Elevating Your Business Performance

How manufacturing and distribution leaders are responding to market volatility and creating value.

CITRIN COOPERMAN’S MANUFACTURING & DISTRIBUTION 2024 PULSE SURVEY

How manufacturing and distribution leaders are responding to market volatility and creating value.

CITRIN COOPERMAN’S MANUFACTURING & DISTRIBUTION 2024 PULSE SURVEY

By now you’ve heard the good news: As of Q1 2024, the Federal Reserve successfully produced a soft landing and the United States (U.S.) economy has avoided a recession, which is well-supported by data. Unemployment in the U.S. has been below four percent for over two years. The last time the nation lost jobs on a monthly basis was in December 2020 when COVID vaccines were the stuff of speculation. Consumers are spending feverishly, producing a record Black Friday and Cyber Monday in 2023, flooding TSA checkpoints, and attending concerts irrespective of elevated ticket prices.

As if that was not enough, stock and home prices have been racing higher, producing massive quantities of new wealth for some in the process. By March 2024, major stock indices were repeatedly attaining record highs as corporate earnings remained solid and momentum investing remained a dominant form of capital allocation.

But peer a bit beneath the headline numbers, and several challenges remain. At the top of the list is inflation, which stubbornly remains above the Federal Reserve’s two percent target. While there has been considerable chatter regarding when rate cuts will commence, recent inflation data, whether from the consumer price index, the producer price index, or other sources indicate that inflation may be heating up again rather than subsiding.

With wage pressures abundant in the context of 8.9 million available, unfilled jobs and new supply chain challenges mounting, whether in the form of pirates in the Red Sea or low water levels in the Panama Canal, inflationary pressures remain apparent, leading many economists to conclude that interest rates are poised to remain higher for longer. Under certain scenarios, the Federal Reserve may not cut rates at all in 2024. It is even conceivable that the next move by monetary policymakers will be to raise already elevated rates higher.

Rising prices help explain why so many consumers have been taking on large amounts of high interest credit card debt recently. According to the New York Federal Reserve, by 2023’s fourth quarter, outstanding credit card debt in U.S. stock was at $1.13 trillion. It is still surging. Also rising are credit delinquencies, and not simply in the credit card category.

During the pandemic and early stages of recovery, many American households amassed significant savings. Stimulus payments and rising wages helped, but so too did postponed vacations and fewer visits to restaurants, gyms, and concerts. According to the San Francisco Federal Reserve, American households had amassed approximately $2.1 trillion in excess savings at the pinnacle, meaning savings above and beyond what they would have saved but for the pandemic. Those same economists find that virtually all of those savings have already been spent.

That leaves the U.S. economy is a precarious position. Manufacturers have already felt the sting of some of these headwinds. A prominent measure of manufacturing activity in America, the Purchasing Managers’ Index, has been in contraction territory for more than a year as many distributors and retailers continue to drive inventories toward more comfortable levels. Cost pressures remain abundant. Thus far, many economic actors have been able to pass along their cost increases to their customers. But with borrowing costs remaining high, banks becoming more cautious in their lending, and less savings available to fuel economic expansion, pricing power may subside among many going forward.

All things being equal, that would help the Federal Reserve bring inflation down to its two percent target, but it would also imply broader economic weakness and stunted profitability. That, in turn, could reduce the pace of job growth which would result in fewer consumer outlays, placing further downward pressure on both pricing power and the pace of economic expansion. Phenomena such as low readings on the Conference Board’s Index of Leading Economic Indicators and a yield

curve that has been inverted since July 2022 remind one that smooth economic growth during the quarters ahead is hardly guaranteed.

In short, it is simply too soon to conclude that the Federal Reserve has successfully engineered a soft landing. This rate-hiking cycle may still end with recession. Accordingly, decision makers should pay close attention to available data, such as the information carefully collected and analyzed by Citrin Cooperman in this annual survey of manufacturers and distributors.

Dr. Anirban Basu

Dr. Anirban Basu

Chairman and CEO

Sage Policy Group, Inc.

Citrin Cooperman’s fifth annual Manufacturing and Distribution Pulse Survey was developed from the responses of over 200 manufacturing and distribution leaders, giving us greater insight into current market trends and challenges. In addition to reporting on overall performance in 2023, our survey shares trend lines and offers perspectives on the future outlook for the industry.

Our goal of this year’s survey was to carefully assess where manufacturing and distribution companies stand in light of recent market volatility, garner unique perspectives from top business leaders, and gain insight into the challenges and opportunities the industry faces today.

This year’s survey provides an in-depth look at the major factors that are currently shaping, and will continue to shape, future growth for businesses in this industry including:

• Engaging with and entering new markets

• Introducing new products

• Managing rising costs and interest rates

• Leveraging best-in-class technology

• Stabilization of the supply chain and workforce

Our hope is that this report provides manufacturers and distributors with the information they need to successfully navigate continued market instability, plan for future growth, and improve organizational decision making to support the strategic vision of their business.

John Giordano Partner and Co-Leader

Manufacturing

and Distribution Industry Practice

Mark Henry Partner and Co-Leader

Manufacturing

and

Distribution

Industry Practice

For the fifth year in a row, Citrin Cooperman polled 200+ senior leaders of manufacturing and distribution companies across the nation to measure the health of their businesses in the moment and take stock of future priorities, concerns, and readiness to rise to new challenges. Our findings highlight what your peers report on the industry now and their considerations about what lies ahead.

The 200+ survey respondents hold positions ranging from VP/SVP of operations to CEO and founder.

75% are owners and C-suite leaders.

70% of their companies have revenues between $100M to more than $1B annually.

86% have a physical presence in multiple states domestically.

6 in 10 operate internationally.

More information on the survey methods and demographics can be found at the end of the report.

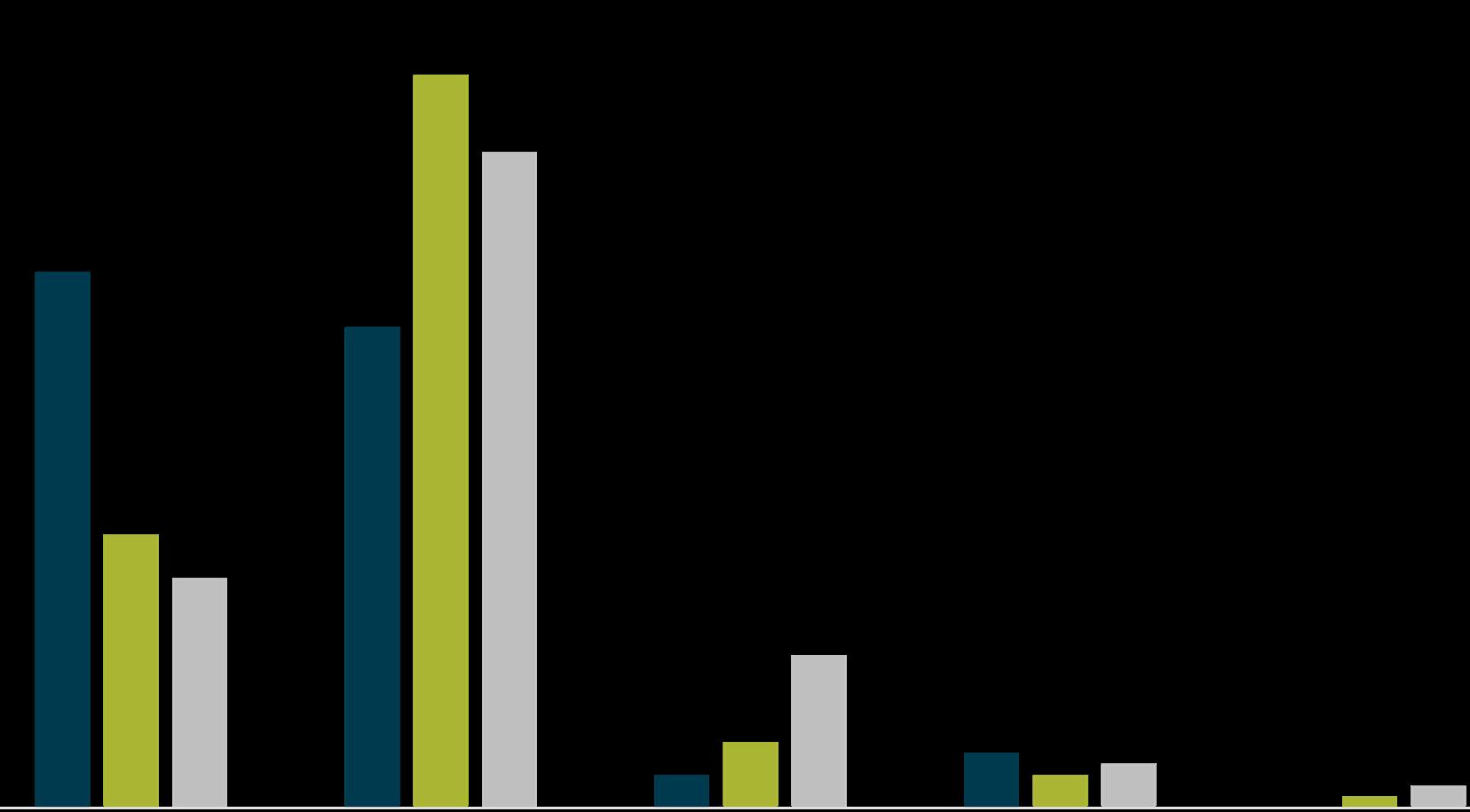

The revenue and earnings year-to-year trend line is exceptionally positive despite today’s inflation/interest rate realities and ongoing concerns. Comparing 2023 to 2022, nearly all respondents report modest or significant growth in revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA). Nearly half say revenue and EBITDA growth was significant. It is no surprise that product performance was also strong, with 84% saying it was somewhat or much better than the prior year.

GROWTH: HOW DID YOUR COMPANY’S

PERFORM IN 2023 COMPARED TO 2022?

How did your company's revenue in 2023 compare to 2022?

DURING 2023, WAS THERE A SIGNIFICANT CHANGE IN PRODUCT PERFORMANCE COMPARED TO 2022?

WHY THE POSITIVE CHANGE IN PRODUCT PERFORMANCE IN 2023 COMPARED TO 2022?

Respondents say the primary reason for better product performance is continued supply chain improvements (30%) and increased demand (25%). Of note, roughly 1 in 10 say their ability to pass on inflation in inventory/supply costs led to positive product performance. Can that continue?

With another strong year of positive revenues/earnings growth and product performance and e-commerce advancements behind them, our survey respondents reflect on readiness for what’s on the horizon. Their responses to challenging headwinds, keys to future growth, actions to remain competitive, and needed upgrades in their businesses follow.

From a list of a dozen common challenges, the top four challenges manufacturing and distribution leaders say their businesses face today are:

48% 30% 41% 22%

Implementation of environmental, social, and governance (ESG) strategies

These challenges certainly reflect the times and the economic environment. Looking forward, the clear majority say that interest rates and the inflationary environment have impacted their spending habits. They also say they expect customer spending to slow in 2024 because of inflation and interest rates. More on that to come later.

Report an increase in the cost of carrying inventory over the last 12 months

Anticipate the cost of inventory will go up in the next 12 months

Report excess inventory

Say the cost of storing inventory increased during 2023

Say employee costs increased in the current year

Say employee costs have increased significantly (the costs of salary and benefits are equally responsible for the rise)

Say accounts receivables turnover and inventory turnover (days to collect receivables and sell inventory) have significantly or moderately slowed down

With one out of two manufacturing and distribution businesses reporting excess inventory, two tax planning options business leaders should consider are last-in, first-out (LIFO) inventory and inventory reserve planning.

In an inflationary time when the cost of the inventory that a business is purchasing is going up, using LIFO will allow you to take the last inventory you bought, typically at a higher cost than the goods currently held in inventory, and use that in your cost of goods sold. This may result in your business paying less in taxes. One of the most important considerations in utilizing the LIFO inventory method is that it must be used on the business’ financial statements, which also may result in less financial statement income.

An inventory reserve occurs when a business has inventory that is not saleable. This causes an inventory reserve to be taken on your financial statements which reduces your profits on your financial statements. An inventory reserve is not deductible for income tax purposes. However, if a business has goods that cannot be sold in normal ways or at the usual prices, due to them being obsolete (i.e., style, damage, imperfections, broken lots, etc.), your business can segregate these items and value them at the current selling price less the cost of the disposition.

Manufacturing and distribution business leaders are encouraged to explore these areas of opportunity with their professional advisor to see if they are applicable to their business.

Joe Bublé Managing Partner Tax Services Citrin Cooperman

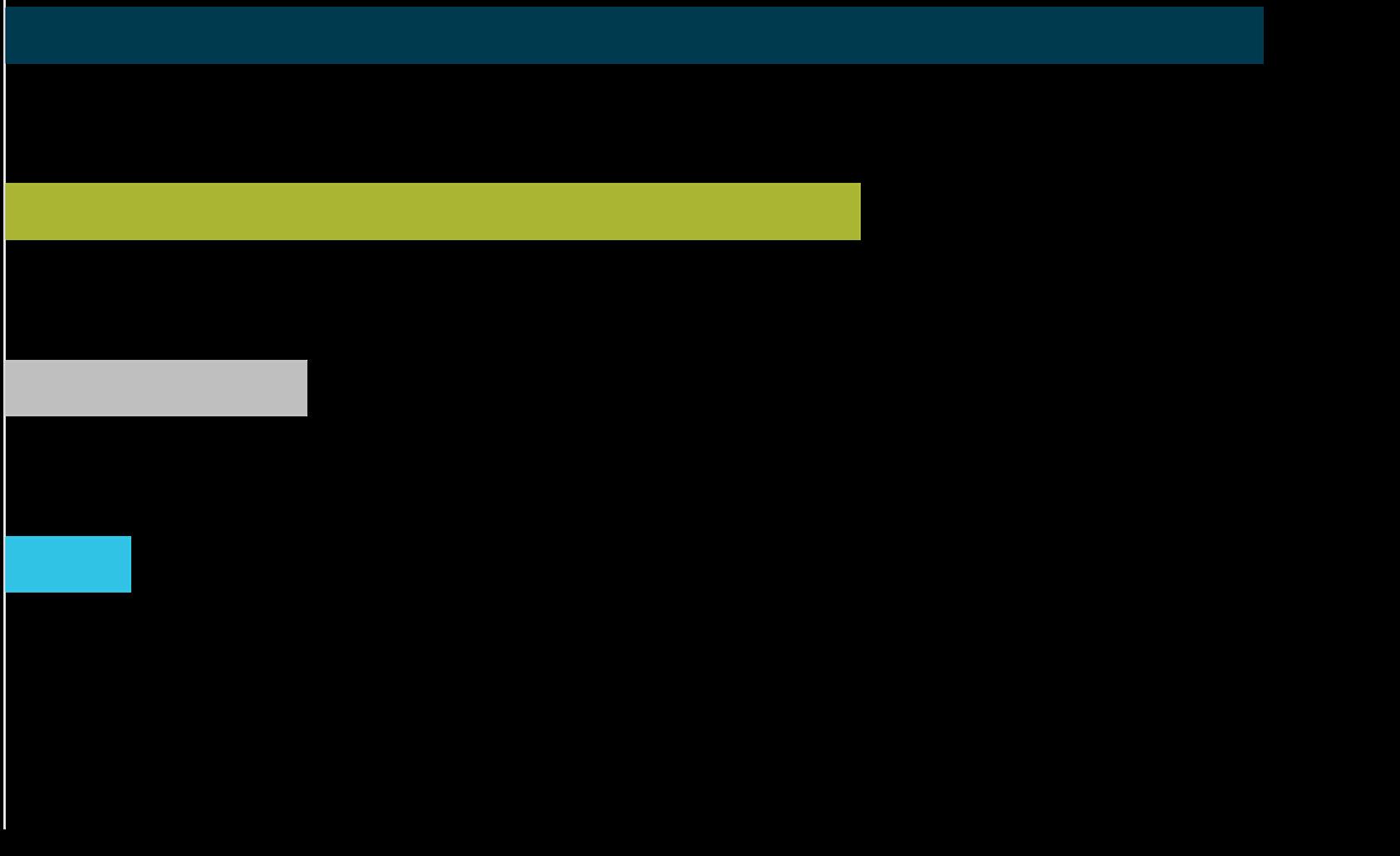

When asked about areas they can control that are the keys to future growth, the top five answers (respondents could make multiple selections) are:

To remain competitive, the top abilities respondents name as current or future needs are:

• Ability to link the company’s ERP platform to its sourcing partners’ platform in order to predict supply chain delays;

• Applying data to better predict customer behavior; and

• The ability to identify when employees are at risk of leaving.

As we will discuss later in our report, the work and investments needed to build these advanced technology abilities, especially data analytics, artificial intelligence (AI), and machine learning (ML) skills, is very much a work in progress for most and there are real challenges and more hard work ahead.

The manufacturing and distribution industry is currently experiencing a significant transformation, with private equity firms, strategic buyers, and independent sponsors driving increased consolidation through mergers and acquisitions (M&A). The trend towards consolidation is in response to evolving market demands, which include increased efficiency and innovation, especially in terms of sustainability and digital transformation. Investors are acquiring startups and established players that provide innovative solutions in automation, data analytics, and eco-friendly processes. Additionally, companies are looking to expand their reach to gain access to new markets, enhance supply chain capabilities, and leverage advanced technologies, all of which can be accomplished through M&A. This consolidation is not only reshaping competitive landscapes but is also redefining industry standards and operational practices. The focus on M&A is expected to continue as organizations seek to mitigate risks associated with economic uncertainties and capitalize on growth opportunities in emerging markets.

Harper Garrett Director

Citrin Cooperman

Beyond upgrading technological skills of the workforce, other challenges persist. Thirty-six percent report they face labor shortages. For those experiencing a labor shortage, the top four areas impacted by the shortage are skilled labor (62%), the warehouse (47%), the salesforce (36%), and the finance and accounting department (33%). The vast majority said that labor costs increased last year with 43% reporting a significant increase.

Is your company experiencing a labor shortage?

Have employee costs increased in the current year?

With the stage set for 2023’s strong performance and a hard look at manufacturing and distribution leaders’ views regarding challenges to sustaining performance, our survey turns to future readiness in the five categories of:

CYBER RISK 2 3 4 1 5

FINANCIAL MANAGEMENT AND FORECASTING

ADVANCED TECHNOLOGY

SUPPLY CHAIN

MANAGING COSTS AND INVENTORY

The pace of online sales quickens as ecommerce becomes business as usual.

FORECASTING AND FINANCIAL MANAGEMENT READINESS

In the face of growth opportunities and pressure on margins due to inflation and other factors, manufacturing and distribution companies share what they are doing to run the business with better information and decision making tools.

Nearly 3 in 4 say that automated strategic planning systems are in place to assist with forecasting and covenant compliance. This is good news. The other news is that 1 in 4 report using manual systems for these purposes.

Do you have strategic planning systems to assist you with forecasting and covenant compliance?

Yes, a manual system (i.e., Excel)

Yes, an automated system (i.e. Vena, Adaptive Insights, Prophix, etc.) No

Looking forward, it is noteworthy that roughly 4 in 10 respondents only “somewhat agree or disagree” with the following statements as they relate to their business’ management preparedness for the future. Clearly there is work to be done by many to be future ready.

“Our company has budgeting and forecasting plans in place to address increased costs in an inflationary environment.”

“Our company has a sufficient workforce to meet our customer needs for 2024.”

“Our company is currently utilizing best-in class technology in most of our business functions.”

“Our employees have the appropriate technology skills to maximize our software currently in place.”

“Our employees have the appropriate technology skills which will be needed to stay competitive over the next five years.”

If your company isn’t forecasting frequently, you are still stuck in a reactionary mode, which means you are not nearly as nimble to adjust to a rapidly changing business environment.

Modern technology is available and your competition is already using it to get ahead. If you plan to not only survive but thrive in the current market, it is imperative that you adopt the technology that is available to augment your people and gain the forward momentum you need to successfully steer your organization in a profitable direction.

Embrace technology as the force multiplier it is designed to be.

Dominic DiBernardo Partner

Digital Services Practice

Citrin Cooperman

While ERP systems connect decision making dots across a number of areas, many of the systems are aging, which explains why so many say ERP systems need improvement to increase the value of their businesses.

94% say their ERP system gives profitability information at the product level.

Over 80% see supplier information by scheduled shipping date, inventory behind scheduled delivery date, and the amount of inventory still being manufactured.

88% report their ERP system is integrated with their inventory sourcing partners’ system.

63% have updated their ERP systems in the last five years to fit the needs of their growing business.

As in last year’s survey, the data shows that larger companies are much more likely to have strategic planning systems in place and ERP systems that provide frequent, vigilant forecasting to guide agile decision making. 94% 80+% 88% 63%

Business applications in the manufacturing and distribution industry inherently must have more predictive capabilities than some other industries. Having a core ERP system that provides mechanisms to track demand, match supply, and keep on top of margins are foundational. The next tier of financial maturity is building capabilities to manage agile and resilient supply chains. From a technology enablement perspective, this translates into what mechanisms companies have at their disposal to model their sourcing decisions, optimize shipping/logistics costs, and effectively design distribution networks. Depending on the technology stack, these can be directly within a core ERP, or through the ecosystem of ERP and boundary systems (planning, transportation, and forecasting).

We are seeing that the larger ERP software publishers are investing in the use of AI and ML in their core ERPs; but it will be a year or two before some of the more complex supply chain use cases are ready for mass adoption. With around a third of the respondents to the survey not having replaced ERP systems in the last five years, a lot of companies could find themselves being on the backfoot when it comes to tapping into new capabilities. A good place to start is by asking for a line of sight into software roadmaps, then as needed, plan for internal roadmaps for modernizing business applications if there are upcoming features that will drive benefits.

Smija Simon Director Digital Transformation Practice

Citrin Cooperman

Of 11 KPIs common to manufacturing and distribution companies, survey respondents say the top KPIs monitored are quality control performance, inventory turnover, material costing, and lead time to order fulfillment. As in past years’ surveys, larger and higher revenue companies are more likely to use financial dashboards to monitor KPIs.

In this continually changing economic environment, businesses need to monitor their key metrics and how they impact financial performance. Quality control performance, lead time, and customer satisfaction are all customer-focused metrics ranking in the top five KPIs with survey respondents. This indicates that even in a volatile supply chain and labor market, the retention of customers is paramount for financial success. It is important for businesses to track and measure these metrics on a monthly or quarterly basis to ensure timely decision making for the best possible financial performance.

Anthony Harrypersad Partner

Manufacturing and Distribution Industry Practice

Citrin Cooperman

ADVANCED TECHNOLOGY READINESS: DATA ANALYTICS, ARTIFICIAL INTELLIGENCE (AI), AND MACHINE LEARNING (ML)

As we previously covered, ERP and automated forecasting systems are in place for most survey respondents. The next frontier involves technology plans and investments that shift from internal forecasting and reporting tools to externally focused predictive technology and analytics tools that can help companies better understand buyer behavior.

Respondents say the top benefit of AI is the ability to gather and utilize data from outside of a company including information about suppliers, customers, and other sources. However, many are still in the process of implementing these tools. Presently, robotic tasks applied to administrative and financial activities are common, but predictive tasks for AI, such as customer service intelligence agents and product and service recommendation systems, are less common.

The most significant barriers to adoption of AI include:

UNDERSTANDING THE COST/BENEFIT

LACK OF EXPERIENCED AI/ML EMPLOYEES

DATA ANALYTICS USE AT-A-GLANCE

Most common data analytics uses

• 65% To improve efficiency of product sourcing

• 65% To improve product profitability

• 58% To better understand buyer behavior

• 53% To better predict geographic product demand

Data analytics implementation progress Implementation success factors for data analytics

• 43% Currently implementing

• 27% Fully implemented

• 24% Planning to implement

• 7% Have no implementation plans

• 78% Leadership buy in and support

• 73% Ensure proper tools are in place

• 66% Encouraging employees to adapt to a digital culture

• 64% Building the digital skills of our people

Leveraging advanced tools to automate processes (64%) and perform service tasks (67%) are the predominant uses of AI/ML. Just under half of the respondents (47%) are not yet applying AI/ML to detect patterns and interpret their meaning for forward thinking decision making. Importantly, 12% of respondents say they are not utilizing AI or ML presently.

Cognitive engagement: Customer service intelligence agents, internal sites for employees, product and service recommendation systems (e.g., chat bots, AI decision making, customer personalization, etc.)

Cognitive insight: using algorithms to detect patterns in data and interpret their meaning (e.g., anomaly and error detection, predictive analytics, decision support, etc.) THREE TOP USES OF AI AND ML

Process automation: using robotic processes for administrative and financial activities (e.g., accounts payable (AP) automation, workflow processing, data extraction, etc.)

The application of AI tools by manufacturing and distribution companies spans many business functions. IT is unsurprisingly the most prevalent function adopting AI, followed by inventory management, quality control, and manufacturing execution. Other functions appear to lag at the moment.

The pace of online sales quickens as ecommerce becomes business as usual.

Biggest AI benefit?

75% say the biggest benefit, by far, is AI “giving us the ability to gather and utilize data outside of our company (suppliers, customers, other outside sources).”

Effect on headcount?

32% say AI has resulted in reduced headcount.

Maximize investment value?

Only 44% say they have the reporting and analytical capabilities to evaluate and maximize the value of current and future intelligent automation investments.

There is no doubt that AI will have an effect on headcount, although it is still early in this overall shift as organizations start to pilot AI programs and deploy initial AI technologies. We will see a skill shift from generative to more technical roles in the near future as this continues to unfold.

Eric Casazza

Managing Partner

Digital Services Practice

Citrin Cooperman

The adoption of increased AI rightfully concerns many employees — what will happen to workers if their jobs are replaced? Without meaningful integration with the human workforce, AI investments will only produce a nominal return on investment (ROI). Leaders should have a plan in place to reskill and upskill their workforce to take on higher level roles once AI replaces rote tasks and have professionals trained to maintain and run these sophisticated technologies. Focusing on the dynamic between strategic technological investments and properly upskilling professionals will be critical to future growth. This approach can also help bridge the workforce shortage many companies are experiencing. Think repurpose versus replace.

John Giordano

Partner and Co-Leader

Manufacturing and Distribution Industry Practice

Citrin Cooperman

Successful manufacturing and distribution companies continue to adapt to supply chain challenges, even as conditions have improved.

90% have seen supply chain stabilization during 2023.

Yet, as we reported earlier in our challenges section, supply chain remains a top concern for nearly 1 in 3 respondents. The top actions taken to rise to supply chain challenges in 2023 include:

Yet, as we reported earlier in our challenges section, supply chain remains a top concern for nearly 1 in 3 respondents.

A third of respondents are reshoring to the U.S. Respondents report top hurdles to reshoring include cost of U.S. labor, lack of access to skilled labor, and capital investment costs.

Earlier in our report, we shared concerns leaders have about inflation, interest rates, and rising costs. Rising costs have changed

habits in 2023 and that change is expected to continue. Over 50% of leaders said the environment has changed their business spending habits and they expect customer spending to slow in 2024. Here, we have looked more closely at the state of rising costs and actions being taken to manage them — in the moment and beyond.

Are passing production, supply chain, and other inflationary costs to their customers through raising prices.

Are applying administrative/service fees to products or services. Use third-party warehouses or logistics companies to help them manage, store, and/or fulfill their products.

A pressing concern for business leaders in the current market is stabilizing their overhead costs. With high interest rates, rising payroll costs, and geopolitical unrest impacting supply chains, manufacturers and distributors are challenged with how to manage these rising costs. Companies must constantly balance what costs they can pass along to their customers without damaging or permanently altering demand.

To remain competitive, businesses are reviewing all of their expenses and evaluating how to remain as operationally lean as possible.

Citrin Cooperman 70% 54% 74%

Mark Henry Partner and Co-Leader

Manufacturing and Distribution Industry Practice

Roughly a third, 36%, of our respondents are monitoring and filing taxes by state with internal resources. A third, 36%, outsource this work to a third-party.

Sales and use tax compliance is an increasingly time-consuming burden for many companies that divert time, resources, and focus away from their core business needs. The compliance function requires dedicated resources with the tax expertise and technology tools vital to ensuring timely and accurate reporting to not only reduce fines and penalties, but to also minimize the risk of audits.

By leveraging sales and use tax compliance outsourcing, you can rely on experienced tax professionals to prepare, file, and remit your sales and use tax returns. Citrin Cooperman’s State and Local Tax Practice professionals are not only well-versed in the nuances of compliance filings, but they also have the necessary insights and can quickly assist with state and local tax matters.

Stacy R.E. Dean Director

State and Local Tax Services Practice

Citrin Cooperman

MANAGING CYBER READINESS

Cyber incidents and breaches grab headlines, cause disruptions, steal attention from growth initiatives, and can cause present and future value disruptions to brands and companies. Unfortunately, they appear to be on the rise in the manufacturing and distribution industry. It is startling to see that 1 in 3 companies responding say they had a cyber incident or breach in 2023. From a risk management perspective, roughly half of survey respondents have:

Performed a cyber assessment during the last 12 months

Considered penetration testing to determine the strength of their cyber environment

Invested in cyber insurance

Internal/external personnel actively monitoring their cyber activity/security

An incident response plan in place

Provided ongoing cyber security awareness training

The Wall Street Journal recently stated that cyberattacks such as ransomware were up significantly for manufacturers in 2023, statistics that are reinforced by a third of our respondents stating they were the victim of a cyber incident. It is imperative for this sector to fortify their defenses by taking strategic steps to stem the tide of this onslaught of attacks and thus reduce the likelihood of becoming the next victim of a catastrophic attack. Measures that should be considered include developing security policies and an incident response plan, meeting the various compliance requirements, setting a regular cadence for patching hardware and software, implementing multi-factor authentication and robust password requirements wherever and whenever possible, and establishing a vigorous cybersecurity awareness training program complete with phishing simulations to help users detect and avoid social engineering attacks such as spear phishing.

Kevin Ricci Partner Risk Advisory and Compliance Practice

Cybersecurity

Practice

Citrin Cooperman

Looking ahead, respondents report a variety of intentions to fuel growth or rise to the next level of performance. When asked, “Which of the following do you anticipate occurring for your business over the next three years,” the answers span initiatives.

Regarding acquisitions, leaders say that the most difficult parts of growth by acquisition are higher capital costs (23%), finding quality targets (19%), and having a management team to run the operation (14%).

The other side of that coin is the potential for a sale of the business. We asked respondents about the likelihood of a sale in the next three years. Fifty-one percent state a sale is “definitely or probably going” to happen.

As we see in our findings, starting with current revenue growth, EBITDA, and product performance, many companies may make attractive targets. Yet, there is work to be done to add new value to the business. Is your business adequately prepared?

Manufacturing and distribution companies contemplating a transaction should consider several best practices to navigate the complex transaction landscape successfully. For strategic buyers, conducting thorough due diligence is paramount. This entails evaluating financials, tax filings, operational processes, market positioning, and legal/environmental risks. Sell-side quality of earnings reports, due diligence, and consideration of strategic tax planning can be very valuable for companies before they go to market. Additionally, maintaining clear communication and transparency with stakeholders, including employees, customers, and investors, is essential to mitigate uncertainty and build trust throughout the transaction process.

Strategic alignment between the merging entities is crucial for long-term success. Companies should prioritize compatibility in culture, values, and strategic objectives to ensure a seamless integration post-transaction. Additionally, leveraging expert advisors such as legal counsel, financial analysts, and industry specialists can provide invaluable insights and guidance throughout the M&A journey.

Lastly, proactive risk management and contingency planning are vital to anticipate and address potential challenges that may arise during and after the transaction. By adhering to these best practices, manufacturing and distribution companies can maximize the value of their M&A endeavors and position themselves for sustainable growth in an ever-evolving market landscape.

Nichol Chiarella Partner and Leader

Tax

Mergers and Acquisitions Practice

Citrin Cooperman

Our respondents were recruited by Quest Mindshare, a global leader in providing opt-in online survey samples. There were a total of 200 surveys completed. Respondents were screened for working at a company involved with manufacturing and/or distribution and working at a company with $10M+ revenue size. All respondents received an incentive for completing the survey.

Some numbers throughout the report do not equal 100% due to rounding.

The survey was in the field from February 20, 2024, to March 5, 2024.

Position/job title

• Owner, C-suite (e.g., CEO, CFO), partner, president: 75%

• Vice president (EVP, SVP, AVP, VP): 25%

Manufacturing: 37%

Distribution: 16%

Both manufacturing and distribution: 47%

Manufacturer demographics

• Manufacturer in the U.S.: 87%

• Manufacturer outside the U.S. (owned affiliate): 3%

• Contract manufacturer in the U.S.: 2%

• Contract manufacturer outside the U.S.: 1%

• My company is not a manufacturer: 7%

• Other: 0%

*Question allowed for multiple responses

• Less than $10M: 0%

• $10M - $99.9M: 13%

• $100M - $249.9M: 12%

• $250M - $499.9M: 16%

• $500M - $1B: 31%

• More than $1B: 28%

*Industry subsector

• Consumer products and retail: 37%

• Industrial products: 39%

• Food and beverage: 22%

• Distribution and logistics: 45%

• Manufacturing: 71%

• Other: 7%

• 0 - 100: 7%

• 101 - 500: 9%

• 501 - 1,000: 12%

• 1,001 - 2,500: 17%

• 2,501 - 5,000: 25%

• 5,001 - 10,000: 21%

• More than 10,000: 7%

• Northeast: 20%

• Midwest: 12%

• West: 38%

• South: 30%

Physical presence or inventory in multiple states

• Yes: 86%

• No: 14%

Physical presence or inventory internationally

• Yes: 61%

• No: 39%

Citrin Cooperman is proud to be home to one of the leading Manufacturing and Distribution Industry Practices in the country. Our dedicated team leverages our deep industry expertise to provide a full range of professional services and industry insights to assist our clients with achieving their business goals.

We strive to deliver value to manufacturing and distribution companies by helping leadership make informed decisions that improve efficiencies, reduce costs, and ultimately improve the bottom line.

SUBSECTORS WE SERVE:

Consumer products and retail

Distribution and logistics

Food and beverage

Industrial products

Manufacturing

ABOUT CITRIN COOPERMAN

Citrin Cooperman is one of the nation’s largest professional services firms. Since 1979, we’ve steadily built our business by helping middle market companies and high net worth individuals find practical, actionable solutions to help them meet their short-term needs and long-term objectives.

Citrin Cooperman clients span an array of industries and business sectors and leverage a complete menu of service offerings. Citrin Cooperman & Company, LLP, a licensed independent CPA firm that provides attest services and Citrin Cooperman Advisors, LLC, which provides business advisory and non-attest services, operate as an alternative practice structure in accordance with the AIPCA’s Code of Professional Conduct and applicable laws, regulations, and professional standards. The entities include more than 450 partners and 2,800 total professionals.

Learn more about Citrin Cooperman here: www.citrincooperman.com

John P. Giordano, Partner and Co-Leader | Manufacturing and Distribution Industry Practice jgiordano@citrincooperman.com

John has nearly two decades of experience providing accounting and assurance services for middle market businesses and their owners. His clients span the manufacturing, wholesale distribution, retail, e-commerce, and service industries.

Mark Henry, Partner and Co-Leader | Manufacturing and Distribution Industry Practice mhenry@citrincooperman.com

Mark has over 15 years of experience in public accounting, and has significant experience providing audit, financial reporting, and business consulting services to clients in various industries, including but not limited to manufacturing and distribution.

Joe Bublé, Managing Partner | Tax Services jbuble@citrincooperman.com

Joe is the firm’s managing partner for Tax Services. He concentrates on strategic tax planning, mergers and acquisitions, and sophisticated tax research for businesses and individuals. He is involved in all aspects of his clients’ tax and financial planning, from the acquisition, operation, and disposition of businesses to individual income and estate tax planning.

Eric J. Casazza, Managing Partner | Digital Services Practice ecasazza@citrincooperman.com

Eric has more than 27 years of experience leading information technology organizations and enterprise solution programs and strategies including ERP, CRM, cloud productivity, integration, and business analytics.

Nichol Chiarella, Partner and Leader | Tax Mergers and Acquisitions Practice nchiarella@citrincooperman.com

Nichol has over two decades of experience in public accounting. She provides high-level tax planning and consulting services related to buy-side, sell-side, and restructuring transactions involving private equity firms, closely held businesses, business owners, and high net worth individuals within the manufacturing and distribution, technology, wholesale, retail, cannabis, healthcare, real estate, staffing, and professional services industries.

Stacy R.E. Dean, Director | State and Local Tax Services Practice sdean@citrincooperman.com

Stacy is an experienced professional with over 26 years of experience in auditing, tax, and accounting. Stacy has extensive experience in leading indirect tax operations across global divisions, managing multistate audits, and implementing and managing tax software and new systems.

Dominic DiBernardo, Partner | Digital Services Practice ddibernardo@citrincooperman.com

Dominic has over 15 years of experience in financial planning and analysis (FP&A). Dom has a passion for helping companies make the transition to a data-driven culture, guiding them through digital transformation leading to both operational efficiency and substantial bottom-line results.

Harper Garrett, Director | Transaction Advisory Services Practice hgarrett@citrincooperman.com

Harper has 15 years of accounting, auditing, and consulting experience with a focus on manufacturing and distribution clients. As a member of this practice, Harper acts as a lead on various financial due diligence projects for both buy-side and sell-side clients, including quality of earnings, net working capital analysis, and additional special projects.

Anthony Harrypersad, Partner | Manufacturing and Distribution Industry Practice aharrypersad@citrincooperman.com

Anthony has over eleven years of experience providing audit and business consulting services to his clients. His clients consists of family owned middle market businesses to large businesses with global operations in a variety of industries, including manufacturing and distribution.

Smija Simon, Director | Digital Transformation Practice ssimon@citrincooperman.com

Smija is passionate about helping organizations drive long-term business success through alignment of strategy, business models, process architecture, organization models, and technology. Smija is an experienced technology and management consultant whose skills range from developing and executing strategic plans to providing world-class project management to implement solutions.

Kevin Ricci, Partner | Risk Advisory and Compliance Practice | Cybersecurity Practice kricci@citrincooperman.com

Kevin Ricci has over 25 years of extensive experience in technology services including consulting, security assessments, cybersecurity awareness training, social engineering simulations, IT auditing, fractional CISO, project management, database development, data analysis, and compliance services including PCI DSS, for which he is a Qualified Security Assessor (QSA).

“Citrin Cooperman” is the brand under which Citrin Cooperman & Company, LLP, a licensed independent CPA firm, and Citrin Cooperman Advisors LLC serve clients’ business needs. The two firms operate as separate legal entities in an alternative practice structure. The entities of Citrin Cooperman & Company, LLP and Citrin Cooperman Advisors LLC are independent member firms of the Moore North America, Inc. (MNA) Association, which is itself a regional member of Moore Global Network Limited (MGNL). All the firms associated with MNA are independently owned and managed entities. Their membership in, or association with, MNA should not be construed as constituting or implying any partnership between them.