2 minute read

Cheaper, Better, Faster, Stronger: Wind, Solar, and Clean Hydrogen

Electricity Canada: The Grid 2022

Matthew Klippenstein

Regional Manager for Western Canada, Canadian Hydrogen and Fuel Cell Association

The Lobster Claw of Emissions Reductions

The path to Net Zero is something of a lobster claw. The bulk of emissions reductions will be done with direct electrification, the large portion of the claw. Hydrogen in various forms from various sources is the “thumb”.

Clean hydrogen is central to Canada’s Net Zero pledges and our energy future. The Hydrogen Strategy for Canada estimates hydrogen could represent 30% of end-use energy by 2050, with the Roadmap to a US Hydrogen Economy estimating up to 14% in the United States. Worldwide, BloombergNEF researchers believe hydrogen could provide up to 24% of end use energy, higher than the Hydrogen Council’s own 18% figure1 .

However large the eventual number, hydrogen can be a way for Electricity Canada members to expand from the electron (electricity) business into the proton business (hydrogen). The proton business may never be as large, but it remains a valuable complement to Canada’s energy mix.

Electricity Canada: The Grid 2022

Up-valuing Electrons

Hydrogen may also be a way to up-value electrons whose wholesale clearing prices have edged downwards as more variable solar and intermittent wind enter the Western Electricity Coordinating Council (WECC), Midwest Reliability Organization (MRO) and Northeast Power Coordinating Council (NPCC).

Alberta’s Transition Accelerator2 noted that in cheaper regions, Canadian grid customers can generate hydrogen for the same cost-per-GJ as the wholesale price for transportation fuels such as gasoline and diesel. Hydrogen fuel cell systems are also more efficient than combustion drivetrains, creating a cost-per-km advantage. But hydrogen distribution and dispensing costs remain considerably higher.

Electricity Canada: The Grid 2022

If Electricity Canada’s members can generate hydrogen competitively, even when paying transmission and distribution costs, some members may be able to generate hydrogen on-site at even more competitive rates.

Adding to the business case for hydrogen, the Government of Canada’s soon to be announced Low Carbon Fuel Regulation should enable a market in which producers of low emissions hydrogen can claim carbon credits. Based on the reference data laid out in British Columbia’s Low Carbon Fuel Regulation, that province’s regulatory credits (recently trading above CAD$450/tonne CO2) implied a credit value of more than CAD $6/kg for hydrogen generated using electricity from the province’s grid, when replacing diesel. (It must be emphasized that past prices may not be indicative of future performance.)

Wind, Solar, Hydrogen

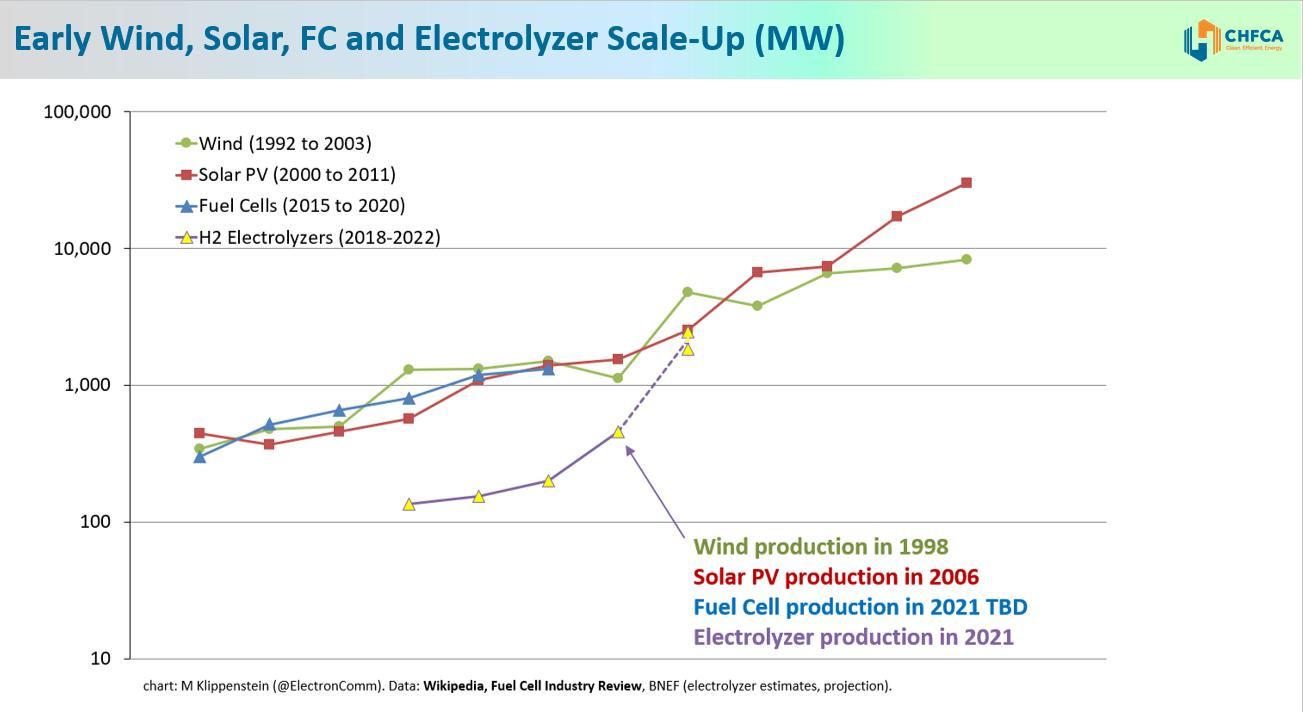

If we chart annual wind turbine production in the wind industry’s infancy (the 1990s) and overlay annual production of solar photovoltaics during their early years (the 2000s) a remarkable thing happens. On a logarithmic scale, the two growth trajectories broadly superimpose.

Recent production totals for the fuel cell industry, whose renaissance Canada’s Geoffrey Ballard sparked forty years ago, follow much the same trend.

Hydrogen electrolyzers are poised to scale up much faster.

Hydrogen electrolyzers’ rapid scale-up will “pancake” capital expenditure costs, which should make it easier for electric utilities to up-value their electrons by adding a complementary proton business. As Electricity Canada members become interested in these new opportunities, the Canadian Hydrogen and Fuel Cell Association can provide guidance on their hydrogen journey.