4 minute read

COVID-19 and the impact of the Suez Canal obstruction

by CILTNZ

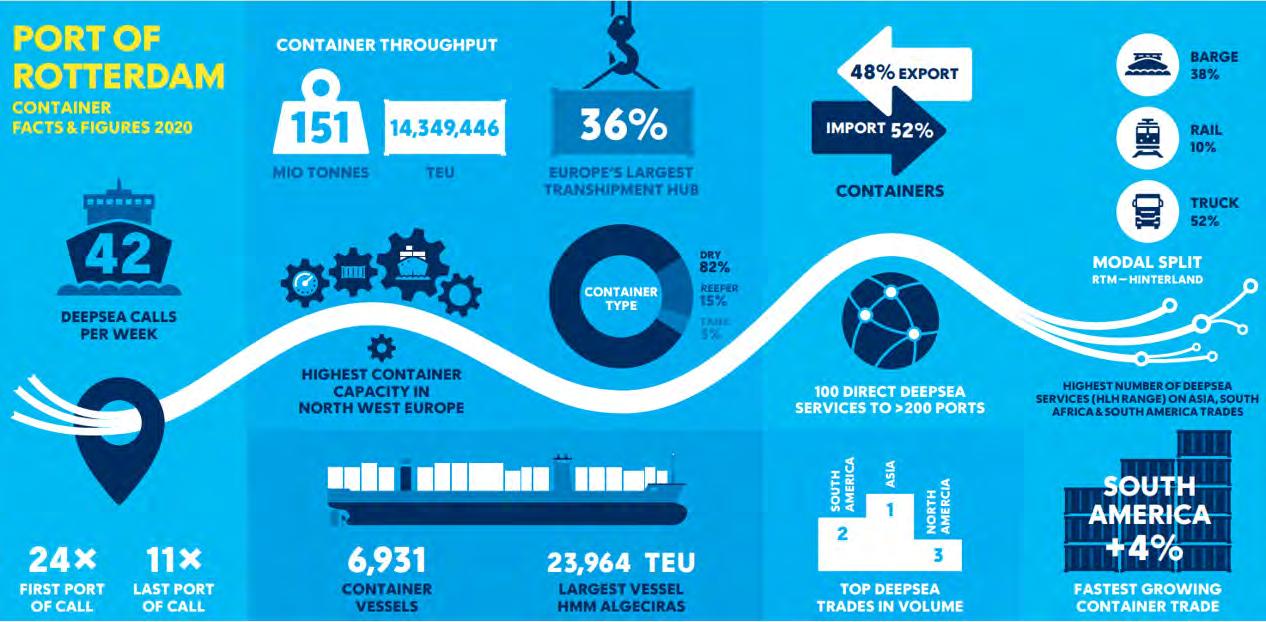

MSC Ship at Port of Rotterdam. Photos : Port of Rotterdam

BY EMILE HOOGSTEDEN

THE PORT OF ROTTERDAM ALONG WITH OTHER PORTS AROUND THE WORLD HAS BEEN IMPACTED BY COVID-19 AND THE SUEZ CANAL BLOCKAGE RESULTING IN DELAYS IN ARRIVAL TIMES OF VESSELS WHICH HAVE LED TO AN INCREASE IN DWELL TIME FOR EXPORT AND TRANSHIPMENT FLOWS.

This combination of events has disturbed supply chain equilibrium and led to an imbalance in empty equipment, and also congestion caused by full and empty containers left in the container yard results in lower productivity in ports and terminals and longer dwell times for containers. Ports and terminals have acted by limiting acceptance of containers (empty, export and, transhipment) to avoid yard congestion, and Port of Rotterdam has worked with other port infrastructure operators (such as depots, hinterland, and regional trade hubs) in order to act as a buffer.

Current Suez situation and action plan

Currently, all vessels (63 excluding the Ever Given) have made their call in Rotterdam. Nevertheless, it will remain very busy for the weeks to come with relief expected around June. This is dependent on efficiency of other modes and improving reliability of deep-sea vessels. The Port of Rotterdam and the port community have taken various actions to limit the effect including additional anchorages for container vessels. Ships were also allowed to anchor closer to the pilot boarding area, allowing swift exchanges with departing vessels. Agents and terminals received a heads-up regarding container vessels with a vertical tidal window as this effects the berth planning. The Coast Guard also allowed bunkering at sea provided the vessel could demonstrate immediate need and weather was suitable. Proactive dredging was instigated during the slow period in anticipation of the ‘Suez Armada’ so that dredging activities during the busy weeks can be limited. Infrastructural works during daytime were, when possible, postponed and we found additional empty depot capacity on request to deal with overflow of boxes on the terminal. Together with terminals and Portbase, Port of Rotterdam launched a website www.portbase.com/suez in order to share information throughout the shipping and port community. In addition, regular sessions with the Logistics Alliance were set up to keep all parties informed on current situation. Other measures that have helped include increased use of night distribution, strategic hinterland hubs, and bundling concepts. Port of Rotterdam also received calls from hinterland operators who actively approached the market to offer support as overflow locations for export cargo and for bundling import cargo.

Cont. on page 4

Longer term plans for optimising the supply chain

Optimising infrastructure in the port area include the on-port road system called the Container Exchange Route. There has also been work undertaken to deepen basins, and new quay walls have been built at Prinses Amaliahaven and Theemswegtracé. Optimising port calls has been managed through the digital platforms such as PortXchange, while hinterland calls have been managed via Nextlogic and data sharing via Portbase datahub, Navigate and Scope. Collaboration between sector players has resulted in the bundling of container volumes in the hinterland and in the port. New agreements with deep-sea terminals regarding call times (fixed windows) and call sizes can further improve the reliability of the container shipping product. Terminals are offering fixed windows, on certain conditions, to support bundling initiatives by means of guaranteed handling times. Small and medium-sized shippers and forwarders are seeking fast, efficient, and sustainable solutions for their supply chain. We believe that transparency of container routeing possibilities will facilitate and optimise the decision-making process of shippers and forwarders and meeting their needs.

Two major trends in recent years

There has been a consolidation of carriers and alliances and we are handling larger vessel- and call sizes.

Causing major impact on port and terminal operations globally and the Asia – Europe trade specifically are: • Fewer port calls and greater peaks; • More pressure on port infrastructure; • Hinterland modes need to match deep-sea scale to avoid congestion and longer lead-times;

• First lockdown led to capacity adjustments carriers by cancelling port calls (‘blank sailings’); • Reopening of economies led to unexpected increase in demand; • Mismatch between surge in volume versus fixed terminal capacity led to delays; • Labour shortage in several ports due to COVID-19 health measures; • Ripple effect of congestion between ports; and • Schedule reliability has dropped drastically. In the meantime, we have the year-to-date figures for January-April 2021 and we see an ongoing increase. We are at 6.3 per cent in twenty-foot equivalent (TEU) compared with 2020 (which equals the 2019 Jan-Apr figures). Asia – Europe volumes are at +11 per cent compared with 2020 (2.443 mio TEU).

Emile Hoogsteden In this role as Vice President Commercial at the Port of Rotterdam, he is responsible for acquisition of shipping line calls and leases concerning containers and other general cargo, logistics, customer relations management and networking.