when I go south west east and north, I will always come back home,” these were the words of the late Nigerian Reggae Gospel legend Evi-Edna Ogholi in her song titled “No place like home” in 1988. One would wonder why such a quote to begin with, this is because shelter is a basic need of every man.

This underscores how important it is for every man to own a decent home and which the Ghanaian is not an exception.

History will tell us how housing has been a concern of the state since independence which led to the establishment of the Tema Development Corporation and the State Housing Corporation by the first President of Ghana and the subsequent entry of many investors in the real estate industry after the collapse of Kwame Nkrumah’s communist government. This witnessed many entries into the Ghanaian real estate industry by both Ghanaians and multinational investors.

All these interventions notwithstanding, the housing deficit keeps widening interestingly with time till date. Driven by the passion to see people own and live comfortably in a decent home, the Chief Executive Officer of the Adom Group of Companies Dr. Bright Adom, took it upon himself to enter into the real estate industry leading to the birth of Adom City Estate in 2009. Since inception, the company has built and sold close to 2,000 housing units putting shelter over the heads of many including multinationals in gated communities across the Greater Accra and Central Regions of Ghana. These gated communities are located in prime areas in Tema Community 25, Kasoa Estate Junction, Shai Hills on the Akosombo road, Kutunse on the Kumasi road and Appolonia City on the Dodowa-Oyibi road.

The Adom brand since 2015 has become the market leader in the real estate industry particularly in the affordable housing bracket in Ghana. This is not by accolades

as it has proofs of both national and international recognition by way of awards coupled with an indisputable client satisfaction testimonial in Ghana and beyond as well as the general public’s admiration of the Adom brand. These awards to list a few include: Best Developer, Mass Social Housing – African Property Awards, 2021 – 2022, 5times consecutive winner, Residential Developer of the year – Mass Housing Category from 2015 to 2019, Residential Developer of the year - Low Income Housing Category – Ghana Business Standards Awards 2021, Residential Developer of the year, Mass Housing Category – Ghana Business Standards Awards 2019, Real Estate Company of the year, CENBA AFRICA Business Excellence Awards, 2019, 1st Runner-up, Mass Social Housing - Africa Property Investment Summit and Awards, 2017 and last but most recent is the award won at the Africa Real Estate Conference and Expo (ARCE) - Leadership in affordable Housing in Ghana, 2022, organized

in partnership with the Ghana Real Estate Professionals Association – The only awards Adom City Estate could not win were those which were never held in the first place comically speaking. This is to wit Adom City Estate in no doubt would have won the Ghana Property Awards 2020 and 2021 if awards were held considering the trajectory.

All these awards could not have come as a surprise because the Adom brand have been so resilient and has become the cynosure of all eyes of individuals, the state and as well as industry stakeholders by virtue of the contemporary touch we give to designing and building of our houses as well as the quality we deliver taking into cognizance the taste, preferences and affordability of clients and prospective clients of our generation and for posterity at large. Be on the watch out in the next few weeks for more ground breaking innovations. Adom City Estate, Still the Pride of Housing. Stay tuned.

MONDAY, SEPTEMBER 26, 202214 | NEWS

The sting of climate risk is in the tails

By Mark Cliff

Scientists have longed warned that climate change will adversely affect weather patterns and living conditions around the world. These warnings are now turning into a painful reality. Worse, the range of possible outcomes has proven to be increasingly “fat-tailed”: extreme weather events such as heatwaves, severe storms, and floods are more likely than normal statistical distributions would predict.

None of this bodes well for future political stability or economic prosperity. Our best hope is that the sharp sting in these tails will goad us into the necessary remedial action before things get even worse. But will it?

The public is increasingly aware that global warming is leading to more volatile weather. There have been record-setting heatwaves around the world this year, not just in India – where temperatures reached 49.2° Celsius (120.5°F) –but also in places like the United Kingdom (40.2°C). France and China are experiencing their worst droughts on record, and four consecutive years of failed rainy seasons in eastern Africa have put more than 50 million people at risk of “acute food insecurity.” Meanwhile, devastating storms and floods have hit Madagascar, Australia, the United States, Germany, Bangladesh, and South Africa.

These events are causing hundreds of thousands of deaths

and enormous economic and financial damage each year, making weather volatility an increasingly important factor in risk assessment. Whereas temperature increases of 0.5°C here or there are barely perceptible, droughts, floods, and other short-term weather fluctuations can wreak deadly havoc.

Moreover, extreme weather events can cause changes that last far beyond the immediate shock and damage, especially when they accelerate developments that might otherwise have taken many years. Scientists are increasingly worried about “tipping points” – such as the melting of polar ice sheets – that would carry us across thresholds of irreversible change. That could create damaging feedback loops between interconnected climate risks, all of which would spill over into the real economy, driving defaults, job losses that disproportionately harm disadvantaged communities, and political turmoil.

Aside from the damage to the physical environment, extreme weather may therefore trigger abrupt and sometimes permanent shifts in social attitudes and public policy. When people start losing their homes, livelihoods, or even their lives, politicians must respond.

Surprisingly, while we are all acutely conscious of extreme weather, forecasters still widely

overlook its role in accelerating structural changes. Mainstream climate scientists and economists tend to focus on the longer-term effects of climate change brought about by global warming, with an emphasis on scenarios involving global average temperature increases in the range of only 1.5°C-2°C – the targets enshrined in the Paris climate agreement. And even in higher-temperature scenarios, it is assumed that the effects – on sea levels and agricultural output, for example – will accumulate only gradually, implying that the ultimate reckoning is several decades away.

But a recent paper – “Climate Endgame: Exploring Catastrophic Climate Change Scenarios” – shows that this conventional scenario analysis gravely understates the long-term risks, because it fails to give the more extreme climate outcomes (the fat tails) the attention they deserve. As the statistician Nassim Taleb has pointed out in the context of financial markets, conventional models struggle to handle the consequences of fat-tail events, creating a dangerous blind spot in their outlook.

Higher temperature pathways would unleash what the authors call the “four horsemen” of the climate endgame: famine and malnutrition, extreme weather, conflict, and vector-borne diseases. It does not take much imagination to see how this herd of apocalyptic

harbingers might create social and political chaos, especially when they are all galloping together – as is already the case today with the global food crisis, a new war in Europe, and the ongoing pandemic. Worse, the mention of the second horseman suggests that the more immediate risks of climate change are still being underplayed. After all, extreme weather is also a driver of the other three horsemen, making it arguably the most important.

Weather shocks cause suffering that grabs society’s attention far more than abstract (though no less warranted) warnings of long-term doom. Polls show that support for climate action is greater for those who have personally experienced extreme weather. Although the current upsurge in inflation means that people are less enthusiastic about measures that would hurt their own finances, the growing incidence of disasters is shrinking the minority that remains skeptical of climate change or climate policies altogether.

In this way, the fat tails of the weather – rather than the fat tails of long-term climate change – are far more likely to prompt action within the shorter time horizons that preoccupy politicians and business. Let us hope that as the stings from these tails become ever more common and painful, they will spur us to sustain the policies necessary to keep the climate horses in their stable.

MONDAY, SEPTEMBER 26, 2022 15| FEATURE

Will Ghana attract two million tourists by 2024?

The President of the republic of Ghana Nana Addo Dankwa AkufoAddo has officially opened the National Museum Gallery which was closed for refurbishment in 2015. Prior to its closure, a Business &Financial Times reportage informed us all that both local and foreign tourists were shunning museums in the country due to their poor state and inadequate artefacts – with one Ghanaian visitor to the National Museum calling it a “national disgrace” “The national museum is a disgrace to the nation for such an educational edifice to be neglected. Many of the things in there are so primitive and only highlight certain cultures, and that does not speak well of us’. Fortunately, government decided to refurbish the museum and it is back to its best. The facility, located on the premises of the Ghana Museums and Monuments Board in Adabraka, Accra, had not seen any major refurbishment since it was first opened in 1957 in commemoration of Ghana’s Independence Day. Some additions have been made to the already existing things to see. Let’s all take for hours off and visit the National Museum. That will also be our little way of supporting domestic tourism.

During the launch, The President challenged the Ministry of Tourism and Creative Arts and it implementing agencies to work towards achieving 2 million international arrivals by 2024, with expected revenue of $4 billion by the year 2024. This is indeed a daunting task put upon the ministry. Less than two years to work towards doubling the numbers we enjoyed prior to COVID-19 pandemic. No matter how ambitious this target may be, I’m somehow skeptical this target may be achieved.

Below are some of the possible reasons.

1. We have been affected by COVID-19 pandemic since 2019 and a rebound is just on the horizon. Tourism expects predicted that the rebound may not really take place until the middle of 2023. The COVID-19 pandemic reduced international travel by 80 % according to figures provided by UNWTO. A vaccine has been put in place and tourists are gradually gaining confidence and many nations have come to accept the fact that we may have to live with COVID-19. Many international tourists may still not perceive Africa and Ghana as the safest place to visit yet and may prefer taking tours closer to them despite a vaccine being in place. A reasonable alternative is intra-Africa tourism which is still not very successful on the

continent and there are many reasons. One which comes to mind immediately is the fact that there is still a large part of the population struggling to make ends meet and are unable to earn a discretionary income. Tourism is perceived as an expensive activity on the continent and that may deterred many Africans. Africa’s working class do not also enjoy paid up holidays entitlements as part of their working conditions.

2. With international growing economic hardship and the increases in fuel prices globally, I cannot foresee a drastic increase in the number of arrivals in Ghana. According to statistics from UNWTO, Africa enjoyed 5% of all international arrivals and on the African continent, some of the top receiving countries include South Africa, Kenya, Morocco, and Egypt. Ghana needs to compete with these top preferred destinations which will become difficult even more difficult. The WTTC’s latest annual research shows that Following a loss of almost

slow the rebound could be.

3. According to the UNWTO report, the number one reasons for travel and tours to Africa are for wildlife, followed by culture and Heritage. When it comes to wildlife, Ghana is at a disadvantage compared with other competing countries on the continent and that becomes a challenge. Culture and heritage is the preferred advantage for Ghana yet the greatest success was during the year of return and the best we could achieve was a little over 1 million. With many tourist having lost their jobs and incomes having been affected especially in North African which is the number one generating country according to data from WTTC, It will becomes difficult increasing the numbers to 2million unless something unexpected happens.

4. Many countries who have developed their tourism and succeeded have depended on domestic spending. A WTTC report further revealed that, domestic tourism continues to represent about 73% of the

are still not easily accessible due to the nature of the poor roads and to achieve our target a facelift of roads leading to all major attractions will need to be considered.

6. One reason why Europe enjoys more than 50% of all international arrivals is due to the well-developed transportation system. This makes traveling easy and affordable. Tour Operators are thus able to package very affordable tours. On the contrary, connecting flights on the African continent is very cumbersome and expensive. Until this challenge is resolved, a large number of African and international tourists will be dissuaded.

7. The top tourism generating countries to Ghana per the latest report from WTTC indicate as follows;

• United States 32%

• Nigeria 18% 3.

• United Kingdom 13%

• Côte d’Ivoire 9%

• Germany 7%

We therefore have two from West Africa, two from Europe and The USA. The US market is dominated

by US$1 trillion (+21.7% rise) in 2021.

• In 2019, the Travel & Tourism sector contributed 10.3% to global GDP; a share which decreased to 5.3% in 2020 due to ongoing restrictions to mobility. 2021 saw the share increasing to 6.1%.

• In 2020, 62 million jobs were lost, representing a drop of 18.6%, leaving just 271 million employed across the sector globally, compared to 333 million in 2019. 18.2 million Jobs were recovered in 2021, representing an increase of 6.7% year-on-year.

• Following a decrease of 47.4% in 2020, domestic visitor spending increased by 31.4% in 2021.

• Following a decrease of 69.7% in 2020, international visitor spending rose by 3.8% in 2021. The above data shows how

between countries, domestic contributions to Travel & Tourism reached 94% in Brazil and 87% in India, Germany, China and Argentina; with China accounting for 62% of global absolute growth in domestic spending over the past ten years. This growth has enabled China to climb from fourth position in 2008 to the top spot, overtaking the USA to become the largest domestic travel market in the world. Unfortunately for Ghana domestic spending is still not encouraging. Local tourists hardly make use of paid up accommodation especially on travels for funerals.

5. Government intend refurbishing a number of tourist site which is a good initiative, however the success of any destination is dependent on the 3As i.e. attractions, amnesties, and accessibility. Many attractions

by the diaspora who visit mostly for heritage tourism. We need to ensure that we grow the Nigeria and Cote d’ivoire market if we are to increase our arrivals. These are our neighbors and we must take advantage and also tap into the East African and Southern African Markets.

Philip Gebu is a Tourism Lecturer. He is the C.E.O of FoReal Destinations Ltd, a Tourism Destinations Management and Marketing Company based in Ghana and with partners in many other countries. Please contact Philip with your comments and suggestions. Write to forealdestinations@gmail. com / info@forealdestinations. com. Visit our website at www.forealdestinations. com or call or WhatsApp +233(0)244295901/0264295901.

Visist our social media sites Facebook, Twitter and Instagram: FoReal Destinations

MONDAY, SEPTEMBER 26, 202216 | NEWS

MONDAY, SEPTEMBER 26, 2022 17| FEATURE

WEEKLY MARKET REVIEW FOR WEEK ENDING - SEPTEMBER 16, 2022

MACROECONOMIC INDICATORS

Q3, 2021 GDP Growth 3.3%

Average GDP Growth for 2021 3.3%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 22.0%

Weekly Interbank Interest Rate 22.05%

Inflation for February, 2022 33.9%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 5.0%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 393.4%

Debt to GDP Ratio – Dec, 2021 78.3%

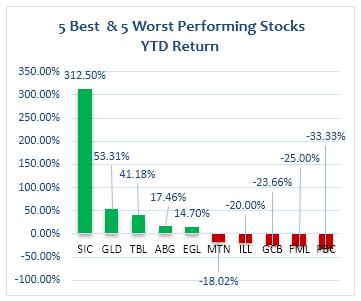

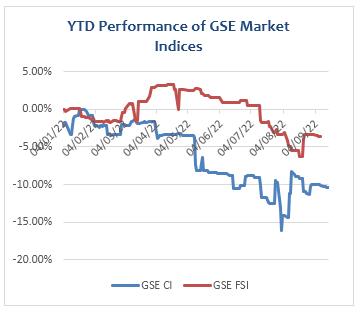

STOCK MARKET REVIEW

The Ghana Stock Exchange closed lower for the second consecutive week on the back of price declines by 7 counters. The GSE Composite Index (GSE CI) lost 8.49 points (-0.34%) to close at 2,499.90 points, reflecting year-to-date (YTD) loss of 10.38%. The GSE Financial Stocks Index (GSE FI) also lost 5.52 points (-0.27%) to close at 2,073.33 points, reflecting YTD loss of 3.65%.

Market capitalization declined by 0.13% to close the week at GH¢64,401.07 million, from GH¢64,482.54 million at the close of the previous week. This reflects YTD decrease of 0.15%.

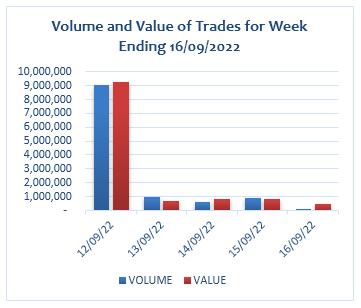

Trading activity recorded a total of 11,666,517 shares valued at GH¢12,084,263.04 changing hands, compared with 3,030,863 shares, valued at GH¢7,592,049.55 in the preceding week.

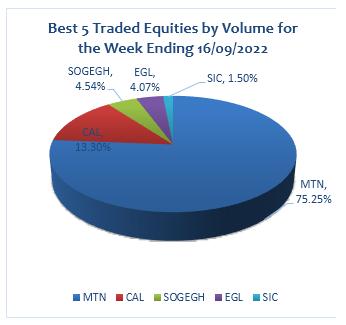

MTN dominated both volume and value of trades for the week, accounting for 75.25% and 66.11% of shares traded respectively.

The market ended the week with no advancer and 2 decliners as indicated on the table below.

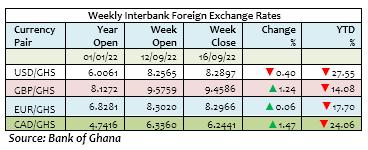

THE CURRENCY MARKET

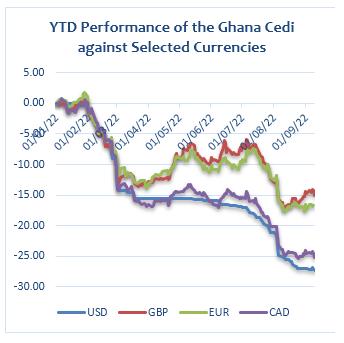

The Cedi continued its downward trend against the USD for the week. It traded at GH¢8.2897/$, compared with GH¢8.2565/$ at week open, reflecting w/w and YTD depreciations of 0.40% and 27.55% respectively. This compares with YTD depreciation of 1.64% a year ago.

The Cedi however strengthened against the GBP for the week. It traded at GH¢9.4586/£, compared with GH¢9.5759/£ at week open, reflecting w/w gain and YTD depreciation of 1.24% and 14.08% respectively. This compares with YTD depreciation of 2.36% a year ago.

The Cedi also strengthened against the Euro for the week. It traded at GH¢8.2966/€, compared with GH¢8.3020/€ at week open, reflecting w/w gain and YTD depreciation of 0.06% and 17.70% respectively. This compares with YTD appreciation of 2.67% a year ago.

The Cedi again strengthened against the Canadian Dollar for the week. It opened at GH¢6.3360/C$ but closed at GH¢6.2441/C$, reflecting w/w gain and YTD depreciation of 1.47% and 24.06% respectively. This compares with YTD depreciation of 1.52% a year ago.

MONDAY, SEPTEMBER 26, 202218 | MARKET REVIEW

GOVERNMENT SECURITIES MARKET

Government raised a sum of GH¢1,929.78 million for the week across the 91-Day, 182-Day and 364-Day Treasury Bills. This compared with GH¢2,226.45 million raised in the previous week.

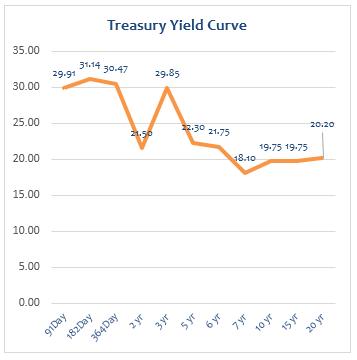

The 91-Day Bill settled at 29.91% p.a from 29.48% p.a. last week whilst the 182-Day Bill settled at 31.14% p.a from 30.05% p.a. last week. The 364-Day Bill settled at 30.47% from 30.03% at last issue. The table and graph below highlight primary market yields at close of the week.

COMMODITY MARKET

Crude Oil prices edged lower on the week pressured by expectations of weaker global demand and by US dollar strength ahead of possible large increases to interest rates, though supply worries limited the decline. Brent futures traded at US$91.10 a barrel on Friday, compared with US$92.84 at week open. This reflects w/w loss and YTD gain of 1.87% and 17.13% respectively.

Gold prices dropped on the back of expectations of more sharp interest rate hikes by the Federal Reserve, coupled with a stronger dollar. Gold settled at US$1,668.15, from US$1,728.60 last week, reflecting w/w and YTD losses of 3.50% and 8.77% respectively.

Prices of Cocoa also declined for the week. The commodity traded at US$2,354.50 per tonne on Friday, from US$2,360.00 last week, reflecting w/w and YTD loss of 0,23% and 6.57% respectively.

INTERNTIONAL COMMODITIES PRICES

ABOUT CIDAN

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

RESEARCH TEAM

Name: Ernest Tannor Email:etannor@cidaninvestments.com Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com Tel:+233 (0) 24 499 0069

CORPORATE INFORMATION

CIDAN Investments Limited CIDAN House Plot No. 169 Block 6 Haatso, North Legon – Accra Tel: +233 (0) 26171 7001/ 26 300 3917 Fax: +233 (0)30 254 4351

Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

Disclaimer

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Copyright @ 2019 Business24 Limited. All Rights Reserved. Limited

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

BUSINESS TERM OF THE WEEK

Money Manaer: A money manager is a person or financial firm that manages the securities portfolio of an individual or institutional investor. Typically, a money manager employs people with various expertise ranging from research and selection of investment options to monitoring the assets and deciding when to sell them.

In return for a fee, the money manager has the fiduciary duty to choose and manage investments prudently for clients, including developing an appropriate investment strategy and buying and selling securities to meet those goals. A money manager may also be known as a “portfolio manager,” “asset manager,” or “investment manager”.

Source: https://www.investopedia.com/terms/m/ moneymanager.asp

Advertising / Sales: +233 24 212 2742

MONDAY, SEPTEMBER 26, 2022 19| MARKET REVIEW

Slamm Foundation launches Nimde3 App that teaches IT skills in local languages

Slamm Foundation, the CSR arm of Slamm Technologies, an IT firm that offers IT Support, Career Services, and Corporate IT Training, has launched Nimde3, a free IT training mobile application that aims at providing on-demand IT lessons to individuals across the world but more specifically in Ghana and Africa via several local languages.

The launch of the app follows Slamm Foundation’s pledge some two years ago to train one million Ghanaians and Africans in a range of topics including: cybersecurity, IT fundamentals, social media, and PC repair to position them take advantage of the jobs of today and tomorrow.

Executive Director of Slamm Foundation, Francisca Boateng said the app will offer a wide variety of lessons to users.

“The app is available to everyone and can be downloaded both on the IOS and the Play store. We have classes from basic, intermediate and advanced levels and these classes can be taken in different languages ranging from, Akan, Dagbani, Ewe, Hausa, English, Spanish, French, Igbo and Yoruba. Anyone that falls under these categories and languages can

access it or even in any language they prefer and learn basic IT training,” she said.

She revealed that more languages will be introduced to increase participation adding that an audio version will also be introduced to serve the purpose of people who would prefer to listen to these courses in their preferred languages.

“As time goes on, we seek to introduce more languages in order to increase the reach of people that can have access to the app. We are also coming up with an audio version whereby users would not need to go through the normal activity but just listen and can also share across with their friends and family,” she said.

Speaking as the Special Guest for the launch, Technical Advisor at the Ministry of Education, Sheila Naah Boamah commended the management of Slamm Technologies and the foundation for their continuous effort in promoting digital inclusiveness stressing that such an initiative is important as it will help to reduce the gap that there is in digital literacy.

this initiative. It is a corporate social responsibility, and the ministry can never do it all by itself, so when other collaborators and other partners come on board, it helps to bridge the gap in digital and IT literacy.

The Ministry is always interested in such initiatives because it helps in driving the overall goal of digital inclusiveness. What they are doing is different as you can see, they are attempting to use the local language to reach out to everybody both the young and old, and to everyone within the formal and informal sectors. This will try to reduce the gap because people will go there to pick up information that would help to empower themselves,” she said.

The App’s developer, Elikplim Baani, said the application is created in a user-friendly manner with easy access allowing users to navigate to learn their registered courses without hesitation.

“The app is easier to use and navigate. Once the app is downloaded, you can easily access it by selecting whatever language you prefer and then you log in your details then you

He said users can also choose to change the languages in which they prefer to learn even after registering with an initial language. “So the app is also designed in a way that even if you register in Ewe and you take a basic course or class, it is easier to change your language to maybe Daagbani or Spanish to continue with your class or course, it is that easy and accessible,” he added.

He added that the app has also been created to give users the opportunity to recommend and make suggestions to the app developer for further addition.

“There is a section that also gives users the opportunity to write down their suggestions and what they think can be done to improve the apps, so more like a review of the app but this gives you the opportunity to suggest and recommend on how easy you are able to access the app and what can be done to improve it and I must say that these suggestions and recommendations would be used,” he said.

The event was also attended by Gunner Hamlyn, the American Embassy’s Economic Advisor, tech

WWW.BUSINESS24.COM.GH | NO. B24/317 | NEWS FOR BUSINESS LEADERS MONDAY, SEPTEMBER 26, 2022

TEL: 030 296 5297, 030 296 5315.editor@business24.com.gh | +233 545 516 133.