25 minute read

Digital transformation on fast forward

from BR/09/2021

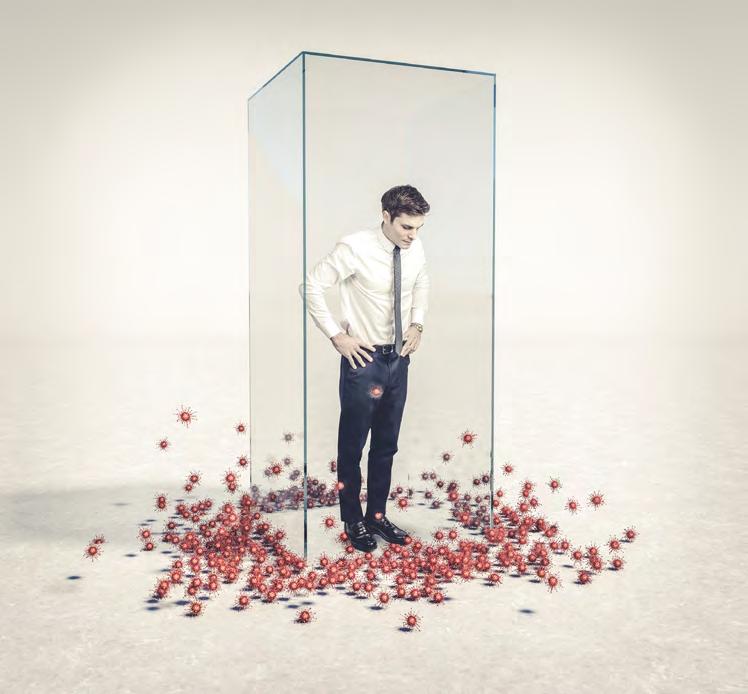

With the covid-19 pandemic having fast-forwarded the digitalization process in fields such as healthcare, education or public administration as well as across the business world, Vodafone will continue to support Romania’s digital transformation, helping it build a new and improved infrastructure and increase the number of high-speed internet connections. Nedim Baytorun, Vodafone Romania’s new Consumer Business Unit Director, sat down with Business Review and talked about the company’s commitment to continue digitalization efforts and investments and to expand its network and services to reach places that no other network covers. He also told us about the operator’s desire to provide better customer experience through its high-quality services and entertainment solutions.

By Anda Sebesi

Advertisement

You took over the Consumer Business Unit Director role at Vodafone Romania just two months ago. What is your perception of the telecommunications market in Romania compared to those in other countries?

The telecommunications industry plays an enormous role in economic growth and social progress in Romania, just as it does in Albania and Turkey, the two other countries in which I’ve had the privilege to work. The telecom infrastructure, with all the services it enables, changes people’s lives for the better, allowing them to communicate, work, learn, and get entertained. At the same time, it provides the business sector the means to grow, streamline operations, and become more efficient.

These three markets are all very dynamic and complex, with Vodafone holding a leading position in all of them, along with strong commitments for the digitalization of society and businesses. In both Albania and Romania, we’ve been seeing consolidation movements over the past two years, which have enabled Vodafone to become a convergent player. In Albania, I had the opportunity to be involved in the acquisition of the largest cable operator, ABCom, a transaction that helped the company become a full telecom service provider.

Last year, Vodafone Romania also finished the merger process with UPC, yet another move that allows us to provide a full portfolio of services to both residential and business customers. Going further, we need to continue our investments in infrastructure – as the pressure on our networks has significantly grown in the pandemic context –, reduce the digital divide, and develop the population’s digital literacy. Above all, Romania has the historic opportunity to access the recovery and resilience funds provided by the EU and to shape its economy and society for the coming decades.

Telecommunications services (including TV) in Romania are the cheapest in the European Union. How do prices compare to those in Turkey and Albania?

Indeed, telecommunications services in Romania are the cheapest in the EU, but compared to Turkey and Albania, which are outside the EU, the average revenue per user is bigger in Romania. However, if we correlate ARPU with GDP per capita, telecom services are still more affordable in Romania. Also worth mentioning is the fact that average data consumption is way higher for Romanian users, reaching 18GB, compared to 12GB in Turkey and 8GB in Albania.

All economies are currently undergoing a digital transformation process. How advanced do you think this process is in Romania?

Looking at what Vodafone Romania has achieved, as well as beyond to what the entire society has had to cope with during the pandemic, I would say that important and rapid steps have been taken in the country. We saw rapid digitalization processes in healthcare, education, public administration, but also in the business sector.

We have enhanced our networks to ensure sufficient capacity for all users, whether they are businesses or individuals, provided support to the authorities by connecting hospitals and medical staff, and provided digital solutions in response to new needs in society. We connected more than 1,000 schools to the internet to allow pupils and teachers to carry on with the school year, and we provided more than 100,000 tablets to children who needed them to attend online classes. At the same time however, the digital divide got even bigger, with the most vulnerable groups getting hit the hardest. The same happened in the business sector, where small and medium businesses, the least digitalized business category, were the most exposed.

The need for digital transformation is critical among small and medium businesses in Romania, as they provide jobs for two thirds of all employees in Romania. To help them in this endeavour, Vodafone Business has launched V-Hub, an online resource and information platform that helps SMEs in the process of digital transformation. At the same time, Vodafone is committed to supporting Romania’s digital transformation, helping it build a new and improved infrastructure and increase the number of high-speed internet connections. Our priorities include expanding 4G services in remote areas, launching 5G networks, and delivering high-quality telecommunications services through environmentally-friendly Gigabit networks. In addition, we are ready to implement and develop IoT solutions for the public and private sectors to reduce energy consumption, optimise and accelerate processes, digitalize education, and provide telemedicine solutions to hospitals. According to a Deloitte report commissioned by Vodafone, accelerated digitalization in key areas, including through the efficient use of EU funds allocated in the national recovery plan, could generate a 16.48 percent increase in GDP over the coming years.

Vodafone Romania expanded internet access in rural areas in the context of pandemic restrictions. How was this received by the population and how is it going to develop in the future? How important is it to ensure digital communications to all areas?

Indeed, following the outbreak of the pandemic, we continued expanding our fixed and mobile coverage in isolated areas and wherever coverage or capacity enhancements were needed, as the crisis brought major changes in the use of electronic communication networks and services. Between March 2020 and June 2021, Vodafone Romania expanded its mobile network by over 700 4G stations, providing connection to voice and mobile data services for approximately 150,000 inhabitants from 158 localities in rural areas. Currently, 96 percent of the rural population is connected. During the same period, Vodafone expanded its fixed network through new developments or extensions of existing networks to 21,000 households in rural areas. One particular story comes to mind to illustrate how the pandemic has brought us together and how it has made us more human, more understanding of each other, and more attuned to the needs of people around us. At the beginning of the year, our office received a letter from the Mayor of Isverna, a commune in Mehedinti county. He wrote the letter on behalf of the citizens of Draghesti, Cerna Varf, and Buzesti villages, asking us to connect them to the Vodafone network. They were completely isolated, with no GSM signal, and with no way to get in touch with their loved ones, access medical services or attend online classes. Within a few days, Vodafone Romania's engineers had installed tens of kilometres of optic fibre, electronic communications equipment, and a dedicated tower for 4G mobile services, providing inhabitants of those villages with the much-needed access to communications services.

That is just an example of many. But Vodafone is committed to continuing its digitalization efforts and investments and to expanding its network and services to reach places that no other network covers. Digitalization has the power to remove boundaries and provide equal opportunities for development to individuals, communities, and entire societies. That means we shouldn’t be talking about big or small localities, about far or near villages, about bigger or smaller needs. The need to keep in touch with family is the same for everyone. These recent times have proven to us that telecommunications networks and services represent critical infrastructure that connects people and businesses, allowing daily activities to carry on.

Vodafone’s integration with UPC has allowed the former to extend its portfolio of services in Romania. What is the current state of the integration process?

We started the integration process in August 2019 and it was estimated to take up to three years. The first step was the merger between EMT and Management, followed by the one between the teams and their relocation into one office. The first fixed and mobile commercial offer was launched soon after, in September 2019, and it represented a milestone as Vodafone became a convergent operator and one of the strongest players on the market. The completion of the legal merger was announced at the end of March last year, and that was followed by the process of rebranding UPC stores. Throughout the rebranding, we served our customers in all retail locations, regardless of the type of service they wanted to acquire, and provided support through the merged call centre teams.

Last September, we brought our new convergent offer to the market with a unique, complete, and fully integrated TV experience, through the Vodafone TV service. We also continued to innovate by offering the first full-fledged digital subscription in Romania, giving users total control and flexibility to customize the subscription’s benefits at any time, by adding bundles with national and international minutes and text messages and extra GBs of mobile data, but

also to temporarily freeze their subscription while still being able to receive calls. In addition to flexibility and unlimited benefits, Flex digital subscriptions allow users to access to Vodafone Romania’s 5G network, regardless of the value of their subscription. We have provided access to attractive offers through the Vodafone Club loyalty programme to all our mobile and fixed customers.

Going further, we’ll continue to invest in expanding 4G coverage in rural areas and 5G services in urban areas, as well as in extending the fixed-line network for television and telephony and improving the quality of fixed internet services. Recently, Vodafone has been recognised as the most reliable 5G network, with the highest mobile scores for data performance as evaluated by independent auditor umlaut. This is the seventh recognition for Vodafone Romania’s mobile network through the measurement campaigns carried out by umlaut.

How did customers receive the new integrated service offerings for internet and cable TV?

One year after the completion of the UPC acquisition, 30 percent of all Vodafone customers were using mobile, fixed, and TV services. Today, 41 percent of customers also use our fixed services. It is obvious that people prefer a one-stop-shop for all their telecommunications services, because it’s more convenient and cost effective. Since its launch a year ago, Vodafone TV has brought Romanian consumers a revolutionary TV service combining interactivity, streaming apps, and digital cable into a platform with the richest content offering consisting of 190 channels in SD, HD, and 4K formats, the most comprehensive on-demand video library, with a dedicated HBO GO section and access to the most popular on-demand streaming apps in Romania, like Netflix, Amazon Prime, YouTube and YouTube Kids, and Hopster. In terms of fixed internet services, Vodafone Supernet Fiber provides up to 1Gbps transfer rates and stable connections along with the best Wi-Fi experience on the market through the Super-Wifi router.

How have consumption trends changed during the pandemic?

The restrictions imposed because of the covid-19 pandemic have generated dramatic changes in our daily lives, forcing us to move work, learning, and entertainment activities online. Employees moved from offices to their homes, children attended online classes, people stopped going out as much, substituting face-to-face meetings with online entertainment. All these translated into a huge pressure on telecommunications networks, with voice and data traffic in both fixed and mobile networks seeing significant increases. Evening calls were replaced by lunchtime calls, as people were probably taking lunch breaks and wanted to get in touch with their families, while video calls saw also a significant increase. The use of digital channels, social networks, video streaming platforms, and online video gaming continued to grow, and so did the adoption of online payments, online shopping, and digital applications. Digitalization was thus no longer a projection for the future but a daily necessity, opening up new possibilities.

What kind of offers is Vodafone preparing for the fall?

We update our commercial offering constantly in order to properly serve our customers’ needs. Recently, in a first for the Romanian telecommunications market, we launched a simplified and flexible subscription for fixed internet and television services, to which users can add free extra benefits, based on their preferences, while having more clarity in terms of package content and associated costs. The Home Deal package includes 500 Mbps Internet and TV services with 157 channels (Sport option included). Additionally, customers can opt for two out of four free extra benefits, choosing from HBO and HBO GO free for 12 months, Vodafone TV with video on demand options and 4K channels, 40 TV channels or a portable Wi-Fi Mini-router (internet back-up). The package is available for EUR 9.9/month for customers who only subscribe to fixed services or EUR 7.9/month for mobile service subscribers. For clients who want the full list of benefits, the All Inclusive package comes with free HBO and HBO GO for 24 months, at the promotional price of EUR 14.9/month for fixed services subscribers, and EUR 12.9/ month for mobile subscribers. Apart from our services, we also want to provide customers with the best experience in terms of entertainment offers. We have recently launched Hit Play, the first fully digital music show in Romania that integrates all the elements of a traditional talent show, adding interactivity. The show is streamed on Instagram and the audience has the chance to choose their favourites. The show is open to anyone, anywhere.

What is Vodafone’s consumer strategy?

Though we can’t disclose our plans for the future, we can tell you that we’ll strive to bring innovative products and services as well as transparency and flexibility to our customers, and that we will continue to invest in our fixed and mobile networks and constantly improve the quality of our services.

How many 5G customers do you have today and what do you think the future holds for this technology?

Vodafone was the first operator on the local market and one of the first in Europe to launch commercial 5G services, about two years ago. Just before the commercial launch, we tested the technology during the first live concert that integrated the hologram of a young guitarist – a world premiere –, proving that 5G was already here. One year later we created the first 4K live holograms using 5G technology to celebrate Mother’s Day. Currently, our 5G service is available in several cities. This technology will certainly mark the beginning of a new era in connectivity and communications, enabling the digital future we all envision.

Baytorun, Vodafone Romania: “Past failures have taught me just as much as past successes”

Recently appointed as Consumer Business Unit Director at Vodafone Romania, Nedim Baytorun talked to Business Review about his vast international experience, highlighting the lessons he learned while building a career in the marketing field and providing insight into his goals as a top executive within Vodafone Romania.

By Anda Sebesi

About

Nedim Baytorun was appointed as Consumer Business Unit (CBU) Director at Vodafone Romania on July 1, 2021. He first joined Vodafone in Turkey in 2013, where he held several commercial and marketing roles, including Head of Segments and Head of Digital Transformation & Revenue Management. In 2019, he took over the Consumer Business Director role at Vodafone Albania, leading the agile transformation of the CBU organisation into a household brand and building a convergent business through the Vodafone – Abcom integration. During this period, he was involved in important digitalization projects, including digital trading platform GigaMarket, a first for the market.

Nedim Baytorun was born and raised in a small town in southeast Turkey; his parents were both academics. Having always been a big fan of Science and Math, he decided to study engineering. However, in his last year of college he discovered the amazing world of marketing, so since graduation, his entire career has been built around marketing and sales. In the early years of his career, he had the chance to work with many international managers – Turkish, German, French, Italian, American, Greek, and Portuguese. As a result, his management style is a mix of many cultures. “I am a big fan of communicating directly and openly with no hidden agenda, empowering teams by being a good listener, and challenging them to always step out of their comfort zones and try new things. The best teams I’ve been a part of have been the ones where there was trust, open conversation, and the willingness to try new things, where you either succeed together or fail together,” Baytorun explains.

A proud father of two daughters, Baytorun says he is fascinated with the natural beauty of our country, the cities he has visited, the friendly and welcoming people, and the good quality of life. About his team, which includes young and very energetic colleagues, he says: “They are very enthusiastic and they want to achieve more, which makes me very happy. In fact, I am looking forward to spending more time with my team outside of work as well.” With cooking as his number one passion and one of the few ways he can really disconnect and clear his mind, he plans to host a cooking event for his team soon. “I’ve taken many cooking classes and got several certificates; one of them was from Le Cordon Bleu, and I am very proud of it. I love having the opportunity to socialise with my friends while I cook for them, so much that I even have a hashtag on Instagram: #nothingtastesbetterthancookingforfriends.”

BOLD PROJECTS

As a marketing professional, Baytorun believes himself to have been extremely lucky to be able to do what he loves in four different countries so far: Turkey, the United States, Albania, and now Romania. “This gives you the opportunity to have many stories of both success and failure in different ecosystems where you can learn so much,” he notes. Asked to recount some good memories from these experiences, he says that launching the first light Greek yogurt brand in the US was one of the top highlights, from when he was the marketing manager for Danone Light & Fit in the US. “It was the challenge of a lifetime to bring a brand new product line to a huge market.”

Later, at Vodafone Turkey, launching the marketplace business during his last year on the job was a major step. “It was one of Vodafone’s first solid steps towards becoming a technology communications company and I learned a lot during the process. From Albania, the highlight was leading the acquisition of the biggest fixed internet & TV company and managing the whole integration process. “All of these projects improved my commercial acumen. I am proud to say I have at least as many stories of failure as stories of success, and I can say that each one of them helped me a lot. One big lesson I took from my biggest failures is that you should always listen to the consumer and make sure you get enough core insight before making a strategic decision.”

As for what’s ahead, Baytorun says that both Romania and the company for which he works represent great progress stories. “I believe the country’s progress will accelerate even more through the digitalization agenda. My goal is to make sure that Vodafone has a big role in supporting and leading the country on this digitalization journey.

The influence of covid-19 on CEE FDI flows

In Central Europe, FDI fell by 58 percent in 2020 compared to 2019

The eleven Central Europe (CE) countries each gained their attractiveness as foreign investment targets, thanks to their closeness to west European markets, well-developed infrastructure, political stability, low tax rates, and a generally welleducated workforce. According to a study published by Les Nemethy, the CEO of EuroPhoenix Financial Advisors, EU membership compensates for the small size of many domestic markets.

The World Bank outlines FDI as a category of cross-border investment associated with a resident in one economy having control or a significant degree of influence on the management of a company that resides in another economy. FDI involves both transborder M&A and organic growth by foreign-owned companies.

Global foreign direct investment flows are expected to bottom out in 2021 and recover some lost territory with an expansion of 10 to 15 percent, according to the UNCTAD's 2021 World Investment Report.

FDI trends in 2020 varied significantly by region. In developing regions and transition economies they were relatively more affected by the impact of the pandemic on investment in global value chain-intensive and resourcebased activities, according to the UNCTAD. Asymmetries in fiscal space for the roll-out of economic support measures also drove regional differences. In Central Europe, FDI fell by 58 percent in 2020 compared to 2019, The coronavirus crisis has had a powerful negative influence on the Central and Eastern Europe (CEE) region. According to forecasts by experts at the United Nations Conference on Trade and Development (UNCTAD), a recovery of FDI flows for countries in this region is expected no earlier than 2022.

By Claudiu Vrinceanu

as the coronavirus pandemic and lockdowns curbed economic activity. The trend is also apparent in Romania: the country’s FDI volume contracted by over 60 percent to EUR 1.92 billion (less than 1 percent of GDP) in 2020, compared to 2019. M&A was also poor in 2020, with 1,705 deals reached in CE for a total of USD 60.8 billion. This translates to a 12.9 percent decline in transactions and a 16 percent decline in deal value compared to 2019. Notwithstanding a solid fourth quarter in 2020 and CE putting in a more robust M&A performance than most other parts of the world, this represents the worst annual M&A performance in over a decade.

Chinese investments are minor in CEE countries, with the exception of Serbia, while Germany and the US are the largest investors in the region. Romania is in fourth place in CEE region in terms of attracting new foreign investments from the US, Germany, and China. German assets drawn in by Romania are half of those gained by Hungary, the Czech Republic or Poland. The situation is similar for China, which does not rank among Romania's top investors. The value of Chinese FDI between 2000 and 2019 in Romania reached USD 1.4 billion, according to a study from the Central and Eastern European Centre for Asian Studies (CEECAS).

Emerging verticals and business models in 2021

June, July, and August 2021 were very active months for the Romanian startup ecosystem, with multiple pre-seed and seed level funding deals. Let’s take a look at the business verticals that were the most exciting for investors this summer.

By Claudiu Vrinceanu

SOCIAL

Investment fund Early Game Ventures signed a EUR 2.5 million round for the startup FameUp, a mobile platform for micro-influencers. Bogdan Gheorghiu, Daniel Dines, and Marian Dinu also participated in the round as angel investors. Framey, a social networking app for travel enthusiasts, secured a USD 1 million seed loan from ICE Capital in Dubai, supported by Romanian investment fund JECO Capital. The startup founded by Romanian entrepreneurs Robert Preoteasa and Alexandru Iulian Florea will utilise the funds to extend operations and launch their application globally.

PROPTECH

Office visualisation solution provider Bright Spaces raised a seed investment of EUR 1.5 million, with French VC Axeleo Capital as the lead investor. The startup’s other investors include British Pi Labs, Romanian Sparking Capital, and Growceanu Angel Investment. Several well-known angel investors, including Marian Dinu of DLA Piper Dinu and Alexandru Boghiu of The Mavers.

FINTECH

Bankata.ro, a fintech platform that aggregates and compares financial products, raised a funding of EUR 180,000 to develop and implement its business plan. The investment is coordinated by Sparking Capital as lead investor, in partnership with private investors (business angels).

Office visualisation solution provider Bright Spaces raised a seed investment of EUR 1.5 million

MARKETPLACES

Metabeta, a data-driven platform for managing investments in startups, took a seed financing round worth a total of EUR 500,000. The investment round was led by Neogen Capital and completed by 15 other business angels (part of groups such as Growceanu, TBNR, TAN - Transylvania Angels Network, and Techangels). The funds are aimed at developing Metabeta into a machine learningbased marketplace for investors and startups.

Romanian startup Stailer.ro, the online booking platform for beauty salons, launched by entrepreneur Andrei Ursachi, raised a preseed investment worth EUR 500,000 from a group of angel investors in a financing round led by serial entrepreneur and tech investor Cosmin Tirvuloiu. Following the investment, Stailer’s value jumped to 5 million euros.

Local startup Storis, which has developed an application for Romanian-language audiobooks, e-books, and podcasts, managed to attract more than EUR 500,000 from over 20 private investors through a campaign carried out on equity crowdfunding platform SeedBlink. In addition to the money raised on SeedBlink, the company also got an EUR 300,000 investment from Litera Publishing House.

SAAS

Vestra, a cluster specialising in the utilities and industrial automation industry, has invested EUR 180,000 in the cash flow analysis and planning platform ThinkOut, which supports companies in managing and monitoring capital flow, giving them an overview of their finances.

HEALTHTECH

Telios Care, one of the leading providers of telemedicine services in Romania, attracted new financing worth EUR 700,000. The lead investor was Fortech, a Cluj-based software development company, which put in EUR 400,000, thus becoming the largest investor in Telios Care, with a 9 percent stake.

Corporates testing waters in local startup financing ecosystem

Corporate venture capital (CVC) financing in the European startup industry reached a record of USD 5.7 billion in the second quarter of this year, but this type of funding remains rather limited on the Romanian market. Corporate-backed initiatives have been visible through acceleration and incubation hubs for startups, but large companies are also starting to scout the market for direct investments in promising entrepreneurs.

By Ovidiu Posirca

The focus of corporates on VC investments has been boosted by the pandemic economy

Investments made by corporations in startups have grown in the pandemic economy from USD 1.5 billion in the first quarter of 2020 to USD 2.3 billion in Q4, according to a report by Stryber, a Swiss company building venture portfolios for corporates.

The UK is the biggest CVC market in Europe, with funding deals worth USD 1.4 billion closed in Q2 alone. Meanwhile, Romania has had no notable transaction of this kind until now.

HOSTING CORPORATE HQS HELPS A COUNTRY ATTRACT FUNDING FOR STARTUPS

lyst Romania, says that CVCs are a newer structure not just in Romania, but in other markets as well.

“CVC activities could not exist in the absence of large corporate businesses with enough funds available and with a specific vision and mission related to funding startups for profit or for other strategic reasons Usual-

ly for CVCs, the driver that’s more important than profit or returns is the fact that they can help grow businesses that complement their corporate ecosystem, which is why bank CVCs will invest in fintech startups, automotive CVCs will invest in industry 4.0 startups, and so on,” Ghenea tells BR.

“The other condition for a CVC to exist in a country is usually for the corporate entity to have its headquarters there. This is actually the main reason why we’re seeing so little CVC activity in Romania, as very few large corporations have headquarters in Romania,” he adds.

E-commerce player eMAG is one of the pioneers of the local CVC market, having launched its own venture fund that will target promising tech startups in the digital economy.

Meanwhile, Cristian Munteanu, managing partner of the Early Game Ventures (EGV) fund, suggests that the risk appeal among Romanian corporations is low, but things are starting to change.

“As proof, several corporations have already invested in our fund, putting their money where their mouths are, actively investing in the best tech startups in Romania. I hope more big companies will follow their lead, especially considering the handsome financial rewards,” Munteanu tells BR.

Single direct investments are the first steps that corporates take into the venture capital space, and this could happen in Romania next given the current state of the market.

Marcus Schroeder, partner at Redstone VC, wrote in an opinion piece that this usually involves minority investments in the target startups and it is decided on in the same way a corporate would decide on a mergers & acquisitions (M&A) investment. Another option is for a corporation to build a portfolio of investments by closing 2-5 deals each year.

The Redstone VC partner suggested that CVC can involve everything from “sporadic investments from the corporate balance sheet to a fully autonomous CVC fund that has been spun out from the parent company.”

US CORPORATES DRIVING FUNDING IN EUROPEAN STARTUPS

GV, the venture capital arm of Alphabet, was the most active investor in Q2, focusing on FinTech startups. US-based Second Century Ventures was the second biggest player with seven deals in the FinTech and SmartHome space. In fact, US corporates closed 15 more deals compared to their European peers in the top ten combined, according to Stryber data. How-

ever,

the biggest CVC deal closed in the second quarter involved Bonnier Ventures, the venture investing arm of Swedish media group Bonnier. The fund contributed to the USD 800 million funding round attracted by Dutch MessageBird, an omnichannel communications platform.

The financing environment for European startups has improved significantly this year, and the downfall caused by the pandemic last year was fully recovered by the end of the first semester. Crunchbase statistics show that venture investment climbed to USD 59 billion in H1 2021, compared to USD 18.5 billion in the first half of last year. There were more than 300 European companies that raised late-stage and growth-equity

funding in H1.

The prioritisation of VC investments by corporates has been boosted by the pandemic economy and the push by companies to digitalize their operations. “Many established companies globally have come to the realisation that they do not need to innovate from scratch, and that a better approach might be to partner with or invest in startups that can help them accelerate their transformation in ways that better align with the new normal,” analysts wrote in a report on venture capital by KPMG, the professional services firm.

VC investment in European startups is expected to remain robust heading into Q3, particularly in industries such as FinTech, HealthTech, and cybersecurity.

The KPMG report points out that the bigger funding rounds in Europe, including CVC contributions, are fuelled by a sense of optimism combined with a significant amount of cash investors. This has also pushed up the valuations of startups across the continent.