You have made an excellent choice!

When you work with us, you are partnering with a true consultant, not just a salesperson.

Our goal is to provide expert advice and guidance to help you make the best decisions for you and your family. We are dedicated to supporting you through every step of the process. We will thoroughly review the current market conditions, whether it’s a buyer’s market or a seller’s market, to ensure you are making informed decisions in securing your home.

Whether you are interested in a pre-existing home, a new home, or a for sale by owner property, we are here to assist you with all your real estate needs.

We look forward to helping you find the perfect home for you and your family!

FICO scores are based on specific credit history, with hundreds of inputs used to find your score. Here are the five main parts of your credit score.

TIPS TO IMPROVE: Make payments on time, all the time - even items in dispute. Pay the bill and worry about refunds later.

TIPS TO IMPROVE: Don’t close out “old” credit cards, and don’t lower your available credit limits. Having access to credit is good.

CREDIT HISTORY LENGTH: 15% OF

TIPS TO IMPROVE: Don’t close out cards with “history”. You need them to show your experience with credit. Don’t close out “old”, no-fee cards when you are done with them. Instead, use them periodically and pay balances in full. This builds credit history and credit length.

TIPS TO IMPROVE: When you shop for a mortgage, multiple credit checks can count as a single credit inquire, protecting your credit score.

TIPS TO IMPROVE: Don’t carry an abundance of store charge cards. Interest rates are high and FICO model looks unfavorable upon them.

Carrying a $500 balance on a credit card with a $500 limit is bad for your FICO because your “maxed out”. Conversely, carrying $500 on a card with a $5000 limit is good. Keep your balance rations under 30% for best results.

Many retail stores offers discounts for opening up a store account. The discounts are tempting, ranging up to 25% off your purchase price. If you ’ re buying a house sometime soon, you may save more money by passing on the store offer.

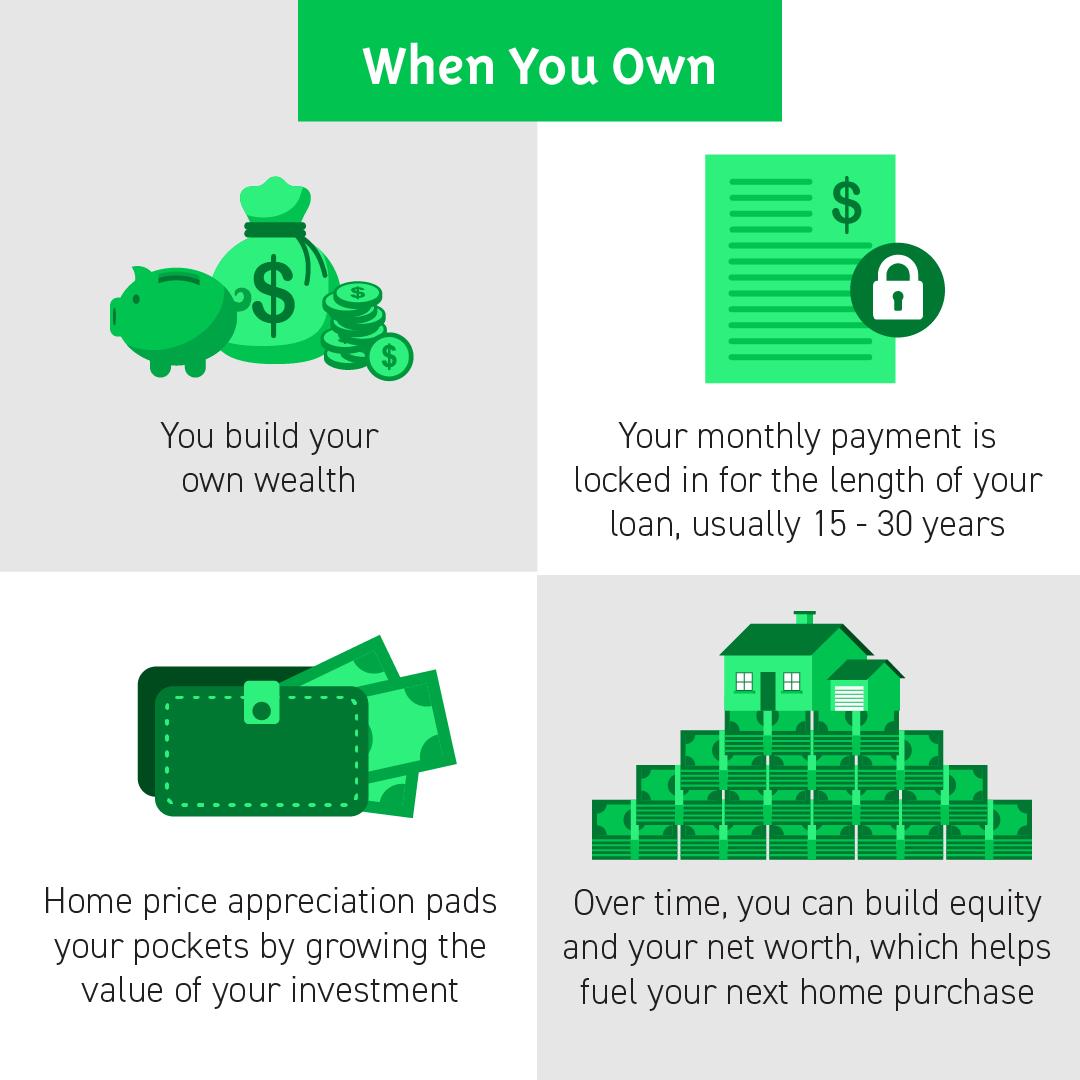

Not sure if you should buy a home? The rent you pay could build equity in your own real estate. Do you realize how much you pay in rent over a period of years?

No interest payment deductions

Rental amount may increase at any time

Landlord approval needed for any changes

No capitalization; your money disappears forever

Rental is temporary and is often subject to 30 day’s notice

Excellent deductions for your mortgage interest paid

Mortgage payments could be fixed

Decorate and make changes, without approval needed

The value of your property will probably increase in time

Your house will become a home, not a temporary living situation; you are not at the mercy of the landlord

A home inspection gives you more detailed information to help you make a wise decision. In a home inspection, a qualified inspector takes an in-depth, unbiased look at your potential new home to:

Evaluate the physical condition: structure, construction, and mechanical systems

Identify items that impact the habitability of the home that will need to be repaired or replaced

Estimate the remaining useful life of major systems, equipment, structure, and finishes

A home inspection gives you an impartial, physical evaluation of the overall condition of the home and items that need to be repaired or replaced. The inspection gives you a detailed report on the condition of the structural components, exterior, roofing, plumbing, electrical, heating, insulation and ventilation, air conditioning, and interiors. If you have asked for an inspection to be done on your new home, you’ll need to pay the inspector at the time of inspection, usually in the range of $400-$500 (the cost is based on the size of the home)

It is your responsibility to be an informed buyer. Be sure that what you buy is satisfactory in every aspect. You have the right to carefully examine your potential new home with a qualified home inspector. You may arrange to do so before signing your contract, or may do so after signing the contract as long as your contract states that the sale of the home depends on the inspection.

The average list price to sales price ratio is % in our overall market.

Listing inventory is % from this same time last year.

When inventory is demand goes .

_________

% of my clients choose Buyer Agency.

All commissions are negotiable!

All brokers have access to the same ___________ .

We work with Builders and have excellent relationships to help get you get the very best pricing.

Open House Guest Pass!

The average Buyer looks at _____ homes before finding the right one.

The most important key to finding the right home quickly is your______________ .

Go through the entire contract so that you find the right home you can __________ and ensure that we get the home you want.

This is a standard form that is approved but the Real Estate Commission.

Earnest money amount will be about of the total offer price.

This is a deposit made with the offer and taken to Title.

Inspection is for items only.

We have a list of inspectors that past clients have been very happy with.

Inspections are paid at the time of the inspection.