4 minute read

Why waiting could cost you

BY CHRIS GRAY, CEO, YOUR EMPIRE

As we kick off a new year, there’s been a lot of noise in the property market about interest rates and this week we had our first 0.25% drop.

This should have a significant impact on the market - not just financially, but emotionally as well.

A lower cash rate means cheaper monthly mortgage repayments, making property more affordable. It also increases buyers' borrowing power - meaning the same repayment could now service a larger loan. But beyond these practical benefits, the biggest shift will be in consumer sentiment.

For years, I believed that property investors, being more analytical than homebuyers, would react logically to market conditions. But over the past 20 years, I’ve seen quite the opposite. Emotions drive markets far more than people like to admit.

The Psychology Of Property Buyers

Most people believe they make rational financial decisions. In reality, they follow the crowd. We saw this play out during the Global Financial Crisis, the credit crunch, the Royal Banking Commission, and most recently, COVID-19.

Each of these events created uncertainty, and buyers hesitated. Yet, those periods turned out to be some of the best times in history to buy property. Why? Because competition was low, meaning prices were more lower, and long-term growth opportunities were huge.

But instead of seizing the moment, most people sat on the sidelines, waiting for a sign that “things were improving.” By the time they felt confident enough to act, the best deals were long gone, everyone jumped in together and it was even harder to buy.

FEAR VS. OPPORTUNITY: WHAT HISTORY HAS TAUGHT US

When interest rates were at record lows, buyers had a golden opportunity. Yet many didn’t take action. Instead, they kept waiting - perhaps for even lower rates, perhaps for someone to tell them it was the “right” time.

Then, rates climbed, doubling or even tripling. Suddenly, buyers who could have comfortably afforded a property were priced out. Their borrowing capacity dropped by 30-40%, and what could have been a $1m purchase turned into a $600K or $700K ceiling.

Fast-forward to today: we’re potentially at the start of the next major shift in the market. Consumer confidence is likely to rise with a rate cut, and once that happens, demand will increase. Buyers who wait too long will find themselves competing again - just like they did in past cycles.

THE BEST TIME TO BUY? BEFORE EVERYONE ELSE DOES

The market doesn’t wait for people to feel comfortable. It moves ahead while they hesitate. Some of the best purchases I’ve made were during periods of uncertainty -when most people were too afraid to act.

Half of my current portfolio was purchased during the Global Financial Crisis, a time when the media was predicting disaster and many people were convinced property would never recover.

In hindsight, would you have bought a two-bedroom apartment in Coogee or Bondi for $600K – $700K in 2009? Of course you would.

That’s the power of making decisions before the crowd catches on.

THE RIGHT TIME IS ALWAYS NOW–IF YOU BUY THE RIGHT PROPERTY

If you’ve been waiting for a sign, this is it. Whether we get another rate drop in April, May or later this year, it doesn’t really matter. What matters is buying the right property in the right location at the right price.

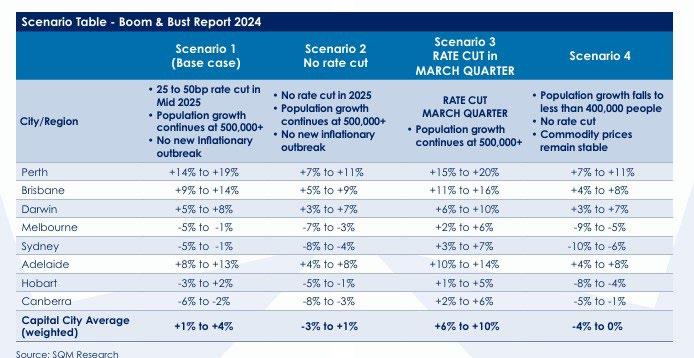

SQM Research predicted late last year that Sydney might drop between 1% and 5% based on certain scenarios. After the rate drop on Tuesday it revised it’s predictions for Sydney to rise by 3% to 7%.

Markets move in cycles, and those who hesitate during uncertainty end up paying a premium later. The best opportunities don’t come when the headlines are positive and everyone feels good. They come when smart investors or homebuyers step in while others sit on the sidelines.

So, ask yourself: Are you going to wait for things to be “perfect,” or are you going to act before the next wave of competition pushes prices higher?

Because in 10 years, you don’t want to be looking back at 2025, saying, "I should have bought when I had the chance."