Year in Review

2023

Dear Investor,

Here at CFMG Capital we have developed a strategic pipeline of projects to be delivered over the next five to seven years, and with the support of our loyal investors, have established a diversified mix of investment product.

Despite the recent market uncertainty presented by rising interest rates and cost of living pressures, we remain very optimistic about the long-term potential of the residential land market with strong underlying conditions, including low unemployment and high population growth.

We are committed to retaining our 100% track record for delivering on our targeted returns and the return of 100% of the capital invested with us and think our track record will serve us well as we head into a new phase for the property market.

During financial year 2023 CFMG Capital successfully completed four investment opportunities on behalf of investors via both the CFMG Land and Opportunity Fund and CFMG First Mortgage and Income Fund returning over $9.3M in invested capital and returns to those investors.

Both the CFMG Land and Opportunity Fund and CFMG First Mortgage and Income Fund are powerful tools for investors seeking exposure to the residential land market.

Even with rising interest rates and general market inflationary pressures, the fund returns are attractive and only achievable through a combination of our internal development expertise, a commitment to putting returns to investors ahead of development profits and the expectation that the residential land market will continue to strengthen over the next few years.

In contrast to volatile property investments based on assumptions, the funds managed by CFMG Capital have a fixed term duration and fixed return policy which provides the confidence that the targeted returns will be delivered.

The key to CFMG Capital’s 100% success rate has been working to a clearly defined strategy which enables our long term vision to be achieved and in turn for us to continue to deliver value to our investors through disciplined acquisition and a conservative but realistic approach to investment.

CFMG Capital’s two alternatives to investing in property without directly buying housing via the CFMG Land and Opportunity Fund or CFMG First Mortgage and Income Fund has seen positive capital inflow with over $36.3M in new capital invested during financial year 2023.

This positive capital inflow has been seen from investors seeking to earn property-based income without direct property ownership, because for some investors direct property investment can be intricate and very involved.

The CFMG Land and Opportunity Fund is an unlisted managed investment scheme that invests in the development of residential land subdivision projects on a case-by-case basis. The Fund currently holds investments in 9 different projects with a gross sales value of more than $294M.

The CFMG First Mortgage and Income Fund is an unlisted managed investment scheme that invests in residential land project opportunities and completed land allotments generally on a shorter term basis and where construction works are not required. The Fund currently holds investments in 3 different project opportunities with an ‘as is’ value of more than $9.8M.

A focus for CFMG Capital during the past twelve months has been on expanding our investment offers with regular income, professional management, diversification and opportunity for growth.

2 CFMG Capital Real people.

In accordance with our strategic plan CFMG Capital have undertaken the following key activities:

• Completed the acquisition of our new project sites at Logan Reserve, Burpengary, Caboolture and Bellmere.

• Prepared and packed 2300 meals via our involvement with FareShare. A charity that has been cooking free, nutritious meals for people doing it tough since 2001.

• Provided in excess of $50,000 in charitable donations and/or sponsorship to local community sporting clubs and groups.

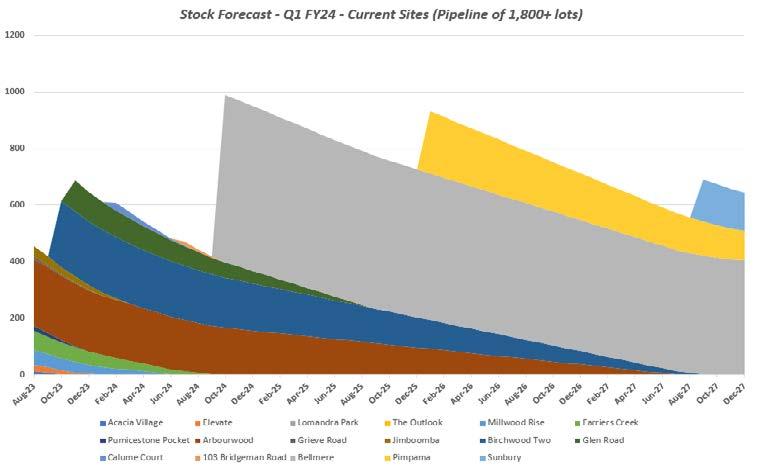

• Contracted the purchase of new project sites at Logan Reserve, Burpengary, Caboolture and Bellmere to expand our forward project portfolio to over 1800 allotments with a total gross realisation of more than $500M.

• Opened the Sunday Living Homes sales centre at the Arbourwood residential community in Morayfield north of Brisbane

In the following pages of this report, you will find some very useful and general information about our business, an overview of our products, our projects and some market commentary. In addition, we supply a sneak preview to some of the upcoming opportunities set for FY 23/24.

As always, if you require anything from our team –please do not hesitate to get in touch. Thank you for your ongoing support and we look forward to continuing to deliver on our commitments to you, our loyal investors, and to building a long term and repeat relationship.

Regards,

Scott Watson Managing Director, CFMG Capital

YEAR IN REVIEW 2023

CFMG Capital First Mortgage and Income Fund

The CFMG First Mortgage and Income Fund is now well established in the product offering at CFMG Capital after it was launched in 2021. Almost $4.7M was raised throughout the financial year off the back of three CFMG First Mortgage and Income Fund offers being released for investment.

The successful redemption of two of these investment offers totalling $4.5M were also made throughout the financial year.

The benefits of the CFMG First Mortgage and Income Fund include:

Targeted returns

5.95% - 7.85% p.a

Start investing with $25,000

Distributions paid quarterly

6 - 18 month terms

4 CFMG Capital Real people.

CFMG Capital Land and Opportunity Fund

The CFMG Land and Opportunity Fund is an unlisted managed investment scheme that invests in the development of residential land subdivision projects that meet the very specific CFMG Capital investment criteria.

Interest in the CFMG Land and Opportunity Fund continues to grow with 12 new investment opportunities launched throughout the financial year. This resulted in a total raise of over $43M and over $4.8M was redeemed to investors across two completed projects throughout the year.

Key features of the CFMG Land and Opportunity Fund include:

Targeted returns 8.95% - 11.95% p.a

Start investing with $25,000

Capital + interest paid at end of term

12 - 24 month terms

5 YEAR IN REVIEW 2023

National Market Update

Over the past few months, the residential property market across Australia has begun to show signs of renewed growth, with both prices and auction clearance rates sharply rising despite the RBA’s recent interest rate hikes.

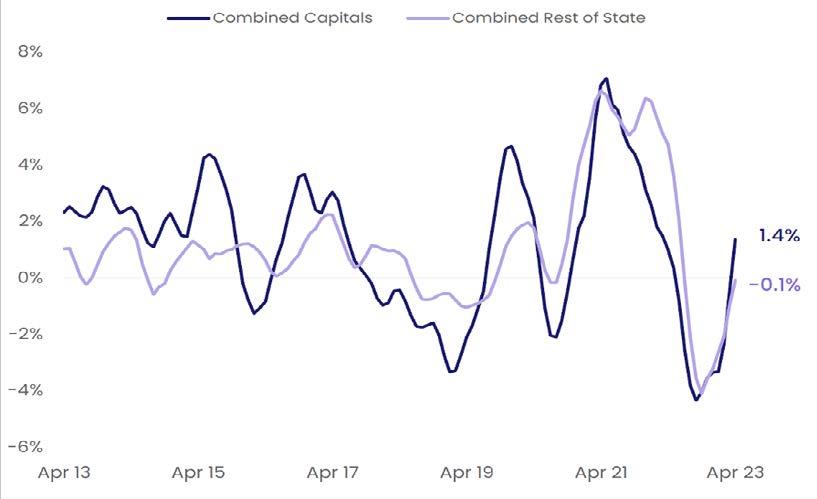

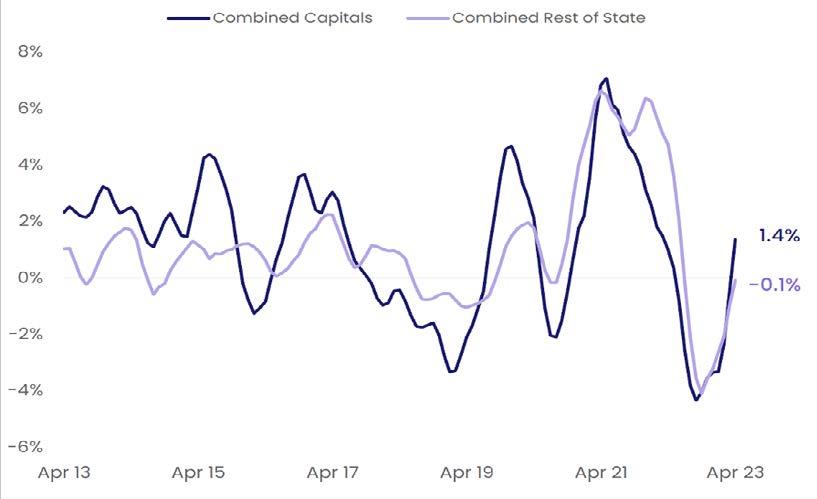

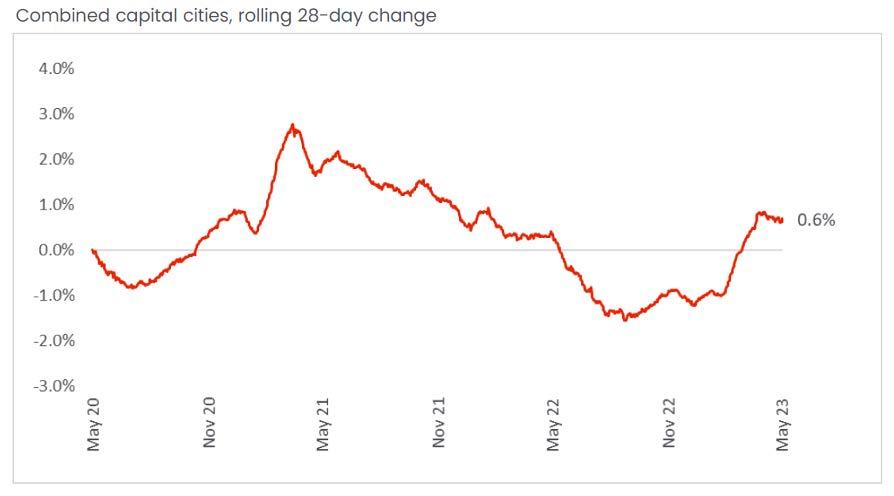

CoreLogic’s most recent ‘Monthly Housing Charts’ for May 2023 show that residential property prices across Australia’s capital cities have risen by 1.4% (see below chart), with this recent quarter marking the first quarterly increase since the same time last year. This increase in property values is largely being driven by a significant increase in overseas migration, with this expected to continue into the future.

Source: Corelogic Monthly Housing Chart

6 CFMG Capital Real people.

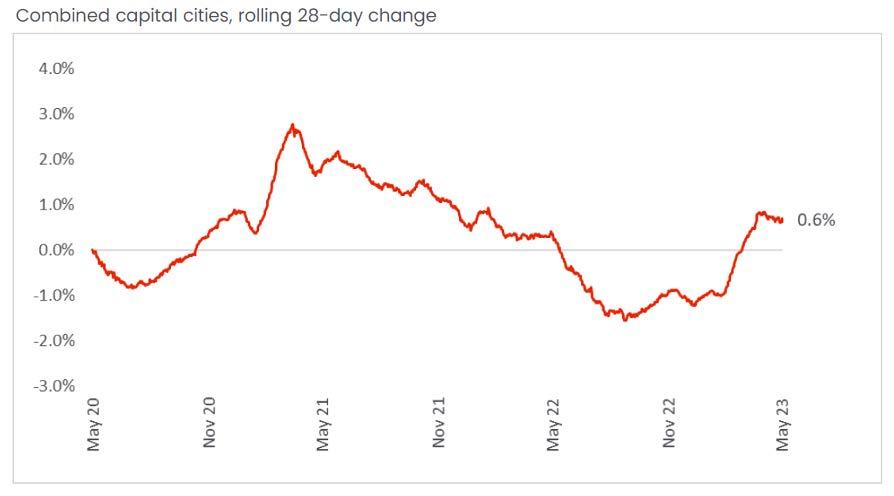

It is becoming increasingly evident that house prices across Australia have started to rebound after bottoming out, with expectations being that they will continue to rise over the foreseeable future. In addition to overseas migration, a lack of supply and vacancy rates reaching as low as 1% will continue to drive property prices recent growth.

As interest rates begin to stabilise, it is thought that housing demand will only continue to grow. According to CoreLogic, if property prices across Australia continue to rise at the current rate, they will end up approximately 4% higher during 2023.

Source: Corelogic Monthly Housing Chart

7 YEAR IN REVIEW 2023

SEQ Market Update

The South East Queensland property market has recently begun to show signs of positive growth with housing prices rising over the past few months. The Brisbane, Gold Coast and Sunshine Coast property markets have seen the biggest rise in price; however, property prices have also begun to rebound across Regional Queensland.

According to recent research data released by CoreLogic, every region across Brisbane has seen their property prices increase over the past 3 months. The biggest increases have been seen in North Brisbane with prices up by 4%, while South Brisbane has seen a jump of 3.2%, East Brisbane 1% and West Brisbane 0.9%.

As previously mentioned, Queensland’s other property markets have also seen property prices rise, with the Gold Coast region seeing its prices rise by 2.6% over the past 3 months, while Logan has risen by 0.7% and Ipswich has risen by 1%.

According to property experts, this recent rebound in Queensland property prices is largely being driven by a lack of supply and positive market sentiment, with purchasers beginning to re-enter the market despite sellers being somewhat reluctant to list their properties for sale. It is expected that prices will continue to rise over the months to come, with momentum continuing to gather.

8 CFMG Capital Real people.

Region 3 months Average price 3-month change Brisbane - East 1.0% $817,155 +$8,091 Brisbane - North 4.0% $775,919 +$29,844 Brisbane - South 3.2% $898,732 +$27,868 Brisbane - West 0.9% $912,352 +$8,138 Brisbane Inner City 1.5% $727,835 +$10,757 Ipswich 1.0% $543,586 +$5,383 Logan - Beaudesert 0.7% $604,677 +$4,204 Moreton Bay - North 1.8% $636,573 +$11,256 Moreton Bay - South 2.2% $720,107 +$15,502 Cairns 1.5% $477,467 +$7,057 Central Queensland 1.4% $392,568 +$5,421 Darling Downs - Maranoa 0.5% $333,519 +$1,660 Gold Coast 2.6% $838,019 +$21,237 Mackay - Isaac - Whitsunday 1.2% $413,087 +$4,899 Sunshine Coast 2.0% $917,497 +$17,991 Toowoomba 1.7% $536,401 +$8,967 Townsville 0.8% $367,571 +$2,918

This lack of housing supply can be largely demonstrated by recent data released by Domain which shows that auction listings are down by 29% over the past twelve months, while auction clearance rates have risen to 70%.

Melbourne Market Update

Melbourne’s property market has also begun to see signs of recovery over the past few months, with property prices experiencing a 1.6% increase during this period. Much like other states across Australia this increase in property prices is largely driven by increased migration and a lack of housing supply.

As discussed in the SEQ Market Update, this lack of housing supply can be largely demonstrated by recent data released by Domain which shows that auction listings are down by 29% over the past twelve months, while auction clearance rates have risen to 70%.

Source : Domain - Monthly Auction Report

9 YEAR IN REVIEW 2023

CFMG Capital by the numbers 2023

CFMG Capital Real people.

100% of capital invested has been returned to our loyal investors

4

investment opportunities completed across the CFMG First Mortgage and Income Fund and the CFMG Land and Opportunity Fund

$36M in new capital invested during last financial year

$9.3M of invested capital was returned to investors

730 total residential lots now make up the future Bellmere project

$50,000 donated to charities, local sporting clubs and groups

2300 meals prepared and packed for the FareShare charity

5 new development sites acquired in Logan Reserve, Burpengary, Caboolture and Bellmere

10 new staff members welcomed to the CFMG Capital team

11 YEAR IN REVIEW 2023

Acquisitions Strategy

The key focus for CFMG Capital is to acquire strategic residential development sites that meet a strict investment criteria and enable CFMG Capital to offer attractive residential investment opportunities to our current and future client base.

In order to achieve this, a steady flow of new acquisitions is required, with the primary challenge being to ensure they meet the clearly defined investment criteria underpinning the CFMG Capital development business. This criteria is defined generally below:

• Proximity to a major capital city;

• Population growth and demographics of the locality;

• Proximity to existing and proposed competing land estates (particularly master planned estates);

• Proximity to key planned infrastructure projects;

• Employment opportunities within the locality; and

• Lifestyle choices including schools, family security, transportation and recreation;

In the assessment of potential projects CFMG Capital targets short, medium and long-term opportunities with the view to fill the groups development pipeline from both ends.

Recently here at CFMG Capital we have taken a more considered approach to site identification, focusing our efforts towards opportunities within the South East Queensland market. Particular attention has been given to targeting opportunities located within the Moreton Bay and Logan growth corridors, while also focusing on sites adjacent to, or in the immediate vicinity of existing CFMG Capital communities.

By purchasing adjacent to, or in the immediate vicinity of existing projects, CFMG Capital are able to expand existing projects taking advantage of existing marketing, development and sales momentum, or in some cases replace completed projects to meet the demands of various sales networks.

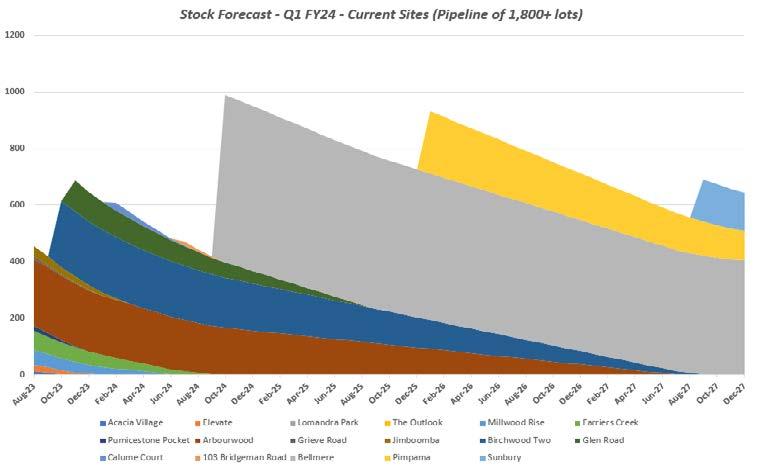

Whilst it is important for CFMG Capital to acquire short and medium-term projects, that can be released into the market over the next couple of years, it is also critical for CFMG Capital to look further into the future and acquire sites on longer-term agreements. This is key for CFMG Capital to future proof the group’s stock supply.

These long-term acquisitions also provide CFMG Capital the opportunity to build future value across these projects by obtaining Development Approvals and/or rezoning, while also allowing CFMG Capital to benefit off the continued growth in residential land values.

During the past twelve months CFMG Capital have managed to acquire short, medium and long-term development sites, over 10 separate transactions totalling approximately 700 residential lots. A snapshot of the Group’s existing development pipeline is shown as follows:

12 CFMG Capital Real people.

Pumicestone Pocket, Caboolture QLD

75 lots Launch: Early 2022

CFMG Capital Project Pipeline

Farriers Creek, Burpengary QLD

115 lots Launch: Early 2022

Arbourwood, Morayfield QLD

240 lots

Launch: Mid 2023

Mallee Grove, Jimboomba QLD

36 lots

Launch: Mid 2023

Riverleigh, Logan Reserve QLD

109 lots

Launch: Mid 2023

Birchwood, Park Ridge QLD

240 lots

Launch: Late 2023

Bellmere QLD

730 lots

Launch: 2024

Logan Reserve QLD

30 lots

Launch: 2024

Pimpama QLD

300 lots

Launch: 2025

Sunbury VIC

150 lots

Launch: 2027

13 YEAR IN REVIEW 2023

Creating real neighbourhoods

CFMG Residential Communities Update

CFMG Residential Communities continues to build a strong portfolio of neighbourhoods across the East Coast of Australia. The team have been focused on selling across a range of South East Queensland communities this year ranging from the Gold Coast up to the Sunshine Coast.

14

Mallee Grove is a residential community located in Jimboomba, south west of Brisbane. The community was launched to the market in May 2023 with a high level of interest from purchasers.

Set amongst a natural parkland, Mallee Grove is a neighbourhood where residents can enjoy being surrounded by nature. With only 36 residential homesites available in the community, and located within the growth corridor of Logan, Mallee Grove is a highly sought-after location.

Sovereign Estates, Rochedale

Sovereign Estates is an exclusive residential community of only 10 homesites located within the suburb of Rochedale in Brisbane. With an average homesite size of 2,000m2, there’s plenty of space for purchasers to design the home they’ve always wanted with room for a pool, tennis court or beautifully landscaped gardens.

With limited land available in Brisbane, this is a unique opportunity for purchasers to build a bespoke home design within 20km of the Brisbane CBD.

15 YEAR IN REVIEW 2023

Mallee Grove, Jimboomba

Choose. Build. Live

BUILD EASY, LIVE FULLY. BUILD EASY, LIVE FULLY. BUILD EASY, LIVE FULLY. BUILD EASY, LIVE FULLY.

All new home constructions for Sunday Living Homes are progressing well with a number of purchasers moving into their brand new homes this year.

Our new display home located at Middleton Park has become popular with our customers to discover the quality behind the homes we build. The Sunday Living Display Home is open Tuesday to Saturday from 10am to 4pm.

16 CFMG Capital Real people.

HOUSE NAME Design 03A Facade A Bed 1 Bed 4 Media Bed 3 Bed 2 Kitchen WIR Ens Ldy Alfresco Dining Living Bath WC Entry Porch Garage 19160 10860 © COPYRIGHT. THIS DRAWING REMAINS THE PROPERTY OF SUNDAY LIVING HOMES & IS PROVIDED FOR THE USE AS DESCRIBED MAY NOT BE USED OR REPRODUCED IN WHOLE OR IN PART WITHOUT WRITTEN PERMISSION. NameArea Living 132.3 m² Garage 36.7 m² Alfresco 10.4 m² Porch 1.5 m² Grand total180.8 m²

Sunday Living Homes continues to grow across our residential communities with a high level of interest from purchasers.

FULLY. BUILD EASY, LIVE FULLY. BUILD EASY, LIVE FULLY. BUILD EASY, LIVE FULLY. BUILD EASY,

An additional Sunday Living Homes Display opened at Arbourwood in Morayfield this year featuring a bathroom and kitchen fit out.

At Sunday Living Homes we understand that building a home can be an overwhelming experience, which is why our pre-packaged home and land bundles make it a simple process for our customers.

17

CFMG Capital Philanthropy

CFMG Capital prides itself on making a contribution to the local community and 2023 has continued this mission with new charities to support.

18 CFMG Capital Real people.

FareShare Volunteering Day

The team at CFMG Capital spent a day at the FareShare kitchen in April to help prepare and pack meals for Australians in hardship. FareShare is a charity that has been cooking free, nutritious meals for people doing it tough since 2001. The CFMG Capital team enjoyed helping out in Australia’s largest charity kitchen and packed over 2300 meals for FareShare.

Guide Dogs Queensland

The CFMG Capital team also took part in a volunteering day at Guide Dogs Queensland in August. The team received a behind-the-scenes tour of the campus, took part in an interactive sensory experience with the guide dog team, assisted with preparing the donation money boxes, and had a Meet n Greet with the Guide Dog puppies.

19 YEAR IN REVIEW 2023

Level 2, 117 McLachlan St Fortitude Valley QLD 4006 PO Box 663, Fortitude Valley QLD 4006 P 1800 155 526 E info@cfmgcapital.com.au cfmgcapital.com.au Real people. Printed: September 2023