4 minute read

Education Buzz

Why should our bank have a training budget during a pandemic?

Why not? What happens if you don’t? You will fall behind if you cut the training budget. Training and development programs support organizations in many ways, especially during a pandemic, a recession, change(s), and strategic efforts. Derrick Thompson, a writer/ editor for Association of Talent Development writes, “that corporate learning programs are essential to workplace transformation.”

Advertisement

Training & Development Budgets and Strategies - do what?

• Invest in your people while investing in your financial institution. • Set up strategies and people for success. • Improve resiliency. • Nurture people and processes. • Provides tools and resources. • Model and shape behaviors. • Develop and improve skills. • Foster understanding and environments for trust, communication, empathy, and support. There are many benefits and value statements that can be written to encourage leaders to implement learning strategies. Supporting and developing leaders should be a priority along with ongoing staff development across the bank’s organization. Our bank’s managers are supporting a diverse workforce; not only a variety of ages and back grounds in experience but diverse locations, varying job responsibilities with internal structure changes and community and customer changes. Leadership development will foster trust and open communication that will produce value.

What are your talent development and employee engagement strategies? What new skills and competencies do your banker’s need? How can The Community Bankers Association support your needs? Our new and enhanced program offerings provide participants opportunities to refocus and to support your bank’s vision, mission, values, and strategic goals. Call us, we work for you and are ready to connect your bankers to the right solution and learning tools.

Kristi Greer

Senior Vice President Director of Professional Development Community Bankers Association of Georgia

CBIZ offers CBA members tailored programs to minimize risk and manage employee services

Customized Insurance & Risk Management mitigate key industry exposures including board liability, M&A, cyber, contracts, Fintech and fast-changing technologies.

Benefits, Retirement Plans, Payroll & HRIS help manage cost & improve the health of your employees with a comprehensive captive health insurance program.

For more information contact:

Kris St. Martin, Bank Services Program Director 763.549.2267 | KStMartin@CBIZ.com www.cbiz.com/Banking

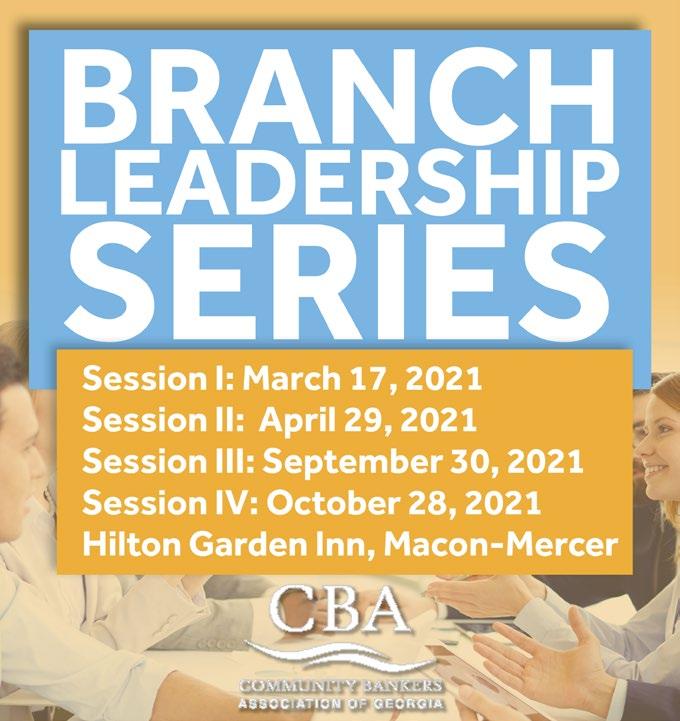

Compliance Program I: Fair Lending

March 16 - Duluth or STREAM March 17 - Macon March 24 - Tifton March 25 - Statesboro or STREAM

We invite you to continue participating in CBA’s annual Compliance Program, the 2021 Why Comply? Package. CBA of GA continues to raise the bar on our program offerings to bring more benefits and value to our community bank compliance professionals. The Why Comply? Package will support your financial institutions strategies for managing an effective compliance program. As your professional development resource, we know you strive to continue growing your knowledge and skills as compliance professionals.

Your Why Comply? Package was built using our member’s ongoing feedback and survey results. Thank you for continuing to provide support and feedback so that we can offer the topics and ongoing resources you request. Sponsored by:

REGISTER TODAY!

Our coverages run the gamut.

At Travelers, we understand that flexible insurance options are important to your future. That’s why we’re committed to solutions that can evolve with the times. From traditional property and casualty coverages to innovative cyber protection packages, Travelers has the ability to adapt to the changing needs of your financial institution. Today – and tomorrow.

travelers.com

© 2020 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries. CP-9173 Rev 1-20

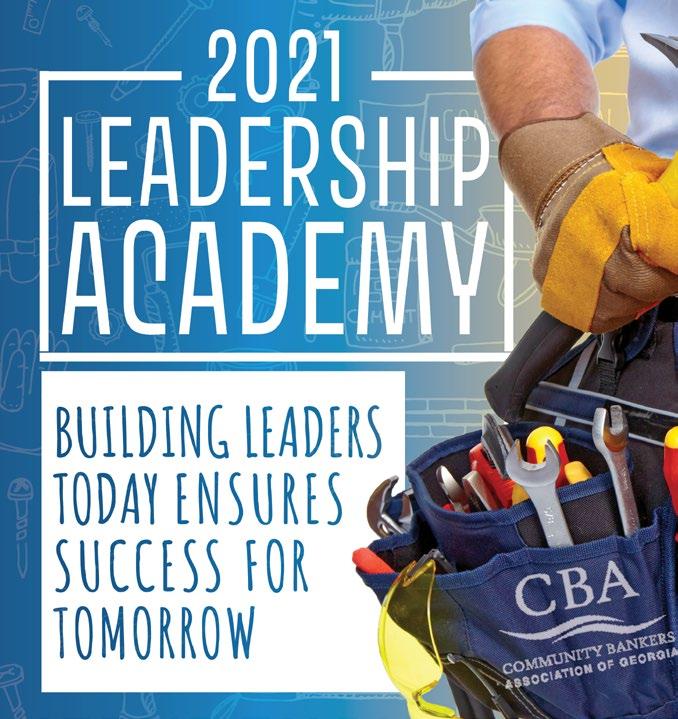

2021 Leadership Academy

The Popular Community Bank Leadership Academy Starts March 22 Register today to participate in four interactive, action oriented learning sessions. Hilton Garden Inn - Mercer | 1220 Stadium Dr., Macon, GA 31204

Join 20 community bankers to develop personal and professional leadership skills through CBAs Community Bank Leadership Academy. Our Leadership Academy is engaging, interactive & effective. Participants will set learning goals, assess and increase their leadership skills including communicating effectively in teams, with clients, and with various personality styles, they will make presentations with confidence, build project action plans, improve performance and continue their ongoing learning. The leadership academy will enhance individual skills that will bring positive influence to your organizations and communities.

Kristy Harrell, SVP/COO First Port City Bank

Executive Channel

You asked for a C-Suite Forum.

We have many members who have asked for a forum to learn, stay abreast of changes, be on top of what’s new and gain insight from other bankers. Our education committee members took this need to the next level to offer a high level program for all executive leaders- CFO, CLO, Directors and CEOs. Our goal is to offer the top-notch, engaging, interactive and action-oriented program that will give our banks tools to benefit their strategies and change goals. The brand new Executive Channel will be customized programming for the bank’s leaders to be exposed to a variety of strategic and progressive topics that will enable our community bankers to implement effective change processes and techniques. These forums will provide for a channel of knowledge, experience and tools to continue supporting successful community banking.

REGISTER TODAY!

LEARN MORE HERE