12 minute read

CHOA PLATINUM SPONSORS

by CHOA

Advertisement

Energy Changemakers In Action

Welcome to CHOA LEARNS: Energy Changemakers!

This year-long series features insightful, interactive talks by technical and business leaders who are shaping the future of Canadian energy. Each event includes dedicated time to network and learn from each other

Let’s get together and learn something new!

16 February 2023

Geothermal

21 March 2023

A Microfluidics-based Approach to Optimizing Heavy Oil Recovery

18 April 2023

Co-Produced Geothermal Power

2 May 2023

I Know my Well is Bent: What Now?

The Energy Changemakers have already delivered four thought-provoking and wellreceived talks The participants have been invited to shape this series by choosing future topics to explore

You can become an Energy Changemaker! Email us topics you are interested in seeing CHOA provide and/or attend one of the upcoming talks of this series.

Energy Changemakers

CHOA LEARNS: ENERGY CHANGEMAKERS

THE NEW ENERGY MAP FOR CANADIAN OIL

Key Insights from Top Consultancy S&P Global

Join us at this outstanding ENERGY CHANGEMAKERS networking event to hear the latest insights from Raoul LeBlanc and Kevin Birn, (S&P Global) into:

How are “Black Swan” events disrupting the trajectories of oil prices and trade patterns?

What is changing for the North American shale juggernaut?

What are early signals from the decarbonization process?

How are these rapidly evolving themes driving oil production, differentials and profitability?

Connect with thoughtprovoking ideas, meet Industry leaders, engage with each other.

21 May 2023

330 PM - 545 PM

Calgary Petroleum Club

Let's lead the way forward together!

REGISTER HERE

The event includes the Annual General Meeting, a short business meeting for members to vote in our next Board of Directors, and complete yearly procedures for the Canadian Heavy Oil Association.

GEOTHERMAL: Is There Any Money in It?

BY TIM MONACHELLO AND PATRICK TANG ATB CAPITAL MARKETS

LEARN MORE ABOUT:

THE ROLE OF CARBON PRICING IN WIDESPREAD GEOTHERMAL DEVELOPMENT

THE TYPES OF CARBON PRICING THAT CAN SUPPORT GEOTHERMAL PROJECTS

STRATEGIC ADVANTAGES OF GEOTHERMAL DEPLOYMENT

ECONOMIC, TECHNICAL AND STRATEGIC FACTORS

In this section, we highlight the major economic, technical, and strategic factors impacting the pace of global geothermal development.

Project economics have been a major hurdle for the advancement of geothermal power developments, especially in areas where there is not a known hydrothermal resource In general, the economics of a geothermal project are a function of the revenue capacity of the project, which itself is a function of: the resource characteristics – most notably the temperature gradient and the flow rates (excluding closed-loop); the project’s revenue streams; the project’s access to carbon credits and government grants; and the market price for power in the region.

… geothermal is a source of renewable, long-life, baseload, dispatchable energy, with new EGS technologies offering the promise of nearly ubiquitous access around the globe over the coming decades.”

“

That said, strategic factors such as energy security and carbon reduction are increasingly playing a role in decisions regarding energy mix. Economics aside, geothermal offers compelling advantages over both renewable and non-renewable energy sources given that geothermal is a source of renewable, long-life, baseload, dispatchable energy, with new EGS technologies offering the promise of nearly ubiquitous access around the globe over the coming decades

Fundamentally, geothermal power production relies on harvesting the heat of the Earth’s core, and higher temperatures translate to higher power generation capacity. However, temperature is a function of depth, so geothermal developers need to optimize for the highest temperature resources at the lowest depths. Additionally, the ability to harvest this heat and bring it to surface, with the exception of closed-loop systems, relies on the presence of an aquifer at depth, and on sufficient permeability of the formation to allow high volumes of fluid to flow to surface – geothermal wells can often produce fluid volumes >10x that of oil and gas wells. Beyond these two factors, which have historically dictated the location where geothermal developments are feasible, proposed projects are increasingly being modelled with ancillary revenue streams, including direct use heating, mineral production, etc.

Temperatures

The bottom-hole temperature of a well, which is a function of the geothermal gradient in a particular part of the world and the characteristics of the well itself (depth), determines how the energy is utilized In general, to generate electricity, the formation must produce fluid (excluding closed-loop systems) sufficiently hot to flash a working fluid efficiently, which is around the 1,100 °C-1,200 °C level, and while higher temperatures offer higher power generation capacity, we understand most flash plants have an optimal efficiency at roughly 1500 °C.

While bottom-hole temperature is generally the focal point when evaluating resource quality, the surface temperature is also important In an ORC power plant, power generation is accomplished by transferring heat from produced fluid to a working fluid.

The working fluid flashes/evaporates and expands, driving the mechanical action of a turbine. To be reused in the cycle, the working fluid must then be cooled by passing through a condenser that can be either air- or water-cooled. Cooler surface temperatures are more efficient at condensing the working fluid given the higher thermal gradient, which effectively increases the generating capacity of a plant. For these reasons, geothermal power plants are generally more efficient in the winter months, though the seasonal variability in power generation capacity is small compared to the seasonality of other renewables such as solar.

“

… geothermal power plants are generally more efficient in the winter months, though the seasonal variability in power generation capacity is small compared to the seasonality of other renewables such as solar.”

When looking to maximize the value of a project, geothermal power developers must choose a resource that has sufficient downhole temperatures (generally above 1,100 °C) and maximizes geothermal heat gradient (difference from bottom-hole to surface temperature) at the shallowest depth possible to minimize drilling costs Moreover, after passing through a power plant’s heat exchanger, hotter produced water generally has higher residual heat, which may increase the water’s viability in secondary direct-use applications.

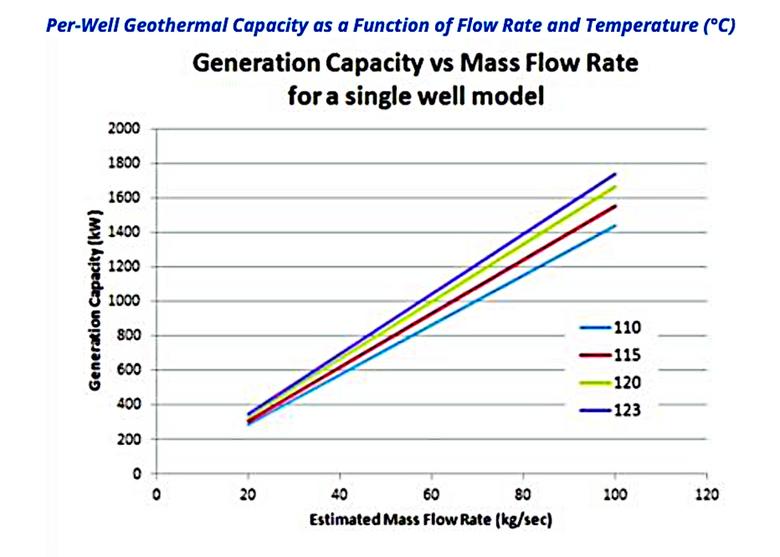

Flow Rates

While higher temperatures determine how the resource is developed, and they and have a positive correlation with the amount of power that can be generated, flow rate is the single largest factor in a conventional geothermal well’s feasibility. Flow rates are ultimately a function of the formation and the porosity and permeability of the rock. To contextualize the typical flow of a geothermal well, at brine temperatures of 120°C, a producing well must flow roughly 300 L/second (~163 mbbl/d) to produce 5 MW using a binary cycle. Figure 27 below illustrates that low flow rates can be a significant bottleneck to power output from a plant, whereas high flowing wells have great potential for economic development. That said, the higher the temperature, the lower the required flow rate.

In areas where the resource is not as prolific, there are certain methods to increase flow rates. The most widely considered is well stimulation – which is similar to hydraulic fracturing in the oil and gas space. When porosity is low, geothermal operators can stimulate the well using hydraulic pressure, which opens fractures in the rock that allow the brine to flow more freely These fractures are often “propped” open by sand or other fine proppants. Beyond stimulation, there has been recent interest in utilizing carbon produced from CCUS projects to pursue enhanced geothermal recovery, similar to enhanced oil recovery in the petroleum industry.

Source: British Columbia Ministry of Energy and Mines

Pricing Mechanisms are a Key Source of Economic Value

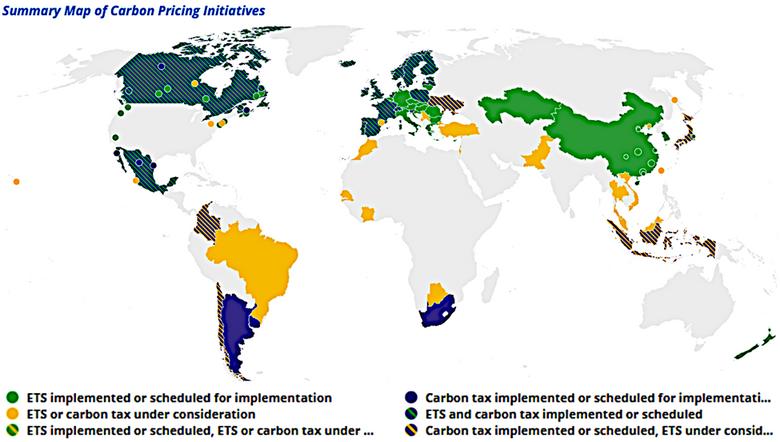

Carbon Pricing Mechanisms are a Core Consideration for Geothermal Developments: Carbon pricing mechanisms are a key revenue stream for geothermal projects and are a major source of economic value. For many geothermal projects, carbon credits and carbon pricing can compete with power generation in terms of economic value contribution for stakeholders. Given the high economic contribution of carbon pricing mechanisms on the economics of geothermal developments, we believe countries and jurisdictions where carbon pricing mechanisms are most robust and where prices on carbon are expected to increase are the most likely areas for geothermal development growth.

“For many geothermal projects, carbon credits and carbon pricing can compete with power generation in terms of economic value contribution for stakeholders.”

For context, our modeling of the No. 1 Geothermal project proposed in Alberta suggests that carbon offsets could represent roughly 31% of project revenue at the current $50/tCO2 price of carbon, with the project generating roughly a 15% IRR over a 40-year period (see Figure 17 for details and assumptions), while the Canadian Federal government’s proposal to increase carbon prices to $170/tCO2 by 2030 would increase the revenue contribution of carbon pricing to 61% (by 2030) and increase the project’s IRR to roughly 23%, which we believe is sufficient for widescale commercial viability.

About Carbon Pricing Mechanisms: Carbon pricing schemes either increase the cost of carbon for emitters or economically incentivize emissions reduction – most commonly, these are in the form of an emissions trading system (ETS) or carbon taxes According to the World Bank, 68 carbon pricing initiatives at the national, regional, and subnational levels have been implemented as of 2022. Overall, these initiatives cover roughly 23% of global GHG emissions (see Figure 28).

Beyond these compliance-type schemes, regulators have also implemented systems for buying and selling carbon offsets or renewable energy credits (RECs), which serve to affix economic value to lower-emitting sources of electricity and/or heating – often overlapping ETSs or carbon taxes. Each of these implementations enable market forces to direct investment and expenditures into emissions-reducing projects. Researchers at MIT and the National Renewable Energy Laboratory (NREL) – among others – have suggested that pricing carbon can be an effective way to reduce GHG emissions. Below, we analyze each system and their pertinence to geothermal developers

Source: The World Bank

Emissions Trading System (ETS)

ETSs are split into two schemes:

Cap-and-trade: In a cap-and-trade arrangement, regulators set an absolute emissions cap for a group – a set of emitters, an industry, or the whole economy – then distributes allowances through an auction or for free to emitters based on a pre-defined set of criteria In this system, emitters that have excess allowances can generate profits by selling to companies struggling to stay within their quota. In many cap-and-trade schemes, the cap is lowered over time to improve emissions performance.

Baseline-and-credit: Baseline-and-credit schemes set baseline emissions intensity levels for individual emitters, and credits are earned from outperforming the benchmark. When combined with a payment-for-results system, the scheme can provide economic benefits to those that make efforts to reduce emissions intensity, or credits earned can be sold to other companies if compliance regulations are put in place. When contrasted with cap-andtrade, which has a hard limit on emissions, baseline-and-credit systems may not directly impact those failing to outperform their benchmark, and there is no guarantee that total emissions will be lower given the absence of a hard cap

In our view, an ETS in either form incentivizes power producers to develop their lower-emitting sources of electricity, which could spur development in renewables, including geothermal. Those that are able to reduce emissions will ultimately benefit at the expense of those that maintain the status quo One benefit of an ETS is that it is not as burdensome as a carbon tax, which virtually guarantees incremental cash outflows for every emitter.

Carbon Taxes

Carbon taxes price emissions directly, and the taxes can be levied on either power producers that generate electricity from carbon-emitting sources (natural gas, coal, etc ), industrial users (i e , users of natural gas in industrial/manufacturing processes), consumers purchasing gasoline or natural gas, or some combination of the three. A main criticism of carbon taxation is that it imposes financial penalties within an economy – regardless of any emissions reductions achieved – which could lead to lower economic activity overall (i.e., deadweight loss), whereas emitters under an ETS may not necessarily be worse off if emissions caps are not exceeded.

“A main criticism of carbon taxation is that it imposes financial penalties within an economy – regardless of any emissions reductions achieved –which could lead to lower economic activity overall (i.e., deadweight loss), whereas emitters under an ETS may not necessarily be worse off if emissions caps are not exceeded.”

Under a carbon tax scheme, power producers are incentivized to shift to renewable sources, which could encourage the development of geothermal power plants Industrial emitters and consumers could also reduce taxes levied against them if natural gas heating is replaced with geothermal district heating. Furthermore, in jurisdictions with carbon taxation, carbon tax revenues are often put to use through subsidization programs for renewables, which could further incentivize geothermal to the extent that geothermal development is eligible for these subsidies.

Carbon Offsets and Renewable Energy Certificates (RECs)

Carbon offsets are commodities that can be bought and sold, with each unit representing a fixed amount of carbon absorbed or prevented from release in some activity. These offsets can be generated through carbon absorption projects (e g , carbon capture and storage) or through the elimination of carbon from a source that normally emits carbon (e.g., renewable energy replacing coal generators).

Depending on the jurisdiction, carbon offsetting may be done on a voluntary basis or a compliance basis, with the latter effectively operating as an ETS. In a voluntary system, companies may purchase offsets to show their commitment to sustainable development or to be able to make claims of low- emitting or net zero operations Emitters in a voluntary system may also generate or purchase offsets with the intention to sell to customers or other end-users. For example, airlines may purchase offsets that consumers can opt into to support carbon reduction.

Renewable Energy Certificates (RECs) are a subset of offsets that are specific to generation projects, representing a fixed amount of electricity that is produced from a renewable source. Similar to offsets, RECs are often sold to end-users to allow them to claim that a portion of their electricity usage as renewable.

“For a geothermal developer, the sale of carbon offsets or RECs can represent a stable revenue stream that improves project returns over a given hurdle rate for investments.”

With both carbon offsets and RECs, there is no guarantee that total emissions will be reduced (in a voluntary system), and such schemes often enable heavy polluters to maintain the status quo. That said, there is no undue financial hardship placed upon emitters, and the sale of units can help finance emissions reduction or absorption projects. For a geothermal developer, the sale of carbon offsets or RECs can represent a stable revenue stream that improves project returns over a given hurdle rate for investments

Carbon Offsets Grants and Credits

In many jurisdictions, governments often offer grants and other incentive structures for companies to fund renewable energy projects or projects that incorporate some degree of new technology that may not be commercially viable at its early stage of development. Often these grants are funded by the proceeds of carbon taxes These grant programs can contribute significantly to the economic viability of geothermal projects. We note some of these sources of funding for Canadian and US geothermal projects below:

Emerging Renewable Power Program: Applications to the Program are now closed, but the fund was aimed at power technologies that were either already commercially established but not in Canada or demonstrated in Canada but not deployed at scale. Under this Program, Natural Resources Canada made a $25 4 mn investment in Alberta No 1 Geothermal and a $25 6 mn investment in DEEP Earth Energy.

Energy Innovation Program: The Energy Innovation Program is managed by the Office of Energy Research and Development and has an annual budget of $24 mn for grants and contributions. Grants are targeted at advancing clean energy technologies, with a specific focus on research, development, demonstration projects, and other related scientific activities. Under this program, grants have been made to Borealis Geocoder ($1 54 mn) and DEEP ($0.35 mn).

Alberta Innovates: Jointly funded by the Department of Economic Development, Trade and Tourism in Alberta and industry partners, Alberta Innovates funds certain renewable and alternative energy projects. Proposed developments that can demonstrate low-emitting alternative electricity generation are eligible for grants from Alberta Innovates. Grants have been made to Eavor ($1 mn through Emissions Reduction Alberta), Razor/FutEra ($2 mn), and the University of Alberta for their Stirling engine technology (similar to the ORC, but the working fluid remains a gas; $0.2 mn). Funding is sourced from Alberta’s Technology Innovation and Emissions Reduction (TIER) system and from the Low Carbon Economy Leadership Fund (LCELF) at the federal level.

Smart Renewables and Electrification Pathways Program: The Smart Renewables and Electrification Pathways Program (SREPs) is funded by Natural Resources Canada and is now closed to new proposals However, with its $922 mn in funding approved for distribution over four years, it aims to facilitate the development of smart renewable energy and electrical grid modernization projects. Through SREPs, Novus Earth has received $5 mn in funding towards its Latitude 53 project.

Renewable Electricity Production Tax Credit (PTC): Established in 1992 and known formally as the Renewable Electricity, Refined Coal, and Indian Coal Production Credit, the PTC is a ten-year, inflation-adjusted US federal tax credit that provides up to $0.025/kWh ($25/MWh) for geothermal power producers, subject to a phaseout after the realized price of electricity exceeds a market- based threshold adjusted upward alongside inflation. We note that other renewable sources (e.g., hydrokinetic, wind, etc.) within the regulation have begun to be phased out altogether, with the applicable credit representing just half or 40% of the base credit. Geothermal – which still earns the full credit – may be subject to phaseout in the future.

Tax Equity Financing Structures:

Available in the US for renewable energy projects, a Tax Equity structure allows tax-laden investors to create partnerships with renewable project proponents whereby tax credits during renewable development flow to the investor, more efficiently offsetting their tax burdens during the early stages of development, and cash flows flow to the project proponent. Later in the life of the project, either after a predetermined time period or after a hurdle rate on investment is achieved, the proportionate allocations change so that the investor receives a smaller share of the tax benefits and a larger share of the cash flows, and often project investors have clauses that whittle down their equity interest in the project over time. These structures allow for more efficient financing options for renewable projects where large tax-laden investors (banks for instance) can invest in renewable projects in efforts to receive the tax benefits, and renewable project proponents can leverage their tax incentives most efficiently to help fund high up-front capital costs.