For more than 100 years, the Commerce Trust team of experienced wealth specialists has helped both individuals and institutions uncover opportunity amid increasing complexity to achieve their long-term financial goals. Meet Lyle Johnson, your dedicated Columbia Market Executive for Commerce Trust, and learn more about our team approach to wealth management at commercetrustcompany.com/Columbia.

▯ Thursday, October 31 ▯ 4:30 – 6:30pm ▯ 5045 Chapel Hill Road ▯

▯ Admission is FREE thanks to our sponsors. ▯

25+ Years Scan

MU Health Care’s

Plastic Surgery and Med Spa With Elizabeth Sundvold, NP

Q: WHAT CAN YOU TELL US ABOUT MU HEALTH CARE’S PLASTIC SURGERY AND MED SPA?

We have a beautiful, newly renovated med spa located at Nifong and Forum, which is really a one-stop-shop for all of your cosmetic needs. We’ve got medical-grade facials, microneedling, cosmetic injections, PRP for hair loss... We also have our cosmetic surgeries, ranging from breast surgeries, facelifts, tummy tucks, nose jobs, really everything.

Q: FOR PEOPLE WHO ARE CONSIDERING A COSMETIC TREATMENT FOR THE FIRST TIME, WHAT SHOULD THEY KNOW?

A lot of patients feel nervous the first time they come in, or are too nervous to come in at all, because they may not even know what they want or need. Our providers are really skilled in the consultation process — which is a key piece to set patients up for success. We always start by discussing goals, and then explore all possible treatments, from aesthetics to surgery. We’ll walk through the whole process and come up with a plan everyone agrees on.

Q: DESPITE PERCEPTIONS, THERE IS A LOT MORE TO COSMETICS THAN LOOKING YOUNGER. CAN YOU EXPLAIN?

A: It seems like people hear the words ‘plastic surgery’ and that’s immediately where their mind goes. Of course we care about helping people look younger, but we also want to help them feel good. That’s such an important piece for us. We see the improvements we give people in their self-confidence and it’s incredible. We have men who have had years of acne scarring that we can help with microneedling, or women who want a breast lift after putting in a lot of hard work to lose weight. We can help that, and it’s pretty rewarding.

Q: YOU AND YOUR TEAM MEMBERS HAVE SOME UNIQUE EXPERTISE THAT SUPPORTS YOUR PATIENTS IN A DIFFERENT WAY — TELL ME ABOUT THAT.

A: Yes! My primary focus is on injectables. Any time you’re dealing with a face, it’s a big deal. There are so many important vessels and nerves running throughout the face, so it’s extremely important to know and understand the anatomy. I trained alongside our surgeons and have helped with a lot of traumas in the ER, where we work closely

together on the face. That’s given me a really great foundation. Another thing that’s important is the field is constantly changing and growing. The reason I love being at an academic health system is that we put an emphasis on continuing education. Our team is constantly educating ourselves and learning new techniques and best practices.

Q: SAY A PATIENT DECIDES THEY DO WANT A COSMETIC SURGERY — WHAT SHOULD THEY CONSIDER?

A: When patients decide they want surgery with us, they can be assured they are in very good hands. Safety is our No. 1 priority. Our surgeons are highly trained, and all of our plastic surgeons are board-certified by the American Board of Plastic Surgery. All of our surgery locations are accredited or licensed for plastic surgery, meaning they meet or exceed patient safety measures. And the last thing I’ll mention is our team-based approach. We’re all here to help you look and feel your best and work together to make that happen. Learn

Keith Schawo, CTFA

A trust is often a foundational component of a comprehensive estate plan. A well-constructed estate plan should offer the benefits of a smooth transfer of your wealth to beneficiaries, facilitate tax planning, and protect assets from creditors. Different types of trusts have distinct advantages and considerations.

Revocable or living trust

Revocable trusts, also known as living trusts, allow the grantor (the person who creates and funds the trust) to make changes to the terms of the trust or revoke the trust during their life.

The flexibility to alter the terms of the trust document is a key benefit to establishing a revocable trust. This allows grantors to respond to changes in life circumstances or family dynamics when necessary. In contrast to a revocable trust, an irrevocable trust is generally irrevocable and unamendable.

Irrevocable life insurance trust (ILIT)

An irrevocable life insurance trust (ILIT) is an irrevocable trust that holds one or more life insurance policies that typically insure the grantor. An ILIT holds the proceeds of a life insurance policy

outside the grantor’s taxable estate, which can potentially lower their estate tax liability if the trust is structured properly.

A spousal lifetime access trust (SLAT) is an irrevocable trust that can reduce the taxable estate of both spouses without completely losing access to their assets as they would with other irrevocable trusts.

A common SLAT technique involves each spouse creating a SLAT for the benefit of the other. Each SLAT is funded with all or a portion of each spouse’s federal lifetime estate tax exemption. If properly structured, each spouse reduces his or her estate by the amount funding the SLAT, which may ultimately lower their estate taxes.

A credit shelter trust allows married couples to fully utilize their federal lifetime estate tax exemptions. To minimize estate tax exposure, the credit shelter trust is funded up to the decedent spouse’s remaining lifetime exemption amount upon their death.

The surviving spouse is typically the beneficiary of the trust. Upon the death of the surviving spouse, the trust assets are transferred to the remainder beneficiaries per the terms of the trust document free of estate taxes in most circumstances.

Choosing the right trust to support your estate plan requires a thorough understanding of your family’s unique circumstances and personal goals. If your estate plan involves establishing a trust, your Commerce Trust team of wealth management professionals can provide the necessary information to facilitate the process and collaborate with your estate planning attorney to help you achieve your goals.

Contact Commerce Trust today to learn more about our estate planning capabilities. Through a team-based approach, our financial planning, investment management, and tax management* professionals will deliver a comprehensive wealth management strategy under one roof.

MANAGEMENT

Erica Pefferman, President Erica@comocompanies.com

EDITORIA L

Publisher | Erica Pefferman Erica@comocompanies.com

Editor | Jodie Jackson Jr Jodie@comocompanies.com

Associate Editor | Kelsey Winkeljohn Kelsey@comocompanies.com

DESIGN

Creative Director | Kate Morrow Kate@comocompanies.com

Senior Designer | Jordan Watts Jordan@comocompanies.com

MARKETING

Director of Client Relations Charles Bruce Charles@comocompanies.com

Director of Web Services J. J. Carlson

Marketing Representative Sarah Swartz SSwartz@comocompanies.com

CONTRIBUTING PHOTOGRAPHERS

Keith Borgmeyer, Anthony Jinson

OUR MISSION

To inspire, educate, and entertain the citizens of Columbia with quality, relevant content that reflects Columbia’s business environment, lifestyle, and community spirit.

CONTACT

The COMO Companies

404 Portland, Columbia, MO 65201 (573) 499-1830 | comomag.com @wearecomomag

SUBSCRIPTIONS

Magazines are $5.95 an issue. Subscription rate is $54 for 12 issues for one year or $89 for 24 issues for two years. Subscribe at comomag.com or by phone.

CONTRIBUTING WRITERS

Beth Bramstedt, Barbara Buffaloe, Caroline Dohack, Andrew Grabau, Lydia Graves, Jodie Jackson Jr, Hoss Koetting, Roger McKinney, Natasha Myrick, Erica Pefferman, McKenna Stumph, Kelsey Winkeljohn

This is always a challenging issue for me to write every year. We do a nance issue every year as it is so core to our community and our homes. No family is untouched by the e ects of rising prices on everything from groceries to gas to interest rates on everything.

On the way to work this morning, I heard on the radio that the cost of rent has risen 25 percent in the last four years while wages have not been able to meet that increase. Families are paying more for everything. Business owners are paying more for paper goods, insurance, and anything else needed to run a company. Nonpro ts and their services are needed more and have less money to do it with. My own costs for paper and postage to put out this magazine every month have increased 16 percent in just the last year, and I have not passed those costs on to our clients. For me, talking about nances can be really demoralizing.

However, while it took me investing all I had in retirement and then some to keep the company together and growing the last four years, we made it. While the company had a tough time coming out of COVID (who didn’t?), we have regained our footing and are growing exponentially. at comes with another set of challenges! When and how do you grow? When do you manage expenses and when do you hire more employees? And then, when do I get to think about my retirement being anything outside of this company? Are we in the clear yet? It just doesn’t feel like it yet. If you’re a business owner, you know 100 percent what I’m talking about. I love to hear older, wiser business owners talk about the “days when…,” as it gives me a perspective that is bigger than just my today. at times like this force you to get real with your “why” and with the “how.” Here’s what I personally have done to work on my nancial freedom in the last year:

• I have begun to meet with a nancial advisor who understands my situation and is kind and caring. She doesn’t care that I’m not moving millions to

her today to manage. She has created an awesome road map for me that is tailored to my goals and understands what my assets are and how they work. It truly is a judgment-free zone which is needed as someone who has consistently dealt with shame as it relates to money.

• I got intense about following Dave Ramsey’s philosophy about getting out of debt. Again. For the third (maybe fourth) time. Every day is a new day, and anyone can start again.

• I have sold things. is last year I made over $2,000 in cash on things just sitting around in the garage. Nothing was big. It was just $40 here or $60 there or sometimes even just $10! But it all added up — and it paid o a credit card. It felt great … and just a little addicting, too. I think the dog was getting nervous.

• I’m helping my kids learn the value of their own money. It’s been tough. I really must resist the temptation to rescue at times. But it is so rewarding when they call to discuss budget decisions with me, and I see them make better choices than I did at their age.

• And I just keep on trucking and having faith. I believe that I’m in the place I’m supposed to be and as long as I am continuing to try to be a good steward of what God has blessed me with, I will be ne. He hasn’t let me down yet even though I have worried my way through all of it. (I have control issues, but we can leave that for another issue.)

I know that talking about personal nances and money is hard. Trust me! No one gets more panicky than me about it. Being authentic can take the fear and stress away and give you the sight to take action and next steps! Good luck! We are all rooting for you!

ERICA PEFFERMAN PUBLISHER erica@comocompanies.com

I love to hear older, wiser business owners talk about the “days when…,” as it gives me a perspective that is bigger than just my today.

We take pride in representing our community well and we couldn’t do what we do without our COMO Magazine advisory board. Thank You!

Beth Bramstedt

Church Life Pastor Christian Fellowship Church

Heather Brown

Strategic Partnership Officer Harry S Truman VA Hospital

Nickie Davis

Executive Director The District, Downtown CID

Sam Fleury

Assistant Vice President

Strategic Communications, Columbia College

Jeremiah Hunter

Assistant Police Chief

Commander Investigations Bureau Columbia Police Department

Chris Horn

Sr. Reinsurance Manager American Family Insurance

Kris Husted Investigative Editor NPR Midwest Newsroom

Amanda Jacobs Owner Jacobs Property Management

Megan Steen

Chief Operating Officer, Central Region Burrell Behavioral Health

Nathan Todd

Business Services Specialist First State Community Bank

Wende Wagner

Director of Resource Development

The Boys and Girls Club of the Columbia Area

Have a story idea, feedback, or a general inquiry? Email Jodie@comocompanies.com.

BY JODIE JACKSON JR

PHOTOS BY ANTHONY JINSON

The formal proclamation has been sounded, inviting all Lords and Ladies to bedeck in breeches, waistcoats, and ballgowns oh, and those grand wigs for the second Bridgerton Ball, a celebration of the local arts community from 7-11 p.m. Friday, October 25, at e Atrium Ballroom.

e 2024 edition of the Bridgerton Ball, formally known as e Queen’s Masquerade, is billed as “a one-of-akind experience for Columbia,” beneting the Missouri Symphony (MOSY) and Mareck Center for Dance. e ball is the brainchild of Columbia dynamo Adonica Coleman, whose contagious energy sparks the creative air for attendees to wow one another with Regency era fashion be tting the popular Net ix series, Bridgerton

e event’s website sums up the expectation like this: “From the aesthetics and food to the live entertainment, guests will be transported to a night of Regency put on by e COMO 411 and their trusted friends.”

Regency era attire and masquerade masks are strongly recommended. All ticket holders will have access to complimentary food from Eclipse Catering, a unique photo exhibit, live music from MOSY, and a performance by Mareck Center for Dance company members.

Coleman has the con dence needed for the task. As the owner and founder of COMO 411 – an agency laser-focused on creating community

connections – she’s also host of e Daily Blend with AC, a daily morning community talk show. ( e show basically took the place of Paul Pepper’s Pepper and Friends show.) Coleman is also the chair of the Columbia Chamber of Commerce Board of Directors for 2024-25.

And just three months ago, she took the reins as executive director of the Daydream Foundation, a local nonpro t that works to eliminate nancial barriers for kids in Columbia to participate in extracurricular activities whether that’s music, sports, art, dance, “or whatever it is.”

“We feel like everybody should have that opportunity,” Coleman explained.

But she does nd downtime “my weekends are sacred,” she insisted and, like the rest of us, has a knack for consuming binge-worthy television productions. Bridgerton captured her curiosity with its attention to compelling storylines, a diverse cast and crew, and the costuming.

“Oh, the costumes,” she exclaimed. As she watched season two of the series, Coleman said, “My event juices started to get going. I do love a themed event.” en came season three and Queen Charlotte and Coleman watched the entire season in one weekend.

“I texted my girlfriends and said, ‘We need to have a ball, don’t we?’” she confessed.

e inaugural Bridgerton Ball at e Atrium in 2023 came barely three months after that text.

“We really didn’t know what to expect,” Coleman said. “But it really just took on a life of its own.”

Two-hundred and twenty- ve people attended. And it was everything Coleman expected it to be, but she wasn’t sure how attendees would react to lounge seating, rather than reserved seating. ( ough VIP tickets do come with reserved seating.)

“It forces people to mingle not just stick with your crowd or your group of friends,” she said. “And it was absolutely heartwarming.”

e Queen’s Masquerade is based on season three, which featured a different ball in each episode. And for those who have not been intoxicated with the Bridgerton series, the opportunity to don Regency era attire can be enticing, Coleman explained.

Last year’s attire featured a number of custom ball gowns and at least ninety percent of attendees were dressed in period attire, she said.

“I think people will level up for this one,” Coleman noted. “I expect to see lots more creativity this year, for sure.”

For the shoot with COMO Magazine Adonica donned her dress from the inaugural ball with a few new additions along with florals from My Secret Garden while Rachel Flynn from Betz Jewelers adorned her with jewelry.

Local parks, old rail corridors provide a plethora of hiking paths.

BY M C KENNA STUMPH

Columbia is known for its trails and outdoor activities. ere are many popular trails in and around the city such as the Katy Trail, MKT, Rock Bridge Memorial State Park, and Cosmo Park. However, there are many more trails scattered around and hidden gems that aren’t as frequently used.

Local adventurer, hiker, nurse, and author Ginger Schweikert gives an overview of scores of trails in her book, Over 300 Miles of Hiking, Biking, and Horsing Around in Mid-Missouri, and a wealth of trail information is readily available from Columbia Parks and Recreation’s website. Here are a few places to take a stroll or a long hike.

DIFFICULTY: Mild

LENGTH OPTIONS: Varied

MAINTAINED BY: Missouri State Parks

THE KATY TRAIL is the longest developed rail-to-trail park in the country, spanning 240 miles from Clinton to Machens near St. Charles. e Katy Trail State Park was built on top of the Missouri-Kansas-Texas Railroad (MKT or Katy) with twenty-six trailheads and four fully restored railroad depots enroute. e double-wide, gravel trail is t for bicyclists, walkers, nature admirers, history enthusiasts, and even cross-country skiing during the snowy, winter months.

ere are many access points between Boonville and Je erson City, however, the Providence access point is most convenient for those in Columbia. From the intersection of Prov-

idence Road and Stadium Boulevard, take Providence Road/MO 163 south for 6.6 miles. At the tra c circle, take the third exit to Old Plank Road for 1.1 miles to the Katy trailhead. e city’s portion of the MKT Trail also intersects with the Katy Trail about eight miles from the trailhead at Flat Branch Park.

Pro tip: Stop at Cooper’s Landing for live music, food, and drinks after time spent on the trail and soak up the stunning view of the Big Muddy. Be sure to check out the food truck and live music updates on the Cooper’s Landing Facebook page.

DIFFICULTY: Mild

LENGTH OPTIONS: 4.8 miles one-way

MAINTAINED BY: Columbia Parks and Recreation

BEAR CREEK TRAIL is located in northern Columbia, linking two of the city’s most popular, large parks: 533-acre Columbia Cosmopolitan Recreation Area and the 81.5-acre Albert-Oakland Park. e double-wide trail merges between gravel, wooden boardwalk, and paved sidewalk to follow the natural drainage system of Bear Creek, running in an east/west direction. e trail’s concept began in the 1990s while planning for Columbia’s greenbelt. ere are greenbelt trails all around the city that will eventually connect, and Bear Creek Trail is a major connector for the northern part of Columbia.

ere are many access points to the trail. ere is parking located at

the north end of Cosmo Park, Creasy Springs Road, Garth Nature Area, and Albert-Oakland Park. ere is also neighborhood or street parking accessible at W. Prairieview Drive, Python Court, Blue Ridge Road, Providence Road, Big Bear Boulevard, Northland Drive, Alaska Court, and Parker Street.

Pro tip: is is a good trail for rainy days. A bike repair station is located near the middle of the trail at Garth Nature Area.

DIFFICULTY: Moderate to difficult

LENGTH OPTIONS : 42+ miles of trails

MAINTAINED BY: U.S. Department of Agriculture Forest Service

MULTIPLE TRAILS make up this hidden gem of a trail system: Cedar Creek, including Moon Loop, lower Loop of the Moon, Smith Creek Loop, Paris Fork Section, Devil’s Backbone section, Dry Fork Trail, Pine Ridge Trail, Pine Ridge Campground Loop, Cedar Creek South section, Bob to Beard section, and Benedict to Backbone section. e trail system is located within Mark Twain National Forest and comprises 16,500 acres of oak, hickory, and pine forests.

Almost one hundred years ago, this land was intensively farmed, resulting in erosion and depleted soil, which was aggravated by the high winds and drought from the Dust Bowl in the 1930s. President Franklin Roosevelt’s Soil Erosion Service was established to rebuild destroyed land by replant-

ing grasses and trees to stabilize erosion. e U.S. Forest Service took over in 1953 to continue to rebuild wildlife and recreation in the area.

To nd trailheads, consult Schweikert’s book or forest service maps, as many of the trails are in remote areas and not clearly marked as a trailhead. To reach the Moon Trail — the more popular trail in the system — drive 7.6 miles south on Highway 63 from the US 63/I-70 interchange, make a U-turn and drive another half mile to turn right on Route AB East. After the road passes South Ginn Lane, it changes name to East Barnes Chapel Road. e trailhead is on the right, 0.7 miles past Ginn Lane.

Pro tip: is trail system is for experienced hikers and adventurers due to its remote location and more di cult terrain. In the spring and summer months, beware of ticks and poison ivy. Find a stick to knock down spiderwebs for the less used trails.

DIFFICULTY: Mild

LENGTH OPTIONS: 8.9 miles one-way

MAINTAINED BY: Columbia Parks and Recreation

THE MKT NATURE AND FITNESS TRAIL is Columbia’s most popular trail in the city. It was ranked second in the nation for “Best Urban Trail” in the 2016 USA Today’s 10 Best Reader’s Choice award. It is a double-wide, gravel path built on top of the old connector rail line from Columbia to the Missou-

ri-Kansas-Texas railway. It is a mainly tree-covered trail that runs along open farmlands, Flat Branch, Hinkson, and Perche creeks. It is 8.9 miles from the start of the trail at Flat Branch Park to the end, where it meets the Katy Trail. It is a great all-season trail for hiking, walking, biking, running, and even cross-country skiing if there’s enough snowfall.

e Flat Branch Park trailhead is located at 101 S. Fourth St.

Pro-tip: After working up an appetite on the MKT Trail, visit one of Columbia’s many restaurants downtown. Flat Branch Brewery, Shiloh, and Addison’s are nearby the Flat Branch Park trailhead.

DIFFICULTY: Mild

LENGTH OPTIONS: 1 mile of trails

MAINTAINED BY: Columbia Parks and Recreation

DIFFICULTY: Mild to moderate

LENGTH OPTIONS: 15 miles of trails

MAINTAINED BY: Missouri State Parks

THE KIWANIS TRAIL is situated in a nineteen-acre park that was donated to the city by the Kiwanis Club in 1958.

e trail is made of gravel and dirt pathways, traversing steep hillsides.

e trail connects two large reservable shelters within the park, with restrooms for visitors. It is nearby many other trails such as the MKT trail.

Kiwanis Trail is located close to Columbia’s downtown. From Providence Road and Broadway, go south on Providence for 1 mile. Turn right on Stadium Boulevard and travel another 1.8 miles. Turn right on College Park Drive and the eastern parking lot is located on the right after 0.3 miles.

Pro-tip: e heavily wooded area is good for nature lovers wanting to observe midMissouri’s native ora and fauna.

ROCK BRIDGE MEMORIAL STATE PARK o ers many hiking and biking trails: Devil’s Icebox Trail, Sinkhole Trail, Spring Brook Trail, Deer Run Trail, Karst Trail, High Ridge Trail, and Grasslands Trail. ese trails differ widely and are unique to the terrain found at Rock Bridge. e history of the area dates to the Woodland period (1000 B.C. to A.D 900) where arrowheads were found, indicating the presence of Paleo-Indians hunting and traveling through the region. It is also the only known location on the planet for the Pink Planarian, a atworm species.

e state park is located a few minutes south of Columbia. To get to the park’s most populated trail, Devil’s Icebox, travel south on Providence Road from the Providence Road and Stadium Boulevard intersection for 3.3 miles. Turn left on MO 163 and continue on for 1.5 miles to the parking lot on the right.

Pro-tip: Devil’s Icebox trail is a great hike during the hot summer months, o ering cave-cooled air in the heat. is trail is a boardwalk with many stairs.

HERE’S

Waters-Moss Memorial

Wildlife Area- Grindstone Creek Trail

DIFFICULTY: Mild to moderate

LENGTH OPTIONS: 1.75 miles one-way; 0.6 miles diversion

MAINTAINED BY: Columbia Parks and Recreation

Garth Nature Area Trails

DIFFICULTY: Mild

LENGTH OPTIONS: 1.6 miles

MAINTAINED BY: Columbia Parks and Recreation

Cosmo Nature Trail/ Rhett’s Run/Rhett Walters Memorial Mountain Bike Trail

DIFFICULTY: Mild to difficult

LENGTH OPTIONS: 6.3 miles of trails

MAINTAINED BY: Columbia Parks and Recreation

Clyde Wilson Memorial Park Trail

DIFFICULTY: Mild to moderate

LENGTH OPTIONS: 0.8 miles

MAINTAINED BY: Columbia Parks and Recreation and University of Missouri- Columbia

BY KELSEY WINKELJOHN

The golden eagle Myria was a rare and magni cent sight in Missouri. According to the 1973 Missouri eagle census, he was one of only twenty-two golden eagles identi ed in the state. With his massive talons, towering three-foot height, and an impressive wingspan, Myria was a marvel of nature.

Tragically, Myria was shot in southeast Missouri, resulting in the near-total loss of his left biceps. e bullet rendered him ightless, jeopardizing his ability to hunt, fend for himself, and, ultimately, survive. But Myria's story didn’t end there, however, thanks to the e orts of the Raptor Rehabilitation Project (RRP) at the University of Missouri’s College of Veterinary Medicine.

e RRP traces its history to the 1960s — more than fty years ago — when many bird of prey populations were experiencing declines. In 1969, the United States Fish and Wildlife Service enlisted the help of Dr. William Halliwell, a pathologist at MU’s veterinary school, to conduct necropsies on eagle carcasses to determine the cause

of these population drops. eir investigation, which led to the development of the RRP, revealed that the insecticide DDT was causing eggshell fragility and reproductive failure.

In 1973, after obtaining a rehabilitation license from the U.S. Fish and Wildlife Service, the RRP became the rst licensed facility of its kind in the Midwest. e license allowed the facility to take in live injured birds, rehabilitate them, and eventually release the birds back into the wild.

at same year, Myria entered the facility and became the project’s rst success story, primarily due to the e orts of Dr. Halliwell and Dr. Greg Ivins, a 22-year-old graduate student (at the time) with a background in falconry. As the only veterinary student with such expertise, Ivins played a critical role in successfully returning Myria to the wild.

“Myria’s rst ights were awkward and laborious,” wrote the late Joel Vance, an author and longtime writer with the Missouri Department of Conservation. “ ough he used the undamaged breast muscles to move his wings up and down, it is the biceps that pulls the wing in and out and maintains maneuverability. Gradually, Ivins extended the distance of each ight until, after four months, Myria could y a mile.”

At the four-month mark, the RRP released Myria. He was nally home once more.

e RRP lives in an unassuming building tucked away down a gravel drive beyond the College of Veterinary Medicine, bordered by lush greenery and mesh fencing.

Inside, the untamed spirit of nature meets the unwavering dedication of bird caregivers. e volunteers work to rehabilitate injured raptors, such as barred owls, red-tailed hawks, and turkey vultures, with the goal of releasing them back into their natural habitats.

e facility is supported by thirty- ve community members, veterinary students, and long-time volunteer Lizette Somer, who now manages the project.

“We feed them [the birds] seven days a week, we y them, we exercise them … and it takes quite a bit to train somebody [on bird care],” Somer explained, noting that it can take anywhere from four to ten hours just to train new volunteers on feeding routines. Much of bird care also involves detailed husbandry, like pulling weeds from the fence line and cleaning enclosures.

e timeline for a bird’s rehabilitation and release depends mainly on the type of injury sustained. For example, fractures may take seven or more weeks to heal, followed by mandatory ight tests to rebuild muscle strength and measure the bird's likelihood of survival in the wild. Birds with head trauma are i y cases, according to Somer; those with ocular (eye) damage may require an extended stay and will need to complete tests to ensure they can nd perches and their prey before being released.

ose with more severe injuries may become permanent residents if they’re unable to survive on their own. If trainable, comfortable in social settings, and having a good quality of life, these birds become education ambassadors who help bring awareness to the project’s initiatives through public presentations. Some of the birds include the Great Horned Owl “Minnie Pearl” (since 2017), the Turkey Vulture “Grimm” (2015), and the American Kestrel “Hephaestus” (2003).

e rehabilitation center is always seeking transporters and volunteers. Individuals must be at least 18 years old, attend meetings, and complete training (if working directly with the birds). For more information on volunteering, please visit their website.

Editor’s Note: If you nd an injured raptor, call 573-823-9398.

Hi Ashley! My fiancé and I are trying to set a budget for our wedding, but it feels overwhelming with all the potential expenses. Where do we even start?

Dear COMO Mag Readers, Welcome back to another edition of “Ask Ashley.” It’s such a pleasure to connect with all of you, answer your questions, and share insights from my experience. As a wedding and event planner, these topics seem to be the majority of the tasks I tackle during our planning process, and I take great joy in providing well-thought-out advice and research-based opinions to my clients. This month, we’re diving into the world of finance, a topic that plays a crucial role in planning not just events but life itself. Whether you’re navigating the complexities of budgeting for a wedding, managing expenses for a large event, or simply trying to stay financially savvy, I’m here to help. So, let’s get to it!

Setting a wedding budget can indeed feel daunting, but it’s a vital first step toward making your big day both magical and financially manageable. Start by determining your overall budget—how much you and your fiancé are willing and able to spend. Next, break that down into categories: venue, catering, attire, decor, photography, and so on. Prioritize what matters most to you, whether it’s the venue, food, or entertainment, and allocate funds accordingly. Don’t forget to set aside a small contingency fund for unexpected costs. An experienced and dedicated wedding planner, although an additional cost, can actually help save you money and help your dollars stretch where it counts! Remember, your wedding should reflect your love story, not strain your finances. Planning ahead and staying flexible will help you create a beautiful day within your means!

Hi Ashley! My partner and I are debating whether to get wedding insurance. Is it worth it, or is it just an unnecessary expense?

Wedding insurance might seem like just another expense, but it can provide peace of mind, especially if you’re planning a large or destination wedding. There are two main types: liability insurance, which covers accidents or damage, and cancellation/ postponement insurance, which covers you in case something unexpected forces you to

reschedule or cancel. If your venue doesn’t already require liability insurance, it’s worth considering, particularly if you’re hosting a lot of guests. Cancellation insurance can be a lifesaver if you’re planning a wedding in an area prone to extreme weather (hello, Missouri!) or if any of your major vendors cancel. While you hope never to use it, wedding insurance can protect your financial investment, allowing you to focus on enjoying your special day.

Hi Ashley!

My fiancé and I want to ask for cash gifts instead of a traditional registry, but we’re not sure how to do it politely. What’s the best way to handle this?

DEAR CASH CONSCIOUS:

Requesting cash instead of traditional gifts is becoming more common, but it’s important to approach the topic with care and tact. The key is to be gracious and respectful of your guests’ preferences. You can include a note on your wedding website explaining that while their presence is the greatest gift, if they wish to contribute, cash would be appreciated for a specific goal—such as a honeymoon fund, a down payment on a home, or another meaningful experience. Consider using a reputable cash registry service that allows guests to contribute easily and securely. Above all, express your gratitude for whatever your guests choose to give, whether it’s cash, a physical gift, or simply their love and support on your special day.

Keep those questions coming, whether they’re about finances, etiquette, or the latest trends in weddings and events. I’m here to help you navigate every step of your planning journey with confidence and style.

Until next time, Ashley

BY ANDREW GRABAU

In Columbia and throughout central Missouri, nancial stability remains a signi cant challenge for many vulnerable families. In particular, Boone County faces higher poverty rates with 17.8 percent of our population living below the poverty line, exceeding the national average of just under 13 percent. For many, the combination of lower wages, a ordable housing options, limits on upward economic mobility, and barriers to essential services makes achieving nancial security elusive. e complexities of creating opportunities for all individuals and families to reach stability in their nances makes it challenging to nd one “perfect solution.” However, there has been extensive research on the categories connected to stability and how to address them. rough national research conducted by Harvard’s Opportunity Insights initiative, led by Dr. Raj Chetty, we know communities challenged with these six key community categories signicantly shape local economic outcomes:

• Quality Education: Better education improves skill development and earnings potential

• Stable Families: Stable households have been shown to increase upward mobility

• Income Equality: Addressing income disparities, higher-paying jobs, reducing the gap between rich and poor

• Social Capital: Strong community networks and ties create support and access to resources

• A ordable Housing: A ordable and diverse neighborhoods create long-term outcomes

• Workforce Development: Training, skills development, job opportunities

I imagine all these categories look familiar. After all, most of us likely feel the pressure of one or more of these in our everyday lives. Taking our lived experiences, community input, and local data as reported on sites like the booneindicators.org, we can analyze the local e ect of these key causes and design programs that are strategically focused, and data driven.

Knowing the barriers and obstacles to upward mobility helps in exploring what policies and programs could have the biggest impact for people. is is being done in our community through various e orts among several local nonpro ts, including the Heart of Missouri United Way. Boone County also plays a vital role through its work with their Upward Mobility project in advancing their Mobility Action Plan. e city of Columbia seeks solutions connected to these categories through vital support and programs. And Veterans United Foundation has also been a pivotal partner in supporting speci c programs to advance upward mobility. All these together play a crucial role in addressing challenges to upward mobility. However, we can all agree that this is not enough.

In addition to the above programs, we should seek additional ways to lift up our community. After all, the solutions to this are not the exclusive role of the private sector, nonpro t sector, or government.

It takes all of us! One way we all can take part is to strive to know our community beyond our immediate neighbors. We should all be active in organizations, like the PTA, Rotary, or other community organizations. We should aim to speak on behalf of the voiceless and neighbors who don’t have the exibility in their work or family life to be as engaged.

And, yes, there is a need to donate and support organizations who are striving to advance upward mobility. Taking action together in addition to the work being done by nonpro t and government organizations can bring about the collective change in upward mobility we all seek and want!

e complexities of nancial stability for vulnerable families in Columbia, Missouri, requires collaborative, multifaceted solutions. Part of this solution includes leveraging the willingness for each of us to be involved and engaged. I hope this inspires everyone to be the change, and to make our community one where everyone has the opportunity to thrive!

BY BARBARA BUFFALOE

Idecided to give up my monthly column in the magazine to let our summer city council interns write about their experience working with the mayor and council. As a reminder, in our form of government, the mayor and city council do not have any sta to help them with research, communications, and scheduling. Because the demands can feel quite high, I asked the leadership with MU’s Truman School of Public

A airs to see if there was the possibility for students in the Master of Public Administration program to intern with the council. Students could both learn and help local government be more e ective. is summer was the rst year the Columbia City Council had interns, and I couldn’t have been more impressed with the students and loved hearing their recaps of the experience and I think you would, too!

Barbara Bu aloe currently is serving her rst term in o ce as the mayor of Columbia.

Marcello Sieverin

During the summer, my colleague and I had the unique opportunity to work alongside the mayor and city council to nd e cient ways of communicating with the public. is internship was more than just a learning experience; it was an eye-opener into the inner workings of local government. While my MPA classes provided a solid theoretical foundation, the real-world application of this knowledge o ered insights that textbooks simply cannot convey. One of the most striking revelations was witnessing the immense e ort that public o cials put into accommodating citizens’ needs, much of which goes publicly unnoticed.

roughout this internship, I sat in countless meetings and observed rsthand the dedication and hard work that goes into public service. ese meetings were more than just formalities; they were dynamic discussions where every decision was scrutinized and debated to ensure that the public’s interest was prioritized. e level of coordination required before and after these meetings was astounding. From drafting proposals to addressing concerns raised by constituents, every step was meticulously planned and executed.

e experience gave me a newfound appreciation for community engagement and the intricate process of policymaking. It was fascinating how much e ort goes into ensuring that the city’s operations run smoothly and that the voices of the citizens are heard and considered. is behind-the-scenes look at local government revealed the complexities and challenges that public o cials face daily.

Government can indeed be daunting at times, but experiencing this process rsthand highlighted the importance of perseverance, communication, and collaboration. is internship not only enhanced my understanding of local government but also inspired me to continue pursuing a career in public service. e experience rea rmed my belief in the power of e ective communication and community engagement in shaping a better future for our cities.

Lacey Salazar

This summer, we had an incredible opportunity to immerse ourselves in local government as interns for city council members in Columbia. Stepping out of the classroom and into the real world has been among the most rewarding experiences. From attending city council meetings where decisions shaping our neighborhoods are made to collaborating on projects for the council, this internship was both an adventure and a valuable learning experience.

Our classes at Mizzou provided a solid foundation, enabling us to follow discussions and decisions at the government level. It was amazing to apply our academic knowledge in real-world settings. One aspect I greatly appreciated from my professors at Mizzou was their encouragement of innovation. is was more pronounced in my graduate studies compared to my undergraduate experience, and I was able to leverage this encouragement during the internship.

Networking was a signi cant aspect of our internship, extending our reach beyond the local level. rough the International County/City Management Association (ICMA), we connected with city sta from across the U.S., all working on similar research topics. Our main project — researching best practices for communication between city council members and the community — was enriched by these connections.

At the beginning of this internship, I didn’t fully understand the importance of planning and zoning in local government. Learning about this topic has broadened my understanding of housing, and I am thankful to be able to follow and comprehend discussions on this subject.

I also want to thank the sta at the Truman School of Public A airs at Mizzou, Mayor Bu aloe, the city council members, and City Manager Seewood for making this happen. I look forward to see where this partnership will go in the future!

What does being a Christian really mean?

BY BETH BRAMSTEDT

My full name is Elizabeth Bramstedt. It is unique enough that I have never been confused with anyone else. at is until my son married an Elizabeth. Now there are two of us! ankfully, I go by Beth, and she goes by Liz, but that does not really matter when the bank still gets our accounts mixed up or the pharmacy switches our prescriptions!

Our names describe us. ey communicate who we are and where we belong. When Liz married my son, she took on the name Bramstedt. She became part of our family.

e same was true for the early followers of Christ. ose who followed Jesus were known as believers or saints. Until Antioch, that is. Acts 11:26 tells us, “In Antioch, the disciples were rst called Christians.”

What is interesting is that Jesus did not give them that name. And they didn’t give themselves that name. ose around them, those interacting and relating with the believers, gave them the name Christians.

Why? What made them di erent?

Antioch was a unique place, and it allowed the citizens to observe something di erent about these believers. An article in Relevant magazine explains it like this:

“Antioch was referred to as ‘all the world in one city,’ where you could see all the world’s richness and diversity in one place. And the marketplace was its hub. Antioch was designed like most cities of that day: A circular wall on the outside, a marketplace in the center, with the interior of the city walled in way that divided di erent people groups from one another.

e Church came to Antioch and began breaking down the dividing barriers in a way that upset society’s existing categories. People from all parts of the city — Jews and Gentiles alike — were suddenly

coming together. is group of people was rede ning community in a radical and unprecedented way, so much so that a new word was needed to categorize what was happening.”

And so, they began calling the early believers Christians.

e word Christian means “little Christs” or “belonging to the party of Christ.” e name denotes that something new was going on. Society could not identify these people by the things that set them apart or divided them from each other. ey had to create an innovative word that described what they had in common.

e word Christian is used two more times in the New Testament. In both cases, outsiders use it to recognize these believers as a distinct group. A group set apart by their commitment to follow the person of Jesus Christ.

A commitment to follow the person who fed the poor, healed the sick, received the children, forgave sin, and counted everyone as equal and welcome in his presence.

e person who perfectly modeled living in both love and truth. e person who gave his life so others could live.

And today, the outside world is still using the name “Christian” to refer to those who follow Christ. Only they often use it in a derogatory manner because those claiming to be Christians are not modeling their lives after Christ. Some use the guise of love to cover actions that dismiss truth. Others use truth as a club and spew hate. Neither of these responses is the Jesus way. Are we living up to our given name? Do our cities look like Antioch? Do our hearts?

How can we be a community in which there is no social, economic, racial, or gender divide?

According to John 13:35, Jesus says the world gets a vote as to how they will know we are his followers: “By this all people will know that you are my disciples, if you have love for one another.”

Let’s own our name.

Beth Bramstedt is the Church Life Pastor at Christian Fellowship.

HEARTLAND

REMODELING &

By Kaine Mancuso kaine@heartlandhomesmo.com

At Heartland Homes

Remodeling & Roofing, I’m your trusted expert for enhancing the value, durability, and aesthetics of your home. Specializing in full exterior facelifts, I help homeowners with everything from roofing and siding to windows, doors, soffit, and fascia. I am passionate about using high-quality products that not only improve the look of your home but also provide longterm protection and value. When it comes to roofing, I recommend Malarkey Class 4 Impact Resistant Shingles. These advanced shingles are designed to withstand severe weather conditions like hail, high winds, and extreme temperatures, offering superior durability compared to traditional shingles. By investing in these impact-resistant shingles, you can reduce maintenance costs, extend the life of your roof, and potentially lower your homeowner’s insurance premiums.

KAINE MANCUSO

ROOFING & EXTERIOR

SALES REP

Originally from Fulton, Missouri, Kaine Mancuso enjoys golf, pickleball, and spending time with family and friends. His energetic personality and “always throwing wood on the fire” attitude bring enthusiasm and dedication to every project. Whether you’re looking to upgrade your roof or give your home a complete exterior transformation, Kaine and the team at Heartland Homes

Remodeling & Roofing are ready to help you every step of the way.

For siding, I trust LP ExpertFinish Siding — a high-performance, pre-finished product that offers enhanced durability and weather resistance. With a wide variety of colors and textures, LP ExpertFinish Siding not only

protects your home from the elements but also boosts curb appeal with a fresh, modern look. It’s designed to resist moisture, insects, and rot, ensuring your home remains beautiful and protected for years to come.

By Geoff Jones & Krista Shouse-Jones

“How’s the real estate market?” It’s the classic question everyone asks, but the answer is rarely as simple as you’d like. The market is constantly shifting, influenced by local trends, economic conditions, and even seasonal factors. To get a clearer picture of what’s happening, let’s dive into the latest trends and data shaping Columbia’s housing market.

If you’ve been following real estate, you’ll know inventory levels are a key metric. Columbia currently has around 328 active listings, with a 7% increase year-to-date compared to last year. Buyers are beginning to have a few more options and sellers could face greater competition, but overall, the inventory amounts remain low, indicating that the market still favors sellers.

The question on many sellers’ minds is, “Will I get a good price for my home?” The answer is likely yes. Columbia’s current average sale price is $362,964, a 5.52% increase from the previous year. The month of August alone saw a record-setting average sales price of $416,048. These trends show that home values are steadily increasing, offering sellers the potential for solid returns.

A strong sale-to-list price ratio is another indicator of a healthy market. In Columbia, homes have been selling at an average of 98.5% to 100.4% of their original asking price. This is great for sellers, as it suggests

most homes are selling very close to the asking price.

After the all-time lows of early 2021, mortgage rates made an uncomfortable jump, deterring many would-be homebuyers. 2024 has experienced a steady decline in rates, with Mortgage Daily News reporting an average 30-year rate in the low 6’s in mid-September, and the Fed recently announcing another rate decrease. This is good news for both sellers and buyers, as many buyers will have the confidence to enter the market.

Everyone has different circumstances surrounding their decision to sell or buy. There is no “one size fits all” answer! Real estate sells year-round because people will always need to sell or buy. If the time is right for your personal situation and finances, a good Realtor will help you successfully navigate a sale, regardless of the market conditions.

So, how’s the real estate market? Sellers are benefiting from rising home values and strong sale-to-list price ratios. Buyers, meanwhile, are seeing an increase in

Prior to their career in real estate, Geoff and Krista served our community as Columbia police officers for over two decades. Their extensive knowledge of Columbia’s dynamics and inner workings is instrumental in serving their clients. They take great care to help our neighbors and future neighbors succeed in their real estate goals and invest in their futures, whether that’s buying a first home, transitioning to a new one, or venturing into rental properties.

inventory and lower interest rates on the horizon. In short, it’s a time of opportunity. Whether you’re buying or selling, staying on top of market trends is the best way to make informed decisions.

If you’re curious about what this all means for you, reach out to us. We’d love to work together to navigate the complexities of today’s market and achieve your real estate goals!

Statistical information provided courtesy of Columbia Board of Realtors, as of 9/18/2024. Images courtesy of Market Focus Media and Carl Neitzert.

By Jeremy McKenzie tintbytoalsonllc@gmail.com

Many people are familiar with window tint on automobiles; however, we chose to specialize solely in residential and commercial applications. We provide service to large commercial projects such as school districts and hospitals as well as single windows in homes. By electing to focus only on architectural window tinting and not automobiles, Tint by Toalson offers superior workmanship in these settings.

Jeremy is a Columbia native who has lived many different places including abroad until finally making his way back home and purchasing Tint by Toalson in 2016. We continue with the small family-owned business mindset that made Toalson such a wellknown name in the Columbia community and always provide completely free estimates.

(573) 443-8468

Tintbytoalsonllc@gmail.com

There is a lot of growing interest today in security film, and I will explain what exactly it is and if it can be a solution in your home or business. Safety and security film is a product that goes over the existing glass and is anchored to the frame using specialized caulking, and the security film can be either clear or tinted. This film will drastically slow or completely stop individuals from breaking the glass and being able to gain access to a building from a window or door. If a window is struck or hit with an object, the glass may crack, but the security film will hold it in place. The main purpose of security film is to prevent an intruder from gaining immediate access into a building in the case of an attempted break in.

I personally wanted to test this product, and I applied security film to a 4-foot by 8-foot piece of glass and tested it at a gun range with local law enforcement. The glass was shot with four different calibers over 40 times and then repeatedly struck with a baseball bat.

While this product cannot be sold as bulletproof, the glass all held in place, and we could not gain access. For this test, I also used a mirrored tinted security film; this prevents an intruder from seeing in from the outside, adding an additional level of security for your home or business.

We have applied security film to many

businesses, churches, homes, hospitals, and school districts. Adding security film to your home or business may lower your insurance costs as well by preventing access through the glass. There are currently grants available that can cover this service. Let us know if we can help keep your home or business safer by adding security film.

By Jaclyn Rogers

Find more at aipaintingplus.com

Not long after the back-to-school season starts to settle in, summer gives way to autumn, and we get some of our favorite combinations of the year: football and sweatshirt weather; cooler days and mosquito-free outings; and pumpkin spice and fall colors.

And speaking of color, did you know that this is the time of year for interior painting? We’re borrowing a cool (pun intended!) acronym that our friends at Image Painting came up with that gives four reasons why fall is the ideal time for interior painting.

Family, friends and neighbors love to gather at your home for the holidays. You’ll feel pride in your space if it has a new, clean and stylish look about it. Plus, it’s a great conversation starter.

Another year will soon be upon us. This is your chance to start off right with a house you love again. Get rid of those smudges, nicks and scratches, and apply a new, fresh look.

Life is busy. You work hard. You deserve this. We’ll do the work and you’ll love the new look of your home as you settle in with a cup of coffee or glass of wine in that newly painted space.

L

ongtime coming! You’ve been thinking about a new interior paint job for a while now. Why wait? Once it’s done, you’ll be so glad it is. Plus, all your decorating efforts will look even better.

Jaclyn Rogers, sales representative at Ai Painting Plus, sees paint as more valuable than simply being an accent in a home. “We are painting joy into people’s homes,” she says. Jaclyn is certified as a Psychological Color Expert, which means she has demonstrated mastery in specifying interior paint in residential applications.

Even though the days get shorter, they’ll seem to zip on past. One minute we’re sharing first day of school photos on Facebook, then there’s a succession of events and holidays: the last outdoor concerts of the year, Halloween, Thanksgiving, and then … Right. Just take a breath now, slow your mind for a minute, and let’s review some other good reasons for interior painting in the fall and winter.

Autumn can provide ideal temperatures for interior painting. The cool air will make it easier for the painters to complete their work. This type of weather is especially advantageous if you are painting the interior of your home, as you can open the windows to ventilate the paint fumes.

Moisture is another important factor to consider when painting your home. Whether you are painting the interior or exterior of your home, the paint must dry and adhere properly. It is only appropriate to apply paint to dry surfaces. Humidity can affect both the application and durability of paint.

Winter is a busy season due to the numerous holidays that require family gatherings and entertaining. If you decide to paint your home in early autumn, you can complete the project before the holidays begin.

Fall undoubtedly has the best conditions for painting your interior, offering cooler conditions, improved ventilation, and many other benefits that contribute to a successful painting project. Whether you’re preparing for the holiday season, seeking long-lasting results, or simply looking to refresh your living spaces, this season provides the ideal window of opportunity. Contact Ai Painting Plus to get started on creating the cozy space of your dreams.

By Nate Anderson Find more at rostlandscaping.com

English gardens are renowned for their timeless appeal and charm. They are defined by blending both formal and informal elements. English gardens started with the idea of a more natural order to the landscape vs the very structured and formal French gardens. English gardens sometimes borrow elements of the French garden, but they are generally more natural, loose and “flowy”. Incorporating aspects of English gardens into your landscape can transform your outdoor space into a picturesque retreat.

1. Create a Naturalistic Layout

One of the hallmarks of an English garden is its naturalistic layout. Unlike the more linear and formal French gardens, English gardens embrace organic shapes. Incorporate winding pathways that meander through your garden, guiding visitors to different focal points. Use materials like gravel, stone, or pavers to create paths. Install sweeping beds filled with a mix of perennials, shrubs, and trees. Aim for a layered planting approach where you place taller plants at the back and shorter ones in the front. This creates depth to the landscape.

2. Embrace the Cottage Garden Style

The term “cottage garden” is sometime used synonymously with English garden design. This style emphasizes a more relaxed, informal planting scheme with a large variety of plantings. To help achieve this look, you would lean towards more densely planted beds filled with a variety

of colorful blooms and foliage types. Some good options for Missouri are peonies, roses, ninebark, and hydrangeas. The key to this look is to let plants spill over edges and intermingle with each other creating a lush feel. Mixing in herbaceous perennials such as coneflower, salvia, and catmint is a great way to add pops of color.

3. Use Hedges and Borders for Structure

While English gardens are known for their naturalistic planting, they also feature structured elements. Hedges are commonly used to create boundaries and add privacy. Consider planting evergreen hedges like boxwood or yew to create separate “rooms” within your landscape. You can also use upright evergreens to highlight the architecture of your house or add focal points. In addition to hedges, use plant borders to define pathways and garden beds. Mixed borders, which combine perennials, shrubs, and annuals, are a staple of English gardens. These borders should be densely planted also.

4. Incorporate Water Features

Water features are another key element of English gardens. If your landscape allows,

Nate Anderson has been a resident of Columbia for seven years, and he has been working in the landscape industry for just as long. Nate is a designer and estimator for Rost Inc. While working on his degree in plant science and landscape design, he also worked as a foreman at Rost Landscaping, where he oversaw landscape construction projects. He credits much of his inspiration to his “early years” where he got to be a part of the construction of many beautiful landscapes.

consider incorporating a small pond, fountain, or even a stream. These features not only provide visual appeal but also add great sounds to the garden and can enhance any outdoor space.

5. Add Garden Structures

Finally, consider incorporating garden structures like pergolas, arbors, or trellises. These elements add height and vertical interest to your landscape. A pergola is a great way to provide shade for a seating area, while an arbor can frame an entryway or pathway. Climbing plants like roses or wisteria can be trained to grow over these structures which also add to the English garden aesthetic.

Creating the English garden look is all about balancing structure with natural beauty. By blending formal elements like hedges and upright evergreens with flowy pathways and informal mass plantings, you can create a garden that feels both structured and naturalistic. Talking to the staff at Superior Garden Center or hiring a qualified designer is a great way to get guidance on your plant selections and overall design.

BY KELSEY WINKELJOHN

Like many cities across the country, Columbia faces challenges with housing insecurity and poverty. As of September 2023, 23 percent of Columbia’s residents (about 27,163 people) were living at or below the poverty line, a number that has steadily increased since 1980. Another 270 or so residents are unhoused.

ankfully, local nonpro ts and social services, such as Central Missouri Community Action (CMCA), are committed to addressing the root causes of poverty and supporting community members in overcoming it.

CMCA’s origins date to 1964, when President Lyndon Johnson signed the Economic Opportunity Act into law. e act enabled the formation of the Central Missouri Counties Human Development Corporation (later known as CMCA).

Over the years, the organization has instituted a wide variety of programs, from child development programs to energy assistance and housing development, all aimed at achieving its mission of “building relationships to empower people, strengthen resilience, and improve quality of life for all members of the community.”

“Our programs range along a whole continuum,” explained Executive Director Darin Preis, “from fundamental needs, like helping people pay their utility bills and rent, to much more long-term interactions, like Head Start, where we’re working with children and families.”

One program that ts into the latter category is the Financial Opportunity Center

(FOC), which assists members in developing a plan to achieve nancial stability. CMCA adopted the FOC model about ve years ago after insights gained through other family programs.

“We do something called a ‘self-su ciency matrix,’ where we measure about twenty-two di erent variables of a family’s health — so income, education level, job stability, access to food,” Preis added. “We were consistently getting information that people really don’t understand their nances.”

Some of the barriers that individuals often struggle with when managing their nances include creating a budget, increasing their credit scores, and opening a bank account.

e FOC model has three components: income support (connection to bene ts, such as SNAP and childcare subsidies); nancial counseling; and employment support services (career coaching, job retention, education, etc.). It functions by pairing individuals with coaching services that help them navigate issues such as increasing their income, decreasing expenses, and acquiring assets.

e goal is to create sustainable change rather than a temporary solution.

“With our anti-poverty mission, we’ve identi ed that almost every need that comes through our doors involvesnance,” noted FOC coordinator Jamie Wallingford. “Our goal is to see where they’re at right now … and our coaching model helps us break it down and really connect with those individuals.”

Financial issues can quickly become overwhelming for people with low nancial literacy. Coaching services start by identifying the individual’s speci c needs, such as rental assistance, and connecting them with someone in the community who can

help. Coaches then work with the individual to address the root of the problem and set goals such as budgeting, improving credit, managing debt, and income management skills based on the person’s needs.

e FOC is the only program at CMCA that doesn’t require individuals to rely on certain bene ts, such as SNAP, to participate. e only stipulation to take advantage of its services is to be at or below 200 percent of the federal poverty level. CMCA won’t turn away individuals above this indicator, however, but rather structure their approach di erently.

With 102 active members in the FOC — and constantly climbing numbers, thanks primarily to internal referrals — the need for nancial literacy programs proves to be signi cant throughout the eight counties served.

One way that CMCA can continually provide more to members in di erent areas is through strategic partnerships with other organizations. anks to Heart of Missouri United Way, for example, CMCA is able to address the issue of saving money that families throughout the Boone, Cooper, and Howard counties face.

“Heart of Missouri United Way has supplied us with funding to help members create an emergency savings fund before we start their debt pay-o plan,” Wallingford says. “ ey’re allowing us to do a dollar-for-dollar match for individuals that are able to save — up to $500.”

at initiative is particularly bene cial for families with nonreducible spending habits, where penny-pinching from necessary spending feels like the only way to save. Independently saving $1,000 might

FOUNDED: 1964

MISSION: To build relationships to empower people, strengthen resilience, and improve quality of life for all members of the community.

Board of Directors:

Jodi McSwain, President

Cotton Walker, Vice President

John Flanders, Treasurer

Ruby Young, Secretary

Elizabeth Anderson

Michelle Barg

Heather Berkemeyer

Khyeese Bethea

Tiffany Burns

Delsa Byrd

Karen Digh-Allen

Stella Druml

Susan Hart

Phillip Iman

Jean Ispa

Dwight Massey

Leslie Meyers

Michael Pryor

Stephanie Schmidt

Paula Sims

Robert Sparks

Janet Thompson

seem daunting for those individuals when many rely on SNAP bene ts and housing choice vouchers; however, the assistance can empower them and help them realize that it’s possible to build their savings. It also prevents individuals from falling into predatory lending.

Over the years, the FOC has seen a number of success stories, each highlighting CMCA’s impactful footprint on the community.

Take single mother, La’Chelle, for instance.

Due to personal circumstances, she worked only eight hours per month. She resorted to payday loans and fell behind on bills and credit card payments. Additionally, she had another baby on the way.

“I met my coach during a time when I didn’t know what I was going to do, trying to gure out how to get out of the dark place I was in,” La’Chelle shared, according to CMCA’s 2023 gratitude report. “I was stressed, overwhelmed, and depressed due to not being able to work and pay my bills.”

Wallingford and the CMCA team helped La’Chelle create a budget and connected her to resources to help her catch up on her bills. After securing proper childcare, La’Chelle picked up more shifts at her PRN job, which allowed her to pay o one of her payday loans. And that accomplishment gave her the momentum she needed

to pursue a second job working fulltime on the weekends.

Within ve months, she had paid o all three of her payday loans — more than $7,000 back.

“She’s now working on obtaining her rst home,” Wallingford said, smiling. “She’s truly one of my biggest successes because of her determination and perseverance through this process. She has had setback after setback after setback, but she keeps going because she realized she has the support.”

La’Chelle added, “CMCA has given me unconditional support and constant encouragement that I can do whatever I put my mind to. I want to continue to learn how to continue saving and working on myself.”

One of the most prominent issues that individuals have when working toward nancial freedom is asking for help. Still, stories like La’Chelle’s indicate that it’s possible to overcome nancial insecurity with support from organizations like CMCA.

Whether you’re ready to meet with a coach or not, CMCA o ers several public resources to help you start on your path toward nancial freedom, including its “Financially Fit Podcast,” available on various platforms.

CENTRAL MISSOURI COMMUNITY ACTION

800 N. Providence Rd.

573-443-1100

cmca.us

Looking for great late-night bites in COMO? Here’s your menu of locations.

BY LYDIA GRAVES

PHOTOS BY KEITH BORGMEYER

The curtains close on a spectacular theater performance, a few workers clock out from their late-night shifts, and the last call echoes through the once-energetic bar. But the night is not over. Crowds ll the streets while the aroma of a freshly cooked meal pulls them every which way. Comforting, like a nice warm blanket at the end of the jam-packed evening. A line forms in front of a bustling

food truck while others seek refuge in restaurants with their lights shiny and bright; beacons for the tastebuds. Columbia’s late-night culinary scene is a vibrant nocturnal landscape, if you know where to look for it.

Right up the block from Blue Note, on the corner of Ninth and Locust, you’ll nd “COMO’S Best Street Meat.”

Owned and co-operated by Rikki Stone alongside her girlfriend Morgan Hauser, Night Owl Eatery has been feeding the night scene for the past four years. Originally starting as a modest hot dog cart, Night Owl Eatery quickly gained popularity with its delicious bites, refusing to comprise quality for the late hour. e past year, Night Owl Eatery came into its own with the upgrade to an enclosed trailer, allowing an expanded menu and catering to a larger crowd.

Night Owl Eatery has become a pillar of comfort and delectable eats for the

city’s night owls. e truck caters to chefs and bartenders seeking a post-shift meal just as well as hungry revelers craving a savory snack.

Drawing inspiration from vibrant street food scenes such as Louisiana, southern Texas, and Chicago, Night Owl Eatery’s menu boasts a tantalizing array of options. Snap a picture of the late-hour ambiance with the “prettiest Chicago style West of the Mississippi,” as Stone boasts. e patty melt is also incredibly popular — think Texas toast bun, double the cheese, topped with caramelized onions. Or opt for the pepper jack white cheddar mac and cheese. Either way, you’re leaving with a warm belly and a smile.

Beyond the food, Night Owl Eatery is more than just a place to grab a bite — it’s a gathering spot for the community. It’s a welcoming atmosphere and Morgan Hauser is smiling to greet you, striking up a conversation. It is a spot that creates memories despite thinking the night might’ve been over.

Whether you’re a regular patron or a rst-time visitor, Night Owl Eatery invites you to join in the nocturnal adventure and discover why it’s become a beloved xture in Columbia’s food scene.

Night Owl Eatery is open 10 p.m. to 2 a.m. Friday and Saturday.

Take a short walk from Ragtag Cinema or Playhouse eatre Company, and you’ll nd yourself craving the enticing, garlicky scent surrounding you. For more than twenty years, Gumby’s Pizza has been a beloved late-night destination in Columbia, serving up pizzas, wings, and the iconic Pokey Sticks to hungry patrons long after the sun sets.

Nestled on the east edge of the bustling street of Broadway, the hotspot has risen into a culinary cornerstone, thanks to Gumby’s commitment to fresh ingredients, friendly service, and a relaxed atmosphere. It is a spot for anyone and everyone, as long as they are hungry.

When Gumby’s was newly established as “the college student hangout” in Columbia, Noah Schmidt joined the team. His contributions helped top o the brand with new avors. Online ordering and revamping the menu with fresher, more creative options has drawn many people in while still maintaining the qualities loyal customers know and love. Schmidt’s vision aligned seamlessly with Gumby’s ethos of providing quality food with a side of fun.

At the heart of Gumby’s success lies its menu — a smorgasbord of pizza creations and a collection of tasty, tender wings that please any late-night cravings.

“ e key to new menu items lies in inspiration and experimentation,” Schmidt says.

If you’re looking for something quintessential to the Gumby brand, try the Stoner Pie. Topped with pepperoni, bacon, mozzarella sticks, french fries, cheddar cheese, and mozzarella cheese, it embodies the eclectic environment the spot is known for. Another favorite — with alfredo sauce, chicken, bacon, and pepper jack cheese — the Uncle Jesse is an easy crowd-pleaser. Pizzas are all crafted with care and creativity, offering customers a taste they won’t nd anywhere else.

But be sure to never leave without an order of Pokey Sticks — a garlic cheese bread that melts in your mouth. e cheesy indulgence has become synonymous with late-night satisfaction.

Beyond the food, Gumby’s Pizza has a bright, relaxed atmosphere paired with a welcoming “hello.” Whether you’re a college student looking for a post-party slice or a local resident craving a square box of comfort, Gumby’s delivers on its promise of delicious pizza and a good time, leaving customers satis ed and eager to return for more. Come to play a game of pool, choose a song from the jukebox, hang out with friends or make new ones over a drink, and enjoy a fresh slice of melty-cheesy goodness.

Gumby’s Pizza is open 10 a.m. to 12 a.m. Monday through ursday, 10 a.m. to 1 a.m Friday through Saturday, and noon to 11 p.m. on Sunday.

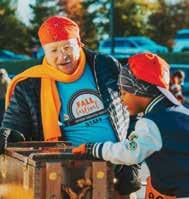

If you’d prefer to venture outside the downtown scene, After Bite is re ning late-night dining at its location on Trimble Road. Josiah and Leanne Geiss are Columbia natives and proud owners. Alongside Chef Craig, the team is the creative force behind the new latenight diner.

Josiah Geiss has a heritage deeply rooted in the culinary industry. He learned the ropes from his father, developing a profound appreciation for the art of avor and technique. Leanne Geiss has an extensive background in event planning and professional sales. She aims to provide a seamless operation and an unforgettable experience for each person who nds their way in the door.

Chef Craig laid the groundwork for innovation and excellence through After Bite’s menu. He keeps collaboration consistent with the owners to ensure the spot remains true to its roots, quality, and creativity.

With everything from sandwiches to donuts to piled-high nachos, it can be

di cult to choose what to order. Josiah Geiss is always reaching for the wings, his personal pick when midnight rolls around. e owners also recommend the beef Philly sandwich for a mouthwatering bite. Or if you’re craving more breakfast for (late) dinner, choose the open-faced chicken and wa e.

Grateful for the unwavering support from their community, Josiah and Leanne Geiss look forward to becoming a staple in Columbia’s culinary scene. e two are constantly sustained by the passion and dedication that de ne After Bite.

“We’ve wanted to build a company that caters to its community in multiple ways,” Josiah explains. “Whether it’s catering a wedding or serving school lunches through our catering company, Eclipse, or serving grab-and-go sandwiches and salads through After Bite, we do just about everything.”

After Bite is open from 8 p.m. to 2:30 a.m. Friday and Saturday.

2 Odd Dawgs is a family-owned food truck that’s been in operation since 2017. e company was born out of a desire to preserve family recipes and create a lasting legacy for generations to come.

Raised in the heart of Columbia, amidst the savory aromas of his grandmother’s kitchen and the wholesome meals crafted by his mother, Marvin Stemmons, the founder of 2 Odd Dawgs discovered his culinary calling at a young age. He was heavily inspired by the creativity and love infused into every dish his family made. He’s aimed to use his business in pursuit of culinary exploration and innovation.

Fueled by a desire to defy convention and celebrate culinary eccentricity, 2 Odd Dawgs earned its name as a testament to the uniqueness of every dish that sets the truck apart.

Stemmons says, “My inspiration for cooking really comes from within. I would imagine something that I would want to cook and that would spark up inspiration for dishes. at’s why we’re called 2 Odd Dawgs — every dish is unique and has its own spin on it.”

Be sure to try the daily special — ranging from wings to cat sh — or go for the namesake “dawg.”

Recognizing the universal need for quality food at any hour, 2 Odd Dawgs ventured into late-night dining, ensuring that a good meal has no curfew. Starting from humble beginnings and a dream, the business has continually expanded,

including a growing presence online — such as recently introducing ordering through DoorDash — and beyond.

At the heart of 2 Odd Dawgs’ menu lies a tantalizing array of late-night delights, from crispy fried chicken and succulent sh to mouthwatering burgers and customizable combo specials. With each bite, patrons are treated to a symphony of avors that defy replication, leaving taste buds craving more.

2 Odd Dawgs hopes to leave a lasting impression on the community it serves. With aspirations to expand into a brickand-mortar establishment and become a cherished location in Columbia for generations to come, 2 Odd Dawgs is more than just a food truck — it feeds not just bodies, but souls. e truck has something for everyone, so take their advice next time you stop by: “Tell a friend, bring a friend.”

2 Odd Dawgs is open 10:30 p.m. to 3:30 a.m. Tuesday through ursday. Watch their socials to nd up-to-date specials and today’s location.