3 minute read

finance

Changes to Private Residence Relief affecting Income from Property

Selling a property is considered to be one of the most stressful times in a person’s life. So, when help comes along in the form of tax exemption, like principal private residence relief (PRR), it can make the experience a little easier to bear.

However, following the 2018 autumn budget announcement, the proposal was made to change the current tax relief criteria relating to principal private residence relief and lettings relief. These changes could leave individuals who are struggling to find a buyer for their home, or those who are no longer living in their property but need to wait to sell, significantly out of pocket when their tax bill arrives. Here we take a closer look at the current private residence relief and lettings relief arrangements and how changes to this system may affect homeowners looking to sell from April 2020.

What is Private Residence Relief?

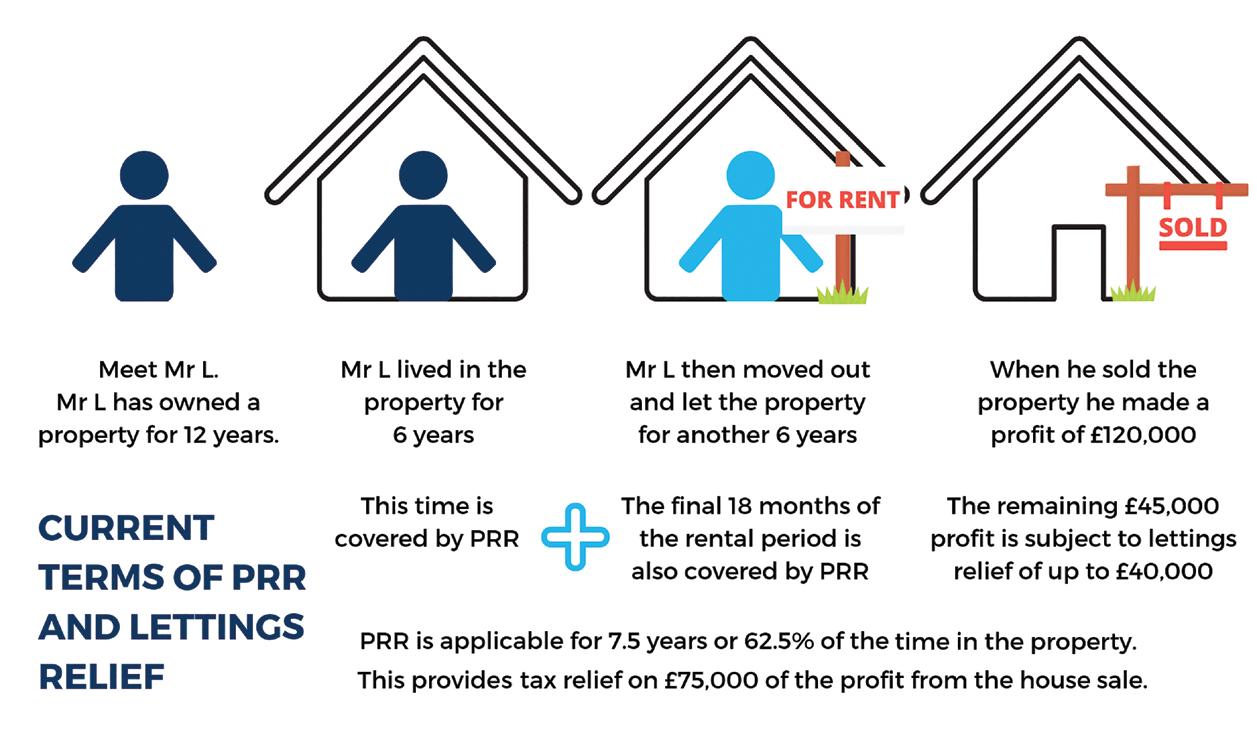

Private Residence Relief was introduced in 1980, targeted at homeowning tax payers to help reduce the impact of Capital Gains Tax (CGT) on the profit made from the sale of their main property, particularly if the property has been rented out during a period of ownership. Along with lettings relief, the terms of the current tax exemption mean taxpaying homeowners can avoid paying a hefty tax bill on any ‘chargeable gain’ once the sale of their only or main home is complete. Here’s an example of how this might look at the moment:

PRR can also help when the taxpayer owns a home but it isn’t their main residence. The current system allows homeowners to only pay a proportional amount of CGT based on the amount of time they’ve spent there e.g. a holiday home, or if they’ve needed to move out to develop the property.

How will PRR changes affect taxpayers?

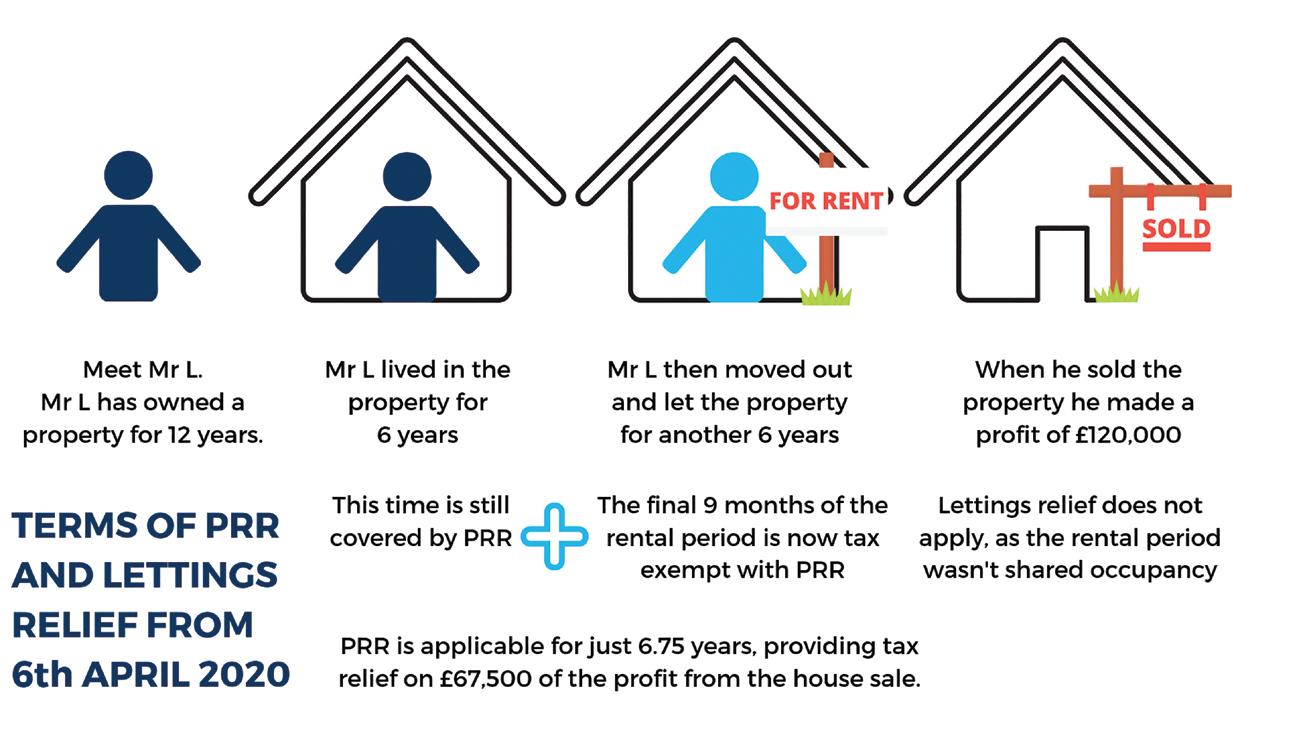

The 2018 autumn budget announced two changes that will alter how PRR and Lettings Relief are claimed. Intended to better target owner-occupiers to receive the tax benefits of PRR, individuals who have become ‘accidental landlords’ by letting a property that they’re having problems selling are likely to be amongst the most affected by the changes. The reform of PRR and Lettings relief is due to come into effect from the 6th April 2020.

Final period exemption

The final period exemption will be reduced from 18 months to 9 months. Although this end period will always qualify for PRR, giving taxpayers CGT free time to sell the property, a reduced exemption period will increase the amount of ‘chargeable gain’. This will ultimately leave sellers paying more in capital gains tax, especially if lettings relief is also not applicable.

Lettings relief

Lettings relief will now only apply where the owner is in shared occupancy with the tenant. It doesn’t apply to buy-to-let landlords or owners who have never lived in a rental property. From the 6th April 2020, any property being sold whilst claiming relief under PRR, must be lived in at the time of sale by the owner of the property. Only the periods when the owner was in shared occupancy with the tenant will qualify for lettings relief. So, what might this look like for Mr L when the changes come into effect:

I have a disability. How will the changes affect me?

The final period exemption of 36 months will stay in place for individuals living with a disability who are waiting to enter a care home. The changes are most likely to affect people who have equity in a property they once lived in, which has been rented out at some time, as they could end up paying more in tax if they chose to sell after April 2020.

If you’d like to find out more about the changes to PRR and Lettings relief and how this may affect your finances, speak to our expert Corporate and Personal Tax team in Warrington on

01925 830 830

or call our Manchester office on 0161 905 1801,

who’ll be able to give you helpful advice in relation to your individual circumstances.

Les Leavitt

Leavitt Walmsley Associates Chartered Certified Accountants www.lwaltd.com