8 minute read

FEBRUARY 2019Digitally Transforming Frac by Melanie Darbyshire

Given the state of the hydraulic fracturing (also referred to as ‘fracing’, ‘frac’ and ‘well completions’) industry over the past five years, one might assume it’s a tough business to be in today. In the last year alone, everything that could have gone wrong for the industry seemingly did: oil fell to negative $37/barrel; a surge of bankruptcies and consolidations swept North American oil and gas companies; the COVID-19 pandemic caused a seesaw in the demand for energy; and, a newly-inaugurated U.S. President Joe Biden banned fracking on U.S. federal land.

If there has ever been a difficult time to be in the well completions business, now seems to be it.

Advertisement

In fact the opposite is true for Calgary’s Cold Bore Technology. Founded in 2014, the company’s SmartPAD - the world’s first and only completions master control system, which allows for truly autonomous frac - has transformed the fracing operations of producers across North America, making Cold Bore a singularly valuable ally to an industry working through turbulent times.

It’s been a slog to be sure, as many tech startups can relate. But, having emerged stronger than ever from a challenging 2020, with the price of oil stabilized and forecast to continue a slow and steady rise, and given the push towards greater automation in the hydraulic fracturing industry, Cold Bore is now capitalizing.

“We’re a survival story,” says Brett Chell, cofounder and president of Cold Bore, proudly. “There’s a triple recession, oil and gas gets crushed, we pivot, we refinance - all of it. We started as two guys and now we’re 65 people. Last year our revenue was $6 million - almost double the year before - during what was conceivably the worst year possible. And we are on track to pass $25 million this year.”

The core of the business is SmartPAD, a completions master control system. “SmartPAD acts as a centralized nervous system,” Chell explains of the made-in-Canada product, “to connect all of the control systems from different service companies on site. It’s a network, a platform that universally brings the whole operation together. Literally brings the whole pad together - from a physical and data perspective.”

DIGITALLY

TRANSFORMING FRAC

COLD BORE’S BRETT CHELL ON BEING AT THE FOREFRONT OF THE DIGITAL REVOLUTION OF WELL COMPLETIONS by Melanie Darbyshire

Brett Chell, co-founder, president & CEO of Cold Bore. Photo by Bookstrucker.

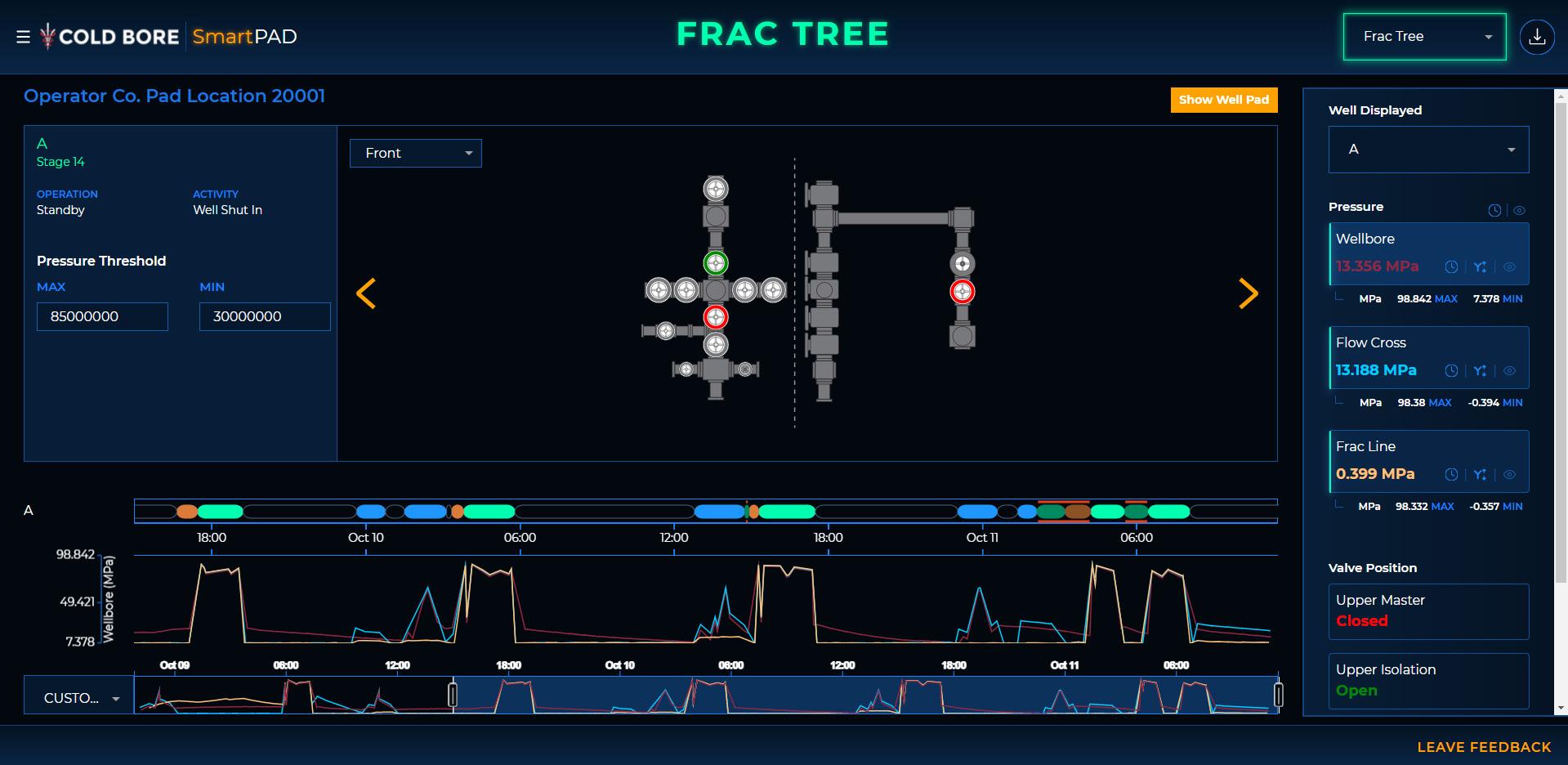

SmartPAD™ Dashboard displaying frac tree and pressure data.

Using sensors on the frac trees, the system autonomously tracks workflow for the entire pad, then provides an auditable baseline.

“It’s the first time a company thought to track the entire pad itself, rather than a single service,” Chell points out. “The result is a one-second accurate workflow that connects control systems and enables zero-human interaction, fully autonomous frac operations.” All users working on the pad, from oil companies to service companies, have access to the dashboard, which has every service screen on location consolidated into one place.

Indeed, Cold Bore has partnered with most major service companies who connect their automated control systems to the “central hub,” so they too can be part of the autonomous frac evolution.

Whereas the traditional method is to manually track frac operations by hand using Excel spreadsheets at the wellhead (each service company tracking and formatting its own data), SmartPAD replaces this inefficient, inaccurate and dangerous job by digitally tracking all of the data from sensors on the frac trees. The data is formatted into the 100 per cent accurate workflow and accessible to all service companies and the operator. “Everybody on the pad sharing one platform and one database that is fully audited in real time,” Chell says. “All while still being able to use their own control systems on location.”

SmartPAD also provides a full real-time analytics platform, with the ability to set alerts and alarms on any service company’s raw data feeds, or share raw data between service companies. This allows them to feed each other’s algorithms and drastically improve operations in dozens of different areas.

“Once we’ve connected all the services with a master control system and made them visible to everybody,” Chell explains, “we then implement automation. We automate all of the inefficiencies and cut unnecessary human interactions out. There is a massive operational efficiency gain, which equates to faster completions.”

“We’re selling informational efficiency gains,” he continues, noting SmartPAD is a giant step above an analytics platform. “Once you fix your information, the visualizations from your analytics are going to be infinitely better and it will be obvious how your operation must change.

Digitally Transforming Frac

You’ll see what you’re missing and can change it automatically. You’ve affected infrastructure, safety, operations, automation - and all of the services will define best practices jointly.”

That operational efficiency also helps operators ‘green’ their completions. “Less time on the pad means less water and chemical usage,” Chell points out, “but also less time that pumps are burning fuel and creating emissions.” Most importantly, because there is a single timestamp of operations on location, operators can provide audited proof of reduced consumption, greenhouse gas emissions and ESG improvements.

All of this means money to operators, more and more of whom are using SmartPAD. “We have clients in Canada and all over the U.S. now,” Chell says. “Eastern Pennsylvania, Pittsburg, Dallas, Houston, Colorado and North Dakota. We’re also inbounded by companies in Australia, the Middle East, Saudi Arabia and Argentina.”

Not bad for a guy from Lethbridge who started his career on a drilling rig. “After high school I went to art school in Vancouver, and then dropped out because I decided I wanted to make money,” he laughs. “All my friends were going out to the oil rigs and I figured I could spend one, maybe two years there.”

Seven years later, Chell had worked his way up the chain, from leasehand (scrubbing the outside of the shacks) to getting offered a drilling job. Wanting a change, he joined Xtreme Coil Drilling in 2005, where he was involved in building drilling rigs and technology development.

A couple of years later he joined a group of Calgary entrepreneurs involved with various tech startups. “That’s where I learned finance from a startup perspective,” he says. “I learned the game of private equity, venture capital, how to raise money, how to build financial narratives, when, how and what you can raise money for in Canada versus the U.S.”

He co-founded Axial Energy Tech in 2014, to fund and build energy startups, one of which was Cold Bore. In time, it became his (and CFO Blair Layton’s) sole focus.

Their original concept for the company was to build directional drilling tools out of acoustics. However, by the end of 2015 the price of oil collapsed, bringing drilling activity down with it. “We had actually been working on a side project digitizing wellheads, so we thought why not take the acoustic tool we have and go to completions,” Chell explains.

“We pivoted,” he continues. “We were basically broke. We’d spent the first $2 million we’d raised from friends and family but had no product, nothing. The industry was down, nobody liked oil and gas. But we bootstrapped another million bucks together, a hundred grand at a time, just keeping it alive, and went to completions.”

To refine the product, Chell spent many hours on completions pads testing the digitized wellheads. Coming from the drilling world, where all of the sensors send data to a centralized computer, he quickly realized there was no centralized control system in frac. “The data was all over the place,” he says, “unformatted and a mess. Some was used, some went to the cloud, some just disappeared. I had nothing to plug into and it became obvious that that was the big opportunity.”

The initial idea for SmartPAD was a centralized control system: “Plug everyone in and show the data, then automate the processes. Network the entire pad. But the original concept is nowhere near what we have today.”

Convincing operators to use SmartPAD in the beginning (when still in development) required

Brett Chell & Engineer Permian.

A control station for monitoring fully autonomous frac on-premises. This view is replicated in the cloud for remote ops as well.

thousands of air miles logged by Chell, who, prior to the pandemic, spent almost every week in Houston, Dallas or Pittsburg. “About two years ago we got to the point where six major companies were using the product and we met up with the Rices (of the Rice Investment Group (RIG)). When I showed it to Toby Rice, he saw the opportunity right away and was in.”

With a cheque for $4 million from the RIG – one of the largest names in U.S. private equity – Cold Bore was well on its way. “We’ve spent the last year-and-ahalf selling and maturing,” he says. “We’ve spent $300,000 to $400,000 a month on software development for two years. We’re now at the point where we’re rolling over. We’re now profitable.”

The company is currently raising a large growth equity round of $14 million in the U.S. “Cold Bore very much has come through its shit kicking,” Chell reflects. “We’ve built into a sophisticated software company. We really now stand in a league of our own.”

It’s that league, Chell believes, which is prime to meet the needs of today’s operators, who spend 60 per cent of their costs on completions: “While a lot of the focus is on controls and automation, it also needs to be on informational efficiency, which will give operators a tenfold uptick in their operational efficiency.”

Having come into itself, Cold Bore is now comfortably leading the digital transformation of the hydraulic fracturing industry. At the company’s helm, Chell does not lack confidence: “This is the space to be in. This is where all the money’s going to be for the next few years. SmartPAD at its core is an automation platform. It follows the same path and methodology Amazon did when it implemented a standard platform for e-commerce, which completely changed how that industry did business.” B EO