PROPOSED BUDGET FY | 23–24

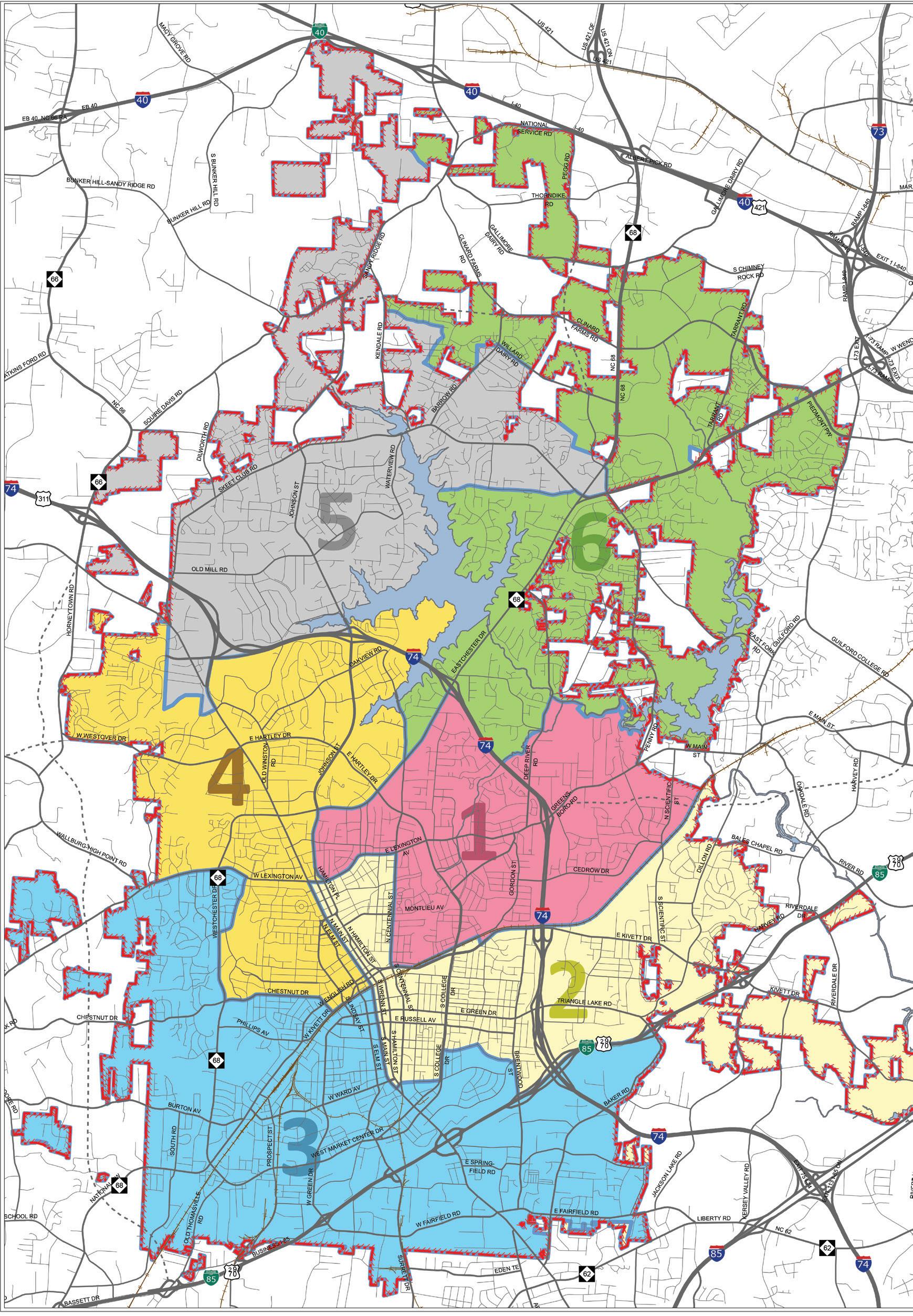

WARD 1 WARD 2

WARD 3 WARD 4

WARD 5 WARD 6

Cyril Jefferson Chris Williams

Monica Peters Wesley Hudson Mayor Pro Tem

Victor Jones Michael Holmes

Britt Moore Tyrone Johnson

Jay W. Wagner Mayor

Cyril Jefferson Chris Williams

Monica Peters Wesley Hudson Mayor Pro Tem

Victor Jones Michael Holmes

Britt Moore Tyrone Johnson

Jay W. Wagner Mayor

PRESENTED TO

For the Fiscal Year Beginning July 01, 2022

Executive Director

May 1, 2023

Honorable Mayor and Members of the City Council City of High Point, North Carolina

In accordance with the General Statutes of North Carolina, I am pleased to submit for your consideration the Manager’s Recommended Fiscal Year 2023-24 Budget. The budget is balanced and was prepared in accordance with the provisions of the North Carolina General Statutes and the policies of the North Carolina Local Government Commission. It incorporates the priorities and policy direction communicated by the Mayor and City Council and reflects the City Council’s commitment to responsible fiscal management, while continuing to provide services that improve the quality of life for the citizens of High Point. The proposed budget keeps the property tax rate at 61.75 cents per $100 of property value, which is based on a total valuation of $13,511,662,146. The property tax rate is allocated to the General Fund (58.35 cents) and the Debt Service Fund (3.4 cents).

The current year has seen High Point adapt to the realities of providing service in the immediate aftermath of the COVID-19 pandemic. Costs have increased, in some instances dramatically, for providing the same level of service due to inflation and supply chain issues. The effects of the Great Resignation continue, as recruitment and retention remain a concern, and higher than normal vacancy levels persist.

Fortunately, economic conditions have continued their upward path, and the proposed budget as presented for FY 2023-24 is able to absorb the higher costs for service delivery and employee salaries and benefits with growth in our existing general-purpose revenues. While hopeful the upward growth trajectory will continue, the current budget also does not include any increase to the property tax rate allocated for debt service. As part of their debt modeling for financing upcoming governmental bond issuances and major projects, Davenport & Company, LLC presented a funding scenario that included a 4-cent increase for the debt service on future capital needs. These additional capital needs include improvements to the stadium, renovations at 300 Oak, downtown parking improvements, and the construction of a new City Hall. Additional information on our debt financing can be found on page MM-17 of this budget message.

The proposed budget recognizes and addresses the many challenges we face. We expect these challenges to remain throughout FY 2023-24. However, while addressing the current challenges, the budget also balances our existing needs while looking to the future and identifying and prioritizing where new investment is needed.

Below are highlights of the proposed budget:

- No increase in property tax rate

- No increase to electric rates

- Solid Waste availability fee increase of $1 for single-family and multi-family solid waste collection users

- Stormwater fee increase of $1 per Equivalent Residential Unit (ERU)

- 4% water/sewer rate increase

- Average 3% mid-year merit adjustment

- Transition of health plan to selfinsured and creation of a full service employee health clinic

- City match of 3% for 401K/457 contributions (of at least 1%)

- The addition of 3 full-time positions and 6 reclassifications of existing positions

- $4.7 million for new and scheduled vehicle and other rolling stock replacements

- $250,000 allocation for marketing/branding efforts

On March 11, 2021, the American Rescue Plan Act was signed into law. Included in this bill is direct financial assistance to local governments that have faced revenue losses and added safety expenses in dealing with the COVID-19 pandemic. The bill included over $1.3 billion dollars for cities and towns in North Carolina. High Point received $22,699,511 million in direct assistance.

In the fall of 2021, two community input sessions were held, with the following themes emerging as priority areas for funding: employment, housing, education, infrastructure, and community programs/non-profits.

Thus far, the city has committed $16,852,085 for the following projects:

Staff will continue to work with the community and the Mayor and City Council on identifying the projects for the remaining funds

In addition to the allocation of American Rescue Plan Act (ARPA) funds, the City has been fortunate to receive federal grant funding for several new projects that align with City Council’s strategic goals.

The purchase by the City of the 300 Oak Street building represents a significant opportunity for the city to impact the economic progress of the surrounding community. Envisioned as an activated small business and entrepreneurial hub, the building will provide support and resources for new and growing businesses, especially those anchored in the area. At more than 62,000 square feet, the project could include several distinct program areas and may be opened in phases based on city priorities, funding availability, and physical limitations. With an overarching vision of economic advancement for the community, several economic development and community engagement activities have been identified as possibilities for the space including a business incubator, coworking space, and a makerspace. The City received a $4.0 million federal grant and has committed an additional $6.0 million to the project, which includes $3.0 million to purchase the building.

In addition to the 300 Oak project, the City has convened a group of stakeholders made up of staff from city, county, regional, community college, and local non-profit representatives that are collaborating on ways to create a commercial shared-use kitchen in High Point. The mission of the group is to support diverse entrepreneurs to start, grow, and sustain successful food businesses. The vision is to establish a commercial shared-use kitchen, providing equitable access to food business resources that build economic resiliency, strengthen capacity, and create connections. Site selection is currently under way for the kitchen. The City received a $2.0 million federal grant and has committed an additional $2.4 million to the project.

Lastly, federal funding has been awarded for a day center for the homeless. The proposed center would provide emergency shelter and transitional housing, as well as opportunities for individuals to access services, learn basic skills, and regain their ability to live independently. There would be an emergency/short-term bed service as well as a long-term supportive care program. This facility would serve as the homeless services center for High Point and facilitate service delivery in one location with partner agencies. The City received a $3.0 million federal grant and has committed an additional $2.0 million to the project.

Funds included in the budget are adequate to continue providing the services that are expected by our citizens.

The total FY 2023-24 budgeted expenditures for the City of High Point amount to $478,537,587. This is an increase of $14,224,261 or 3.1% from the FY 2022-23 budget.

Below is a chart of total 2023-24 budgeted revenues and expenditures compared to the 202223 Adopted Budget:

The proposed FY 2023-24 property tax rate remains at 61.75 cents per $100 of valuation. The general fund allocation of the property tax remains at 58.35 cents and the debt service fund allocation remains at 3.4 cents.

There is no rate increase to electric fees but there are several proposed changes to fees in the proposed budget.

• A water/sewer rate increase of 4%. The increased rates will help fund increases in operating costs, including fuel and chemicals, as well as the infrastructure needs of the aging system.

• The proposed budget includes increased fees in Customer Service for after-hour service fees, extra trip fees, and electric services disconnected at the pole. These fee increases will help offset the cost of staff and transportation for these service calls. There is also a proposed increase to the meter tampering/investigation charge, in an effort to discourage customers from tampering with their meters and increasing customer safety.

• A stormwater fee increase of $1 per Equivalent Residential Unit (ERU). This fee is charged monthly, and the increase will assist in funding growing costs, the increased use of outside contractors to perform projects, and several large stormwater improvement projects currently under development.

• Due to the expansion of residential units in the City of High Point creating more accounts, more miles on the equipment, higher fuel costs, and more trips to the landfill due to increased solid waste, an increase of $1 per month to the solid waste availability fee is proposed. This fee is applicable to all customers who receive solid waste collection services – both single and multi-family homes.

Additionally, there are proposed fee increases to the rental of a Red Box (4x8x14 feet) for major clean-up projects and for garbage roll-out containers (for new residents) and recycling and yard waste carts. The cost to acquire these carts has increased and the higher fee will allow for continued cost recovery for the Solid Waste Division.

• The proposed budget also includes increased cemetery fees for Public Services. The cost to perform grave openings and closings has increased and the increased fee will assist in recovering this cost. Additionally, a range of costs for cremation urns is proposed, based on size, instead of the existing flat cost no matter the size of the urn.

• Lastly, the proposed budget includes increases in parking rates at our city parking decks. While the hourly rate remains at $1.00, the daily maximum is increased to $10.00. In addition, the flat cost for monthly parking (currently $35/month) is increased based on the number of spaces rented.

The current fiscal year has included several expenditure challenges that have continued from last year, including rising costs due to inflation and the recruitment and retention of city employees.

Recruitment and retention of employees continues to be a challenge in this current economic environment. Influential factors include competition from the private sector and other public entities, accelerating retirement rates, and a shortage of qualified applicants. Reliance on more expensive options has included the use of contractors to provide services and increased overtime costs. While it will take time to return to some level of normalcy with vacancy rates closer to the five-year average of 5-6% prior to the pandemic, the city continues to explore creative ways to recruit and retain employees.

Human Resources staff, working with outside partners, perform a compensation and classification review of one-third of city positions each year. This past year saw significant adjustments, specifically for the Police Department, that were able to be absorbed into the current budget. In addition, due to market forces, a mid-year adjustment was implemented to address salaries for Fire Department personnel as the next phase of the pay study is currently underway. Funding is in place to continue systematic reviews of our pay structure as remaining competitive is critical for the city to maintain quality service delivery.

We expect this trend to continue, as our benchmark local governments are updating their salaries as well on an annual basis. We will continue to assess where our pay plan stands in comparison, while also exploring other benefits that can help us remain competitive in the marketplace. As the volatility of the market continues, new strategies could emerge during the year that may need to be evaluated.

Inflation has remained a growing issue not only for our citizens, but our departmental budgets as well. We have been fortunate to re-prioritize needs without impacting on the services we provide, but the cost of doing business continues to increase, and that is reflected in this proposed budget.

The needs, priorities, and details of each fund are highlighted in detail throughout this document. Below are the major expenditure recommendations included in the FY 2023-24 Proposed Budget:

• Fully funds the City’s Pay for Performance Program. An average 3% mid-year merit adjustment is programmed, at an estimated cost, including benefits, of $1.97 million.

• Increases pay plan ranges by 3% to maintain pace with market trends.

• Continued funding of the increased employer contribution to the Local Government Employees’ Retirement System (LGERS) for regular, fire, and sworn police employees. The cost of this increase for FY 2023-24 is about $1.28 million

• Transition to a self-insured health plan and creation of a full-service employee health clinic. The City has built up a reserve in the health fund over the past several years. Due to the availbility and amount of reserves, the new fiscal year will see the city transition to self-insured for the insurance reserve fund. This transition will also allow the addition of an employee health clinic that will expand services offered at the health and wellness clinic for employees. The intended purpose would be to continue to lower healthcare costs and maximize employees’ health.

• Creation of a six-week paid parental leave/family caregiver leave policy effective in the new fiscal year. This benefit will have no direct budget impact.

• Outside agency funding reflects the value of one-third of a cent on the property tax rate, to a total proposed amount of $446,401

• Funding for marketing/branding efforts totaling $250,000.

• Funding for Forward High Point downtown development group of $250,000.

• Furniture Market Authority funding of $240,000

• Funding for the repayment of the twenty-year internal loan for the Catalyst Project land purchases. The amount is $443,323.

• Funding for the repayment of the fifteen-year internal loan for the improvements to City Lake Park. The amount is $600,000.

• Incremental tax revenue payment for the Catalyst project of $1,652,294. The taxable value of this area has increased $267,577,969 from its 2017 assessed value.

• Investments in the City’s Information Technology network including updated software, maintenance of existing systems and applications, and upgraded infrastructure, totaling $941,000

• Replaces $4.7 million in vehicles funded with pay-go funding from the Fleet division of the Central Services Fund. Planned fleet purchases include one (1) tandem dump truck, five (5) police vehicles, two (2) fire SUV’s, three (3) automated refuse trucks,

two (2) small rear packing refuse trucks, small SUV’s, light duty pickup trucks, body equipped work trucks, a bucket truck, two 15-passenger vans, an underground utilities vehicle, a Jet/Vac truck, a paving patching truck, and other necessary rolling stock.

In addition, the proposed budget funds the fire apparatus replacement program, budgeting for the replacement of an engine ($920,000), for the Fire Department.

• The addition of three full-time positions, highlighted below:

In addition to the above recommended position additions, the proposed budget includes 6 position reclassifications within the General Fund. Existing full-time and part-time positions are utilized to minimize the fiscal impact of these reclassifications.

GENERAL FUND

The 2023-24 General Fund Budget of $142,113,256 is $9,284,187, or 7.0% more than the adopted 2022-23 budget of $132,829,069. The FY 2023-24 General Fund Budget is balanced with current revenues and does not include an increased allocation of the property tax rate, nor an appropriation of fund balance reserves.

General Fund revenues and expenditures are summarized below:

Below is a summary of major General Fund revenue changes:

• Property tax revenues represent 55.3% or $78,601,085 of the total General Fund revenues. Property tax collections are projected to increase approximately $3,500,918, or 4.7%. The projected collections are based on a collection rate of 99.3%.

• Sales tax revenues represent 28.8% or $40,869,580 of General Fund revenues and are projected to increase approximately $4,527,428, or 12.5% due to strong increases in retail sales tax during the current year and projected to continue in FY 2023-24. Sales tax revenue is estimated to increase approximately 4.5% above the year-end estimates. In addition, occupancy tax revenues are increasing $571,000 compared to the FY 2022-23 budget.

• License and permit fees are projected to increase $329,000, or 7.8% due primarily to increased building permit activity.

• Charges for services are increasing by $455,751, or 8.7% due to increases in Parks and Recreation program revenue, including at Blair Park and Oak Hollow golf courses and at Oak Hollow Campground

• Miscellaneous revenue is estimated to increase by $585,100. This is due to stronger investment income projections.

The proposed FY 2023-24 tax rate is 61.75 cents, unchanged from the FY 2022-23 approved rate. The value of one cent in tax rate will produce approximately $1.34 million of revenue. The total proposed tax rate is divided between the General Fund and the General Debt Service Fund. The General Fund allocation remains at 58.35 cents, and the General Debt Service Fund allocation remains at 3.4 cents.

A collection rate of 99.3% is planned for the proposed tax year collections.

The combined total assessed valuation estimates for our four County taxing authorities are $13.511 billion for FY 2023-24, for a 2.2% increase over the estimated current year valuation. Below is a chart of our historic assessed value history:

The sales tax category includes sales tax related to retail sales, utility sales tax, room occupancy tax, and rental vehicle tax. Current year sales taxes are expected to outpace budgeted projections by 8.6% or $3.11 million, and FY 2023-24 sales taxes are projected to increase 12.5%, or $4.52 million from the current fiscal year budget. Below is a chart of our historic sales tax history:

Below is a summary of major General Fund expenditure changes:

• Personnel services are increasing $4,758,127 or 5.2%. This includes increases to fund the following:

o Compensation and classification adjustments approved during FY 2022-23: $1.05 million.

o Average 3% mid-year merit increase: $1.44 million.

o Required increase to the City’s contribution to the Local Government Employees’ Retirement System (LGERS) for regular, certified fire, and sworn police employees: $949,000.

o Increased employer costs for health insurance plan: $379,000

o Higher workers’ compensation expenses to meet higher claim costs: $275,000.

The General Fund budget also includes one additional full-time position, as well as six position reclassifications, as outlined earlier in this message.

• Operating expenditures are increasing $1,845,750 or 7.2%. $571,000 of this is an increase to the contribution to Visit High Point, which is completely offset by the increased budget for occupancy tax revenues. Other drivers include increases to computer and software license fees ($524,000), higher Fleet Services charges for additional vehicle replacements ($510,000), and increased consulting/professional services (389,000), mainly due to inflationary pressures.

• Capital outlay funding is budgeted at $1,480,546 for FY 2023-24. This is driven by maintenance and repairs for Parks and Recreation, Information Technology equipment, and funding for the fire apparatus replacement program.

• Interfund transfers out are increasing by $1,908,088 The general fund contribution for capital projects increased $1,132,575, helping meet growing deferred maintenance and other capital needs of the general fund service areas. The proposed budget also includes a $600,000 reimbursement to the Solid Waste Post-Closure Fund, the first payment for the interfund loan provided for the City Lake Park improvements.

The $66,203,918 Water and Sewer Fund Budget for FY 2023-24 represents a 5.7% or $3,594,682 increase from the 2022-23 adopted budget, as summarized below:

Below is a summary of Water and Sewer revenue changes:

• The proposed budget increases water and sewer rates by 4%. The increased rates will help fund increases in operating costs, including fuel and chemicals, as well as the infrastructure needs of the aging system.

• The proposed budget for water and sewer operations does not include any appropriation of reserves.

The 2023-24 Water and Sewer Fund includes an increase to water and sewer rates of 4%.

Below is a history of water and sewer rate increases:

Water and sewer revenue rates are a critical component of funding the operation, maintenance and needed capital improvements for water treatment facilities and distribution lines, and for wastewater collection lines and treatment systems. Property taxes are not used to finance water and sewer utility services.

Below is a summary of Water and Sewer Fund expenditures:

• Personnel Services is increasing $626,940, or 5.0%, due to an average mid-year merit adjustment of 3% and an increased employer contribution for retirement.

• Operating expenses are increased $1,393,174, or 8.8% due to significant increases in costs for chemicals, funding for testing to meet EPA guidelines, emergency sludge hauling, painting, and other professional services, and maintenance supplies for the aging parts of the system.

• Pay-go capital includes $10,998,250 in funding for water and sewer capital projects.

The 2023-24 Electric Fund Budget of $135,366,700 represents a 3.3%, or $4,672,144 decrease from the 2022-23 adopted budget. The proposed budget includes no changes to electric rates. Currently, our rate consultant is finalizing a rate study for a restructuring of rates on the commercial/industrial side. Once complete, the findings will be presented to the City Council.

The proposed budget includes two additional positions for Electric, a utility locator to assist with the growing number of locates requested each year, and a power line technician to aid with the continuing growth of energy infrastructure.

Wholesale power cost for FY 2023-24 is budgeted at $90.0 million, which is the single largest expense in the Electric Fund and citywide budget.

The budget plan continues to invest funds to maintain electric infrastructure and includes $9,850,000 in major capital projects. These routine capital investments are necessary to maintain efficient and ongoing operation of the Electric System.

Capital investments and reinvestments are critical elements in the City’s total financial program. Capital improvements are financed by one of several methods.

The first method involves the issuance of voter approved general obligation bonds generally backed and paid by property taxes. The second method is a slight variation of the first and allows the City to issue small amounts of what are known as two-thirds general obligation bonds from time-to-time that do not require tax increases or voter approval. Limited obligations bonds are a general government debt financing mechanism similar to general obligation bonds; however, limited obligation bonds do not require voter approval to issue the debt. Another method involves revenue bonds, backed and paid by revenues from our water and sewer and our stormwater system. Revenue bonds do not require voter approval. The final method is pay-go capital financing. The pay-go alternative, developed and expanded in the past ten years, allows us to finance needed capital improvements from current revenues, grants, and other funds, thereby avoiding the additional and higher cost associated with the issuance and financing of long-term debt.

Capital investments are necessary for a city to replace existing infrastructure and to invest in new infrastructure. Debt financing of this infrastructure is a sound financial strategy if the borrowing is done in a strategic and conservative manner. Local policies are in place to ensure that borrowing is done responsibly, and oversight of our borrowing practices are in place through the Local Government Commission. The city is well prepared to address replacement of existing infrastructure to meet and provide for future growth and development.

The City has engaged Davenport & Company, LLC of Richmond, Virginia as our financial advisor since 2003. Davenport has assisted the City with general obligation and revenue bond planning and modeling, financial policies, rating agency strategies and interactions, bond issuance, investment analysis, and bond refunding analysis.

This spring, Davenport & Company, LLC were utilized to model potential debt scenarios for both general obligation and revenue bond (Water/Sewer) debt issuances in the near term and present their findings to the Mayor and City Council. This provided the most up-to-date information on our debt capacity and ability to fund future debt service payments.

General obligation bonds are a common type of municipal bond that are secured by the full faith and credit of the tax rate to repay bond holders. This debt instrument was used to fund the 2004 bond authorization and is being used to fund the $50.0 million authorization that was approved by voters in 2019. The authorization is for the following uses:

• Streets and Sidewalks - $22,000,000

• Parks and Recreation - $21,500,000

• Housing - $6,500,000

The first tranche of bonds was issued in FY 2021-22. Issuances of $12,000,000 for Transportation (FY 2023-24) and $12,000,000 for Parks and Recreation (FY 2025-26) remain. The debt service fund has the capacity for the payments on these issuances with no change to the current property tax allocated for debt service (3.4 cents).

Two-thirds bonds are State authorized General Obligation bonds that may be issued without voter approval. The statute allows a local government to issue up to 2/3 of the amount of GO bonds that were paid off in the previous year. These bonds can be used for any other general obligation purpose other than the financing of auditoriums, coliseums, arenas, stadiums, civic centers or convention centers, art galleries, museums, historic properties, public transportation systems, cable television systems, or redevelopment projects.

There are planned two-thirds bond issuances of $5,425,000 for Transportation (FY 2023-24) and of $5,550,000 for Parks and Recreation (FY 2025-26). In addition to the upcoming general obligation bond issuance, the debt service fund has the capacity for the payments on these issuances with no change to the current property tax allocated for debt service (3.4 cents).

Limited obligations bonds are a general government debt financing mechanism similar to general obligation bonds; however, limited obligation bonds do not require voter approval to issue the debt. An asset is pledged as collateral to secure the financing. Recent projects that utilized LOBS as a funding strategy include the downtown stadium and the new Police Headquarters.

Several projects included in the debt modeling, totaling approximately $84,500,000, could utilize this funding strategy. The projects include stadium improvements, 300 Oak Street, a new City Hall, and downtown parking improvements. The debt modeling included several tax rate increase scenarios to fund the debt service on these projects.

The current budget does not include any increase to the property tax rate allocated for debt service. Staff will continue to work with Davenport & Company, LLC on the future debt modeling, recasting the model when new information is available. The city will also continue to assess our debt capacity, and explore new sources of revenue, to ensure sound long-term fiscal management while making investments that further support growth in High Point.

Revenue bonds are municipal bonds that finance income-producing projects that are secured by a specified revenue source, such as water and sewer or stormwater rates. Revenue bonds are issued by the government agency for operations that run in the manner of a business, with operating revenues and expenses, such as our Water & Sewer Fund. The pledge to repay the bond is guaranteed by the rates of the Water & Sewer Fund.

Over the next five years, staff has identified an estimated $170.2 million in additional major water and wastewater bond projects. The capital improvement plan anticipates cash funding of $65.0 million and debt funding of $105.2 million in water and sewer projects.

The debt plan modeled by Davenport & Company for future revenue bond issuances for the Water & Sewer Fund assumes rate increases in the 4-6% range. As with governmental debt, staff will continue to work with Davenport & Company, LLC on future debt modeling for enterprise funds, recasting the model when new information is available. Capital project costs have increased significantly over the past year and these increases, along with the potential for additional federal and state regulations on emerging compounds like PFAS, will have an impact on the future debt capacity for Water & Sewer.

The City’s capacity to finance and pay for needed improvements is evaluated from time to time by the following rating agencies: Moody’s Investment Services, Standard & Poor’s, and Fitch Ratings. Protecting and enhancing our bond ratings is one of our highest priorities.

The City has seen a series of bond rating upgrades since 2003, including the addition of a AAA bond rating assignment by Standard & Poor’s. The City’s bond ratings were re-affirmed in conjunction with our bond sale in April 2022.

The City has made a commitment to fund a healthy level of pay-go financing for routine improvements, infrastructure maintenance, and grant matches of capital projects funded from state and federal grant programs. Below is a summary of pay-go projects in each fund.

The proposed budget includes $5,689,595 in general pay-go projects.

*The ERP Upgrade includes funding from the General Fund ($375,000), Water/Sewer ($375,000), Electric ($600,000), Solid Waste ($105,000), and Stormwater ($45,000).

**The Local Match for NCDOT Projects includes funding from the General Fund ($113,060) and Federal Grants ($792,000).

***The CMAQ – Traffic Signal Timing Project includes funding from the General Fund ($196,515) and Federal Grants ($1,218,020).

Water and Sewer pay-go capital reinvestments are budgeted at $10,998,250. A list of 202324 Water and Sewer pay-go investments are shown below:

The Electric pay-go projects are budgeted at $9,850,000. Projects include:

The Solid Waste pay-go budget is $1,021,000. The projects planned are:

The $7,871,763 in other FY 2023-24 pay-go investments includes the scheduled replacement of vehicles, normal computer and radio replacements, routine stormwater projects, and others outlined below:

In addition to the above pay-go projects, the capital improvement plan includes $5,000,000 in federal grant revenue for the W. Green Drive Stormwater Improvement Project. The project will be an innovative redevelopment of a key city arterial in a distressed part of town that has been facing long-standing issues for decades with decayed infrastructure, flooding, and nonpoint source watershed pollution.

Fund balances and retained earnings are critical, but often misunderstood and an overlooked part of the Annual Budget. Fund balances and retained earnings consist of unencumbered and unappropriated monies. They are essential for maintaining our strong bond ratings as well as maintaining positive year-round and year-to-year cash flows. Strong fund balances are essential as we plan for subsequent budgets.

The North Carolina Local Government Commission recommends maintaining a minimum of 8.0% balance in each fund. This is necessary for maintaining positive year-round cash flows, reducing the need for short term borrowing, and assisting in maintaining investment grade bond rating. The High Point City Council adopted Fiscal Policy calls for a minimum 10.0% fund balance of estimated expenditures as a signal of financial strength and fiscal stability. The City of High Point applies the policy to all operating funds except the WaterSewer Fund, which calls for a 50% fund balance, and the Economic Development, General Debt, and General Capital Project funds, which are covered by more specific strategic plans.

In March of 2016, the City Council developed a strategic plan, which has been reaffirmed and expanded by the current City Council. The strategic plan has guided the last several budgets, although the fiscal realities during the pandemic have limited the amount of funding we could devote to these activities. The initial goals are below:

• Increase the population of active, engaged, and entrepreneurial and working young professionals living in High Point by 25%

• 100% proactive enforcement of codes

• Create a downtown catalyst project that produces:

o 500 private sector jobs

o 15-20 new restaurants and shops

o 250 additional housing units

o A centralized gathering place

The City Council met in February 2020 and added three new short-term goals:

• Design a marketing campaign focused on diverse groups, events, and quality of life

• Select target neighborhood and coordinate necessary city departments to implement holistic strategy

• Recruit 50 new office jobs and 5 new investors for catalyst project

This past November, the Mayor, City Council, and senior staff held a strategic planning retreat, facilitated by Fountainworks. The objectives of the retreat were to revisit strategic plan priorities, reflect on the recent successes of High Point, revise existing goals to accommodate community changes, and develop a plan for implementing priorities. Out of this retreat came an updated framework of long-term and short-term goals, as shown below:

● Downtown Catalyst Project

○ Complete Streets & Walkability

○ Stadium renovations

○ Parking

○ Streamline business activation process

○ Implementation of Raise Grant

● Southwest/Small-Scale Manufacturing Corridor Plan

○ Develop 300 Oak vision

○ Revisit & align existing plans/strategies

○ Phase 1 greenway design

○ Benchmark industrial revitalization in other cities

● Reduce (Residential) Blight

○ Pick a neighborhood and develop implementation plan

○ Involve Tree Initiative

● Raise High Point’s Profile as a World Arts & Design Capital

○ Adopt a public art policy

○ Make Arts & Design a focus of our downtown aesthetic

○ Enhance capacity to host Arts & Design events

○ Explore Arts District

○ Explore creation of an Arts & Design Museum

● Increase Quality and Quantity of Housing

○ Dirt moving behind left field

○ Zoning policies for mixed use & density

○ Follow EDC model/mindset

○ Housing policies/receivership (Make local friendly)

The past few years have been challenging for our citizens and the organization, but they have been patient, adapted, and shown great resiliency as we’ve transitioned to a post-pandemic world

I want to acknowledge all the staff members who assist in the preparation of this policy document. The efforts and professionalism of Deputy City Manager Greg Ferguson, Assistant City Manager Eric Olmedo, Assistant City Manager Damon Dequenne, Managing Director Jeron Hollis, Financial Services Director Bobby Fitzjohn, Budget and Performance Manager Stephen Hawryluk, Budget and Evaluation Analysts Roslyn McNeill and Don Scales, Executive Assistant Amy Meyers, and the rest of our executive team are appreciated.

I also want to thank all the City’s employees who work tirelessly each day to face the challenge individually to act as the most creative version of themselves. Finally, I thank the Mayor and City Council for your leadership and commitment to the City of High Point. As a city, we have to remain diligent to grow our tax base, seek out new sources of revenue, and take deliberate steps to ensure sound fiscal management. The proposed budget funds our existing services, while looking to the future with new investments that further support the growth

and vitality of our city. While it can be a difficult balancing act, when you work from a place of building creative collaborations with the understanding that what we create in High Point changes the world, it's well worth it. The City of High Point will continue to grow and thrive.

Respectfully submitted,

Tasha Logan Ford City ManagerCreating the single most livable, safe, and prosperous community in America

The City will serve as the catalyst for bringing together the community's human, economic, and civic resources for the purpose of creating the single most livable, safe, and prosperous community in America

DOWNTOWN CATALYST PROJECT

• Complete Streets & Walkability

• Stadium renovations

• Parking

• Streamline business activation process

• Implementation of Raise Grant

MANUFACTURING CORRIDOR PLAN

• Develop 300 Oak vision

• Revisit & align existing plans/strategies

• Phase 1 greenway design

• Benchmark industrial revitalization in other cities

REDUCE BLIGHT

• Pick a neighborhood & develop implementation plan

• Involve Tree Initiative

WORLD ARTS & DESIGN CAPITAL

• Adopt a public arts policy

• Make Arts & Design a focus of our downtown aesthetic

• Enhance capacity to host Arts & Design events

• Explore Arts District

• Explore creation of an Arts & Design Museum

• Dirt moving behind left field

• Zoning policies for mixed use & density

• Follow EDC model/mindset

• Housing policies/receivership (Make local friendly)

Contained in this document is the City of High Point Fiscal Year 2023-2024 Budget. The budget format was prepared to make it simple and easy to read. We have tried to prepare a document that contains the information necessary for the City Council and the citizens of High Point to understand the operations of the City and the resources and costs necessary to carry out its various missions for fiscal year 2023-2024

The book is divided into funds beginning with the General Fund. The City's Five-Year Capital Improvement Program along with a description of each project is found in the Capital Improvement Program section.

The Summaries/Analyses section contains revenue and expense summaries, assumptions, charts, and other data pertinent to the preparation of this budget.

Revenue information is presented first and expense summaries follow.

Additional summaries, charts and graphs, such as the various funds, Revenue and Expense Summaries, are found at the beginning of each fund's section. The Revenue and Expense Summaries provide a consolidated picture of each fund's revenue and expense status.

A glossary of frequently used terms is found in the last section of the document to assist you in understanding the budget.

We hope that this book is presented in a fashion that will aid you in the location of specific information. Your comments and suggestions are greatly appreciated in helping us compile a document that serves your needs.

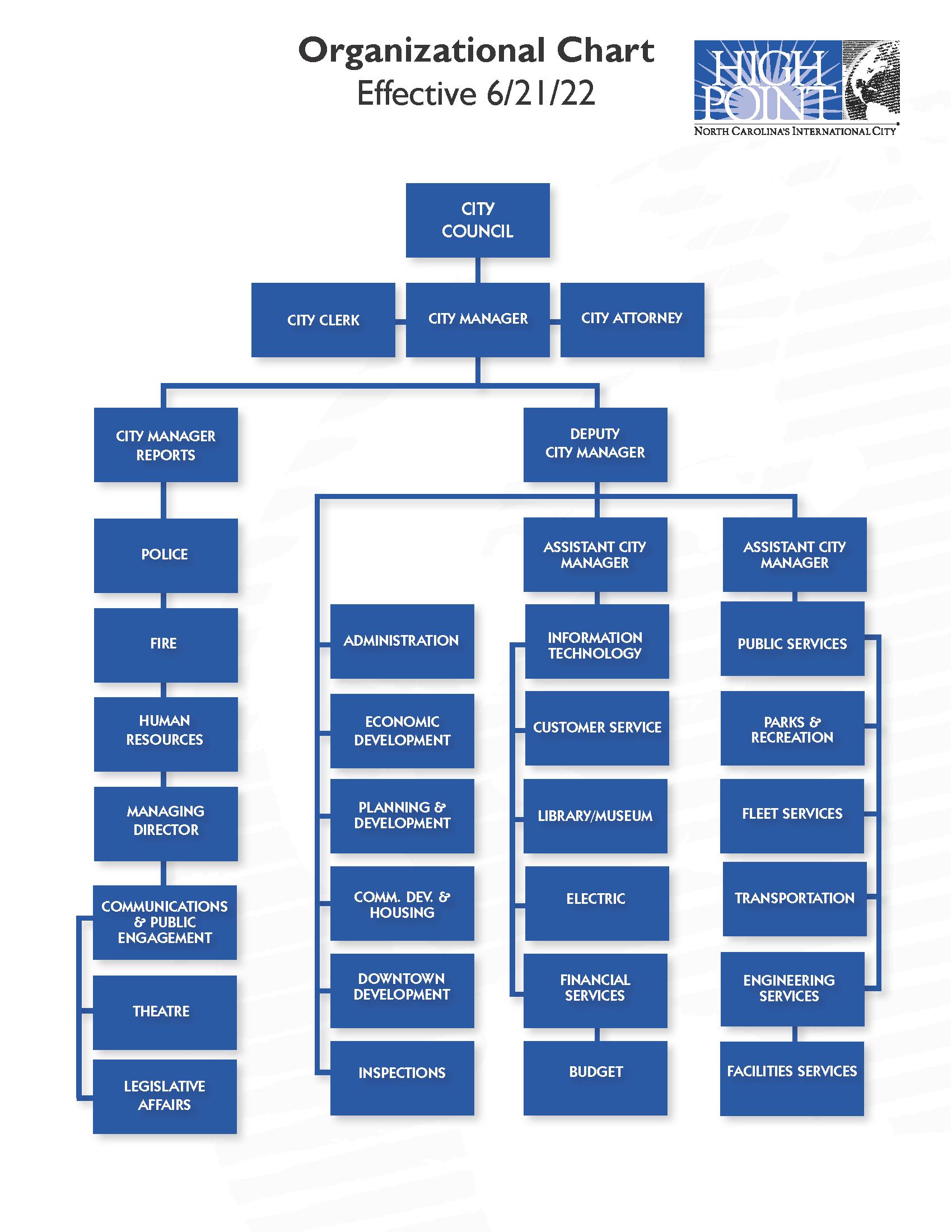

Managers

City Manager

Deputy City Manager

Assistant City Manager

Assistant City Manager

Managing Director

Department Directors

City Attorney

City Clerk

Community Development Director

Customer Service Director

Economic Development Director

Electric Utilities Director

Engineering Services Director

Financial Services Director

Fire Chief

Fleet Services Director

Human Resources Director

Info. Technology Serv. Director

Inspections Services Director

Libraries Director

Parks & Recreation Director

Planning & Development Director

Police Chief

Public Services Director

Theatre Director

Transportation Director

Budget & Evaluation Staff

Tasha Logan Ford

Greg Ferguson

Eric Olmedo

Damon Dequenne

Jeron Hollis

Meghan Maguire (interim)

Sandra Keeney

Thanena Wilson

Jeremy Coble

Sandy Dunbeck

Tyler Berrier

Trevor Spencer

Bobby Fitzjohn

Tommy Reid

Kevin Rogers

Angela Kirkwood

Steven R. Lingerfelt

Reggie Hucks

Mary M. Sizemore

Lee Tillery

Sushil Nepal

Travis Stroud

Robby Stone

David Briggs

Greg Venable

Stephen Hawryluk, Budget & Performance Manager

Roslyn J. McNeill, Budget Analyst

Don Scales, Budget Analyst

High Point is a city centrally located in the Piedmont Triad region of the State of North Carolina and is currently the ninth-largest municipality in North Carolina. Settled before 1750, High Point was incorporated in 1859.

Being a great place to live also means being a great place to work. High Point is a thriving city of 117,279 residents situated along the rolling Piedmont crescent region of North Carolina. High Point lies in four counties, Guilford, Davidson, Forsyth and Randolph. Being centrally positioned along the East Coast with easy access to several interstate highways and the Piedmont Triad International Airport, High Point is a great place to live and to do business.

High Point Public Library: A massive fullservice public library contains nearly 400,000 books, music recordings, videotapes, audiobooks, periodicals, newspapers, and a comprehensive collection of books related to history and genealogy equipped with many attractions for Youth and Young Adults.

Missions of the High Point Public Library

A globally-connected community, High Point earned its nicknames as North Carolina's International City™ and Home Furnishings Capital of the World™. The first North Carolina furniture exposition was held in High Point in 1905. In 1921, a brand new Southern Furniture Exhibition Building was built with ten stories and 249,000 square feet at a cost of $2 million and the event has grown into an internationally renowned furniture trade fair for all home furnishings. Twice each year, the City hosts the High Point Market, the world's largest home furnishings trade show. High Point Market has a tremendous impact on the economy of the entire Piedmont Triad. All 50 states and more than 110 foreign countries are represented at these markets. High Point continues to be the prime location in the United States to purchase brand-name furniture at a substantial discount.

The furniture industry and developing textile manufacturing set the pace for two 20th century growth booms in High Point.

• Nurturing the joy of reading.

• Sharing the power of knowledge.

• Strengthening the sense of community.

• Enhancing cultural and economic vitality.

The High Point Library also hosts the High Point Farmers Market which aligns itself to promote a healthy lifestyle and a sense of community in a family friendly gathering place. Opening and closing dates are subject to change. Admission to the event is free for shoppers, however vendor booth spaces require a minimal fee to cover the costs of event production.

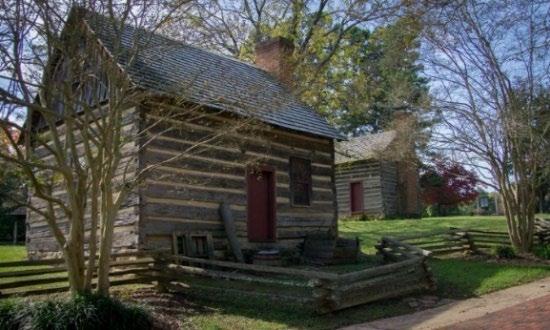

The High Point Museum is a thriving, trusted community center where people come to learn about themselves and our city.

The Museum has two galleries - the Lecture Gallery and the Changing Gallery. It also hosts smaller exhibits in the lobby and on the mezzanine.

Each of the Museum’s permanent exhibits offers insight into High Point, NC’s past where you can explore the images and stories that record the individuals who lived, worshiped, and worked in High Point.

Adjacent to the High Point Museum is the Historical Park which features three historic buildings including the John Haley House (1786), the Hoggatt House (1801) and a working blacksmith shop (1841).

Owned and operated by the City of High Point, the complex represents one of the nation's first cooperative ventures between municipal government, private enterprise, and the arts. In 1975 the International Home Furnishings Center was awarded the Esquire/BCA "Business in the Arts" award in recognition of its cooperation with the City of High Point.

Constructed in 1975, the facility combines contemporary "sculptured" architecture with an interior design dominated by earth tones. The Theatre features an elegant 900 seat auditorium with continental style seating. Other facilities include three large exhibition galleries for meetings, display, or receptions. The center is suited for meeting use, all types of performing arts, and is available to both professional and amateur groups on a rental basis.

Preparation of the City of High Point's fiscal year budget is a process that involves the citizens of High Point, the Mayor and City Council, individual city departments, and the City Manager's budget team.

It is a process that begins in October with preliminary budget meetings and budget software and process training sessions with departments. During the Fall, the Budget and Evaluation Division prepares revenue and expenditure forecasts for the current budget year. The Budget and Evaluation Division distributes operating base budget target numbers and personnel workpapers to departments, and distributes grant request forms to departments and to outside agencies requesting funding.

City management and department directors meet to discuss immediate goals and directives, strategic plan initiatives, and major issues to be emphasized in the upcoming year. The City Manager gives general direction regarding economic conditions and how these conditions should relate to budget proposals.

In October, departments begin preparing their Five-Year Capital Improvement Program. This process requires departments to submit financial information for each project, detailing the description of the project, the projected begin and end dates, as well as how the project will be financed.

In late January, department directors submit the Five-Year Capital Improvement Program (CIP) requests to the Budget and Evaluation Division. Each department ranks their department projects by priority. The Budget and Evaluation Division prepares the CIP recommendations to be included in the proposed CIP plan. The assistant city managers, department directors, and the budget office perform the next review of these requests. At this time, changes that best meet the City’s needs as a whole are incorporated into the departments’ requests. Upon completion of these reviews in February, the program is then presented to the City Manager for review at which time additions or reductions may be made as any new priorities are identified.

Each Fall, the Budget and Evaluation Division meets with department staff and conducts budget software training and outlines expectations for the upcoming budget year. The Budget and Evaluation Division prepares revenue forecasts and operating budget target numbers for the upcoming year. The budgeting software is opened for each department to begin the input of their operating budget requests. The Budget and Evaluation Division distributes personnel workpapers and grant request forms to each department.

At the City Council's discretion, a City Council/Management Team retreat is held early in the calendar year, during which the City Council communicates their concerns and priorities and updates the Strategic Plan for the upcoming year. The City Manager’s staff presents an overview of the current budget year, preview of the year-end financial picture, and major capital projects on the horizon. This important meeting provides valuable insight and feedback from Council members for the management team to use in developing the proposed budget.

Once budget information is input into the budget software, budget review meetings are scheduled as necessary during March with department heads and the Budget and Evaluation Division to study their requests. The City Manager is given a briefing on any new programs that are being proposed, new position requests, as well as major increases in the budget requests. The Budget and Evaluation Division produces the initial recommended budget to be reviewed with the City Manager. The Manager makes any final revisions to the proposed budget along with the proposed tax rate and any utility rate or other fee changes being proposed for the new fiscal year.

In May the City Manager's proposed budget is presented to the Mayor and City Council, the press, and the public. The proposed budget is made available for public inspection in the office of the City Clerk, the Library, and the Budget and Evaluation Division.

During May/June, the City Council holds a series of budget study sessions in which intense study of the budget occurs. During these meetings the City Council reviews the budget and makes any necessary adjustments. North Carolina General Statutes require one public hearing be held for public comment on the proposed budget. This hearing is conducted in May or June, prior to adoption of the budget. The City Council is required by law to formally adopt the budget at a City Council meeting on or prior to June 30.

The adopted budget is also posted on the City of High Point’s website and can be accessed at www.highpointnc.gov.

PLANNING October - January

• Budget team prepares revenue and spending forecasts for current budget year

• Budget Kickoff - January 13, 2023

• Budget team distributes operating base budget target numbers and personnel workpapers to departments

• Operating/Performance Measures training sessions - Jannuary 18 & 19, 2023

• Budget team distributes Grant request forms - Due January 6, 2023

BUDGET REVIEW February - April

• Revenue, Expenditures and Change Requests updated in Questica - Due February 1, 8, & 15, 2023

• Performance Measures for the first six (6) months of the current year - Due February 1, 8 & 15, 2023

• Budget team mails/distributes Outside Agency Grant Application - Due February 17, 2023

• Budget team initial review of departmental requests

• Budget team review with City Manager's Office

• Budget team to distribute Comprehensive Fee Schedule for updating - Due March 20, 2023

CITY COUNCIL REVIEW May

• Proposed budget presentation to City Council - May 1, 2023

• City Council Budget Review

• Budget Work Session - May 10, 18, and 24, 2023

• Budget public hearing - May 15, 2023

ADOPTED BUDGET June

• Adoption of FY 2023-2024 Annual Budget and Related OrdinancesJune 5, 2023 (tentative)

The City of High Point annual budget shall be prepared in accordance with the General Statutes of the state of North Carolina section 159-8(a) that requires an annual balanced budget defined as follows: The budget ordinance is balanced when the sum of estimated net revenues and appropriated fund balances is equal to appropriations.

The City of High Point adheres to state statutes by strictly applying the following policies in the development of its annual operating budget. These policies provide the basis for decision-making and in continuing a tradition of financial stability in High Point’s operation.

1. The City of High Point shall prepare an annual budget appropriation document covering the twelve-month period beginning July 1 and ending June 30 of the following year.

2. Before April 30th of each year, each department head shall present budget requests and revenue estimates for the coming budget year.

3. The proposed budget document shall be presented to the City Council for consideration no later than June 1 with adoption of the approved ordinance by June 30.

4. One public hearing is mandated by North Carolina State General Statutes.

5. The City budget will be developed incorporating all programs and service levels as established by City Council and as required by all statutes.

6. Budgets shall be prepared at the department level and provide the basis for the City’s financial management and operation. The adopted appropriations by fund shall constitute the maximum expenditure authorization for that fund and may be amended only by action of the City Council.

1. Estimation of revenue receipts shall be realistic and attainable both in the determination of fund balance generation in the current fiscal year and in the estimated receipts for the following fiscal year. Where judgment is required, conservatism shall be the rule.

2. Amounts appropriated into fund balance shall not exceed the sum of cash and investments minus the sum of liabilities, encumbrances, and deferred revenues arising from cash receipts at the close of the fiscal year preceding the budget year.

3. Every effort shall be made to maintain a balance of 10% of the City’s estimated expenditures in undesignated fund balance. Appropriations from unappropriated fund balance shall be made only at the direction of the City Council.

4. Water, sewer, stormwater, and electric rates shall be set at an amount that will enable these funds to be self-supporting.

5. The practice of transferring from the Electric Fund to supplement the General Fund was eliminated beginning with the 2000-2001. The Proposed 2023-2024 budget does not include a transfer of electric funds.

6. One-time or special revenues shall not be used to finance ongoing City operations but rather be used for the funding of special projects.

7. An aggressive policy of seeking the collection of delinquent utility and license fee accounts will be maintained.

The goal of the City’s debt policy is to manage debt by maintaining a sound fiscal position and protecting the City’s credit rating. Long-term debt shall only be used to finance those capital projects that cannot be financed with current revenues and will require strong financial administration.

When the City considers debt financing, analyses of the financial impact of short-term and long-term issuing of the debt is considered. Issuing long-term debt commits the City’s revenues several years into the future, and may limit its flexibility to respond to changing service priorities, revenue inflows, or cost structures. For this reason, it must be determined that future citizens will receive benefit from the capital improvement that the debt will finance.

Bonds may be sold as authorized or by first issuing bond anticipation notes (BANs) to finance the bond projects. When BANs are issued, such shall be retired by the issuance of the bonds historically within a period of one year.

The payment of debt service shall be developed on a schedule that provides even or level debt payments annually in order to prevent major swings from year to year

1. The issuance of all bonds for the purchase of or construction of major capital projects will be with the approval of the North Carolina Local Government Commission

2. In adherence to North Carolina General Statute 159-7, funds shall be appropriated to cover debt service before any other appropriation is authorized.

3. The legal debt margin of 8% of assessed valuation shall be maintained.

1. The City shall prepare a Five-Year Capital Improvement Program (CIP) in conjunction with the annual operating budget. The first year of this program shall be presented for adoption. The subsequent four years shall be for information and planning purposes.

2. Capital expenditures included in the CIP are attributable to a specific fund (General, Water, Sewer, Electric, etc.) and will be financed from revenues assigned to that fund. Projects included in the CIP shall have a cost greater than $15,000 and a useful life of at least ten years.

3. Capital acquisitions costing not less than $5,000 and having a useful life of at least three years and which do not materially add to the value of existing assets shall be budgeted for in the operating budget of the department to which the asset is to be assigned. These acquisitions shall not represent major acquisitions that are budgeted for in the CIP. Vehicles for the City’s fleet are not budgeted for in the CIP. First-year acquisition of vehicles is budgeted in the using department; subsequent replacement vehicles are managed through the City’s Fleet Replacement Program.

4. Capital Project Ordinances (CPO) shall be established and adopted by the City Council separate from the regular operating budget ordinance and shall authorize the construction or acquisition of major capital that spans a period of time greater than one year to complete. The appropriation of the capital project ordinance budget shall remain in effect for the life of the project and not require reappropriation each fiscal year.

5. The expenditure of all bond-authorized projects will be controlled through the establishment of capital project ordinances.

North Carolina General Statute 159-8 states that each local government shall operate under an annual balanced budget ordinance.

The budget ordinance as adopted by the City Council may be amended in two ways:

(1) Budget transfers within a fund authorized by the City Manager, or

(2) Appropriation increases or decreases authorized by the City Council including transfers, contributions, and reimbursements among funds.

The first procedure authorized by the budget ordinance states that the City Manager is authorized to approve transfers of appropriations within a given fund. Conversely, transfers cannot occur between funds without authorization from the City Council.

In order to initiate a transfer of budgeted funds from one line item to another within the same fund, the department requesting the transfer must complete a “City of High Point Budget Transfer Request” form indicating the budget account number to transfer from, the budget account number to transfer to, and the amount to be transferred. An adequate

explanation of the need for the transfer must accompany the request.

The completed form must be signed by the department head and submitted to the Budget and Evaluation Division. Upon receipt, the Budget and Evaluation Division reviews the form for completeness and accuracy, verifies that the requested transfer amount is available for transfer, and determines if the request is valid.

Upon signature authorization and approval by the Budget and Performance Manager or appropriate designee, the request is entered into the general ledger system to process the budget transfer. Budget transfers result in no increase or decrease in the fund’s budget.

One exception to the City Manager’s authority to transfer budget within a fund is that of contingency transfers. The City Manager is required to communicate to City Council any transfers by his/her authority out of a fund’s contingency account into any other budget for expenditure.

The need for any budget ordinance amendment that results in either increases or decreases in a fund’s total budget or which involves transfers of budget between funds requires City Council formal authorization and approval.

For example, if revenue is made available during the fiscal year that was not included in the original adopted budget ordinance, the City Council may elect to appropriate this revenue and budget a corresponding amount of expense for a stated purpose.

In addition, the City Council may elect to transfer, contribute, or reimburse one fund from another fund for a stated purpose.

In any of these instances an increase in the fund’s budget is the result.

To implement this, the Budget and Evaluation Division prepares a Budget Ordinance Amendment which states the revenue and expense accounts involved, the amount of the amendment, and the purpose of the amendment. This Appropriation Ordinance is then presented to the City Council for deliberation and approval. When approved, the Budget and Evaluation Division files the ordinance with the City Clerk and prepares the appropriate budget transfer request forms and processes them as outlined in the section above.

The accounting policies of the City of High Point shall conform to the generally accepted accounting principles as applicable to governments.

The diverse nature of governmental operations and the requirements of assuring legal compliance preclude recording all governmental financial transactions and balances in a single accounting entity. Therefore, from an accounting and financial management perspective, a governmental unit is a combination of several distinctly different fiscal and accounting entities, each having a separate set of accounts and functioning independently of each other.

The basis of accounting refers to the point at which revenues or expenditures are recognized in the accounts and reported in the financial statements. It relates to the timing of the measurements made regardless of the measurement focus applied. As in the basis of budgeting, accounting records for the City of High Point governmental funds are maintained on a modified accrual basis with the revenues being recorded when available and measurable and expenditures being recorded when the services or goods are received and the liabilities are incurred. In contrast to the basis of budgeting, accounting records for proprietary funds are maintained on the accrual basis in which revenues are recognized when earned and expenses are recognized when incurred.

The City of High Point’s accounting system is organized and operated on a fund basis. Each accounting entity is accounted for in a separate fund, which is defined as a fiscal accounting entity with a self-balancing set of accounts recording cash and other financial resources together with related liabilities and residual equities or balances, and changes therein. Two fund types defined in the “Description of Budgeted Funds” are further defined below as well as the addition of Fiduciary Funds.

Classification Fund Type

Governmental Funds

General

Special Revenue

Debt Service

Capital Projects

Proprietary Funds

Fiduciary Funds

Enterprise

Internal Service

Agency

Expendable Trust

Governmental Funds | These funds are, in essence, accounting segregations of financial resources. Expendable assets are assigned to the various governmental funds according to the purposes for which they may or must be used; current liabilities are assigned to the fund from which they are to be paid; and the differences between governmental fund assets and liabilities (the fund equity) is referred to as Fund Balance. The primary measurement focus is “flow of current financial resources.” Increases in spendable resources are reported in the

operating statement as revenues or other financing sources, and decreases are reported as expenditures or other financing uses.

Proprietary Funds | These funds are sometimes referred to as income determination, non-expendable, or commercial-type funds and are used to account for a government's on-going organizations and activities which are similar to those often found in the private sector. All assets, liabilities, equities, revenues, expenses, and transfers relating to the government's business and quasibusiness activities, where net income and capital maintenance are measured, are accounted for through proprietary funds. The generally accepted accounting principles here are those applicable to similar businesses in the private sector, and the measurement focus is the economic condition of the fund as a result of the events and transactions of the period. Events and transactions that improve the economic position of a proprietary fund are reported as revenues or gains in the operating statement. Those that diminish the economic position are reported as expenses or losses.

Fiduciary Funds | These funds account for assets held by the City in a trustee capacity or as an agent for other governmental units and for other funds. Each trust fund is accounted for as either a governmental or a proprietary fund.

Fiduciary funds are not budgeted in the annual budget process.

These represent another accounting entity used to establish control and accountability for the City's general fixed assets and the outstanding principal of its general long-term debt (General Fixed Assets Account Group and General LongTerm Debt Account Group).

These records are accounted for in a selfbalancing group of accounts because the City's General fixed assets -- all fixed assets except those accounted for in Proprietary Funds or Trust Funds -- are not financial resources available for expenditures. The outstanding principal of the general longterm debt and general long-term liabilities not accounted for in the Proprietary Funds or Trust Funds do not require an appropriation or expenditure during the account year.

In developing and maintaining the City's accounting system, consideration is given to the adequacy of internal accounting controls. Internal accounting controls are designed to provide reasonable, but not absolute, assurance regarding the safeguarding of assets against loss from unauthorized use or disposition and the reliability of financial records for preparing financial statements and maintaining accountability for assets.

The concept of reasonable assurance recognizes that the cost of a control should not exceed the benefits likely to be derived, and the evaluation of costs and benefits requires estimates and judgments by management.

All internal control evaluations occur within the above framework. We believe that the City's internal accounting controls adequately safeguard assets and provide reasonable assurance of proper recording of financial transactions.

Because of the major impact that this revenue source could have on the General Fund, and therefore, the tax rate, special comment is warranted on the Electric Fund.

On February 1, 1996, the High Point City Council adopted an Electric Fund Transfer Policy, which restricts the amount of funds which can be transferred to the General Fund from the Electric Fund. The policy provisions are summarized below:

♦ Whereas the City Council desires to preserve the financial integrity of the Electric Fund and to reduce the General Fund’s dependence on Electric Fund transfers…

♦ Whereas if electric services had been provided by an investor-owned utility instead of the city’s Electric Fund, such utility would have paid municipal ad valorem taxes to the General Fund of the City and would have been entitled to a return on investment;

♦ Therefore, be it resolved by the City Council, that the following policy regarding payments in lieu of taxes and operating transfers from the Electric Fund be adopted:

1. The City shall budget annually a payment in lieu of taxes amount from the Electric Fund to the General Fund that approximates the amount of ad valorem taxes that would have been paid had electric services been provided by an investor-owned utility

2. Operating Transfers: The City may budget an operating transfer from the Electric Fund to the General Fund not to exceed 3% of the gross fixed assets of the Electric Fund as reported in the City’s most recent audited financial statements

The transfer to the General Fund was eliminated in fiscal year 2000-2001. The 2023-2024 Proposed Budget does not include a transfer from the Electric Fund. The amount budgeted for payment in Lieu of Taxes from the Electric Fund to the General Fund for fiscal year 20232024 is $978,944.

The City’s budget is developed on a modified accrual basis for all funds, which means that obligations of the City are budgeted as expenditures, but revenues are recognized only when they are measurable and available. Available means that the funds are collectible within sixty days of the fiscal year-end. The Local Government Budget and Fiscal Control Act requires that the budget ordinance be balanced. North Carolina General Statute 159-8(a) states:

Each local government and public authority shall operate under an annual balanced budget ordinance....A budget ordinance is balanced when the sum of estimated net revenues and appropriated fund balance is equal to appropriations.

Appropriations are exclusively limited to cash and cash equivalents less current claims against that cash. The statutory formula is cash and investments minus the sum of liabilities, encumbrances, and deferred revenues arising from cash receipts.

The Annual Budget authorizes and provides the basis for the City's financial management. The adopted appropriations constitute the maximum expenditure authorization during the fiscal year and can only be amended by action of the City Council.

The City's budget is divided into funds. An annual budget is adopted for the General, Special Revenue, Debt Service, General Capital Projects, Enterprise and Central Service Funds. (These are illustrated in the “Budgetary Fund Structure” chart and further defined in the “Description of Budgeted Funds” on the following two pages). Within each fund are the separate departments with various activity budgets. The Annual Budget is adopted at the department level.

Beginning with the budget for fiscal year 2016-2017, a new budget software system was implemented. Questica is a webbased application that uses state-of-the-art technology to provide entities the functions and features necessary to gain visibility into their financials and control their operating budgets. The program ensures the budgeting cycle runs smoother and securely for users. The product also includes a Salary and Position Planning module, a Capital Improvement Planning module, and a Performance Management module.

The implementation of this software has eliminated the need for the Budget and Evaluation Division to push spreadsheets out to departments for budget preparation. Departments enter budget requests directly into the budget system, and have the ability to generate individual reports at the fund, department, and accounting unit levels.

The system will also allow many “what if” scenarios to be tested. All preparation of the budget up to adoption is done in the Questica software. The budget system is solely a system for preparing and balancing the budget. The budget is uploaded into the Lawson Financial System following adoption.

The financial system implemented in fiscal year 2006-2007 by the City of High Point is Infor Lawson Enterprise Resource

Planning (ERP) that provides for excellent fiscal management.

The General Ledger acts as the heart of the financial management system. The General Ledger function interfaces with other Infor Lawson Applications such as Purchasing and Accounts Payable each of which feed into the General Ledger.

The Infor Lawson Financial System budget edits allow for excellent budgetary control at the department or accounting unit level. This functionality checks for available funds before new commitments and encumbrances are released by the system.

General Fund

• General Government

• Public Safety

• Public Services

• Planning & Community Development

• Cultural & Recreation

Internal Service Funds

• Central Service Funds

• Print Shop

• Radio Repair

• Computer Replacement

• Fleet Maintenance

• Insurance Reserve

Economic Development

Special Revenue

• Special Grants

• Community Development

• Market Authority

Debt Service

• General Debt Service

Capital Projects

• General Capital Projects

Enterprise Funds

• Water-Sewer Fund

• Electric Fund

• Mass Transit Fund

• Parking Fund

• Solid Waste Fund

• Stormwater Fund

Legend: Fund Group Level: Gray Fund Level: Blue Below Fund Level: Red

The City’s budget is developed on a modified accrual basis for all funds, which means that obligations of the City are budgeted as expenditures, but revenues are recognized only when they are measurable and available. As in the basis of budgeting, accounting records for the City of High Point governmental funds are maintained on a modified accrual basis with the revenues being recorded when available and measurable and expenditures being recorded when the services or goods are received, and the liabilities are incurred. In contrast to the basis of budgeting, accounting records for proprietary funds are maintained on the accrual basis in which revenues are recognized when earned and expenses are recognized when incurred.

The City of High Point budget consists of two basic fund types: Governmental Funds and Proprietary Funds

The measurement focus of governmental funds is upon determination of financial position and changes in financial position rather than upon net income.

The General Fund is used to account for general government operations of the City, which are financed through taxes or other general revenues, contributions, reimbursements, or transfers from other funds. The General Fund accounts for all financial transactions not required to be accounted for in another fund. The Economic Development Fund is used to account for funds appropriated for investment incentives to aid in attracting investors to the City.

Special Grants is used to account for revenues received from federal, state, and local sources or groups designated for expenditure on particular programs and projects. These programs and projects are usually non-recurring in nature and of short duration.

Community Development is used to account for revenues and expenses derived from the Community Development Block Grant entitlements to the City.

Market Authority is a public-private partnership sponsor of the International Home Furnishings Market and is used to develop strategies and priorities to address and promote improvements for the annual spring and fall markets

The General Debt Service Fund is used to account for the accumulation of resources for and the payment of general long-term debt, principal and interest for bonded indebtedness incurred for the financing of projects associated with General Fund activities. (Debt service for enterprise funds is accounted for in those funds.)

The General Capital Projects Fund is used to account for the acquisition or construction of major capital facilities, equipment, and improvements other than those financed by the enterprise funds.

The measurement focus of proprietary funds is upon determination of operating income, changes in net assets, financial position and cash flows. Use is required for operations for which a fee is charged to external users.

The Central Services Fund is used to provide centralized services such as radio, computer, and fleet services on a cost-reimbursement basis that provides the revenue to support the Central Services Fund.

Insurance Reserve Fund is used to account for revenues and expenses for Health, Dental, Life Insurance, and Worker’s Compensation.

Water-Sewer Fund is an enterprise fund used to account for the provision of water and sewer services to the residents of the City and some county residents. It includes all operating, debt service, and capital improvements associated with providing water and sewer services.

Electric Fund is an enterprise fund used to account for the provision of electric service to the residents of the City. It includes all operating, debt service, and capital improvements associated with providing electric service.

Mass Transit Fund is an enterprise fund used to account for the operation and maintenance of the City’s public transportation system, High Point Transit System.

Parking Fund is an enterprise fund used to account for the operation and maintenance of the City’s various parking facilities. It includes all operating, debt service, and capital improvements for the parking facilities.

Solid Waste Fund is an enterprise fund used to account for the operation and maintenance of the City’s landfill, municipal recycling facility and garbage collection. It includes all operating, debt service, and capital improvements for the landfill and recycling facilities.

Stormwater Fund is an enterprise fund used to account for the operation and maintenance of the stormwater program, which manages stormwater runoff, bank stabilization, and maintenance of retention lakes and ponds. All expenses including debt service and capital improvements for the stormwater operation are included in this fund.

The City of High Point’s Fiscal Policy Guidelines were originally adopted April 3, 2006 and were most recently revised on June 1, 2021. The Guidelines consist of six sections: Objectives, Capital Improvement Budget Policies, Debt Policies, Reserve Policies, Budget Development Policies, and Cash Management and Investment Policies.

This fiscal policy is a statement of the guidelines and goals that will influence and guide the financial management practice of the City of High Point, North Carolina. A fiscal policy that is adopted, adhered to, and regularly reviewed is recognized as the cornerstone of sound financial management. Effective fiscal policy:

• Contributes significantly to the City's ability to insulate itself from fiscal crisis,

• Enhances short-term and long-term financial credit ability by helping to achieve the highest credit and bond ratings possible,

• Promotes long-term financial stability by establishing clear and consistent guidelines,

• Directs attention to the total financial picture of the City rather than single issue areas,

• Promotes the view of linking long-run financial planning with day to day operations, and

• Provides the City Council, citizens and the City’s professional management a framework for measuring the fiscal impact of government services against established fiscal parameters and guidelines.

To these ends, the following fiscal policy statements are presented.

1. The City will prioritize all capital improvements in accordance with an adopted capital improvement program.