NHIS to undergo review

By Eugene Davis

By Eugene Davis

MTN Ghana suspends data zone bundle

Also on page 4

By Eugene Davis

By Eugene Davis

Also on page 4

the membership bene t package informed by actuarial projections and sustainable nancing, enhance operations of the scheme, fuse a viable, preventive insurance model into the current curative model, increase participation of private health insurance schemes and ensure human resource development and harmonization.

The premium from informal sector is budgeted at GH¢126.87m. This represents an average premium of GH¢18.00 approximately per member for projected membership of 7,048,475 expected to register and renew within the year 2023 from the informal sector.

The National Health Insurance Scheme (NHIS) says it will go ahead to implement the recommendations of the technical sub-committee on the review and re-structuring of the entire NHIS, with GH¢0.18m allocated towards it.

This was contained in the report of the National Health Insurance Fund Allocation Formula 2023, which reveals that “in 2023, we intend to implement the recommendations of the technical sub-committee on the review and re-structuring of the entire NHIS, in collaboration with the Ministry of Health.

An actuarial study of the recommendations of the technical committee was undertaken in 2019. A total of GH¢ 0.18m has been allocated towards this end.

The report also indicates that the Authority will continue to contribute towards programmes aimed at ensuring social and environmental

sustainability, with an amount of GH¢23.00m earmarked to cater for this move.

As part of the digitisation agenda of the Authority and the government, it intends to support the policy on electronic pharmacy to improve healthcare, with an allocation of GH¢1.65m earmarked.

The NHIA requires a new Data Centre redesigned for high service availability and an improved IT sta workspace, with GH¢5.91m earmarked for its construction. The Data Centre also hosts other health information systems for health sector.

The strategic intent of the Authority as captured in the Medium Term-Strategic Plan, 2022-2025 is the position of the NHIS as preferred nancing mechanism for reducing nancial barriers to health care in Ghana, through a social health insurance scheme.

The strategic objectives of the Authority include: improve

The Authority expects to receive an amount GH¢12.46m to the USAID in the year 2023. The funding which is expected to cover the period from 2023 –2027 in support of clinical audit, stakeholder consultations, tools for internal and external audit, collaboration with Ghana Health Services among others.

The report further highlights registration coverage, noting that the population of Ghana in 2022 was estimated at 31.45million, but in 2023, it is projected to be 32.08m. Current registration gures for the period ending December 30,2022 indicates an active membership of 18.27m, constituting approximately 56.95percent of the projected population of 2022.

The Authority plans to intensify e orts through membership drive and policy reforms to encourage enrolment and renewal of membership. They project that 60percent of the projected population or 19.25m will constitute active membership of the NHIS in 2023.

Perceived threats to the dollar’s role in the global nancial system are nothing new; they have been a frequent occurrence since the 1980s. But until would-be challengers can nd a credible alternative to the dollar for their own savings, the greenback’s dominance will not really be in doubt.

Russia's war in Ukraine, Vladimir Putin and Xi Jinping's recent meeting in Moscow, and China's apparent success in brokering a diplomatic rapprochement between Iran and Saudi Arabia have fueled renewed chatter about threats to the global primacy of the United States – and particularly to that of the US dollar.

I encountered such commentary in the responses to my recent Global Policyarticle assessing the future of the BRICS (Brazil, Russia, India, China, and South Africa). The group is now considering an enlargement that would bring in countries like Iran and Saudi Arabia, raising questions about its criteria for mem-

bership and the role of its own New Development Bank. But would a larger and more in uential BRICS-Plus really create risks to the dollar?

Perceived threats to the dollar's role in the global nancial system are nothing new; they have been a frequent occurrence since I began my career in the 1980s. Obviously, if there comes a time when the US ceases to be the world's largest economy, the dollar's status will be called into question. The same was true of pound sterling in the rst half of the twentieth century (though the pound was not knocked o its global perch until well after the United Kingdom had been surpassed economically).

The eclipse of the dollar would not necessarily be a bad thing for the US, given all the added responsibilities that come with issuing the world's main reserve currency. In a global economy where the US already is no longer as dominant as it once was, it is not optimal to have everyone else be so dependent on the American monetary system and the Federal Reserve's domestically driven priorities. Other economies would much prefer that their own currencies,

monetary policies, and trade patterns not be so in uenced by those of the US. But the fact that a US-excluding group of emerging powers has higher aspirations for itself does not necessarily mean anything for the US-centered nancial system. After all, the BRICS and potential BRICS-Plus countries face many signi cant challenges of their own, and it is not clear what they hope to achieve together beyond issuing symbolic statements. Crucially, the group's most important economies are China and India, bitter adversaries that rarely cooperate on anything. Until that changes, it is fanciful to think that the BRICS or even an expanded grouping could mount any serious challenge to the dollar.

I often despair at the lack of cooperation between China and India – the world's two most populous countries by far. If they could overcome their historic animosity and develop an ambitious shared agenda for expanding trade and tackling issues like health threats and climate change, the idea of a BRICS-driven challenge to the nancial and monetary status quo would become not just plausible but imminent.

In this spirit, I have long argued that China should make the rst move by inviting India to help co-design elements of its signature Belt and Road Initiative. Realizing the BRI's ambitious agenda of transnational infrastructure investments in cooperation with India would make a far more powerful and lasting contribution to Asia and beyond. Otherwise, the BRI will remain

a narrowly Chinese initiative that exists primarily to impose Chinese preferences on others.

The potential addition of Saudi Arabia and Iran comes with similar caveats. Yes, bringing on two major oil producers (in addition to Russia) increases the likelihood of some oil being priced in currencies other than the dollar. But unless edging out the dollar is an explicit, genuinely shared, and deeply held goal, such invoicing changes will be exciting only to niche nancial writers. I have lost count of the times I have heard arguments about why oil could soon be priced in a new currency. First it was going to be the Deutsche Mark, then the yen, then the euro. It's still the dollar. Finally, and most importantly, for any BRICS (or BRICS-Plus) member to pose a strategic challenge to the dollar, it would have to permit – indeed encourage – foreign and domestic savers and investors to decide for themselves when to buy or sell assets denominated in its currency. That means no capital controls of the kind that China has routinely deployed. Until the BRICS and potential BRICS-Plus countries can nd a credible alternative to the dollar for their own savings, the greenback's dominance will not really be in doubt.

Jim O'Neill, a former chairman of Goldman Sachs Asset Management and a former UK treasury minister, is a member of the Pan-European Commission on Health and Sustainable Development.

Project Syndicate

Many years ago, when the very rst tax treaties were concluded, countries such as the United Kingdom and the USA were mainly using these treaties as a tool for facilitating trade with other major trading partners and to also eliminate economic double taxation.

Double taxation occurs when the Story continues on page 4

Story continued from page 3

same taxpayer is taxed twice on the same income (or capital) by one or more tax authorities in one or more tax jurisdictions.

As the years passed, economic transactions or activities globally transcended territorial and geographical borders culminating in the emergence of several Multinational Enterprises (MNEs). This phenomenon led most countries to enter bilateral tax treaties described as Double Tax Agreements (DTAs) with the aim of reducing the incidence of double taxation and allocating taxing rights of incomes sourced from the treaty partner countries to the contracting countries or states.

Over the years, DTAs have served other purposes such as serving as a legal basis or a protocol for the exchange of information between tax authorities and anti-discrimination provisions. The presence and use of these treaties have also reduced the incidence of tax and scal evasion. Ghana, as a developing economy has concluded several DTAs with di erent countries in Africa, Europe and Asia.

As of the time of writing, Ghana currently has thirteen (13) DTAs that are in force. These DTAs are with Germany, Belgium, France, the Netherlands, Italy, the United Kingdom, South Africa, Switzerland, Denmark, Czech Republic, Singapore, Morocco and Mauritius. While Ghana has signed DTAs with Ireland, Malta, Qatar, Norway

and United Arab Emirates, these are yet to enter into force. Approaches to granting tax reliefs Where double taxation is more likely to occur, DTAs are used as a mechanism for the reduction or where possible, elimination of the incidence of the double taxation. Traditionally, DTAs have employed two main approaches or methods in granting tax relief from double taxation, namely: the exemption method and the credit method.

As the name suggests, the ‘exemption method’ seeks to exempt foreign income from domestic taxation, whereas the ‘credit method’ seeks to grant tax credits domestically for foreign taxes incurred.

Typical of countries that have concluded DTAs with other states, Ghana’s DTAs mostly provide for these two methods of double taxation relief.

The Ghana Revenue Authority (GRA) published a circular note document on “How to Obtain Tax Treaty Bene ts in Ghana” which prescribed an additional three methods of double taxation relief. While the methods for tax relief are usually by way of a lump sum, the thrust of this article is mainly focused on understanding how the two main methods prescribed by most DTAs concluded by Ghana operate in the Ghanaian tax landscape.

The next paragraphs will provide some additional information on these.

The Exemption method First let’s talk about the ‘exemption’ method.

For illustrative purposes, let’s

use Mr. A who is tax resident in Country R, a country which has signed a DTA with Ghana. Mr. A earns income of US$ 500 from Country R and earns income of US$350 from Ghana. Therefore, from the perspective of Country R (which operates the ‘worldwide system of taxation’ like Ghana), Mr. A’s worldwide income subject to tax in that country is US$850, all other things being equal. As such, Country R would ordinarily have taxed Mr. A based on his worldwide income of US$850. Where the exemption method is in operation, Country R would not tax any income which ‘may be’ taxed in Ghana. That is, Country R will only tax US$ 500, with Ghana taxing the income of US$350. The fundamental concept with this method of double taxation relief is that, with the exemption method, the DTA operates such that the taxing rights in most cases solely lie with the source country, with the country of residence allowing an exemption of foreign sourced income.

A source country is where the activity giving rise to the income or the person making the payment is situated while the country of residence is the country where the recipient of income is deemed to be permanently based for purposes of taxation giving that country rst right to taxing all income of such a person.

On the other hand, under the credit method, the country of residence gets a subsidiary or residual taxing right which is invoked or triggered when the

country of source levies a lower tax than the country of residence.

This is so because in such a case, an additional tax needs to be paid on the worldwide income in Country R.

In much simpler terms, Country R includes the income earned in the country of source for computing total tax liability in Country R out of which credit is given for taxes already paid in Country of Source. For illustrative purposes, Mr. A, who is tax resident in Country R, has derived an income from Ghana of US$5,000 and has accordingly paid taxes of US$1,250 in Ghana (at 25%).

In Mr. A’s resident country, the same income would have been assessed to tax at a tax rate of 30% (US$1,500). Consequently, the foreign tax paid is credited against the Country R’s tax amount (US$1,500 – US$1,250). Mr. A must only pay US$250 in his country of residence - Country R. It is worth noting however that, the amount of foreign tax credits allowed would not exceed the amount of tax payable in Country R. That is, where Mr. A paid more than US$1,500 in Country of Source, Country R would only grant him a tax credit up to the US$1,500 amount, being the amount of tax payable under the tax rules of Country R. In Part 2 we will focus on how to claim the treaty bene ts and the limitations (if any) to claiming such bene ts.

Data Zone bundle is due to a review of the bundle o er in line with the Signi cant Market Power (SMP) directives applied to MTN Ghana in June 2020, not to be the lowest priced on any o er in the industry.

Data Zone bundle is an innovation by MTN Ghana that gives customers a 1-day validity bundle at discounted rates at the point of purchase. Subscription is through the Short Code 135.

Scancom PLC (MTN Ghana) has announced a suspension of its MTN Data Zone bundle e ective April 05, 2023.

The suspension of the innovative

The telecommunication giant in a press release said, “We are currently engaging and collaborating with the Regulator, as we seek alignment on a revised Data Zone bundle to be reinstated as soon as possible. We will notify you in due course of

“MTN Ghana would like to reassure its customers that it would continue to roll out innovative and a ordable products and services for the bene t of its cherished customers,” the release added.

Old Mutual has long been a leader in the nancial services industry. One of the ways that the business shows appreciation to employees is by recognizing their hard work and dedication through various incentives and awards.

Some groups of Old Mutual sales employees were recently rewarded with a trip of a lifetime for their exceptional performance. The trip was a ve-day, all-expenses-paid adventure to Namibia, one of the world's most beautiful cities. The winners were a diverse group of sales employees from various branches

across the country, representing di erent levels of experience and expertise. They were selected based on their exceptional sales performance over the past year, exceeding their targets and demonstrating a commitment to delivering excellent service to their clients.

The group's itinerary was jam-packed with exciting activities and experiences. They visited some of the city's top attractions. The group enjoyed a thrilling desert safari, where they rode camels and experienced an evening of ne dining and entertainment under the stars.

One of the highlights of the

trip was a visit to Old Mutual's Namibia o ce. The winners had the opportunity to meet with the company's top executives and learn about the company's operations in the region. The visit provided valuable insights into the global nancial services industry and gave the winners a chance to network with colleagues from di erent parts of the world. The trip was not just a reward for the winners' outstanding performance but also a way for Old Mutual to show its commitment to employee development and engagement. The experience provided the winners with an opportunity to bond with each other, form

new friendships, and create lasting memories. It also demonstrated Old Mutual's dedication to creating a positive and supportive work environment that fosters employee motivation and engagement. Old Mutual Ghana is a leader in the Life Insurance and Pensions industries in Ghana.

Old Mutual Ghana is part of the Old Mutual Group which has over 176 years of experience in providing Insurance, Banking, and Investment solutions in Africa. The Group has presence in 13 African countries. At Old Mutual, we exist to provide nancial advice that delivers positive futures for our customers..

The Global Chamber of Business Leaders (GCBL) has announced the appointment of seasoned entrepreneur and Strategic Advisor, Gregor Kos, as its new Head of O ce.

Mr. Kos is to oversee operations at GCBL headquarters in European Union.

He joins the global body with a great deal of professional experience, having served in several high-pro le positions with a number of multi-national organizations.

As an entrepreneur and Strategic Advisor, Mr. Kos gained extensive professional experience when he served as Secre-

tary-General of the Ministry for Education, Science and Sport, Government of Slovenia. He served a previous Key Expert position with the International Organization for Migration (IOM) in Serbia, where he used to be a member of the United Nations (UN) Country Communication (2008-2009).

Mr. Kos also held positions of Key Expert with the Danish Refugee Council and with the Commissariat for Refugee Council of the Republic of Serbia.

He is a holder of the IOM Cer-

ti cate of Attendance in the eld of Selected Modules of Essentials of Migration Management, the Diploma in Project Management in Development Cooperation, and the London School of Public Relations (LSPR) Diploma.

Mr. Kos has also completed UN Field Security Basic as well as the Advanced Course.

Commenting on Mr. Kos' appointment, Chairman of GCBL, Dejan Stancer, said "We invited Gregor to the GCBL team because of his strong analytical, organizational and management skills, as well as excellent

coordination and interpersonal skills. Communication has consistently been his strength throughout his professional career, which headed him to the Deputy President position of the Slovenia Public Relations Association, co-authoring 'Recommendations on Assuring Publicity of Work in Public Sector' and translating and adopting 'Seven Principles of Public Life.'"

Mr. Stancer added, "It is worth mentioning Gregor has acquired substantial working experience in the governmental, Public and private sectors, as well as through insight and knowledge of the local and international socio-political conditions."

Inclab, PKA Leadership Foundation and KNUST GRASAG are excited to host the 4th Revolution Leadership Conference and invite all organizations and individuals who are passionate about leadership and making a di erence in the world to join us on this amazing journey.

Inclab and PKA Leadership Foundation, in collaboration with KNUST GRASAG, are proud to host the 4th Revolution Leadership Conference

which will take place on May 27th, 2023 at KNUST. This is the rst joint project of its kind between these two respected NGOs and KNUST GRASAG.

The conference aims to inspire and educate emerging and experienced leaders, providing them with the opportunity to network with industry experts and bene t from keynote speakers and panel discussions. Attendees will have the chance to explore

topics such as discipline, consistency, team building, communication, and principle-oriented leadership.

The 4th Revolution Leadership Conference will feature a variety of topics designed to help attendees hone their skills and gain a greater understanding of what makes a great leader. Moreover, attendees will become part of a larger community of like-minded individuals and organizations that are dedi-

cated to advancing the eld of leadership. However, Inclab, PKA Leadership Foundation, and KNUST GRASAG are passionate about the potential of this conference to empower the youth of Africa to be a part of the new leadership revolution. The conference will have esteemed keynote speaker, Captain Prince Ko Amoabeng, Chairman of PKA Leadership Foundation and author for “UT STORY”.

The only entertainment event for corporate executives in Ghana, 'Simply Irresistible' has nally returned after taking a short break.

Organizers of the event, A-Town Entertainment announced its return with much excitement, promising to give matured ravers the best of entertainment every Friday evening from 7pm till 4am.

Simply Irresistible returns with performances from Liv North & The Soho Band, an all-girls band. There are also performances from artiste, magicians, dancers and comedians at the opening of the event before the DJs take over to serve great tunes.

Proli c Ghanaian disc jockey,

DJ Mensah, says 'Simply Irresistible' which returned last Friday, has moved from its original venue, the Movempick Ambassador Hotel, to Soho Marina Mall.

Simply Irresistible is a business event designed for metropolitan elites and mature ravers.

It is de ned by eternal blissful moments and a profound self-awakening experience with a variety of music, drinks, foods. Simply Irresistible is always organized in a setting of distinction and elegance.

Simply Irresistible is absolutely an event worth attending every Friday evening after a long week of work.

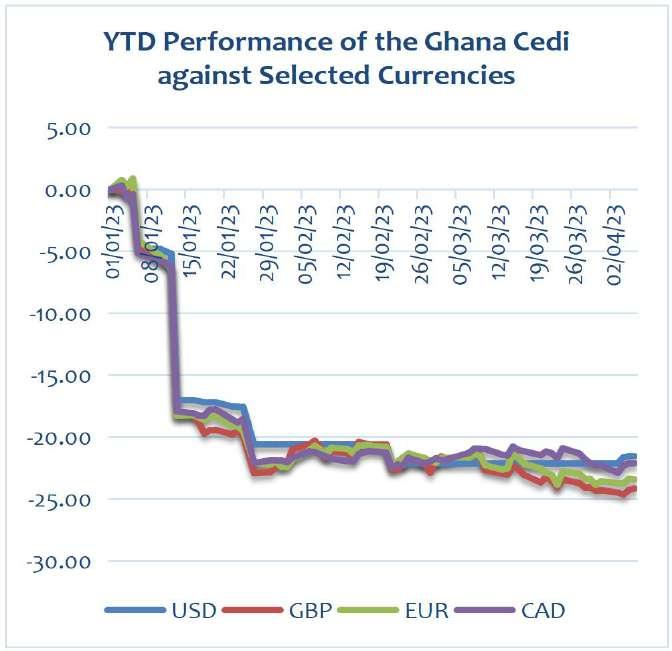

J anua r y 20,202 3

April 6, 2023

J anua r y 20,202 3 April 6, 2023

The Spring Meetings of the World Bank Group (WBG) and the International Monetary Fund, which kicked o on April 10 in Washington, provide an opportunity to re ect on the Bank’s ongoing evolution. As development confronts both longstanding and emerging challenges, the Bank needs to reform itself in ways that enable it to provide more ambitious solutions.

Over the past half-century, the WBG has worked with developing countries to help hundreds of millions of people rise out of poverty. But global progress ground to a halt in 2020, after ve years of slowing gains, as the COVID-19 pandemic pushed 70 million people into extreme poverty. If left unchecked, climate change could do the same to 132 million more by 2030. According to WBG estimates, the number of people living in extreme poverty (on less than $2.15 per day) will increase to 600 million by 2030, and more than three billion people will live on less than $6.85 per day. The WBG is uniquely equipped to mobilize the nancing needed to address these global challenges. But the Bank must ensure that its ambitions, strategies, and nancing mechanisms align with developing countries’ needs and realities. While we are pleased with the Bank’s progress on internal reforms, at least four areas require more work before its annual meetings in October.

First, the WBG must rea rm its commitment to promoting

sustainable, inclusive, and resilient economic growth. Boosting growth remains the best way to create quality jobs and opportunities and achieve the Bank’s twin goals of ending extreme poverty and fostering shared prosperity. But, as the Bank’s own research nds, “nearly all the economic forces that powered progress and prosperity over the last three decades are fading.” With global growth slowing, the WBG now estimates that the international community is unlikely to meet the goal of ending extreme poverty by 2030.

Addressing the root causes of poverty and economic slowdown would require adopting new instruments and ways of working, increasing sta capacity, and setting targets that would enable the Bank to play a greater role in fostering a healthy business environment and unleashing private investment. This would require a less risk-averse approach and improved coordination with the WBG’s private-sector arms. It also means listening carefully to Global South members’ needs and concerns when de ning and selecting criteria for the “global challenges” the Bank will focus on over the next decade.

Second, the WBG must ensure that low-income countries can exercise more agency in shaping the development agenda. A key principle underlying the WBG’s operating model is country-driven engagement: the borrowing government leads in coordinating and moni-

toring its own portfolio. This client-centered model has helped ensure that the Bank’s strategies for borrowing countries align with national priorities and have the political support they need to sustain investments over time.

One proposal currently being considered is to create stronger incentives for countries to invest in global public goods, such as reducing greenhouse-gas emissions. While this is a positive step, the Bank must refrain from compromising countries’ “ownership” of policies by imposing excessive or burdensome conditions on them. Moreover, the Bank must ensure that concessional loans or grants aimed at encouraging such investment do not lead to higher borrowing costs or trade-o s between middle-income countries and low-income countries. Nor should they come at the expense of o cial development assistance (ODA). If the goal is to promote investments that bene t the international community, then the international community –particularly advanced economies – should bear the costs.

Third, to achieve the United Nations Sustainable Development Goals, WBG shareholders must do more to increase the Bank’s nancial capacity. To that end, shareholding governments and other partners must meet their existing commitments, such as developed countries’ pledge to provide $100 billion per year for climate-mitigation and -adaptation e orts, private-sector commitments to

mobilize $1 trillion for climate action, and the G7’s commitment to raising $600 billion for global infrastructure investments. But more is needed. For example, early estimates suggest that adjusting the WBG’s capital-adequacy framework could make available $50-200 billion over the next decade. While some nancial innovations have shown promise, it is important to consider their full e ects. For example, raising hybrid capital could increase the Bank’s borrowing costs at a time when clients are facing historically high interest rates and unsustainable debt burdens.

A capital increase could be one way to leverage available resources and the clearest sign of strong shareholder support. But this must be accompanied by an overhaul of the Bank’s cost pass-through model to enable it to make greater use of low-interest, long-term debt instruments, thereby ensuring that countries can tackle development challenges without incurring unsustainable debt. The need for more ambitious ODA replenishments over the coming years must be met. Lastly, reducing poverty would be a daunting (perhaps even impossible) task

Story continued from page 13

without access to clean, a ordable, and reliable energy sources, as well as emissions-generating investments in manufacturing and transportation. Letting the climate e ort overshadow the World Bank’s broader objectives would be a grave injustice –and might not be the most e cient strategy. If, say, Sub-Saharan Africa (excluding South Africa) were to triple its electricity consumption overnight by relying on natural gas to power the increased demand, it would add only 0.6% to global carbon emissions.

Attempting to tackle poverty and climate change simultaneously could lead some governments to make costly and counterproductive decisions. Instead, it would be more e cient – and fairer –

for WBG shareholders to nd the right balance between focusing on reducing emissions in upper-middle and high-income countries and focusing on adaptation in order to help vulnerable communities and countries build climate resilience.

The Global North and South have a historic opportunity to reinvigorate the multilateral development-bank system.

Building on the World Bank’s legacy of innovation and progress is the best way to advance the goal of a more sustainable, resilient, and inclusive world.

The authors’ views are their own and do not necessarily re ect those of the World Bank Group or its member countries. Project syndicate