FBNBank in Sierra Leone, DRC, Gambia now FirstBank Ghana, Senegal and Guinea next in line

First Bank of Nigeria Limited, Nigeria’s premier nancial services institution, has begun a phased corporate name change of its subsidiaries in the United Kingdom and sub-Saharan Africa.

FBNBank UK, FBNBank Sierra Leone, FBNBank Gambia and FBNBank DRC are the rst set of subsidiaries e ecting the name alignment.

They are now known and addressed as FirstBank UK, FirstBank Sierra Leone, FirstBank Gambia and FirstBank DRC. The Ghana, Senegal and Guinea subsidiaries will be next in the phased name change implementation.

The name change is being implemented to align the subsidiaries with the parent brand and to enjoy the strong heritage and brand equity built by FirstBank Nigeria in its 129 years of banking leadership. This will further enhance the quality-of-service delivery resulting in better brand clarity, uniformity and consistency across all the markets where the Bank operates.

A leading nancial inclusion services provider, FirstBank Group is committed to its nation-building goal. It has taken giant performance

strides on its unique growth trajectory as it continues to build distinctive capabilities through partnerships and the constant drive to reinvent itself. This performance is evidenced in the numerous awards and recognitions bestowed on the institution. These awards include Best Private Bank for Sustainable Investing in Africa 2023 by Global Finance Awards; Best Corporate Bank in Western Africa 2022 by Global Banking & Finance; Best CSR Bank Africa by International Business Magazine in 2022; and ranked as number one in Nigeria in terms of Overall Performance; Pro tability; E ciency and Return on Risk by the Top 100 African Bank Rankings 2022 released by The Banker Magazine from the stables of Financial Times.

In addition, in Euromoney Market Leaders, an independent global assessment of the leading nancial service providers conducted by Euromoney Institutional Investor Plc., the Bank was crowned: Market Leader in Corporate and Social Responsibility (CSR); Market Leader in Environmental, Social and Governance (ESG); Highly Regarded in Corporate Banking and Digital Solutions and Notable: in SME Banking.

Speaking on the name change, Dr. Adesola Adeduntan, CEO of FirstBank Group,

said ‘’ the name change which coincides with FirstBank’s 129th founding anniversary (March 31st, 2023) is indeed a milestone re ective of our resolve to continuously provide the gold standard of excellence and value as we put our customers First.

The new identity of the subsidiaries contributes to an enhanced brand presence. It helps our customers and stakeholders better appreciate the value of the diversi ed products suites, competitive pricing and extensive business networks the FirstBank Group o ers.

These include our commitment to boosting cross-border businesses including trade and investment opportunities essential to enhancing trade relations amongst countries, thereby strengthening the economies of host communities and reducing poverty,” he concluded.

First Bank of Nigeria Limited (FirstBank) is the premier Bank in West Africa and the leading nancial inclusion services provider in Nigeria for 129 years.

With over 750 business locations and over 200,000 Banking Agents spread across 99% of the 774 Local Government Areas in Nigeria, FirstBank provides a comprehensive range of retail and corporate nancial services to serve its over 36 million customers.

Story continues on page 3

Story continued from page 2

The Bank has an international presence with subsidiaries operating in 9 other countries. These subsidiaries are FirstBank (UK) Limited in London and Paris, FirstBank in The Gambia, FirstBank Sierra-Leone, FirstBank in the Republic of Congo, FBNBank in Ghana, FBNBank in Guinea, FBNBank in Senegal as well as a Representative O ce in Beijing, China.

The Bank is at the forefront of promoting digital banking in the country and has issued over 12 million cards, the rst bank to achieve such a milestone.

FirstBank’s cashless transaction drive extends to having more than 12 million people on its USSD Quick Banking service through the nationally renowned *894# Banking code and over 4.5 million people on the FirstMobile platform. It is, by far, the leader in the number of digital transactions per minute across multiple channels.

FirstBank’s commitment to Diversity is shown in its policies, partnerships and initiatives, such as its employees’ ratio of female to male (about 39%:61%; and 32% women in management) as well as the FirstBank Women Network, an initiative that seeks to address the gender gap and increase the participation of women at all levels within the organization.

In addition, the Bank’s membership of the UN Women is an a rmation of a deliberate

policy that is consistent with UN Women’s Women Empowerment’s Principles - Equal Opportunity, Inclusion, and Nondiscrimination.

Since its establishment in 1894, FirstBank has consistently built relationships with customers focusing on the fundamentals of good corporate governance, strong liquidity, optimised risk management and leadership.

Over the years, the Bank has led the nancing of private investment in infrastructure development in the Nigerian economy by playing key roles in the Federal Government’s privatisation and commercialisation schemes.

With its global reach, FirstBank provides prospective investors wishing to explore the vast business opportunities available in Nigeria an internationally competitive world-class brand and a credible nancial partner.

For six consecutive years (2011 – 2016), FirstBank was named “Most Valuable Bank Brand in Nigeria” by the globally renowned The Banker Magazine of the Financial Times Group and “Best Retail Bank in Nigeria” eight times in a row, 2011 - 2018, by the Asian Banker International Excellence in Retail Financial Services Awards.

Notably, in 2022, the Bank took a long stride on its growth trajectory with the Bank’s Viability and Long-Term Issuer Default Ratings upgraded to 'B' from 'B-' (with Outlooks Stable)

by Fitch, a leading global rating agency.

This is an indication of the Bank’s strong internal capital generation and the corresponding recession of its risks to capitalisation. Fitch also upgraded the Bank’s National Long-Term Ratings to 'A (nga)' from 'BBB (nga)', to re ect its improved creditworthiness relative to that of other issuers in Nigeria. Furthermore, the Top 100 African Bank rankings 2022 released by The Banker Magazine revealed FirstBank’s ranking as number one in Nigeria in terms of Overall Performance, Pro tability, E ciency and Return on Risk.

Other laudable feats in 2022 include FirstBank’s international recognitions on major indices by Euromoney Market Leaders, an independent global assessment of the leading nancial service providers where FirstBank was crowned: Market Leader: (tier-1 recognition) in Corporate and Social Responsibility (CSR), Market Leader: (tier -1 recognition) Environmental, Social and Governance (ESG), Highly Regarded: in Corporate Banking and Digital Solutions, Notable: in SME Banking.

Also, in 2022 International Finance Magazine named the Bank “Most Innovative Banking Product in Nigeria” and “Best Retail Bank in Nigeria”. FirstBank was also awarded “Best Corporate Banking Western Africa, 2022” and “Best CSR Bank Western Africa,

2022’’ by Global Banking and Finance Magazine.

Other notable awards in FirstBank co ers include: “Best Bank in Nigeria” by Global Finance magazine - fteen times in a row; “Best Private Bank in Nigeria-2021” awarded by Global Finance magazine; “Best Internet Banking Nigeria” and ‘’Best CSR Bank Africa’’ by International Business Magazine.

In 2023, FirstBank has received notable awards including “Best Private Bank for Sustainable Investing in Africa 2023” by Global Finance Awards; “Best Sustainable Bank in Nigeria 2023” by International Investors Awards; “Best Bespoke Banking Services in Nigeria 2023” by International Investors Awards; “Best Financial Inclusion Service Provider in Nigeria 2023” by Digital Banker Africa; and “African Bank of the Year” by African Leadership Magazine.

Our vision is ‘To be Africa’s Bank of rst choice’ and our mission is ‘To remain true to our name by providing the best nancial services possible. This commitment is anchored on our core values of EPICEntrepreneurship, Professionalism, Innovation and Customer-Centricity. Our strategic ambition is ‘To deliver accelerated growth in pro tability through customer-led innovation and disciplined execution and our brand promise is always to deliver the ultimate “gold standard” of value and excellence to position You First in every respect.

to develop the aluminium downstream sector is expected to bene t the Volta

By Eugene Davisited (VALCO), following plans to modernise and retro t the facility to smelt alumina produced in The downstream policy, according to the CEO of

Story continued from page 3

the Ghana Integrated Aluminium Development Corporation (GIADEC), Michael Ansah is hopeful it will pass to become a legal document sometime this year. Key partners such as VALCO, GBCL, Rocksure and MoTI have all had inputs in the maiden policy.

Valco is the second largest smelter in Sub-Saharan Africa and is a major producer of primary aluminium. Today, the company produces approximately 50,000 tonnes of aluminium per annum out of its installed capacity of 200,000 tonnes per annum.

Currently, the company is 100percent owned by GIADEC. As the only existing smelter in the country, Valco is integral to the development of the Integrated Aluminium Industry in Ghana. Under Project 4, GIADEC seeks to partner a strategic investor to upgrade the plant’s equipment and technology to improve e ciency and increase its capacity to 300,000 tonnes per annum.

The VALCO smelter is currently running on two out of its ve potlines and producing about 50,000 tonnes of primary aluminium per year, out of its installed capacity of 200,000 tonnes. The other 3 potlines have been shut down, and beyond repairs due to lack of maintenance and repairs over the years. VALCO has the capacity for direct employment of over 1,200 Ghanaians but currently employs 705 Ghanaians.

When all is said and done, and the VALCO retro t hits the ground running, approximately 300,000 tonnes of aluminium will be available to the Integrated Aluminium Industry (IAI) annually. This is an increase from the 40,000 –50,000 tonnes produced presently.

The expected bene ts from the retro t following increased in aluminium production includes; it will encourage the consumption of aluminium locally, thereby replacing imports of aluminium products, new markets will be explored for aluminium export in Africa and

beyond leveraging support of AfCFTA and other trade agreements.

Further, it will encourage the production and consumption in speci c sector -transport, construction, packing and electrical, as well as create a policy and incentive framework to attract both local and foreign investors into the downstream industry.

Valco started operations in 1967, with ownership then vested in Kaiser Aluminium and Chemical Corporation (Kaiser) and Reynolds Metals Corporation (Reynolds). Kaiser owned 90percent of the shareholdings and the remaining 10percent by Reynolds, but Reynolds sold its shares to Aluminium Company of America (Alcoa) before the company began operations in 1967.Following the establishment of GIADEC in 2018, and the consequent transfer of the Government of Ghana’s 100% holding to GIADEC, immediate steps were taken by GIADEC to establish the VALCO Board. The Board was duly inaugurated in August 2020.

A collaboration between GIADEC and VALCO, as part of VALCO’s recovery plan, secured an approval from government for an injection of funds into the Company’s operations in 2021, leading to the maintenance and repairs of its two (2) and only operating potlines. This completed the stabilization phase of the Company.

GIADEC working closely with VALCO has recorded some modest gains over the period. VALCO for the rst time in twelve (12) years, recorded a positive Earnings Before Interest, Tax, Depreciation & Amortization (EBITDA) for the year 2021. The trend is expected to continue in 2022, and in the

coming years, if the required investments are made.

The implementation of Project 4 - the modernisation and expansion of the VALCO smelter to improve e ciency and increase capacity, is to ensure that VALCO is positioned to sustainably grow and be pro table, and to contribute towards establishing and realising the linkages of the upstream and downstream components of the Masterplan for Ghana’s IAI. The mordenisation and retrotting of the VALCO smelter will result in a new installed capacity of 300,000 tonnes that will be a major boost to realisation of the plan.

A well-capitalized VALCO, operating with modern technology, will ensure that the plant is more e cient, more productive, competitive, and can ultimately drive the transformation of the downstream sector of the IAI in Ghana.

The execution of Project 4 alone, will require signi cant investments in excess of USD 600 million. This will thus, require a strategic investor/partner with the nancial capacity and technical know-how, to partner GIADEC to expand, retro t and modernize the plant.

Ghana’s downstream sector remains underdeveloped using less than 7,000 tonnes of the about 50,000 tonnes of aluminium VALCO currently produces. With a forecast of about 300,000 metric tonnes of aluminium after VALCO has been retro tted, GIADEC is working to revive and expand the downstream sector to take advantage of the excess aluminium that would be produced. This will ensure that we maximize in-country value by producing nished aluminium products to substitute

imports and grow domestic market share in the Automotive, Electrical, Construction and Packaging sectors.

A thriving Downstream Aluminium Industry will be a vibrant industrial powerhouse made up of manufacturing companies creating thousands of jobs, including high paying jobs for the teeming youth.

Project 4 - the modernization and expansion of VALCO is, therefore, key to achieving the vision for the downstream.

The Integrated Aluminium Industry is a ‘game changer’! It is at the heart of Ghana’s industrial transformation agenda. When fully implemented prioritized, it will lead to a transformation of Ghana’s economy, and massively turn-around the economic fortunes of Ghana. The IAI, alone, has the potential to create the hundreds of thousands of jobs across every level of the value chain and could be the panacea to Ghana’s unemployment woes, whilst improving Ghana’s GDP substantially.

The timing for developing Ghana’s IAI is right as the aluminium market, though volatile, is looking very favourable and is forecasted to even get better. There has been a rising demand in the use of aluminium signi cantly by about 54% in the last decade due to its lightweight, high strength, and recycling properties. This upward trend in production is likely to continue in the years to come along with the healthy pace of increase in the usage of aluminium. The development of the downstream will ensure we lock in value in Ghana while signi cantly boosting the economy.

The execution of all four (4) projects under the IAI masterplan are at various stages of implementation. The infrastructure underpinning the IAI i.e power, ports and harbour, railway and roads are equally being developed under the relevant agencies in tandem. This is a multi-year,

Story continued from page 4

multi-billion-dollar investment programme.

There are four projects in the upstream part of Integrated Aluminium plan; rst one relates to the existing mine which is being expanded from 1.5m tonnes to about 5m tonnes production of bauxite per year [GIADEC, OPCl fully owned by Ghana], second one is expected to produce about 5m tonnes of bauxite at Nyinahin in a bid to develop a re nery solution which is at advanced stage with companies who can come in to produce alumina plants which

will take stocks for these mines to re ne, the third project is a partnership which GIADEC is developing with a major European aluminium company which will lead to the development of a mine at Nyinahin-Mpasaaso area as well as a re nery [integrated project] which is before cabinet and the fourth project is the modernization and retrotting of Valco.

The vision of developing an IAI in Ghana is now clearly de ned, and execution is on course. The integration of four (4) operating bauxite mines, two re neries, the

Enterprise Group PLC has announced Keli Gadzekpo as its Group Chairman, e ective April 3, 2023

Mr. Gadzekpo who turned 60 years in 2022 takes over from Trevor Trafgarne who retired as Chairman of the Board after 25 years in that role.

A circular from the Ghana Stock Exchange indicated that Daniel Larbi-Tieku, the Deputy Group Chief Executive O cer will take over as

the new Group CEO.

It added that Mr. Larbi-Tieku had over 30 years of experience in accounting and nance and had been with the Enterprise Group since 2011.

Mr. Trefgarne welcomed the changes expressing condence in Mr. Gadzekpo and Mr. Larbi-Tieku’s abilities to lead the company.

Mr. Trefgarne remarked that “it is a great pleasure that my friend and colleague, Keli

VALCO smelter, and a vibrant downstream industry, accompanied by the supporting infrastructure i.e an expanded ports and harbour with increased capacity, railway and supporting network, and a low-cost and stable power supply, will be critical to success.

Since its establishment, GIADEC has been living up to its mandate of developing and promoting an Integrated Aluminium Industry, giving credence to President Akufo-Addo’s vision of a “Ghana Beyond Aid”.

Gadzekpo, is taking the Chair in my place. Shareholders can be con dent their company’s Board will be in good hands”, it said.

Mr. Gadzekpo also said “I am also delighted that my association with this great company has not ended and look forward with excitement as I take up the mantle of Group Board Chairman”, i said. Mr Larbi-Tieku similarly expressed humility and opti-

mism about serving as Group CEO and creating value for all stakeholders.

“I accept with humility to serve as Group CEO of this great company”.

“I am aware of the enormous task ahead, especially during the current economic challenges this role must deal with”, he added.

Enterprise Group PLC is one of the most active stocks on the GSE.

Enterprise Group PLC has announced Keli Gadzekpo as its Group Chairman, e ective April 3, 2023

Mr. Gadzekpo who turned 60 years in 2022 takes over from Trevor Trafgarne who retired as Chairman of the Board after 25 years in that role.

A circular from the Ghana Stock Exchange indicated that Daniel Larbi-Tieku, the Deputy Group Chief Executive O cer will take over as the new

Group CEO.

It added that Mr. Larbi-Tieku had over 30 years of experience in accounting and nance and had been with the Enterprise Group since 2011.

Mr. Trefgarne welcomed the changes expressing con dence in Mr. Gadzekpo and Mr. Larbi-Tieku’s abilities to lead the company.

Mr. Trefgarne remarked that

Story continued from page 5

“it is a great pleasure that my friend and colleague, Keli Gadzekpo, is taking the Chair in my place. Shareholders can be con dent their company’s Board will be in good hands”, it said.

Mr. Gadzekpo also said “I am also delighted that my association with this great company has not ended and look forward with excitement as I take up the mantle of Group Board Chairman”, i said. Mr Larbi-Tieku similarly

expressed humility and optimism about serving as Group CEO and creating value for all stakeholders.

“I accept with humility to serve as Group CEO of this great company”.

“I am aware of the enormous task ahead, especially during the current economic challenges this role must deal with”, he added.

Enterprise Group PLC is one of the most active stocks on the GSE.

Mining giants, Adamus Resources Mining Company Limited (Ghana) CEO, Angela List emerged as ‘Africa’s Most Outstanding Woman in Mining’ in the recently held awards ceremony, Africa Outstanding Women Awards in Cote d’Ivoire.

Her outstanding works in the mining sector in the year under review attracted the attention of the organisers board-ASKOF Productions for recognition. And for her outstanding works, she received a citation and a beautiful plaque.

The versatile CEO in a post-presentation interview said, “Indeed, l am humbled by this recognition, it goes to show that people and organisations like you monitor what we do.

“It will certainly urge us to push harder. I dedicate this award to my hardworking team, they have been amazing. This is for all of us.”

CEO of ASKOF Productions Limited, Afua O. Aduonum said, “We are charity driven biased, our primary objective is to recognize and reward organizations and individuals who are

charitable by impacting their communities positively.

“The board combed through and saw your mining company as the deserving candidate for the award. We want to urge you to continue with your charity work.

“If companies around will follow your shining example, we will have better communities, and our joy would be completed as a body that rewards companies and individuals a ecting social change in various communities.”

Adamus Resources Mining Company (Ghana) is a multiple award-winning company that delivers above-forecast gold production.

Standard Chartered Bank Ghana PLC has appointed Albert Larweh Asante as an Executive Director for the bank, e ective March 21, 2023.

Mr Asante is currently the Chief Financial O cer of Standard Chartered Bank Ghana PLC. He joined Standard Chartered Bank Ghana Ltd in 2006 and has held various senior roles including Head, Wholesale Banking Business Finance, Ghana, Financial Controller and Chief Financial O cer for Standard Chartered Bank, Angola S.A. He also served as an Executive Director of the Bank while in Angola. Prior to his appointment as Chief Financial O cer for Standard Chartered Bank Ghana PLC,

he was the Cluster Head of Finance for Corporate, Commercial & Institutional Banking, West Africa with oversight responsibility for Nigeria, Ghana, Cameroon, Cote d’Ivoire, Gambia, and Sierra Leone.

Albert is a Fellow of the Institute of Chartered Accountants, Ghana; a CFA Charterholder, holds an MBA from the University of Warwick, United Kingdom, and a Bachelor of Science in Administration (Accounting option) from the University of Ghana, Legon. A release issued by the bank said he brings a wealth of experience in Strategy, Financial Planning and Analysis, Leadership and Enterprise Risk Management.

including the approval of the Canadian Securities Exchange. The company also noted that the securities to be issued under the O ering would be subject to a four month plus one-day hold period from the date of issue in accordance with applicable securities laws. No commissions or nder’s fees will be paid by the Company in connection with the O ering

The release further noted that the company was currently at an advanced stage of securing a senior debt facility to support capital investments and development of its assets.

Asante Gold Corporation has ntered into an agreement with a major institutional investor to sell 18,232,000 units of the company.

The deal which expected to be on a non-brokered private placement basis will go at a

purchase price of C$1.50 per unit and expected to raise C$27.34 million.

Proceeds from the o ering is expected to be used for exploration and development of the its mineral properties and for general corporate working cap-

ital purposes. Closing of the o ering is expected to occur on or about April 3, 2023, and is subject to a number of closing conditions including, but not limited to, the receipt of all necessary regulatory approvals,

The comapny also announced that Asante Gold had terminated the brokered private placement nancing previously announced on January 23, 2023, due to unfavorable market conditions.

so far, GH¢4.6 billion has been allocated as follows: GH¢3.1 billion to Amalgamated Fund Tier 1 payments and GH¢1.45 billion assigned to Amalgamated Fund Tier 2 payments.”

According to the SEC statement, all investors with validated claims have been contacted by Amalgamated Fund and GCB Capital Limited for further action.

The Securities and Exchange Commission (SEC) has rejected claims that the GH¢5.5 billion approved by Parliament in 2021 to settle owed customers of defunct fund management companies is only for Defunct Gold Coast Management, now Blackshield customers.

According to the SEC, the approved funds are for all

investors in the 47 fund management companies that were closed down by the regulator.

The clari cation follows comments from some Blackshield Fund Management clients who suggested that the funds should only be distributed to fund investors.

“The update received by the SEC from the implementing agencies of the Bailout is that

“This disbursement includes the partial bailout program which entailed the payment of a sum of up to GH¢50,000 to clients of Blackshield/Gold Coast and other companies who had not received Winding up orders from the Court by October 2020 but whose claims had been validated. The total amount paid to Blackshield clients in the partial bailout is GH¢1.34 billion covering a total of 73,541 investors. Out of this amount, a total amount of GH¢757,539,141 has been used to fully settle 61,734 customers of Blackshield”, a release from the regulator clari ed.

The SEC also assured Blackshield Fund Management customers of its ongoing compliance.

The SEC revoked the licenses of some 53 fund management companies, which according to them was to protect the integrity of the securities market and investors.

The disgruntled customers have embarked on a series of protests to push for the government’s intervention in retrieving their funds from BlackShield Fund Management after the SEC announced a bailout package for clients of the collapsed companies.

When Prince Acquaye '13 joined Ashesi to study Management Information Systems, he believed it was time to give up on his childhood goal of becoming a lawyer. In his second year, however, he learned about ENS Africa's Ghana O ce, then known as Oxford and Beaumont Solicitors, thanks to another Ashesi student who had interned with the law rm.

Prince also applied for an internship with the rm and joined in his third year at Ashesi as a non-legal intern. The experience reignited his desire to pursue a career in law.

After graduating from Ashesi, Prince spent nearly eight years at ENS Africa. Starting as a Paralegal, he eventually became an International Associate, earning a Barrister-at-Law certicate from the Nigeria School of Law and a Qualifying Certi cate in Law from the

"My years as a paralegal were exciting, challenging and fun," says Prince. "For those who have watched the TV series 'Suits', I proudly felt like the Rachel Zane of my team and took every opportunity to capture memories with my team members."

As an international lawyer, Prince developed specialisations in corporate governance, intellectual property, immigration, general corporate commercial, and mergers and acquisitions.

His work covered a wide range of clients, including Google, International Finance Corporation (IFC), Coca–Cola Bottling Company of Ghana Limited, Emirates Airlines, Mastercard, and Zen Petroleum.

"I share with younger people that I speak to that some opportunities come on a platter, but many don't," says

Story continues on page 9

......."My years as a paralegal were exciting, challenging and fun,"

Story continued from page 8

Prince. "Dreams require tough work. I had pictured myself as a lawyer for a long time and had to navigate through a lot of work to get here. There were many bottlenecks, but I chose to persevere. I am glad to be here today because I do not have to ask myself 'what if?' anymore."

Helping students at Ashesi understand the legal profession

Re ecting on his experiences, Prince believes many young people may believe they cannot pursue a career in law because they are not on a conventional path to it. But as he did, several Ashesi alumni have pursued careers in law. Prince is now working to demystify the legal profession for other students at Ashesi. In 2021, he joined the Business Administration department as an Adjunct, teaching Business Law, and Company and Commercial Law. Working with other Business Law faculty, he has helped strengthen the teaching of law at Ashesi and hopes to see more students take the

classes.

In December 2022, Prince helped organise Ashesi's rst Moot Court session - a simulation of real court proceedings. Students had to argue whether bail should be granted to a person arrested for possession of narcotics pending a trial. As part of the debate, the class also got the opportunity to educate the broader audience about Ghana's drug laws and the repercussions for those who broke them; a secondary goal for the faculty in organising the session. Her Ladyship Justice Rosemary Baah Tosu, a High Court Judge, presided over the session.

"It was an exciting experience for me," shared Emmanuel Nti '23, who took the class and participated in the debate. "I always had an interest in nance, but I am beginning to recognise how I can bring this interest into a career in law."

Today, Prince serves as a Managing Partner at Corporate and Allied Attorneys, a rm he

established in 2022. He hopes that he can build a legal rm that is recognised across Africa and that inspires many others.

"I draw a lot from the lessons of my former boss Elikem Kuenyehia and his journey of starting and growing Oxford and Beaumont," says Prince. "Elikem started a young rm that became recognised among some of Ghana's biggest names, so I know it's possible. I hope Corporate and Allied Attorneys can grow into one of Ghana's leading

legal rms, harnessing technology."

"For any young person who wants to become a lawyer or a professional in any eld, go forward with that dream," adds Prince. "It may be dicult, but follow it. Write that exam. Take that interview. You do not want to look back, wondering what could have been. Every young person should be able to take some career risks with their lives. I hope to serve as a good example of risk-taking for those needing one."

Trea sury Bills un

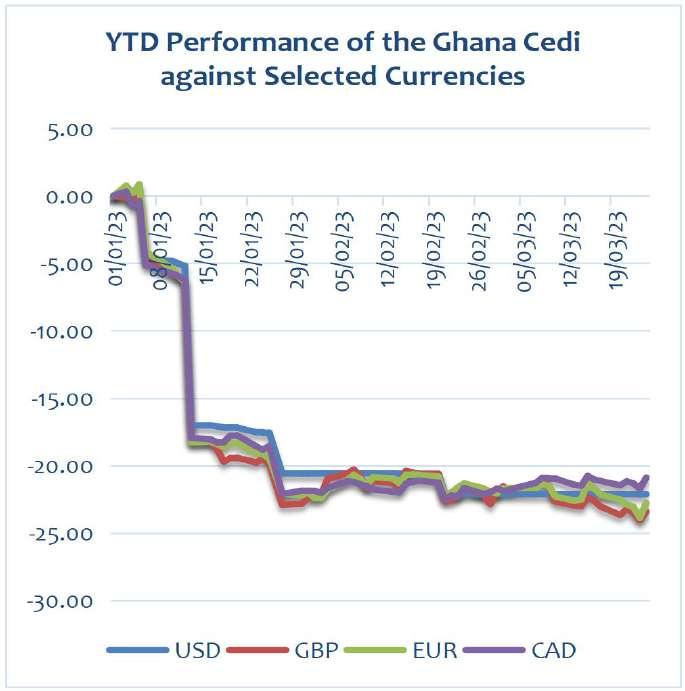

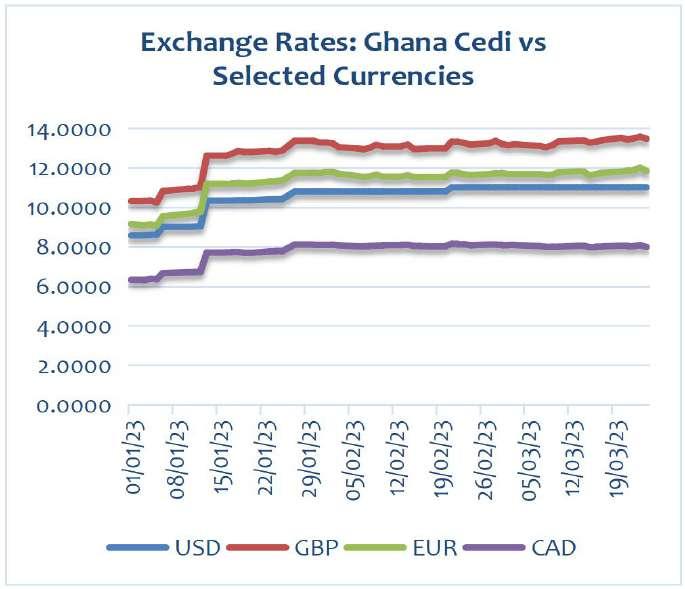

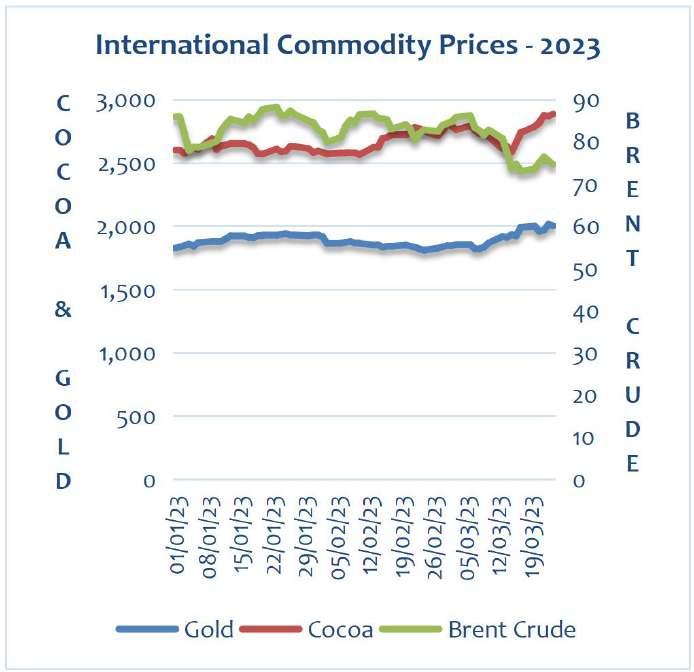

ed by 23% Cedi depreciates by 22.1 0% a s of March 2023. GSE sign s MoU with MIIF to increase lis�ng o f min erals companies

debt remains unchanged at GH¢575.70 billion – BOG Trading of government bon ds fall by 21.09%

OUR SOURCES: GSE/GFIM/B OG/CS D

March 24,202 3

March 24,202 3

March 24,202 3

The Chief Executive O cer of the Institute of Directors-Ghana (IoD-Gh), Mr. Clement Wiredu, has urged organizations to take deliberate steps towards bridging the gap between the Board of Directors (BoD) and worker unions.

Highlighting the relevance of corporate governance to businesses on the March 21, 2023 edition of Sunny FM’s Business Magazine Show, CEO of the professional body, underscored the importance of unions to business growth and good corporate governance, calling on Ghanaian businesses

to be more intentional about their interactions with worker unions.

“One thing that people miss increasingly in governance in the corporate world is the role of the Union. And I've seen many people talk about governance, and talk about the board, talk about the CEO but even when the organization has a union, they’re not mentioned.

And when you go there, they’re not even on the Management Team. While we start to de ne and get into good corporate governance, we must evolve around looking at unions as part of manage-

ment”, he said.

He added that recognizing the role of Unions plays a crucial role in the success of the company. “If there's a union in that organization, then one wants to see that they are part of the governance of the organization and the governance is not just reporting to them, but they are aware of the direction the organization is going and the challenges”, he emphasized.

Speaking on the same program, a Fellow of the IoD-Gh, and Managing Consultant at The Family O ce Africa, Mr. Theodore Albright, called on board members to build awareness and knowledge

about the organization on whose board they serve.

“At the very least, you should understand the operations because you're going to give birth to a strategy. Remember, you're the custodian of the company, you have a duciary responsibility to the company and you're the custodian of the strategy. How can you couch a strategy when you don't understand the industry?”, he stressed.

The Institute of Directors-Ghana is a professional body committed to the practice of e ective Corporate Directorship to champion director professionalism and development through good corporate governance.