Special Edition

FEBRUARY 22-23, 2024

DeVos Place | Grand Rapids, MI

2024 CONFERENCE GUIDE

MIDWESTREICONFERENCE.COM

FEATURES

5

21

6

12

22

27

61

The

50

58

FEBRUARY 2024 MICHIGAN LANDL O RD 3 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

MICHIGAN LANDLORD magazine's goal is to provide a forum for real estate investment and rental property ownership and management ideas and news. Our articles, columns, and other features should not be construed as investment advice, nor does their appearance imply an endorsement by the Rental Property Owners Association of Kent County or the Real Estate Investors of Michigan of any specific real estate investment

management strategy. An investor’s and manager’s

course of action must be based on individual circumstances. VOLUME 60, ISSUE 2 www.rpoaonline.org

or

best

THANK YOU 2024 SPONSORS!

WELCOME NEW MEMBERS!

MEMBER-TO-MEMBER DISCOUNTS

ARTICLES

SCOTT

YOUR INVESTMENT PROFITABLY

MEYERS: PLANNING YOUR SELF-STORAGE EXIT STRATEGY: HOW TO ENSURE YOU LEAVE

TOM KOETSIER MEMORIAL SCHOLARSHIP

ALEX JARBO: PROTECTING YOUR FUTURE IN SHORT-TERM RENTALS: IT STARTS BY PROVIDING A POWERFUL GUEST EXPERIENCE

14

MARIA GIORDANO: CAN I REALLY AMORTIZE 400 MONTHS?

JONATHAN MAST:

CUSTOMGPTS: A COMPREHENSIVE GUIDE

ADRIAN SMUDE: THREE TYPES OF MOBILE HOME INVESTMENTS

ANTHONY CHARA: WHERE DO YOU FIND GREAT DEALS ON APARTMENTS?

JEFFREY TAYLOR: MANAGEMENT TIPS FROM MRLANDLORD.COM

REVOLUTIONIZING SOCIAL MEDIA MARKETING WITH OPENAI’S

34

39

44

RYAN KILPATRICK: HOW RYAN KILPATRICK AND HOUSING NEXT ARE CHANGING THE PARADIGM ABOUT AFFORDABLE HOUSING

CARA MIDDLETON: VACATION RENTALS IN MICHIGAN

MICHIGAN VACATION RENTAL INCLUDES A PRIVATE ISLAND, HISTORIC

CABIN ON A RIVER CONTENTS

/ THIS

LOG

Adam Porczynski

Amanda Andrulis

Amy Curcio

Amy Powers

Brian Stewart

Carol Schulz

Carrie Drier

Christopher Silker

Dameta Dow

Dannie McDaniel

Douglas Haase

Duane Blauwkamp

Gary L Ehlke

Greg Hatcher

Gregory Kris

Haris Guric

Jay Roney

Jeff Haveman

JD Ramey

Jeff Pilon

Jennifer Swack

Jeremy Annen

Jessica Kohn

Joe Bellew

Joe Long

Kenneth Nicholson

Lisa Flores

Lynette Fitzpatrick

Michael Maher

Michelle Coulier

Mike DeVries

Nadejda Bontcheva Loyaga

Nate Versluis

Nathan Kirgis

Paul Green

Randall Groendyk

Rob Fishbein

Ryan McNamara

Sarah Johnston

Sarah Kramer

Scott Mostert

Shane Galbraith

Sidney Norden

Stacey Clark

Susan Fryover

Sydney Noeske

Terry Perysian

Timothy Botruff

Zach Ensing

FEBRUARY 2024 MICHIGAN LANDL O RD 5 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

WELCOME NEW MEMBERS!

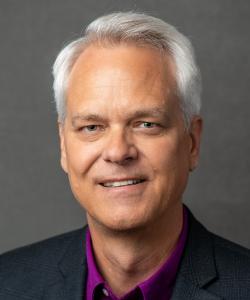

FEATURED CONFERENCE SPEAKER

SCOTT MEYERS

SELF-STORAGE INVESTING: PROVEN STRATEGIES FOR SUCCESS

Friday, February 23rd

1:30pm - 3:30pm

River Overlook EF

Planning Your Self-Storage Exit

Strategy: How to Ensure You Leave Your Investment Profitably

By Scott Meyers

In his book “The 7 Habits of Highly Effective People,” author Stephen Covey recommends that we “begin with the end in mind, which means to begin each day, task or project with a clear vision of your desired direction and destination, and then continue by flexing your proactive muscles to make things happen.”

As you approach your next self-storage acquisition, conversion or ground-up development, apply this mindset to ensure you exit successfully. New investors tend to overlook this critical component of their overall strategy. They’re simply too excited to start to think about the stop. To be forward-thinking, you must consider several factors from the very beginning,

6 RENTAL PROPERTY OWNERS ASSOCIATION

including the timing and method of your exit along with tax implications, financials and others that’ll shape your decisions up front.

This is why it’s critical to create a business plan before you search for a self-storage asset to acquire or develop. You need a clear vision that defines the ownership structure, geographic concentration, marketing strategy, capital stack, asset management, key team players, third-party vendors … and your exit strategy! For this article, let’s focus on that last piece as it fits into your overall investing approach.

Personal Goals

It’s easy to let the excitement of a new self-storage opportunity override our ability to stick to the business plan. It’s easy to say, “I’m going to buy nothing but C-class, value-add facilities with 150-plus units that are within a two-hour drive of my home and cash-flow positive in six months or less. I’ll then reposition these as B-class properties, drive up the net operating income and sell the portfolio in five years.”

In practice, this should define your search efforts. In reality, you’ll likely find a 90-unit self-storage facility that’s five states away, won’t cash flow for a year and has $300,000 in deferred maintenance, but it has a tremendous upside! If your goal is to roll up several facilities within a single area to exit at the same time, this asset wouldn’t fit your strategy. You’d have to sell it separately, which isn’t terrible, but you’d miss out on the economies of scale while managing it as well as the compressed capitalization (cap) rate of selling it as part of a larger portfolio. When seeking opportunity, it’s important to know—and aim—for the goal.

Investor Returns

Another important exit consideration pertains to the overall return on a self-storage project, especially one with a longer-term play such as a new development or distressed portfolio you intend to turn around. If you plan to bring in private equity to produce the returns your partners seek, there needs to be a cash event such as refinancing or a sale at a predetermined date. You must project this cash event within three to five years to calculate the internal rate of return (IRR) your investors will receive—a formula that considers the

FEBRUARY 2024 MICHIGAN LANDL O RD 7 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

length of time their money was tied up in the project.

In this scenario, you must consider the timing of the exit during initial project evaluation. The overall timeline includes acquiring or developing the self-storage project, leasing it to stabilization, and then selling it for your expected value. It might take three, four or five years, so the plan should be backed by your own experience, along with the help of a feasibility study and professional consultants.

Pay extra attention to the timing of your exit when syndicating, since these projections become part of the private-placement memorandum that’s shared with equity partners and governed by the Securities and Exchange Commission. As such, you need to make sure you’re hitting your marks.

Value Projections

In addition to defining your self-storage exit strategy and timeframe, you need to consider what plays into the projected value for your pro forma. In terms of predictions, what’ll the economic climate look like regarding interest and cap rates?

Our economy operates in seven- to 10-year cycles. We tend to experience a recession, followed by seven to 10 years of expansion, before heading into the next cycle. When interest rates rise, cap rates do, too. If you’re exiting at this point in the cycle, it puts downward pressure on values. Conversely, when interest rates fall, cap rates compress and values increase, which is the best time to sell.

Knowing this and planning for your exit on the front end will determine your overall profit for an individual project or portfolio. If you can’t exit in five years because you find yourself in a high rate point in the cycle, you may have to hold on until cap rates fall in line with your assumptions. Remember, IRR is key, not only for yourself, but for any equity partners tied to the project.

Wholesale Opportunities

All this isn’t to suggest you can't be opportunistic while operating within the constraints of

8 RENTAL PROPERTY OWNERS ASSOCIATION

your business plan. For example, let’s say you cranked up your marketing machine, have brokers looking for self-storage facilities that fit your acquisition goals, and have multiple options sitting on your desk. Some won't fit your overall plan, but that doesn't mean you can't monetize them with a separate exit strategy.

It can be as simple as getting a property under contract and assigning it to somebody else. Perhaps you engage in a joint venture in which you keep a small piece of the project. In this case, it wouldn’t require a lot of your resources. It would lie outside of your core business.

Another wholesale opportunity might be finding a piece of land you take through entitlement, with the exit defined as the sale of a shovel-ready parcel to another developer. There are many ways to exit gainfully when you uncover a profitable opportunity, without deviating completely from your original business plan and its defined exit strategies.

Sale/Leaseback

Another possible exit strategy is to sell your self-storage facility or portfolio but assume the bank role by financing the purchase. For example, you could offer your asset to the market and create your own loan, complete with a promissory note and mortgage for 60% to 95% loan-to-value on the new appraisal.

Under this scenario, the buyer brings the down payment or equity. The deed crosses the table, and you’re no longer the owner/operator. Should the buyer default, you’ve already received the upfront equity, and you have the ability to foreclose and take possession of the property.

Another benefit is this strategy defers your capital gains since you’re only receiving a portion of the sale proceeds at closing. This is an excellent tax strategy and a way to retain an income stream.

Legacy

For many self-storage investors, the primary strategy is to grow a portfolio of cash-flowing properties and sell them when the depreciation and tax benefits run out. Some owners

10 RENTAL PROPERTY OWNERS ASSOCIATION

choose to gift their properties to their heirs and place them in retirement or other vehicles for asset-planning purposes. Another way to exit is to perform a 1031 exchange into other projects of greater value.

At some point, you should set a cash-flow goal or dollar number with your financial adviser that you can work toward and add to your overall approach and exit strategy as you build your empire. In practice, it’s important to understand there are multiple exit strategies possible. This won’t only help you be well-prepared, it can allow you to be extremely opportunistic once you crank up your efforts and get in the game.

Scott Meyers has been involved in the self-storage industry as a developer, owner, syndicator and operator since 2005. He owns and operates 22 facilities in nine states and has bought, developed, and sold over 4,200 units and over 4 million square feet of commercial and self-storage properties.

Scott Meyers is known as the nation's leading expert on self-storage investing. Scott will join us to discuss the benefits of investing in self-storage, the latest self-storage investing strategies and teach you how you can take advantage of the incredible demand for self-storage facilities to make massive profits!

Scott Meyers will be presenting at the 2024 Midwest Real Estate Investor Conference in Downtown Grand Rapids on The Future of Hospitality Management on Friday, February 23rd at 1:30pm - 3:30pm in River Overlook EF. Register now!

The self storage business is widely regarded as the most profitable and easily managed real estate investment in the country. It's one of the best ways to earn significant passive income without all the hassles of tenants, toilets, or trash!

Scott Meyers will provide you with valuable insights on how to capitalize on the high demand for self-storage facilities in virtually every market, allowing you to generate substantial passive income. You'll learn how to assess a promising market for self-storage and uncover undervalued deals that often go unnoticed by others. Discover strategies for funding self-storage deals and gain knowledge on initiating the development of your own self-storage facility. Scott will also introduce you to the latest innovative business models and strategies in the self-storage industry, ensuring you leave the session with a comprehensive understanding of this lucrative investment opportunity.

Finally. Peace of Mind.

FEBRUARY 2024 MICHIGAN LANDL O RD 11 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS Creating happy, healthy, environmentally friendly communities while generating higher profitability for our clients. livegreenlocal.com | 866.954.7336 xt.6 | reception@greenpropertymgt.com

Service

Firm

Your Full

Property Management

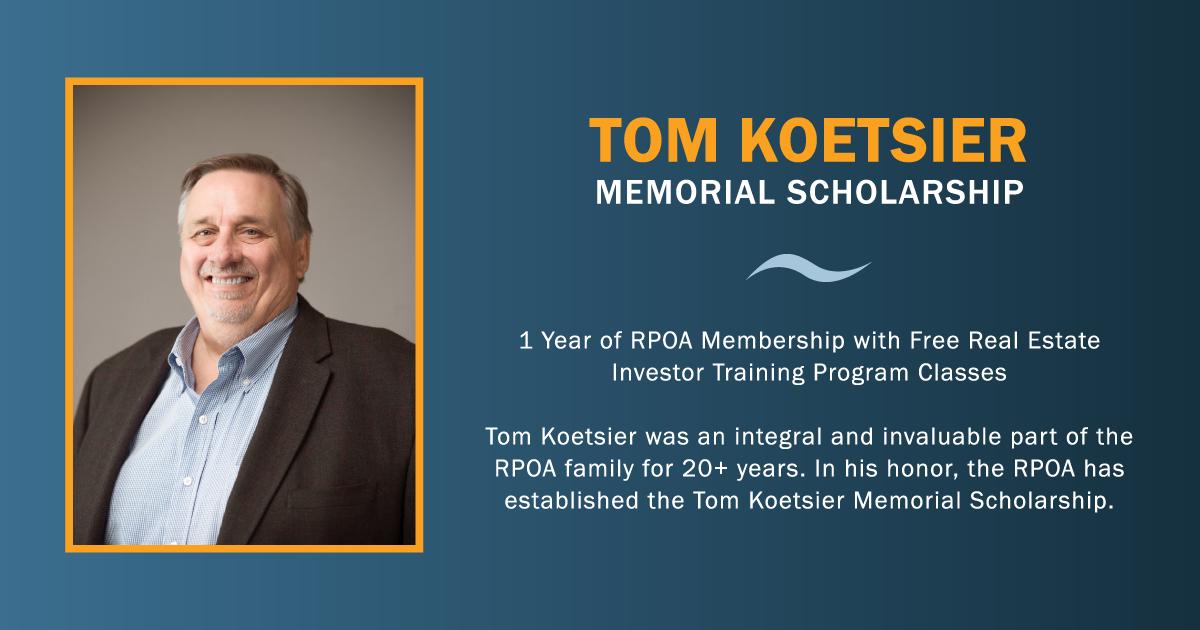

Apply now for the Tom Koetsier Memorial Scholarship!

Scholarship recipients will receive 1 year of RPOA membership and free RPOA Real Estate Investor Training Program classes.

Tom Koetsier was an integral and invaluable part of the RPOA family for 20+ years.

Tom always found time to help members with their personal real estate questions and to assist the RPOA staff by answering technical questions. Many investors in the community acknowledge Tom as their mentor and friend—responsible for, to some degree, their success in the business.

In his honor, the RPOA has established the Tom Koetsier Memorial Scholarship.

12 RENTAL PROPERTY OWNERS ASSOCIATION

Get

of FREE

& FREE Real

Apply Now for a Chance to

1 Year

RPOA Membership

Estate Investor Training Courses!

Anyone who has never been a member of the RPOA is welcome to apply. The scholarship will cover one (1) year of RPOA membership as well as our 1 year of RPOA's Real Estate Investor Training Program classes for one (1) year.

You can apply online here.

You can also download a fillable application and email to contactrpoa@rpoaonline.org.

Please use the subject line: Tom Koetsier Memorial Scholarship.

Applications must be submitted by 3:00 p.m. EST on Wednesday, February 21st, 2024.

The scholarship recipient will be announced at the 2024 Midwest Real Estate Investor Conference. The recipient will also be notified by email and/or phone call.

Please call the RPOA office at (616) 454-3385 with any questions.

FEBRUARY 2024 MICHIGAN LANDL O RD 13 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

FEATURED CONFERENCE SPEAKER

ALEX JARBO

THE FUTURE OF HOSPITALITY

MANAGEMENT

Thursday, February 22nd 1:30pm - 3:30pm River Overlook AB

Protecting Your Future in Short-Term Rentals: It Starts By Providing a Powerful Guest Experience

By Alex Jarbo

Article posted on September 3 , 2023 by Alex Jarbo on BiggerPockets, biggerpockets.com .

The line between vacation rentals and hotel/resort accommodations has continually narrowed over the past five years. When people ask me what business I work in, I don’t say “Airbnb,” “vacation rentals (VRs),” or “short-term rentals” (STRs). I say, “I’m in hospitality.”

Whether you’re already in the industry or looking to get into VRs, STRs, and midterm rentals (MTRs), you need to understand that you’re in the hospitality industry. Airbnb has been called “the hotel killer,” but accommodations like vacation rentals have been around for a very long time—just the way we book and list properties has changed.

14 RENTAL PROPERTY OWNERS ASSOCIATION

When I first started in vacation rentals almost seven years ago, there were barely any resources on the topic. So, when it came to optimizing my vacation rentals, I leaned very heavily on books written on hotels and resorts. It may sound crazy, but I purchased university textbooks written on how to manage and optimize hotels/resorts. I even read books written by Disney on how to provide a memorable experience no matter what industry you’re in.

Right now, the economy is stuck in limbo, and it may seem like STRs have a bleak future based on things that have been recently written on them. For anyone who has followed my articles here on BiggerPockets, I have said for a long time now that you should be looking at your STRs/VRs/MTRs as a business, not just a property you place on one platform and forget about.

As the industry evolves and a flood of new properties hits the market, you need to be able to position yourself and your company as a premier hospitality provider in your area. As of now, I am in the slow season of my hospitality business during an economic correction, but all of my properties are currently operating at 85%+ occupancy, with tens of thousands worth of bookings coming in every week.

Here is a culmination of everything I have learned and applied from studying over 25 hospitality/hotel/resort books. This blog article will be split into a three-part series, with the first part discussing guest experience.

What Disney Can Teach Us About Guest Experience

The very first book I picked up when I started reading about hospitality was written by Disney, called Be Our Guest. You might say, “Disney!?” I know it sounds crazy, but to my surprise, I learned that when it comes to hospitality, Disney offers some of the most in-depth training through the Disney Institute. The most interesting thing that the Disney book teaches is utilizing all the five senses when it comes to the guest experience.

Try to figure out how to utilize the five senses when it comes to your properties, both inside and out. Ask yourself: What does the guest first smell when they walk into the property? We try to use air fresheners that are similar to scents in the environment where the property is.

FEBRUARY 2024 MICHIGAN LANDL O RD 15 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

Bonus tip: Walt Disney was a huge believer in having a centerpiece for whatever property you owned. When you think of Disney, what is the first image that comes to mind? It’s probably Cinderella’s castle.

Thinking along those lines, I want you to consider different ways to make your property unique. I like to say ways to make your property “Instagrammable.” This can be as simple as adding a unique accent wall to one of your rooms, all the way to the structure of the property itself. I’ve seen hosts use murals, both inside and outside, to enhance the entire guest experience.

You can include an Instagram handle to a social media account for your company within the property so your guests can share it. I see this a lot whenever I visit hotels or resorts. The best spokespeople for your properties are previous guests, and establishing a strong social media presence is one way to do that.

Market Like the Pros

I have said this consistently for the past two years: Your properties should not exclusively live on one site. If your property is on only one site, say Airbnb, I would be worried.

It’s not anything against Airbnb per se, but you are at the mercy of platform and algorithm changes when you have your property only live on one specific site.

Don’t get me wrong: Platforms like Airbnb and VRBO can be a phenomenal source of booking guests, but they should be looked at more as a marketing arm to your business, not where your business exclusively lives.

Let’s go back to the hotels and resorts and see what we can learn. My wife and I booked a trip to Tulum Beach in Mexico through Expedia. When we checked into the resort, we had to provide our contact info to get access to the Wi-Fi (like any other place).

We had a phenomenal stay, and afterward, we started receiving emails from the resort every couple of months to book directly through their website, with links to their social media accounts.

16 RENTAL PROPERTY OWNERS ASSOCIATION

It got me thinking about how we can apply that to our own business. Luckily, I found a service called StayFi, which I’ve discussed before. They sell a service that essentially turns your internet into an email capture tool. From there, you are able to run seasonal emails to your previous guests directly through their platform. All the emails and related marketing are already created for you.

We utilize this service with a direct booking site. Our guests see our properties on one of the online travel agencies like Airbnb, VRBO, or Booking.com. Once they book their stay and stay with us, we collect their email through StayFi. We then start sending seasonal emails to the guest, directing them to our direct booking site.

This allows you to have complete control over your guests’ stay without an intercessor. It also allows you to build a business asset if you ever want to sell your entire portfolio.We’ve purchased properties in the past that came with a large email list of previous guests, and we were able to load those guests into our database and start sending emails to book directly with us.

The Bottom Line

I truly believe that the future of STRs and VRs is providing unique accommodations to your guests—properties they would be proud to stay in and post about on their social media.

With that being said, I believe an untapped gold mine is studying what hotels/resorts do to manage their guest experience, operations, and financials. At the end of the day, it all falls under the umbrella of providing phenomenal hospitality to the people staying at your properties.

WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

globemwai.com Property Insurance Claims Are Complicated. 616.272.7200 lcradit@globemwai.com

Alex Jarbo has extensive experience in the short-term rental industry and owns 16 successful short-term rental properties. He is the founder of Open Atlas, an investment and management firm dedicated to developing and acquiring distinctive short-term rentals worldwide. Over the past 7 years, Alex has coached over 5,000 students and provided personalized guidance to more than 300 individuals, empowering them to run thriving vacation rental businesses.

Additionally, Alex serves as the primary writer on short-term rentals for BiggerPockets, the nation’s largest real estate education and publishing platform. His blog posts have garnered a readership of over 500,000 people in the past year alone.

Alex Jarbo will be presenting at the 2024 Midwest Real Estate Investor Conference in Downtown Grand Rapids on The Future of Hospitality Management on Thursday, February 22nd at 1:30pm - 3:30pm in River Overlook AB. Register now!

In this thought-provoking presentation you'll gain an understanding of how the industry is evolving and what the future holds for those at the helm of short-term rentals, hotels, resorts, and other accommodation ventures. Alex Jarbo will share his insights into emerging trends, disruptive technologies, and changing consumer expectations that are reshaping the hospitality sector. From the adoption of smart hotel technology to the rise of sustainable and experiential travel, discover how these factors are influencing the way hotels and resorts are managed.

By the end of this session, you'll be equipped with a forward-looking perspective on hospitality management, enabling you to navigate the challenges and seize the opportunities that lie ahead!

Alex Jarbo will also be participating in the Elevate Your Portfolio: Boutique Hotels & Resorts panel discussion along with Jeremy Garcia on Thursday, February 22nd at 8am - 8:50am in River Overlook AB.

Delve into the world of boutique hotels and resorts! In this breakout session, industry experts Alex Jarbo and Jeremy Garcia will unravel the secrets to successful investments in accommodations that stand out from the crowd.

You will discover the allure of boutique properties and how they capture the hearts of travelers seeking unique experiences. They will provide insights into the strategies for identifying, acquiring, and managing these high-end investments, from historic city gems to serene beachfront retreats.

The discussion will encompass market trends and demand for boutique hotels and resorts, property selection and due diligence, design and branding that sets boutique properties apart, marketing approaches that optimize the guest experience, and the financial analysis and considerations that underpin these investments.

We are proud to partner with RPOA members to bring affordable housing to West Michigan!

Thank you for your support of our residents and agency!

18 RENTAL PROPERTY OWNERS ASSOCIATION

Visit

on the web: www.grhousing.org

us

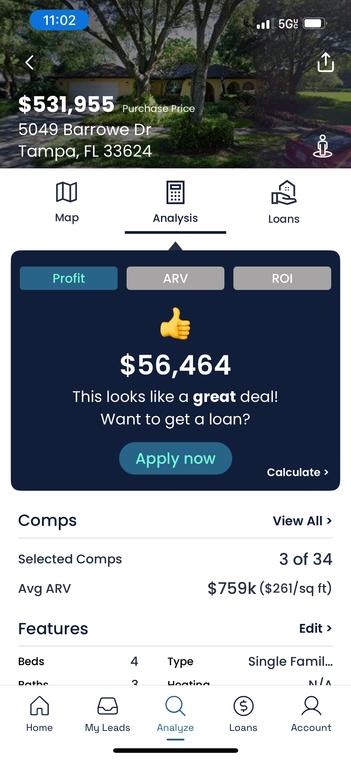

FEBRUARY 2024 MICHIGAN LANDL O RD 19 WHERE REAL ESTATE INVESTORS AND LANDLORDS W W W . D O B A C K F L I P . C O M Run comps and analyze opportunities whenever, wherever they come in. o f f y o u r f i r s t l o a n w h e n f i n a n c i n g w i t h B a c k f l i p ! * E x c l u s i v e O f f e r Never miss a great deal again! Suite of AI-powered tools to help you make strategic investing decisions. Fast, personalized loans to take your business to the next level. * o f f e r v a l i d u n t i l 1 2 / 3 1 / 2 4

RPOA Member-to-Member Discounts

1LASTEYE, LLC 12% discount on monthly bookkeeping to RPOA members.

ACCRUIT $0 dispatch fee (normally $49, excludes emergency service). Free* plumbing inspection. Just mention your RPOA membership and this discount. Call to schedule 616-888-1546.

BENDER MAINTENANCE & HOME IMPROVEMENT 10% off hourly rate for RPOA members. Property maintenance, general repairs; prepare property to rent at acquisition; inspection compliance for Section 8, City of Grand Rapids. General Contractor, Certified Lead Renovator, RPOA Member. (616) 885-0132.

BERGSMA PLUMBING is offering a 15% discount to RPOA members when they mention seeing this listing on the website. Members must provide their RPOA member number to receive this discount.

BOATHOUSE

COMMERCIAL FUNDING GROUP offers a nocost 10 page Property Valuation Report. This report is like Zillow on steroids. The report includes: House value, market rent value, sales and rental comparables, active listings, market analysis… everything you need to compare your property to others around you.

COMPASS REALTY RPOA exclusive discount! Free 1 hour real estate consultation. Call Allison Koetsier at 616-6339445.

CONSUMERS ENERGY AC

Peak Cycling Program: Join the movement, choose clean and cut costs for you and your tenants. Enroll in Consumers Energy’s AC Peak Cycling program to save energy and receive $25 for each rental unit where a device is installed. (Ex.: 100 units is $2,500 for you!) Tenants also receive $25 in addition to earning up to $32 in bill credits each year from June to September.

DISCOUNT HOME IMPROVEMENT

RPOA members receive 6% off your order. (616) 451-3600.

FOUNDATION SPECIALIST is offering to waive inspection fees and give free estimates for customers who mention they are a member of the RPOA when scheduling. (616) 438-0551.

GREAT LAKES ACE 10% discount on all purchases. Some restrictions apply. Offer valid at our two Grand Rapids stores, 1234 Michigan St. NE and 1205 Fulton St. West and our Walker store, 4300 Remembrance Rd.

HD RECOVERY is offering free impound service for abandoned vehicles. Call Jordan Morren at

(616) 325-5751 with questions!

THE HOME DEPOT Sign up for the Home Depot rebate program through the RPOA and receive a 2%* rebate on all your purchases—no matter how small or big. Call the RPOA office to get your rebate program started now! (616) 454-3385.

*2% OF TOTAL PURCHASES OVER $5,000 SEMI-ANNUALLY.

J R MORTGAGE SERVICES LLC

Free appraisals for 1 to 4 family unit homes with closed loan application for RPOA members only. Call Jim Riley at (616) 2924491.

KABINET With a Kabinet Business Plan, add one property to your account and get the second property free for the 1st year (a $39.99 savings) with code “RPOA”. Kabinet is a secure digital platform allowing you to keep track of your entire real estate portfolio in one place, anytime and anywhere. kabinethome.com

KURTIS BUILDING & REPAIR LLC

Now offering 10% discount for new RPOA members who use their services.

LAKE MICHIGAN CLEANING

RPOA members receive $20 off per vent. Contact Dudley Larson at (616) 240-0682 for more information.

20 RENTAL PROPERTY OWNERS ASSOCIATION

Take advantage of these great RPOA member-only discounts!

LOCKER PROFESSIONAL CLEANING SERVICES offers full service deep cleaning, rental/ vacation property cleaning, move-out real estate cleaning, move-in full-service cleaning, commercial cleaning. RPOA members get $100 off deep clean discount or $50 off your first clean. Discounts available for long term contracts. Free estimates. Call 616-490-7894 for more information.

MICHIGAN SCREEN & WINDOW REPAIR 10% labor discount on replacement window packages for RPOA members. Mention you are an RPOA member when you schedule a visit to get this discount.

ODP BUSINESS SOLUTIONS

• Up to 55% off on office supplies

• Up to 55% off on cleaning & breakroom items

• 10% off branded; 20% off private brand ink & toner

• Average 10% off on over 200 technology core items

• Free next-day shipping on orders of $50 or more

• SIGNIFICANT savings on copy & print

• Customize pricing for the items you buy most often*

Please contact the RPOA office to access this discount. odpbusiness.com

PRIORITY PAINTING LLC offering

a 7% discount to RPOA members. Contact David at (616) 8937932.

RENTAL HERO Accounting software for rental property owners. RPOA members get the first year for only $79 then pay only $7.95/month, billed annually at $95 after that. Free 30-day trial. To sign up, visit rentalhero.io/rpoami.

SIMPLIFYEM SimplifyEm is an easy-to-use property management software designed by real estate professionals . They are offering a 25% discount for a 1 year subscription and a 50% discount for a 3 year subscription. Contact Bert Foreman at (510) 876-7070 for more information.

SUTHERLAND LAW PLC Now offering $25 off hourly rate to new RPOA clients.

SWEEP LLC Sweep LLC is offering RPOA members a 10% discount off any order. Please call the RPOA office to access this discount. sweepllc.com

SYMMETRY BOOKKEEPING LLC

Offering RPOA members a 15% discount on services.

TROUT PLUMBING $0 dispatch fee (normally $49, excludes emergency service). Free* plumbing inspection. Just mention your RPOA membership and this discount. Call to schedule 616-888-1546.

VREDEVOOGD-BRUMMEL RISK MANAGEMENT & INSURANCE

Independent insurance agency representing multiple insurance companies. Always providing home and auto insurance but specializing in rental and vacant property insurance. We do all the shopping for you and special RPOA member discounts are available. Call Joel Emerson at 616-797-9988 for more details.

ASSOCIATE MEMBERS WHO WOULD LIKE TO PARTICIPATE IN THE DISCOUNT PROGRAM SHOULD CALL THE RPOA OFFICE AT 616-454-3385.

"The promotion of offers, including discounts, rebates and other such benefits, goods, and services provided by the Rental Property Owners Association of Kent County (“RPOA”) members and advertisers within the Michigan Landlord magazine (collectively, the “Offers”), are for informational purposes only and are not an endorsement or recommendation. The Offers are not made by the RPOA or the Michigan Landlord magazine and the advertiser/member is solely responsible to you for the delivery of any goods or services. Your correspondence or business dealings with, or participation in the Offers or promotions of, advertisers/members found in the Michigan Landlord magazine, including payment and delivery of related goods or services, and any other terms, conditions, warranties or representations associated with such dealings, are solely between you and such advertiser/member. Neither the RPOA nor the Michigan Landlord magazine guarantees the existence or continued existence of any Offers, which may change from time to time. You agree to waive and release the RPOA and the Michigan Landlord magazine from and against any and all liability, loss or damage of any sort, incurred as the result of any such dealings with, or as the result of the presence of, any advertisement or promotion within the Michigan Landlord magazine.”

FEBRUARY 2024 MICHIGAN LANDL O RD 21 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

FEATURED CONFERENCE SPEAKER

MARIA GIORDANO

DYNAMIC DEAL STRUCTURING: INVESTING WITH NO LIMITS

Thursday, February 22nd 4:00pm - 6:00pm River Overlook EF

Can I Really Amortize 400 Months?

By Maria Giordano

I was in the middle of negotiating on a probate property. It was the original home the seller’s family built in 1962. I could see the seller was very attached to this home. Why wouldn’t he be? He had an amazing childhood in this home. The first time I met with him I spent about two hours getting to know him. Finding out what his goals are and what he is looking for in a buyer.

This may sound remedial, but it’s important to understand; the seller is really the one who has some pain that he is trying to avoid. This is something many new and experienced real estate investors forget. It’s for this reason, I spend so much time on the phone and in person speaking with the seller. Many people have told me this is a waste of time. To them I ask, “Is it really?”

If you don’t spend the time getting to know your seller, how will you ever find out what their

22 RENTAL PROPERTY OWNERS ASSOCIATION

real estate problem is to create a deal that will resolve/ease their pain?

As the potential buyer, you need to take the time building rapport with the seller. Don’t forget, you can be up against more than a half dozen potential buyers. What is going to make you stand out as, “the only logical choice.” Understanding what the seller’s needs are must be crystal clear.

Mr. Seller really wanted all cash for this property. I mean who doesn’t? Almost every seller I speak to without exception originally “thinks” they want all cash. It’s up to you to convince them otherwise. As I was getting to know Mr. Seller and learning about his situation, I found out he already had other investors making him a bunch of low-ball offers. I was able to find out what they were offering him, by simply asking Mr. Seller what the other offers are. In doing so, I discovered all these offers really irritated him.

Mr. Seller is emotionally attached to his childhood home. He wanted his price more than anything. After sitting down with Mr. Seller, I found out he’s an experienced investor. He has about nine rental properties in other cities and carries paper (Notes).

From this one piece of information, I now know he understands investing. This makes him perfect for a seller carry. If Mr. Seller wants price, then I need my terms. This seller already understands taking his equity over time. I asked Mr. Seller what he would want for interest. He said between 3% and 4%. I told him I liked 3%, obviously he liked 4%. The seller suggested meeting in the middle. Now he sees this as a win for him. He got to pick his interest. I’m shocked whenever an experienced investor offers me less than 6% interest, but it happens all the time. I even have properties I bought from experienced investors that have zero interest.

The next thing Mr. Seller and I have to agree on is our price. Mr. Seller’s property hadn’t been updated since it was built in the 60’s. This includes the furniture. I’m telling you; I thought I walked in on a 1960’s tv set. The good news is the property has been properly maintained over the years and needs cosmetic repairs; this would mostly be paint and carpet. If it went on the market in its current conditions, it would probably sell for around $185k to maybe $200k just because of the shortage of available houses in that area and it’s on 2.5 times the lot of other properties in the area. Mr. Seller was hoping to get $250k. All fixed up, the property could probably net for $300k. Mr. Seller and I settled on $225K, again this is the

FEBRUARY 2024 MICHIGAN LANDL O RD 23 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

number he came up with.

The best part is how we negotiated our terms. I have to thank my husband Gary for this one. It sometimes helps to have a partner go with you. We knew the property would rent for $1400 to $1600 per month. We wanted our payment to be less than $900 per month. Gary told Mr. Seller that we can do his 3.5% interest and his asking price of $225. This made the seller very excited.

However, Gary asked him if he can help us. Remember, we are giving the seller what he wants and he’s feeling indebted to us. So naturally, he wants to help us. Gary told the seller that we really needed to keep our payments below $900/month. Gary was able to back up our monthly payment by showing him our numbers based on what actual area rents and monthly expenses we would incur. Mr. Seller understands this very well. This is where it gets very interesting.

How would you make your payments less than $900/month with that purchase price and a balloon in 15 years. Real simple! Ask the seller if it’s okay to do a 400-month amortization. How brilliant is that? We just knocked our payment way down to something that is now quite affordable. With that low interest and payment, we now would have a balloon of around $140k.

Mr. Seller wanted to go over this with his wife who was unable to be there because of health reasons. Whenever possible, if there is more than one decision maker try to get both deciding people to meet you at the same time. What Gary and I learned was his wife use to be a loan officer up until a few years ago. After he spoke with her and staying in touch with him over the next 5 days. Mr. Seller came back to us with a few concerns. The seller’s main concern is in 15 years he would be 79 years old, and he didn’t like that. He wanted a shorter balloon.

My shortest time is usually a ten-year balloon and that was precisely what he wanted. However, if Mr. Seller wants something so do I. Since, I would be going on vacation for three weeks, I asked Mr. seller since we would be willing to give him a balloon in 10 years, would he be willing to give me an extended inspection period of 30 days. This does not include the additional time needed to close and allow the seller to finish moving and selling his parents belongings. This was no problem for Mr. Seller. I already knew Mr. Seller was likely to say yes.

24 RENTAL PROPERTY OWNERS ASSOCIATION

From talking to him I knew he was going to be leaving town for an extended period of time.

I wouldn’t have gotten past first base with this seller if I simply showed up. Walked the property and sent him an all-cash low-ball offer. I would have successfully shut him down and walked away with nothing. This example is a complete win-relief for both the buyer and the seller, which is exactly what you want to be creating. Always take your time and look for what no one else is seeing. That’s where the real goodies are!

Maria Giordano is a full-time real estate investor and nationally recognized speaker on real estate investing. Her Real Estate Profit System Facebook page has amassed over 211,000 followers. With over two decades of experience in the industry, Maria knows the ins and outs of real estate investing like the back of her hand. Maria has done just about every deal you can imagine, but her real specialty is making the impossible possible and profitable through options, seller financing, subject-to’s, and WRAPS, which means she has seen every scenario out there of what gets people in trouble.

Maria is the author of four books on real estate and has been interviewed by numerous news articles and websites, including RealtyTrac, Investors Business Daily, and The Wall Street Journal. She has also been featured on ABC's Nightline and Good Morning America.

Maria Giordano will be presenting at the 2024 Midwest Real Estate Investor Conference in Downtown Grand Rapids on Dynamic Deal Structuring: Investing with No Limits on Thursday, February 22nd at 4:00pm - 6:00pm in River Overlook EF. Register now!

Maria Giordano will share creative strategies for navigating the real estate market successfully, encouraging you to move beyond conventional approaches like low-ball all-cash offers. Discover methods to buy properties at low or no interest rates without traditional financing or large down payments. Maria will discuss the current real estate market speculation, emphasizing the importance of strategic decision-making. Her blueprint for financial freedom, achieved within six months, is applicable to various investment models such as Airbnb, buy and hold, wholesaling, fix and flip, and more.

FEBRUARY 2024 MICHIGAN LANDL O RD 25 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

WHAT MAKES A PROPER POLICY ?

CUSTOM COVERAGE FOR YOUR SHORT-TERM RENTAL

Property Entrustment

When you hand your keys to a guest, standard policies exclude coverage for theft, vandalism and intentional damage to your property. Proper does not exclude these items.

Pet & Animal Liability

Guest’s dog bites your neighbor?

Alligator at your beach home? Bear in your mountian cabin? Proper has no limitations on type of animal or pet breed.

Bed Bug & Flea Protection

No need to worry about unwanted critters in your home. Proper offers bed bug and flea liability, removal, and loss of business revenue as a result of infestation.

Squatter Protection

If you have a guest wo refuses to leave your property, Proper covers up to $5,000 in eviction costs and up to $10,000 in loss of business revenue.

Amenities Off-Premise

Many policies exclude coverage for bikes, boats, and golf carts or limit coverage to your property line. Proper covers liability for common amenities on or off your property.

Liquor Liability

Wheather you include a beverage gift for your guest or want to enure that alcohol left by guests doesn’t end up in the wrong hands when the next group arrives, we’ve got you covered.

26 RENTAL PROPERTY OWNERS ASSOCIATION

Building & Contents Special cause of loss (all risk), replacement cost (new for old). Liability $1M Commercial General Liability protection with increased limits available. Revenue Actual loss sustained business revenue coverage with no time limit.

Wel com e! WW W .PR O PER. INS UR E 888-631-668 0

FEATURED CONFERENCE SPEAKER

JONATHAN MAST

SMART INVESTING: MAXIMIZING AI'S IMPACT ON SHORT-TERM VACATION RENTAL INVESTING

Friday, February 23rd 10:30am - 12:30pm

River Overlook AB

Revolutionizing Social Media Marketing

With OpenAI’s CustomGPTs: a Comprehensive Guide

By Jonathan Mast

Social media managers have a challenging task - creating fresh, engaging content daily across multiple platforms to attract and retain followers. The emergence of AI tools like ChatGPT and Claude-2 provides exciting new opportunities to make this process faster, easier, and more effective.

The Social Media Manager’s New AI Sidekick

Content creation is the heartbeat of social media management. Although constantly pumping out fresh, engaging posts, blogs, captions, and more taxes, even the most creative

FEBRUARY 2024 MICHIGAN LANDL O RD 27 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

teams. Just keeping up with daily demands can burn out writers. What if AI could help?

Exciting new AI tools like ChatGPT and Claude-2 are poised to become social media managers’ new virtual assistants. These conversational AIs can rapidly draft and ideate content with just a short text prompt. While they have limitations, they enable scaling highquality social content creation like never before.

With the right human guidance, AI-generated drafts and ideas can kickstart and enhance the content process. Combined with supplementary AI tools that feed real-time data, social teams may find endless new ways to leverage AI for efficiency and inspiration.

In this article, we’ll explore how ChatGPT, Claude-2, and other AI can provide social media managers with fresh superpowers. From quick post drafts to evergreen blog ideas, AI looks ready to take on content creation’s heavy lifting - while humans provide the finesse. It’s an emerging partnership between man and machine that forward-looking social teams should start exploring now.

Let’s dive in to see how AI can become social media managers’ new sidekick, multiplying capabilities while retaining each brand’s unique voice. The future of social content is AIaugmented.

Key Takeaways

The emergence of AI writing tools like ChatGPT and Claude-2 offers new opportunities for social media managers to streamline and enhance their content creation workflows. Some key lessons covered in this article include:

● Use ChatGPT for quick drafts and brainstorming based on prompt descriptions. Claude-2 for more accurate, up-to-date information citing sources.

● Feed real-time data into ChatGPT and Claude-2 from tools like Perplexity AI and Harpa AI to overcome limitations in awareness.

● Provide very specific, detailed prompts to get better results from these AI tools…

● Combine ChatGPT and Claude-2 to leverage both for different strengths: ideation versus accurate, timely information.

● These AI tools as assistants to aid human creativity, judgment and editing - not as

28 RENTAL PROPERTY OWNERS ASSOCIATION

complete solutions.

By incorporating ChatGPT, Claude-2, and supplementary AI in thoughtful ways, social media managers can unlock new levels of efficiency and effectiveness in engaging content creation.

Introduction

ChatGPT burst onto the scene in late 2022 as a remarkably adept conversational AI. While it has some clear limitations, ChatGPT can generate high-quality long-form content on a wide variety of topics with just a short text prompt. Many social media managers are already using it to draft compelling social media posts, blogs, and other content.

The key benefit of ChatGPT is its ability to take a few sentences describing the desired content and return thoughtful, nuanced paragraphs or even full articles. The AI attempts to match the style and voice requested, though the results still require editing. Overall, ChatGPT represents a powerful brainstorming and drafting tool to jumpstart quality content creation.

Claude-2, developed by startup Anthropic, improves upon ChatGPT in important ways. Claude has more up-to-date knowledge, refuses unreasonable requests, and provides sourcing for facts. This makes it better suited for drafting accurate, informative content. Claude can be prompted to write social media posts around trending topics and current events. It cites sources so content creators can verify facts.

Tips

Here are some tips for social media managers looking to utilize these AI tools:

● Use ChatGPT for quick content ideation - describe the tone, length, and goal of the content needed and let the AI generate a first draft.

● Ask Claude-2 to write posts about newsy topics and trends. Verify the facts are correct.

● Edit any AI-generated content extensively for tone, concision, accuracy, and originality.

● Rephrase prompts for the AI if you don’t get the results you want. Being very specific helps.

● Never use AI content as-is - add your own flair, analysis, and connecting of ideas.

● Combine the strengths of both tools depending on your needs for a given project.

FEBRUARY 2024 MICHIGAN LANDL O RD 29 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

Feeding AI Tools Real-Time Data

A key limitation of conversational AI tools like ChatGPT and Claude-2 is their lack of access to current, live information from across the internet. Since these models were trained some time ago on fixed datasets, they do not have real-time awareness.

Social media managers can overcome this by using additional AI tools to feed timely data to ChatGPT and Claude-2 when generating content. Two options are Perplexity AI and Harpa AI.

Perplexity AI is an AI-powered search engine with a conversational interface similar to ChatGPT. However, it provides citations and sources for the information it returns. This makes it useful for fact-checking and gathering reputable sources on current events, statistics, company information, and more. Sources found in Perplexity can be fed into a ChatGPT or Claude prompt to ensure accurate, up-to-date information.

Harpa AI is a Chrome extension that uses AI to monitor websites, track changes, and automate other online tasks. For social media managers, Harpa can monitor news sites, company blogs, industry publications, and other sources. It can then feed real-time updates to ChatGPT and Claude-2 when asking them to write posts about those companies or topics. By combining these tools, social media managers can create a workflow where real-time data is retrieved by Perplexity and Harpa, verified via sources, and then channeled into content generated by ChatGPT or Claude. This allows AI assistants to incorporate current facts, announcements, trends, and news even though they cannot search the web themselves.

Jonathan Mast is a leading expert on AI and topical authority. He has roots in the digital world dating back to 1995, and has cemented his reputation as a visionary in leveraging artificial intelligence (AI) and establishing topical authority online.

In his latest venture, White Beard Strategies, Jonathan delves deep into the realms of AI, demonstrating its potential to revolutionize online business strategies. He's passionate about guiding professionals to not just navigate, but lead in their niches by becoming undeniable topical authorities. He believes that by mastering AI tools, professionals can become more efficient, saving precious minutes daily and elevating their digital presence.

Jonathan Mast will be presenting at the 2024 Midwest Real Estate Investor Conference in Downtown Grand Rapids on Smart Investing: Maximizing AI's Impact on Short-Term Vacation Rental Investing on Friday, February 23rd at 10:30am - 12:30pm in River Overlook AB. Register now!

In this in-depth session, Jonathan Mast will delve into the exciting world of short-term vacation rentals and how artificial

30 RENTAL PROPERTY OWNERS ASSOCIATION

intelligence can supercharge your efficiency. Explore AI-driven tools and strategies that can help you optimize pricing, enhance guest satisfaction, and automate time-consuming tasks. Join us to discover how AI can elevate your vacation rental business, making it more efficient and profitable than ever before.

Jonathan Mast will also be presenting on Unleashing AI's Potential for Housing Providers & Investors on Thursday, February 22nd at 8am - 8:50am in River Overlook EF.

Explore the transformative potential of AI in revolutionizing your real estate investing business. Jonathan Mast will illuminate the remarkable ways in which AI-driven tools and technologies can supercharge your decision-making process, streamline operations, and uncover hidden opportunities in the real estate market. You'll gain invaluable insights on how to harness the power of AI to drive efficiency and profitability. Discover how AI can be used to identify market trends, optimize portfolios, and keep you one step ahead of the competition. This session will empower you with cutting-edge strategies for success. Join us on this journey into the future of real estate!

And don't miss Jonathan's other presentation on AI Insights for Short-Term Vacation Rentals: A Preview of What's Possible on Thursday, February 22nd at 9:10am - 10:00am in River Overlook AB.

Join us for a sneak peek into the world of AI-driven short-term vacation rental management! In this breakout session, Jonathan Mast will provide a glimpse into the power of artificial intelligence for short-term vacation rentals. Learn about the key ways AI can help your vacation rental business, from optimizing pricing and boosting occupancy to enhancing guest satisfaction. This teaser presentation will leave you eager for the full-length session later in the day, where Jonathan will dive even deeper into the exciting possibilities that AI holds for efficiency.

SAVING YOU TIME & MONEY

Do you know where your money is going, or how to stop the leaks? We let you focus on running your business, and we handle the numbers... saving you time and money.

FEBRUARY 2024 MICHIGAN LANDL O RD 31 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

culver | group CPAs & Business Advisors 616.456.6464 . culvercpagroup.com . 1419 Coit . Grand Rapids

WE ARE CPA’S WHO OWN REAL ESTATE

THURSDAY, FEBRUARY 22, 2024

7:30 a.m. Registration Opens, River Overlook Area, Near Escalators

8:00 a.m. – 5:30 p.m. Expo Open Check out the offerings of over 50 exhibitors.

8:00 a.m. – 8:50 a.m. Breakout Sessions:

Elevate Your Portfolio: Boutique Hotels & Resorts Alex Jarbo, Jeremy Garcia | River Overlook AB

Unleashing AI's Potential for Housing Providers & Investors Jonathan Mast | River Overlook EF

You Bet Your Assets! What You Need to Know About ESAs Victoria Cowart | River Overlook CD

8:50 a.m. – 9:10 a.m. Networking Break

9:10 a.m. – 10:00 a.m. Economic Insights for Real Estate Investors: Navigating 2024 and Beyond Paul Isely, Economics Professor, GVSU | River Overlook EF

AI Insights for Short-Term Vacation Rentals: A Preview of What's Possible Jonathan Mast | River Overlook AB

10:00 a.m. – 10:30 a.m. Networking Break

10:30 a.m. – 12:30 p.m. Featured Speaker, Adrian Smude, Wheels of Fortune— Cashing in on Mobile Home Investing | River Overlook EF

10:30 a.m. – 12:30 p.m. Featured Speaker, Cara Middleton, From the Front Lines: Navigating Michigan's Short-Term Rental Landscape | River Overlook AB

12:30 p.m. – 1:30 p.m. Lunch Break Concessions Available in the Chase Board Room

12:30 p.m. – 1:30 p.m. Deal Room (Bring Your Lunch) River Overlook CD

1:30 p.m. – 3:30 p.m. Featured Speaker, Alex Jarbo, The Future of Hospitality Management | River Overlook AB

1:30 p.m. – 3:30 p.m. Featured Speaker, Jeffrey Taylor, How to Create Your Own Supply of Qualified Applicants to Fill Your Vacancies | River Overlook EF

3:30 p.m. – 4:00 p.m. Networking Break

4:00 p.m. – 6:00 p.m. Roundtable Discussions on Various Short-Term Rental Topics | River Overlook AB

4:00 p.m. – 6:00 p.m. Featured Speaker, Maria Giordano, Dynamic Deal Structuring: Investing with No Limits | River Overlook EF

The schedule is subject to change.

32 RENTAL PROPERTY OWNERS ASSOCIATION

2024 CONFERENCE SCHEDULE

FRIDAY, FEBRUARY 23, 2024

7:30 a.m. Registration Opens, River Overlook Area, Near Escalators

8:00 a.m. – 5:30 p.m. Expo Open Check out the offerings of over 50 exhibitors.

8:00 a.m. – 8:50 a.m. Breakout Sessions:

Scaling Your Investment Strategies with Apartments Anthony Chara | River Overlook AB

Elegant Escapes to Cozy Comforts...Strategies for Every Property Type Pam Westra, Carrie Drier | River Overlook EF

Financing Options for Investment Properties Frederick SaintAmour | River Overlook CD

8:50 a.m. – 9:10 a.m. Networking Break

9:10 a.m. – 10:00 a.m. State of the State: A Data-Driven Analysis of the ShortTerm Rental Market Kate Stoermer | River Overlook AB

RPOA Annual Meeting River Overlook EF

10:00 a.m. – 10:30 a.m. Networking Break

10:30 a.m. – 12:30 p.m. Featured Speaker, Anthony Chara, Building Generational Wealth: Increase Your Wealth Exponentially with Multifamily Properties | River Overlook EF

10:30 a.m. – 12:30 p.m. Featured Speaker, Jonathan Mast, Smart Investing: Maximizing AI's Impact on Short-Term Vacation Rental Investing | River Overlook AB

12:30 p.m. – 1:30 p.m. Lunch Break Concessions Available in the Chase Board Room

12:30 p.m. – 1:30 p.m. Grand Rapids Lead Hazard Control Grant Program (Bring Your Lunch) River Overlook CD

1:30 p.m. – 3:30 p.m. Featured Speaker, Katie Johnson, Short-Term Rental Regulation on the Rise...Strategies for Success Amid Changing Tides | River Overlook AB

1:30 p.m. – 3:30 p.m. Featured Speaker, Scott Meyers, Self-Storage Investing: Proven Strategies for Success | River Overlook EF

3:30 p.m. – 4:00 p.m. Networking Break

4:00 p.m. – 6:00 p.m. Roundtable Discussions on Various Short-Term Rental Topics | River Overlook AB

4:00 p.m. – 6:00 p.m. Featured Speaker, Ryan Kilpatrick, Opportunities for Housing Growth in West Michigan | River Overlook EF

The schedule is subject to change.

FEBRUARY 2024 MICHIGAN LANDL O RD 33 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS 2024 CONFERENCE SCHEDULE

FEATURED CONFERENCE SPEAKER

ADRIAN SMUDE

WHEELS OF FORTUNE—CASHING IN ON MOBILE HOME INVESTING

Thursday, February 22nd

10:30am - 12:30pm

River Overlook EF

Three Types of Mobile Home Investments

By Adrian Smude

Mobile homes are a forgotten asset class, which is one reason why they still produce great returns. Since it’s not often discussed, there’s a lot of confusion about investing in mobile homes. But after reading this short article, you’ll understand the three types of mobile home investments: Mobile Home Parks, Mobile Homes on Rented Land, and Mobile Homes with Land.

Mobile Home Parks

Mobile home parks can be two or more mobile homes on the same parcel. If you own a mobile home park, you may own just the land, or the land and mobile homes. Quick heads up — most municipalities require inspections and special licenses for mobile home park

34 RENTAL PROPERTY OWNERS ASSOCIATION

owners.

When the same person owns the home and the land, think of it as a flat apartment complex. The owner is responsible for everything. With the right management, these can be very profitable. When the landowner doesn’t own the homes, think of the mobile home park as a big parking lot. The parking spaces are a little larger, and people pay a monthly fee to park their mobile home. This requires less maintenance because the homeowners are responsible for maintaining their homes.

I believe long-term mobile home park owners will benefit from seller financing if you’re able to educate the seller about their tax burden if they sell for cash. If you decide to use bank financing, you’ll likely have the best luck talking to a community bank.

This space has become very competitive with the hedge funds buying mobile home parks typically 100 units or larger. Unfortunately, this has made it difficult to get great returns.

Mobile Home on Rented Land

When you only own the mobile home and NOT the land, you own personal property. In most states, this is governed by the DMV. The owner of the land who allows you to park the mobile home will charge you a monthly fee commonly called lot rent. The landowner may have set rules about resident age restrictions and subletting. It’s important to talk to the landowner/ manager of the mobile home park before purchasing a mobile home on rented land to ensure they support your plan. The lot rent, and any fees associated with the home, stay with the home.

Pro Tip: When purchasing a mobile home on rented land, it’s important to verify that the seller is current on their payments.

Ideally, when purchasing a mobile home on rented land, I want the rent or monthly purchase payments I will collect to be double the lot rent. This sets me up for success in the event I have months of vacancy.

Mobile homes on rented land are the lowest cost of the 3 ways to invest in mobile homes.

FEBRUARY 2024 MICHIGAN LANDL O RD 35 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

But banks don’t like to finance these. The key is to find private money from friends/ investing colleagues or use some cash of your own.

One challenge with not owning the land is you lose control. The landowner makes the rules. I once had the manager contact me on the 5th of the month to let me know by the end of the month, I wasn’t allowed to own anything in the park which I did not live in.

Mobile Homes with Land

When you buy the mobile home and the land it sits on, you have a real estate transaction. This has become a forgotten way to invest in mobile homes. This is great because you have less competition, which means more profit for you. I believe this is the best way to invest in mobile homes.

The major reason I purchase mobile homes with land is for the monthly cash flow, but I have the asset of the land in the event something happens to the mobile home. I have found residents stay longer when they have privacy compared to living with a neighbor a few feet away.

I enjoy cash flow, so I buy and rent these aluminum castles, but that doesn’t mean you cannot fix-andflip them. You need to research the qualifications banks require to ensure your end buyer will be able to cash you out.

An experienced title company will have someone in the office who specializes in these closings. Don’t forget to do a lien search on the title(s) of the home(s) as well as the land. And remember that the legal description typically includes the mobile home and VIN.

I’ve found owners of mobile homes with land are not as timid to talk about seller financing the property to you (the investor). I believe this is because it’s more common that the seller purchased the home on seller financing themselves. When making payments to the seller doesn’t benefit their life, I give the opportunity to a financial friend to lend on the property. Banks aren’t very fond of lending on mobile homes for investment purposes.

Now that you know 3 types of ways to invest in mobile homes, it’s time to decide which fits

36 RENTAL PROPERTY OWNERS ASSOCIATION

your business goals and take action!

When it comes to rentals, mobile homes with land have given me a wonderful lifestyle. I am receiving 857% more cash flow for the same amount invested in 7 mobile homes with land as I did with one site-built home.

Adrian Smude got his start in real estate in 2002 when he was evicted which led him to become a landlord. After 11 years of being a hobby landlord, he discovered his passion for real estate investing by attending a real estate investor meeting. He tapped into the untapped gold-mine of mobile homes and has been following that path ever since. He is a member of three mastermind groups, including a high-level mastermind which he hosts. He is the author of the bestselling book How to Buy Mobile Homes and he travels the country teaching and sharing his secrets for success.

Adrian Smude will be presenting at the 2024 Midwest Real Estate Investor Conference in Downtown Grand Rapids on Wheels of Fortune—Cashing in on Mobile Home Investing on Thursday, February 22nd at 10:30am - 12:30pm in River Overlook EF. Register now!

Are you ready to take your real estate investment journey to the next level? Join us to uncover the keys to success in mobile home investing.

Adrian will debunk common myths surrounding mobile home investing, revealing why it's a recession-proof choice that outshines other real estate investment avenues and why NOW is the ideal moment to dive into this lucrative market. Plus the three pathways you can choose from to do it!

You'll learn how to harness the power of mobile home investments without the need for traditional banks as well as low-cost and no-cost marketing strategies that can be implemented in minutes, ensuring you hit the ground running.

FEBRUARY 2024 MICHIGAN LANDL O RD 37 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

FEATURED CONFERENCE SPEAKER

ANTHONY CHARA

BUILDING GENERATIONAL WEALTH: INCREASE YOUR WEALTH

EXPONENTIALLY WITH MULTIFAMILY PROPERTIES

Friday, February 23rd 10:30am - 12:30pm

River Overlook EF

Where Do You Find Great Deals on Apartments?

By Anthony Chara

I often receive this question, especially during or just after a presentation where I illustrate an apartment complex with a 'cash on cash' return exceeding 20%. If you were to approach a Commercial Broker and inform them that you are seeking properties with a 20% COCR, they would likely respond in one of two ways:

1) They would express their interest in buying the property themselves if they ever came across one with a 20% COCR or

2) They might dismiss your inquiry, assuming your expectations are unrealistic.

FEBRUARY 2024 MICHIGAN LANDL O RD 39 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

It is improbable that you will come across an apartment complex openly advertised with a 20% COCR. Just as the broker mentioned, if such an opportunity were to land in their lap, they would seize it. Nevertheless, you can enhance your chances of discovering remarkable deals by adopting a different approach.

To begin with, there are no well-guarded secrets to 'finding' apartment complexes available for sale. Start by employing the same methods that most investors utilize. For instance, you can explore listings on Loopnet.com or visit the websites of major or regional commercial brokerages such as Marcus & Millichap (MarcusMillichap.com), CB Richard Ellis (CBRE.com), or Sperry Van Ness (SVN.com), to name a few. Numerous other options are also available.

You can also examine local newspapers in the region that piques your interest. Keep in mind that not all newspapers are created equal; some may advertise commercial properties in the business section rather than the classifieds. Another overlooked source is the Wall Street Journal, which features both national and local properties available for sale.

Another approach to locate apartments for sale is to consult with Property Managers or Commercial Financiers operating in the area you intend to purchase. Often, they are acquainted with property owners seeking to acquire another property and consequently needing to sell their current one, or they may know someone who is preparing for retirement.

These are just a few of the sources I rely on; I provide more in-depth information during my workshops and boot camps. While the information presented above might set you on the path to discovering great apartment deals, the real key lies in the details below.

As I mentioned earlier, there are no major secrets to uncovering apartment complexes for sale. The pivotal factor is identifying a superb deal, and here's how I go about it. The first decision is selecting the market in which you wish to make a purchase. This decision can be based on various factors, such as economic indicators like job growth or a thriving local economy. It could also be a personal choice if it's a place you'd like to visit frequently.

The subsequent step involves reaching out to at least 3-4 reputable commercial brokers in your chosen market and establishing a lasting, mutually beneficial relationship with one or two of them.

40 RENTAL PROPERTY OWNERS ASSOCIATION

Here's my approach and how I utilize my research. Ideally, I aim to find a commercial broker who holds a CCIM designation. CCIM stands for Certified Commercial Investment Member, and most CCIMs indicate this designation in their online and print advertisements. CCIMs undergo extensive training in commercial property and must possess a proven track record of successful transactions or consultations demonstrating their extensive commercial knowledge. They also need to pass a comprehensive examination. I consider a CCIM equivalent to a PHD. Incidentally, you can also locate CCIMs at CCIM.com. It's estimated that only 6% of the roughly 125,000 commercial brokers in the market have a CCIM designation.

After identifying 5-6 brokers in your chosen market, with or without the CCIM designation, make contact with them to introduce yourself. Inquire about market conditions, recent sales in the area, and their personal experience as a commercial broker. It's astonishing how much information you can glean by asking the right questions, and you can also gauge whether you envision a long-term relationship with them.

Once you have a favorable impression of 3-4 of the brokers you've spoken with, share with

Rental property financing

solutions from United Bank.

Here at United Bank, we do more than write mortgages; we create, customize and innovate to provide a loan that fits your unique situation. Whatever it takes, we’re here for you. Now that’s a real mortgage solution.

FEBRUARY 2024 MICHIGAN LANDL O RD 41 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

Member

FDIC

UnitedBank4U.com | 616.559.7000

them the criteria you are seeking in an apartment complex. Your criteria should encompass the number of units, unit mix, minimum Cap Rate, price range, the quality of the complex (A, B, or C), and the area within the city. You might also express your desire for the owner to provide some or all of the financing.

Follow up your phone conversations by emailing or faxing your contact information and criteria to the brokers. Then, contact the brokers every 1-2 weeks by phone or email to maintain the connection. Since the brokers are well aware of your specific requirements, it becomes easier for them to locate properties that match your criteria.

The brokers who present potential deals are those you should prioritize. Naturally, they receive their commission, but it's the additional gestures, such as sending them a restaurant gift card for a night out or offering tickets to a local sporting event or a bottle of wine, that make a difference. This way, you remain at the forefront of their minds whenever a promising deal crosses their desk.

You've probably heard of the term 'Pocket Listing,' but I aim to be a 'Pocket Client.' When the broker obtains a new listing, I want to be one of the first clients they reach out to, sometimes before disclosing the details to other brokers within their office. This is the key to finding exceptional deals.

If you think about it, everyone has access to the same sources for deals, but it's the individuals who have nurtured and cultivated their relationships with brokers who reap the greatest rewards. These relationships are pivotal in negotiations with the seller, particularly if you seek something beyond a conventional 20%-25% down payment. Your brokers will advocate on your behalf, explaining to the seller why it is financially advantageous for them to offer financing for a portion or the entirety of the purchase price, rather than selling the property outright.

Even in the commercial world, success hinges on relationships. Once you establish these connections, you significantly increase the chances of turning an average deal into a fantastic one. A 10% COC return can evolve into a 20% COC return, effectively doubling your cash flow. What is that worth to you?

42 RENTAL PROPERTY OWNERS ASSOCIATION

Anthony Chara is a nationally known, seasoned real estate investor with over 30 years of experience. He has owned or managed several successful multimillion-dollar companies and owns and/or has syndicated over 2,000 apartment units around the country.

Anthony offers superior technical training to real estate investors specifically targeting commercial investing with an emphasis on apartment complexes. Anthony Chara has taught several thousand aspiring real estate investors how to analyze properties to see if they can increase cash flow and value for themselves and their investors.

Anthony Chara will be presenting at the 2024 Midwest Real Estate Investor Conference in Downtown Grand Rapids on Building Generational Wealth: Increase Your Wealth Exponentially with Multifamily Properties on Friday, February 23rd at 10:30am - 12:30pm in River Overlook EF. Register now!

Are you ready to embark on a journey to financial success through apartment and multifamily property investments? During this dynamic presentation, you will delve into the core strategies and insights needed to create lasting wealth through apartment investments.

Anthony's expert guidance spans analyzing local and nationwide apartment markets, mastering property hunting, understanding crucial financial metrics, exploring diverse financing options, and creating streams of income that can last for generations. Learn unconventional methods for property location and quick analysis, ensuring you're equipped to seize valuable investment opportunities. Don't miss this chance to exponentially increase your wealth through the strategic insights shared in this dynamic presentation.

Alex Jarbo will also be participating in the Scaling Your Investment Strategies with Apartments panel discussion on Thursday, February 23rdd at 8am - 8:50am in River Overlook AB.

Join us for a panel discussion with Anthony Chara and other industry experts where they will explore the unique challenges and opportunities associated with venturing into apartment investments, offering practical insights on maximizing returns, managing risks, and scaling investment portfolios effectively. Whether you're a new investor looking to enter the multifamily space or a pro seeking to optimize your apartment investments, this panel discussion promises to provide actionable strategies and a comprehensive understanding of the nuances involved in scaling your real estate investment strategies with apartments.

FEBRUARY 2024 MICHIGAN LANDL O RD 43 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

30+ DAY STAYS FULLY FURNISHED RENTALS Designed for traveling professionals, relocation, insurance restoration or anyone in a life transition Contact us for more information on how you can work with us Lynette & Rachel michiganfurnishedrentals com michiganfurnishedrentals@gmail com 616-581-2776

Some

44 RENTAL PROPERTY OWNERS ASSOCIATION FEATURED CONFERENCE SPEAKER JEFFREY TAYLOR HOW TO CREATE YOUR OWN SUPPLY OF QUALIFIED APPLICANTS TO FILL YOUR VACANCIES Thursday, February 22nd 1:30pm - 3:30pm River Overlook EF Management Tips from MRLANDLORD.COM By Jeffrey Taylor, “Mr. Landlord” Article posted on February 1, 2024 by Apartment Owners Association of California Inc., aoausa.com. The tips in this column are shared by regular contributors to the popular MrLandlord.com Q&A forum, by real estate authors and by Jeffrey Taylor. Location, Location, Location!

great advertising opportunity is to take advantage of location. In retail, it’s all about location, location, location. But this also applies to rentals. Where your property is located can be a huge asset. If it’s located on a busy street or near an intersection, you have automatic, free publicity. How?

One

obvious ways:

• Put a “For Rent” sign in the yard of your rental.

• A banner on the front of your multi-unit building.

• Balloons and streamers on the front porch of your property.

• The more exposure you get with passing vehicles and foot traffic, the better.

And some less obvious – take a fresh look at your property to see what shops, businesses, parks, schools, colleges, or attractions are near to your property. The best way is to simply take a walk through the neighborhood. I’m always amazed how much I discover when walking through a neighborhood. Suddenly, I start noticing locations and features about the neighborhood that have always been there and I’ve driven by a hundred times but I have never seen before. Is there a dry cleaner, flower shop, restaurant, grocery store, auto repair shop, laundry mat, library, etc? Customers who shop at these locations tend to live close-by as well, and may be good candidates for your property.

If you’re near a hospital, advertise on the bulletin boards or weekly newsletters distributed in the hospital.

Is a business, shopping or retail park nearby?

Near a big manufacturing plant or large office building? Reach out to the employees of companies in the building, as well as building maintenance, security, and reception with a “walk to work” offer targeted especially to them. Ask building management how you can reach tenants within the building. You may even be able to use the human resource dept. of the companies to get to interviewees and new hires alike. With the high price of gas and appeal of shorter commute times, your nearby property could be very attractive to people who are fed-up with a long commute and want to spend more time with their families and less time in the car.

If you’re close to a college, advertise on bulletin boards, in the student lounge, in the student newspaper, and even at local on-campus sporting or social events.

Is there a daycare facility nearby? Tout this in your advertising, on the phone with prospects, post a flyer or in an ad within the daycare. This way you can reach out to parents who drop their kids off. You can also put an ad in parent-teacher newsletters, circulars, or other

FEBRUARY 2024 MICHIGAN LANDL O RD 45 WHERE REAL ESTATE INVESTORS AND LANDLORDS GO FOR SUCCESS

publications to reach this target audience with your great location.

Any big company have their headquarters nearby? Consider advertising your rental as a more convenient and cozy alternative to sterile, cold, and impersonal corporate housing. Renting your place out to visiting people could boost your occupancy rates.

In addition to a steady stream of visiting business people as tenants, you may be able to charge a premium of 30-50% more than your standard monthly rental rate because the competition in the corporate housing market is typically mid-to-higher end hotels with daily rates of $200-$300 or more. Multiply this daily amount over a week, and you quickly get a pretty big number ($1,400 and up). If your standard monthly rental rate is $1,000 per month, then you could easily charge $1,300-$1,800 for a monthly stay. Visiting business customers will gladly pay the premium over your normal rates because of your relative value compared to options like corporate housing or a hotel. Plus, many business people are traveling on the company’s dime and will be reimbursed for travel expenses anyway. So, they tend to be less sensitive to price.

Tourist Attractions