Sustainable Companies

Business travel Is India ready for takeoff?

How to take the Asian Gen AI opportunity

Sustainable Companies

Business travel Is India ready for takeoff?

How to take the Asian Gen AI opportunity

CEO CP GURNANI talks turnarounds, lifelong learning and the rise of AI

Business Chief magazine is an established and trusted voice with an engaged and highly targeted audience of 670,000 global executives

Digital Magazines

Website Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

Events: Virtual & In-Person

WORK WITH US

EDITOR-IN-CHIEF

SCOTT BIRCH

EDITORS

KATE BIRCH

TOM CHAPMAN

CHEIF DESIGN OFFICER

MATT JOHNSON

HEAD OF DESIGN

ANDY WOOLLACOTT

LEAD DESIGNER

MIMI GUNN

FEATURE DESIGNERS

SOPHIE-ANN PINNELL

HECTOR PENROSE

SAM HUBBARD

REBEKAH BIRLESON

JULIA WAINWRIGHT

VICTORIA CASEY

ADVERT DESIGNERS

DANILO CARDOSO

CALLUM HOOD

ADRIAN SERBAN

VIDEO PRODUCTION MANAGER

KIERAN WAITE

SENIOR VIDEOGRAPHER

HUDSON MELDRUM

DIGITAL VIDEO PRODUCERS

ERNEST DE NEVE

THOMAS EASTERFORD

DREW HARDMAN

SALLY MOUSTAFA

PRODUCTION DIRECTORS

GEORGIA ALLEN

DANIELA KIANICKOVÁ

PRODUCTION MANAGERS

JANE ARNETA

MARIA GONZALEZ

YEVHENIIA SUBBOTINA

KENDRA LAU

PROJECT DIRECTORS

THOMAS LIVERMORE

JAKE MEGEARY

RYAN HALL

TOM VENTURO

STUART IRVING

JAMES BERRY

MARKETING MANAGER

KAYLEIGH SHOOTER

MEDIA SALES DIRECTOR

JAMES WHITE

JASON WESTGATE

CHIEF COMMERCIAL OFFICER

JONATHAN CROPLEY

MANAGING DIRECTOR

LEWIS VAUGHAN

CEO

GLEN WHITE

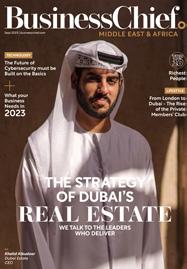

Transformation can be both a challenge and a privilege. Regular readers of Business Chief will note that this issue marks the start of a new chapter in the 100-issue history of our brand, as we expand to now include four regional editions for truly global coverage.

You are reading Business Chief Asia & ANZ, and from today you can also enjoy insights and executive success stories from Business Chief Chief UK & Europe. Last month, we launched Business Chief Middle East & Africa and Business Chief US & Canada.

These four editions combine into a comprehensive deep dive into the challenges and opportunities facing CEOs, founders and public sector leaders right now, and in the future.

From Generative AI to Gen Z, green finance to black swans, Business Chief 4.0 has you covered with exclusive interviews, roundtable discussions, and the latest research and reports.

Striking a work-life balance, you will also see more Lifestyle content for our executive audience, especially on our reimagined websites.

SCOTT BIRCH Chief Content Officer, BizClik scott.birch@bizclikmedia.com

From Generative AI to Gen Z, green finance to black swans, Business Chief 4.0 has you covered

10 BIG PICTURE

Apple celebrates 30 years in China

12 LIFETIME OF ACHIEVEMENT

Shemara Wikramanayake – the woman shaping the future of climate finance

18 THE BUSINESS CHIEF INTERVIEW

Diane Wang – from Microsoft executive to ecommerce entrepreneur

26 TOP 10 Asia companies leading the charge for sustainable change

42 TECH MAHINDRA

New chapter for India's tech turnaround CEO

50 LEADERSHIP

The importance of shareholder value on Asian societies

58 LEADERSHIP

Driving transformation at the ‘world’s best bank’

66 PEOPLE & PLANET

B Corp: Asia’s next big business opportunity?

THE TOP 100 COMPANIES IN TECHNOLOGY READ NOW

74 SUSTAINABILITY

Why Australia must embrace digital reporting – or get left behind

82 SCHNEIDER

ELECTRIC

Schneider Electric provides sustainability leadership

98 TECHNOLOGY

The risks and rewards of Generative AI opportunity in Asia

106 OKADA MANILA

How Okada Manila is taking full advantage of the AI boom

128 LIFESTYLE

Is India ready for takeoff?

It’s been 30 years since China first took a bite out of Apple and in the three decades since, the iPhone maker has built a vast manufacturing operation there and taken a fair slice of the devices market.

Largely credited for Apple’s success in China is CEO Tim Cook who shifted the company’s production from the US to China where 95% of all iPhones, AirPods, Macs and iPads are made today.

Under Cook’s leadership, Apple’s China business has grown from a fledgling success to an empire with 20% of the company’s global revenues – amounting to US$74 billion in 2022 – hailing from China.

While Cook – who speaks Mandarin and takes frequent visits to China – remains committed to the country (announcing in March the expansion of a multimillion-dollar rural education programme there) he is also looking to diversify Apple’s manufacturing supply chains beyond China.

Increasingly bullish on India, Cook opened the first Apple store in Mumbai earlier this year and is now looking to set up iPhone manufacturing operations in the country.

Driving performance at Macquarie Group for 35 years, Shemara Wikramanayake has delivered record profits and secured a seat at the top table of climate finance

WRITTEN BY: KATE BIRCHThe lightning pace of the financial services industry leads to a clear divide – leaders who can’t keep up and those who set the pace.

Shemara Wikramanayake sits squarely in the latter camp, having been a driving force at Australia’s largest investment bank for 30 years.

Not only has the 61-year-old executive earned her financial leadership stripes, but she has done so successfully and seemingly without fuss as a woman in a male-dominated industry –scoring a hat-trick of firsts along the way.

As CEO since 2018, Shemara is the first woman to lead Macquarie Group, the first

Asian-Australian woman to lead an ASX 200 company, and the first woman to top reported earnings table for successive years –though her earnings are the lowest for a chief executive at Macquarie since at least 1999.

Being named the world’s fifth most powerful woman by Fortune prior to becoming CEO is perhaps testament to the influence she has wielded in her 35-year-long finance career.

And since securing the top job, her name has appeared regularly on consecutive power lists, ranking among global female financial greats such as Jane Fraser of Citigroup.

15

The number of different jobs Shemara has held in her three decades at Macquarie Group

9

The number of cities Shemara has lived and worked in spanning six countries during her career at Macquarie

58%

The percentage by which Macquarie Group earnings have risen in the four years Shemara has served as CEO

Shemara first cut her investment banking teeth in Sydney in 1987 aged 25 – when she turned her back on the legal profession in favour of banking – and Macquarie Capital.

In the three decades since, she has worked in six countries across numerous business lines, establishing and leading Macquarie’s corporate advisory offices in New Zealand, Hong Kong and Malaysia, and its infrastructure funds management business in the US and Canada – driving the emerging asset management division of the business.

As head of Macquarie Asset Management for 10 years, she managed a team of 1,600 and 24 markets and led the division to become a top 50 global public securities manager and the bank’s most profitable venture – an achievement that no doubt propelled her to chief executive status.

The secret to her success? Confidence and resilience, both characteristics she learned during her childhood, when facing financial hardship and living in three countries and five schools by age 13 she cultivated a “natural resilience”.

Her disrupted childhood gave her the strength to succeed and the confidence to be whoever she wanted to be, she said in a rare speech about her life back to the Melbourne Foundation for Business and Economics back in 2020.

“You shouldn’t restrict yourself to the box that you come in.”

That resilience (and attitude) has served her well, prepared her for life in the finance sector, where she has never been part of a majority, and for life as a leader in turbulent times.

In the four years she has been CEO, earnings have risen 58% to A$4.7 billion.

Shemara has led the global financial services group to record-breaking heights, with profits of US$3.5 billion in 2022, up 56% over 2021’s then best-ever financials.

Growth spans all four of the diversified company’s operating businesses, covering

six continents and activities including asset management, retail banking, renewables development, and capital raising.

Macquarie is now Australia’s ninth largest listed company by market value and its leading investment banker – with A$871 billion assets under management, 19,000 employees and offices in 33 markets. But the numbers are just one part of the story.

UK-born but of Sri-Lankan descent, Shemara has pushed herself and Macquarie into the heart of the global finance industry’s efforts to discuss, coordinate and advocate on climate change.

Just months into her role as Macquarie chief, she became one of only three CEOs to be named commissioner of the World Bank-led Global Commission on Adaptation and was further appointed as the founding CEO of the UN Climate Finance Leadership Initiative (CFLI) – working with others towards a six-fold increase in climate mitigation from the private sector.

This has seen her play a major role in consecutive COPs, most recently at COP27 in Egypt, where she joined various executive panels, including with former Bank of England head Mark Carney on unlocking climate finance for emerging markets, and with UN Special Envoy for Climate Action, Michael Bloomberg, on the importance of accessible, reliable and comparable climate data.

Her focus is to drive investments towards renewables and climate-resilient solutions and to help energy transitions of poorer countries.

She is leading by example too, moving Macquarie away from hydrocarbons and financing solar, offshore wind and hydrogen projects instead. Among her climate action

You shouldn’t restrict yourself to the box that you come in

TITLE: CEO AND MANAGING DIRECTOR

COMPANY: MACQUARIE GROUP

INDUSTRY: FINANCIAL SERVICES

LOCATION: AUSTRALIA

While Shemara kicked off her career as a corporate lawyer in Sydney in the 1980s, within a few years she had pivoted towards investment banking, joining Macquarie Capital in 1987.

In her three-decade-long career with Macquarie, she has served in leadership roles of increasing seniority from Hong Kong to Canada. As Head of Asset Management for 10 years, she led a 1,600-strong team in 24 markets.

Taking the company helm as CEO in 2018, Shemara has led the group to record profits and made significant inroads on climate action and the diversity agenda.

Passionate about both, Shemara is Commissioner of the Global Commission on Adaptation and a member of the UN Climate Finance Leadership Initiative, which seeks a six-fold increase in climate mitigation investment from the private sector.

hits, she led an effort to raise A$1 billion for renewables investment and more recently partnered with the UN’s Green Climate Fund on a project to get EVs and their charging infrastructure in place and operational, raising an initial US$205 million from institutional investors.

Her ambition for a smooth transition to green energy is matched only by her drive for diversity both in the community and the workplace.

As an ethnically diverse woman in the upper echelons of world finance, Shemara used her platform to advocate and action change for others.

Under her leadership, Macquarie has smashed its UK Women in Finance Charter female representation, 18 months ahead of schedule, and in India, ranked in the top 100 Best Companies for

Women – a listing historically less common in investment banking circles.

Female representation has increased at all levels – with gender parity at board level and 21.8% at senior executive level, up from 17.2% in 2018. Under her watch, four in five roles filled globally last year had at least one female candidate on the shortlist and one or more female Macquarie staff on the interview panel, and women are being hired in greater proportion than the underlying application rate.

Shemara’s push for ethnic diversity in finance is equally forceful. At least half of Macquarie female employees identify as hailing from a culturally diverse background; while globally, more than a third of female directors identify as ethnically diverse.

“We need the richest possible combination of different ages, genders, cultural and racial backgrounds, diversity of sexual orientation and socio-economic backgrounds and experiences – and regardless of any disability,” Shemara told attendees during a Chief Executive Women Event in 2020.

It’s perhaps ironic then to consider the one inequality she continues to face.

Though she is the highest-paid CEO in Australia, Macquarie salaries based on profits, and the first woman to top the reported earnings table for successive years (2021 and 2022), Shemara is not the highest- paid executive at Macquarie.

She is also the bank’s first chief executive to be regularly paid less than her subordinates and, based on profits, is the lowest-paid since at least 1999.

We need the richest possible combination of different ages, genders, cultural and racial backgrounds…

CEO and entrepreneur Diane Wang discusses her journey from Microsoft China’s youngest executive to the first generation of ecommerce entrepreneurs

WRITTEN BY: KATE BIRCH

t takes a brave person to walk away from a leadership role in one of the world’s biggest tech companies – even more so, when they are trailblazing female leadership.

But that’s exactly what Chinese national Diane Wang did at the dawn of the new millennium.

Once the youngest director at Microsoft China, Diane was working at Cisco China in 1999 as the company’s most senior female leader when she made the ‘brave new world’ decision to chuck in the corporate towel and take the entrepreneurial highway.

This was the height of the dot-com boom and the year Alibaba set in motion its online shopping platform – and like Jack Ma, Diane spotted the potential in ecommerce and wanted in on the action.

Fast forward 24 years and Diane has founded and led two highly successful ecommerce companies – China’s first B2C trading platform, Joyo.com, which she built into the largest B2C marketplace in the country, and was later acquired by

Amazon; and DHgate – one of China’s leading ecommerce companies, which she continues to lead today.

In the process, she has helped millions of founders launch their own tech startups, sat on multiple boards, and earned dozens of honorary awards, including recognition among Forbes’ most powerful women and China’s top 10 influential leaders in IT.

While the decision to leave senior leadership in big tech wasn’t an easy one – for Diane, it was inevitable given her mission: to drive the digital inclusion agenda for entrepreneurs in China and empower women with the tools to succeed.

“When I left Cisco to start my entrepreneurial journey, I knew it would be a difficult path, especially as I was among the first generation of ecommerce entrepreneurs in China – but I was hopeful,” Diane tells Business Chief from DHgate HQ in Beijing.

During her six-year big tech tenure at Microsoft and Cisco, Diane witnessed and contributed to the then nascent but soon-to-

I KNEW I WANTED TO BUILD A COMPANY CULTURE THAT VALUES CULTIVATING FEMALE

FROM THE GROUND UP

Diane Wang Founder, Chairperson, and CEO of DHgate Group

Diane Wang Founder, Chairperson, and CEO of DHgate Group

explode ecommerce environment – which was already visibly changing the lives of people throughout China.

“Ecommerce was democratising the landscape for entrepreneurs, allowing people who had never had the opportunity to start businesses due to structural reasons begin to have an equal choice and chance.

“I knew I had to be part of this, to expand this space and have an impact,” says Diane, who set up her first business Joyo.com during the birth of the ecommerce boom – growing the startup to such success, it was acquired by Amazon five years later.

This only fuelled the entrepreneurial fire in Diane’s belly, and having seen first-hand the impact ecommerce could have on people’s lives, she founded her second ecommerce startup, DHgate, in 2004 – with the mission to make global trade accessible by empowering everyone through digitalisation.

Growing a world-leading ecommerce company

Leveraging her more than 30 years of business and digital experience, Diane has built DHgate into the world’s leading cross-border B2B ecommerce infrastructure for micro, small,

“Successful leadership comes down to cultivating a positive culture. If you only care about profitable success, then you will attract only people who think the same way. But if you take a more nuanced approach to what success or failure means, and recognise that supporting people is just as important, then you will attract those with the same values – and that will make all the difference.

I value employee wellbeing and foster an environment that allows them to support each other. I have developed a concept called ‘Everyone is a dragon’, which signifies that every individual possesses the potential for greatness. As a leader, I consider it my responsibility to unlock and harness the potential and energy within each individual. This plays a vital role in everyone’s self-realisation and personal growth.”

and medium enterprises (MSME) – covering B2B commerce, retail, social commerce, logistics, and payments networks.

Within the first three years, the company secured 1 million registered buyers and ranked seventh in the Deloitte Technology Fast 50 for APAC.

Two decades of development later and DHgate has the largest market share in the US and second largest worldwide, with some 59.6 million global buyers from 225 countries, 2.54 million Chinese sellers and 34 million product listings. With a 1,000-strong workforce and offices worldwide, from Beijing to Paris to

California, DHgate works with more than 100 logistics service companies, provides over 100 logistics routes and has 10 overseas warehouses.

Little wonder then that the company continues to secure global accolades, recognised in 2023 alone by The Stevie Awards for being at the frontline of global trade and the internet industry, and ranked among the HURUN Chinese industrial IoT top 30.

Such success has propelled Diane to global trading heights. She was named a member of the High-level Advisory Council of the World Internet Conference in 2018 and is the sole representative from China to join the World Trade Organisation Business Advisory Group.

The critical focus for DHgate is empowering women and societies through digital inclusion –something Diane is especially passionate about. “Our future is digital, so I feel it is imperative to equip everyone with the resources required to move with the times.”

Spotting an opportunity to drive digital inclusion further, in 2020, Diane launched a new business under the DHgate Group umbrella – social commerce platform MyyShop.

“We began to see social media as a vital channel for entrepreneurs and founded MyyShop with a mission and passion for uplifting the young and underserved communities, especially women, students, stay-at-home mothers, the unemployed, or simply those who don’t want a conventional full-time job.”

Powered by big data, AI, and cloud computing, the platform aims to empower

China has been a pioneer in social commerce and is now the most developed social commerce market in the world, buoyed by its advanced influencer, creator and UGC economy. In 2022 alone, 84% of Chinese consumers shopped on social media platforms, Statista data reveals.

“Like China, many other Asian countries like India, Indonesia, and the Philippines are mobile-first cultures with increasing smartphone and internet penetration, and therefore also have a high social media use rate,” says Diane.

Naturally, this has created a huge opportunity for social commerce in Asia, especially with the growing influence of social media on people’s daily lives and as users and consumers demand speed and simplicity in everyday tasks such as shopping.

“Social commerce combines the best of both traditional retail and e-commerce to provide consumers with convenience and genuine product advice and recommendations.”

different types of creators – from nano to meta-influencers – to turn their social media influence and passion for content creation into thriving online businesses.

MyyShop has grown quickly to 60,000 creators, US$500 million in gross merchandise value and more than 100,000 collaborators in 2022 alone.

“Social media and by extension, social commerce, is opening up an entirely new channel for entrepreneurs to be successful and practical digital skills and tools are key to cultivating this next generation of entrepreneurs.”

This is especially true for women – who still face a very high barrier when it comes to gaining the knowledge and skills needed to start and succeed as an entrepreneur, says Diane.

Recent research from the APEC Business Advisory Council found that 63% of women from MSMEs reported they felt they had a lack of professional skills and more than 50% needed training in digital tools.

Attracting funding as a female entrepreneur is equally challenging, given that a staggering 90% of VC decision-makers are men, who in turn invest 86% of their capital in male leaders.

“My unchanged belief is that women should help women,” says Diane – and as a firstgeneration female entrepreneur in China in the internet era, that is exactly what she is doing.

As well as empowering female entrepreneurs via her digital platforms, she is cultivating female leadership culture within the company.

“I knew I wanted to build a company culture that values cultivating female leadership from the ground up. At DHgate, we’ve been

able to not only build a global company, but to maintain a supportive environment for employees and stay true to our mission of empowering women and underserved communities with entrepreneurship.”

Diane has taken her passion for supporting women beyond the four walls of her business and works closely with international organisations and associated working groups to support female economic participation and promote gender equality and inclusion.

She has taken on leadership advisory roles at various international organisations, including the APEC Business Advisory Council (ABAC), Business 20 (B20), and BRICS Women’s Business Alliance with an aim to “connect the dots across different organisations, coordinate efforts, maximise resources, and more importantly increase visibility to get women’s voices heard”.

“I want to make sure that female entrepreneurs are given every chance to pursue their business ambitions. This means tearing

down barriers that have traditionally slowed or halted progress, while introducing new pathways for success.”

Diane launched a digital capacity building programme in 2014, and has trained more than 100,000 MSMEs from more than 50 countries; and in 2016, she founded APEC Women Connect (AWC), a digital entrepreneurship community which convenes female entrepreneurs, policymakers and business leaders for networking, e-learning and mentorship.

Not one to stand still, Diane is now building a new community, providing mentorship, support and recognition for young female entrepreneurs in the digital sector.

“I believe it is critical that we keep improving, updating and expanding these types of programmes to help more women grow their businesses more quickly and effectively.

“It is a long road to achieving gender quality and empowerment in entrepreneurship, but we have to keep pushing.”

ENTREPRENEURIAL JOURNEY, I

IT WOULD BE A DIFFICULT PATH, ESPECIALLY AS I WAS AMONG THE FIRST GENERATION OF ECOMMERCE ENTREPRENEURS IN CHINA

When it comes to ESG adoption, Asia is lagging Europe and the US.

The continent accounts for the most global carbon emissions – 17.7 billion tonnes of carbon dioxide was generated by energy from Asia in 2021, compared to 5.6 billion from North America.

Recognising this, Asia’s largest economies are stepping up efforts to increase emphasis on ESG, while eight in 10 countries in Southeast Asia have pledged a target of netzero emissions by 2050.

HKEX now requires listed companies to report KPIs on ESG, and the Singapore Exchange leads the way in urging boards to acknowledge ESG reporting requirements.

This, coupled with other regional regulations, is upping the ESG ante, with 30% of Top 2000 corporations in Asia predicted to monitor ESG performance in 2023, IDC research finds.

Some companies are already putting sustainability front and centre.

From reducing operational emissions to pioneering sustainable solutions – here is our list of ten companies leading the charge for change.

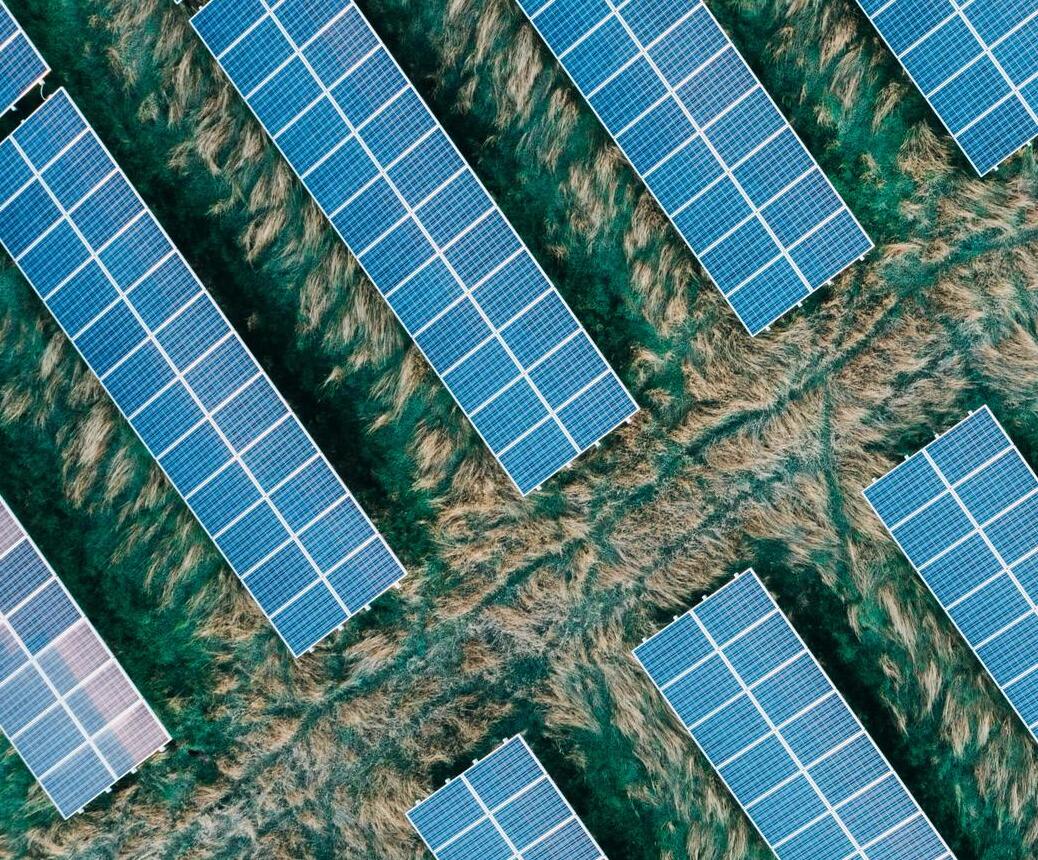

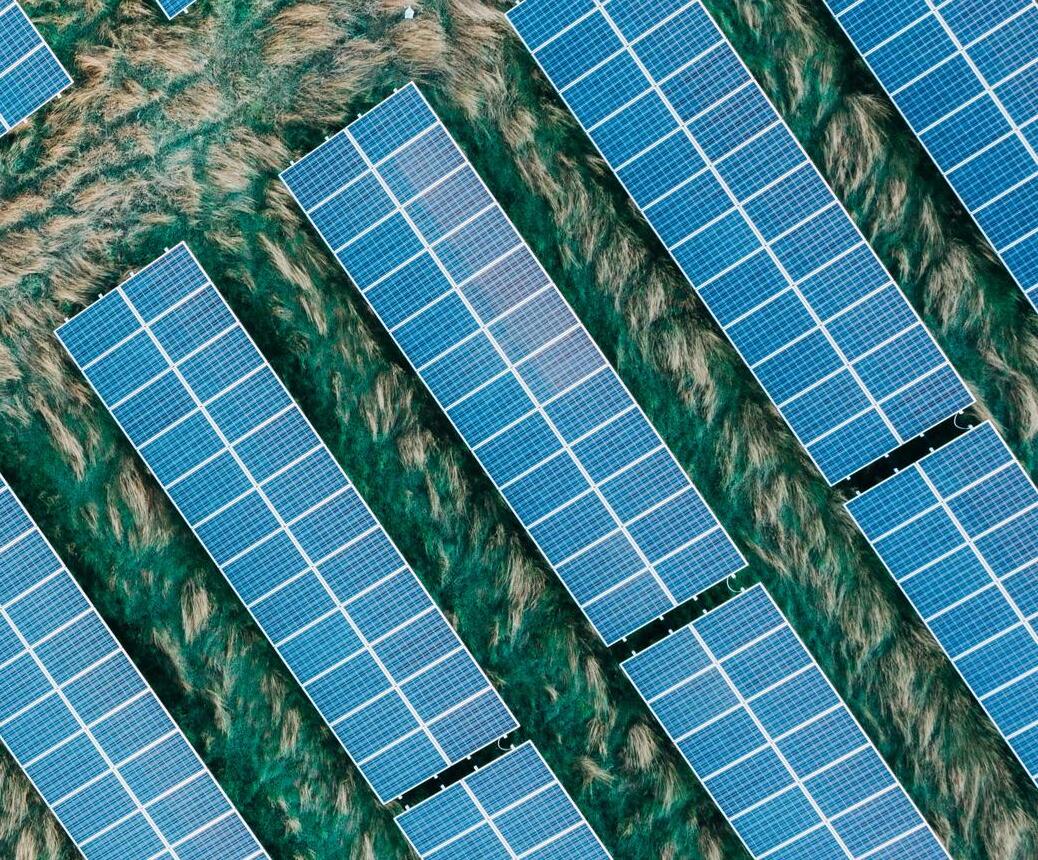

These Asia-based companies are putting ESG at the heart of their operations, and pioneering industry solutions to shape a more sustainable world

Founded: 2014

Headquarters: Shanghai, China

CEO: William Li

Number of employees: 26,000+

As well as manufacturing and selling premium smart EVs, NIO drives innovation in next-gen technologies in autonomous driving, electric powertrains and batteries, including its industry-leading battery swapping technologies.

The EV pioneer, which recently raised US$800m from the Abu Dhabi government, commits to promoting full-lifecycle carbon footprint management, energy conservation, and emissions reduction. In 2022, NIO launched the Clean Parks initiative to support the use of smart EVs in nature reserves worldwide and construct clean energy infrastructure – and has further created the world’s first photovoltaic self-consumption system with V2G charger.

The Shanghai-based company, which saw vehicle sales increase 103.6% YoY in July, has also established an ESG Committee and steering team.

Founded: 1968

Headquarters: Singapore

CEO: Piyush Gupta

Number of employees: 36,000

The first bank in Singapore to sign up to the UN Net-Zero Banking Alliance, DBS Bank is credited for its work in facilitating the transition to clean energy in Asia.

The bank has won awards for its work in green bonds, and as of March, grew its sustainable finance portfolio to SGD 61 billion, providing loans, bonds, and trade financing to accelerate companies’ transition into sustainable business models. Among projects, the bank financed two of the largest floating solar projects in Asia.

DBS has transformed its own operations to be more energy-effective and is empowering employees to adopt a zero-food waste lifestyle. In 2022, the bank established the first net zero building in the city-state.

Founded: 1971

Headquarters: Hong Kong

CEO: Robert Ng

Number of employees: 7,000

Hong Kong property developer Sino Land has earned its sustainability stripes this year with inclusion in the S&P Global Sustainability Yearbook, placed among the top 15% of real estate firms, and a MSCI ESG rating upgrade to AA.

One of the first real estate developers in Hong Kong to publish climate-related financial disclosures and the first to develop a climate risk assessment tool, Sino has signed up to Business Ambition for 1.5C as it targets net zero by 2050.

Driving its green building portfolio is the board’s sustainability committee, which has set 38 goals, from transitioning to a circular economy to preserving urban biodiversity. They have also established the Sino Sustainability Academy empowering leaders to keep up with practices.

Founded: 1940

Headquarters: Hong Kong

CEO: Roberto Guidetti

Number of employees: 7,000+

With the understanding that the food system accounts for over 25% of all greenhouse gas, leading F&B manufacturer Vitasoy is driving the plantbased sector in Asia.

With 89% of its products plant-based, including plant milks, teas and tofu, Vitasoy is committed to sustainable farming, best manufacturing practices, circular waste processes, and community engagement – and has seen revenues double in the last decade to almost a billion US dollars.

Raw materials are sourced mainly in mainland China and follow strict sustainable farming practice guidelines. Exporting to more than 40 countries, products are packaged in FSC-certified cartons. The company’s Singapore business is now certified B Corp.

Founded: 1933

Headquarters: Mumbai, India

CEO: Rohit Jawa

Number of employees: 21,000

The Indian arm of Unilever, HUL is the FMCG giant’s biggest business in sales volume and among India’s most valuable companies. Renowned for its purpose-driven brand campaigns and for championing change across India, HUL ranked among the top 10% S&P Global ESG firms in 2023 for the first time.

Since 2008, HUL factories have seen a reduction in waste (55%), water usage (48%) and CO2 emissions (97%) with 100% of electricity now sourced from renewables. HUL has also secured sustainable sourcing for 95% of its total paper and board and 69% of its tea.

HUL recently set up the pioneering Centre for Sustainability Leadership, aimed at helping other Indian businesses achieve net-zero.

Founded: 1985

Headquarters: Taichung City, Taiwan

CEO: Young Liu

Number of employees: 10,000+

The world’s largest bicycle manufacturer, Giant has grown over 50 years into a world-renowned brand with revenues in H1 2023 of US$1.34 billion –35% came from e-bike sales.

With a focus on circularity, from packaging to materials, Giant has established an industry sustainability alliance (BAS) to work towards more sustainable practices and work with suppliers to track carbon emissions of various parts. Giant uses tire recycle carbon reduction technology, recycles and reuses carbon fibre, and utilises solar technology across four factories.

The company is on track to reduce CO2 emissions by 40kg per bicycle by 2030 and achieve 100% plastic-free packaging. They also offer a popular pre-loved bicycle programme.

Founded: 1928

Headquarters: Japan

CEO: Toshimitsu Talko

Number of employees: 39,000+

Japanese multinational Konica Minolta has put sustainability centrestage since 2003, an approach that has won the firm numerous accolades, from CDP Climate A List status to inclusion in the top 5% of sustainable firms by S&P Global.

With a legacy spanning 150 years and presence in 150 markets, the company commits to reducing 60% CO2 emissions in its product lifecycle by 2030, net zero by 2050. Already, its MFP factories in China and Malaysia and European HQ are 100% powered by renewables.

The US$4.43 billion firm invests heavily in innovation, from digital manufacturing to smart workplaces, and sales of products certified as sustainable hit a healthy 77% of all sales in 2021.

Founded: 1986

Headquarters: India

CEO: CP Gurnani

Number of employees: 152,000

One of the few organisations to prioritise ESG early on, embedding principles into its core strategy, Tech Mahindra emerged as the global IT leader in the DJSI Index in 2021. Forming part of the Mahindra Group, the US$6.5 billion tech company focuses on leveraging nextgen technologies to enable end-to-end digital transformation for its 1,297 global customers.

As a signatory to 1.5C Supply Chain Leaders and the ESG Center of Excellence, the IT major has pledged carbon neutrality by 2030 and 50% renewable energy mix by 2025. The firm has implemented the Green Tuesday Initiative, cutting down serving meat by 20% across all offices in India to reduce food-related carbon footprint.

Founded: 2009

Headquarters: China

Chairman: Dr Lee Yin Yee

Number of employees: 7,000+

A subsidiary of Xinyi Glass and parent of Xinyi Energy, multi award-winning Xinyi Solar is the world’s largest solar glass manufacturer.

As well as promoting and supporting renewable energy in business, with a target to meet 40% of annual global demand for new PV installations by 2050, Xinyi Solar is also working

to lower emissions within its own operations –with energy and water consumption reduced in 2022 by 15.1% and 7.8%, respectively.

The solar farm projects held by the Group generated 4.4 billion kWh of electricity last year, resulting in a reduction of 3.64 million tonnes of CO2 emissions, equivalent to 92.6% of GHG emissions from solar glass production in the same period. Among its many farms, the world’s first large-scale floating solar farm in Xinyi, which has the potential to save 28,000 tonnes of standard coal every year.

Along with an A- ESG rating on the Hang Seng Index, Xinyi Solar has outperformed its peers in global ESG ratings, including CDP and S&P Global.

A brief history of Taiwan’s high-speed rail

Founded: 1998

Headquarters: Taipei, Taiwan

CEO: James Jeng

Number of employees: 4,700+

As the high-speed railway of Taiwan, THSRC provides safe and fast transportation services for commuters. Through smart technology, the railway operates one 350-km railway line along the west coast of Taiwan with trains running at 300-km per hour, achieving 99% punctuality and no accidents.

Widely recognised for being green, THSRC stands out for its sustainable investment and low-carbon emissions compared to railway counterparts. THSRC undertakes greenhouse gas inventories, promotes waste reduction, and saves electricity – conserving 12.38% more per passenger in 2022 than the year before.

Not just that, but the railway promotes energy-saving initiatives at its solar-powered maintenance depots and stations and has also set up wastewater treatment plants at specified stations. Around one-third of waste is recycled, while the rest is incinerated, and the company further pledges to the reduction of waste among suppliers.

Committed to decreasing carbon emissions by 50% by 2030 and 75% by 2050, THSRC was the nation’s first public transport service to issue green bonds to fund its sustainability projects.

Among recent green accolades, THSRC was ranked in the top 10 most sustainable companies in the world by sister publication Sustainability Magazine and by Corporate Knights

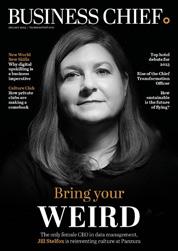

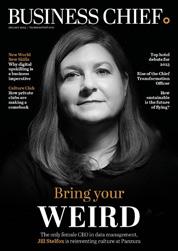

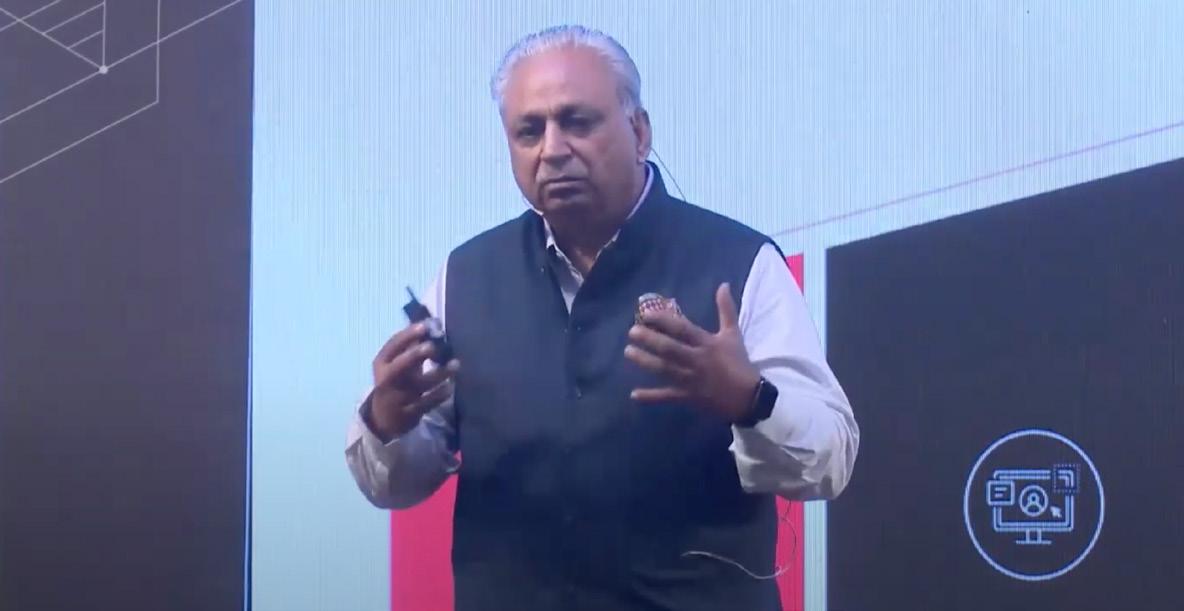

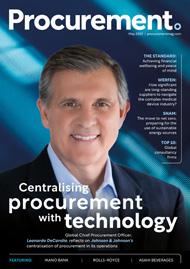

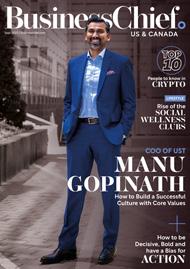

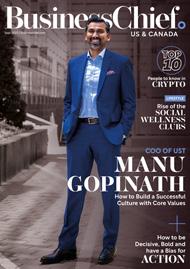

Having led one of the biggest turnarounds in Indian corporate history, Tech Mahindra CEO CP GURNANI sits down with Business Chief to talk future challenges, lifelong learning, and the rise of AI

WRITTEN BY: KATE BIRCH

WRITTEN BY: KATE BIRCH

December 19 2023 will be bittersweet for Chander Prakash Gurnani. As well as being his 65th birthday, the celebration of that arrival will also mark his departure from Tech Mahindra – the company he has led as CEO for 14 years.

Digital transformation specialist Tech Mahindra has evolved and thrived under his reign, leveraging emerging technologies like cloud computing, artificial intelligence, data analytics, the metaverse and Internet of Things (IoT) to drive innovation and efficiency in business processes.

CP, as he is affectionately known by friends and colleagues, has built his reputation on the ability to transform, so this passing on of the baton – to former Infosys boss Mohit Joshi on December 19 – is a natural progression rather than the end of the CP story.

“I don’t think I am even close to retiring. I will be shifting gears in my life and transitioning into a new phase as a ‘coach’,” he tells Business Chief, in an exclusive interview.

“I have dedicated a significant portion of my life to the tech industry, starting as a professional and attaining the position of CXO at age 38. Having served as a captain in this field for an extensive period, I believe it is time to explore a different perspective. I want to pursue endeavours that deeply resonate with my passions and values. I see it as a good time to embark on this personal journey of self-discovery after a long, fulfilling career.”

That impressive career saw CP join Tech Mahindra in November 2004 after 18 years as Founder and CEO of Perot Systems India. He has won dozens of awards in that time having led Tech Mahindra’s remarkable transformation journey – and one of the biggest turnarounds of Indian corporate history.

IT IS IMPORTANT TO ME TO LEAVE A LEGACY AT TECH MAHINDRA THAT REFLECTS MY SUCCESSES AS A VISIONARY, STRATEGIC THINKER, AND AMBASSADOR FOR MY COUNTRY

14

152K

90

“Leaders must embrace 4Ps in their professional life – Purpose, Passion, People, and Performance. As leaders, we must be open to new ideas, encourage a culture of innovation, and provide an environment where employees can experiment and learn from failures.

They must follow a customer-centric approach and seek opportunities to collaborate with other organisations, startups, academia, and even competitors to drive innovation, address complex challenges, and foster ecosystem growth. Finally, leaders in the tech industry must respond quickly to market dynamics, customer needs, and emerging trends. Challenging the status quo is the only way we progress.”

His single biggest business achievement was the acquisition of Satyam Computers which has even been featured as a Harvard case study.

“Navigating the Titanic called Satyam was truly a defining moment in India’s corporate history – it established Tech Mahindra as a turnaround and people-centric company,” says CP.

“We turned a crisis into an opportunity. The merger, that now seems like a perfect match, came with its own share of challenges, including lawsuits. The learnings are some of the best in my life.”

CP describes the Satyam acquisition as a “daring and caring” effort where many difficult decisions had to be made to provide a leadership that was honest, credible, and decisive.

Corporate governance, shareholder value protection, business and revenue

management, transparent communication and talent management were the other high priority agendas that had to be set right.

“For me, recognition and awards are purely incidental,” he adds. “My underlying philosophy is that when I wake up in the morning, nobody owes me anything. I must find my place in this world. It has been my constant endeavour to create new benchmarks of excellence. It is important to me to leave a legacy at Tech Mahindra that reflects my successes as a visionary, a strategic thinker, and an ambassador for my country.”

Talking of strategic thinking, Business Chief is interviewing CP on the sidelines of a new chess tournament launched in Dubai and with Tech Mahindra as sponsor. It’s a logical fit and, as ever, CP is looking to transform –invigorating this rather cerebral activity into something of a spectator sport in the form of the Tech Mahindra Global Chess League.

For those interested, Triveni Continental Kings beat upGrad Mumba Masters in the final, with Denmark's Jonas Buhl Bjerre beating Javokhir Sindarov in a sudden death match.

The game provides many useful analogies for the world of business, and CP is not slow to use chess terminology when it comes to reflecting on some of his biggest challenges.

“I look at both challenges and opportunities with excitement. A leader creatively finds opportunities from the challenges and checkmates them,” he says.

“The resilience that a business develops in the face of disruption can provide a new foundation for growth and success. I have witnessed and dealt with many such complex scenarios in my career. The encouraging news is that we have not only persevered but have emerged stronger and more resilient from those challenges.”

When it comes to challenges, CP has steered Tech Mahindra through some

I REMAIN STEADFAST IN MY FAITH IN THE INDIAN TECH ECOSYSTEM’S ABILITY TO CREATE AI FOUNDATION MODELS ON PAR WITH – OR ABOVE – GLOBAL STANDARDS

blockbusters. Back in 2008 there was the global financial crisis. Then came Covid-19. Many countries around the world adopted a lockdown strategy, but none bigger than India, when PM Modi ordered a nationwide, three-week lockdown for the entire 1.3 billion population.

Interestingly, Tech Mahindra was one of those organisations that made major moves during the dark days of the pandemic.

According to Brand Finance, the digital transformation consultancy’s brand

value soared by 66%, making it the fastest growing in the top 25 IT services brands.

Aside from ‘obvious’ global crises, CP cites attracting and retaining top talent as one of the IT industry’s ongoing battles. Then there is expanding into new markets while managing cultural differences, regulatory complexities, and operational challenges – which all present tests of leadership and organisational agility.

“My working style has always been inclusive, adaptable, and customer-centric,” says CP.

“Identifying emerging trends and technologies helped me steer Tech Mahindra in the right direction and stay ahead of the competition.”

When it comes to the Next Big Thing, there is only one show in town – artificial intelligence.

CP actually found himself in a chat faceoff with OpenAI founder Sam Altman recently when the ChatGPT chief suggested Indian tech startups would never be able to match what his company had achieved. CP simply said on social media ‘challenge accepted’.

“I remain steadfast in my faith in the Indian tech ecosystem’s ability to create AI foundation models on par with – or above – global standards,” CP tells Business Chief

“India has been making significant strides in the field of artificial intelligence and hasa strong foundation to become a global leader in the AI space. The country has a large pool of highly skilled IT professionals, a thriving startup ecosystem, and a supportive government that recognises the importance of emerging technologies like AI.

A joint venture between Tech Mahindra and The International Chess Federation (FIDE), The Global Chess League took to the Dubai stage this summer for its inaugural edition. Set to transform the world of chess, this one-of-a-kind initiative delivers a neverbefore-seen format from all over the world to compete in a unique joint team form that focuses on diversity and technology. The league features male and female chess champions competing on the same team and is the first-ever Live televised chess event of its kind. Offering a new way of viewing chess, the league is leveraging nextgeneration technologies, from AI to VR, to offer fans an engaged and interactive viewing experience.

When considering the future of shareholder value, we have to look at the history. You have to go back to the dark economic times of the 1970s – a period of global stagnation. Open the pages of The New York Times and you’ll find an essay by a certain Milton Friedman titled ‘The Social Responsibility of Business is

The concept of shareholder value is changing but is more important than ever as companies in APAC look for long-term profits for social stability

to Increase its Profits’. Economist Friedman effectively said that an organisation should show no regard or responsibility for anything other than its shareholders.

As often happens with unpopular new concepts, it took a few years for other voices to echo Friedman’s doctrine, and it was not until the 1980s that the pursuit of

shareholder value at any cost became the new purpose for doing business.

And it worked. Shareholders made fortunes, and stock exchanges from New York to London to Tokyo all benefitted – right up to the 2008 financial crisis which pulled the plug on Gordon Gecko’s ‘greed is good’ mantra.

Or did it? Has the relentless pursuit of shareholder value at all costs gone out of fashion in the face of sustainability and societal pressures? And what difference does it make if you are a company based in Denver, Dusseldorf, Dubai or New Delhi?

One fact is certain – you cannot ignore the importance of shareholder value in the APAC region.

According to the latest available data from the World Bank (which is admittedly a couple of years old but important for context), the market capitalisation of domestic listed companies in China – the regional leader – is US$12.21 trillion.

While China’s total may be dwarfed by the likes of the US (US$40.72 trillion), it is way ahead in APAC and ANZ. Japan’s listed companies market cap comes in at US$6.72 trillion, India has US$2.6 trillion, and South Korea US$2.18 trillion. In ANZ, Australia sits on US$1.72 trillion, and New Zealand on US$132 billion. This highlights disparity around the world, with some

countries having more of a focus on government- or familyowned large businesses, making the idea of shareholder value in those countries less significant.

The very concept of ‘value’ also varies regionally, so what do CEOs need to know about the changing nature of shareholder value?

Shareholder value as important today as ever “Different corporate governance systems, legal frameworks, and cultural norms exist across regions globally,” says Barbara Spitzer, Founder and CEO at Two Rivers Partners and a former senior executive at Accenture.

“The prominent stakeholder model in Europe and Japan sees corporations as social institutions responsible for stakeholders, including employees, customers, suppliers, and the local community, not just shareholders.

“Japanese firms often focus on long-term stability and growth, sometimes at the expense of short-term profits. Shareholder value is essential, but it's balanced against the interests of other stakeholders.

“Swinging in the opposite direction is what we see in China, where corporations often follow a state capitalism model, where the government plays a decisive role in the economy. These companies may prioritise national economic goals, such as employment, social stability, or strategic industrial growth, over immediate shareholder value.”

Harry Turner, founder of The Sovereign Investor says that shareholder value may be more relevant today than ever – especially with an ageing population to consider. As Baby Boomers enter retirement and live longer, it will become increasingly critical for the private sector to generate enough wealth to support this demographic.

By focusing on shareholder value, corporates alleviate this problem in two ways. Firstly, the more money they make, the more they contribute to government tax revenues, which helps fund state pensions. Secondly, the more shareholder value they create, the more likely their share prices rise too, which directly benefits savers who own financial assets in their retirement portfolio.

Japanese firms often focus on longterm stability and growth, sometimes at the expense of short-term profits

Barbara Spitzer Founder

CEO, Two Rivers Partners

Craig

Craig is the New York Times bestselling author of ‘The Caterpillar Way. Lessons in Leadership, Growth and Shareholder Value’. He founded three companies that achieved roughly US$1 billion of revenue within 18 months. Craig was a finalist for the prestigious Platts S&P CEO of the Year award in the global metals industries in 2018.

Barbara

As an advisor to boards, CEOs, and business leaders, Barbara helps transform businesses. She leverages her skills across industries, solving complex problems, reimagining workforces, and galvanising organisations around corporate goals with an understanding of risk and regulatory pressures. As the founder and CEO of Two Rivers Partners, Barbara provides solutions to evolve operating models, build human capital strategies, develop C-suites, cultivate cultures, and build change management strategies. Barbara also served as the board and CEO advisory lead at Accenture.

Harry Turner, founder, The Sovereign Investor Harry is a former hedge fund manager, with more than 10 years of experience co-managing a global macro fund and two long-only equity funds. He has an MSc in Finance & Economics from the London School of Economics.

Bouchard, Founder and Executive Chairman, Ecolution kWh

Harry Turner

Bouchard, Founder and Executive Chairman, Ecolution kWh

Harry Turner

“Japan is a perfect case in point of this right now,” says Turner. “The Japanese government has explicitly stated their concerns about its ageing population and the associated pension liabilities. As such, they have instructed the Tokyo Stock Exchange (TSE) to put pressure on companies trading below book value to improve shareholder returns or risk being delisted.

“This has sparked a wave of corporate governance reforms at companies that have long been criticised for allocating capital inefficiently, operating under stodgy conglomerate structures with complex crossshareholdings, and generally running the company for corporate insiders as opposed to shareholders.”

According to the WHO, 30% of Japan’s population

are already over 60 years old. Globally, by 2030, 1 in 6 people will be over 60. By 2050, there will be more than 2 billion people aged over 60.

Shareholder value should be main focus for CEOs

When it comes to shareholder value, Craig Bouchard wrote the book – literally. His New York Times Best Seller ‘The Caterpillar Way. Lessons in Leadership, Growth and Shareholder Value’ may have been written a decade ago, but “shareholder value will always be considered relevant, especially in our highly competitive investment arena,” the Founder and Executive Chairman of Ecolution kWh tells Business Chief.

“Exceeding shareholder expectations is the single

most important performance indicator to attracting and retaining professional investors.”

When comparing the approach taken in Asia versus the US/UK, Bouchard says companies and families of companies in APAC have closer relations with each other and with the government.

“They tend to be more focused on stable employment for workers, key customer relationships or keiretsu type relationships,” he says. “Short-term gains are less important. These types of companies look to the development of the community and society in addition to bottom line results. Access to capital from their stakeholders is less volatile.”

The Japanese government has instructed the Tokyo Stock Exchange to put pressure on companies trading below book value to improve shareholder returns or risk being delisted

Founder of The Sovereign Investor

While Bouchard says that shareholder value should absolutely still be the main focus for CEOs, he believes that most leaders are getting it wrong, and that there should be a greater focus on allocating capital correctly.

“Even in the Fortune 500, I give a grade C to over half of the CEOs I’ve observed or studied,” declares Bouchard.

There are lots of financial, strategic, operational, governance and transformational levers COEs can use. As a human capital strategist, Spitzer says CEO skills are crucial. She says the non-technical shareholder value capabilities CEOs require are:

+ 360-degree view of strategy that includes both the normal stuff (value drivers, markets, customers, competitors, products and services, financials, and risk) and the new stuff (human capital, environmental, societal, and governance)

+ Purpose-informed capital allocation and financial planning viewed that considers the impact investment decisions have on people and the planet, alongside profit

+ Ethical integrity and the ability to establish trust and credibility by exhibiting high standards and responsible leadership

+ Stakeholder engagement with a keen ability to listen, empathise, communicate, build relationships, and understand diverse perspectives

+ Adaptive leadership to navigate change, embrace innovation, drive transformation, and guide teams through uncertainty; being open to new ideas, willing to challenge the status quo, and capable of making tough decisions

+ Understanding the ROI of diversity and inclusion and promoting a culture that values and respects differences

Continuous learning to stay on top of industry trends, regulatory changes, and best practices

“In addition, CEOs need fluency in cybersecurity, artificial intelligence, digital transformation, human capital management, and environmental, social, and governance (ESG), which present significant competitive, reputational, and financial threats,” adds Spitzer.

The reasons for continuing to pursue shareholder value are clear, but leaders also need to marry this with responsible business practices, otherwise they risk losing out to more agile and enlightened organisations.

“I truly believe we are witnessing the force of business used for positive change in the world,” says Spitzer.

“I believe that corporations are, and can be, drivers of the systemic change needed to not only create commerce, support capitalism, and build wealth, but to also make the world a more just, safe, healthy, and welcoming place.”

Companies in Asia tend to be more focused on stable employment for workers, key customer relationships or keiretsu type relationships

Founder & Executive Chairman, Ecolution kWh, LLC

Few banks globally can match the recent credentials of Singapore’s DBS Bank. Since 2018, the financial institution has been named Best Bank in the World 2022 (Global Finance), World’s Best Bank 2021 (Euromoney), and Global bank of the Year 2018 (The Banker) – seven times in just five years.

DBS was not just the first in Singapore but the first bank in Asia to receive such global recognition.

Founded in 1968, DBS now has more than 36,000 employees, a presence in 19 markets globally, and recently enjoyed its most profitable quarter, with net profits jumping a forecast-beating 48% to a new record high

of SG$2.69 billion (US$1.99 billion). This came off the back of a breakout year (2022) for the bank, which delivered a record net profit of SG$8.19 billion.

An early adopter of technology, DBS has also picked up numerous digital banking awards and now considers itself as a tech company offering financial services.

As they say, ‘a different kind of world calls for a different kind of bank’.

Driving that change and digital transformation is Lim

Him Chuan, Head of Group Strategy, Transformation, Analytics and Research, where he works closely with the Group CEO Piyush Gupta and the Group Management Committee.

Him Chuan most recently served as CEO of DBS Bank Taiwan, overseeing a successful period where it was named Best International Foreign Bank in Taiwan by Asiamoney.

In his new role, which he took up in April, the 22-year DBS banking veteran is now driving strategy and planning; and on top of this, his team has a mandate around transformation, data science and ecosystem partnerships. This includes end-to-end accountability, championing change and transformation and enabling excellence to achieve sustainable outcomes

Culture transformation

DBS has been on a transformation journey for more than a decade – transforming not only into a digital bank but changing the culture of the entire organisation.

While many companies swear by the oft-quoted management adage that ‘culture eats strategy’, DBS has stretched that notion in an ethos they call ‘culture by design.’

Culture does not happen by accident, it needs to be carefully shaped and nurtured

“I believe that one cannot be a leader unless you have willing followers, so my leadership style is anchored around how to create a sense of HOPE for my people: a higher sense of purpose (H); ownership of people and business, from end-to-end (O); peopleoriented with empathy (P); and everything fun (E).

My five years spent as CEO of DBS in Taiwan sharpened my leadership style with greater empathy along with what I like to call the five Ls: Listen better with intent and an open mind; Learn and unlearn, with humility; Link the dots together to create purpose and a sense of urgency; Leverage resources with influence and moral authority; and Laugh – as a sense of humour is always important when the going gets tough.”

“What that means is having a very clear vision of the culture we want in the bank, then running programmes of change to shift mindsets and nudge behaviour towards that vision,” Him Chuan tells Business Chief

Culture does not happen by accident, it needs to be carefully shaped and nurtured, he says.

“When we embarked on our digital transformation in 2014, we wanted to change the way we worked such that we became more nimble, more agile, more innovative – in other words, more like a startup, and less like a traditional bank.

“Our aim is to build a dynamic culture that embraces innovation, while future-proofing employees by equipping our

people with digital skill-sets.”

To deliver customer service with a DBS touch and a unique brand of Asian service, the bank came up with its ‘RED’ ethos, which stands for Respectful, Easy to deal with, and Dependable.

“Our aim for RED was to have something that every employee at every level could understand and remember effortlessly, which in turn makes it easier to implement initiatives that bring this customer service ethos to life.

“Under RED, we created cross-functional teams called PIEs (process improvement events) to take the waste out of operating processes and improve customer service. We initially set out to achieve 10 million customer hours saved through PIEs, but eventually achieved about 250 million customer hours saved annually. We have since evolved this into ‘customer journey thinking’, which entails having a deep understanding of the end-to-end experience of various customer interactions with DBS and relentlessly eliminating pain points.”

With more than two decades of banking experience across Asia, Him Chuan has certainly seen the landscape change

– from the rise of Asia-focused banks as they capitalised on regional business growth, to rapid digitalisation driven in part by the rise of fintechs, to sustainability becoming top of mind.

“We are mindful of a world emerging from the throes of Covid-19 that calls for a different kind of bank – one that is more technology and sustainabilityfocused,” says Him Chuan. “These are areas we know DBS can step up to the plate.”

“In recent years, sustainability has become a key theme for banks, and it has become increasingly important for the industry to work with clients to transition to net zero.”

Already, DBS has taken significant strides in sustainability, embedding

environmental and social considerations into the fabric of the business.

In its Responsible Banking pillar, DBS seeks to empower its clients to be more sustainable; and in its latest sustainability report – Our Path to Net Zero: Supporting Asia’s Transition to a Low Carbon Economy – details the selection of science-informed decarbonisation pathways and further sets interim 2030 targets for a large number of sectors.

“As of today, this is one of the most comprehensive and ambitious sets of decarbonisation targets among banks globally,” he declares.

As of today, [we have] one of the most comprehensive and ambitious sets of decarbonisation targets among banks globally

The Global FinTech Awards 2024 will be celebrating the very best in Fintech with the following categories:

Digital Banking Award

–PayTech Award

–

Digital Currency Award

–

FinTech Award

–InsurTech Award

–

Sustainable FinTech

–

FinTech Technology Award

–

FinTech Consultancy Award

–

Future Leader Award

–

Executive of the Year Award

–

Project of the Year Award

–

Lifetime Achievement Award

The appetite for B Corp certification is growing across Asia, as companies doing good look to differentiate from those that just talk a good game

In tough economic times, it is easy to ignore ‘nice-to-haves’ in business. As companies look to cut back on everything from hybrid work to perks, you could be forgiven for thinking that ESG concerns would be one of the first casualties of hard times. Not so across large swathes of Asia, where the appetite for being B Corp –a business driven by doing good rather than prioritising profits – is growing.

“The growth of the B Corp community in Asia is on the rise, driven by a collective vision of an inclusive, equitable, and regenerative economy. The movement’s recent acceleration

is evident, with over 245 B Corps in the region,” Eleanor Allen, Lead Executive of B LabGlobal, tells Business Chief

Founded in 2006, non-profit network B Lab believes that all businesses can use a stakeholder-driven model to be better, to be B Corporations. B Lab oversees the certification of companies that meet high social and environmental standards. The overall aim is to create a global economy that instead of lining the pockets of the few instead benefits everyone.

It is a lofty ambition, but more than 7,200 companies have been certified in 93 countries, and Asia – with its growing economic power –could be the next big opportunity. Especially when you consider there are currently just 245 B Corps in Asia.

“B Lab is evolving its standards and digital platform, collaborating with the Centre for Impact Investing and Practices (CIIP) to align with regional markets and drive the adoption of our standards across Asia,” adds Allen.

The B Corp movement saw its fastest growth in 2022, fuelled in part by increased ESG regulation and pressures from stakeholders and investors. With trillions of dollars being diverted to funds that prioritise ESG investments, and more being pledged, being good is also good for business.

According to Forbes, 58% of companies in APAC say ESG is critical to their long-term success, but only 29% have developed KPIs for ESG performance.This is where B Lab can help, with tools to help measure and manage company impact.

Adoption in Asia is growing, with a few notable hotspots showing rapid recent acceleration.

Take Singapore, which had just two B Corps in 2015, 24 in 2022, and 33 at last count. In Hong Kong & Macau, there are now 25 – up from just one single B Corp in 2016.

“B Lab is committed to supporting and fueling ongoing growth in Asia,” says Allen. “We believe this is just the beginning.”

There is also a perception that being B Corp is only possible for small businesses with a low footprint. This is a misconception. While many B Corps are indeed small and medium-sized ventures, large organisations can also make the grade.

In Asia, four B Corps are publicly listed. These include O-Bank from Taiwan, certified in 2017 and the first digital native bank in Taiwan. Then there is SIGMAXYZ Holdings from Japan, a digital transformation consultancy certified in 2022. This year, real estate

The growth of the B Corp community in Asia is on the rise, driven by a collective vision of an inclusive, equitable, and regenerative economy

Eleanor Allen Lead Executive, B Lab Global

developer Olive Tree Estates from Singapore joined the list, as well as Malaysia’s personal care products retailer InNature Berhad.

The franchisee for The Body Shop (which itself became B Corp in 2019) in Malaysia, Vietnam and Cambodia, InNature Berhad’s MD Datin Mina Cheah said: “Our belief that business can be a force for good is embodied in every aspect of our business and operations.”

You only have to look at the numbers to realise that while Asia holds incredible potential, it is lagging when it comes to B Corp awareness and uptake.

According to the International Monetary Fund, Asia and the Pacific will deliver 67%

of global economic growth in 2023, as many economies struggle with inflation and supply issues. Three of the world’s top five countries ranked by GDP are also in Asia (China, Japan, and India).

With such monetary muscle, imagine how the world of B Corp would look with Asian companies accounting more than for the lowly 3% they currently claim.

That is one reason why B Lab Global teamed up with Singapore’s Centre for Impact Investing and Practices (CIIP) to establish the B Lab & CIIP Centre of Excellence for Asia.

CIIP was established and supported by global investment company Temasek Trust, and has strategic partnerships with ABC Impact, a private equity fund dedicated to impact investing in Asia. This is important to bring investor perspectives and sensibilities to the table.

Dawn Chan is the CEO at CIIP and she believes B Corp resonates with Asian culture and society.

“Many businesses in Asia have a history of active involvement in their community,” says Chan. “Culturally, many Asian investors and companies are motivated to practice a version of impact, even though they may not be conversant with the vocabulary of impact practice.

Chan believes that Asia offers a unique opportunity to deliver impact at scale – from empowering hundreds of millions of small to medium-sized enterprises, and smallholder farmers in the region, to developing a roadmap for a just climate transition.

Dawn Chan CEO, Centre for Impact Investing and Practices (CIIP)“These positive dynamics, together with the region’s underlying cultural values, create conditions highly conducive for driving impact in Asia,” she adds. “We are actively engaging B Lab Global to offer more customised products and

We are actively engaging B Lab Global to offer more customised products and services for the Asian context, and to cater to Asian languages

services for the Asian context, and to cater to Asian languages.”

There has been a positive reception to the new Singapore centre, and Chan hopes it will kick-start a broader B Corp movement in the region, by spreading the word and sharing success stories.

Stories like Education for Good – Hong Kong’s first B Corp. Founded in 2012, EFG is the only social enterprise dedicated to social entrepreneurship education and incubation in Hong Kong.

EFG’s principal consultant Gilbert Lee says survival is the main challenge for small businesses operating in an environment like Hong Kong.

“As a B Corp, we need to pay extra effort to fulfil the B Corp recertification and obligations,” says Lee. “The benefits are seeing EFG’s mission and corporate values become more solid with the entire team and with the board of directors, not to mention clear positioning with clients. Even though they may be familiar with B Corp, they recognise and appreciate our corporate values once they are explained.”

Lee is also co-chair of B Lab Hong Kong & Macau – a thriving chapter in the region tasked with promoting awareness, assisting companies with their certification journeys, and building that B Corp community by nurturing advocates.

Lee admits B Corp was slow to get off the ground in Hong Kong, partly due to the complexity of the process and the time investment required.

There is also the need to create a bespoke solution for companies in Asia that takes into consideration regional priorities, language, and culture. Despite these hurdles, B Corp is still gaining traction.

Hong Kong has long been considered a pioneer and rolemodel in capitalism, especially in financial markets. However, capitalism needs a major revamp to tackle the pressing global challenges

“It took four-and-a-half years to have the first 10 B Corps in Hong Kong and just two years for the next 10,” says Lee. “We now have 25 Certified B Corps in Hong Kong and we aspire to have 100 by the end of 2026.

“Hong Kong has long been considered a pioneer and role-model in capitalism, especially in financial markets. However, capitalism needs a major revamp to tackle the pressing global challenges. We believe the B Corp movement is a relevant framework for systemic change and helps make capitalism more equitable, more inclusive and more regenerative for us and our future generations.”

B Lab Global’s Allen understands the need to simplify the processes, addressing Lee’s point to evolve and adapt the certification process for an Asian audience.

“We are currently evolving our standards to meet the challenges of today and tomorrow,” says Field.

“In catalysing a broader movement of using business as a force for good, CIIP will collaborate with the B Lab Global Standards Management team to ensure that the standards are relevant to Asian markets.

“Additionally, we are improving our digital platform and certification processes so it will be easier for companies to engage with the new standards.

“The economy across Asia is a significant contributor to the global economy – it is shaping the next phase of globalisation. At B Lab, we want to use this momentum to further catalyse the B Corp movement of business as a force for good.”

Digital reporting hasn’t gained traction in Australia, but the burning platform is the impact of ESG reporting, says Deloitte Australia’s Managing Partner Joanne

Gorton

WRITTEN BY: KATE BIRCH

Gorton

WRITTEN BY: KATE BIRCH

When it comes to digital reporting, Australia has long been a laggard.

Unlike the rest of the world, Australia doesn’t mandate digital reporting – one of just two developed countries without a digital reporting regime.

And while companies can do so voluntarily, the process just hasn’t gained traction.

“Companies here have had the ability to report in a digital way to regulator ASIC for more than a decade, but no company has chosen to do so,” Joanne Gorton, Managing Partner of Audit and Assurance at Deloitte Australia tells Business Chief

But that could all be about to change.

With the new climate and sustainability standards set to be adopted from 2024, companies will need to add ESG disclosures to their portfolio of reporting requirements – the impact of which could be the “burning platform”, declares Joanne.

The Treasury has proposed mandatory climate-related reporting for the country’s largest companies and financial institutions starting 1 July 2024. Once implemented, Australia will join 35 nations and regions worldwide – including New Zealand – in the roll-out of mandatory climate disclosures.

“The new ESG reporting requirements are the biggest reporting change Australian companies have had to deal with – larger even than the transition to International Accounting Standards back in 2005,” shares Joanne.

And as the demand for more information grows, so too does the need for that information to be standardised, consistent, accurate and comparable.

If we had a digital corporate reporting regime, we would be on par with our major economic trading partners like the US, UK, Europe and Japan

Joanne Gorton

Managing Partner of Audit & Assurance | DeloitteJoanne

This significant increase in reporting requirements could be the push needed for Australian companies to embrace and prioritise digital reporting.

While Joanne and her team at Deloitte are pushing for structural reform in making digital reporting mandatory, something that would bring the country in line with the world’s advanced economies, the Treasury has a different view, however.

“In their most recent Climate reporting consultation paper, the Treasury noted that they would not mandate digital reporting for climate disclosures ahead of financial reporting,” she explains.

Currently, annual reports and financial statements are provided to regulators such as ASIC (Australian Securities & Investments Commission) and the

ASX (Australian Stock Exchange) in a PDF document which is not able to be read and easily analysed by technology.

Not only are companies spending hundreds of hours in preparing and lodging financial reports, but the process gives rise to error, with Deloitte research finding there were more than 8,000 documents re-lodged with the ASX since 2019 due to mistakes made.

By embracing digital reporting (in short, presenting information in a machinereadable way) companies not only reduce errors, enhance productivity, and improve efficiency, but crucially increase transparency – ensuring reliable information is in the public domain.

Corporate digital reporting plays a huge role in making this happen, “making it easier for international investors to read and analyse their financial information and making them more likely to invest in

Australian businesses have a oncein-a-lifetime opportunity not only to facilitate interest from overseas investors, but also to make meaningful change that will help society as a whole

Gorton Managing Partner of Audit & Assurance | DeloitteMeet Joanne Gorton As Managing Partner of Audit & Assurance

and a member of the National Executive, Joanne leads the A&A Deloitte Australia business made up of more than 2,300 people. She has more than 25 years of multi-industry experience as an auditor working with high-profile ASX100 clients and large public companies. A trusted advisor at Board and C-level, Joanne’s career has spanned Australia’s two largest professional services firms, Deloitte and PwC. Passionate about client service, diversity and inclusion, and people development, Joanne is Executive Sponsor of Deloitte Australia’s Neurodiversity network.

Australian businesses”, explains Joanne.

Backing this up, a 2019 inquiry into the regulation of auditing in Australia noted that the roll-out of digital financial reporting has the capacity to assist not only auditing, but the efficient and transparent functioning of financial markets more broadly.

Machine-readable financial statements can be easily and accurately analysed not only by audit firms but other interested third parties including regulators, academics and investors – a shift that could build trust and deliver better social and environmental outcomes, and crucially drive investment.

$7.7 bn

Predicted annual net GDP gain from 2030 with the introduction of mandatory digital financial reporting –a $40 billion total gain over 20 years

According to Joanne, increasing visibility of their companies on the world stage is the biggest opportunity Australian companies have in the shift to digital reporting.

“We are a small country, and we need to attract our fair share of the foreign investment from international capital markets into the Australian economy.”

Joanne points out that Australia, like many other countries, needs to make the transition from reliance on fossil fuels to renewables and with this, there are huge implications for the country and economy.

“Therefore, the more we can do to make Australia an attractive destination for foreign capital, the stronger our economy will be.”

New modelling from Deloitte Access Economics (DAE) shows mandatory digital financial reporting for all large Australian businesses would grow the economy by up to $7.7 billion annually and support more than 14,000 jobs from 2030.

The biggest barrier is the willingness of Australian companies to embrace and prioritise digital reporting, largely due to time and costs.

While year one brings extra time and costs in setting up systems to tag the information and report it in a digital way, from year two onwards the benefits outweigh the costs, says Joanne.

Then there is AI, which could well be the catalyst for change. With companies around the world scrambling to take advantage of advancements in AI and the automation benefits it can bring, now could be the perfect time to shift to digital reporting voluntarily to get a jump start on your competition.

While Joanne is excited by the possibilities of AI, she believes only a mandatory shift to standardised reporting methods and metrics would allow for meaningful comparison between Australian companies.

Following the release in June 2023 of a consultation paper titled Climaterelated financial disclosure, the Australian government is looking to enforce mandatory climate-related reporting obligations for the country’s largest companies and financial institutions starting 1 July 2024. When implemented, this would require companies to “make disclosures regarding governance, strategy, risk management, targets and metrics, including greenhouse gases”, the consultation paper states. Among specific proposals, companies are required to disclose transition plans, including information on offsets, target-setting and mitigation strategies, as well as processes used to monitor and manage climate-related risks and opportunities. The rules would also require reporting of Scope 1 and 2 and material Scope 3.

Thankfully, those companies are waking up to the productivity and competitive advantages a shift to digital reporting would bring.

The impending ESG reporting requirements should therefore be seen as an opportunity to make the switch to digital reporting across the board.

“If we had a digital corporate reporting regime, we would be on par with our major economic trading partners like the US, UK, Europe and Japan,” says Joanne.

“Australian businesses have a once-ina-lifetime opportunity not only to facilitate interest from overseas investors, but also to make meaningful change that will help society as a whole.”

There need not be disparity between small-to-medium enterprises (SMEs) and the multinational companies (MNCs) that seemingly tower above them in the race to sustainability. In fact, businesses are linked more than they realise, which is why the world is entering a more collaborative state whereby businesses become partners and goals are unified. This is particularly so in the case of supplier and customer interactions as relationships between parties are critical in helping them build resilience and reduce their overall impact in line with all Scope emissions.

There are two factors to this. Firstly, there’s the understanding of the necessity and the opportunities presented to businesses when they take climate change on board as a key component of business. And several elements are to be considered here by businesses as a part of their business strategy:

• Regulatory: with increasing constraints & incentives for businesses to decarbonize coming to enforce the “Net-Zero World” such as the CSRD from the EU.