Tourism Matters

Welcome to the 2024 Tourism Forum

Chair of the West Midlands Tourism and Hospitality Board

Scan the QR code to submit your questions:

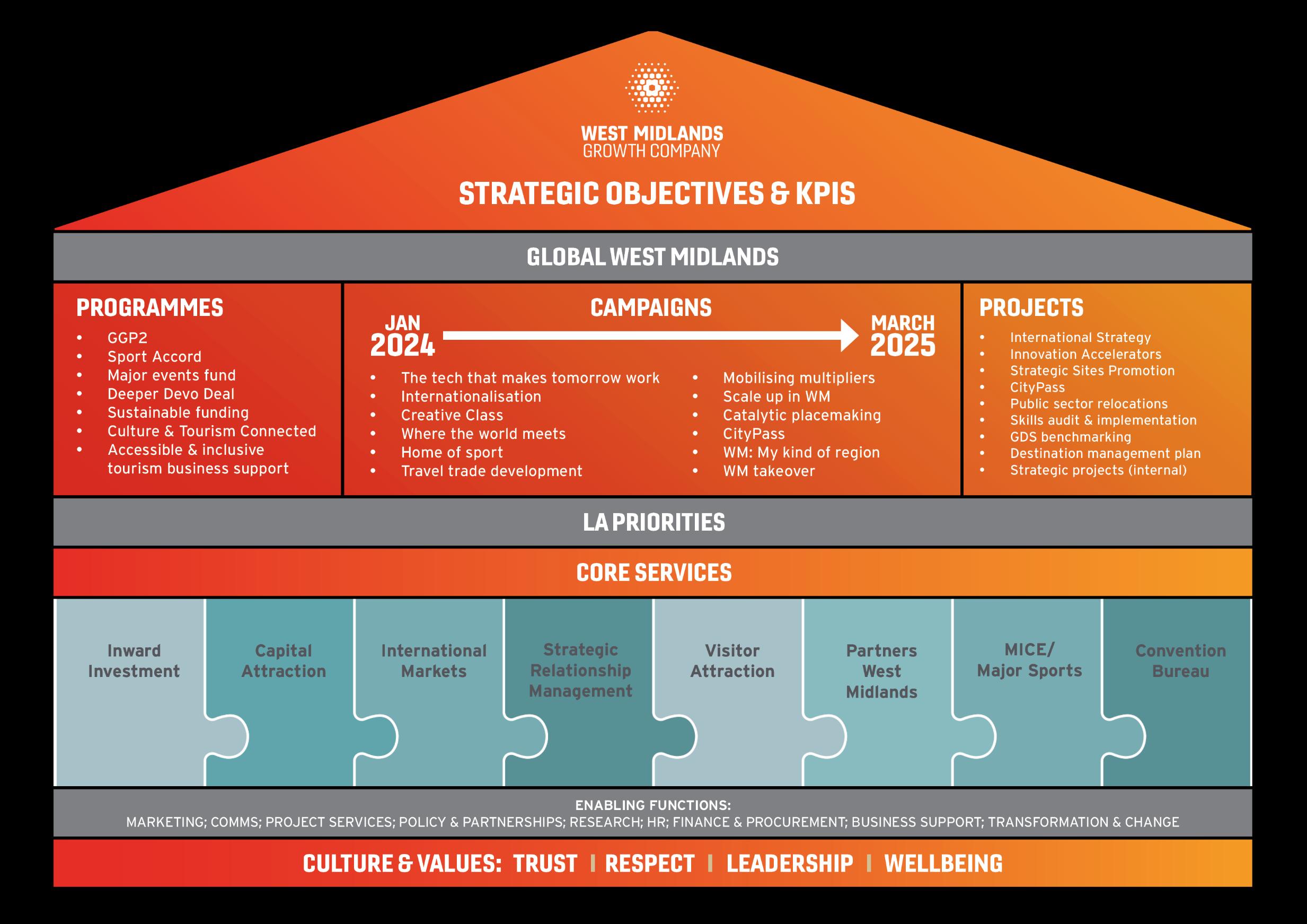

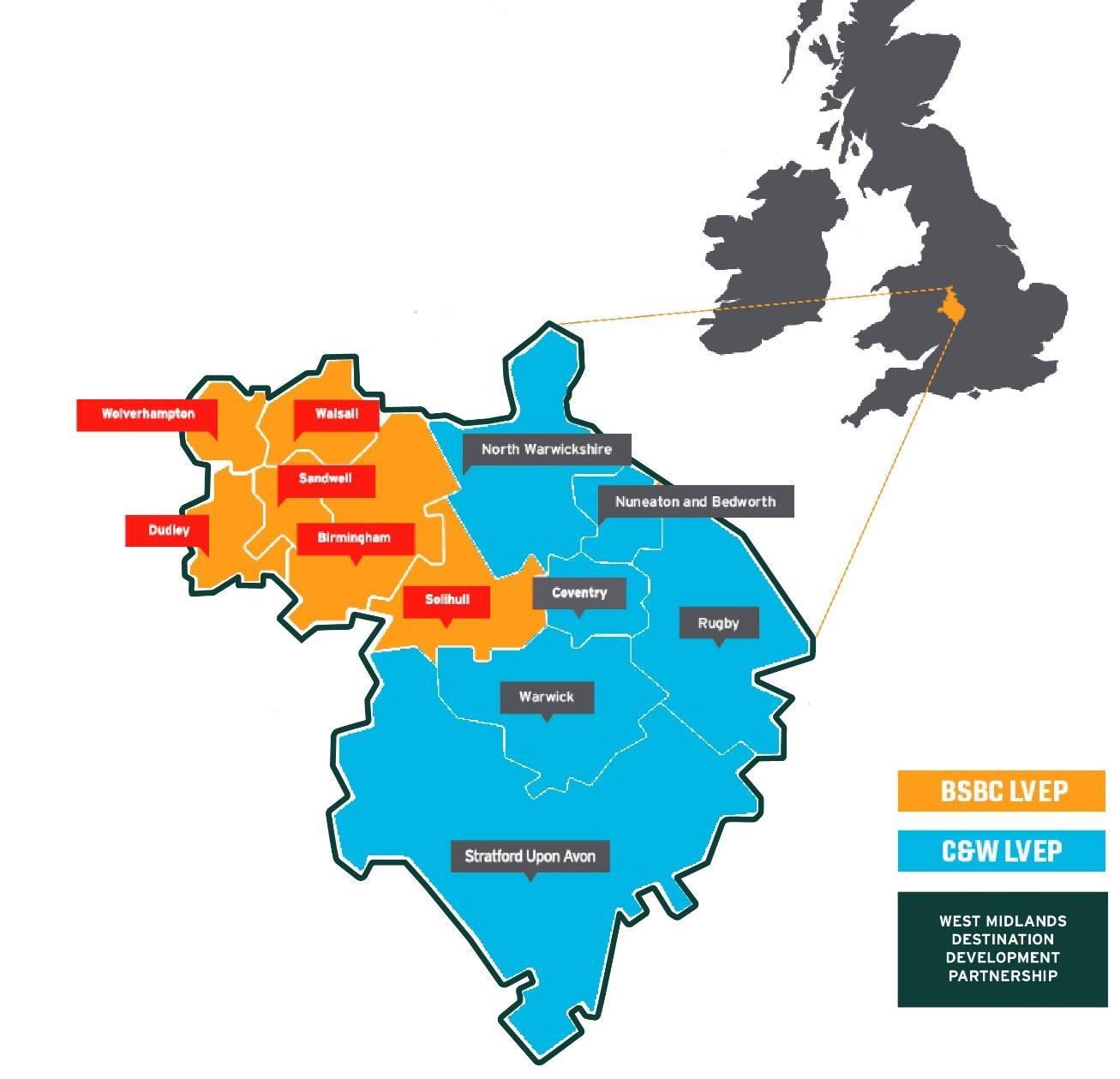

Update on ’Global West Midlands‘ activity

Director of Policy & Partnerships, West Midlands Growth Company

Through partnership working, we enable sustainable economic growth upon which West Midlands residents and businesses can thrive and prosper.

Through partnership working, we enable sustainable economic growth upon which West Midlands residents and businesses can thrive and prosper.

To develop and promote an ambitious and aspirational West Midlands brand that drives investment, events and visitors to enable a thriving, sustainable regional economy.

Enhance the profile and reputation of the region

Improving perceptions of the region as a place to invest, visit and host events

Create and sustain good jobs for local people

Growing and increasing the productivity of the regional economy by attracting inward investment to the region.

Facilitate the regeneration of the built environment

Securing transformational capital from global and domestic investors in brownfield real estate and regeneration projects

Create and sustain vibrant destinations

Harness sustainable domestic tourism and growing demand for inbound international tourism to enhance the region’s quality of life by growing and strengthening the visitor economy

The programme is forecast to deliver:

• Improved awareness, sentiment, and consideration of the West Midlands’ offer across key audiences

• 117 inward investment projects landed

• 12 sporting events and 11 business conferences attracted

• 3 capital investment projects landed

• 235,233 visitors attracted, spending £23.457m in the region

It is currently on track to meet these targets.

Visitor Economy update

BECKY FRALL Head of Tourism, West Midlands Growth Company

Together, through telling the stories of our destinations, we will reveal our hero themes and products to attract visitors, transform perceptions and promote sustainable, inclusive growth to ensure our industry partners and communities thrive

WELCOMING 1,700 DELEGATES TO SPORTACCORD WORLD SPORT & BUSINESS SUMMIT

”…the best SportAccord ever.“ SportAccord President, Prof Dr Uğur Erdener

• The West Midlands Tourism and Hospitality & Advisory Board has a voice –where there are issues that need prominence, let’s use it

• We have programmes of business support and development – if you aren’t sure how to get involved, the last session of today will enable you to talk to the managers leading each area of work

• Want to feature in campaigns and assets? We are always on the lookout for backdrops, press visit hosts and for travel trade or business event ready businesses, fam trips and educationals. Make sure we know you are interested.

VisitBritain/VisitEngland forecasts, trends, and insight

RICHARD NICHOLLSHead

ofResearch and Forecasting,

VisitBritain

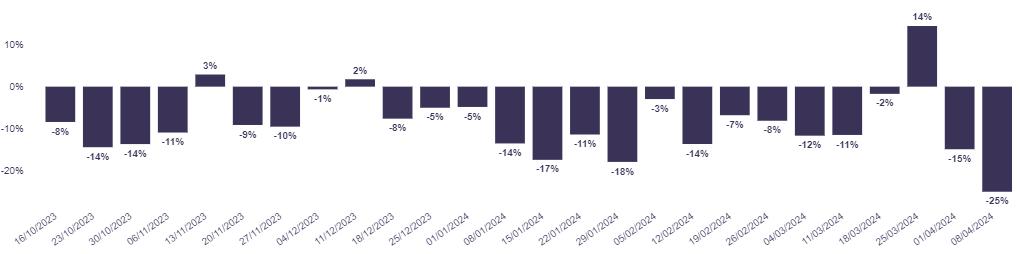

Inbound flight arrivals to the UK made in each week starting on the date shown, vs. those made the same time in 2019, within the ForwardKeys database

NB timing of Easter

Source: Forward Keys data refreshed 22/04/24. Growth vs 2019 is shown to compare against a normal year baseline. Please note that weekly data can be volatile

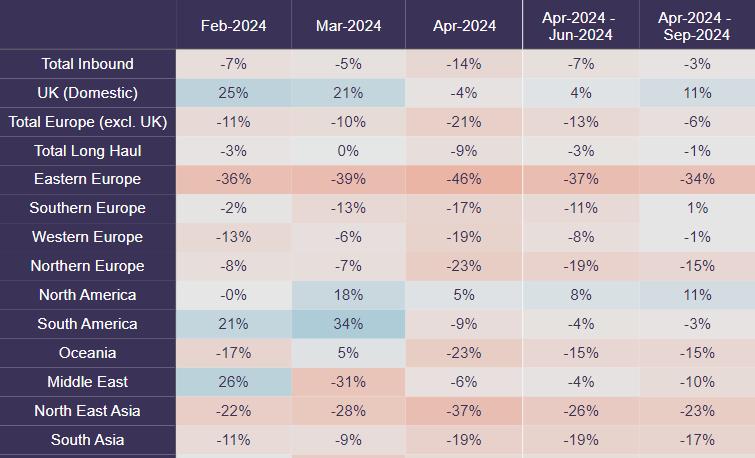

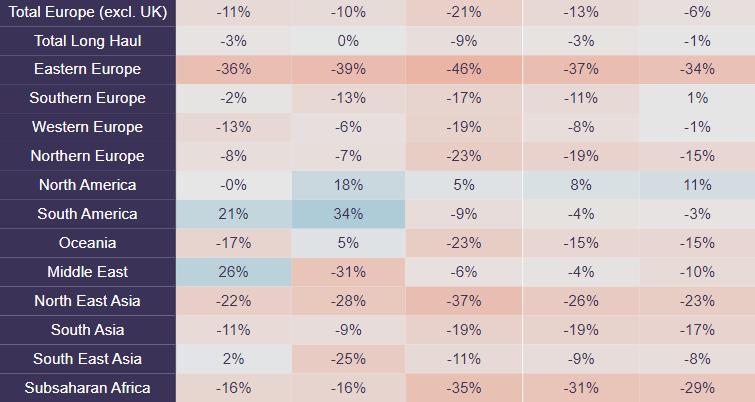

• Arrivals set to pick up from current levels based on current bookings

• North America continues to lead with bookings well ahead of pre-COVID

• Western and South Europe around par with 2019

• NE Asia still the slowest but has picked up

• NB the pattern has been for longer lead times for bookings post COVID, so we expect these numbers to decline

Source: Forward Keys data refreshed 08/04/24. Growth vs 2019 is shown to compare against a normal year baseline.

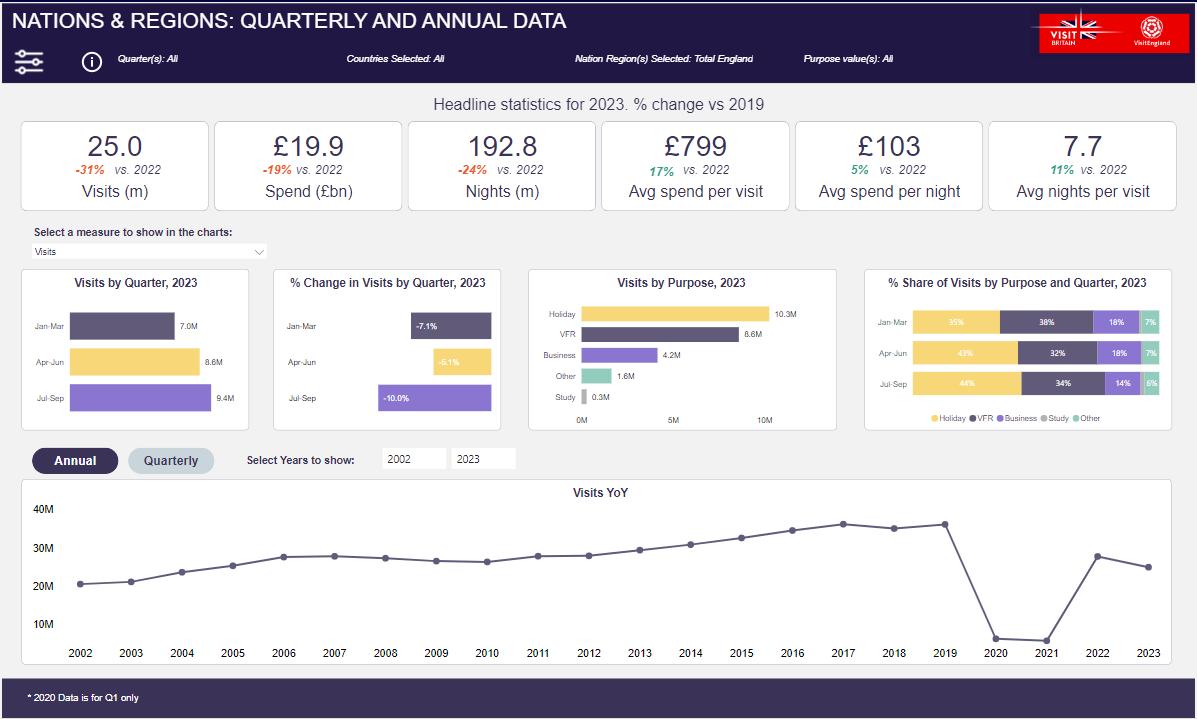

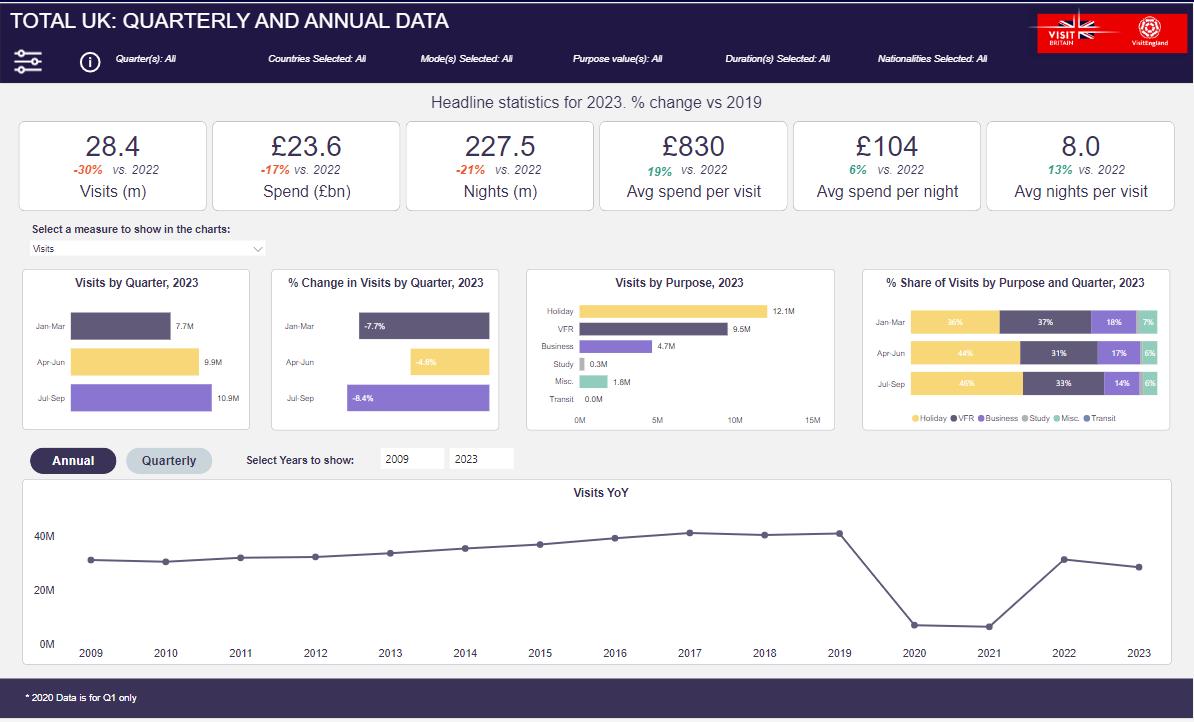

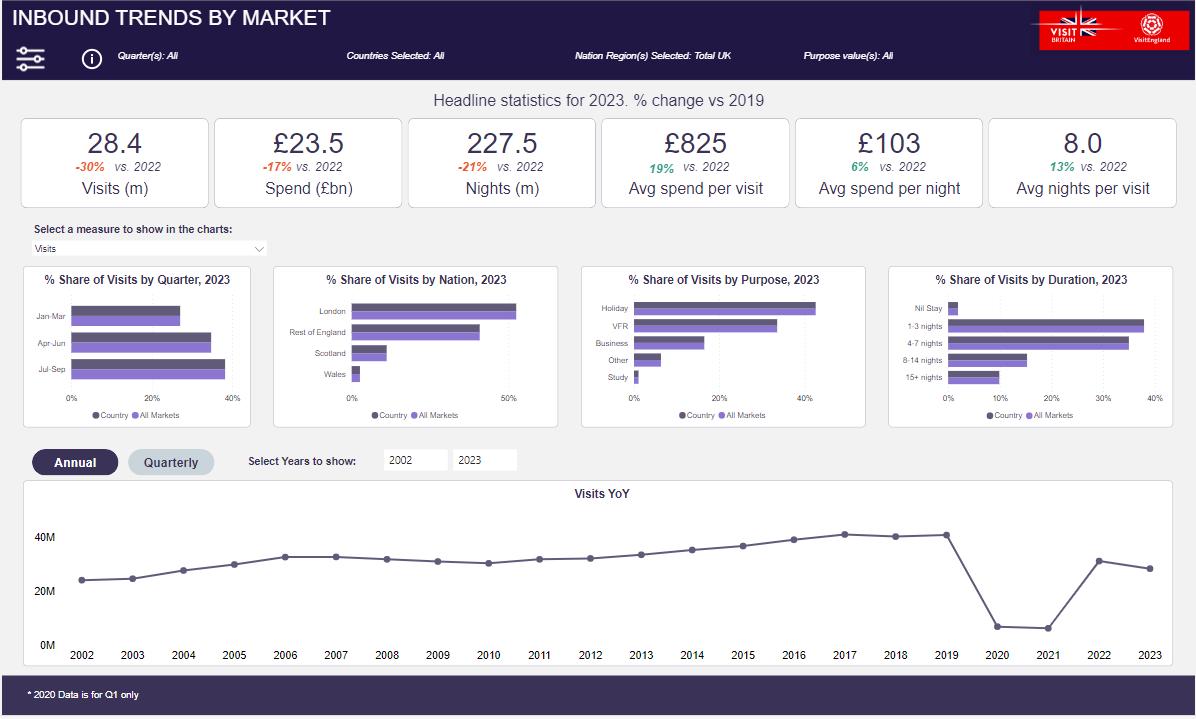

• Visits: recovery of visits plateaued and remained below pre-pandemic levels throughout the year

• Spend: up in nominal terms but tracked down in real terms in the first three quarters of the year but was below 2019 level in Q4

• Spend per visit was broadly tracking inflation until the final quarter of the year

• Duration: nights spent in the UK were just behind pre-pandemic levels with average length of stay still elevated

Journey purpose: VFR visits remained above 2019 whilst holiday visits were just behind and business visits were lagging further behind

→ VFR up 2% on 2019

→ Holidays down 6%

→ Business visits down 25% (though MICE down 17%)

Global region: North American visits continued to surpass 2019 visits whilst Europe was just below 2019. Rest of World mixed picture.

→ Europe down 9% on 2019

→ North America up 14%

→ Rest of World down 17%, though wide variation (Aus/NZ and Saudi up, East Asia still well below)

International Passenger Survey by the ONS. For more information please go here: https://www.visitbritain.org/research-insights/inboundvisits-and-spend-quarterly-uk. MICE and nation/region data based on Jan-Sep.

Inbound tourism to the UK – visits (millions), trend and forecast

Woman walks past colourful houses in Notting Hill, London, England. ©VisitBritain/@lifewithbugo

Incidence of UK short breaks or holidays intended within next 3 month and taken in last 3 months

UK Trips Intended UK Trips Taken

VB2a. Thinking of the next UK/overseas holiday or short break you are likely to take, when are you likely to plan, book and go on this trip?

VB13a: Now reflecting on your recent behaviour, have you taken an overnight short break or holiday in the UK in the last 12 months? Base: All UK respondents = 1755. Data shows the proportion intending to take a trip within the next 3 months – this will not account for intentions established less than 3 months ahead of trip date – and trips taken.

The leading reasons summer 2023 non-trip-takers did not take a trip (despite originally intending to) were financial – nearly half stating this

Reasons for not taking a UK overnight trip despite originally intending to do so, Percentage, UK summer non-trip-takers originally considering a trip

Net: 45%

I couldn’t afford it I’m cutting back on spending UK weather I didn’t have time/ no annual leave I went abroad instead I couldn’t find anywhere available to stay when I wanted to go I couldn’t decide where to go Unable to travel due to a health condition / ill health Lack of transport / places to stay and visit that suited my accessibility needs I didn’t have anyone to go with Lack of accessibility information about places to stay and visit I don’t tend to travel much / not interested

Source: VisitEngland Domestic Sentiment Tracker 2023

Focusing on barriers related directly to the cost of a domestic overnight trip, the ‘cost of accommodation’ remains at the top, followed by ‘cost of drinking/eating out’ – the latter increasing for the second consecutive wave

• The official domestic tourism volume and value surveys (Great Britain Tourism Survey – overnight tourism and day trips) were relaunched in 2021 after going dark in 2020 due to COVID and a change in methodology.

• Links:

• https://www.visitbritain.org/gb-domestic-overnight-tourism-latestresults

• https://www.visitbritain.org/gb-day-visits-latest-results

• Detailed results for Scotland and Wales are published on their websites: VisitScotland and Visit Wales

• We have released data for 2021 (Apr-Dec), 2022 and 2023

• These are classed as Statistics Under Development and we are rerunning the data to make the trend less volatile – expected release June/July

• The results are not comparable to the old surveys (up to 2019) due to the change in methodology

• https://www.visitbritain.org/research-insights/aboutinternational-passenger-survey

• IPS dashboards – official inbound tourism statistics

• Total level, region/nation, and market level visualisations

• Domestic tourism dashboards planned

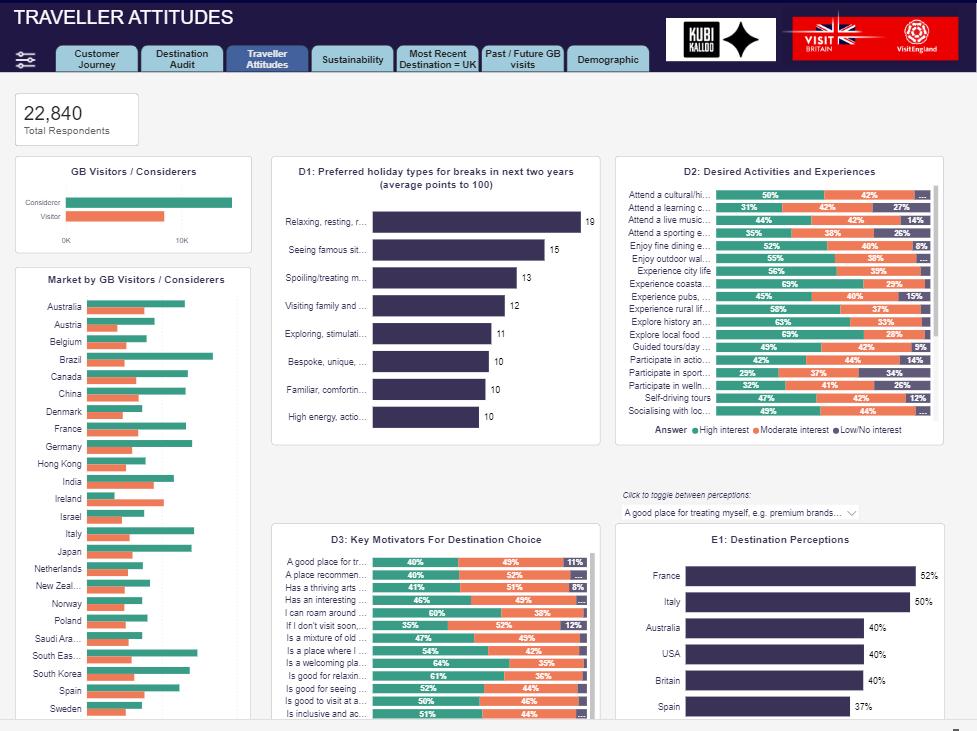

• https://www.visitbritain.org/research-insights/motivationsinfluences-decisions-and-sustainability-research

• An interactive visualisation built for our MIDAS project (Motivations, Influences, Decisions And Sustainability). A major quantitative research study we conducted in 2022.

• Topics covered in survey: Appetite for Travel and Appetite for Britain; European Travel Post Brexit; Headwinds of Note; Drivers and Motivations; Britain’s Perceptions & Brand Implications; Products & Experiences; The Visitor Experience; Emerging Drivers; The Customer Journey

• Surveyed international leisure travellers in: Australia, Austria, Belgium, Brazil, Canada, China, Denmark, France, Germany, Hong Kong, India, Irish Republic, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Poland, Saudi Arabia, South East Asia, South Korea, Spain, Sweden, Switzerland, UAE, USA

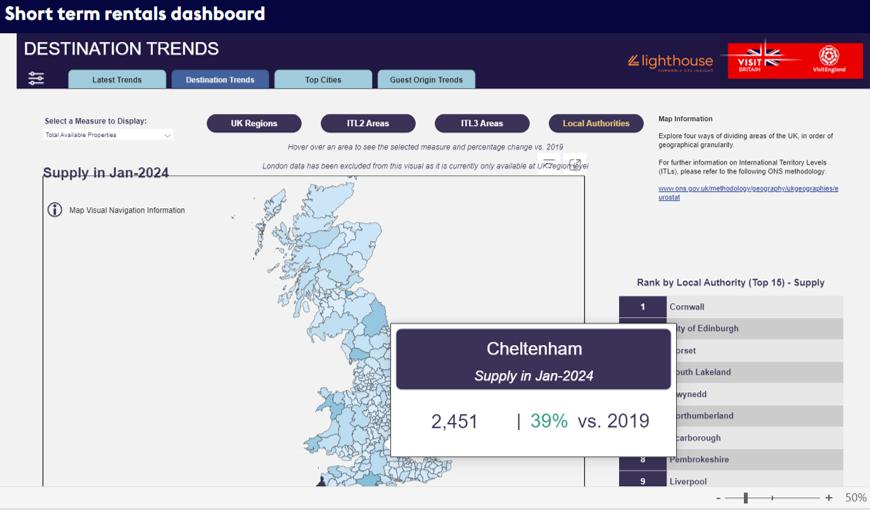

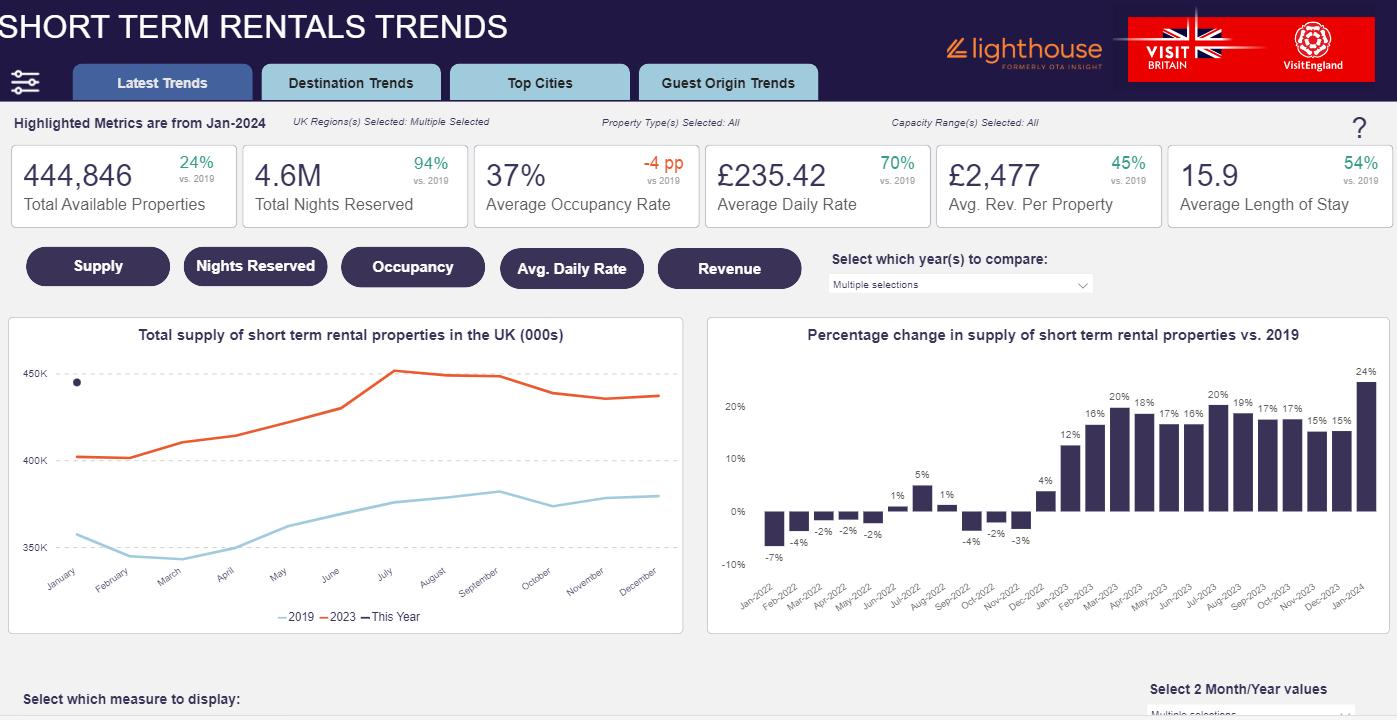

• https://www.visitbritain.org/integrated-report/short-term-rentals-dashboard

• Short term lets dashboard – data from Lighthouse aggregates information from several channels –can compare year on year or back to 2019

• Metrics now available at local authority level

International Passenger Survey (Office for National Statistics)

• Full annual 2023 results to be released May 17th

• Some methodological changes in July to both outbound and inbound statistics

Monthly

• Our usual monthly domestic sentiment tracker

• Hotel accommodation and short term rentals data

Visa card spending data

• Monthly data from 2022 onwards, and a historic data pull from 2019

• Available at county and LVEP level

• Inbound spending by country of origin, and domestic

• Data by merchant type

Ad hoc research

• Customer Journey and Premium Travellers reports from our MIDAS project – available on our website

• Film and TV tourism research – fieldwork conducted in 21 international markets, analysis in progress

• Drivers and barriers to visiting Britain – currently in field in 6 markets (China, France, Germany, Italy, India, UAE)

• Business event delegate spending – currently in field, update of previous analysis and new insights

Senior Research and Evaluation Manager, West Midlands Growth Company

ARPIL 2024

Accommodation Supply Data – by type, location, capacity, seasonality, tariffs and pipeline

Accommodation Performance Data

• Occupancy

• Average Daily Rate (ADR)

• Revenue per Available Room (RevPAR)

• Forward booking data

Retail and Footfall - City / Town / Shopping Centre / BIDs

Transport Data - Car Parking / Road Use

Visitor Attractions and Events – Attendances / Throughput

Business Tourism Sector Insights and Analysis

Insights on visitor experiences

Visitor origins, gender, age, and employment status

First-time or returning visitors

Group composition and size

Mode of travel

Length of stay

Type and location of accommodation

Spend – breakdown by subsectors and type of visitors

Impact of marketing activity

Information sources used to plan the visit

Perceptions and satisfaction

Visiting attraction(s)

Business purposes

Arts, culture and heritage

Visiting friends or relatives

Watching or participating in sport

Shopping

Food and drink

ICCA MEETINGS / CONFERENCES RESEARCH

WALSALL HIGHSTREET POLICY BRIEF

ACCOMMODATION STOCK AUDIT & DATA ANALYSIS

ATTRACTIONS & FESTIVALS/EVENTS DATA COLLECTION

WM & STAFFORDSHIRE STEAM REPORTING

ROUTE DEVELOPMENT RESEARCH

VISITOR SURVEY RESEARCH PLANNING

VISITOR SURVEY FIELDWORK

PERCEPTIONS RESEARCH

VISITOR SURVEY DRAFT REPORT

TAX-FREE SHOPPING BUDGET

PROPOSAL & BCC TOURISM SERVICE

POLICY ROUNDUPS: AIR PASSENGER DUTY & DCMS AUDIT TO ARTS COUNCIL

Reflections on the West Midlands Tourism Awards & an exclusive forward look

Chair of the West Midlands Tourism and Hospitality Board

”We would definitely recommend the Awards to other local businesses. It is a great opportunity to meet other people, have fun, and allow you to strive to be the best you can possibly be“Chapter Birmingham

”Our team work so incredibly hard day in and day out, delivering memorable experiences for our guests, and the West Midlands Tourism Awards play a big part in making sure our team realise how excellent they truly are“

Shakespeare Distillery

”We would absolutely recommend other local businesses enter the West Midlands Tourism Awards. It is a fantastic way to get recognised for the hard work that you put in and to also network with other “West Midlands Police Museum

”These Awards are all about the teams that are delivering experiences in the region. There is no better way to get people on board with who you are and what you do than this. They allow you to focus on what you are doing well and also what you might not be doing as well, giving a real opportunity to self-reflect “Warwick Castle

”We would 100% recommend the West Midlands Tourism Awards to other businesses - it is truly phenomenal, so get yourselves involved! The feedback we received from the judges in the 2023 Awards has really benefited us and allowed us to make improvements to our business –helping us win our category this year! The feedback from the industry experts is extremely valuable“

Shrewsbury Food Festival• Awards launch and applications open - 8 May 2024

• Closing date for entries – 8 July 2024 (30 November for Events ONLY)

• Round 1 Judging - 9 July – 30 August 2024

• Round 2 Judging (site Visits) – 2 September - 30 November 2024

• Awards launch and applications open - 8 May 2024

• Closing date for entries – 8 July 2024 (30 November for Events ONLY)

• Round 1 Judging - 9 July – 30 August 2024

• Round 2 Judging (site Visits) – 2 September - 30 November 2024

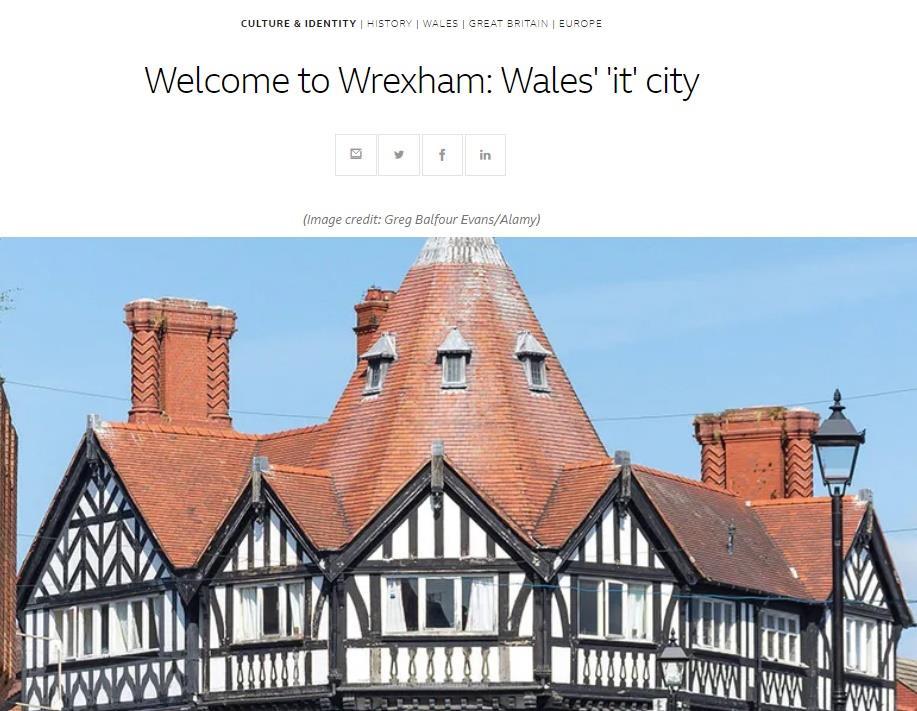

PR and communications:

Travel writing Q&A

TOM MARLOW Communications Manager, WestMidlands Growth Company

Through partnership working, we enable sustainable economic growth upon which West Midlands residents and businesses can thrive and prosper.

Travel writer (and stand-up comedian!) based in Brighton for publications including Metro, Daily Telegraph, The Sun, The Independent and The Observer.

Travel writer (and musician!) based in Birmingham for publications including Lonely Planet, BBC Travel, National Geographic Traveller, The Independent and The Culture Trip

‘How to' - free sustainability accreditation

SCOTT MCLEAN Managing Director, Green Tourism

Introducing Green Tourism, Green Meetings, and Local Pioneering Work

• COP 26, 27 (Egypt) & 28 (UAE)

• The Paris Agreementbelow 2ᵒC, preferably below 1.5ᵒC

• Deep emission cuts needed

• Wide Ranging Implications

Limit warming to 1.5ᵒC above PreIndustrial Levels Already wideranging implications at 1.2ᵒC

The asked….

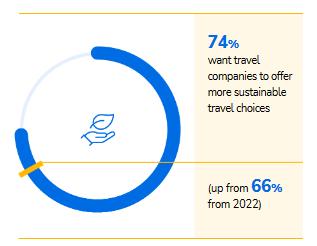

• Over 33,000 travelers

• Across 35 countries and territories

Sustainability demand always growing

• Each and every year, sustainability demand grows

• 74% want travel companies to offer more sustainable travel options

• 65% would feel better about staying in a particular accommodation if they knew it had sustainability certification.

• The UK & Ireland’s leading tourism sustainability certification

• Established 1997

• c.3000 members

• All types and sectors: hotels, guesthouses, self-catering, hostels, visitor attractions, tours, event venues, activity providers, restaurants, pubs etc

“Many of our customers tell us that our green commitment is the reason that they chose our accommodation over another.”

Andrea Bramhall, Deepdale Backpackers

Hostel

• Responding to industry demand

• Meetings industry-specific criteria and award

• Includes meetings-specific Marketing Playbook

• Partnership with the MIA

Improve your Sustainability Practices

Tell your Story

Improve: No sustainability expertise needed Your Story: The Support you Need

Improve: No sustainability expertise needed Your Story: The Support you Need

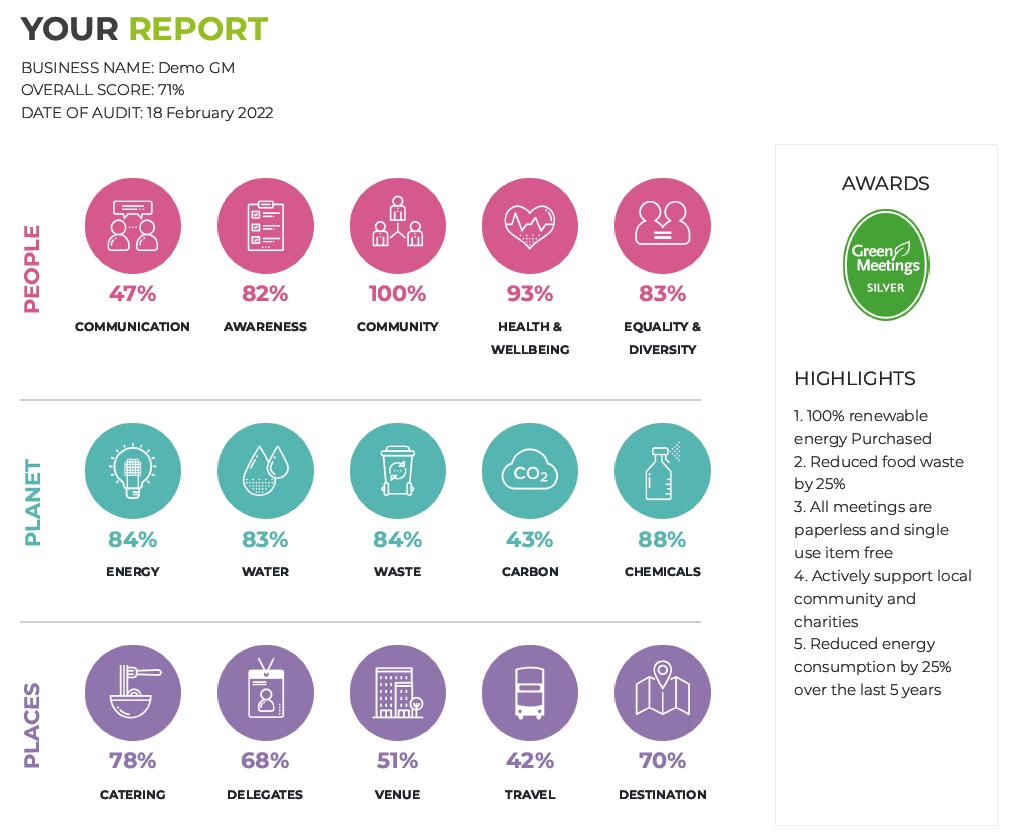

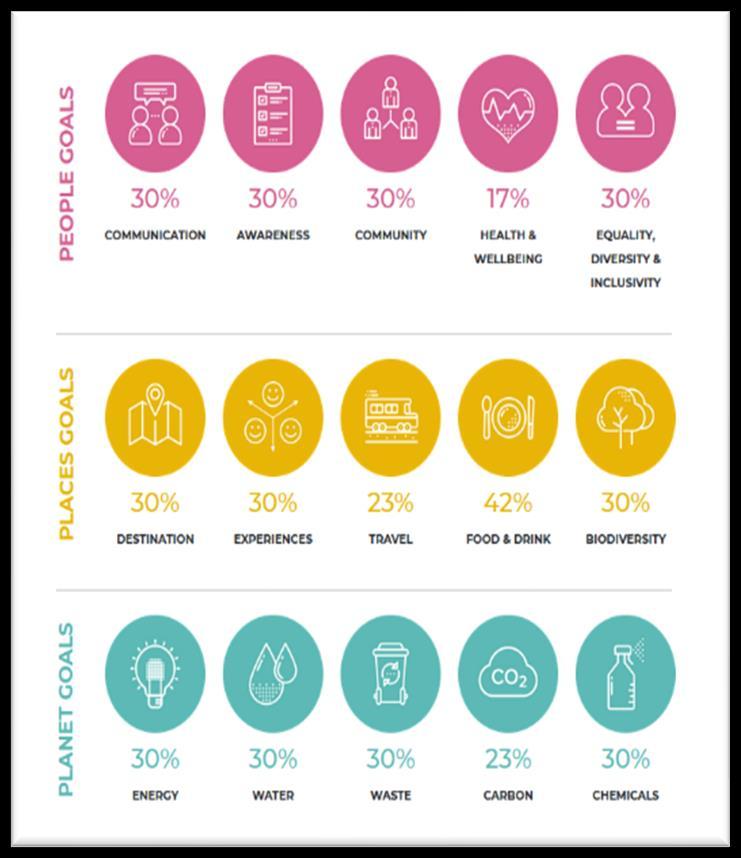

• 3 Pillars

• People

• Places

• Planet

• 15 Goals

• 70 Criteria

• Aligned to the UN SDG’s

• Prepare for assessment

• Interactive dashboard

• Real-time Scoring

• Criteria / Evidence

• Submit for Assessment

• Verification by Assessor

• Online support & Information

• Interactive Query

• Bespoke Action Plan

• Record & Review Progress

• Download to share

• All information automatically saved for future reference

• Standard evidence framework

• Evidence key highlights

• Provide key sales messages

• Inform key marketing messages

Regular Webinars & Recordings On-Demand

Including:

• Communication & Awareness

• Biodiversity

• Introduction to Carbon

• Waste

• Measuring your GHG emissions

• Energy

• Water

Everything you need - the ‘how to’, the copy, and the assets - to share your award success:

• Your website

• Social media

• In sales conversations

• In your onsite customer experience

• Your staff recruitment

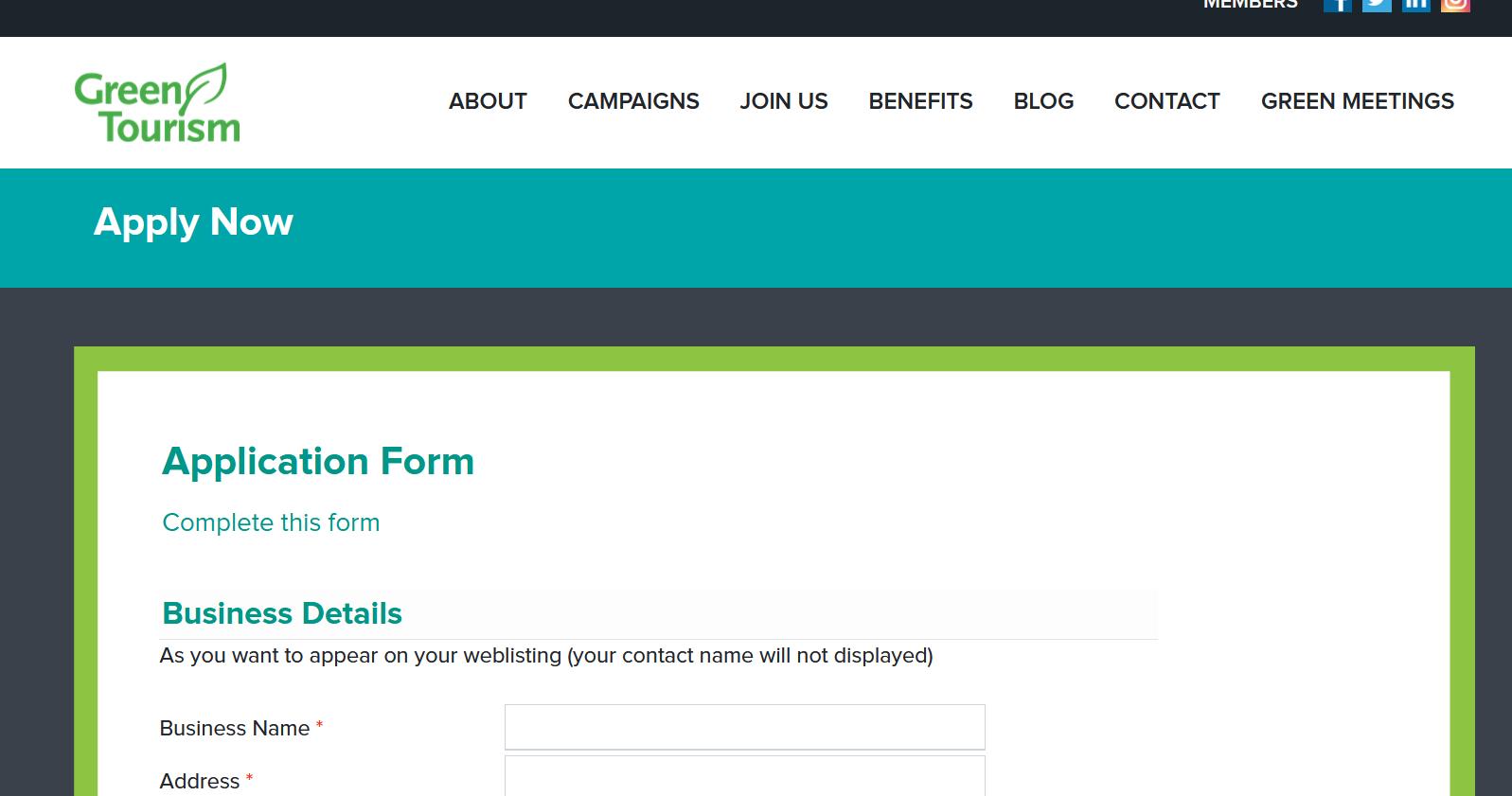

• Year 1 is fully funded • Join before 31st March 2025 • One year membership from date of joining • To continue after year 1: years 2 and 3 have 50% & 25% discounts respectively

1

• Complete the application form • Campaign name West Midlands • Invoice / payment • Welcome pack • Access to GreenCheck

• Joined in January 2022 at the outset of a sustainability improvement drive.

• Utilised the assessment criteria as a guide, providing focus to sustainability work..

Gold award with First Submission

• Achieved Award in January 2023 –achieving gold within first assessment

• Now achieving many sustainability accolades, and promoting successes widely

• Removed all single use plastic including plastic bottles (to refillable glass bottles)

• Engaged delegates, promoting the use of public transport to and from the hotel

• Reviewed menus – increasing the prominence of local produce

• Moved exclusively to refillable toiletries & removed sing use sachets from the dining

• Exclusively use a coffee supplier with a powerful grower payback initiative

https://www.trac klements.co.uk

https://paddyands cotts.shop/

“The award has supported us to communicate our sustainability commitment, and the assessment criteria has been an invaluable guide as we have prioritised and planned our improvement initiatives”

Krishna Pastakia, Director of Sales

• The Museum Conference Centre joined Green Meetings in 2022 achieving Bronze.

• With focus from the team and using the framework provided as a guide, Conference Centre advanced to Silver in 2023.

• February 2024 - the Museum added Green Tourism Silver accreditation and will be looking to build on both awards in the future.

• Implemented responsible delegate and visitor charters

• Prioritised local food and beverage suppliers

• All single use plastics removed from the museum cafe

• Renewable electricity supplied to the site

• All food waste is collected and sent to an anaerobic facility to help generate renewable energy

“The British Motor Museum is proud to be associated with both Green Tourism and Green Meetings. The help and support offered has enabled us to embark on what initially appeared to be a very overwhelming journey.

We are excited to carry on improving our sustainability practices and look forward to continuing to work with Green Tourism to achieve the Gold accreditation level”

A look into AR and VR

Introduction to the World Café Workshop

Chair of the West Midlands Tourism and Hospitality Board

Meet the team and discuss future opportunities

• A chance to meet the team at West Midlands Growth Company, understand what we do, and discuss opportunities to working together.

• You can remain seated. Our team members will move around the room.

• You will have 5 minutes with team members before they move to the next table.

• The whistle will blow at the end of the 5-minute.

• We will share the contact details of all those who you. meet so you can follow up with them after the event

Reflections on the day

Chair of the West Midlands Tourism and Hospitality Board