4 minute read

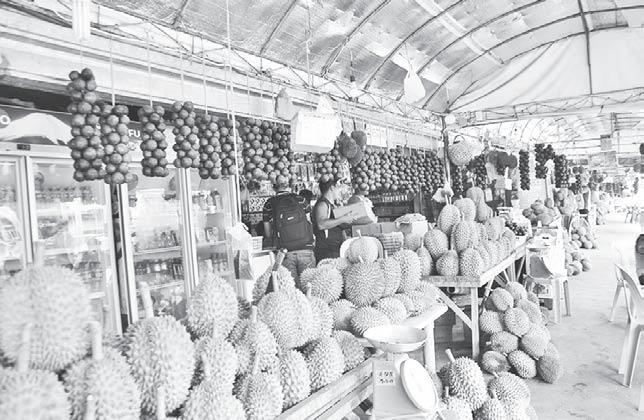

Davao ARBs keen on exporting durian–DAR

By Jonathan L. Mayuga @jonlmayuga

A total of 48 durian farmers attended the training which equipped them with skills and knowledge on how to produce highquality durian fruits that could pass the stringent food safety and quarantine measures, according to the Department of Agrarian Reform (DAR).

“GAP training aims to equip the durian growers here in Davao with advanced knowledge and skills in durian production. The participants were also oriented on the exportation of their durian products as well as on the phytosanitary protocols that govern the production, marketing, and export of durian products,” said Joseph H. Orilla, DAR Davao regional director.

He said the training is part of the DAR’s effort in providing support services to make the

Big chocolate backs new deforestation law of the EU that risks pricier bars

BIG chocolate companies are welcoming new European Union rules that protect forests, but which risk further hitting consumer wallets.

The EU is introducing laws that ensure that commodities including cocoa, coffee and palm oil aren’t grown on deforested land—and is also putting in measures to tackle issues like child labor in supply chains. Firms like Lindt & Spruengli AG, Ferrero SpA and Unilever Plc say they back the move because it looks after the environment and those who grow the crops.

But for shoppers—who increasingly want to know where their food comes from and whether it was ethically produced—it could come at a cost. No. 2 cocoa grower Ghana has warned that buyers should be ready to pay more because of the investment needed to set up systems tracking beans back to farms. That may potentially raise prices of everyday items like chocolate bars and shower gel for European consumers struggling with a cost-of-living crisis.

“There is clearly an investment that needs to be made,” said Francesco Tramontin, vice president of EU institutional relations at Kinder maker Ferrero. He said the company already has full traceability of farms it buys cocoa from.

The prospect of having to pay more for commodities like cocoa comes as inflation remains a particular problem for indulgent treats because of supply constraints. For example, cocoa futures have soared to a multiyear high and coffee prices have also jumped in London.

Premium chocolate producer Lindt, which also welcomed the new regulation and had been working toward it, declined to comment on the potential impact on consumers. The new rules on deforestation come into force now, though companies have until the end of next year to comply. Ivory Coast and Ghana, the source of two-thirds of the world’s cocoa, are having to set up special systems that adhere to the EU’s requirements—such as geotagging land on which those products were harvested.

Unilever, which uses chocolate for its ice creams and buys Ghanaian cocoa through processor Barry Callebaut AG, said the “planet desperately needs” the measures and that they’ll mean a level playing field in Europe.

“I think Ghana’s right to say for as a country, they will need everyone to pay more, just like we do,” said Unilever head of nutrition Hanneke Faber. She said the company pays extra to make sure the commodity is produced without deforestation or slavery.

Unilever said so far it’s been able to avoid passing on prices to consumers and that it hopes it’s the case for the entire industry going forward.

Tracing cocoa currently takes place through voluntary sustainability programs run by individual companies. Each program has different criteria and national governments have no oversight. Ferrero’s Tramontin says the industry needs sustainability standards at policy level.

“Otherwise you will have just companies that kind of seal their supply chain, which will be good for them in terms of getting the cocoa in Europe, but not necessarily the impact that say at scale that everyone wants to have,” he said.

Nestle SA has committed to deforestation-free cocoa sourcing by 2023. Unilever says by the end of this year the cocoa it buys will also be deforestation-free. Some firms say that compliance with the rules is already embedded into their systems, but analysts have warned of a hit to some profitability.

For example, Barclays Plc estimates that compliance processes related to the rules for Barry Callebaut in 2025 will impact around 9 percent of 2023 Ebitda. The processor declined to comment. Bloomberg lands awarded to ARBs under the Comprehensive Agrarian Reform Program more “productive and market-driven.”

DAR noted that GAP is a certification system for agriculture and facilitates access to new markets.

Orilla said GAP ensures the quality of the food and the safety improvement of raw and processed products to be produced by the farmers. It aims to help farm owners maximize yields and optimize business operations while minimizing production costs, and keeping high regard for environmental protection as well as health, safety, and welfare of the workers.

GAP, as defined by the Food and Agriculture Organization, are a “collection of principles to apply for on-farm production and postproduction processes, resulting in safe and healthy food and non-food agriculture products, while taking into account economic, social and environmental sustainability.”

FAO said many importing countries as well as domestic buyers, especially organized retailers, are now requiring producers to implement GAP as a prerequisite for procurement to ensure the quality and safety of their produce.

The GAP training, stakeholders meeting for high-value crops, and other capability enhancement programs were spearheaded by DAR

Undersecretaries Jeffrey M. Galan of the Finance Management and Administration Office and Atty.

Milagros Isabel A. Cristobal of the Support Services Office.

Durian became one of Davao City’s top fruit exports after local growers sent 28 tons of the fruit on a chartered cargo flight to Beijing, China last April 6.

The first shipment was made after the General Administration of Customs of the People’s Republic of China (GACC), the headquarters of China Customs, confirmed Beijing’s approval to receive the durian from the Philippines after a series of farm inspection here and businessto-business negotiations since December 2022.

Abel James I. Monteagudo, director of the Davao regional office of the Department of Agriculture, said the initial shipment was bought at a farmgate price of between P65 and P80, already a big improvement from the much lower buying price in the past, when prices could fall to as low as P20 during harvest.

Davao City growers produce 41,145 metric tons (MT) of durian annually, accounting for slightly half of the country’s annual output of 79,000 MT. Other production areas are in the Davao Region and in North Cotabato.