46 minute read

Debates arise on security law’s effects on Hong Kong finance sector

FINANCIAL INSIGHT: BANKS Debates arise on security law’s effects on Hong Kong finance sector

Various sources claims that there is a capital exodus from Hong Kong to Singapore, but both markets deny it.

Amidst all the ruckus brought about by the Singapore according to a Reuters report. pandemic, tensions have flared again as China will benefit Although customers have been mulling about imposes a national security law on Hong Kong, from growth relocating their money elsewhere, Jefferies Head of which would allow for the establishment of a national as a wealth China FIG Research Shujin Chen doesn’t see a lot of security agency in the city and would criminalise management outflows at the moment. In an exclusive interview, subversion and secession. People across the city and centre as she said that whilst clients have been moving their around the world raised alarm bells and protesters assets under registrations to Singapore, Hong Kong remains an returned to the streets once more. In response, the management attractive destination for foreign money, especially United States government has stripped Hong Kong of flee Hong Kong. from the mainland. its special status, a move which will further jeopardise “There are still quite a lot of inflows to Hong Kong. the city’s image as a global business hub. We do hear from banks that some private banking

Hong Kong has been struggling to keep itself clients move their registrations to Singapore. But Hong attractive to foreign businesses ever since the antiKong’s capital market is more mature and it has more extradition protests began in 2019. Banks’ asset exposure to Mainland China where a lot of investors qualities have taken a heavy beating and the COVIDwant to invest in,” Chen explained. led economic downfall made it worse. As a result, Alicia Garcia-Herrero, the chief economist for Asia some have seen increasing enquiries about moving Pacific at NATIXIS, also expressed concern about capital to other Asian countries like Singapore. private banking clients “as wealthy individuals may not feel fully protected,” she said. Money moves Nevertheless, if China goes ahead with the security Talks about capital flight were first reported in early law, the US could conduct more actions on the banking June when HSBC, Standard Chartered and Citigroup sector. Commercial banks with more overseas business, saw spikes in enquiries about offshore accounts, including those that help firms go abroad under the with Singapore, Sydney and Taiwan as the popular One Belt One Road projects, may be more affected, destinations. In particular, HSBC and Standard Chen told Hong Kong Business. Chartered have seen enquiries surge by 25-30%, Moreover, Garcia-Herrero thinks Hong Kong banks

Citigroup is one of the banks that got a bulk of enquiries about offshore accounts in other APAC markets.

The Monetary Authority of Singapore debunked reports on a number deposits flocking from Hong Kong.

will diversify their operations further into the rest of Asia, but mainland banks operating in the city will not see a major difference.

Singapore as main beneficiary?

The Lion City is said to be gaining from the supposed capital outflow from Hong Kong even with denials from analysts and regulators of outflows happening in the first place. A UOB Kay Hian (UOBKH) analysis revealed that non-resident deposits jumped 43.8% YoY to $44.6b (S$62.1b) in April, with overall deposits for domestic banking units (DBUs) rising 13% YoY in the same month because of individuals’ “flight to safety”.

“Singapore will benefit from growth as a wealth management centre as assets under management (AUM) flees Hong Kong and repositions in Singapore,” UOBKH analyst Jonathan Koh wrote.

The spike in bank deposits likely stipulates the deleveraging of private banking portfolios and increasing risk aversion as Hong Kong’s political woes go on, according to a Bloomberg Intelligence analysis.

But just like its Hong Kong counterpart, the Monetary Authority of Singapore (MAS) came out to dispel reports of capital inflows, saying that currency deposits have actually risen since 2020 began but “have come from diverse sources and for varied reasons.”

Whilst Garcia-Herrero thinks that Singapore is “clearly” benefiting from all the events unfolding in Hong Kong, she cautioned that the degree of relocation might not be as large.

“Whatever is Mainland-related will remain in Hong Kong and this is the bulk of Hong Kong’s financial transactions even today. This is particularly true for IPOs and bond issuance but less for syndicated loans,” she said.

On the other hand, Chen noted that it is hard to say whether Singapore or other Asian markets would gain from the money exodus from Hong Kong or from the mainland, as the Chinese market

Eddie Yue

Alicia Garcia Herrero

Shujin Chen

is too big and Hong Kong enjoys much greater freedoms regarding capital restriction.

In addition, relocating business may prove to be an ordeal for Chinese banks but they may still try to move their US operations to Hong Kong or to the mainland. The process may be even harder for Hong Kong banks as they have nowhere else to go, she said.

Banks unfazed

Whilst the general consensus is that the security law symbolises China’s deep-seated attempt to ensnare Hong Kong once more, some financial institutions are not that worried about its potential implications on the wider monetary system.

The Hong Kong Monetary Authority (HKMA) opines that the law should not bring forward any fundamental changes to the city’s monetary and financial system. In a 26 May statement, chief executive Eddie Yue assured that the Article 112 of the Basic Law will preserve “the free flow of capital and free convertibility of the Hong Kong dollar” and that the banking system has strong capital positions, adequate liquidity, good asset quality and a convincing track record in operational resilience.

“The Hong Kong dollar exchange rate has remained stable and on the strong side of the convertibility zone. Interest rates have stayed low. Financial markets have also been operating in a smooth and orderly manner. There has not been a noticeable sign of fund outflow from either the Hong Kong dollar or banking system,” he said, adding that the regulator will be on the lookout to allay “unfounded rumours.”

One week later, on 2 June, Yue came out again with a statement after the US government announced that it is ending its special treatment of Hong Kong. He reiterated that the HK$ market has been “functioning normally” and dismissed reports of fund outflows and shortage of US$ banknotes amongst certain bank branches. Regarding the sustainability of the Linked Exchange Rate System (LERS) and whether the US can revoke it, Yue stated that the best approach in keeping confidence in the system is “to stick to facts and uphold a high degree of transparency.”

“Hong Kong’s financial sector continues to display strong resilience in adversity: the Stock Exchange of Hong Kong (HKEX) continues to be the world’s top listing destination, turnover of the Shanghai-Hong Kong Stock Connect has doubled, and that of the Bond Connect has tripled. All these are testaments to Hong Kong’s edge as a dominant gateway to the Mainland,” he wrote.

The Bank of China (Hong Kong) believes that the formation of the security law “will help restore social order and the stability of the business environment.” The bank explained that the security law, under the current “one country, two systems” principle, will clear the path for the city’s long-term development and bolster enterprises’ and investors’ confidence.

“It will also create favourable conditions for economic recovery, ensure the prosperity, stability and robustness of Hong Kong, and further consolidate Hong Kong’s position as an international financial centre,” told Hong Kong Business.

Regardless of everything that has taken place, Garcia-Herrero opines that Hong Kong’s rule of law regarding commercial transactions is still in good standing which will give the city an edge to prosper even more, in addition to a taxfree environment and full capital account convertibility. She praised HKMA’s move to enact free liquidity requirements for banks, something that may help the industry adjust.

However, despite numerous assurances that everything will be alright, Garcia-Herrero has warned that the security law’s intention not to affect the sector was much easier said than done.

“In reality, Hong Kong’s financial centre is set to be even more focused on the Mainland and, at most, the rest of Asia, but it will not be as global as before,” she said.

Chow Tai Fook outlet in Hefei

Online-to-offline retail model gains ground in Hong Kong

The unlimited operating hours that the internet allows has attracted merchants towards selling online.

Retailers in Hong Kong delivery, whilst Thailand has Analysts noted developed O2O tool in Hong have been facing a steep leaned heavily on this channel. that a tailorKong and Macau earlier in 2020. fall in demand, with retail Hong Kong consumers have made strategy The company shared that sales falling as steeply as 44% embraced food delivery and that caters to these O2O tools helped them YoY in February, according to light cooking,” commented their specific leverage the social presence in data from the city’s Census and Andrea Borelli, the managing concerns and e-shopping and connect with Statistics Department. This has director for Nielsen in Hong needs is vital for their customers effectively driven them to turn to online Kong and Macau. the success. despite business disruption. “We avenues to get by. In the case of As retailers began found that O2O sales channels the food and beverage segment, experimenting with online can lead to higher customer nearly half or 46% of consumers avenues to tap into this demand, trust through private domain in the city are looking to eat at the online-to-offline (O2O) engagement. During February home more often, a survey by model has been emerging to April 2020, our CloudSales Nielsen revealed. amongst businesses. 365 generated higher average

“The shifts away from outFor instance, Chow Tai Fook selling price, higher nonof-home dining to at-home Jewellery Group rolled out gold product mix and higher food delivery, takeaways and an O2O sales channel called conversion than our eShop,” a cooking during the COVID-19 “CloudSales 365”, which was spokesperson from Chow Tai period are locally nuanced built on WeChat Work for its Fook told Hong Kong Business. by traditional consumption frontline and back office staff in They shared that the company habits but also by the different Mainland China to promote and has been stepping up their O2O quarantine and shutdown sell products to their families, integration efforts, aiming to measures by market. For friends and customers through enhance customers’ experience. example, the Japanese have their social media networks. “For instance, we leverage hardly increased ordering food They have also launched a selfthe Group’s physical stores to

Source: Nielsen

deliver online product orders to customers located nearby, so as to shorten customer’s waiting time,” the spokesperson said.

A white paper by e-commerce platform Shopline reflects this as a trend, revealing that over half of Hong Kong merchants on the platform already have physical stores, whilst over a fifth or 21.6% are planning to set up one in the future. Similarly, 20% of its merchants are planning to focus on O2O as part of their future plans in the long term, such as opening pop-up stores.

“Traditionally, visiting physical retail outlets in the city’s shopping malls has been a very popular pastime. But since summer of last year, political turmoil in the city acted as a big push for retailers to start experimenting with O2O business models,” Shopline’s general manager Plato Wai said.

Whilst brick-and-mortar shops would typically close at nighttime, what’s driving merchants to consider O2O is the extended operating hours to sell and operate online. Nearly four in five or 78.3% of the merchants felt that being open all day can give them a competitive edge.

To tide over the current uncertainties in the market, merchants have been opting for multiple channels.

One in five or 20% of the merchants are selling on Facebook, and a few others are selling on other platforms. For their future marketing plans, 90% of the respondents plan to use social channels for marketing, followed by SEO (51.6%).

Plato Wai

Simon Haven

Growing online and-mortar shopping paradise” In general, one strategy that has for the foreseeable future, and been key for local retailers in Euromonitor is not expecting any order to cope with the changes significant shift toward online sales in consumer demand driven in the city for the next six to 12 by the pandemic is the shift months. “The next 12 months are towards online sales, commented expected to remain challenging for Euromonitor international’s the industry as a whole, and times senior analyst Simon Haven. of crisis are not generally seen as

“Although not all retailers have favourable for major investments the necessary infrastructure to and change in strategic direction make a total shift toward online for companies,” he said. sales, those that have been able Still, merchants are expected to go are faring better than others,” from offline to online in the longer Haven said. term. “Over the next two to three

However, the crisis has years, as the industry recovers, highlighted that many retailers there will be a growing incentive to have not yet been well-equipped shift toward online and become less to venture into the e-commerce reliant on physical traffic in-store,” era, he added, citing long Haven said. queuing times, websites that have On top of the push factor caused issues handling the increased by the pandemic, the cost of traffic, and products quickly expanding stores physically might going out of stock experienced also encourage further digital push by the city’s stores. Further, for the retailers. the online shopping market in “In Hong Kong, opening a Hong Kong is still considered physical shop is costly in terms to be relatively small. Wai cited of rent and labor costs, whilst the the high density of shopping cost of operating an online store is malls and advanced transport much lower,” Wai noted. connectivity in the city, which Looking forward, the city’s enables easy access to physical revenue from e-commerce is tipped shops, as one of the biggest to grow at an annual rate of 6.8% challenges hindering the from 2020 to 2024, which would development of Hong Kong’s result in a market volume of $7.16b e-commerce market. As a result, by 2024. “With customers no analysts noted that a tailor-made longer venturing out for shopping strategy that caters to their and food, e-payments and last specific concerns and needs is mile delivery has never been more vital for the success. important. Customers have become

Haven expects Hong Kong more comfortable and familiar with to likely remain a “bricke-commerce,” Wai said.

Budget allocation for online ads will rise whilst offline sinks

INTERVIEW Meet ZA Bank, Hong Kong’s first virtualonly lender

The bank’s slogan of co-creation belies a strong charm offensive of attractive deposit rates.

The first half of 2020 saw the dawn of a new era of Due to an banking in Hong Kong, with the city’s virtual-only efficient lenders kicking off operations. The recent lockdown operating resulting from precautions amidst the pandemic outbreak model only further fueled digital banking take-up. In fact, a survey and lower by the Finastraexpects that almost a third or 28% of Hong operating Kong’s adult population will own a digital bank by 2025, cost, ZA Bank with around 760,000 people forecasted to open a virtual-only can provide account in the next five years. For Finastra, whoever emerges attractive on top will depend on which of the eight digital-only banks pricing to its would be the quickest to establish operations in Hong Kong customers. and the first to do so is ZA Bank, that has no plans to focus on cooperation rather than competition. This is a thought reflected on its slogan ‘“Be Different, Together.” “ZA Bank does not see other virtual banks as competitors. On the contrary, we hope to promote financial inclusion together with them, to foster the development and innovation of the banking industry,” Rockson Hsu, CEO of ZA Bank, stated.

The brainchild of ZA International—the business development platform of Chinese online-only insurance platform ZhongAn Online— instead highlights its operating model, which is centred on co-creation with its clients.

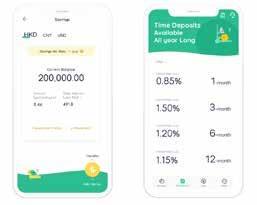

But as every business man knows, it’s the silent competitor that often proves to be the most deadly, and ZA Bank has definitely launched a strong charm offensive to mark its entrance in the industry. In January, the bank offered a competitive introductory rate of 6% for deposits capped at $200,000, over 3 percentage points more than established banks such as HSBC, Standard Chartered, and Bank of China Hong Kong. Currently, ZA Bank offers a savings rate of 1% for a deposit value of up to $500,000, compared to the 0.001% general savings deposit rate.

Hong Kong Business caught up with ZA Bank CEO Rockson Hsu to learn more about ZA Bank, it’s goals for the future, and outlook for Hong Kong’s virtual banks.

Tell us more about ZA Bank. What have you been up to since you first launched?

Unlike traditional banks, ZA Bank provides users with a full suite of services, 24/7. These services include efficient mobile banking facilities, such as remote account opening, multicurrency savings accounts, time deposits, local transfers, and e-statements

The structure of ZA Bank is relatively simple, and it has strong innovation capabilities. We can quickly respond to market needs with innovative products. ZA Bank does not have any physical branches. Due to an efficient operating model and lower operating cost, we can provide attractive

ZA Bank CEO Rockson Hsu

pricing to our customers. For example, savings products with attractive interest rates. Because of our commitment to financial inclusion, we do not impose a minimum savings balance requirement or any maintenance charges.

With its community-driven approach, ZA Bank has prioritised the rapid launch of its innovative capabilities that align with customers’ changing lifestyles. In March 2019, a community known as ZA Fam was established by ZA International, in which members are invited to participate in ZA Bank’s product development and design processes, thus guiding ZA Bank to create innovative products and services to better serve the needs of Hong Kong users.

Tell us more about your products and services. What services does ZA Bank offer, or plan to?

For individual customers, we provide savings deposits, time deposits, loans and transfers. We launched ZA Savings Go, a flagship savings product on 24 March. With ZA Savings Go, we offer a savings rate of 1% for deposit balances at $500,000 or below, whilst base interest rate will be applied to deposit balances exceeding $500,000 .

Time deposits offer multicurrency deposits, including HKD, RMB and USD. Minimum time deposits start at just $1 and the range of tenors is flexible from one month to one year.

We also introduced Hong Kong’s first-ever 30 Minutes Pledge for our loan service. From submitting the complete set of information and documents to receiving the application

ZA Bank mobile app

Source: ZA Bank mobile app

results, the whole process will be within 30 minutes. Should any applicant have to wait for more than 30 minutes, we will provide a cash rebate of $10 for every minute of overtime until the application result is provided to the applicant, with an upper limit of $500. There will also be a seven-day cooling-off period for ZA Personal Loan, during which users may choose to repay early without incurring any early repayment charge.

Regarding fund transfers, the Faster Payment System (FPS) offers round-the-clock instant fund transfers with no service fee. With just a mobile number, email or QR code, users can transfer HKD and RMB. We also support “5 seconds recall” in case users transfer to the wrong account. Users can also transfer USD to other local banks through “CHATS”.

Can you give us an estimate of when you believe you will start making a profit?

We have set a “Five-year Plan” for our future development, one of the targets is to break even within the period. As an important initiative of the fintech reform and innovation in Hong Kong, virtual banks aim to lower the entry barrier of banking services by fintech, to cover more people with different financial needs.

How has ZA Bank been received by the public so far? Can you reveal some numbers?

ZA Bank has been well received since our official launch on 24 March. Notably, since we launched the promotion campaign riding on the Government’s cash payout scheme “I Want 11K” in late May, the number of new customers grew faster than we had ever seen.

A month after our official launch on 24 March, we published the data of our first batch of customers. Surprisingly, our youngest and oldest customers are 18-year-olds and 87-year-olds, respectively. As of the end of May this year, the oldest customer we have is 93 years old. This interesting data showcases that virtual banks could be an emerging service that brings innovative user experiences to different age groups. On the gender perspective, we found that the ratio of men to women is about two to one.

Has the pandemic affected your operations, or led ZA Bank to reangle its strategies and goals? If so, how?

As a virtual bank, ZA Bank has no physical branches and

ZA Bank’s ultimate goal is to make banking and financial services more user-friendly and support Hong Kong’s underserved population.

can open accounts and conduct transactions online. Our customers can enjoy 24/7 banking services anytime, anywhere, only needing a mobile phone and their Hong Kong ID card, and account opening can be completed in only five steps. Customers’ mobile phones become their personal branch. Our digital-only service covers the most basic multicurrency savings accounts, time deposits, local transfers, and electronic statements, amongst others. Therefore, pandemic or not, our users can always use the banking service on their phones, without leaving the house.

Since the beginning of this year, we began to conduct risk assessments and prepare contingency plans to minimise the impact of the epidemic. Right after the Chinese New Year holiday, we asked all employees to work from home, even after the public holidays. At the same time, we already made a good deployment of hardware, so that every colleague can work remotely through the intranet and their laptops at home. ZA Bank operates as usual during the epidemic period, to provide customers with 24-hour banking services.

If possible, can you share with us your future projects and plans you have in store in the coming year?

Currently, we are still focussing on the Hong Kong market, as there is still quite a journey for Hongkongers to take before they fully embrace virtual banking and fintech in everyday life. We will focus on nurturing the local users for the time being. We are putting customers at the heart of our product design to solve their pain points and allow users to enjoy offerings that break the traditional boundaries of time and conventions.

Our ultimate goal is to make banking and financial services more user-friendly and support Hong Kong’s underserved population, which will in turn accelerate fintech innovation in the city and, at the same time, encourage traditional banks to up their game in Hong Kong. Ultimately, this will help to build the Hong Kong economy for the benefit of all consumers.

What is your outlook on Hong Kong’s virtual banks for the next few years?

Hong Kong’s fintech sector is growing fast. With the full launch of other virtual banks in Hong Kong this year, as well as traditional banks beginning to embrace AI and cloud technology, fintechs are set to disrupt the traditional model of financial services and blur the lines between different sectors.

At the same time, traditional banks are expected to adopt more technology-based solutions to manage costs and achieve operational efficiency amidst a rapidly evolving and increasingly competitive industry landscape.

As we look to the financial industry’s future, one thing is certain: change will be the only constant. The broad themes we are predicting are around the changing nature of risk, a more competitive environment and increasing digital transformation, all underpinned by a focus on data.

The development of virtual banks in Hong Kong will promote fintech application and innovation, enabling the expansion of banking services to people with different financial needs, to foster financial inclusion.

The Hong Kong Science and Technology Parks Corporation teamed up with one of the Hottest Startup Genvida for R&D in sensor technology.

Startup funding goes low key amidst

COVID-19 and social unrest

The total value of startup deals hit $9.84b, a 39% drop compared to last year.

Venture capital (VC) firms are starting to ($1.16m), Zhenhub ($1.16m) and Bookairfreight hold back on injecting funds into startups as ($777,725) Overall, the average funding of these 17 economic uncertainties continues to threaten startups is at $8m. Hong Kong’s financial stability. But despite this, it is “It’s been a tough last year for Hong Kong in general business-as-usual for some startups and VCs. due to the political climate and protests which caused

In this issue of Hong Kong Business’ Hottest Startups, some uncertainty in the economy,” said Betatron’s we identified the 17 biggest disclosed and early-stage venture partner Sam Ameen. funding rounds between Q2 2019 and end-Q1 2020, by startups that are not more than three years old. Sam Ameen “It’s certainly caused a knock-on e ect for our startup ecosystem with investors becoming more risk-averse.

On top of the list is indoor mapping startup Mapxus, ey have been closely monitoring the situation before also known as Maphive Technology Limited, which committing to deploying capital.” clinched $23.28m in a seed funding round led by For the whole of 2019, data from the Hong Kong Beyond Ventures last November. Venture Capital and Private Equity Association

Coming up at second place is gaming firm Area28 (HKVCA) showed that venture capital (VC) firms Technologies with a $16.69m seed funding from Vectr participated in 58 startup funding deals, which totalled Ventures and Alibaba Hong Kong Entrepreneurs Fund, $9.84b (US$1.27b). This was a 39% drop compared to followed by fashion edtech startup MOTIF which $16.2b (US$2.09b) in 2018, despite having fewer deals, secured $15.52m. Denis Tse 51, in the prior year.

Proptech startup HOMI Smarthome came in at fourth “The fund-raising activities were active particularly in place, with a $13.19m funding, whilst rounding up the the first nine months of 2019. But the situation turned top five is business spaces booking platform Booqed, around since October 2019 due to the social movement which secured $13m in funding. in Hong Kong especially the implementation of anti

Other notable startups are OneOneDay ($10.09m), mask law and the siege of the Hong Kong Polytechnic Genvida (10m), OliveX ($7.76m), Volt14 ($7.41m), University in October and November 2019 respectively,” Carnot Innovations ($6.21m), enabot ($3.88m), ZuBlu Lap Man, co-founder and managing partner of Beyond ($2.33m), Wizpresso ($2m), GitStart ($1.16m), Neufast Ventures, told Hong Kong Business.

Industry breakdown of startup investments

Source: HKVCA

In addition, HKVCA noted that H1 2019 had 31 deals with a total deal amount of US$872.1m. Comparably in H2 2019, it only saw 27 deals garnering US$399.73m.

“In 2018, you saw big fundraising rounds. So they’re very cashed up right now and have been executing for quite a while. There have been some political barriers raised by the US government in relation to what they call ‘the blacklisting’. But given that they have already raised significant rounds in 2018, [startups] have been able to execute quite well,” said Denis Tse, founding managing partner of Asia-IO Holdings.

Rising government support

Despite the drop in funds injected into Hong Kong, the government has been showing continuous support for deeptech startups. “We still see some deals in HK initiated by VC Funds and co-invested by those VC Funds and HKSAR Government,” Man added.

“The government has been quite supportive in two separate directions: through co-investing with a few of these venture managers by means of a formalised co-investment programme; and also the government indirectly through their secretary bodies and affiliated organisations have also set up their venture funds,” Tse, of Asia-IO Holdings, stated.

One of these funds is the Innovation and Technology Venture Fund (ITVF), which serves as a co-investment vehicle that goes alongside selected VC funds as coinvestment partners. They invest in local I&T startups at a matching investment ratio of approximately one to two.

In the first batch, it co-invested in seven deeptech startups in H2 2019. In HKB’s Hottest Startups list, there are three startups that received indirect funding from IVTF, namely, Mapxus, Genvida and enabot. The funding scheme was due close applications for another round of funding on 31 March.

In addition, the Hong Kong Budget last February mentioned that $380m of the $30b fiscal stimulus would be used to subsidise the rents of Hong Kong Cyberport and Hong Kong Science & Technology Park’s tenants.

Banks adopting blockchain

Even though there have been no big funding rounds in fintech lately, Ameen stated that blockchain startups have been getting a lot of attention as banks turn their heads toward technology investments. “Every bank and most large financial institutions are assessing blockchain

Lap Man

Alfred Lam

opportunities right now—whether that’s a direct investment or integrating blockchain into their internal operations.

“I see this trend continuing given the favourable regulations in Hong Kong compared to other jurisdictions around the world,” Ameen added.

Apart from blockchain, Man observed another trend amongst startups. “Those Chinese companies producing products, such as fast-moving consumer goods, beverage, cosmetic and electronic appliances, leveraging the China brand. These goods used to be monopolised by the Western brands,” Man stated.

He noted that in the past one or two years, the quality and design of those products and services are catching up or even outperforming those Western brands with more competitive prices.

“Chinese investors tend to look at Hong Kongbased ventures run by Hong Kong founders, or in other instances, Hong Kong-based entrepreneurs that have been actively reaching out into the China market. So there has to be some connectivity already between the entrepreneurs. They have their attention on the China market” Tse explained.

Alfred Lam, research and policy director of HKVCA, is also expecting to see more online tutorial platforms in Hong Kong and China as education technology has become an attractive segment for retail investors.

VCs also mentioned other underserved verticals have been gaining traction, including insurance technology, healthcare technology, biotech and life sciences, logistics, supply chain, and marine shipping.

1. Mapxus

Founders: John Chan, Ocean Ng Funding: Mapxus (Maphive Technology Limited) has raised $23.28m (US$3m) in funding over a seed round in November 2019, led by Beyond Ventures. Start of operations: 2018

AI startup Mapxus brings the location technology commonly developed for outdoors to indoor spaces through its indoor mapping technology platform. The startup digitises indoor navigation by providing a ready-touse software development kit so that business organisations, government bodies, and social enterprises alike can build city-based indoor map applications for public sharing. In July 2019, the startup became part of Apple’s Indoor Maps programme, providing indoor mapping services to enable app development for iPhones and iPads.

2. Area28 Technologies

3. MOTIF

Founder: Tony Zander Funding: Area28 Technologies bagged $16.69m (US$2.15m) from a seed round in December 2019, led by Vectr Ventures and Alibaba Hong Kong Entrepreneurs Fund. Start of operations: 2017

Gametech startup Area28 develops a collaborative Googledocs-like platform for game developers. The firm claims to be the first and only cloud-based game engine. Area28’s Content Development Suite (CDS) feature enables realtime collaborative development amongst dispersed game developer teams. It also eases game builders’ workflow by allowing game testers to play multiple iterations. The platform is also said to feature stakeholder reviews, where game studios can track the progress and feedback of the individual aspects of the development process.

4. HOMI SmartHome

Founder: Amar Dhillon Funding: In July 2019, HOMI SmartHome raised $13.19m (US$1.7m) in a seed round led by Singapore-based investors SeedPlus, AngelCentral, and Xoogler Angels. Start of operations: 2017 HOMI SmartHome is a consumer IoT services company that provides smart home services across Asia. It offers consolidated smart home systems with consultations, installation, and 24/7 customer support and charge their customers for as low as $2 a day. The startup’s products include a wide array of products such as light switches, smart locks, cameras and modules. It comes with an app for efficient management of these smart home devices. Their installation services can take no more than three hours.

Founder: Alvanon Global fashion innovation company Funding: In November 2019, MOTIF secured $15.52m ($2m) in a seed round from The Mills Fabrica. Start of operations: 2017

Started by global fashion innovation company Alvanon, MOTIF is a fashion industry-focused e-learning platform for professionals and companies, built to respond to the fast-paced emergence of new skills in the apparel industry. Aiming to close the skills gap in this segment, the learning hub offers eight programmes, which include courses on 3D transformation, apparel costing, and how to run a fit session. They also have courses aimed at corporate HR or business teams that need to make sure employees have sound fundamentals and cross-functional understanding. They plan to add more courses on commercial and soft skills.

5. Booqed

Founders: Charles Oh, David Wong, Ken Huang Funding: In October 2019, Booqed bagged $13m ($1.68m) in a seed funding led by real estate management firm Colliers, US-based seed accelerator Techstars and investment firm Lazard Korea. Start of operations: September 2016

Booqed is an online platform for booking short-term meeting and working spaces with operations across nine cities in Asia. Guided by the goal of making every space attainable for business, the platform facilitates transactions between tenants and landlords, helping tenants find shortterm spaces and aiding landlords in monetising unused spaces. Aside from coworking spaces, Booqed also boasts a mobile app for faster transactions and a concierge dedicated to meeting every clients’ needs.

6. OneOneDay

7. Genvida

Founder: Rick Tsing Funding: In May 2019, OneOneDay secured $10.09m (US$1.3m) in a pre-series A funding round from individual investors such as Tiberius Holdings’ founding partner Rohan Malhotra. Start of operations: 2017

Adtech startup OneOneDay allows users to block out and plays ad videos that the user only wants to see. Its app uses blockchain, artificial intelligence and psychometrics analysis for viewers to register their preferences and replace intrusive ads. It will then put together a ‘playlist’ of ads that users can choose. Watching an ad also allow viewers to earn cash rewards, whilst a part of that revenue goes to charity works. Users may choose on what causes they would like to support.

8. OliveX

Founder: Keith Rumjahn Funding: In 2019, OliveX secured $7.76m (US$1m) in a seed round from Lithuanian strategic investors Alabaster and Anatanas Guoga. Start of operations: 2017 OliveX is a fitness app that utilises artificial intelligence and gamification to help users track their fitness habits. One of its apps is KARA Smart Fitness, which allows clients to exercise with celebrity trainers by streaming pilates, yoga, boxing, and high intensity interval training (HIIT) workouts. Their second app is Ba Duan Jin, which is a Google Play users’ choice award nominee for 2019. It is a gamified fitness app that teaches users the martial art of eight brocades, which is a scientifically proven exercise that improves fitness for all ages, especially for the elderly.

Founders: Daniel So, Chi Yip Ho, Ka Wai Hong Funding: Genvida raised $10m (US$1.28m) in a series A funding round through the government’s Innovation and Technology Fund. Start of operations: 2019

Founded by a group of engineers, biotech firm Genvida aims to help physicians, government officials and the patient themselves make better decisions. Their key product is the Solid State Nanopore Sequencing (SONAS) technology, which offers a fourth-generation nucleic acid sequencing solution. Genvida claims that this tech makes the lowest possible per base and per run cost, assuring high quality results by their systems’ ultrahigh accuracy. It partnered with the Hong Kong Science and Technology Parks Corporation to establish the Sensor Lab.

9. Volt14

Founders: Adam Haldar, Animesh Kumar Jha Funding: Volt14 bagged $7.41m (US$955,000) in a seed funding round on November 2019, from 500 Durians, Hong Kong Science and Technology Park’s venture arm, and Entrepreneur First. Start of operations: 2018

Volt14 is a nanotech startup which develops ultra-high performance materials for lithium-ion (Li-on) batteries, aiming to double the energy densities of mass-produced batteries. They claim that its anodes will accelerate battery energy densities by up to 70%, which eliminates range anxiety of dollar per kilowatt-hour ($/kWh) storage costs by almost 40%. The anodes can be used by any Li-on battery, from 3C applications to defence and space. Volt14 stated that compared to other battery materials startups, they use a wet chemistry approach where a battery producer can use their existing production lines to mass produce their anodes without any manufacturing bottlenecks.

10. Carnot Innovations

11. Enabot

Founders: Ashish Jerry Justin, Chris Choy Funding: In November 2019, Carnot Innovations secured $6.21m (US$800,000) from 500 Startups’ Southeast Asia-focussed 500 Durians Fund, MTZ Holdings, and Entrepreneur First (EF). Start of operations: 2018

Carnot Inovations uses advanced machine learning algorithms to detect and predict maintenance, control logic and operations defects in HVAC systems such as chillers, pumps, cooling towers, heat pumps, AHUs. They assist facility managers to perform targeted defect rectifications at optimal times and ensures persistent energy and maintenance cost savings of over 20%. It also features equipment life and efficient utilisation of operator time and enables AI-powered continuous commissioning.

12. ZuBlu

Founders: Adam Broadbent, Matthew Oldfield Funding: ZuBlu has raised a total of $2.33m (US$300,000) from Betatron. Start of operations: 2017 ZuBlu is an innovative travel platform to search, compare and book scuba diving and underwater adventure travel in Asia. With ZuBlu, divers can make sustainable travel choices effortlessly, whilst actively contributing to ocean conservation. With over 250 eco-friendly resorts and liveaboards to choose from, guests can explore some of the best diving throughout Indonesia, Malaysia, Philippines, Thailand, Pacific, Maldives and the Red Sea. An experience-driven platform, ZuBlu puts the power of discovery in the hands of the user, offering the choice to search the best location based on a desired encounter - from seeing sharks, turtles and manta rays, to diving coral reefs, shipwrecks as well as underwater caves.

Founder: Erika Zhu Funding: Its latest funding round raised $3.88m (US$500,000) in a pre-series A funding round last January. Start of operations: 25 June 2018

Enabot is a technology startup, manufacturing smart robots equipped with artificial intelligence. Its main product Ebo, is a smart robot companion for cats that works in various ways. It can take photos and videos of cats remotely, allows users to interact with their pets, roll and spin around to entertain cats and functions as a trainer. Other features include self-learning AI, automatic docking and charging. In addition, it comes with a smart collar that allows Ebo to monitor cat’s activity and mood trackers. All of these features can be accessed through a mobile app.

13. Wizpresso

Founder: Calvin Cheng Funding: Wizpresso has raised a total of $2m in a pre-seed round raised last March 2019. Start of operations: 2018

Looking to take the pain away from the conventional paperwork, Wizpresso allows investors and analysts collect, benchmark and analyse operational and alternative data online. It uses proprietary machine learning algorithms with search engines across public filings of listed companies in Hong Kong, China and the US. The startup’s CEO, Calvin Cheng claims this also takes the pain away from the fact that some companies do not reveal susbstantial operational data or even alternative data. The platform’s subscription plans are said to have the same costs with a cup of coffee every day, thus complementing their name “Wizpresso”.

14. Gitstart

15. Neufast

Founder: Hamza Zia Funding: GitStart has raised a total of $1.16m (US$150,000) last August 2019 in a seed round led by Y Combinator and Pioneer Fund. Start of operations: 2017

As companies scramble in acquiring the best tech talent suitable for their company, GitStart aims to equip software developers with the necessary skills for firms in need of a specific skillset. Through its AI-powered platform, developers who wish to improve their skills may start with small coding jobs. As they improve, GitStart will then recommend these individuals to companies for full-time hiring. The platform sets a base income higher than the minimum wage. Their CEO Hamza Zia, said that they’ve accepted 200 developers from the launch of their platform and rejected 1,200 at the same time.

16. Zhenhub

Founders: Eric Choi, Sheldon Li, Vince Poon Funding: ZhenHub bagged a total of $1.16m (US$150,000) in a seed round on October 2019, led by Betatron and SparkLabs Accelerator. Start of operations: 2016 Logistics startup Zhenhub enables retailers to execute global logistics operations in one platform, from ecommerce vendor’s search for warehouses, gathering quotes, inbounding products, and to tracking those products after they’ve been shipped. Their free platform allows merchants to manage their inventory, integrate with sales channels and fulfill their orders. Zhenhub claims that they take their users away from messing around in Excel for checking every error. Some of its partners are Shopify and crowdfunding firms Indiegogo and Kickstarter.

Founders: Agnes Wun, Dennis Lee Funding: Neufast Limited has raised a total of $1.16m (US$150,000) last February 2020 from the Hong Kong Science and Technology Parks Corporation (HKSTP) and Chinaccelerator . Start of operations: 2018

Human resources startup Neufast has created a platform that scans a candidate’s CV, matches their abilities to the job requirements, and benchmarks against the skills the candidate should have. It then puts the candidate through an array of online psychometric tests before finally moving to a 30-minute video interview with the hiring manager. This technology is rooted in the research of I/O psychology and AI computing. assessment needs. After a few tests, it submits the overall performance score to the HR manager, which is said to predict their success in the workplace.

17. Bookairfrieght

Founders: Daisy Jiang, Stefan Vanberg Funding: Bookairfreight has raised a total of $775,225 (US$1m) in a seed round in October 2019, led by VC firm and startup accelerator Betatron. Start of operations: 2018

Bookairfrieght calls themselves a one-stop freight solution for SMEs. They provide instant quotations, transparent pricing and trackings. They also cover up to US$10,000 on insured value and offer compensation for late deliveries. The startup’s platform carries a network of tier 1 freight forwarders across 51 countries and its transparent pricing service lays out wholesale air freight rates before clients are committed to a purchase. Its Instant Quotation feature claims to save 72 hours of clients’ time and that their rates are 20% cheaper than other air freight booking platforms.

Hong Kong Disneyland made salary cuts to some of their senior managers last April.

Pay cuts, salary stagnation await workers in post-pandemic workplace

Salary hikes will be few and far between as firms grapple with COVID-19’s sudden impact.

When Matthew’s employer home setup due to the coronavirus In the worst different from other countries. Unlike asked him to work from pandemic. “Historically, Hong Kong case scenario, in other jurisdictions, the Hong home late in February, the hasn’t had a huge ‘flexible working’ if economic Kong government has not imposed father of two was initially jubilant. “I culture. Because most firms were conditions mandatory rules in relation to workplace thought it was great to have more time forced into it to get some productivity continue to arrangements for employees in the to spend with the kids,” he shares. But outcomes during the work from deteriorate in private sector. However, compared with as the coronavirus pandemic ran its home period, most are realising it is a Hong Kong, other Asia-Pacific countries, Hong Kong course, Matthew found himself longing really good thing and a huge retention firms may has also reported fewer wide-scale layoffs for the comfort of the office. “Keeping factor for their millennial workforce,” trigger their and retrenchments. productive at home was difficult—my notes Sharmini Wainwright, senior redundancies in A survey by Wills Towers Watson kids would sometimes smash my managing director at Michael Page December and revealed that only 2% of employers keyboard or ask to watch videos while Hong Kong. “I think this is one January. in Hong Kong state that they will I’m working.” of the best outcomes to come out implement salary reductions, compared

Soon, though, he had no choice but of the pandemic as it has forced to a staggering 18% in neighbouring to find a way around the distractions. organisations to embrace technology Singapore. Meanwhile, 7% of employers He ended up exclusively working and flexible working solutions. in Hong Kong are mulling layoffs. from home for over six weeks, and his However, Hong Kong does have one And although there have been a few employer has implemented a reduced significant constraint in that most high-profile redundancies—such as work week once restrictions were lifted. people live in apartments without the Sa Sa Cosmetics, which axed 3% of its “I don’t mind working from home, but luxury of having a designated ‘study’ 2,500-strong workforce and reduced pay it’s hard to juggle it all with childcare, area,” she adds. by up to 40%—experts expect that the amongst other things” he says. job market will remain relatively resilient.

Matthew is one amongst thousands Corporate cost-cutting “Whilst we have seen a small portion of Hong Kong workers who had to Hong Kong’s experience of the of layoffs, it has not been as large scale rapidly transition to a work from coronavirus pandemic is significantly as we expected and to some degree,

challenging period with support, with if economic conditions continue to deteriorate in Hong Kong, firms may trigger their redundancies in December and January.”

KPMG’s latest executive salary outlook reveals that more hiring managers expect headcount to be reduced in 2020. The wary sentiment was especially pronounced in the consumer markets and real estate sectors, where 41% and 27% forecast headcount reductions as compared

looking at cost management strategies, Top strategic priorities for Hong Kong CFOs in financial services In 2020 we found that redundancies and workforce reductions are not the first actions that organisations necessarily choose to take. Common alternatives include hiring freezes, furloughs, reduction in benefits and limits on Murray Sarelius overtime or other expenses,” explains Edward Hsu, leader of data services and compensation software for Asia Pacific at Wills Towers Watson. “Some organisations are also considering enacting early retirement programmes. Amongst the 73% of organisations that

Source: Hays Salary Survey 2020 Simon Lance would plan to implement other cost reduction measures before redundancy. Hong Kong should benefit from a 2019. Sectors that bucked the Whilst the change is likely to be somewhat ‘V’-shaped recovery that trends included the innovation disruptive, Hsu adds that employers have Mainland China has a chance of and technology sector, where 52% already taken many steps to safeguard achieving,” Generous government expected an increase in headcount, their employees. Many are cutting the subsidies may be a key reason behind compared to 44% in 2019. The higher salaries of their senior staff, including the relatively smaller number of headcount demand for innovation at the CEO level; retail, restaurant, and layoffs in Hong Kong. In recent and technology is likely due to the gig economy firms have adjusted leave weeks, the government introduced a growing reliance and openness of Sharmini Wainwright policies to provide pay to staff recovering range of budgetary measures to keep consumers across the Greater Bay from a coronavirus-related event; whilst employees at work. In particular, Area to use digital tools. tech companies are paying hourly the government has introduced the These forecasts have already started workers impacted by office closures. Employer Support Scheme, where to play out during the height of the “With the evolving situation, business eligible employers will receive a pandemic. In April, Hong Kongpriorities will be reviewed and resources maximum of $9,000 per employee headquartered booking platform will be re-allocated according to per month in exchange for an Klook revealed that it has reduced changing business objectives. For employer undertaking to implement its global headcount and furloughed instance, we can already observe some no redundancies and to spend all a portion of its workforce due to employers focusing on key talent government wage subsidies in paying COVID-19, whilst the startup’s retention and incentivisation, which may wages to their employees. founders will forego pay until the end have a positive impact on business in an

“The government subsidy scheme of the crisis. Meanwhile, cruise ship uncertain environment,” Hsu says. is effective from June through to and casino operator Genting Hong November 2020, and all firms Kong revealed that its top executives No salary growth, no hiring partaking need to make a pledge to will waive their fees and compensation As companies grapple with the scale of not enact redundancies within their from February until the end of the the pandemic, experts warn that there organisation,” Wainwright explains. year, whilst other senior staff will suffer will be minimal to no salary growth this “The best case scenario is that this will pay cuts ranging from 10% to 50%. year. “For corporate professionals, our allow firms to get through the most “With many businesses urgently overall salary growth outlook is minimal. a view of being self-sufficient from December. In the worst case scenario, HK jobseekers prioritise the following non-financial benefits

do not have a hiring freeze in place, 26% to 18% and 8% respectively in Source: Hays Salary Survey 2020

Top strategic priorities for Hong Kong CIOs in 2020

Mid-career professionals who are immediately available and out of work can actually secure some meaningful contract work during this period.

Source: Hays Salary Survey 2020

We envisage that the focus will be more around ‘retaining roles’ than salary growth,” Wainwright notes.

Corporate perks will also disappear in the near future, she adds. “Usually in a normal market these perks are viewed as being very important. I think this challenging period has allowed most working professionals to be grateful for continued employment, hence the lack of ‘perks’ are at the bottom of their priority list.”

This sentiment is echoed by Murray Sarelius, head of people services at KPMG China. “The priority is checking that people are safe and then implementing business continuance plans if they’re available, or working out how to react and cope in the new environment,” he said.

In terms of hiring, experts warn that domestic hiring will grind to a halt during the course that companies ride out the pandemic. “When the pandemic moved from Greater China to Asia, then, globally we experienced both domestic firms and multinational organisations question their hiring needs and prioritise what were viewed as business critical roles,” Sarelius says.

For fresh graduates or entry-level jobseekers, Wainwright notes that despite job prospects currently looking more bleak, some customer service roles may remain open amidst the pandemic. “A number of notable management training programmes have been put on hold and graduate intakes have significantly reduced in size for the typical large hirers. If these individuals have been “flexible” they are likely a natural talent pool for customer service roles, many of which have increased (vacancies) during this period,” she notes.

Job prospects of mid-career professionals vary per industry. Mid career professionals in technology, digital, analytics, procurement, risk, credit and accounting functions are in high demand, due to the nature of work they provide being directly linked (with workload increased) during this pandemic. However, the most impacted professions are human resources, marketing, administration and property. “Mid-career professionals who are immediately available and out of work can actually secure some meaningful contract work during this period, as organisations may have resourcing needs but not be able to commit to a permanent headcount,” Wainwright says.

There remains a silver lining when it comes to hiring during this period. “We have recently seen a strong emergence in hiring activity from Mainland China-headquartered firms in Hong Kong whilst domestic and multinational firms are slower to pick up in their hiring volumes. Within our work portfolio, we currently have the highest number of confidential searches, signifying that a number of organisations are using this pandemic season as a reason to replace and upgrade senior members of their leadership team, particularly in the sales function,” she shares.

The end of the office?

With regard to continued work-fromhome arrangements, employers have the discretion to allow requests for more permanent work from home arrangements, taking into account the health and safety of its employees. “It is advisable for employers to clearly communicate their work from home policy and provide proactive support, such as IT support to make WFH accessible and convenient. In addition, such a policy should clearly stipulate the obligations of both employers and employees during any work from home arrangement,” notes Ken Ng, associate at Baker McKenzie Hong Kong.

But overall, the jury is still out as to whether the pandemic will spell an end to the workplace as we know it. “We are already seeing clients adapt their property plan for their next lease renewal with a smaller property footprint—taking into account that a portion of their workforce will work from home at any day,” Wainwright says. “However, I don’t see such a dramatic change to areas such as the open plan workspace, but no doubt more consideration will be put into the layout and spacing between desks and the amount of people in any one designated area. Again, flexible working helps with this problem.”

Simon Lance, managing director for Greater China at Hays, notes that the pandemic will push organisations to rethink their use of physical office space. “There is some discussion in China about the overall purpose of physical office space, when tasks can be done efficiently elsewhere. Its purpose has progressed beyond just the completion of tasks and there are issues about innovation or collaboration, team culture, and emotional support,” he notes. “I think everyone is still feeling their way about how to integrate that into a company’s operations, but it will perhaps prompt organisations and even entire industries to rethink how they feel and think and plan about physical office space.”

As the pandemic runs its course, both employers and employees should be proactive and flexible. “The advice that I’ve been giving to a lot of senior-level or executive candidates is to rethink how their value to an organisation is going to be perceived in a radically different world. From an executive recruitment position, companies are now extremely interested in someone’s aptitude for ongoing learning and selfdevelopment,” Lance notes.