23 minute read

Confectionery

Making life sweeter

After more than a year of the pandemic, which has stifled growth in the confectionery market, Kevin Whitlock considers the state of play as lockdown eases and looks ahead.

There’s nothing like a small indulgent treat to lift the spirits, and there’s no treat which offers as much for as little money as confectionery, be it sugar or chocolate-based. Given how convenience stores, independents and symbols have seen sales move upwards during the past 13 months, it would be natural to assume that confectionery, as an affordable treat, would likewise prosper.

However – and although no definitive figures are yet available – there is plenty of anecdotal evidence to indicate that confectionery sales haven’t prospered in lockdown as much as one might expect. This is primarily due to the decline of shopping on the go, thanks to the cessation of commuting and travel more generally.

With this decline of shopping on the go, there is a need for suppliers to differentiate, innovate and excite consumers–and market their products to stimulate growth as lockdown eases and consumers start to move around more freely. It’s worth remembering that confectionery remains the top impulse purchase in the independent and convenience channels.

Figures from Valeo Confectionery show that during lockdown, shoppers have been shopping less frequently (-0.7%) and buying more packs of confectionery per trip (+3.4%). Prior to the first lockdown last March, the category saw strong growth, due to wider ‘stockpiling’ missions. But the category then experienced significant sales decline and never truly caught up to 2019 levels.

“Different formats and types of sweets have been affected very differently,” says Russell Tanner, marketing & category director. “Aside from the impact of the first lockdown, sharing bags of sweets have seen continued growth. This is driven primarily by gums and chews, popular with the whole family and purchased by shoppers as mood boosters.” Levi Boorer, customer development director at Ferrero, believes there is an opportunity to be had in the crisis: “Having had to remain away from loved ones during the pandemic, we are seeing shoppers wanting to treat their family and friends more than ever. Wholesalers should therefore stock affordable luxuries, meaning retailers can make these occasions even more special for their shoppers,” he says.

“Confectionery is one of the few categories where retailers are willing to spend money on the products that shoppers love, in order to cater for demand for treating. While the recent lockdown has added a degree of uncertainty to how people might celebrate, retailers will still be looking for highquality products to stock. We know retailers turn to the brands they know and love during times of uncertainty.”

Swizzels is the largest British-owned sugar confectionery manufacturer in the UK and has enjoyed good growth in these difficult times. Mark Walker, sales director, says that keeping the innovation and NPD pipeline flowing will be crucial over the coming months, as will keeping ‘much loved’ brands top of mind via strong marketing initiatives.

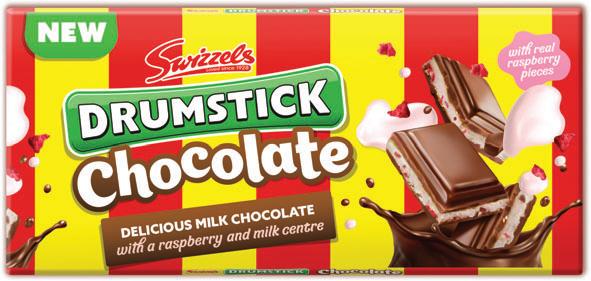

‘‘Sugar confectionery continues to perform well over the course of the pandemic as shoppers seek out treats from well-known brands to cheer themselves up,” he says. Swizzels’ NPD includes Drumstick Chocolate Bar. This new concept for Swizzels sees the flavour of the Drumstick Lolly, which has been a firm consumer favourite for more than 60 years, encased in milk chocolate.

The chocolate bar has a raspberry and milk fondant centre and real raspberry pieces, bringing Drumstick into the chocolate category – currently in growth, with chocolate blocks up 21% (IRI). Available to depots now in the standard pack format, there will also be a wholesale-exclusive PMP introduced later this year.

Walker adds that hanging bag (100-199g) sales have seen growth of 6% over the past year and now account for 54% of total sugar confectionery sales (IRI), indicating that consumers are choosing to engage with these products most during lockdown: “We expect this to continue this year, so these are also a must stock for cash & carries.”

Swizzels’ newest addition to its hanging bag range is Great British Puds, invented by an avid Swizzels fan who won the chance to have her own sweet brought to life through the company’s 90th anniversary competition. Great British Puds includes individually-wrapped chew bars in four nostalgic British dessert flavours – Sticky Toffee Pudding, Rhubarb Crumble, Apple Pie & Custard and Lemon Meringue.

Five key trends for 2021

1.Sharing: Within traditional confectionery, sharing has continued to grow in the market by 0.3% (IRI). This increase is due to individually-wrapped and portionable sizes, which are two purchase drivers that grew exponentially last year. People seeking new ways to enjoy their evenings indoors, especially during key occasions like Easter or Halloween, are also likely to look to their favourite treats or snacks for familiar comforts at home. 2.Flavour: Teenage and young adult shoppers like their refreshment novel and indulgent, which means that combining flavours such as mint or exotic fruit with chocolate is likely to be a hit. 3.Better for you: The ‘better for you’ confectionery market is worth £28.5 million and is growing (IRI), especially reduced-sugar, sugar-free, and gelatine-free products. ‘Vitamin rich‘ confectionery is a trend that may take off this year. 4.Premiumisation: With sharing on the increase, and virtually every night being a ‘big night in’, there is a trend towards choosing more indulgent and ‘treaty’ selections, with the boxed chocolate segment seeing growth. 5.Brands, brands, brands: “In uncertain times consumers look for reassurance and brands they know and love,” says Susan Nash, trade communications manager at Mondelez International. “Consumers can trust in category-leading brands to deliver on familiarity and taste.”

Also benefiting from the trends for nostalgia and sharing, says Walker, is Swizzels’ Variety range, which contains a selection of individually-wrapped sweets and lollies in different hanging bag varieties “with something for everyone, making them the ideal product for sharing occasions”. There will be a new on-pack offer for the Variety range – available in £1 PMP and 40% extra free formats –to engage consumers over the summer months.

Also from Swizzels are Drumstick and Refreshers Choos, which have been redeveloped to satisfy growing consumer demand for softer sugar confectionery products. What’s more, “the recipe was purposefully developed to ensure it is suitable for vegans, a trend that has continued to grow across confectionery,” says Walker.

The successful Squashies hanging bag brand will be at the forefront of Swizzels’ summer marketing activity, with consumer competitions supported by digital and PR activity.

Over at Mars Wrigley UK, sales vice president Nick Reade comments: “Despite a turbulent 2020 for all, we remain undeterred and are looking forward to rolling out a host of exciting NPD and brand campaigns, set to shake up the market in 2021. “Last December, and in celebration of its 60th year on our shelves, we heralded a new era for the Galaxy brand by announcing an exciting bold packaging redesign, alongside the launch of two new NPDs – Galaxy Orange Block and Fusions. Staying on-trend is key to increasing relevancy and recruiting the next generation of consumers for years to come.”

This year, the company is supporting Galaxy’s redesign with a campaign incorporating TV, digital, social and influencer activity.

Mars Wrigley kicked off 2021 with the launch of 100kcal bars into the UK market. As a means of catering to the 25% of shoppers who say that calorie labelling impacts their purchase decisions (Kantar), the company has introduced new 100kcal (or less) versions across its top three most popular singles bars – Mars, Snickers and Twix.

The company is also accelerating its sustainable packaging programme, starting with the reduction of packaging for some of its most popular brands. From this month selected ‘Standard’ and ‘More to Share’ sharing pouches across brands such as M&M’s, Galaxy Counters, Minstrels, Revels, Maltesers, Buttons, Skittles and Starburst will be narrower in the UK and Ireland, reducing the plastic used by around 647,000 square metres a year – equivalent to over 90 football pitches.

In the gum category, Mars Wrigley recently launched ‘Get Your Ding Back’, a multimedia campaign for Extra created to drive chewing gum consumption in home –with in-store activations coming soon. Christine Cruz-Clarke, marketing portfolio director, says: “The campaign aims to drive category growth within mints & gum by sharing humorous insight on when and why consumers chew gum. The first piece of content focuses on home dating as it’s a passion point for Next Gen, the biggest age group of chewers.”

She continues: “As consumer behaviour evolves, new shoppers and new purchase occasions are emerging in the gum category; these include morning routine, chewing alone, work/study, leisure at home and freshening moments.”

Mars Wrigley is also launching Extra Refreshers in a new bottle format and flavour –Tropical –to capitalise on the popularity of tropical flavour profiles with younger consumers. Nearly 50% of gum consumption comes from ‘Gen Zers’ (those aged about 19 to 24), especially fruity gum which over-indexes with under 25-year-olds and is 51% incremental to the category (Kantar).

Extra Refreshers bottle (rsp £2.19) is available in three flavours: Peppermint, Spearmint and new Tropical, which also comes in a single pack of seven pieces at 59p rsp.

The launch of the Extra Refreshers bottle and Tropical flavour will be supported by in-store and multimedia campaigns featuring in-store displays and PoS, as well as comprehensive consumer online activation. Additionally, prefilled counter-top units will be available via wholesalers.

Sasha Storey, senior brand manager of Extra, says: “Consumer habits evolve constantly, and format can play a key role in these changes. Whilst individual packs remain essential lines for stores of all sizes, the larger bottle format is set to be one of the bestselling formats of the year. Gum bottle will be driving the growth in 2021 with 1.7% projected growth, so we recommend it is stocked alongside core single packs for maximum sales success. Flavours are also set to grow, especially as we head into summer.”

Perfetti van Melle (PvM) has launched two new Pure Fresh gum products in its Mentos range: a Bubblefresh bottle (rsp £2.25) and a Cherry roll (rsp 65p). The new variants build on the 101% growth of the range following its launch last year (IRI). Fruit-flavoured gum currently has a 20% share of the chewing gum market, says PvM, and the merging of fruit flavours with traditional, functional gum occasions increases category penetration and is generating incremental sales, says product manager Kim McMahon.

The launches will be supported by a £2.1 million abovethe-line ‘Yes to Fresh’ campaign, which includes in-store, digital, video on demand and out-of-home advertising.

McMahon says: “There are 30 million gum chewers in the UK, but we have seen a decline in frequency, driven by consumer changes in habits due to reduction in travelling and commuting. That’s why we’re investing in the category, to ensure the products are front of mind to ultimately encourage more sales at till point – we want the nation to ‘Say Yes to Fresh’.

“With the wider gum market mainly focusing on two reasons to chew gum – fresh breath and clean teeth – the Mentos Pure Fresh fruit offering opens up more occasions to consumers, such as for enjoyment, as a snack, or to satisfy a sweet craving.”

Two big names at Valeo Confectionery are to have a makeover in 2021: this month sees the roll-out of a rebrand for Fox’s Glacier, capitalising on the brand’s 100 years of heritage and 91% brand recognition to create a new proposition that heroes the iconic Fox’s polar bear and creates shelf standout to drive trial from new audiences. This is supported with an abovethe-line campaign and more NPD later in the year. In the chocolate category, which accounts for 75% of confectionery sales in value (Nielsen), Valeo’s Poppets brand has seen 29% value growth, primarily driven by sharing bags as consumers have treated themselves at home during periods of lockdown.

Ambitious growth plans for UK

Kervan Gida is a family-owned business with 25 years’ experience and €100 million global sales. Owner of the sugar confectionery brands Bebeto and Dexters, the company has grown to become Turkey’s largest soft candy producer and exporter, with offices in the UK, the USA, Germany and Russia.

Established in 2015, the UK office now distributes Bebeto and Dexters to over 12,000 retailers across the UK.

Managing director Stuart Johnston says that the company has ambitious growth plans for this country: “Our UK business has grown by 25% over the past year. In 2021 we have the same ambition to deliver healthy sales that exceed our forecasts. We’ve grown to sit among the market leaders in the UK wholesale sector. This year we will focus on broadening our product range and our distribution channels.

“We are an ambitious company by nature, so we have big plans to grow and expand over Stuart Johnson: ‘UK business has grown by the coming years. Although we 25% over the past year.’ will continue to innovate and release new products, we have some excellent existing products in our portfolio and our objective over the coming year will be to invest in brand awareness.”

UK brand marketing manager Gabriella Egleton adds: “We began the year by reintroducing our consumers to our range of vegan laces and soft candy pencils, which consists of 13 SKUs in total, all of which have been certified vegan-approved by the Vegetarian Society.

“The vegan market is expected to rise to £1.1 billion by 2023, so it’s important for retailers to ensure they have an inclusive confectionery range that is accessible to a wide audience. Like all our products, our vegan range is also 100% Halal certified.

“We’re also delighted to announce the release of our new 150g gummy range. This includes Fizzy Watermelons, Strawberries, Big Mix and Big Fizzy Mix, available in both pricemarked and nonprice-marked packs.” Kervan Gida has plenty of marketing activation planned for Bebeto this year. It is revamping its online presence by focusing on its website and social media. “We know that consumer engagement and feedback is invaluable, and we have big plans to interact through competitions and engaging content,” says Egleton.

Poppets is getting a new look and a Salted Caramel variant to tap into consumer demand for that on-trend flavour. Later in the year, wholesalers should look out for NPD from Fruit Salad and Wham.

Other NPD in confectionery comes from Mondelez International, which has just launched Cadbury Dairy Milk Caramel bar in a 60p PMP.

Nielsen research shows that PMPs offer a number of advantages for shoppers and retailers, and therefore are an important part of a store’s offering, generating a perception of improved value, convenience and trust from their shoppers. The research also found that Cadbury Dairy Milk singles PMP packs achieve a better unit rate of sale than the non-price-marked packs.

Mondelez has also announced a packaging refresh for the Green & Black’s Organic tablets range, designed to capture the attention of shoppers looking to trade up within the category. The new visual identity, which has already started to appear in depots, reinforces the brand’s commitment to ethically sourced cocoa and high quality chocolate. By celebrating these core attributes of the Green & Black’s brand, the new design marks “a return to its roots, with a nod to its heritage and values”. The packaging refresh for five Green & Black’s Dark bars will be registered with The Vegan Society (70% Dark, 85% Dark, Ginger, Maya Gold, and Hazelnut & Currant).

Storck UK has added new Mint Fondants to the Bendicks range. Available in an 180g box (rsp £4.11), the new line combines soft peppermint fondant with 50% dark chocolate. Bendicks hopes that the launch will tap into the growing trend for indulgent options as more shoppers buy into darker chocolate.

Rebecca Robert, marketing director at Storck UK, says: “Having monitored consumer behaviour, we see an increased demand for dark chocolate, dairy-free and vegan options, as well as indulgent flavours and softer textures.

“Bendicks Mint Fondants use the highest quality ingredients, and are Kosher Pareve, gluten-free and vegan, so certainly deliver against these consumer desires. We’re confident that the new pack will be enjoyed by our existing Bendicks customers, but will also encourage new shoppers to buy into the finest, quintessentially English after-dinner mints.

“Stocking products that balance health and indulgence claims offers the greatest potential to drive value. The new Mint Fondants provide retailers with an opportunity to offer their customers great flavour and texture combinations as well as catering to shoppers looking for allergen-free chocolate treats.”

Same taste, much less waste: Nestlé redesigns sharing bags

In recognition of the nation’s growing awareness of environmental issues, Nestlé in the UK and Ireland has redesigned its confectionery sharing bags to use “significantly less” packaging – a move that will see at least 83 tonnes of virgin plastic taken out of its supply chain every year, the company claims.

From this month, favourite brands, including Milkybar, Aero Bubbles, Munchies, Rolo, Yorkie, and Rowntree’s Randoms will come in narrower pouches. Nestlé sells approximately 140 million confectionery sharing bags in the UK and Ireland every year; this change will save almost one million square metres of packaging – equivalent in area to 131 football pitches.

Cheryl Allen, head of sustainability at Nestlé Confectionery, told Cash & Carry Management: “We are working hard to reduce our use of virgin plastic by onethird by 2025. Removing 15% of the packaging from our sharing bags is an important step towards this goal. The move will not only save on the amount of virgin plastic we use each year, it will also have significant benefits throughout our supply chain in the UK and Ireland.

“For example, we can now pack more sharing bags at a time, which means that fewer lorries are needed to transport them. In total, we will be able to take the equivalent of 331 lorries off UK roads every year, saving 71,472 road miles and 130 tonnes of CO2 emissions.”

Alongside reducing the amount of packaging used, Nestlé plans to make it easier to recycle plastic wrappers which are not currently collected at kerbside. Its partnership with TerraCycle3 gives consumers the ability to recycle confectionery wrappers now, while changes in technology and infrastructure are being worked on.

Flexible plastic packaging can be dropped off at around 300 TerraCycle recycling points across the UK and Ireland. The waste is sent to a specialist recycler, where it is turned into plastic pellets that can be used to manufacture new products such as outdoor furniture and storage boxes, meaning that wrappers recycled this way will not end up in landfill or as litter in the environment.

Further initiatives that Nestlé is undertaking as it works to make all its packaging recyclable or reusable by 2025 include making all Smarties packaging paper-based. This will remove approximately 250 million plastic packs sold worldwide every year.

Also catering to vegans, Nestlé recently announced the launch of a vegan KitKat. Arriving in the UK this year, KitKat V features chocolate blended with plant-based ingredients to balance the brand’s trademark crisp wafer. Louise Barrett, head of the Nestlé Confectionery product technology centre in York, says: “Taste was a priority when developing the plant-based chocolate for our new vegan KitKat. We used our expertise in ingredients, together with a test and learn approach, to create a delicious vegan choice for KitKat fans.” Alex Gonnella, marketing director at Nestlé Confectionery, adds: “We have seen an incredible response to our veganfriendly Fruit Pastilles since their launch last year, so we know how much people want to enjoy alternative versions of their favourite treats.”

KitKat V is certified vegan by the Vegan Society and is made from 100% sustainable cocoa, sourced through the Nestlé Cocoa Plan in conjunction with the Rainforest Alliance.

Walker’s Nonsuch has, unlike many confectionery companies, always specialised in making one thing – in this case, toffee. Using traditional methods and working to the motto of founder Edward Joseph, “to make quality toffee at affordable prices”, the Walker’s Nonsuch range includes toffee bars, bags, slabs and gifts.

Innovation and inspiration

Leading confectionery wholesaler Hancocks has expanded its offering with several new lines.

Bonds Just Desserts Berry Mess Mix Shaker Cup and Chocky Road Mix Shaker Cup take their inspiration from the chocolate treat rocky road and the dessert Eton mess.

In addition, the PEZ portfolio has been extended with several new character dispensers, including Luigi in the Best of Nintendo selection, Black Panther in the Marvel Avengers range, and Miles Morales in the Spiderman selection.

Hancocks has also added 10 new lines to its pick & mix range. These are Kingsway Sugared Multi 3D Hearts and Yellow Belly Snakes, and seven Makulaku liquorice sweets, each of which comes in a 2kg bag.

The company’s latest launch is Arabica Coffee Toffees. Made with coffee beans roasted in the UK, real Arabica cold brew coffee is added to Walker’s toffee during the final stage of the cooking process along with a natural coffee flavour. The cold brew coffee has hints of both milk chocolate and cocoa which “blend blissfully well, creating the perfect satisfying chew”. “With coffee consumption at an alltime high, our Coffee Toffees seemed a natural and exciting development to bring to our current range, as we look to attract younger consumers to the global toffee market,” says Jonathan Rae, production manager and grandson of the late Ian Walker, former chairman of the business.

Arabica Coffee Toffees are available in 150g bags and 2.5kg bulk bags and, like all Walker’s Nonsuch products, are vegetarian-friendly and free from artificial colours, preservatives, hydrogenated vegetable oils and gluten. CCM

For further information:

Ferrero UK 020-8869 4000 Kervan Gida (01243) 530550 Mars Wrigley UK (01753) 550055 Mondelez International (01214) 582000 Nestlé Confectionery 020-8686 3333 Perfetti van Melle (01753) 442100 Storck UK (01256) 340300 Swizzels (01663) 744144 Valeo Confectionery (01977) 692500 Walker’s Nonsuch (01782) 321525

It’s the little It’s the little things that make life sweeter

The next few years are set to be pivotal for Kervan Gida. The vision is to drive Bebeto to become one of the top fi ve sugar confectionery brands worldwide by 2023.

Kervan Gida is a family-owned business with 25 years’ experience in the confectionery manufacturing sector. Owner of sugar confectionery brands Bebeto and Dexters, the company has grown to become Turkey’s largest soft candy producer and exporter, with offi ces in the UK, the USA, Germany and Russia.

Having achieved year-on-year growth since it was established in 2015, the UK offi ce now distributes the Bebeto and Dexters brands to more than 12,000 retailers across the UK. It has established itself as one of the leading suppliers of sweets across the country and has ambitious plans to maintain this position. We’ve taken our best-selling shapes and fl avours and we’ve mixed, matched and repackaged them in a bigger bag format.

Kervan Gida’s UK Brand Marketing Manager, Gabriella Egleton, commented: “Bebeto is all about the little things that make life sweeter. Packed full of fun fl avours and tempting tastes, our range includes laces, soft candy pencils, gummies, marshmallows and bubble gum lines.”

Managing Director, Stuart Johnston, says: “The UK offi ce has a pivotal role to play in the expected growth of Kervan Gida. Our UK business has grown by 25% over the past year, and Kervan Gida has reach sales of over €100m worldwide.”

“In 2021, we have the same ambition to deliver healthy sales that exceed our forecasts. We’ve grown to sit among the market leaders in the UK wholesale sector. This year we will focus on broadening our product range and our distribution channels.”

“We’re confi dent in our long-term growth strategy.”, he adds. “In December 2020, we announced that we had become a public company, listed on the Turkish Stock Exchange. In line with our strategy, and to strengthen the position of Bebeto outside of Turkey, we’ve recently signed a preliminary protocol for the acquisition of shares in the European market. We will undoubtedly continue to look at acquisitions within Europe if and when they become available.” “We are an ambitious company by nature, so we have big plans to grow and expand over the coming years. Although we will continue to innovate and release new products, we have some excellent existing products in our portfolio and our objective over the coming year will be to invest in brand awareness.”

“We began the year by reintroducing our consumers to our range of vegan laces and soft candy pencils, which consists of 13 SKUs it total - all of which have been certifi ed vegan-approved by the Vegetarian Society. The vegan market is expected to rise to £1.1bn by 2023, so it’s important for retailers to ensure they have an inclusive confectionery range that is accessible to a wide audience. Like all our products, our vegan range is also 100% Halal certifi ed.”

“We’re also delighted to announce the release of our new 150g gummy range. We’ve taken our best-selling shapes and fl avours and we’ve mixed, matched and repackaged them in a bigger bag format. This range includes Fizzy Watermelons, Strawberries, Big Mix and Big Fizzy Mix, and are available in both price-marked and non-price marked packs.”

“We’ve got plenty of marketing activation planned for Bebeto this year. Given the current restrictions on events and face-to-face experiences, we’ll be revamping our online presence by focusing on our website and social media. We know that consumer engagement and feedback is invaluable, and we have big plans to interact through competitions and engaging content.”