Prepared for Raleigh's Triangle Area and all markets we serve.

Dear Friends and Neighbors,

As we release our 2024 Q3 Market Report for Charlotte and all the markets we serve across North Carolina, we want to take a moment to recognize Hurricane Helene's impact on Western North Carolina (WNC) In times like these, we are reminded of the strength and resilience that defines our mountains region. At ERA Live Moore, we are committed to serving your real estate needs and standing with our WNC neighbors in times of challenge.

Our recent fundraiser on Amazon has transitioned to focus on cold-weather essentials providing warm clothing, blankets, and other critical items as we prepare for the cooler months ahead We invite you to join us in supporting this effort at: https://bit ly/WNCSupplyDrive or consider contributing to other local organizations dedicated to helping those affected by the storm. Visit us on ERA Live Moore social media to keep up with the latest news and information around Hurricane Helene recovery efforts.

Our major markets remain active and resilient as we shift toward a more balanced landscape Across most areas, inventory levels have increased, giving buyers more options and leverage, while sellers are adjusting to a more competitive environment Despite a moderation in price growth, economic strength driven by key industries like finance, education, and healthcare continues to attract new residents and sustain demand in areas such as Raleigh, Charlotte, and Winston Salem. With new listings contributing to longer sales cycles, both buyers and sellers must adapt their strategies to make the most of current opportunities

Overall, the market reflects stability and potential as it responds to changing dynamics. As we move through the fourth quarter, we anticipate these trends to continue. For a more in-depth analysis and personalized advice, please reach out. We’re here to help you navigate the evolving real estate market and make informed decisions.

Our commitment is to go beyond expectations, providing unparalleled support to both buyers and sellers in fulfilling their real estate ambitions.

Our professional REALTORS® are always available to guide you through the entire process and address any questions you may have. Your success is our top priority!

Eb Moore, President & CEO ERA Live

Moore Real Estate &

Our

Family of Companies.

“Charlotte's real estate market remains active and resilient as it shifts toward a more balanced landscape.”

- Eb Moore

The third quarter of 2024 for the Raleigh, Durham, and the broader Triangle Region reflected continued market momentum despite some fluctuations. In Raleigh, home values reached record highs, with the average sales price of $598,587, an increase of 16.2% compared to 2023 figures, but still demonstrating an overall upward trend. New listings continued to flow into the market, contributing to an increase in available inventory and signaling a positive development on the supply side.

Throughout Durham, the market presented a solid performance, with many indicators showing modest growth. Closed sales increased, bucking the trend seen in the Triangle Region which is down more than 3.8%. Despite these fluctuations, the Triangle Region remains competitive, with rising sales prices and growing inventory, indicating underlying solid demand.

The third quarter in these regions highlight a balancing act between increasing property values and the availability of homes for sale. Buyers are still actively engaging with the market, although affordability remains a consideration. As prices continue their upward trend and inventories rise, the Triangle Region offers opportunities and challenges for prospective homeowners.

Raleigh’s real estate market continues its forward momentum, with sales prices at record highs Home values have been rising marginally, pushing the Average Sales Price of Raleigh homes to $598,587, which is up 16 2% on 2023 results for the same period, indicating an upward trend in pricing This marks another month in Raleigh with increased monthly sales and a rise in inventory of available homes for sale

The Median Sales Price in September 2024 for a single family home in Raleigh was $445,000 for a year over year increase of 6.8%

As of October 2024 the Average Month's Rent in Raleigh for a 2 bedroom was $1,603

Raleigh Occupied Housing Units

51% of homes are owner-occupied households and 49% are renter-occupied households

The Median Sales Price in September 2024 for a single family home in the Entire Triangle Region was $416,623 for a year over year increase of 0.03%

Triangle Area real estate markets remain active, with Durham and Wake County areas showing particular demand. That's positive news for sellers, for now. For buyers, reduced inventory will add more balance to this highly competitive market. Sellers will be happy to see Average Sales Prices decreased slightly in September by more than 1.1% on 2023's figures and Days on Market dropped -35.7%!

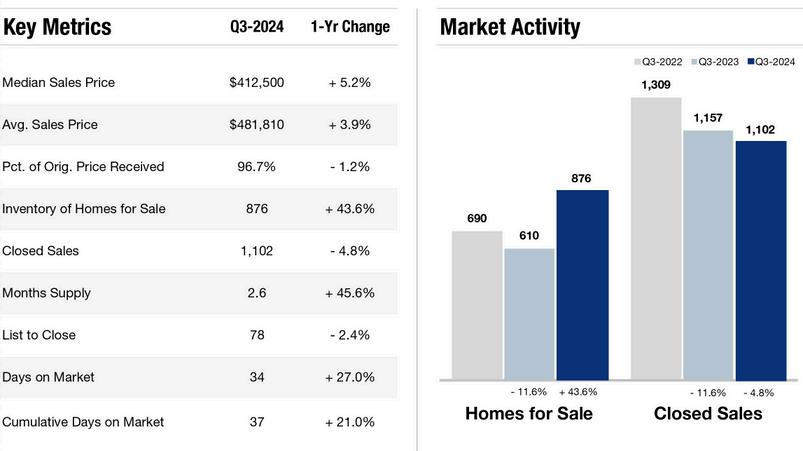

In the third quarter of 2024, the Charlotte region's real estate market maintained steady growth, with modest increases in both median and average sales prices. Inventory levels continued to rise, while a virtually unchanged closed sales signaled a possible cooling trend across the region, setting a baseline for other local markets. This shift suggests a continued stabilization of our market following several years of rapid growth.

Mecklenburg County, which includes the city of Charlotte, reflected these broader regional trends but with some distinct features. The county recorded consistent yearover-year increases in both median and average sales prices, along with surging inventory. Closed sales declined in Q3. Notably, Mecklenburg County—once known for its relative affordability—now boasts a higher average sales price than the overall Charlotte region, highlighting evolving market dynamics.

The past quarter once again illustrates a transition towards a more balanced market for the Charlotte area, characterized by rising prices and expanding inventory but fewer transactions. This environment indicates that buyers and sellers are adapting to a “new normal”, marked by less urgent activity and more sustainable price growth.

Median and Average Sales Price saw an increase, along with Inventory, while Closed Sales continue to stay level This activity defined much of the Charlotte Region and established a baseline for our other markets

The Median Sales Price in Q3 2024 for a single family home in Charlotte was $398,495 for a year over year increase of 3.5%

As of October 2024 the Average Month's Rent in Charlotte for a 2 bedroom was $1,885

Charlotte Occupied Housing Units 53% of homes are owner-occupied households and 47% are renter-occupied households

The Median Sales Price in Q3 2024 for a single family home in Mecklenburg County was $445,000 for a year over year increase of 4.2%

Charlotte's home county shows an increase in Median and Average Sales Price year-on-year, with a sizable increase in inventory and a slight reduction in Closed Sales that closely tracks Charlotte. The county, once a respite for buyers seeking affordability, now has a higher Average Sales Price than the Charlotte Region.

Cabarrus County is one of Charlotte's largest neighboring counties and home to the county seat of Concord and the pretty towns of Mt. Pleasant, Midland, & Kannapolis. Union County features the charming and in-demand town of Waxhaw–growing in both popularity and Increasing in Average Sales Price

The major metro area surrounding Charlotte includes seven different counties, each with its distinctive towns, cities, and townships. Charlotte’s surrounding counties provide greater inventory at various price points with something for everyonefrom charming rural communities to vibrant market towns and commercial areas

In Q3 of 2024, the Median Sales Price in Winston-Salem, NC was $287,500K, trending down year-over-year by -2.9%. This laid-back city poised for continued growth is located in Forsyth County in the north-central part of North Carolina. The metro area lies along the Carolina Core in the heart of North Carolina, a 120+ mile stretch running between Winston-Salem, Fayetteville, Greensboro, & High Point. The Triad's continued big draw? Affordability!

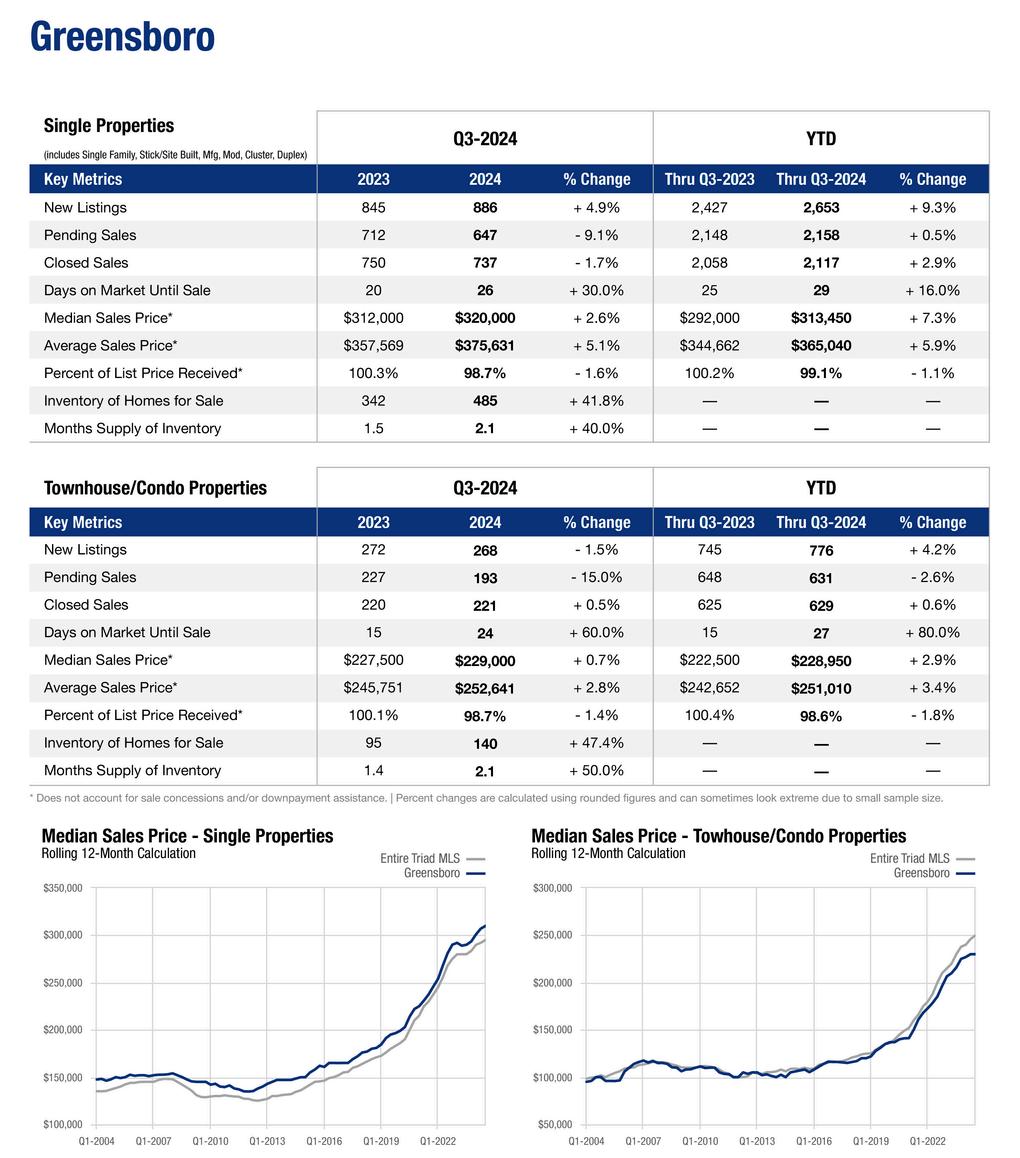

U.S. News and World Reports ranked Greensboro #94 in the nation for Best Places to Live and #71 in Best Places to Retire. Part of the Piedmont Triad, with a low cost of living and a Q3 2024 Median Sales Price of $320,000, it's one of North Carolina's more affordable metro areas. Inventory in Greensboro has been on the rise, with an increase in new listings of 4.9% year-overyear.

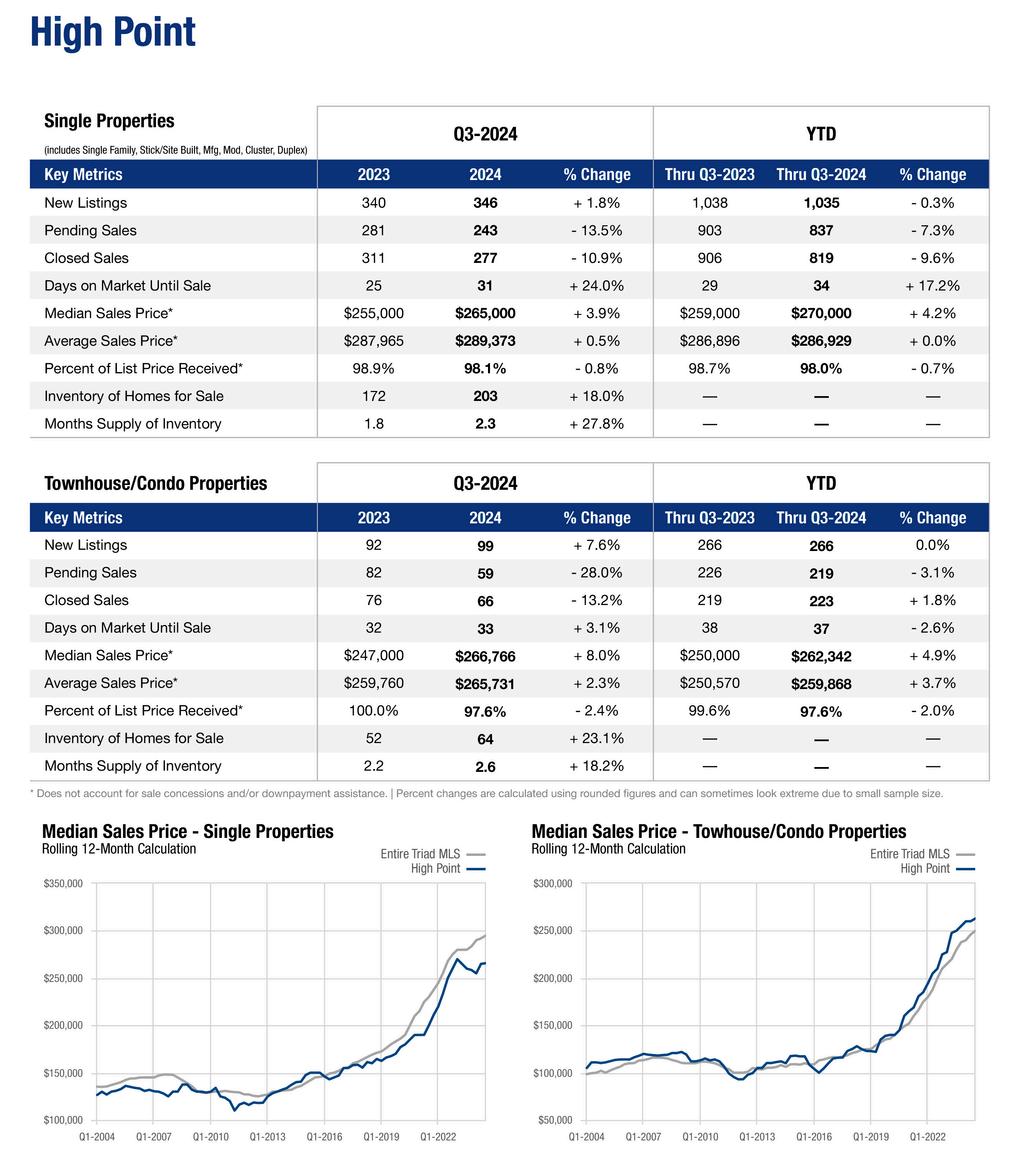

High Point is located alongside Greensboro and Winston-Salem in the Piedmont Triad region of North Carolina, the nation’s 33rd largest metro area with a population exceeding 1 7 million Home of High Point University and the famous annual High Point Market, the world's largest home furnishings trade show High Point offers outstanding value for homebuyers, while sellers can expect to receive 98 1% of List Price

Wilkes County is widely known for its county seat, Wilkesboro, and its largest town, North Wilkesboro The area is widely known for MerleFest, an annual "traditional plus" music festival held in Wilkesboro each spring. Wilkesboro home-buyers enjoy a relatively low sales price compared to larger metro areas in North Carolina and an increase in the number of homes available for buyers seeking value and proximity to Winston Salem

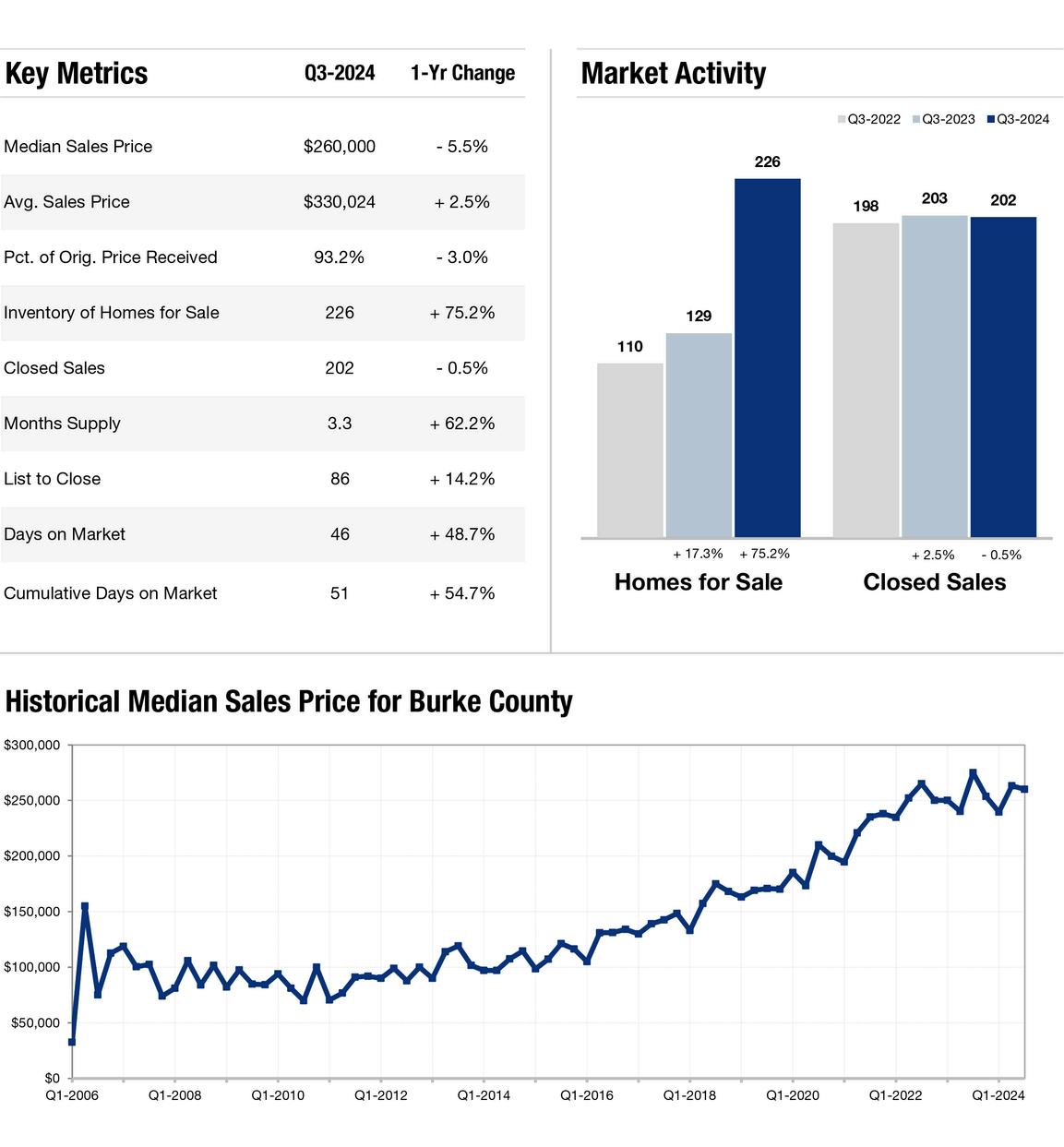

In Q3 2024, McDowell County continues to showcase its natural beauty and outdoor attractions. Quaint shops line the streets from the market town of Marion to the charming country town of Old Fort. The region is now focused on recovery efforts following the impact of Hurricane Helene, which disrupted local communities and businesses. Despite these challenges, McDowell and neighboring Burke Counties remain among the most affordable housing markets in the state, second only to Wilkes County, offering opportunities for both residents and investors as recovery progresses

Burke County, nestled in the foothills of North Carolina's Blue Ridge Mountains, continues to draw visitors with its scenic attractions, including Linville Gorge, the Fonta Flora State Trail, and portions of the Pisgah National Forest. The attractive market town of Morganton offers a blend of laid-back living and small-town charm. The county is navigating the recovery process in the aftermath of Hurricane Helene, which disrupted local life and tourism. Burke County's housing market continues to attract families and professionals, providing stability and a sense of community in this picturesque region

Asheville continues to see Average and Median Sales Price increases, while Month's Supply rose a considerable 34% Not surprisingly, Asheville’s Closed Sales have dropped more than 8 4% on Q3 2023 figures Expect prices to stabilize through a recovery-focused Q4 and Days on the Market to increase

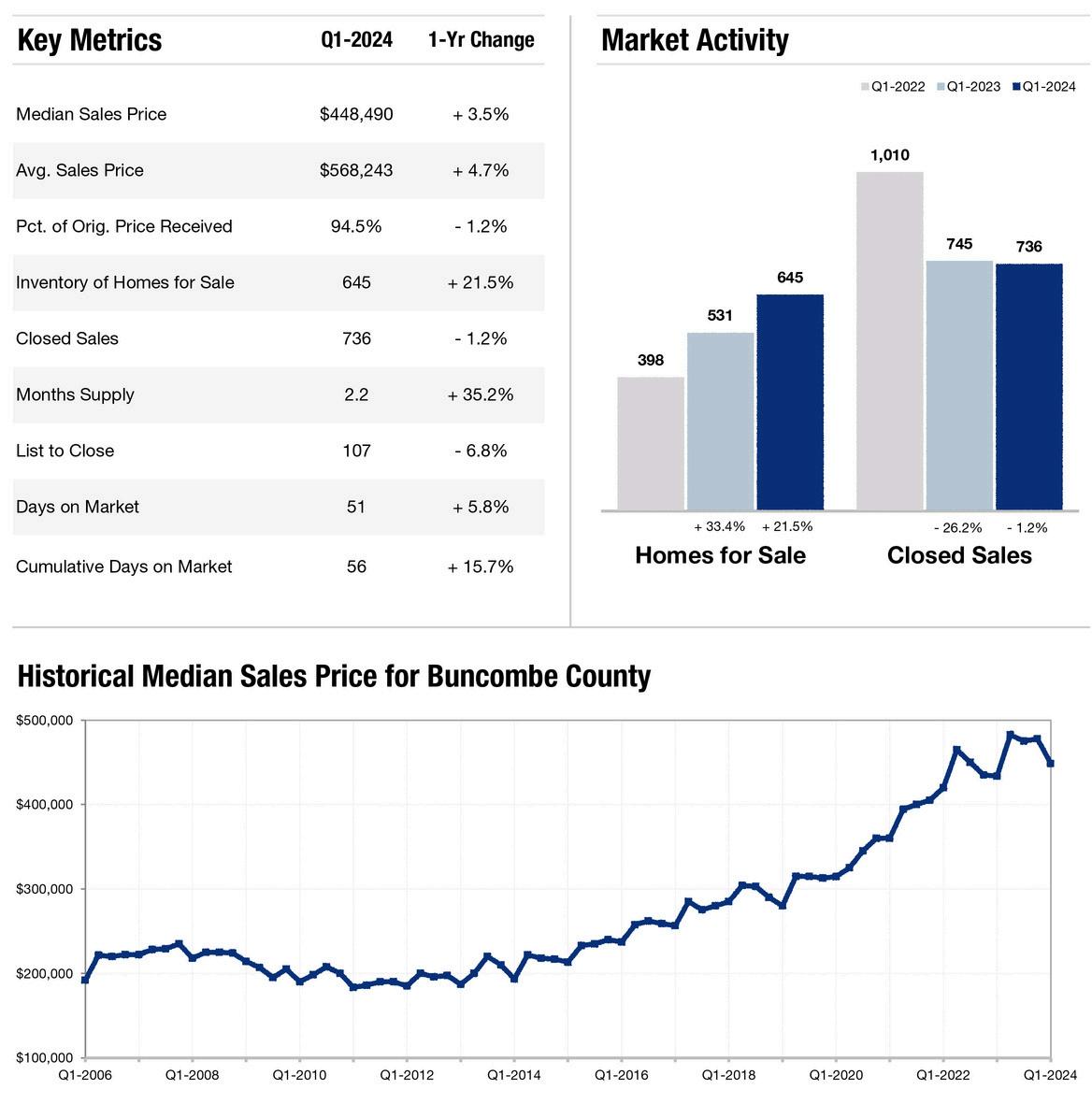

In the pastoral setting of Buncombe County, Asheville's home county, the Q3 Average Sales Price for homes was up 8% year-on-year. On average, homes in Buncombe County are on the market for 45 days. While Buncombe County offers a considerable selection and opportunities for first-time buyers, its new developments and luxury communities have put upward pressure on home prices, often outpacing Asheville.