5 minute read

FINANCIAL MOMENT

Debt Recycling

Todd Burrows has been a leading Financial Adviser in Hobart for over 25 years and is the founding partner of Strategic Financial Planning (recently rebranded to Strategic Invest Blue). This month Todd shares his insight on Debt Recycling.

WHAT is debt recycling? It sounds a bit like throwing out your old debt and taking on new debt, right? Exactly!

In a nutshell, debt recycling is simply borrowing money to invest but with a twist. The twist is that it’s a system that allows you to replace your ‘bad debt’ with ‘good debt’.

‘Good debt’ and ‘bad debt’ are terms coined by Robert Kiyosaki, author of the bestselling finance book, Rich Dad Poor Dad. Kiyosaki refers to ‘bad debt’ as debt that you cannot claim the interest you pay on it as a tax deduction. For example, home loans and personal loans. Naturally, this is also debt we want to pay off quickly.

‘Good debt’, on the other hand, is debt used for investing in assets such as property (both residential and commercial) and shares. Shares can be those purchased on the stock exchange via a broker or by an investment manager on your behalf (managed funds). This type of debt is considered ‘good’ because any accumulated interest on the amount of money borrowed is tax deductible.

So how do you use debt recycling to reduce your ‘bad’ debt?

A Brief Overview

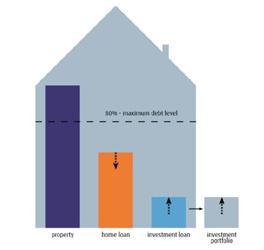

The idea behind debt recycling is to use the reduction of the principal amount in your home loan to redraw from and to put that money into investments that produce capital growth and income, such as dividends or rents. The income derived from such investments can then be used to pay down your home loan – to reduce that ‘bad debt’ as it were.

For example, if you were to pay $500 a week off your $400,000 home loan home with an interest rate of 2.75% per annum, you would be able to redraw around $6,000 after one year of those home loan repayments.

Whilst this amount ($6,000) is not enough to purchase an investment property, it would allow you to buy shares or purchase property via a managed investment fund.

A good financial adviser will ensure that the investments for this purpose produce a good income as well as capital growth over time.

Any income derived from your investment is then funneled back into your mortgage. And while you may be starting small, over time this income grows and you’re seeing an obvious reduction to the principal amount of your home loan.

I can say with utmost confidence that we all want to put ourselves in a better financial position. Don’t we? Debt recycling enables you to pay more off your home loan each year whilst slowly but surely building an investment portfolio that will grow over time. The beauty of this strategy is that, if set up correctly, there’s little to no impact on your cash flow.

Additionally, it’s a fair assumption that the value of your home will increase over time. This provides the opportunity to use the equity between the growth in your home value and your home loan amount for further investment purposes (i.e., purchasing a commercial or residential investment property.)

Obviously borrowing to invest is not without certain risks which is why seeking expert advice is highly recommended. A good adviser will help negate the associated risks. They will also ensure that all financial strategies are tailored to your individual circumstances.

We look forward to the opportunity of helping you turn your ‘bad debt’ into ‘good debt’.

How debt recycling works: dividends/distributions back to home loan

At Strategic Invest Blue we’re dedicated to providing holistic advice to our clients, be it young families, empty nesters or retirees so that they can live their best possible lives. We welcome you to arrange a complimentary consultation to ascertain how we can be of assistance.

Proving your vaccination

Hank Jongen

THERE is an increasing need for people to be able to access evidence that they are fully vaccinated for COVID-19.

The good news is, there is a simple way for you to get proof of your vaccinations, whenever and wherever you may need to.

Services Australia looks after Medicare and the Australian Immunisation Register (AIR), which is where the records of Australians’ vaccinations are kept.

The AIR provides the information that populates COVID-19 digital certificates which gives people proof of their COVID-19 vaccinations.

As of 31 October, more than 330,000 Tasmanians are now fully vaccinated, and of those, about 52 per cent have already accessed their COVID-19 digital certificate.

For those who haven’t yet, there are a few simple steps you can follow to access the COVID-19 digital certificate online: • Create a myGov account; • Link your Medicare online account to myGov; • Download the

Express Plus Medicare app on your mobile device; • Sign in to myGov and click the ‘Proof of

COVID-19 vaccination’ quick link; • If you’re using the app, click on ‘Proof of vaccinations’ in

Services.

You’ll then have access to your proof of vaccinations whenever you need it.

If you’re not able to access online services, there are other ways you can get proof of your COVID-19 vaccinations.

You can call the Australian Immunisation Register and ask for a copy to be posted to you.

Or you can visit one of our service centres and ask for one to be printed for you.

You can also ask a vaccination provider to print a copy of your immunisation history statement for you.

Keep in mind, if you can use myGov, but don’t have a smartphone to save your certificate to, you can print your own at home. There’s no need to call us for a copy.

If you aren’t eligible for Medicare, you can still get proof that you’re fully vaccinated.

Once you’ve created a myGov account, instead of linking Medicare, you can choose to link to the Individual Healthcare Identifier service.

Once you’ve done that, there’s a quick link in myGov that takes you to your certificate.

When you’ve accessed your COVID-19 digital certificate, it’s easy to put a copy in your Apple Wallet or Google Pay so you can have a copy in your pocket wherever you need it.

You can also save your certificate for offline viewing in the Express Plus Medicare app.

The Parkside Foundation

Supporting people with a disability

• Individual and group support • Life skills development • Recreation and Leisure • Supported holidays • School holiday and after school programs • Respite - evening and overnight weekend • Coordination of supports – improving life choices

LOCAL AND TASMANIAN

Large enough to support you, small enough to care.

For further information

Phone 03 6243 6044 Email enquiries@parkside.org.au www.parksidefoundation.org.au