meatbusinesspro.com $7.99 THE BEEF, PORK & POULTRY INDUSTRY DIGITAL MAGAZINE February 2023 FAKE MEAT WAS SUPPOSED TO SAVE THE WORLD. IT BECAME JUST ANOTHER FAD. Worldwide Pork Industry is Expected to Reach $418+ Billion by 2028 Equifax Acquires Profile Credit’s Food Industry Credit Bureau New Sustainable Ground Meat System Provides Savings to Packaging and the Environment Meat Industry Hall of Fame Class of 2022 Celebrating Women in Agriculture

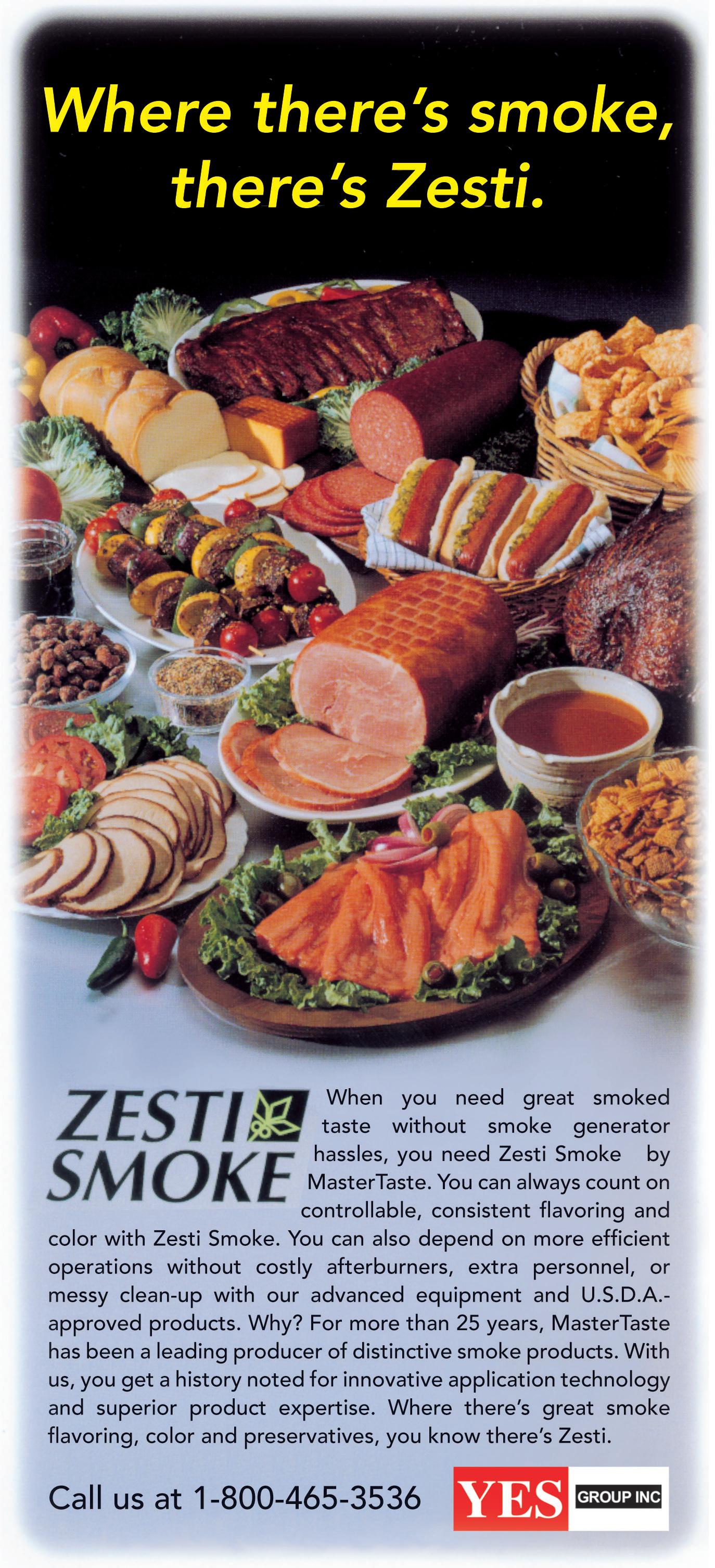

https://www.yesgroup.ca

February 2023

5 6 10 12 14

BCRC Celebrates 25 Years of Beef Industry Research Fake Meat was Supposed to Save the World Worldwide Pork Industry is Expected to Reach $418+ Billion by 2028

Formost Fuji Announces New Headquarters and Plant Locations

Equifax Acquires Profile Credit’s Food Industry Credit Bureau

16 18 20 30 33

New Sustainable Ground Meat System Provides Savings to Packaging and the Environment New CPC Chair Outlines Key Issues

Meat Industry Hall of Fame Class of 2022

Celebrating Women in Agriculture

Tom Kittle retires, Patrick McGady to head Handtmann USA

https://www.yesgroup.ca

February 2023 Volume 24 Number 2

PUBLISHER

Ray Blumenfeld ray@meatbusiness.ca

MANAGING EDITOR

Scott Taylor publishing@meatbusiness.ca

DIGITAL MEDIA EDITOR

Cam Patterson cam@meatbusiness.ca

CONTRIBUTING WRITERS

CREATIVE DIRECTOR

Patrick Cairns

Meat Business Pro is published

12 times a year by We Communications West Inc

BCRC CELEBRATES 25 YEARS OF BEEF INDUSTRY RESEARCH

Since 1998, the Beef Cattle Research Council (BCRC) has operated as a division of the Canadian Cattle Association (CCA), and 2023 marks 25 years as Canada’s national industry-led funding agency for beef, cattle and forage research.

Directed by a committee of beef producers from across the country, the BCRC has played an important role in identifying the industry’s research and technology transfer priorities influencing public sector investment in beef, cattle and forage research.

“As a beef producer and past chair of the Beef Cattle Research Council, I have had a front-row seat to observe how applied research and extension is improving productivity and profitability for Canada’s beef producers,” said Matt Bowman, BCRC past chair. “By leveraging producer-paid Canadian Beef Cattle Check-Off dollars and listening to the industry’s needs, the BCRC has continued to develop practical resources to help farmers and ranchers make informed decisions that improve profitability, reduce risks and enhance consumer confidence in Canadian beef production.”

CO MMUNICATIONS W EST IN C

We Communications West Inc.

106-530 Kenaston Boulevard

Winnipeg, MB, Canada R3N 1Z4

Phone: 204.985.9502 Fax: 204.582.9800

Toll Free: 1.800.344.7055

E-mail: publishing@meatbusiness.ca

Website: www.meatbusinesspro.com

Meat Business Pro subscriptions are available for $28.00/year or $46.00/two years and includes the annual Buyers Guide issue.

©2020 We Communications West Inc. All rights reserved.

The contents of this publication may not be reproduced by any means in whole or in part, without prior written consent from the publisher. Printed in Canada. ISSN 1715-6726

The 25 years of industry investment into Canadian beef industry research and extension has resulted in significant strides in mitigating production issues and advancing management practices including pain control, extended grazing, feeding/finishing and the reduction of the contamination of E. coli O157:H7.

“Change and growth takes time. As producers we put our heads down and get to work, often forgetting to look back and reflect at how our operation has changed over time,” said Craig Lehr, BCRC chair. “In the last 25 years the BCRC has grown into an indispensable organization for Canadian beef producers. From advancements in the feed we grow to the way we feed it, genetics to animal health, pasture to the feed yard, there is no aspect of Canadian beef production that hasn’t been changed through research and extension. Leadership initiatives, such as the Beef Researcher Mentorship Program, have also helped connect researchers with industry and producers.”

Throughout the coming year, articles, videos and other media will be released to celebrate 25 years of check-off dollars advancing research in the beef sector. For more information, visit https://www.beefresearch.ca/

5 meatbusinesspro.com December 2022 MEATBUSINESSPRO

THE BEEF, PORK & POULTRY INDUSTRY DIGITAL MAGAZINE

Deena Shanker, Fred Wilkinson, SeoRhin Yoo, Cam Patterson, Jack Roberts

FAKE MEAT WAS SUPPOSED TO SAVE THE WORLD. IT BECAME JUST ANOTHER FAD

By Deena Shanker, Bloomberg

Beyond Meat and Impossible Foods wanted to upend the world’s $1 trillion meat industry. But plant-based meat is turning out to be a flop

Ever since founding Beyond Meat Inc. in 2009 with the then fantastical idea of making meat without animals, Ethan Brown has been giving the equivalent of one extremely long TED Talk.

so, too, would his system of breaking down plants transform the protein at the center of the plate.

"This," he said, "is something that I feel is inevitable."

Silicon Valley didn't need much convincing that a better veggie burger could become the next worldchanging disruption. Whereas the quinoa-and-bean patties of yore were for the crunchy set, Brown's beef facsimile, concocted in a lab to look and taste like the real thing, meant the vast majority of meat eaters could give up their burgers without having to give up anything at all. Along with the venture capitalists came investors from every corner of culture—Leonardo DiCaprio, the Humane Society of the United States and former McDonald's Corp. Chief Executive Officer Don Thompson.

In 2013 he took the stage at the Wired Business conference, explaining that the world had a very real greenhouse gas-emitting meat problem and that venture capitalists could make a bigger impact investing in fake meat than in solar energy. At Toronto's annual Ideacity gathering three years later, he said his goal was to replicate the "blueprint of meat." By the time he appeared at Goldman Sachs Group Inc.'s Builders & Innovators Summit 2019, he explained that his mission demanded the urgency and scale the U.S. mustered for World War II and that his products would simultaneously help solve heart disease, diabetes, cancer, climate change, natural resource depletion and animal welfare. Just like technology had rendered the horse-drawn carriage obsolete, he told the crowd at the New York Times' climate conference this past fall,

Even Tyson Foods Inc., the biggest maker of real meat in the US, invested and then invested again, catapulting the young El Segundo, California-based startup to a $1.3 billion valuation by 2018.

6 MEATBUSINESSPRO December 2022 meatbusinesspro.com

Bill Gates wanted in, too, backing not one but two companies with veggie burgers that "bleed" like real beef—Beyond, as well as its rival Impossible Foods Inc. Brown had licensed someone else's process, but Impossible was the brainchild of a Stanford University biochemist named Pat Brown (no relation to Ethan). When Pat founded Impossible in 2011, his big breakthrough was realizing that a molecule called heme was the key to meat's meatiness. He made heme with genetically modified yeast and patented the use of what the company called its magic ingredient: soy leghemoglobin.

Before Impossible had sold even a single burger, the company managed to raise $183 million. Pat also worked the circuit, including an actual TED Talk (technically, it was TEDMed) in 2015. Speaking in slightly more apocalyptic terms than Ethan, Pat referred to the "ongoing wildlife holocaust" caused by the world's insatiable demand for meat, while an assistant sizzled an Impossible Burger onstage beside him. "I know it sounds insane to replace a deeply entrenched, trillion-dollar-a-year global industry," he said, "but it has to be done." Four years later, when the New Yorker profiled Impossible, Pat predicted his company would "take a double-digit portion of the beef market" by 2024 before sending it into a "death spiral." Next he would target "the pork industry and the chicken industry and say, 'You're next!' and they'll go bankrupt even faster."

7 meatbusinesspro.com December 2022 MEATBUSINESSPRO

VEMAG REPLACEMENT PARTS https://www.dhenryandsons.com

But Big Meat is still alive and well. After Beyond went public in 2019—at the time the most successful major initial public offering since the 2008 financial crisis—competitors rushed into the space, followed by a category wide pandemic surge. Since then the industry has plunged. Supermarket sales of refrigerated plant-based meat plummeted 14% by volume for the 52 weeks ended Dec. 4, according to retail data company IRI. Orders of plant-based burgers at restaurants and other food-service outlets for the 12 months ended in November were down 9% from three years earlier, according to market researcher NPD Group.

Beyond lost sales in almost every channel last quarter. Over the past year it laid off more than 20% of its workforce, lost more than half of its C-suite and halted projects including vegan hot dogs and the next altprotein frontier of cell-cultured meat, according to people with knowledge of the matter, who asked not to be named discussing private information about the company. None of the biggest fast-food chains that had announced partnerships with Beyond—KFC, Pizza Hut and, most important, McDonald's—have put a single permanent item on their U.S. menus. While an index of packaged-food companies on the S&P 500 was up about 4% from a year ago, as of Jan. 17, Beyond's stock price is now hovering around $16, down about 76% from a year earlier and roughly 93% from its peak in the summer of 2019.

Impossible, meanwhile, is faring better—but Pat is out at the company. Last April he stepped down to chief visionary officer, replaced as CEO by a Chobani Inc. executive, before taking a leave of absence. Under new CEO Peter McGuinness, Impossible has spun up new products such as animal-shaped faux chicken nuggets and blitzed supermarkets, leading to more than 50% retail sales growth in the US in 2022. While it has added restaurant partners, some of its long-standing ones are finding consumer excitement has either hit a wall or is declining. Shares of Impossible, a private company, are currently trading at around $12, says Prab Rattan, head of capital markets at Hiive, a marketplace for private stock trading. That's about half the price during its last fundraising round, based on PitchBook data.

Plant-based meat's most reliable enthusiasts at this point are those original veggie burger stans, vegans and vegetarians. The all-important meat eaters do partake, but at a much lower frequency. "They're just not that into it," says Chris DuBois, head of IRI's protein practice.

How did an industry with so much riding on it— backed by so much money—suddenly fizzle out? The companies declined to make Ethan Brown and Pat Brown available to talk to Bloomberg Businessweek, but at that New York Times climate conference in October, Ethan pointed his finger at the actual meat industry for fake meat's headwinds. "They are doing their very best today to suggest that our process is somehow unhealthy or that our products are full of chemicals," he said. "These things are not true."

Continued on page 24

8 MEATBUSINESSPRO December 2022 meatbusinesspro.com

WORLDWIDE PORK INDUSTRY IS EXPECTED TO REACH $418+ BILLION BY 2028

Research and Markets is the world’s largest market research store with clients all over the world, including 450+ of the Fortune 500 Clients. The company recently released its report entitled "Global Pork Market, Size, Global Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis".

The report summarized that the Global Pork Market is expected to be US$ 418.37 Billion by 2028 as pork is the most widely and popular consumed meat source worldwide.

The global swine industries are very dynamic and the primary protein source for millions across numerous cultures. Pork is cheaper than any other meat source, which is a significant factor in its high consumption.

A significant middle-class population, growing disposable income, and changing consumer preferences are levitating pork demand. However, the rise in the adoption of veganism and stringent law against the animal cruelty act are the major restraints of the global pork meat market.

The growth of the pork meat market can be attributed to changes in the food consumption pattern of people worldwide. In addition, the expansion of the retail market and easy availability of the product through various sales channels make it convenient for consumers to purchase packaged pork meat, which drives the sales figures.

WORLDWIDE PORK MARKET WAS VALUED

US$ 254.53 BILLION IN 2022.

Frozen pork meat is growing manifold due to the rapid increase in consumption of meat.

The growth in the online application of pork purchasing can be directly attributed to the surge in the working population and the trend of consuming meals outside homes.

Increasing the popularity of organic pork meat and clean-label products is expected to offer lucrative opportunities for expansion and the growth of the global pork meat market.

Consumers increasingly demand ready-to-eat and ready-to-cook pork meat products with better taste and quality. The increasing awareness about the risks associated with using nitrate for curing purposes in processed meat has enabled manufacturers to replace nitrate with other curing agents, such as celery powder, to achieve the same effect. Such factors register a significant demand for nitrite-free processed meat products such as bacon in European countries.

Household consumption of pork has increased considerably because it is a staple food and has various benefits associated with pork meat, such as its rich source of proteins and vitamins and its luscious taste.

10 MEATBUSINESSPRO December 2022 meatbusinesspro.com

GLOBAL PORK INDUSTRY IS EXPECTED TO GROW WITH A CAGR OF NEARLY 8.64% FROM 2022 TO 2028

The pig industry continues to thrive in areas with plentiful access to grains and protein sources. Pigs are adaptable to various climatic conditions, as evidenced by a large number of breeds present throughout the world. According to USDA, in 2021, worldwide, over 752 million pigs, increasing from the previous year. In this same period, China was home to the most pig and head. In other meaning, China produced more than half of the global pig population, and Europe and the United States were second and third. Brazil, Canada, Mexico, the Philippines, South Korea, Japan, and Hong Kong was in the top 10 producing countries.

The Five biggest imported pork markets are Japan, mainland China, Mexico, Italy, and South Korea. During 2022, Asian countries imported the highest worth of pork, of the world's total. Europe is also one of the biggest pork importer. Some of import were bought by customers in Latin America excluding Mexico but including the Caribbean, Oceania led by Australia and New Zealand, and Africa.

Pork consumption is very high in North America, Europe, and developing Asian regions, such as Japan and China. According to the United States Department of Agriculture's National Agricultural report, the most commonly consumed meat in the world is pork and poultry. The factors influencing change are generally related to economic efficiency and competition from alternative protein sources.

The global trend is for fewer producers responsible for more significant numbers of pigs and more concentration within the swine industry. The ability to maintain economic viability is a function of providing optimal facilities, genetics, nutrition, and health programs to the pig in a system that addresses the cost of production and generates revenue from the marketing of a high-quality product.

Asia is the leading pork consumer, with more than half of the world's production. Apart from this, South Korea, Taiwan, and Japan are the markets for pork consumption, while Vietnam and the Philippines are emerging markets. Pork meat has been consumed in the East Asian region since ancient times and is the most preferred meat due to its taste and fat content.

Asia Pacific is the world's largest exporter of pork, followed by Europe and North America. In contrast, China, the U.S., Canada, Brazil, and European countries are the major pork exporters. In global pork exports, European Union maintained its leadership. The U.S., Canada, and Brazil ranked top five in world pork exports. The pork meat players have adopted new product launches as their key development strategy to maintain their presence in the pork meat market.

Some key players in the report include JBS S.A., Tyson Foods, Pilgrim's pride corporation, Danish crown group, Vion Food Group, WH Groups, Hormel Foods Corporation, and Muyuan Foods.

For more information, visit https://www. researchandmarkets.com/

11 meatbusinesspro.com December 2022 MEATBUSINESSPRO

FORMOST FUJI ANNOUNCES NEW HEADQUARTERS AND PLANT LOCATIONS

Formost Fuji Corporation, a leading manufacturer of packaging equipment, has purchased a 65,000 square foot building, located in Everett Washington, to house their corporate headquarters and manufacturing facilities. This acquisition is needed to meet the company’s demand for growth and their vision for innovation in the packaging machinery industry.

This building purchase will allow Formost Fuji to expand their manufacturing and assembly floor as well as provide a modern, larger office space for the engineering, sales, service, accounting, and administration departments. The transition planning has already begun, and the move from their current facility in Woodinville, Washington will be completed by mid Q3, 2023.

Dennis Gunnell, President, Formost Fuji states, “We are excited to be able to purchase this beautiful property that will provide our employees with a great space to cultivate a positive work environment while we expand and grow.” Gunnell added that they are taking steps needed to ensure the least amount of interruption to production and accessibility to parts during the transition period, “Formost Fuji’s dedication and support to customers has always been and will continue to be top priority. This new space builds on that premise.”

Abbey Equipment Solutions is the Canadian distributor of Formost Fuji. For more information, visit www. abbeyeqipment.com

ABOUT FORMOST FUJI CORPORATION

Established in 1964, Formost Fuji Corporation manufactures world class packaging equipment, such as horizontal wrappers and bagging machines. Their team of dedicated and hardworking people are known for designing packaging solutions that are simple, built to last, and value driven. Formost Fuji’s horizontal form-fill-seal machines are custom designed to wrap a wide variety of products while the Formost Bagger is recognized as the most versatile bagging machine in the industry.

12 MEATBUSINESSPRO December 2022 meatbusinesspro.com

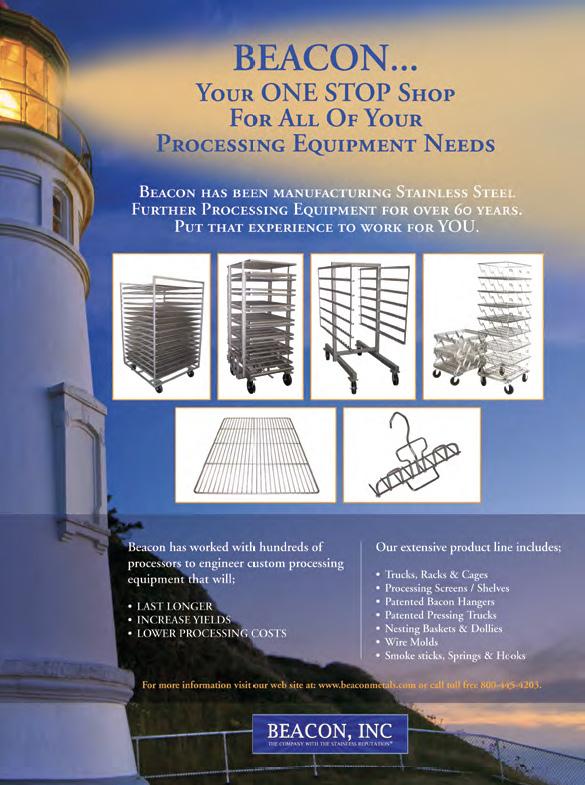

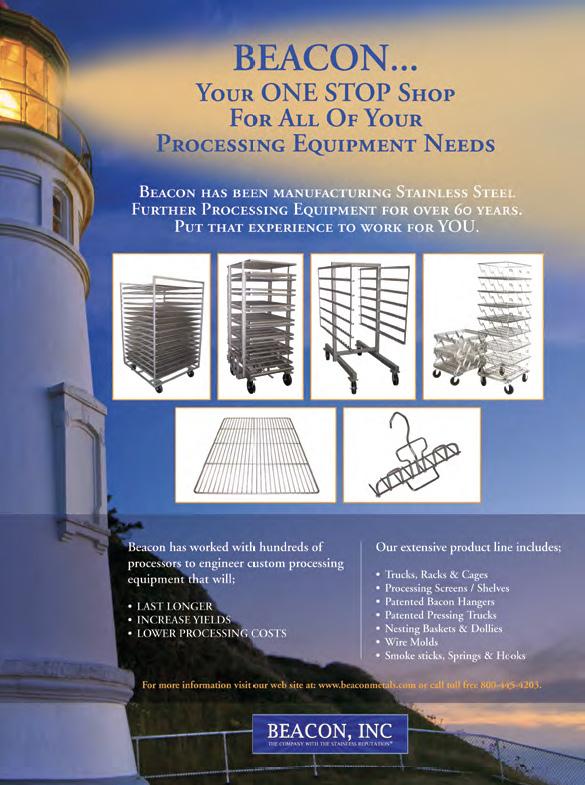

https://www.beaconmetals.com

EQUIFAX ACQUIRES PROFILE CREDIT’S FOOD INDUSTRY CREDIT BUREAU

Acquisition Expands the Breadth of Small Business Insights Equifax Can Provide in Canada and Worldwide

Equifax recently announced the acquisition of The Food Industry Credit Bureau, the leading provider of credit information for the food industry in Canada, from Profile Credit. This acquisition expands the breadth of commercial credit insights available to Equifax customers in Canada and worldwide, making differentiated data insights on over 90% of the Canadian food industry available.

"Small businesses are the foundation of the global economy. With this acquisition, we are bringing powerful new insights on businesses in Canada’s food sector to Equifax customers,” said Mark W. Begor, CEO of Equifax. “Strategic, bolt-on M&A is central to the EFX2025 growth strategy as we broaden our capabilities and position Equifax for strong future growth. Profile credit’s Food Industry Credit Bureau is one of 13 acquisitions totaling more than $3.5 billion that Equifax has completed over the past 24 months. We are maximizing our investment in the Equifax Cloud to rapidly integrate acquired solutions into the Equifax portfolio, helping our customers to drive innovation and growth through unique access to our enhanced data, insights and analytics.”

14 MEATBUSINESSPRO December 2022 meatbusinesspro.com

NSF INTERNATIONAL FOCUSES ON CANADIAN FOOD INDUSTRY WITH NEW WEBSITE FOR SERVICES IN CANADA

Global public health organization showcases services for Canada’s growing and fast-changing

“Over the last three decades, Profile Credit has achieved its leadership in credit information for the food space by enabling our clients to have the data they need at their fingertips,” said Jean Gauthier, Founder and President of Profile Credit. “Food is at the heart of the global supply chain and strong data makes it much easier to make the quick, critical decisions needed to be profitable. As part of Equifax, the Profile Credit food industry credit bureau will have access to expansive global capabilities and cloud-native data, products, decisioning and analytical technology for the ongoing development of new products and solutions that can help our customers make credit decisions with confidence.”

For more information, visit Equifax.ca/business.

accredited International Association for Continuing Education and Training (IACET) site. Topics include HACCP, food safety and quality, GFSI benchmarked standards, regulations (including FSMA), food science, food packaging,

Based in Montreal, The Food Industry Credit Bureau from Profile Credit works in partnership with over 1,000 companies, such as food and beverage service providers, meat and poultry processing, and distribution to provide up-to-date credit data on over 200,000 businesses. The bureau has one of the most comprehensive platforms for bringing together members of the agri-food industry to solve collectively for the challenges and specific dynamics of the sector.

International Canadian office with access to NSF International’s global services dedicated to food safety and quality.

Evolving regulations across countries and increasing complexities associated with a globalized food supply network present challenges for NSF International clients in Canada and around the world. The new Canadian website offers expertise and services to help companies navigate these challenges, including certification and auditing, consulting, technical services, training and education, food and label compliance, packaging, and product and process development.

“The combination of Profile Credit’s Food Industry Credit Bureau and Equifax creates the largest source of commercial credit information in Canada, complementing our market-leading position in consumer credit,” said Sue Hutchison, President of Equifax Canada. “The Canadian agri-food industry employed 2.1 million people and generated around 6.8 percent of Canada’s gross domestic product in 2021. As the food supply chain becomes increasingly global, the integration of insights into Canadian agrifood businesses across sectors benefits customers worldwide, enabling them to make the decisions needed to minimize risk and maximize profitability.”

NSF International’s Canadian website provides information on the following services:

Certification & auditing: Third-party food safety audits and certifications, which are integral components of supplier selection and regulatory compliance. Accurate audits are the first step toward successful verification of a company’s food safety system, providing improved brand protection and customer confidence. Certifications and audits are available for animal and produce in the agriculture industry, GFSI certification and management system registration.

Consulting: A full-service team approach providing technical resources, expertise and insight for a wide range of food safety and quality services. NSF International

A one-stop solution for food product product, including food and label compliance, packaging,

https://www.yesgroup.ca

15 meatbusinesspro.com December 2022 MEATBUSINESSPRO

September/October 2017 CANADIAN MEAT BUSINESS 23 meatbusiness.ca

Training and education: Training for the global food and beverage industry across the supply chain as an

SAVINGS TO PACKAGING AND THE ENVIRONMENT FORMOST

Many retailers are looking at changes in packaging to achieve sustainability goals. Major meat departments are shifting away from wasteful products like foam trays and stretch plastic meat packages. Sustainability and waste reduction are not just environmental initiatives for retailers, they are also a way to save money, as the cost of raw materials and labor impact the economic equation for meat companies. Reducing transportation and storage costs go a long way to bringing the price down for processors.

https://www.youtube.com/watch?v=sYjUKIWuiP0

The Formost Fuji ground meat system does just that. In developing efforts to create a more sustainable solution, this new system eliminates greater than 50% of the material that goes into your standard ground meat package. Along with eliminating foam trays that are harmful to the environment, the full system has a smaller footprint than current ground meat packaging systems used by most meat producers. With the reduction of the equipment, comes savings on energy, valuable floor space, parts, and labor for maintenance.

The Formost Fuji

also offers advantages for shipping, storage, and valuable shelf space. The trayless package uses 50% less space on a truck, thus providing a 100% increase in shipping capabilities. With twice as many trayless packages on a truck than the trayed product, we can take one truck off the road for every two that is currently used for shipping ground beef, therefore reducing greenhouse emissions tremendously. In today’s world, that is a valuable advantage to the producer and the consumer.

16 MEATBUSINESSPRO December 2022 meatbusinesspro.com

Wrapper

NEW SUSTAINABLE GROUND MEAT SYSTEM PROVIDES

FUJI – GROUND MEAT SYSTEM

THE BEST DEFENSE

A STRONG OFFENSE

PROMOTING THE HEALTH BENEFITS

Red meat is often wrongly portrayed as being unhealthy. some in the media as unhealthy or not environmentally friendly.

liver, 625 spinach.

The Formost Fuji Wrapper also offers advantages for shipping, storage, and valuable shelf space. The trayless package uses 50% less space on a truck, thus providing a 100% increase in shipping capabilities. With twice as many trayless packages on a truck than the trayed product, we can take one truck off the road for every two that is currently used for shipping ground beef, therefore reducing greenhouse emissions tremendously. In today’s world, that is a valuable advantage to the producer and the consumer.

meat messages has influenced many families to cut back on their meat and poultry purchases. Perceptions may reality but truth trumps misinformation. Parents and other consumers want what is best for their health and that of their families. They are also aware that a lot of false information is out there and as such, are open to scientific facts that can correct their misconceptions.

This positive change will not only provide you with a “GREEN” packaging line but will pay for itself over a short period of time. The new ground meat wrap produced by this system has excellent seal strength for product protection, as well as maintaining package integrity and extended shelf life. All while creating a smaller package that takes up less room on store shelves. Your consumer will find this package easy to use with the ability to remove the product without having to handle the contents.

This provides an opportunity for retail meat departments to implement an instore ‘Healthy Meat Facts’ nutritional campaign to set the record straight and convince their customers that meat and poultry are actually good for one’s health and that they should increase rather than decrease their purchases of it. The campaign outlined below can have

Iron found found absorption.

2. Eat Being linked Dr. Charlotte California, Zinc is preserves

3. Boost Due to antibodies chronic

4. Power The protein Muscles building The protein growth

The flow wrapper is fed product from a ground meat line that includes a mincer, portioner, blade, and weigher, prior to being timed into wrapping material where the individual package is produced. With the Formost Fuji Ground Meat System, the paper or absorbent pad can be used under the ground meat while it is gently transferred to the conveyor and into the flow wrapper.

equal (the iron content) in a steak,” says Christopher Golden, an ecologist and epidemiologist at Harvard University in Cambridge, Massachusetts. (As quoted by nature.com in the article ‘Brain food- clever eating’.)

View our Formost Fuji page – button

Check out more of our integrated project solutions! Abbey integrated project solutions - button

For a woman to receive her recommended daily intake of 18 mg of iron, she would need just 300 grams of cooked bovine

5. Meat Meat contains body cannot isoleucine, threonine, protein.

6. Eat Meat contains production functioning Say ‘hello’ acid, vitamin The line only apply meat health Facts’ and poultry. education

Ronnie P. meat and

https://www.mmequip.com

17 meatbusinesspro.com December 2022 MEATBUSINESSPRO

22 CANADIAN MEAT BUSINESS September/October 2017

NEW CPC CHAIR OUTLINES KEY ISSUES

The Canadian Pork Council’s (CPC) Board of Directors has named a new board chair and a new vice-chair as part of the organization’s first steps into the New Year.

At a board meeting in Banff, Alberta, at the recent Banff Pork Forum, René Roy, a pork producer from Quebec, was elected as the new chair, and Scott Peters of Manitoba has been elected as the new first vice-chair. At the same time, Rick Bergmann, the organization’s longest-serving chair in its history, retired from the board after eight years as chair and a total of 15 years of service to the national organization.

board in 2008, such as the global pandemic, WTO challenges, CPTPP and NAFTA trade negotiations, so many other issues. He should be congratulated for his successes.”

For his part, Bergmann congratulated his successor and congratulated the board for the work it has been doing during his time.

“René Roy and Scott Peters will help lead the industry into the future, and I have faith in the board’s direction and in the organization’s ability to serve the best industry in Canada, the Canadian pork industry,” said Bergmann. “I am proud of my time as Chair of CPC. Nowhere have I met better people than the producers and staff involved with this organization.”

“I would like to thank my friend Rick for representing our 7,000 Canadian pork producers for the past eight years as Chair,” said Roy. “Being chair of this organization is important and rewarding work, and Rick has tirelessly taken time away from his farm, business, and family to advance national files on behalf of all producers.”

“By all measures, Rick has navigated our industry through several challenging issues since joining the

Canadian Pork Council’s newly elected executive team is already at work, with ongoing work on the plans related to the potential response and recovery plan for an ASF disaster in Canada, as well as the CPC’s effort to draft and implement a new strategic plan in 2023. Brent Moen, from Alberta, and Jack Dewit, from British Columbia, will continue to serve the industry as Second Vice-Chair and treasurer respectively.

ABOUT CPC

The Canadian Pork Council is the national voice for hog producers in Canada. A federation of nine provincial pork industry associations representing 7,000 farms, the organization plays a leadership role in achieving and maintaining a dynamic and prosperous Canadian pork sector.

18 MEATBUSINESSPRO December 2022 meatbusinesspro.com

https://www.cfib.ca

MEAT INDUSTRY HALL OF FAME CLASS OF 2022

By Fred Wilkinson, The National Provisioner

The members of the Meat Industry Hall of Fame’s Class of 2022 exemplify not just a depth and breadth of knowledge in meat science, product development, and food safety -- but also an ongoing commitment to sharing their knowledge for the betterment of the meat and poultry industry and, ultimately, for the health and eating enjoyment of the public.

Here are the six pillars of the industry as they have been inducted into the Meat Industry Hall of Fame.

Campano has fostered a new approach to food safety and food ingredients, with his leadership impacting not only the growth of Hawkins’ food ingredient business but the meat industry as a whole. His contributions include pioneering low-inclusion antimicrobial technology, and developing and securing regulatory approval for ingredients to enable clean-label meat and poultry products. His antimicrobial knowledge helped in the creation of a mold inhibition system for hay production, enabling improvement in hay quality with reduced spoilage.

2022’s Meat Industry Hall of Fame Supplier Inductee

Steve Campano, began his tenure in the meat industry by working at the U.S. Department of Agriculture’s Meat Science Research Laboratory in Beltsville, Md., before going on to work at a number of companies, including Viskase Corp. (formerly Union Carbide Corp. Film Packaging Division), Greenwood Packing Co., Central Soya Co., and Trumark. Inc. His current role is vice president at Hawkins Inc.

Dr. Gordon W. Davis has served the industry as a leader and educator to the meat science community through his work with students. Davis’ company, CEV Multimedia, has reached countless students, allowing them to learn about and, ultimately, find success in the meat industry.

Davis served as a meat science professor at theUniversity of Tennessee and at Texas Tech University,

20 MEATBUSINESSPRO December 2022 meatbusinesspro.com

STEVE CAMPANO

GORDON DAVIS

where he continues serving in an adjunct role. During his time as an academic meat scientist, Davis published journal articles, book chapters, technical articles, abstracts, and video productions. Meat judging was a particular passion for Davis, who co-founded the Cargill High Plains Meat Judging contest in 1981, which has hosted more than 4,500 collegiate students from 40 colleges and universities. He also hosted the first A Division Southeastern Meat Judging Contest at the University of Tennessee. While in academia, he advised and encouraged students to become interested in meat judging, graduate school, and careers in the industry. Among the students he guided through graduate school were Terry Rolan and Rody Hawkins, co-project managers for Oscar Mayer’s Lunchables production; Mark Miller, Tommy Wheeler, and 2019 Hall of Fame Inductee, Chris Calkins.

NEW SURREY SLAUGHTERHOUSE ‘WOULD OPEN DOOR’ TO NEW BEEF MARKETS

establishing Eickman’s Processing in Pecatonica in 1953. Now located in Seward, Ill., Eickman’s Processing now is run by Merlyn’s grandson, Tom Eickman, who took over the reins from his father, Mike, (Merlyn’s son) in 2020. The company provides custom processing services to farmers in Northern Illinois. In addition to award-winning cured products that the company sells at its own market, Eickman’s supplies fresh meat cuts to restaurants, producers, and distributors throughout Northern Illinois.

Tom Eickman credits his grandfather for laying the groundwork for Eickman’s current success, including his cure mixture. “I still refer to this as ‘grandpa’s cure,’ and it is the same cure that we have been working with as long as I have been here.” Tom says. “We still utilize the old smokehouses that grandpa had. He taught me to run them, and they keep putting out the same quality as they always have.”

Proposed 30,000-square-foot beef abattoir in Cloverdale would be B.C.’s largest such facility

“There’s a new building coming forward, a new abattoir, I think that’s the French pronunciation of slaughterhouse,” said Councillor Mike Starchuk. “So Surrey will have a newer facility with a better capacity so people will have the ability to not have to ship an animal to Alberta to have it processed. The applications have gone through the Agricultural and Food Sustainability Advisory Committee.” The facility is proposed on a 25-acre property within the Agricultural Land Reserve at 5175 184th St. The planned 30,000-square foot abattoir in Cloverdale would process up

According to a city report, that would make it larger than any other processing facility in B.C.. But it would still be small by industry standards, compared to the largest meat processing plants in Alberta that process 3,000 heads of

This year’s Small Processor Inductee Merlyn Eickman got his start in the meat industry working at plants in Rockford, Ill., and Pecatonica, Ill., eventually

21 meatbusinesspro.com December 2022 MEATBUSINESSPRO

A federally licensed beef processing facility is in the works

The proposed facility would be fully enclosed and designed

but it’ll be a big upgrade from the site currently.”

Continued on page 32 https://www.tcextrade.com

MERLYN EICKMAN

David McDonald currently serves as president and chief operating officer of OSI Group, a premier global food provider that operates nearly 60 facilities across 17 countries.

Dave began his career with OSI shortly after graduating from Iowa State University with a bachelor’s degree in Animal Science. In his 35 years with the company, Dave credits OSI’s family-like atmosphere and values-based culture as the foundational tenets of his professional development. Dave also cites the hard work of OSI’s impassioned team members as the catalyst to building the company into a respected, vital partner to the world’s leading foodservice and retail food brands. This recognition is a true result of the many exceptional teams with which he has worked.

Dave serves on the Board of Managers for OSI Group and many of its companies. He also served as the chairman of the American Meat Institute, the first chairman of the North American Meat Institute (NAMI), and is currently an active member of the Executive Board of NAMI.

Andrew Milkowski was born in Munich, Germany to parents displaced by World War II. His family soon immigrated to the U.S. and settled near Chicago, where he was raised. He received a bachelor’s of science degree chemistry at the University of Illinois, Champaign-Urbana, and a PhD in biochemistry from the University of Wisconsin-Madison.

Milkowski joined Oscar Mayer in Madison (now a division of Kraft-Heinz) as a research scientist initially working on by-products as raw materials for pharmaceuticals. At Oscar Mayer Foods, he led the Applied and Basic research programs. In 2006, he joined the Animal Sciences Department at University of Wisconsin-Madison as an adjunct professor and member of the Food Research Institute Executive Committee. He is a member of the American Meat Science Association and is a past member of AMSA’s board. Milkowski has provided his guidance to the North American Meat Institute as chairman of the Sodium Nitrite Advisory Committee, educating scientists and regulators about the safety of sodium nitrite as an essential ingredient in cured meat

Milkowski is a food safety expert in the processed meats industry, with his expertise and leadership in food safety research exemplified by efforts of Oscar Mayer to address Listeria monocytogenes in processed, ready-toeat meats. His efforts led to the effective use of lactate, diacetate, and other antimicrobials to prevent the growth of this pathogen while preserving food quality.

22 MEATBUSINESSPRO December 2022 meatbusinesspro.com

DAVID MCDONALD

ANDREW MILKOWSKI

has really impacted us negatively one way or the other. We’ve traveled a lot, met a lot of other farmers and livestock producers in other parts of Canada, and

was the first in Atlantic Canada to be

Yes, I think we were the first farm east of Ontario as far as I understand.

Chairman of the Board of Sugar Creek

associations wouldn’t have previously nominated anybody because there are many farms here on PEI doing every bit as much as we are as to attain a high level of sustainability. Anyway, we were very surprised when the PEI Cattleman’s Association nominated our farm.

CMB: And then you were attending the Canadian Beef conference in Calgary and you won.

Packing Co. John Richardson has more than 46 years of experience working in the meat industry as an innovative entrepreneur. As a teenager, he held various operations positions in his family’s business, manufacturing private-label bacon. After graduating from college, Richardson became a plant manager of a new facility and went on to take over the business after his father’s retirement.

DF: Yeah! That was a very nice moment for us. But I don’t like to use the word win actually. However, being recognized for our commitment was a real honour. If you want to know the truth, it was a pretty humbling experience. As I said to CBC when they phoned me after the conference, I was just floored, really couldn’t believe it.

CMB: So now that you have been recognized, do you think that will draw more attention and garner more nominations out of Atlantic Canada going forward?

Expansion plans under Richardson’s leadership focused on product and customer diversification. He remodeled plants and built new plants, including the 2016 Food Plant of the Year in Cambridge City, Ind. He made major investments in manufacturing technology and added several lines of ready-to-eat, fully cooked bacon, sausage, and other meat products, including sous vide proteins for the retail and foodservice. Sugar Creek’s diversified portfolio of products and customers has contributed to sales approaching $1 billion in annual revenue.

DF: Absolutely. We’ve gotten a lot of good press highlighting the island cattle industry. I’m positive you’ll see more farms in our neck of the woods nominated next year. And I have to give https://www.yesgroiup.ca

23 meatbusinesspro.com December 2022 MEATBUSINESSPRO September/October 2017 CANADIAN MEAT BUSINESS 17 meatbusiness.ca

JOHN RICHARDSON

Whatever critiques the meat industry is lobbing are the same ones plenty of consumers are figuring out for themselves. Like fat-free Snackwell's cookies or Lay's olestra-laden WOW Chips—or any other glut-withoutthe-guilt food trend that periodically cycles in and out of the zeitgeist—the incremental benefits are eventually offset by concerns over what else might be in there. Many meat eaters initially excited by fake meat, who didn't mind the not-quite-there taste or texture, eventually took a closer look at the ingredient list and couldn't figure out whether they were actually trading up. Were they eating these burgers to curb carbon emissions or lower their blood pressure? Was it a healthier alternative or a sodium-filled, overprocessed substitute? Plant meat still costs more than the real thing, and with inflation pushing up prices across the supermarket, many grocery shoppers have swapped the expensive imitation for chicken or, in some cases, beans and lentils.

Meatless meat, it turns out, seems less a worldchanging innovation than another food trend whose novelty is wearing thin. "Before we were seeing this incredible growth rate. But when you lose that momentum, you lose your certainty around how big plant-based meats can be," says Thomas George, portfolio manager at investment research company Grizzle, who in 2019 predicted plant-based meat could overtake 10% of the meat industry in 10 years if it could match meat's prices. "The opportunity for this category," he says now, "is more murky."

Before Beyond Meat unveiled the Beyond Burger, there was the Beast. When Ethan introduced the frozen patty in 2015, the company called it a "protein shake on a bun." Although he ended up ditching it, the Beast's health claims, such as high levels of protein and zero gluten or soy, remained front and center on Beyond Burger's packaging. (Whenever asked, Pat defended the health cred of Impossible's product against beef, though he preferred to talk about replacing animal agriculture by 2035.) But nothing preached the virtues of plantbased eating to the masses like The Game Changers, a James Cameron-produced documentary that hit Netflix in 2019.

The Game Changers followed world-class vegan athletes, with cameos by doctors, scientists and even Arnold Schwarzenegger, who, before he became mostly vegan, once told Sylvester Stallone that he "hit like a vegetarian." Veganism, according to the film, would make a person not only healthier but also stronger, with better endurance and even longer, harder erections.

Ethan added the film to his arsenal. "If you look at movies like Game Changers, etc.," he told Bloomberg Television in 2019, "you can affect even individual day performance, from a student-athlete, for example, through the consumption of our products over animal protein." He said Beyond's own athlete ambassadors, including NBA stars Kyrie Irving and Chris Paul—also investors in the startup—were "adopting our products in their training regimes, and they're seeing great results."

24 MEATBUSINESSPRO December 2022 meatbusinesspro.com

FAKE MEAT CONT'D

The Beyond Burger originally was sold in supermarkets, while Impossible went with celebrity chefs such as David Chang. By the end of 2019, Carl's Jr., Dunkin' and White Castle were all selling some Beyond or Impossible product or other—and Burger King had launched the Impossible Whopper nationwide. The food giants didn't want to get left behind either. Tyson had shown an interest in buying Beyond, according to former Beyond board member Greg Bohlen. When that didn't pan out, the meat company announced plans for its own plant-based "billiondollar brand." (Tyson declined to comment.) Nestlé SA introduced an Awesome Burger, and Conagra Brands Inc.'s CEO said it would create "the next generation of beefless burger."

Still, that criticism hadn't yet made its way to people such as Michelle Darby, a mother stuck at home with four kids, in Marlton, New Jersey, during the early days of the pandemic. She found The Game Changers on Netflix. "It gave a very compelling argument," she says. "And I'm on the borderline of high cholesterol."

Darby, like many others in lockdown, started buying faux meats. The real thing was scarce, and people had extra cash to try out this buzzy new product. Americans bought 5.3 million units of fresh-meat alternatives in the eight weeks ended April 25, 2020—three times the amount from a year earlier, according to Nielsen Holdings Ltd. Suddenly, Beyond's prediction in one of its investor pitch decks that fake meat was on track to become the new fake milk was looking increasingly plausible: Just as the alt-milk companies could claim to be 13% the size of the $16.1 billion dairy milk category with new products such as oat milk, alt-meat would similarly undercut the even bigger $270 billion US meat industry. ("That's the floor," Ethan said at a 2019 Barclays Plc conference.)

As Darby stocked up, she noticed that she and her family were gobbling up the chickenless nuggets at a much faster pace and that the imitation hot dogs left her feeling uncomfortable. At a checkup with her doctor she mentioned the diet changes they'd made—the fake chicken nuggets, the Impossible sausage sandwich at Starbucks—and their disappointment with the lack of results. The doctor had a simple explanation: "You are eating processed foods."

At first, fake burgers and sausages seemed like a potential solution to Americans' obsession with red and processed meats, which have been linked to cancer and other chronic diseases. But over the years, skepticism about their healthfulness grew. Within months of Beyond's IPO, onetime fan and whole-foods maven Mark Bittman criticized the fake meat products for their "hyperprocessing." Chipotle Mexican Grill Inc.'s CEO said they didn't fit with the fast-casual chain's "food with integrity" mantra. Even John Mackey, co-founder of Whole Foods Market Inc.—the grocer that had been instrumental in introducing the category—went on the record calling plant-based meat "super, highly processed foods." (The Center for Consumer Freedom, a front group that represents tobacco, alcohol and meat companies, ran a Super Bowl ad in February 2020 attacking fake meat's ingredients with a mock spelling bee that repeated long-held health advice: "If you can't spell it or pronounce it, maybe you shouldn't be eating it.")

Darby went home and looked at the packaging, taking particular notice of the salt content. "It should have been obvious to me the whole time," she says. She stopped buying plant-based meats, except for an occasional purchase of Impossible ground beef. Meanwhile, she's doing what a lot of consumers are: going back to meat. "If they [her family] want hamburgers, we'll occasionally buy ground meat or we'll make ground chicken, and they don't notice the difference," she says.

25 meatbusinesspro.com December 2022 MEATBUSINESSPRO

In 2020 half of Americans thought faux meats were healthy; now 38% think so, a recent report from Citi Global Insights shows. Dr. David Katz, founding director of Yale University's Prevention Research Center, who appears in The Game Changers, says the Beyond Burger and its ilk are "ultraprocessed"—made from processed ingredients such as pea protein, potato starch and potassium chloride. When comparing them with fast-food burgers, he cites the environmental and animal welfare advantages but says that any health benefits are still unclear. "At worst," he says, "it's a lateral move." A Beyond Meat spokesperson told Bloomberg Businessweek that there are "wellaccepted health benefits of plant-based meat" and directed Businessweek to two health professionals: Stanford's Christopher Gardner, who's received funding from Beyond Meat, conducted a small study that pointed to improvements in weight and cholesterol. He says the health benefits he identified, however, have yet to be replicated. "You can't answer a question with only one study," Gardner says. And Dr. Michael Greger, author of How Not to Die, says that fake meat is a better choice than a fast-food burger, but that doesn't make it good for you. "Nobody should be under the illusion that these are health foods," he says.

Nowhere is this more obvious than when you discover that a key ingredient in Beyond Meat has its origins in Dippin' Dots, the tiny "beads" of ice cream frozen with liquid nitrogen, available in flavors including banana split and cotton candy. Beyond started working with Dippin' Dots LLC in 2019. The Dots business was sold in June 2022, but Beyond still works with Scott Fischer, its former CEO, through his company, Cryogenic Processors LLC. Beyond buys fats such as expellerpressed canola oil and refined coconut oil, which Fischer processes into "little pellets or cryogenically frozen balls of fats," he says. Cryogenic Processors sends the fatty balls back to Beyond to mix with water, rice protein, cocoa butter, methylcellulose and more than a dozen other ingredients found in the Beyond Burger.

The white globules are meant to give the burgers a meaty juiciness, but plant-based fats can also emit an off-putting smell when some of these products are cooked, says Tom Mastrobuoni, who led the second Tyson investment in Beyond and is now chief investment officer at the food-tech-focused Big Idea Ventures LLC. Commenters online have compared the odor of Beyond's raw plant meat to that of cat food, and one message board poster said he had to ventilate his kitchen to clear the air after cooking it. "If any other food smelled that way, I would throw it out," says Jeremy Sklarsky, a former Beyond customer who tried the products out of health and environmental concerns before going back to beef.

In September, Beyond Meat Chief Operating Officer Doug Ramsey was arrested in Arkansas for allegedly biting someone's nose in an altercation after a college football game. Ramsey, a former Tyson executive, was one of the meat industry vets Ethan had wooed in 2021 to help Beyond expand. By mid-October, Ramsey, along with the company's chief financial officer, chief growth officer and chief supply chain officer, was gone.

26 MEATBUSINESSPRO December 2022 meatbusinesspro.com

The love affair between Beyond and the fast-food giants has faded, too. Dunkin'—once the company's biggestname partner—pulled the faux sausages in its breakfast sandwiches from almost all the menus nationally in 2021. Beyond's delayed chicken tenders rollout had no big-name chains in sight. Taco Bell tested Beyond's carne asada, but last month its CEO told Axios the reviews were "mixed" and a national rollout isn't likely coming anytime soon. Meanwhile, photos and documents from Beyond's plant in Pennsylvania— where both the KFC nuggets and Pizza Hut pepperoni were partially manufactured—revealed that listeria and foreign materials such as wood and string had been showing up in products made there as late as May 2022. (A spokesperson for Beyond Meat said at the time that the company's food-safety protocols "go above and beyond industry and regulatory standards.") Yum! Brands Inc., which owns Taco Bell, KFC and Pizza Hut, didn't respond to requests for comment.

Beyond also trialed its burger at about 600 US locations with McDonald's, its most important customer, with little to show for it. For a brief moment in April it looked like the McPlant meatless burger would stay for good. Fast Company misreported that the McPlant would become a permanent menu item, sending Beyond's stock price up as much as 34%—until McDonald's disputed the news, causing shares to fall just as quickly. In July a JPMorgan Chase & Co. analyst said he'd checked with 25 Mickey D's: None were offering the McPlant anymore. "Not surprisingly, the reason sometimes being cited is that the product did not sell well enough," he said. Then came the nosebiting fiasco. "Negative PR around a senior member of management with key MCD relationships likely hurts whatever slim chances may have remained," Piper Sandler Cos.' Michael Lavery wrote in a note.

McDonald's still sells the McPlant internationally, but it hasn't confirmed results of the US test or future plans.

When Beyond hired the world's biggest influencer, Kim Kardashian, it managed to flub that, too. In the spring of 2022 the company announced its splashy new "chief taste consultant." But it quickly led to viral mockery when online sleuths noticed she didn't seem to actually be eating the Beyond Burger in a commercial. (Kardashian later released footage from the set showing she had, in fact, swallowed the food.)

Impossible, meanwhile, is discovering that upending animal agriculture is difficult. Burger King has added another Impossible Burger to its mix, but after trying the company's faux chicken nuggets, a chicken sandwich and sausage patties, it didn't put any in its regular lineup. FAT Brands Inc. restaurants are selling a steady million Impossible Burgers a year—which is good, but not as good as beef, whose sales are climbing. At Bareburger, also an Impossible early adopter, the burger's sales went from "astronomical" to about 6% of all burgers and sandwiches in 2021 to 4% in 2022, says Euripides Pelekanos, the chain's CEO. "The fanfare has definitely subsided," he says. The price of the burger—more than that of the beef, elk and black bean versions—doesn't help.

Pat Brown's replacement at Impossible, McGuinness, an ad industry veteran who left yogurt maker Chobani last year, says he has new growth plans for the Redwood City, California-based startup. "I don't want to talk about the category declining—it doesn't exist," he says, even though Impossible has been trying to lead it for the better part of the past decade.

27 meatbusinesspro.com December 2022 MEATBUSINESSPRO

This time, though, McGuinness's plan is to "operate like a food company." Instead of predicting the end of the meat industry, the new CEO talks about reaching carnivores by boosting total distribution points, doubling consumer awareness and bundling promotions for his faux chicken nuggets with faux pork products, so shoppers who like one will try the other. Just like a yogurt shelf grabs customer attention with variety, so, too, will Impossible products. In October he laid off 6% of the staff as part of a broader restructuring, telling employees the company was focused on its "R&D and innovation pipeline." Pricing, which has already come down, could match beef as early as the end of the year, he says, as his costs continue to improve with increased efficiency. Then there's the burger's nutritional profile. "The cake for us is to make a delicious product," McGuinness says. "The icing—it's better for you, better for the planet."

The 2022 Expo felt a lot more like a regular old trade show. There were no signs of Beyond, unless it was from an exhibitor answering a question to differentiate itself from the onetime star. Booth after booth showcased products such as Shark Tank-backed faux deli slices and textured soy protein "jerky," but few were good enough to go back for seconds, many more so unpalatable that this meat-eschewing Bloomberg reporter spit them out. By far the best-tasting food at the event was in the Italian Pavilion, where chefs served cheeseless vegetable pizzas and pasta puttanesca sans the anchovies—no imitation animal protein to be found. Asked what he was doing at the fake meat show, Italian chef and restaurateur Fabrizio Facchini was taken aback. "We also have a lot of plant-based," he said, relying on the literal meaning of the phrase more than on the marketing term. "We don't use cheese on everything."

Three and a half years ago, New York's Javits Center hosted the first Plant Based World Expo. Amid hawkers of seitan corned beef, pea-and-tomato-based chorizo and mold-based dog treats, the real excitement was Beyond. Fresh off its IPO, the company's executive chair was a keynote speaker. "I wish I had invested in them," Andy Levitt, founder of vegan meal-kit startup Purple Carrot, said at the time. When Levitt started his company in 2014, vegans were the "tattooed girl with Birkenstocks in Vermont," he said. Beyond's products had catapulted an entire generation of startups, becoming the "gateway drug to plant-based foods."

When industry watchers were still figuring out whether plant-based meat might pull an alt-milk-size disruption, many missed two key differences: lactose-intolerant consumers and milk's primary use as an ingredient, not a main course. Many soy, almond and oat milk drinkers add it to their coffee because real milk simply isn't an option. But they're mostly not drinking it by the glass. Even predictions of a sales rebound for plant-based meat are dwarfed by what's happening in dairy. Bloomberg Intelligence's Jennifer Bartashus wrote in November that in the second half of 2023, "we expect plant-based dairy sales to rise 6-8% and meat alternatives 1-2%."

Beyond Meat's current market capitalization is about $1 billion—down from its peak of more than $14 billion. Bringing costs down is the company's priority as it pledges to finally become cash-flow positive in the second half of this year and tries to keep up its dwindling cash reserves. In the company's November earnings call, Ethan Brown talked up another limited-time offer with Panda Express Inc. and the company's 2022 food award from People magazine.

28 MEATBUSINESSPRO December 2022 meatbusinesspro.com

The analysts, though, peppered him with questions about high inventory levels and why Beyond was making only ingredients instead of prepared meals. Brown blamed inflation and shifting consumer tastes as blips in his long-term mission. "I am certain that as we hit price parity with that, as the products become indistinguishable, as the climate situation worsens, as people get a clear sense of what the real health benefits are," he said, "this conversion will happen."

The big food companies have cooled on the category, too. Tyson scrapped its plant-ish burger—a half-beef, half-pea-protein concoction that was supposed to launch its future "billion-dollar brand." Products from Kellogg's Morningstar Farms, Conagra Brands' Gardein and Nestlé's Sweet Earth are all still selling, some well, but none are breakout hits.

What remains looks more like a niche category than a meaningful displacement of an entrenched industry. After Beyond, Impossible and their copycats spent years trying to seduce everyone away from meat, it appears their best customers are, well, the 5% of the population who didn't eat meat in the first place. Kevin Lindgren, director of merchandising at food distributor Baldor Specialty Foods Inc. in New York, says more restaurants are ordering plant-based burgers simply to make sure they have something to serve vegetarians "that's not a salad or cauliflower." Alt-burgers' continued expansion into restaurants is largely being propped up by establishments protecting themselves against this "veto vote"—the lone nonmeat eater in a group of diners who can thwart a destination decision if there's not a suitable meatless entrée. "It's frozen, throw it in the freezer," Lindgren says, summarizing restaurants' enthusiasm. But even that's not a sure shot. Plenty of vegetarians would prefer a veggie burger made of actual vegetables, and definitely not one that "bleeds."

Impossible is now venturing beyond the coasts, where many have already moved on from fake meat, hoping to jump-start interest in the rest of the country. (Lindgren says he recently spotted an Impossible Burger on a menu in a South Dakota sports bar.) But when Impossible sausage was added to the menus of more than 600 Cracker Barrels last summer, the company quickly got a taste of this new customer base. "YOU CAN TAKE MY PORK SAUSAGE WHEN YOU PRY IT FROM MY COLD, DEAD HANDS," one of the thousands of angry commenters wrote when the Southern country-themed chain posted the new offering on Facebook.

Meanwhile, a new meat alternative has found its way into the next hype cycle: cellular meat. Grown in giant tanks from cells harvested from living animals, labgrown beef, chicken and fish are theoretically better for the environment than the real thing and should taste as good. Startups in this space have raked in $2.6 billion in funding from investors including, once again, Bill Gates and Leonardo DiCaprio. The category will have to overcome even bigger hurdles than plant-based meat, from the massive amount of energy required to make the products to exorbitant costs. But for boosters, its potential is already limitless. "This," Whole Foods co-founder Mackey said after investing in cellular startup Upside Foods Inc., "could change the world."

https://www.tbsnews.net/bloomberg-special/fakemeat-was-supposed-save-world-it-became-justanother-fad-571714

29 meatbusinesspro.com December 2022 MEATBUSINESSPRO

CELEBRATING WOMEN IN AGRICULTURE

On February 15th, we celebrate Canada’s National Agriculture Day and come together as a nation to appreciate those who work tirelessly to put fresh food on the table for every Canadian. Now with March quickly approaching bringing with it International Women’s Day on March 8, what better than to also designate time to celebrate the thousands of Canadian women who work in agriculture!

Our Canadian agriculture sector, like many other countries around the world, typically has always been and still is a male-dominated industry. To put it into perspective, a recent 2021 census by Statistics Canada (StatsCan) shows that out of 262,450 farm operators, 182,655 were male and only 79,795 were female – in other words, there are over two times as many male farm operators to female farm operators.

programs. While three-quarters of agricultural managers are male, only one-quarter are women. Similarly, the ratio of male Agricultural business owners to female owners are 7:3, and the ratio of male national and provincial ag-association chairs and presidents to female chairs and presidents are 9:1 (both respectively).

As an underrepresented group in the sector, women agri-business owners and workers continuously face challenges.

For instance, according to the Canadian Agricultural Human Resource Council (CAHRC), women in agriculture are regularly underrepresented at the leadership level despite the fact that more women have participated in post-secondary education and leadership

zzzAccording to the same study, the leading barriers that prevent women from reaching new heights include factors such as balancing career and family and the lack of role models. Longstanding issues that have often been a factor in dissuading women from dipping their feet into the vibrant sector. Fortunately, in recent times, there have been great supports from organizations that advocate for women in agriculture. For example, in Manitoba, the Manitoba Women in Agriculture & Food (MWAF) is an organization that champions the voices of women in the sector, facilitate training workshops and provide business resources for its members. Women are invaluable resources for agriculture. They always have been and always will be.

30 MEATBUSINESSPRO December 2022 meatbusinesspro.com

On top of managing their families and doing miscellaneous work to keep the business flowing - such as bookkeeping and childcare - women bring a special perspective to the sector, challenging traditional bounds of what we may think of and define as agriculture.

According to an article in 2021 written by Bob Tosh (Family Business Advisor for MNP), many of the women in the field are said to show more likeliness in exploring farm-based side businesses such as bed and breakfasts and retail shops, adding value to farms by increasing its product versatility and clientele.

Trends in economic styles also differ for male and female farmers. For instance, female farm operators who work other jobs off the farm is increasing at a faster rate compared to the male farm operators. StatsCan reported that in 2020, 38,610 Canadian female operators worked off the farm – a 10 per cent increase from 2015, compared to a 1 per cent increase for male operators. A large chunk of this off-farm work is due to full-time employment; in 2020, 28 per cent of female farm operators who worked off the farm had a full-time job.

Furthermore, according to StatsCan data, many women farm operators are increasingly using sustainable energy sources and/or technology for the betterment of the environment. In 2021, the number of female operators working on farms that reported renewable energy production totaled 10,340 (out of a total number of 22,576 of farms that reported renewable energy production) – more than doubling since 2015. The same research outlines, from 2015 to 2020 there was a 45 per cent increase of female farm operators who worked on farms with automated guidance steering systems. Numbers showcasing their wide range of skills and expertise.

The future is bright for women in agriculture as more are entering the field. For instance, StatsCan recently released a report in November 2022 showing that the number female farm operator increased for the first time in 30 years while the total overall number saw a decrease (from 271,935 in 2016 to 262,450 in 2021). As previously mentioned, in 2021, there were 79,795 Canadian female farm operators – up from 77,970 female operators in 2016. This positive net increase is not just important in the number of women agribusiness owners, but also for the sector itself that has seen a continual loss in the number of small farms for many years.

31 meatbusinesspro.com December 2022 MEATBUSINESSPRO

Aiding in the movement of recruiting more women into the sphere is a growing number of support programs becoming available for women. For example, mentorships for women are becoming increasingly accessible. Internationally, the Women in Food & Agriculture (WFA) has a Mentorship Program open to women in the agriculture sector, from hands-on farmers to client-savvy CEOs of agri-businesses, to female agricultural scientists, at no cost. The Ag Women’s Network in Ontario also has a mentorship program, open to all women and men who are involved in the agriculture industry in Ontario, over the age of 18.

The Canadian Federation of Independent Business (CFIB) partnered up with Scotiabank on several occasions as well in effort to support our women in the field. Women-led agri-businesses were provided opportunities to attend a webinar on HR information (still available to watch on Scotiabank’s YouTube under the title HR for Agriculture | Recruitment and Performance Management Best Practices with CFIB), and there were segments with different sessions for different regions offering CFIB’s business tools. The webinar was open to both CFIB members and nonmembers in which all attendees received perks such as CFIB’s letter of offer template and an HR A to Z document. In November 2021, CFIB was invited to speak at Scotiabank’s Advancing Women in Agriculture Conference which allowed table talks, networking and breakout sessions. All great initiatives allowing businesswomen in the agriculture sphere to help advance themselves and one another.

When it comes to agriculture support, Scotiabank gets it. For over 185 years they've been providing financial services to Canadian farms and agri-businesses. They understand the ups and downs of agriculture and are committed to the future of our customers and businesses. Continuously improving their services for the needs of the sector, Scotiabank also offers an incredible support program for women called the Scotiabank Women Initiative™ that supports women in agriculture with networking events and expertise in succession planning, managing farm risk and more, thanks to their specialists and departments dedicated to the agriculture and the small business sectors.

The agriculture sector is becoming incredibly diverse and has graciously shown acceptance of vast changes – displaying the adaptive and strong character of the industry. We only hope that the support for all individuals in the field continues to evolve for an even more blooming sector.

Not a member? JOIN CFIB today for more help and information.

SeoRhin Yoo is a Policy Analyst for the Canadian Federation of Independent Business (CFIB). CFIB is Canada’s largest association of small and medium-sized businesses with 95,000 members (6,000 agri-business members) across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings. Learn more at cfib.ca.

32 MEATBUSINESSPRO December 2022 meatbusinesspro.com

TOM KITTLE RETIRES, PATRICK MCGADY TO HEAD HANDTMANN USA

Harald Suchanka, CEO Handtmann Filling & Portioning Systems (F&P), recently announced the retirement of Tom Kittle effective March 31, 2023 and the appointment of Patrick McGady as President of Handtmann Inc as of April 1, 2023.

“Under the leadership of Tom Kittle, Handtmann Inc has grown to become an integral part of our global success over the past 14.5 years, while its role as a key player in the food processing industry of North America was further strengthened. I wish to extend my heartfelt gratitude to Tom for his outstanding achievements and best wishes for a well-deserved retirement,” comments Suchanka. “Patrick has been working closely with Tom to build on our Handtmann performance culture that is so important to the success of our customers. He possesses deep market knowledge, respected senior management skills, and a clear strategic vision for the continued growth and success of Handtmann, Inc.”

McGady is a senior sales and marketing professional with extensive experience in inside and field sales, sales management, corporate management and international marketing gained during his more than 18 years with Handtmann. In his previous role as Vice President of Sales and Marketing, McGady saw the expansion of Handtmann from meat specialist to a more diverse range of processing sectors, including bakery, pet food, alternative proteins, and dairy. He has managed the company’s growth in sales and initiated the successful development of marketing and communications segmentation strategies.

“Patrick’s appointment concludes an extensive selection process. He understands our corporate values, has driven our vision, and brings bold leadership skills that make him the perfect senior executive to succeed Tom

and grow our global Handtmann business in the U.S.,” emphasizes Suchanka.

As a family business in which the 5th Handtmann generation has recently taken over the company management, it is important for us to offer opportunities for development to our top performers. The USA is a key market for Handtmann, and the goals for the future are ambitious. The appointment of Patrick also ensures continuity in the extremely successful business development of Handtmann, Inc.

“I am honored to now lead this company,” says McGady. “We are a group of innovative professionals with industry leading technologies and a powerful commitment to growth and the success of our customers. I will work together with our Handtmann team, our partners, and our customers to achieve even greater successes.”

COMPANY OVERVIEW

Handtmann F&P is a leading global capital equipment provider of grinding, mixing, emulsifying, portioning, depositing, forming, hanging, filling, extruding and co-extruding technologies to the food processing industry. Advanced Handtmann technologies and full line solutions are known for their reliability, accuracy and operational ease. Handtmann, Inc. is the wholly owned sales and service subsidiary of the Handtmann Group of Companies serving the United States with headquarters in Lake Forest, IL.

The global Handtmann Group is a family-owned business established in 1873 and headquartered in Biberach, Germany. Besides the Food Processing division with 1,400 employees, Handtmann Group divisions include Light Metal Casting (automotive industry), Plant Engineering (brewhouse, filling and filtration), Plastics Technology (LAURAMID® structural components) and System Technology (intelligent systems for the mobility of tomorrow). www.handtmann.com/food

33 meatbusinesspro.com December 2022 MEATBUSINESSPRO

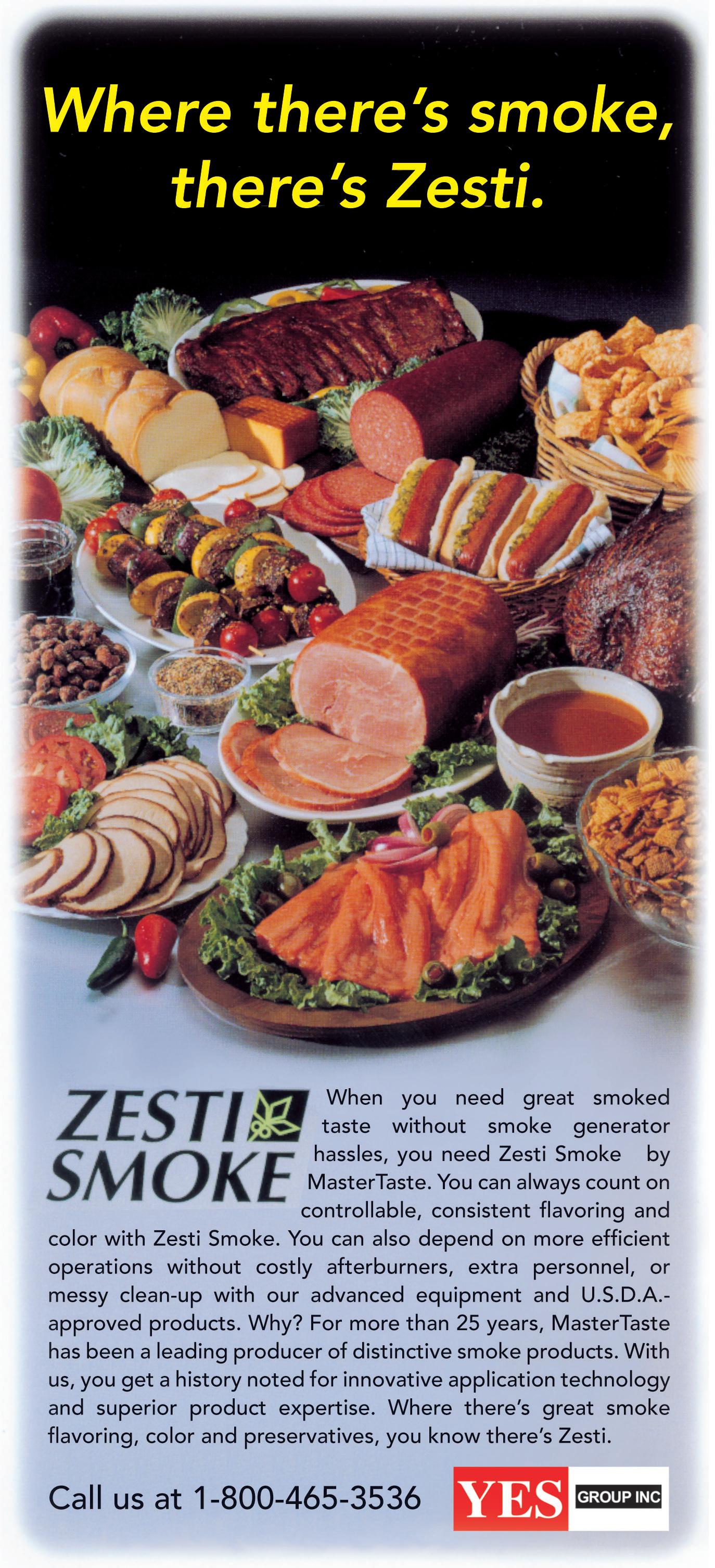

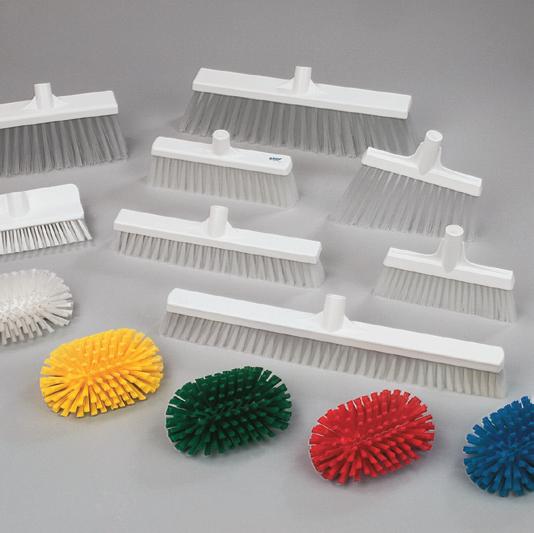

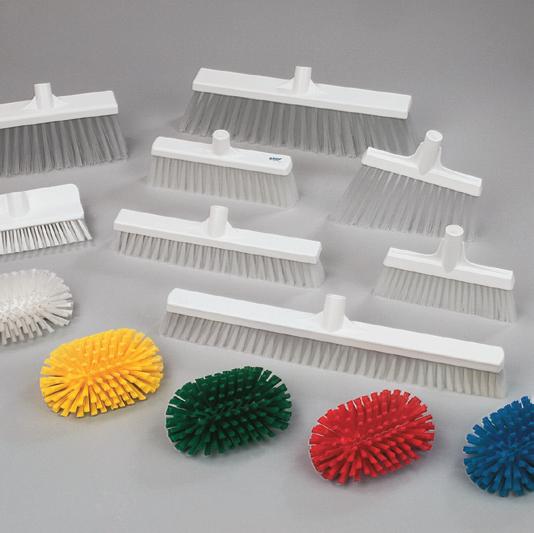

Remco and The Yes Group Protecting

Remco products are colour-coded to help divide the production cycle into different zones. By identifying these zones as different cleaning areas, the movement of bacteria around the production area can be blocked.

Our products were developed with the Hazard Analysis Critical Control Point (HACCP) in mind.

No matter what colour-coding plan is implemented, Remco Products from The Yes Group provides significant added value at no additional cost. From scoops to squeegees, from brushes to shovels, we have the products and the colours to enhance any professional quality assurance program.

34 MEATBUSINESSPRO December 2022 meatbusinesspro.com meatbusinesspro.com 31 September/October 2018

201

1,

L3R

1-800-465-3536 Fax:

Website:

Don Park Road Unit

Markham, Ontario,

1C2 Phone: 905-470-1135

905-470-8417

www.yesgroup.ca email: sales@yesgroup.ca

your Customers https://www.yesgroup.ca