3 minute read

Indonesia’s non-bank financial firms could face closures in 2020

INVESTMENT BANKING FEES IN SINGAPORE HIT $868.1M IN 2019

SINGAPORE

Singapore investment banking activities generated more than $868.1m (S$1.17b) in fees during 2019, up 22.1% YoY from the previous year and the country’s strongest annual period since records began in 2000, reports Refinitiv.

Advisory fees for completed mergers and acquisitions (M&A) totalled a record-high $261.4m (S$354.29m) in 2019, up 14.6% YoY compared from 2018.

ECM underwriting fees skyrocketed 90.3% YoY from a year ago to a nine-year high of $208.6m (S$282.73m) whilst fees from DCM underwriting edged up 2.7% YoY to $175m (S$238.14m).

Syndicated lending fees also expanded 10.2% YoY to totaling $222.4m (S$301.43m). Of the three major banks, DBS Group Holdings earned the most in investment banking fees for the year and topped the fee league table with a total of $102.4m (S$138.79m) to clinch 11.8% share of the total fee pool in Singapore.

By industry, financials and real estate tied for the first spot, each making up approximately 27% of the market share. Government and agencies followed, taking up 16% of the share; whilst industrials, as as well as media and entertainment made up 11% and 9%, respectively. Source: Refinitiv

Indonesia’s non-bank financial firms face getting axed in 2020

NBFI’s business models will come under pressure if banks continue to restrict funding, which may result in industry consolidation. Bank Indonesia

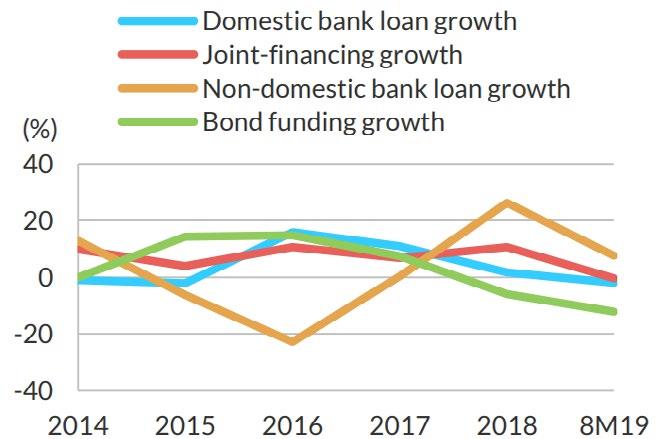

NBFIs face reduced access to domestic funding Source: Fitch Solutions, Financial Services Authority (OJK) INDONESIA I ndonesia’s smallest non-bank financial and leasing companies may be forced to sell, merge, or cease operations altogether in 2020 as regulators move to require these firms to maintain a minimum capital of $7.1m (Rp100b), according to a report by Fitch Ratings. Analyst Roy Purnomo noted that independent companies’ business models are likely to come under pressure if banks continue to restrict funding, which may result in industry consolidation and an increased market share for the largest players.

Non-bank financial and lending companies face funding challenges as domestic banks, the largest source of debt financing for local finance and leasing companies, are expected to remain cautious in extending credit to small and mid-sized independent companies that are not affiliated with banks or automotive entities.

The banking sector’s confidence in NBFIs remains weak following a 2018 default of a local mid-sized company amidst allegations of fraud, Purnomo explained.

In contrast, large finance and leasing companies have been less affected by the funding crunch due to their stronger franchises and access to offshore financing and joint-financing from banks, the latter typically extended to bank-owned finance companies.

Small firms are most vulnerable to the oncoming challenges in the operating environment whilst large firms are well-positioned to handle headwinds in the industry, he added. “The largest finance and leasing companies appear well placed to face headwinds, thanks to satisfactory earnings buffers from wide margins, low leverage, and, in many cases, funding and liquidity profiles that benefit from ordinary support from higher-rated bank or automotive affiliates,” he said.

Slower growth in the sector due to falling automotive sales is also likely to intensify competition amongst smaller players as well as put pressure on profitability and asset quality, Purnomo noted.

This protracted competition could tempt companies to loosen underwriting standards to maintain growth and defend market share. Relaxed macro-prudential measures since 2018 could also lead companies to take on greater credit risk.

“Many have sought to offset lower new-vehicle financing by boosting used-vehicle financing in their asset mix,” noted Purnomo.

“Any asset-quality weakening is likely to be manageable for the largest finance and leasing companies, due to better underwriting standards and risk controls,” he added.