Residential

Overview 2023

Communities

Here at CFMG Capital we have developed a strategic pipeline of projects to be delivered over the next five to seven years, and have the vision to be the leading developer of residential communities having established a diversified mix of land for future community developments.

Despite the recent market uncertainty presented by rising interest rates and cost of living pressures, we remain very optimistic about the long-term potential of the residential land market with strong underlying conditions, including low unemployment and high population growth.

Our Directors and Senior Management have a strong history in real estate and believe there is an opportunity at this point in the property cycle to continue to expand the CFMG Capital forward strategic pipeline and deliver on the vision for future growth.

The key to CFMG Capital’s success has been working to a clearly defined strategy which enables our long term vision to be achieved and in turn for us to continue to deliver value to our customers through disciplined acquisition and a conservative but realistic approach to investment.

A focus for CFMG Capital during the past twelve months has been on expanding our forward project pipeline and to the ongoing development of our existing residential communities.

In accordance with our strategic plan CFMG Capital have undertaken the following key activities:

Completed

The acquisition of our new project sites:

• Future Pimpama development site

• Mallee Grove at Jimboomba

• Farriers Creek at Burpengary

• Pumicestone Pocket at Caboolture

• Extensions to Arbourwood at Morayfield

Contracted

• Riverleigh at Logan Reserve

• Extensions to Arbourwood at Morayfield

• Extensions to our future Bellmere development site

• Extensions to our future Logan Reserve site at Calume Court

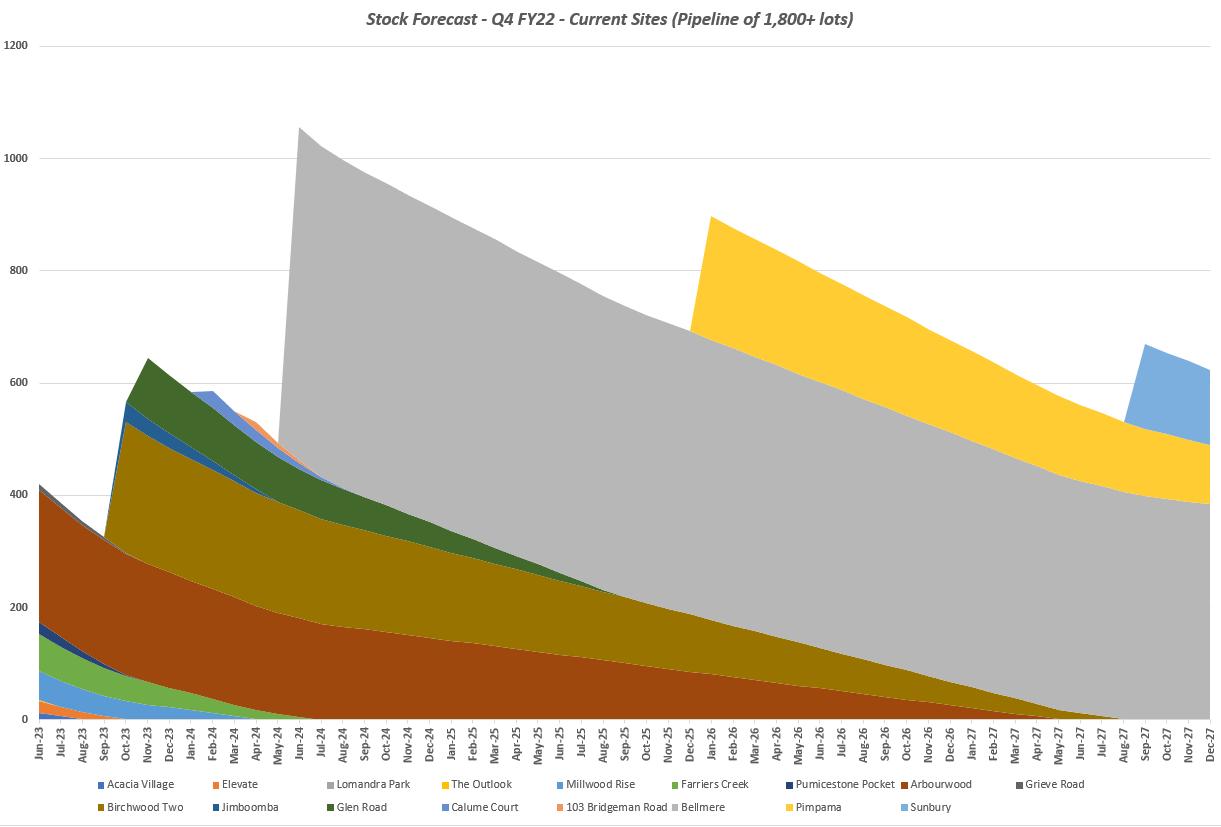

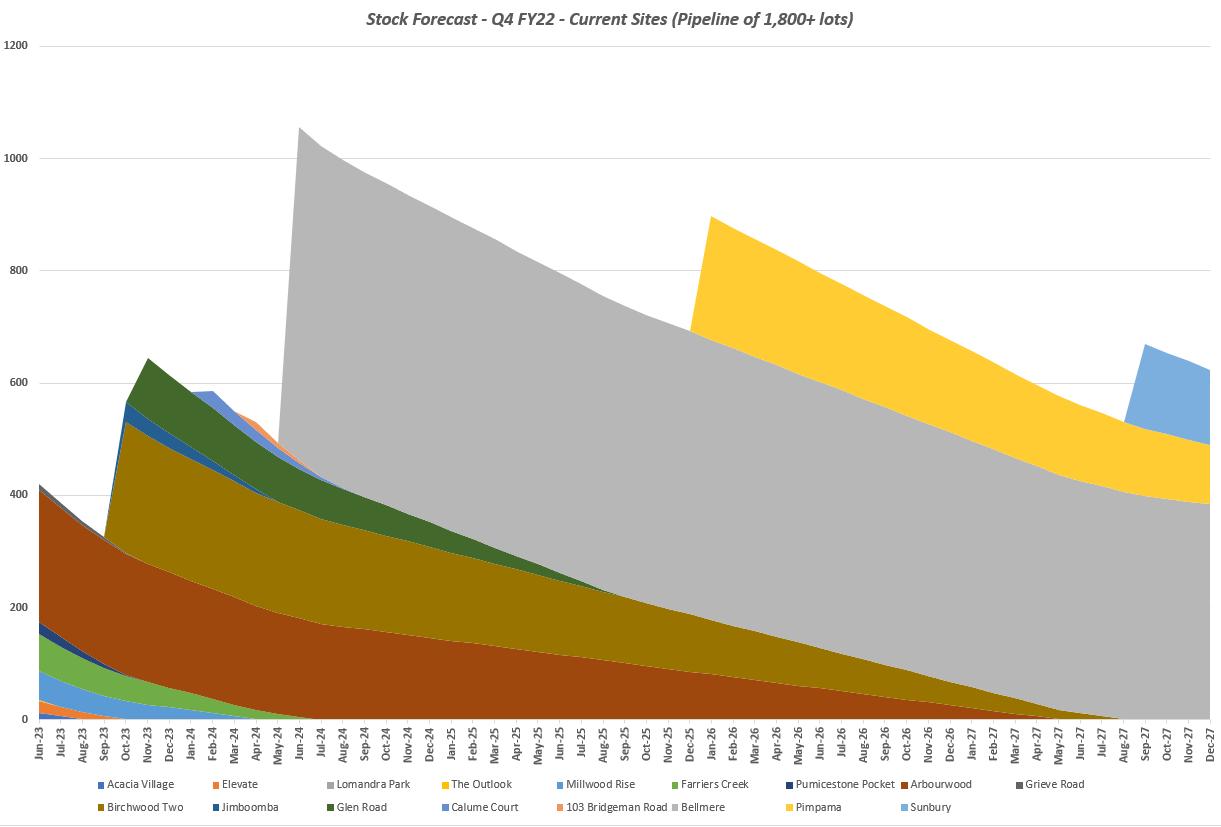

The CFMG Capital forward project pipeline is now over 1800+ lots with a total gross realisation of over $650 million.

Opened

The Sunday Living Homes sales and experience centre at the Arbourwood residential community in Morayfield in north Brisbane.

In the following pages of this report, you will find some very useful and general information about our business, an overview of some new projects, our current projects and some market commentary.

To existing clients and customers, thank you for your ongoing support and to potential new clients we look forward to building a long term and repeat relationship.

Regards

Scott Watson Managing Director, CFMG Capital

2 CFMG Residential Communities Creating real neighbourhoods

Contents Executive Summary 2 Residential Communities 4 CFMG Capital Project Pipeline 5 Market Analysis 6 SEQ Market Update 7 Melbourne Market Update 8 Acquisitions Strategy 8 - 9 Current Projects 10 - 11 CFMG Capital Management 12 - 13 Board 14 - 16 Values & Testimonials 17 Sunday Living Homes 18 - 19 3 RESIDENTIAL COMMUNITIES OVERVIEW 2023

Residential Communities

Creating real neighbourhoods

CFMG Residential Communities have a proud history of creating successful communities across Australia. Our ability to develop with focus, agility and experience means our residents benefit from well considered and carefully constructed communities.

Over 5,000 people call a CFMG Residential Community home.

CFMG Residential Communities by

CFMG Residential Communities Creating real neighbourhoods 4

CFMG Capital Project Pipeline

Pumicestone Pocket, Caboolture QLD

75 lots

Launch: Early 2022

Farriers Creek, Burpengary QLD

115 lots

Launch: Early 2022

Arbourwood, Morayfield QLD

240 lots

Launch: Mid 2023

Mallee Grove, Jimboomba QLD

36 lots

Launch: Mid 2023

Riverleigh, Logan Reserve QLD

109 lots

Launch: Mid 2023

Birchwood, Park Ridge QLD

240 lots

Launch: Late 2023

Bellmere QLD

730 lots

Launch: 2024

Logan Reserve QLD

30 lots

Launch: 2024

Pimpama QLD

300 lots

Launch: 2025

Sunbury VIC

150 lots

Launch: 2027

RESIDENTIAL COMMUNITIES OVERVIEW 2023

5

SEQ Market Update

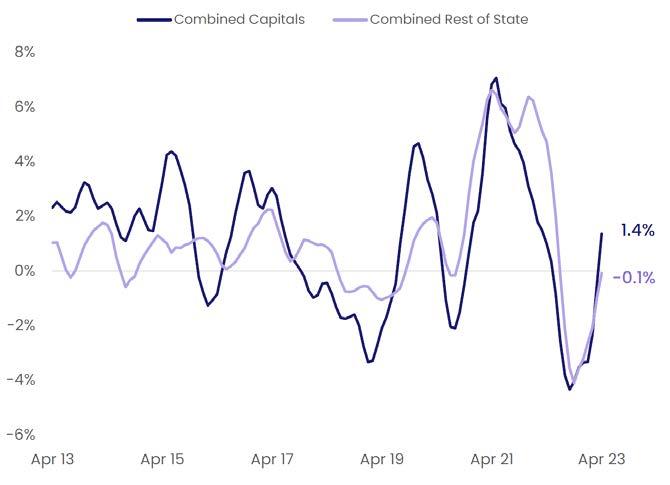

The South East Queensland property market has recently begun to show signs of positive growth with housing prices rising across the past few months. The Brisbane, Gold Coast and Sunshine Coast property markets have seen the biggest rise in price; however, property prices have also begun to rebound across Regional Queensland.

According to recent research data released by CoreLogic, every region across Brisbane has seen their property prices increase over the past 3 months. The biggest increases have been seen in North Brisbane with prices up by 4%, while South Brisbane has seen a jump of 3.2%, East Brisbane 1% and West Brisbane 0.9%.

As previously mentioned, Queensland’s other property markets have also seen property prices rise, with the Gold Coast region seeing its prices rise by 2.6% over the past 3 months, while Logan has risen by 0.7% and Ipswich has risen by 1%.

According to property experts, this recent rebound in Queensland property prices is largely being driven by a lack of supply and positive market sentiment, with purchasers beginning to re-enter the market despite sellers being somewhat reluctant to list their properties for sale. It is expected that prices will continue to rise over the months to come, with momentum continuing to gather.

Here at CFMG Capital, much like the wider property market over the past few months, we have started to see buyers returning to the market, with both enquires and sales steadily increasing across all of our South East Queensland estates.

7 RESIDENTIAL COMMUNITIES OVERVIEW 2023

Region 3 months Average price 3-month change Brisbane - East 1.0% $817,155 +$8,091 Brisbane - North 4.0% $775,919 +$29,844 Brisbane - South 3.2% $898,732 +$27,868 Brisbane - West 0.9% $912,352 +$8,138 Brisbane Inner City 1.5% $727,835 +$10,757 Ipswich 1.0% $543,586 +$5,383 Logan - Beaudesert 0.7% $604,677 +$4,204 Moreton Bay - North 1.8% $636,573 +$11,256 Moreton Bay - South 2.2% $720,107 +$15,502 Cairns 1.5% $477,467 +$7,057 Central Queensland 1.4% $392,568 +$5,421 Darling Downs - Maranoa 0.5% $333,519 +$1,660 Gold Coast 2.6% $838,019 +$21,237 Mackay - Isaac - Whitsunday 1.2% $413,087 +$4,899 Sunshine Coast 2.0% $917,497 +$17,991 Toowoomba 1.7% $536,401 +$8,967 Townsville 0.8% $367,571 +$2,918

Melbourne Market Update

Melbourne’s property market has also begun to see signs of recovery over the past few months, with property prices experiencing a 1.6% increase during this period. Much like other states across Australia this increase in property prices is largely driven by increased migration and a lack of housing supply.

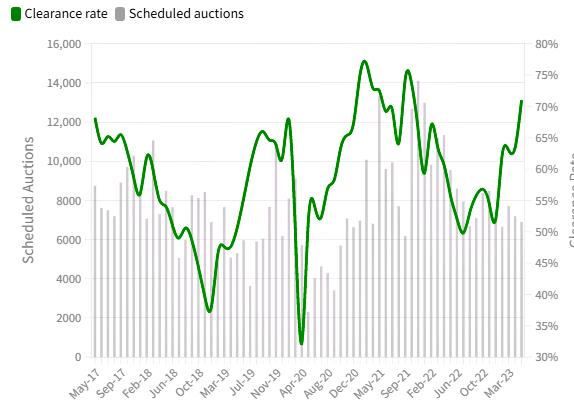

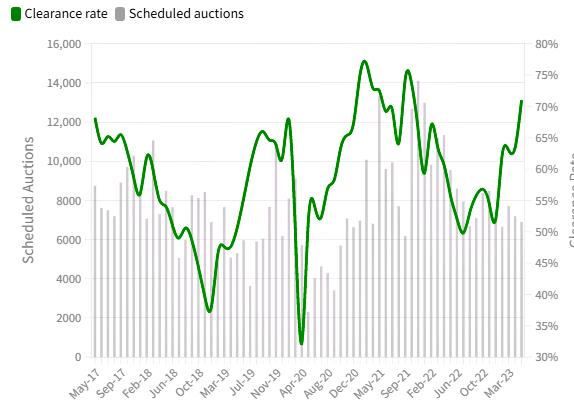

This lack of housing supply can be largely demonstrated by recent data released by Domain which shows that auction listings are down by 29% over the past twelve months, while auction clearance rates have risen to 70%.

Acquisitions Strategy

The key focus for CFMG Capital is to acquire strategic residential development sites that meet a strict investment criteria and enable CFMG Capital to offer attractive residential investment opportunities to our current and future client base.

In order to achieve this, a steady flow of new acquisitions is required, with the primary challenge being to ensure they meet the clearly defined investment criteria underpinning the CFMG Capital development business. This criteria is defined generally below:

• Proximity to a major capital city;

• Population growth and demographics of the locality;

• Proximity to existing and proposed competing land estates (particularly master planned estates);

• Proximity to key planned infrastructure projects;

• Employment opportunities within the locality; and

• Lifestyle choices including schools, family security, transportation and recreation.

8 CFMG Residential Communities Creating real neighbourhoods

In the assessment of potential projects CFMG Capital targets short, medium and long-term opportunities with the view to fill the groups development pipeline from both ends.

Recently here at CFMG Capital we have taken a more considered approach to site identification, focusing our efforts towards opportunities within the South East Queensland market. Particular attention has been to targeting opportunities located within the Moreton Bay and Logan growth corridors, while also focusing on sites adjacent to, or in the immediate vicinity of existing CFMG Capital communities.

By purchasing adjacent to, or in the immediate vicinity of existing projects – CFMG Capital are able to expand existing projects taking advantage of existing marketing, development and sales momentum, or in some cases replace completed projects to meet the demands of various sales networks.

Whilst it is important for CFMG Capital to acquire short and medium-term projects, that can be released into the market over the next couple of years, it is also critical for CFMG Capital to look further into the future and acquire sites on longerterm agreements. This is key for CFMG Capital to future proof the group’s stock supply.

These long-term acquisitions also provide CFMG Capital the opportunity to build future value across these projects by obtaining Development Approvals and/or rezoning, while also allowing CFMG Capital to benefit off the continued growth in residential land values.

During the past twelve months CFMG Capital have managed to acquire short, medium and long-term development sites, across over 10 separate transactions totalling approximately 700 residential lots. A snapshot of the Group’s existing development pipeline is shown as follows:

9 RESIDENTIAL COMMUNITIES OVERVIEW 2023

Current Projects

Acacia Village

84 Residential Lots

$27.6m Gross Realisation

Wollert (VIC)

This 5.81 hectare site will be developed into an 84 lot residential community together with some associated retail and commercial uses. Located just 25km north of the Melbourne CBD, this project will be established within an already abundant collection of lifestyle amenity, health and education facilities, public transport infrastructure and major road networks. Launched in 2020 for expected completion in 2023.

Millwood Rise

63 Residential Lots

$25.7m Gross Realisation

Nambour (QLD)

Millwood Rise is a boutique residential community nestled in the hillside of Nambour. Immediately surrounding the property are a mix of modern sub-divisions and acreage properties, including several similar projects either recently completed or currently being developed. The location is picturesque and expansive with modern amenity close by.

Pumicestone Pocket

75 Residential Lots

$26.2m Gross Realisation

Caboolture (QLD)

Pumicestone Pocket is a 3.1 hectare site located in Caboolture, north of Brisbane. This development is close to the Caboolture Hospital, transport options, a range of education amenity and approximately 30 minutes drive from Bribie Island and Redcliffe.

Farriers Creek

105 Residential Lots

$35.3m Gross Realisation

Burpengary (QLD)

Farriers Creek is a 12 hectare site located in the highly sought after suburb of Burpengary in North Brisbane. Within close proximity to schools, shops, education and medical amenity, Farriers Creek is ideally positioned for growing families to build their dream home.

10 CFMG Residential Communities Creating real neighbourhoods

Arbourwood

240 Residential Lots

$80.4m Gross Realisation

Morayfield (QLD)

This 10.07 hectare site is ideally located in Morayfield in the northern suburbs of Brisbane, and has the benefit of an existing preliminary development approval to form a highly sought after multi stage residential community.

Sovereign Estates

10 Residential Lots

$20.7m Gross Realisation

Rochedale (QLD)

This 3.5 hectare site is ideally located in Rochedale situated 15km’s east of the Brisbane CBD and is to be developed into a boutique high end residential enclave of 10 residential allotments with an average size over 2000m2

CFMG Capital have successfully completed the nearby Mayfair Lane residential community and this is a prime opportunity to benefit from existing market momentum and experience.

Elevate

100 Residential Lots

$46.95m Gross Realisation

Ormeau Hills (QLD)

This 5.7 hectare site sits in a strategic elevated location in Ormeau Hills, situated in the thriving development corridor between Brisbane and the Gold Coast. Just 25km north of the Gold Coast CBD and 40km south of the Brisbane CBD, the site is being developed by CFMG Capital to create Elevate at Ormeau Hills, a high quality lifestyle community of 100 residential allotments.

Mallee Grove

36 Residential Lots

$11.2m Gross Realisation

Jimboomba (QLD)

This property is a 4.18ha site located 40km from Brisbane’s CBD in the Logan growth corridor, the site benefits from neighbouring an established housing development with services located at the property boundary and is within close proximity to schools, public transport services, retail and healthcare services.

11 RESIDENTIAL COMMUNITIES OVERVIEW 2023

Management

The Directors and Senior Management have a strong history in real estate investment and believe there is an opportunity at this point in the property cycle to expand the CFMG Capital forward strategic pipeline and deliver on the vision to be the leading developer of residential communities for future growth.

The Management Team include staff who are highly skilled and experienced individuals in the fields of finance, property development, management, sales and marketing.

CFMG Capital has full service research, acquisitions, legal and project marketing teams to support and guide projects from inception through to completion.

Further, CFMG Capital has employees with experience in the fields of accountancy and finance, corporate governance and compliance to enable effective discharge of responsibilities in the areas of corporate governance, social responsibility and sustainability.

Key management personnel of the group are:

ANDREW THOMSON General Manager

With close to 15 years experience in management, marketing and strategy development, Andrew brings to the group an indepth understanding of property and financial services sectors through senior marketing and operations roles at AMP, Devine Limited and Ausbuild.

With significant involvement in the sales, marketing and leasing of in excess of $2.5 billion worth of residential, retail and commercial property in Queensland, NSW, Victoria and South Australia, Andrew brings expertise throughout a project lifespan from acquisition to final settlements.

Andrew has also worked in large organisations in specialist strategic marketing positions such as Suncorp & Australian Insurance Holdings and holds a Bachelor of Business (Management) specialising in Marketing, Human Resource Management and Industrial Relations and has commenced a Masters Degree in Property Economics.

12 CFMG Residential Communities Creating real neighbourhoods

Elio oversees the sales and marketing functions across all aspects of the business.

Elio works closely with Sales Managers in both the land development and investment management departments, while leading the marketing team across both digital and offline, as well as brand development.

A national and international award winning dynamic marketing professional with significant experience in managing brands, products and places – Elio has experience across a range of major organisations in development and asset management such as Aveo Group, Charter Hall, Lend Lease, Stockland and Colonial First State.

Duncan is the Acquisitions & Analysis Manager at CFMG Capital and has over 6 years’ experience in the property industry.

He’s worked for Villa World, Orchard Property Group and Aspen Group with the last three and half years spent acquiring developments for CFMG Capital.

Duncan has worked in Sydney, Brisbane and the Gold Coast and has acquired developments across Queensland, Victoria and New South Wales.

Brad is a highly experienced Development Manager at CFMG Capital and brings a wealth of knowledge to the role with over 20 years’ experience in the property industry.

He is responsible for managing the development process for all CFMG Residential Communities projects from acquisition through to construction completion.

Brad has worked across a range of developments for Defence Housing Australia, PEET and Sunland.

13 RESIDENTIAL COMMUNITIES OVERVIEW 2023

ELIO IACUTONE National Sales and Marketing Manager

DUNCAN MACPHERSON Acquisitions & Analysis Manager

BRAD COOK Development Manager

Scott is a founding Director of both the residential land development and income fund businesses of CFMG Capital.

After five years as a solicitor in private practice advising a wide range of clients including State Government departments, publicly listed and private companies, Scott joined a private development and financial services group where his responsibilities included management of the group’s legal requirements and obligations, project management and broad acre land acquisitions.

From 2008, Scott has been actively involved in overseeing the governance and compliance obligations in relation to residential land development companies.

Scott holds Bachelor degrees in Law and Accountancy, a Graduate Diploma in Urban and Regional Planning and has more than 20 years broad experience in the property development and finance industries.

During a career spanning more than 40 years, Ross has held a number of senior executive positions with a strong emphasis on the Financial Services sector, particularly with a Property and Real Estate background.

In 1998, Ross was a founding partner and Managing Director of ASX Top 200 company Cromwell Corporation Limited (ASX Code CMW), now known as Cromwell Property Group, and managed and directed the growth of the Company, now one of Australia’s largest Real Estate Investment Trusts with a market capitalisation of more than $2 billion as at 31 December 2017, and total assets under management of $11.2 billion. Apart from his role of Managing Director at Cromwell, Ross was Compliance Director and Responsible Manager for the Managed Investment Schemes the company promoted.

Since his retirement from Cromwell in 2008, Ross has maintained his interest in property and real estate, undertaking a number of residential and industrial land developments in his own right.

14 CFMG Residential Communities Creating real neighbourhoods

ROSS STILES Independent Director & Chairman CFMG Capital

SCOTT WATSON Managing Director - CFMG Capital

Board

Wayne has 18 years lending experience working with various types of loan scenarios and debt structuring. Wayne has held state and national manager positions with finance brokerage and property companies. With experience in corporate governance and compliance as a Responsible Manager across mortgage broking and financial planning. Wayne has had extensive dealings with new land estates throughout Australia.

Wayne holds a Diploma of Financial Services (Finance / Mortgage Broking Management), Advanced Diploma of Financial Services (Financial Planning), Advanced Diploma of Business (Accounting), Graduate Certificate in Management and Graduate Diploma of Commerce. He is currently studying a Master of Commerce (Financial Planning). Wayne is an MFAA Accredited Finance Broker with the Mortgage & Finance Association of Australia, Associate Fellow of the Australian Institute of Management and a Justice of the Peace (Qualified).

Barrie has enjoyed his careers in the private sector and with the Commonwealth and State Governments.

He commenced with the Shell Group of Companies in Brisbane then Sydney and Melbourne which culminated in his appointment as the South Pacific Audit Manager.

Barrie then returned to Brisbane where he held a number of senior positions in the Corporate Affairs Office, including in 1989, his appointment as Director, Corporate Development and Operations.

He held a senior corporate regulatory position from 1991 to 2000 and was awarded the Public Service Medal for outstanding public service.

Barrie has been an active member of CPA Australia and was a Director on the board of CPA Australia for 3years. Since leaving the public service, he has held board positions on listed and unlisted public companies and not for profit companies. Barrie continues to hold board positions and is the Chairman of three Compliance Committees.

Barrie delivers presentations on Corporate Governance and Ethics and Risk Management, Directors’ Duties and Corporate Social Responsibility.

15 RESIDENTIAL COMMUNITIES OVERVIEW 2023

WAYNE HAMBURGER Independent Director - CFMG Capital

BARRIE ADAMS Independent Director

Jim has over 40 years’ experience in chartered accountancy in audit and corporate services fields.

Mr Frayne was appointed as a partner of PKF Chartered Accountants and Business Advisers (now BDO Chartered Accountants) in 1983 and from that time headed up the Audit and Assurance Division of PKF Brisbane until his retirement in June 2006.

He is a Director of Aveo Limited and Black & White Holdings Limited.

Jason has had a broad range of property experience across all sectors including residential, commercial, retail, industrial, rural, special purpose and mixed use. This range of experience has seen Jason and his Valuation Practice (JPM Valuers & Property Consultants) actively providing advice to the public, private and government bodies across Victoria, New South Wales, Queensland and Northern Territory.

Prior to Jason setting up his own valuation practice he held positions with Brisbane Real Estate specialising in site acquisition and asset realisation for receivers; and approximately 10 years with Australia’s largest valuation and advisory firm Herron Todd White Valuers.

Jason holds a Bachelor of Applied Science (Property), is a Certified Practicing Valuer in Queensland and New South Wales and an Associate member of the Australian Property Institute.

16 CFMG Residential Communities Creating real neighbourhoods

JASON MATIGIAN Independent Director

JIM FRAYNE Independent Director

Board

Values & Testimonials

Real People.

CFMG Capital create long term value through active investment in and development of residential land subdivisions.

At CFMG Residential Communities we seek not only to make the dream of home ownership affordable, we also care about making real neighbourhoods and real communities.

The core focus of CFMG Capital is to create value through disciplined acquisition and a conservative but realistic approach to investment. In a climate where residential real estate sector indicators across the country are positive, spurred by a shortage of land supply, it is anticipated that strong medium to long term earnings can continue to be achieved through residential property investment.

The Real People behind CFMG Capital are proud of our track record and history of delivering residential communities across Australia.

Over 5000 people call a CFMG Residential Community home.

“I now have several years of positive experience with CFMG Capital. Excellent finger-on-the-pulse of growth markets and rock solid to deal with.”

17 RESIDENTIAL COMMUNITIES OVERVIEW 2023

“It’s a great relationship to have, someone like that, that you can rely on and trust”

Richard, Wollongong NSW

George, Melbourne VIC

Sunday Living Homes was created to expand our products and services to include fixed price Home & Land bundles exclusively at CFMG Residential Communities.

Sunday Living Homes is for Aussie families and savvy individuals that understand looks are important, but value is paramount.

Without skimping on quality, our smooth purchase process gets our residents into their homes sooner, so they can get on with life’s bigger and better things.

18 CFMG Residential Communities Creating real neighbourhoods

Sunday Living Homes prides itself on the below values:

19 RESIDENTIAL COMMUNITIES OVERVIEW 2023

Level 2, 117 McLachlan St Fortitude Valley QLD 4006 PO Box 663, Fortitude Valley QLD 4006 P 1800 155 526 E info@cfmgcapital.com.au cfmgcapital.com.au Real people. Printed: June 2023