ACCLAIM

RECOGNISING LEADERS AC ROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE WealthBriefing AWARDS PROGRAMME

The Third Annual WealthBriefing WealthTech Americas Awards 2024

March 2024

Why Wealth Managers are the Ultimate Private Market Matchmakers

(in partnership with Hywin Wealth & VP Bank)

This report tackles both the supply and demand for private market opportunities in both the Asia-Pacific region and globally, a topic which will continue to be hugely important for the wealth management industry as H/UHNWs seek enhanced returns and diversification in a challenging investment environment and billions of “dry powder” await deployment.

External Asset Managers in Asia - New Directions for Rapidly-Expanding Sector

(in partnership with UBS)

Our second annual report examining the growth of Asia’s EAM sector, covering both the powerhouses of Singapore and Hong Kong, and emerging markets like Thailand and the Philippines. This study looks at the growth prospects for independent advisors in the round as they seek to tap the region’s booming wealth and growing client acceptance of the EAM model.

Family Office Focus: An Update of the Industry's Efficiency in Accounting and Investment Analysis

(in partnership with FundCount)

A deep dive into the key technological and operational challenges facing family offices in their accounting and investment analysis activities. Based on surveys and interviews

among family offices managing over $72 billion in assets, this is an invaluable benchmarking tool for the sector which presents fascinating insights into future developments from a range of industry experts.

Applying Artificial Intelligence in Wealth Management - Compelling Use Cases

Across the Client Life Cycle

(in partnership with Finantix & EY)

This comprehensive report identifies elements of the institution and advisor’s workloads that are ripe for AI amelioration, and points the way for firms seeking to maximise the competitive advantages offered by new technologies. AI experts and senior industry executives enrich each chapter, answering crucial questions on risk, KYC/ AML, compliance, portfolio management and more.

Decoding The Digital Landscape for UHNWIs

(in partnership with Jersey Finance)

This report explores the digitalisation of - and digital assets in - Jersey’s wealth management sector. It explores the shifting sands - both economic and regulatory - on which the digital sector rests.

Winning Women in MENA

(in partnership with First Abu Dhabi Bank)

This ground breaking new research examines the growth of female

entrepreneurship in the region. More specifically it looks at how women are driving family office strategy as well as the relationship between MENA’s UHNW female clients and the wealth management industry.

Technology & Operations Trends in Wealth Management 2023

(in partnership with SS&C Advent)

This succinct yet wide-ranging report shines a light on both macro and micro trends, beginning with industry growth sentiment and ending on operating model evolution, taking in every key area of development in between. It brings together datapoints and candid comments senior executives at leading consultancies across the world’s major wealth markets to create an invaluable peer benchmarking tool.

Technology Traps Wealth Managers

Must Avoid 2023

(in partnership with EY)

With EY providing the overview, this report draws on the front-line experience of many of the technology sector’s biggest names, in recognition of the fact that they are the ones going in to solve wealth managers’ most pressing problems and have typically seen the ramifications of firms’ choices play out numerous times – not to mention in various contexts globally.

© Copyright 2024 ClearView Financial Media Ltd, publisher of Family Wealth Report and WealthBriefing, 83 Victoria Street, London, SW1H 0HW / Tel: +44 (0) 207 148 0188 / info@clearviewpublishing.com / www.clearviewpublishing.com VAT Reg No: 843 3686 09 / Registered in England: 06784131

TECH & OPS TRENDS IN WEALTH MANAGEMENT 2023 AL DEVELOPMENTS EXPLAINED BY LEADING INDUSTRY EXPERTS NOW IN ITS ELEVENTH ANNUAL EDITION Winning Women In MENA How Wealth Managers Can Help Further Female Empowerment 1 WHY WEALTH MANAGERS ARE THE ULTIMATE PRIVATE MARKET MATCHMAKERS WHY WEALTH MANAGERS ARE THE ULTIMATE PRIVATE MARKET MATCHMAKERS 20 22 APPLYING ARTIFICIAL INTELLIGENCE IN WEALTH MANAGEMENT: COMPELLING USE CASES ACROSS THE CLIENT LIFE CYCLE NEW DIRECTIONS FOR A RAPIDLY-EXPANDING SECTOR EXTERNAL ASSET MANAGERS IN ASIA DECODING THE DIGITAL LANDSCAPE FOR UHNWIs This port explores the digitalisation of - and digital assets in - Jersey's wealth management secto It explores the shifting sands both economic and regulatory on which the digital sector rests. 2022 FAMILY OFFICE FOCUS: An Update on the Industry’s Efficiency in Accounting and Investment Analysis 2023 4 ANNUAL EDITION Expert guidance on strategy, selecting solutions and implementation TECHNOLOGY TRAPS WEALTH MANAGERS MUST AVOID Sponsored by

RECENT RESEARCH OUTPUT

Foreword

TOM BURROUGHES Group Editor, WealthBriefing

The Third Annual WealthBriefing WealthTech Americas Awards 2024 shine a sharp and important light on a sector that is now integral to the wider wealth management, banking and family offices world. Technology comes in all shapes and sizes, and is developing fast. To handle this variety, make best use of it and keep ahead of competition requires relentless focus, imagination and energy. These awards raise a salute to those qualities.

Now a significant part of a global series of awards, this program is an important way of honouring the mass of businesses and people who aren’t always the public face of wealth management, but their technologies and services make much of it work. The variety of the award categories in this publication demonstrates what a busy sector this is.

As with all the other awards, a big vote of thanks must go to the judges for their energy, commitment and professionalism in drawing up a list of winners. Their involvement is greatly appreciated. Thanks are also due to the sponsors of the awards for their support, the organisers at the WealthBriefing team for their work, and last but not least, for all the individuals and firms who entered the awards.

The team learn much from the awards because they can reveal names of businesses putting themselves forward, how they see themselves and the challenges and opportunities. And the awards are a morale-booster for teams, and an important business development and marketing team for companies as they seek to build revenues and reputations.

Contents

Overview of the Wealth Technology Market in the Americas

North America has the world’s largest market for wealthtech solutions – perhaps unsurprisingly given the continued importance of Silicon Valley, notwithstanding global competition.

The technology solution market in North America is expected to grow from $18.81 billion in 2021 to $42.06 billion by 2028, according to Business Market Insights. It is estimated to grow at a compound annual rate of 12.2 per cent from 2021 to 2028.

In the past few years – and accelerated by the pandemic –digitalization of the wealth value chain has accelerated. We have seen continued development in tech such as distributed ledger technology – blockchain – that is most usually connected with cryptocurrencies. The hottest area now appears to be artificial intelligence, and we are seeing use cases being developed, such as in investment, portfolio risk analysis, compliance functions, customer relations (chatbots, mass-customization in certain fields, cybersecurity, and more).

There is much more to technology than bright shiny objects and cool tools for RMs. It is about changing the entire process from the front to the back office. Technology can help advisors locate new clients, and faster.

The range of firms is bewildering, such as InvestCloud, SS&C, Avaloq, FundCount, Canoe Intelligence, FactSet, Refinitiv, Eton Solutions, and more. A challenge is understanding how to choose the most suitable vendors – no wonder consultants are busy.

Whether an organization is a small RIA, multi-family office, trust bank or full-service bank, technology is central. Tech experts are often part of the C-suite, and drive strategy.

There remain challenges, not least managing costs of implementing new systems, ensuring they achieve intended results, and that staff can make the most of tech. Cybersecurity, cost-overruns and outages remain pain points.

is not a silver bullet for wider problems.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 3

Tech

WEALTHBRIEFING WEALTHTECH AMERICAS AWARDS JUDGING PANEL 5 INTERVIEWS: Addepar ........................................................................... 7 AgilLink ............................................................................ 9 Asset Vantage ................................................................. 11 Broadridge Financial Solutions ....................................... 13 Canoe Intelligence .......................................................... 15 Charles River Development ............................................ 1 7 Croesus ............................................................................ 19 FactSet ............................................................................. 21 Franklin Templeton ......................................................... 2 3 NICE Actimize .................................................................. 25 Nines ......................................................... 2 7 Plumb Bill Pay .................................................................. 29 Practifi ............................................................................. 31 PwC .................................................................................. 33 The Collaborative ............................................................ 35 Vestmark ......................................................................... 37 WEALTHBRIEFING WEALTHTECH AMERICAS AWARDS WINNERS IN FULL 39

Winner: Client Communication Solution or Tool (US) Scan the QR code to learn more SCALING MOMENTS THAT MATTER™ Connects via APIs into your CRM Alerts you of advice opportunities Equips you with impactful content www.bentoengine.com

The Judging Panel

The WealthBriefing WealthTech Americas Awards 2024 judging process was guided and assisted by a panel of independent experts, each of whom has been actively involved in the wealth management industry for many years and have an in-depth knowledge of the WealthTech sector.

PATTI BOYLE Chief Marketing Officer Dstillery

VIKRAM CHUGH Chief Operating Officer Robertson Stephens

DOUGLAS FRITZ Founder and CEO F2 Strategy

HOWARD GELLER

Principal, Strategic Consultant Hudson Peak Group

TANIA NEILD

CTO and Owner InfoGrate

RONALD MACLEOD

Managing Partner Baciu Family Capital

KAYLYN MELIA Chief Operating Officer Socius Family Office

JONATHAN NORTH Head of Products 4Pines Fund Services

GREGORY F. ROLL Co-Founder Touchpoint

WILLIAM TROUT

Director of the Securities and Investments Datos Insights

DANIELLE ROSEMAN

Managing Director Lazard Family Office Services

DANIELLE VALKNER

Private, Family Office Leader PwC

GARY W POTH Executive Managing Director, Head of Family Wealth Key Private Bank

MIKE SLEMMER

LP Sales Director Dynamo Software

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 5

Your $100M innovation investor every year

Addepar invests $100 million annually in R&D to fuel innovation and deliver exceptional value to our clients. We are the total portfolio solution trusted by hundreds of thousands of users who manage and advise on $5 trillion in assets on the platform.

Learn more about how Addepar can help you simplify complexity, deliver exceptional client stewardship and support your goals by visiting addepar.com

© 2024 Addepar

Empowering Growth And Client Centricity At Scale

What was the winning formula of your firm/you that explains why you won?

Addepar was born out of the wake of the 2009 financial crisis when the industry was forced to fight through the storm without the right technology, data, and perspective to navigate fast-moving markets and a dynamic risk landscape. We had a vision to build a tech and data company that partners deeply with the best investors and advisors to solve industry-wide and global problems in a scalable, sustainable way. Today, Addepar stands as the market-leading platform for data management and aggregation, analysis and reporting, at a time when wealth, investment and asset management firms globally are recognizing that this is now a requirement. We are proud to now serve more than 1,000 client firms who manage and advise on $5 trillion in assets on the platform.

Addepar’s founding thesis has proven to be true: investment professionals and financial advisors require robust technology, comprehensive and precise data, specialized tools, and a contextual perspective to deliver value to their clients.

What sort of challenges did you surmount to reach this level and how have you been able to succeed in such fast-moving circumstances?

While Addepar started as a Single Family Office solution, today we serve four primary client segments: Single Family Offices, RIAs/ Multi Family Offices, Enterprises and Institutions.

We spent our first decade building a technology foundation and data network to empower our clients to answer these common questions, when they want: What do I own? Where do I own it? How do I own it? What am I exposed to?

By starting with these basic questions and building robust solutions, Addepar now empowers financial professionals to

Molly Lynn VP, Head of Account Management and Client Success Addepar

• Data Management and Analysis (US) Winner

see the world in the way they want and is the only platform that can model any currency and asset type in one place. The critical market needs Addepar solves are surprisingly similar for any firm managing or advising on multi-asset investment portfolios, and thus, we have dramatically expanded our scale and client reach.

What are you going to do to remain competitive and stay ahead?

Addepar is committed to fostering a culture of relentless innovation. Each year, Addepar invests more than $100 million a year in R&D, underscoring our commitment to innovation and the talent of our people.

Addepar ships meaningful updates every two weeks, showcasing the power of our R&D team – which makes up more than 50% of staff. This rapid pace is unmatched in the industry and underscores our dedication to staying ahead in a competitive landscape.

Where do you see the wealth management industry and your part of it going in the next five years?

The past few years brought global market turbulence and an increasingly competitive market for advisors. Client needs have grown complex and we expect to see continued demand for reliability, speed, transparency and a genuine human touch. Advisors are also facing increased pressure to provide greater access to alternatives and other hard to access asset classes that are uncorrelated to market dislocations.

As part of this, more and more firms will turn to innovative technology solutions to help achieve their goals. Addepar is in a unique position to continue investing heavily in our platform to further enhance the value we can bring to our clients. We see countless opportunities to add to our platform, and the level of engagement across our clients and the broader market has never been stronger.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 7

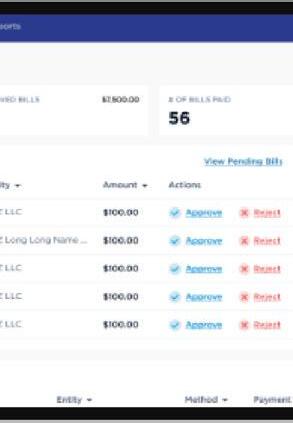

Making Clients The Priority In Every Decision

What was the winning formula of your firm/you that explains why you won?

In what has been a year of unprecedented growth and change, it is AgilLink’s clients that have handed us the edge. Each of our clients has unique needs, and as such it has allowed us to demonstrate our ability to combine over thirty years of family wealth expertise, with our best-in-class bill pay and accounting platform, to meet and exceed their objectives. As an affiliate of City National Bank, the adaptability of our technology is what ultimately empowers AgilLink clients, but it’s our people that make success possible.

What sort of challenges did you surmount to reach this level and how have you been able to succeed in such fast-moving circumstances?

One of our primary challenges, is also a key differentiator in the marketplace. Being an RBC company, one of the world's most successful financial institutions, means we are held to the highest standards of security and compliance, particularly crucial in the realm of payments and finances. Our clients find immense value and trust in the robust security measures we adhere to, setting us apart from competitors. While some independently owned competitors may claim nimbleness, we prioritize bank level security protocols. The peace of mind our clients receive regarding the safety of their Ultra-High-Net-Worth (UHNW) client data is one of the most important assurances we can offer. Competition can be tough; however, our unwavering commitment remains centered on doing what is best for our clients. Whether it involves introducing innovative functionalities, swiftly resolving issues, or engaging in collaborative problem-solving, our clients are at the core of our business.

Who inspires you, either inside or outside your organization?

Our clients are a constant source of inspiration for us. Looking back over the decades, we have watched a new operations manager

Erin Oremland General Manager AgilLink

• Bill Pay (US) Winner

that was part of our onboarding, advance to becoming the COO of the same organization. We have witnessed a small single-family office that was handling less than a hundred bills grow into one of the country’s largest multi-family office that handles multiple thousands. We have watched them grow and evolve over the years, which has pushed and inspired us to do the same.

How do you hope your firm will benefit from getting this award?

For decades AgilLink’s incredible growth has been almost exclusively fueled by client referrals and positive word of mouth stemming from the efficiencies they’ve gained. Ultimately, our hope is that winning this prestigious award acts as a beacon, attracting the attention of firms outside of our existing network that are seeking ways to streamline, automate, and scale their bill payment and client accounting services.

Where do you see the wealth management industry and your part of it going in the next five years?

In the next five years generational transitions are going to become a top concern for family offices. This shift is going to require firms to meet the expectations of their new tech savvy clients. This transition will also likely result in more accounting complexity, an increase in entities, and the number of bills family offices are responsible for paying.

AgilLink is prepared to help family offices meet the needs of the next generation with our mobile app, scalable and efficient bill payment process, Application Program Interface (API) integrations with Investlink and InAssist.

AgilLink is an RBC company and is an affiliate of City National Bank Member FDIC. InvestLink is a service mark of Aspire Financial Services, LLC which is not affiliated with AgilLink.

InAssist is an independent company and is not associated with AgilLink, City National Bank, or RBC.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 9

Leverage AI to track investment performance, analyze portfolios, project cash flows, track income, expenses, and more - all through a simple text query to your AV license.

their

Families and

trusted advisors can now get super quick investment insights with AV EDGE , your AI-assisted edge in making thoughtful financial decisions.

www.assetvantage.com | inquiry@assetvantage.com

YOUR

An award-winning integrated performance reporting and general ledger solution for global family offices. Experience the future of family office operations with AV.

GET AI TO QUERY

OWN DATA.

Putting Clients In Charge Of Data – Helping Navigate The Investor Journey

Chirag Nanavati Managing Director Asset Vantage

Winner

Chirag Nanavati Managing Director Asset Vantage

Winner

What are you going to do to remain competitive and stay ahead?

We have only just scratched the surface of what we can do with the unique integration of performance analytics and the general ledger. AV Edge, our newly launched AI-enhanced mobile app, will bring hundreds of micro-interactions for clients to get pointed answers and insights to specific questions and will bring the ability to set up dynamic and comprehensive notifications.

In addition to AV Edge, we continue working closely with our customers to enhance the AV Pro platform and experience by increasing automation and third-party API support for integrations which makes data aggregation and any up-stream and downstream use cases more impactful.

These on top of our already easy-to-use platform, featuring comprehensive integrated performance reporting analytics, best-in-class customer service, optional managed services for data reconciliation and financial reporting - all with simple and transparent pricing for family offices – these enhancements will further position AV at the cutting edge of wealth tech platforms.

Who inspires you, either inside or outside your organization?

Our customers are our inspiration. Family members go to great lengths to understand and track their complex wealth. We aim to empower them by giving full control over their financial data. Working closely with them and their teams and professional advisors, we have created a wealth management platform with a powerful, fully integrated, and automated dual-entry general ledger engine.

How do you hope your firm will benefit from getting this award?

This award validates our efforts and fuels our drive to continually enhance the

customer experience with our product and service. Alongside the award, the launch of AV Edge, an AI-enhanced mobile app, will further establish AV as the highest value, fastest on-boarding, global ready platform for families with complex wealth. We look forward to building many partnerships with upstream and downstream solutions to enhance AV’s value proposition for UHNW clients and their trusted advisors.

Where do you see the wealth management industry and your part of it going in the next five years?

The wealth management industry needs to focus on offering privacy, hyperpersonalization, hyper-availability, and direct access to end clients. There is a strong underlying wave of generational wealth transfer in the United States and globally, marked by significant wealth creation events that will drive the need for clients to own their data, create personal and actionable views, and interact with their wealth in various ways anytime, anywhere. Industry players must adapt and engage the next generation with the technology and seamless experience they have come to expect from retail technology products.

What was the winning formula of your firm/you that explains why you won?

The challenge was to break into the strong-hold of incumbent competitive products used in this industry. Over the last few years, we have acquired a critical mass of customers with complex data management needs in North America. We are dedicated to creating an integrated platform, with comprehensive coverage in performance and accounting, featuring a world-class interface, global data feeds and support, as well as engaged and white-glove customer service - all with transparent pricing which is a rarity in this space. We have always been on this path and continue to forge ahead in executing our mission to help global UHNW families manage their complex wealth like they would their business.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 11

• Family Office Solution (US)

Transform on your terms with the Our open, modular platform helps wealth managers modernize. Drive advisor productivity Digitize operations Personalize investor experiences Broadridge Wealth Platform © 2024 Broadridge Financial Solutions, Inc., Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc.

Broadridge’s Innovative Approach To Wealthtech Solutions

How has Broadridge Canada adapted to changes in wealth management, considering regulatory shifts and evolving client expectations?

Karin Kirkwood President Broadridge Financial Solutions

• Overall Canadian WealthTech Provider (Canada) Winner

business models and regulatory requirements. Continuous investment ensures innovative solutions, cementing Broadridge as a trusted partner for clients’ success.

As President of Broadridge Canada, I am inspired by the impactful daily contributions of my colleagues to our industry. Their unwavering dedication to serving our clients and our market is evident in the Broadridge Wealth Platform’s transformative suite of capabilities provided to our Canadian clients.

Wealth management clients rely on Broadridge for robust, innovative, and transformative solutions that meet regulatory demands like CIRO and the new First Home Buyers Savings Plan. Our capabilities, including predicative analytics and powerful advisor workstations, drive growth. Using our solutions, financial institutions can respond with velocity and efficiency to exceed client expectations through market shifts in Canada and beyond.

Broadridge is undeniably shaping the next generation of wealth management in Canada, accelerating the pace of transformation in the industry.

What was the winning formula of your firm/you that explains why you won?

Broadridge’s winning formula is a combination of three things:

First is our extensive expertise, proven in almost six decades of providing wealth solutions to clients globally. Our clients know we can be trusted to deliver on their needs, create value for their advisors and investors, and help them grow their business.

Secondly, our best-in-class technology reflects this expertise and empowers firms to create a create a powerful open-architected eco-system leveraging Broadridge components, in-house proprietary elements, and third-party solutions. Our clients realize a reimagined digital experience focusing on driving advisor productivity, personalizing the investor experience, and digitizing enterprise operations. Finally, we’re at the forefront of innovation with solution components that seamlessly supports diverse

What are you going to do to remain competitive and stay ahead?

To maintain our competitive edge and propel innovation, Broadridge will continue to invest in tools and capabilities that enrich the client and advisor experience, drive efficiencies and STP, and increase the velocity by which our clients run their businesses. Building on our commendable scope of products and services, we will continue to strengthen our partnership ecosystem and make investments in research, product development, and innovation to reinforce our ability to respond to market changes and deliver for our clients as their needs evolve. Our commitment to delivering exceptional value, validated by clients citing us as “very well ahead of peers,” will guide our market impact.

Where do you see the wealth management industry and your part of it going in the next five years?

We are in the midst of a transformation period, and the next 5 years will see major shifts in our industry, including wealth management, emphasizing increased digitization, personalized client experiences and leveraging the power of generative AI. Broadridge’s robust books and records solutions, and data serve as the foundation for these capabilities. As a leader in innovation, Broadridge will be instrumental in shaping this future landscape. Increased integration of cutting-edge technologies, such as AI-driven insights and comprehensive digital platforms will become the standard, while mitigating risk. We will continue to offer innovative solutions that guarantee flexible and expandable frameworks. With our dedication to client-centricity, regulatory alignment, and technical excellence, Broadridge is positioned to play a pivotal role in driving and accelerating industry innovation, fostering lasting client relationships, and propelling the expansion of the industry as client expectations evolve.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 13

Automate

Alts, smarter. TRUSTED BY 300+ FIRMS TO MANAGE CANOEINTELLIGENCE.COM LEARN MORE

We transform complex documents into actionable intelligence within seconds.

your alts document and data management with the industry leader.

Leveraging Artificial Intelligence To Drive Next-Level Automation For Alts Investors

How is Canoe applying artificial intelligence to supercharge wealth managers’ processing capability? At a high level, our technology clusters documents into neat groups. If one document stands alone and says it's a capital call but doesn’t look like other capital calls, that can lower the confidence level across all groups. To prevent that, we route outliers to human review. If the human validates that the model is right, it becomes reinforcing data to retrain our model, expanding Canoe's definition of a capital call. If the human agrees the model is wrong, and it’s truly an outlier, that’s negative reinforcement; when the model sees that document again, it won't be classified as a capital call.

Over the last seven years, there have been groundbreaking, exponential developments in the ability to process text and extract value. For those who have been deeply involved, it's a nice evolution, where each iteration is ten times better than the previous. But, for most people, it looks like a miracle happened last year with ChatGPT.

Since joining Canoe, I’ve been determined to make generative AI work for the business, particularly around speeding up our technology development processes. How do we take advantage of that exponential growth in large language models (LLMs)? Specifically, can we take this generative AI-led leap in processing to automate more, and do it more accurately, without creating more manual work?

LLMs are a type of artificial intelligence model that get pre-trained on vast quantities of text data and learn continuously with use. Though “new” to the public, I believe LLMs will soon become a commodity product. Some models have certain strengths; ChatGPT-4, for example, has medical diagnosis training data, so it's

Noel Calhoun Chief Technology Officer Canoe Intelligence

Winner

• Artificial Intelligence (AI) Application (US)

significantly better at medical responses than Meta’s open-source model LLaMA. However, the models will generally be similar under the hood, so the data used to train and fine-tune them becomes the primary differentiator.

We route exceptions through a very detailed human review process to create a high confidence level in our data. People think the tech gets 95% of the way there, but that’s only true if they feed great training data into their model. Without excellent exception management, they’re never quite sure if the data is right, leading to distrust in the output. For Canoe, data processing, review, and quality control have always been a priority.

Our library contains millions of meticulously parsed and labeled documents, and humans historically completed some of that processing work.

"We have a very high confidence level in Canoe’s data, and that data is the rocket fuel for developing our machine-learning models. Our output should be so trustworthy that we don't have to route it back to human review."

Our process constantly brings feedback into Canoe’s model, so we can routinely reevaluate, rerun, and retrain it to be constantly tuned to the market. If there is a trend or a broader drift, it will pick that up over time. That iterative learning and improvement is fundamentally part of Canoe’s artificial intelligence approach – and I believe that's why we're leading in AI applications in the wealth management space.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 15

The Charles River ® Wealth Management Solution

Charles River is creating a new paradigm in the industry with a cloud-based, interoperable, and powerful platform. Our solution empowers wealth managers, sponsors, and advisors with the technology and services that help drive business growth and improve investor outcomes.

Winner of Best Portfolio & Wealth Management (US)

©2024 State Street Corporation - All Rights Reserved State Street Corporation, One Congress St, Boston, MA 021146382767.1.1.AM.

Charles River Development Offers A New Paradigm For Wealthtech

Randy Bullard Global Head of Wealth Charles River Development

Randy Bullard Global Head of Wealth Charles River Development

What was the winning formula of your firm/you that explains why you won?

Charles River began as a technology provider for institutional asset managers and our wealth business grew from there.

Therefore, our wealth solution is built to meet the needs of institutional managers, giving wealth firms powerful capabilities with the flexibility and extensibility needed to remain competitive, all while allowing managers who run both wealth and institutional business lines to use a single platform.

Finally, our technology is built 100% in-house. That is a significant advantage that helps us keep pace with rapidly advancing technology needs and to meet the needs of our global clients.

We also invest substantially in technology research and development. We invest over USD $80M annually across the Charles River product suite with USD $10M allocated to our wealth management solution.

Please describe how your colleagues made a difference?

Our engineering, product, and client management teams are key to our success.

Charles River’s teams of highly skilled technologists and professionals are agile thinkers and problem solvers, committed to our end users and engineering excellence.

We use mentorship and teamwork to impact and drive our business forward every day, working collaboratively across geographies and markets to ensure that we provide technological leadership and innovation to the global wealth management community.

What are you going to do to remain competitive and stay ahead?

We are keenly aware of the challenges facing advisors as well as wealth and asset managers. As they try to innovate and remain competitive, they are dealing with fee compression, increased operating costs, advisor retention, among others.

"We believe that staying competitive in the market requires a modern, complete technology solution that can handle high volumes and the flexibility to manage multiple lines of business on one platform."

We regularly partner with our clients to solve for their real, everyday challenges, and bring that knowledge into our product development.

In addition to our core platform, offerings such as Tailored Portfolio Solutions and the Wealth Hub are simplifying and streamlining processes that were once cumbersome and manual.

Who inspires you, either inside or outside your organization?

Our global client base of top-tier firms inspire our product and engineering teams to provide the best technology and client experience possible.

Client feedback and collaboration enables Charles River to continuously incorporate new innovations in our wealth management platform.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 17

• Portfolio and Wealth Management (US) Winner

Benefit from significant productivity gains and facilitate team work

Croesus Central

The next generation automated portfolio rebalancing solution

Rules-based system

Optimization of after-tax returns

Modeling and what-if scenarios

Compliance by design

Customizable solution

croesus.com

Innovation, Creativity, And People At The Heart Of The Croesus Journey

What was the winning formula of your firm that explains why you won?

As a pioneer in the Canadian WealthTech industry, Croesus has always demonstrated a solid technological track record and has become the preferred technology partner of many chartered banks and large financial institutions. Over the years, wealth management technologies have taken on such an important role that they now influence firms' business models, profitability, and performance. For over 35 years, Croesus's mission has been to contribute to its clients’ success by offering cutting-edge wealth management solutions adapted to their needs and providing best-in-class experience. This approach makes us an exceptional partner and results in a sustained leadership position in the Canadian market. Croesus has invested in a pool of talented employees whose dedication and collaboration allow us to offer clients innovative solutions. In 2018, Croesus launched Croesus Lab, an internal applied research center focused on driving innovative ideas that can transform products and services. The lab consists of professionals with Master's or Ph.D. degrees. Its main goal is to inspire innovation within the company and develop technologies that can be integrated into products or internal processes. It strives to be an innovative technology leader in the WealthTech industry for the benefit of our clients. The lab also shares knowledge internally and participates

Marc Riel Vice-President, Business Development and Strategic Partnerships, North America Croesus

in activities to stay at the forefront of technology and establish Croesus as an influential player in the financial technology sector. To further help our clients, Croesus organizes events, such as the Croesus Finnovationn WealthTech conference. During last year’s event, our clients met with our experts to discover how innovative solutions can turn uncertain situations into business opportunities. It is also an opportunity for Croesus to learn more about clients issues and goals to serve their needs.

Please describe how your colleagues made a difference?

Our colleagues make a profound impact because they embody Croesus’s values of Respect, Integrity, Collaboration, Ethics, and Fun. By demonstrating unwavering respect, we cultivate healthy relationships with clients and each other which is crucial to our success. Our colleagues’ integrity elevates human interactions, setting the stage for excellence. Through collaboration, our colleagues fuel their creativity, and achieve together, fostering a sense of belonging. By upholding ethical standards, we guide each other to be the best versions of ourselves and bring forward the best in one another. Finally, infusing fun into work inspires motivation and innovation.

Who inspires you, either inside or outside your organization?

Sylvain Simpson, the President of Croesus, embodies inspiration. His profound financial and technical knowledge shapes our company’s success. A charismatic and humble individual, Sylvain fosters a work environment where inspiration and innovation thrive. His leadership transcends traditional boundaries, engaging our employees with a human touch. Under his leadership, Croesus has become more than a business - it has become a community working towards common goals. Sylvain’s ability to connect with individuals transforms the workplace into a space where creativity and innovation flourish, making him not just a leader, but an inspiration for all who have the privilege to work alongside him at Croesus.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 19

Innovative Client Solution (Canada) Winner

•

Elevate Your Wealth Management Workflow with FactSet

Create exceptional digital client experiences by leveraging FactSet’s suite of portfolio analytics, multi-asset class research, global market analysis, and tools. We offer open, flexible technology personalized to every client’s needs through our workstation, CRM integration, client portals, standalone applications, and more.

www.factset.com/wealth

FactSet – Data, Analytics & Technology To Enhance Advisors’ Efficiency

What was the winning formula of your firm/you that explains why you won?

“FactSet's investment in data quality and ability to connect it seamlessly with client portfolios and internal research help wealth managers uncover unique and actionable insights to reduce risk, operate more efficiently, comply with local regulations, and create a competitive edge to win and retain business.

More than half of our organization is dedicated to data integrity and concordance. We integrate and offer 30+ FactSet-owned datasets and 1,000+ from third-party data providers. FactSet’s flexible technology lets users consume data in a variety of ways, including via data feeds, a configurable mobile and desktop platform, digital portals, APIs, and more. Our unique data symbology links and aggregates a variety of content sources to ensure consistency, transparency, and data integrity.”

Where do you see the wealth management industry and your part of it going in the next five years?

“We are not afraid to say that we are client obsessed, we spend a lot of time gathering their needs and answering their requests. Our clients say it best, as Jamie Coulter, Executive Vice President, Wealth Management, Raymond James Ltd. shared:

“FactSet’s solution raises the bar in our ability to deliver best in class market data and provide for our advisors and the individual investors and families they serve.”

There are a few trends we see and are addressing across our suite of data and solutions:

• Wealth firms are looking for fewer and deeper relationships with their technology providers. They are searching

for more strategic vendors they can consolidate with that can efficiently fit in and connect with the firms’ technology stack and to ultimately lower their total cost of ownership.

• Wealth organizations want to create greater capacity for their Advisors by facilitating the much-needed collaboration between the firm’s home office research and due diligence teams and the Advisors in the field. The emphasis is on helping Advisors spend less time researching securities and building portfolios and more time working with their existing clients and onboarding new relationships.

• Investors expect personalized advice, transparency, and communication from their financial advisor. Advisors need to bridge the gap between in-person and digital interactions and find the appropriate mix of both. Our open and flexible technology provides user friendly level of detail on the wealth institution’s online client portals, creating an engaging and personalized digital experience for their end-clients, and powered by the same solutions provider.

• Generative AI is revolutionizing how financial advisors interact with their technology solutions, understanding their needs and building interfaces to automate manual tasks, so that Advisors can focus on high value activities, cultivate deeper relationships with their clients, and increase efficiency is one of our biggest short-term priorities.

• Of course, providing transparency and education on how the market impact investors’ financial goals will remain a focal point for financial advisors – and our role is to enable that communication with sophisticated data and analytics. This means exposing the appropriate level of detail on the wealth institution’s online client portal, creating an engaging and personized digital experience for their end-clients, powered by the same solutions provider, allowing Advisors and clients to be on the same page.

Greg King Senior Director, Head of Wealth Management FactSet

Greg King Senior Director, Head of Wealth Management FactSet

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 21

• Data, Information or Business Intelligence Provider (US) Winner

A new partner for a new era

Global scale and investment specialization.

With our collection of specialist investment managers, we aim to offer the best of both worlds all in one place. From small caps to private credit and real estate, we have options for a wide range of investment goals.

All investments involve risk, including possible loss of principal. © 2024 Franklin Distributors, LLC. Member FINRA/SIPC. All entities mentioned are subsidiaries of Franklin Resources, Inc.

Moving Wealth Management Forward With AI

Ratna Srivastav Head of AI and Digital Transformation

Franklin Templeton

Why is AI so important to the continued evolution of wealth management?

Demand for wealth management services has exploded and continues to grow rapidly as investors seek more personalized and comprehensive solutions. Yet scaling up traditional wealth management offerings to meet growing demand is tougher than it might seem. There are capacity constraints across the whole value chain which drive up costs, hurt affordability and limit market penetration.

Technology clearly has a huge role to play in enhancing the quality and efficiency of wealth management advice. That’s why forward-thinking asset managers like Franklin Templeton are looking to AI.

"We want to be more nimble in developing successful solutions as well as more efficient in bringing them to market."

How are you using AI technology to improve your products and services?

To build out our capabilities, we first turned to academic research on goals-based investing. We then developed AI techniques that would allow us to provide the appropriate level of personalization at scale. The next step was to connect these new ways of investing with specific wealth management concerns such as annuities and taxes. We ended up with a massive body of findings that we continue to leverage now.

One of the biggest challenges was implementation – moving these products from theory to reality. That required us to adopt AI-oriented product management practices, a go-to-market strategy and a buildout of the surrounding ecosystem (e.g. recordkeepers, data providers, digital platforms). This ultimately required a series of interconnected transformations across the enterprise as well as our broader ecosystem.

The results have been very exciting. They include comprehensive advice for investors that ties in to financial planning and investment capabilities; greater consistency in investment guidance available to financial advisors; and true high end personalization.

What have you learned in applying AI to wealth management?

Planning:

Developing new AI solutions require experimentation, meaning some capabilities we develop may not produce expected outcomes. It’s essential to accept and account for this when creating program plans and release schedules.

Mindset:

In this rapidly evolving landscape, speed to market matters more than ever. We must adopt a fail-fast mindset to quickly assess whether new solutions will yield value.

Integration:

AI solutions must be designed to integrate with existing workflows and tools. These products rarely exist on a stand-alone basis, so it is also important to understand our third party partners so products work across the entire ecosystem.

Going forward, the challenge is to strike the right balance between applying our research to product development and identifying new possibilities up and down the whole value chain.

What’s the significance of this award for you?

This award matters a lot, both to me and to Franklin Templeton. It’s a testimony to the firm’s innovation focus and client-centric approach, as well as our commitment to fintech in general.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 23

Deep

• Innovator of the Year (US) Winner

Know more. Risk less. SURVEIL Holistic Conduct Surveillance for Wealth Management Multi-Dimensional Analytics Using Trades & Communications Monitor Advisor Disclosures and Recommendations Discover Previously Unknown Risk Comply with Global Regulations Increase Compliance Agility niceactimize.com | compliance@niceactimize.com

Expanded Regulatory Guidelines Create New Challenges For Wealth Managers

Suitability and related regulations have grown in scope and impact in the Americas. New regulatory guidelines and requirements that further protect consumers and provide new objectives for wealth management teams are being addressed from a technology support standpoint, and NICE Actimize continues to lead in addressing these new challenges.

In recent months, both the SEC and FINRA have taken several actions to address emerging risks and trends in the securities industry. For example, in March 2023, the SEC issued a proposed rule requiring investment advisers to provide more information about using ESG factors in their investment decisions. In April 2023, FINRA issued a guidance alert reminding firms of their obligations under the SEC's Regulation Best Interest (Reg BI). Reg BI requires firms to act in the best interests of their customers when recommending securities. In May 2023, the SEC charged two cryptocurrency companies with fraud for misleading investors about their products and services.

During this change, NICE Actimize's product and subject matter experts stayed close to the regulatory environment to ensure alignment with its technology offering and the regulatory climate. Compliance officers are arming themselves with advanced monitoring and analytics technology to safeguard against advisor misconduct and other risks. The variety of regulated communications continues to grow to include email, phone conversations, video conferencing, and many texting and chats, which NICE Actimize's surveillance solutions can monitor.

Explained Osvaldo Berrios, SME, Financial Markets Compliance, NICE Actimize, “Now, compliance teams can have the capability to build trust and ensure the firm is compliant and its reputation is being upheld. Tools must also be flexible enough to tackle new regulations, such as Regulation Best Interest or Reg BI, to ensure that a compliance program is future-proof.”

Berrios added, “NICE Actimize supports firms as they regularly review the SEC's and FINRA's compliance focus areas and take steps to ensure that they comply with all applicable requirements. Firms are leveraging a robust compliance program to identify and mitigate risks. NICE Actimize continues to provide holistic compliance management, which simplifies and captures the various layers of data that a wealth management firm needs to monitor and assess. Part of this is a requirement to capture, and evidence results to the regulators. Whether it is using communication surveillance solutions to monitor digital communications between personnel and clients, or using market surveillance solutions that ensure that employees do not compromise the integrity of the markets.”

Most importantly, NICE Actimize's industry-leading and dedicated sales practices and suitability solution, which helps compliance supervisors validate client recommendations and account integrity, continue to support the growing requirements and complexities of the suitability category.

NICE Actimize's Sales Practices & Suitability solution uses a built-in broker risk dashboard for an intuitive and instant view of individual brokers' risks. By automating oversight and supervision, firms can ensure consistency and maintain a consolidated audit trail, lowering regulatory risk while improving productivity and efficiency. Consistent controls and processes, along with sophisticated analytics, help firms address sales practices and investment suitability requirements from regulatory bodies such as FINRA, IIROC, MiFID, CFTC, UK FCA, BaFin, AMF, CONSOB, HKMA, and ASIC.

NICE Actimize’s investment in sales practices and suitability solutions, along with communications monitoring technologies, will continue to grow in its support for this critical market requirement.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 25

• Suitability (US) Winner

Osvaldo Berrios SME Financial Markets Compliance NICE Actimize

Realising The Importance Of A Holistic Approach

What was the winning formula of your firm/you that explains why you won?

The next generation of high-net-worth individuals is looking for guidance beyond financial support. They want to spend their time meaningfully and live well – but success comes with an unexpected level of complexity.

Many families fall into a wealth spiral, buying luxury homes and assets, then hiring staff to help them manage it all. Suddenly, they find themselves in a state of chaos. Rather than living the life they imagined, families struggle to keep up with the demands of running 4-5 properties and managing several household staff members. Nines fills an important gap in the support system for UHNW families and individuals. Rather than focusing on finances, we help families and individuals live with ease.

We are a household management technology platform, built with security and ease-of-use in mind. Hundreds of discerning families and family offices use Nines as a centralized household manual and operating system to simplify the way they manage properties, assets, vendors, staff, projects, and more.

We also offer in-house estate management support, workshops, and consulting, and are the hosts of Easemakers, the industry leading community with 1,000+ household and estate managers.

What are you going to do to remain competitive and stay ahead?

We are constantly talking with principals, family offices, and private service professionals to build the future of household management.

Today, Nines is the digital household manual platform the industry has been waiting for – it allows households to centralize critical information (from daily housekeeping checklists and principal

Mohamed Elzomor Jacco de Bruijn Co-Founders Nines

Winner

preferences to annual maintenance plans and vendor contact information), find answers quickly, assign tasks, and more.

In the year ahead, we’re excited to continue to evolve our platform based on client feedback, adding features that will empower households to identify windows of opportunity, improve efficiency and make smarter decisions.

Who inspires you, either inside or outside your organization?

Our north star is the concept of arete, the idea of realizing one’s full potential. We are inspired by the principals we serve, and we believe that home plays a central role in their ability to achieve their maximum potential. We are inspired by the family office teams and private service professionals we work with every day – the “service hearts” – and we are driven to help them achieve their own maximum potential in their careers. Everyone in this ecosystem is striving for excellence, and we feel fortunate to support them along the way.

Where do you see the wealth management industry and your part of it going in the next five years?

We believe in a holistic approach to wealth management. Increasingly, principals expect more from their advisors, and we believe that over the next five years, wealth managers will adopt a more integrated, cohesive strategy.

Wealth managers will expand beyond financial services and provide support for factors like health, well-being, personal values, and life aspirations. Rather than providing these services in-house, financial advisors will likely partner with trusted experts who can help them serve clients holistically. Home is an essential element in a family’s holistic success, and estate management support presents an exciting opportunity to reduce a family’s everyday stress and frustration and empower them to focus on what’s most important to them.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 27

Newcomer/Start-Up (US)

•

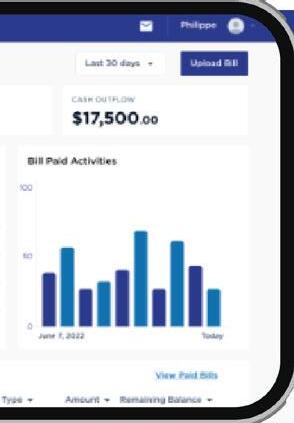

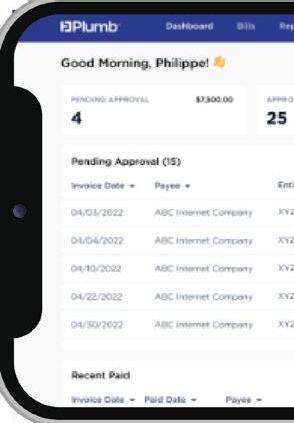

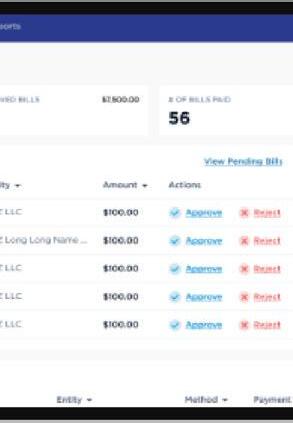

Service First At Plumb Bill Pay

We are thrilled to be recognized as the Winner in the 'Payment Reconciliation' and 'Client Accounting' category. At Plumb, our focus has always been - and will continue to be - “Service First”.

Serve our clients.

Serve our referral partners.

Do a great job and do that by embracing our role in the UHNWI industry.

Technology is critically important, and we will continue to invest in and grow our software platform while continuing to provide the highest level of service, evolve based on customers’ needs, and stay on the pulse of changes to stay ahead of the curve.

We do this by creating our own proprietary Bill Pay Workflow Application tailored specifically to the High-Net-Worth and single and multifamily offices.

We understand the accounting necessary to support complex estate planning and consolidated reporting, and The Plumb Bill Pay app integrates with QuickBooks Online and SAGE Intacct to ensure ease-of-use and clear financial reporting.

Anneke Stender

Executive Vice President

Plumb Bill Pay

Winner

• Client Accounting (US)

• Payment Reconciliation Services (US)

We offer Family Office Accounting Services, including Investment Accounting Reconciliation, Private Equity Tracking, Consolidated Financial Reporting, Entity Bookkeeping, Cash Flow Management, Financial Reporting & Analysis, Budgeting and Cash Flow Projections, Foundation Accounting, Trust Accounting, Insurance Coordination & Oversight, and an Annual Tax Organizer.

The innovation behind our technology is powered by our ever-growing team of trusted professionals. Our team’s high level of knowledge and service in the UHNWI space is the foundation of our technology, as well as what fuels the ongoing innovation of our product.

High touch technology fused with top level service is what truly sets us apart. With that being said, once our clients’ need us to dig deeper, they come to understand and value the depth and breadth our team brings.

While we continue to invest in and improve our proprietary bill pay technology, it’s our smart and caring people that routinely make the difference. Our team serves our clients and partners with the utmost care. Exceptional service will always be relevant. Plumb Bill Pay was developed by financial experts and accounting professionals with a deep understanding of the unique challenges of high-net-worth individuals and the needs of Family Offices, and we are grateful to be recognized for our dedication and expertise.

We would like to thank our clients, our partners, and our super-star employees, because without them, there would be nothing to recognize today. We would also like to thank the Family Wealth Report WealthTech Americas Awards for giving us this award. It is both humbling and inspiring.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 29

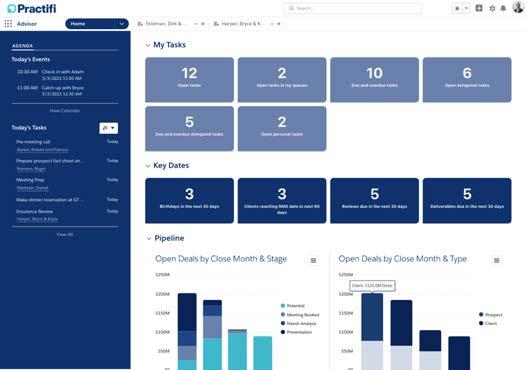

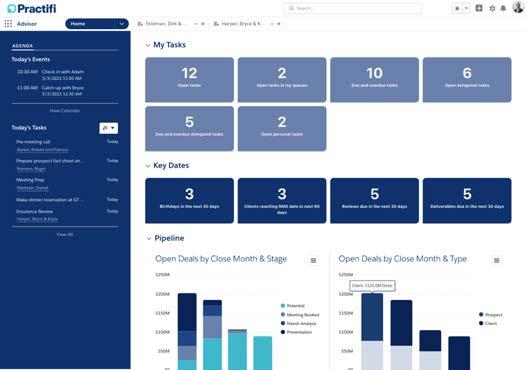

Powerful CRM built for RIAs

Practifi is designed around a deep understanding of who you are, what you do and the capabilities your firm needs to succeed. Partner with us and you’ll never grow out of another CRM again.

Learn more at

Powering The Future Of Wealth Management CRM

Adrian Johnstone CEO Practifi

• CRM Provider (US) Winner

Adrian Johnstone CEO Practifi

• CRM Provider (US) Winner

Please describe how your colleagues made a difference?

My colleagues have played an instrumental role in the success we've achieved. Their impact goes beyond conventional team dynamics. We've collectively recognized the profound importance of understanding client relationships at a deep level. Through our collaborative efforts, we've not only segmented and serviced clients at a highly personalized level but also identified and nurtured key connections and relationships. I firmly believe that our most effective sales team is our existing clients. Their insights and feedback have been invaluable, shaping our strategies and contributing significantly to our overall success.

What are you going to do to remain competitive and stay ahead?

It’s no secret that the CRM category is a crowded space, and remaining competitive and staying ahead in the dynamic wealth management landscape is a multifaceted commitment. Beyond efficiently capturing client relationship information through our CRM, we view CRM technology as a transformative tool to elevate the client experience. Our strategy involves staying ahead of industry trends, making strategic investments in technology, and continually refining our processes.

Innovation is at the core of our approach, leading the industry and providing our clients with a cutting-edge and enduring solution. This commitment to innovation is not isolated; it's reinforced by our active engagement with Product Advisory Councils. These collaborative sessions with various subsections of RIAs allow us to directly gather feedback, deepen our industry knowledge, and collaboratively shape our future innovations to meet evolving client needs.

What sort of challenge did you surmount to reach this level and how have you been able to succeed in such fast-moving circumstances?

Navigating the challenges inherent in the wealth management industry demands

adaptability and strategic foresight. A significant challenge we faced was the fast-paced nature of the industry characterized by dynamic shifts in regulatory landscapes, concerns about data security, and the added volatility introduced by political events. To overcome these multifaceted challenges, we strategically defined our niche, fostering a deep understanding of client relationships.

Proactively embracing technology was not merely a reaction to change but a deliberate and strategic move to position ourselves ahead of the curve. Through a continuous process of learning and meticulous strategic planning, we not only successfully overcame obstacles but thrived in the face of fast-moving circumstances.

Where do you see the wealth management industry and your part of it going in the next five years?

We anticipate that the wealth management industry will face challenges in the form of international conflicts, market volatility, and political events in the next five years. Amidst these challenges, our vision for success centers on understanding client relationships better than anyone else. We foresee a transformative shift towards a more personalized client experience, and in navigating this evolution, we believe that our commitment to serving clients goes beyond providing a service — it's about fostering an ongoing, successful partnership.

Leveraging technology strategically will be crucial, not just for efficiency but to profoundly enhance the overall effectiveness of wealth management firms.

Our strategic goal aligns with running our firm much like a high-net-worth RIA would operate theirs. We view our clients as integral to our growth, enlisting them as partners and ensuring they derive maximum value from our technology. As we look ahead, our focus in the coming years will be on adapting to these industry changes and persistently providing a tailored platform for our clients.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 31

© 2024 PwC. All rights reserved. PwC refers to the US member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Wealth Compass is your family office accounting outsourcing provider. It brings the best of experience and tech together to make your life easier and your portfolio work harder. See how better visibility and better insights can help protect and build your wealth over time. It’s all part of The New Equation. Learn more at: www.pwc.com/us/wealthcompass Human-led, tech-powered, real-world change.

Always Looking To The Future

Paul Freeland

Private, Family Enterprises, Partner

PwC US

What was the winning formula of your firm/you that explains why you won?

Our human-led, tech-powered solutions have driven PwC to an award-winning level. Our deep bench of talented professionals across tax, accounting and consulting specialties combines the right technology with industry leading practices to help families manage the whole family enterprise. PwC’s multidisciplinary team and tailored service models allow us to understand the complex and varied needs of family offices and deliver real results; in some cases, serving as an outsourced family office for clients.

One example of this is Wealth Compass, a managed service we developed to address a specific need for high net worth individuals and family offices. We combined our experience as trusted advisors with leading technology to simplify the complexity of diverse portfolios, providing individuals and family offices with a reconciled view of their assets, independent from asset and investment managers. With greater control and visibility, family offices and high net worth individuals are empowered to manage their personal wealth more effectively. We have no conflict of interest when it comes to managing investment data or recommending technology solutions.

There is no other managed service like it on the market today, and we’re proud to offer this as just one of the many ways we can help family offices and high net worth individuals.

Please describe how your colleagues made a difference?

At PwC, our people are the heartbeat of our firm. We are a community of solvers that come together to build trust in society and solve important problems. When it comes to serving the needs of high net worth individuals and family offices, we have the experience and diverse perspective it takes to deliver sustained outcomes that are both true to our clients’ needs and look ahead to where they want to go.

Winner

• Outsourcing and Business Process Management (US)

Our ecosystem of solutions can help address almost any issue high net worth individuals and family offices face. In addition to being super users of various technology platforms, we apply our automation tools and build customized solutions, so we can help families get the most out of their investments and realize value faster.

What are you going to do to remain competitive and stay ahead?

Our purpose – to build trust in society and solve important problems – is at the core of everything we do, and across our global network of nearly 328,000 professionals in 152 countries, we are committed to advancing quality in everything we do.

PwC recently announced a plan to invest $1B over the next three years to expand our artificial intelligence offerings as part of our commitment to continually invest in upskilling our people and technology. We pair the right tech with the right solutions to help you gain a competitive edge.

How do you hope your firm will benefit from getting this award?

We hope this award will bring awareness to the ecosystem of solutions we offer family offices and high-net-worth individuals.

PwC is known for the accounting, tax and consulting work we do with public and private companies, but we also serve the needs of high-net-worth individuals and families.

Whether you’re a private company owner, public company executive, entrepreneur, private equity partner, venture capitalist or you have inherited your wealth, our passionate community of solvers can address your wealth needs.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 33

Collaborating To Deliver Action-Oriented, People-Centric Learning Opportunities

What was the winning formula of your firm/you that explains why you won?

We believe it is our sincere and dedicated focus on our clients. We treat every client as if we are employed by their firm, not just a vendor but an actual extension of their staff. Every learning opportunity we provide is focused exclusively on what the client needs and will benefit from learning about. We have client team members go through our learning experiences and tell us it is the singular best experience they have ever had in training, and we firmly believe it is about caring what they care about and serving them as their partner.

Please describe how your colleagues made a difference?

First: Our team members are super responsive. We often have clients compliment us on fast we respond. We believe our clients matter and responding to them in a timely and efficient manner is paramount. Second: Our team members sincerely care. We all have a deep level of empathy for what our clients are facing. This is not about delivering training; it is about delivering an experience that will stay with the client long after we leave. Third: We know the business. Our clients don’t have to explain their goals, needs, obstacles and objectives to us in much detail.

What are you going to do to remain competitive and stay ahead?

We are already doing it! This year we have partnered with a very progressive firm called The Rebellion to create a unique learning experience whereby small groups are able to benefit from our proven material in an outdoor setting. In addition, we are taking

Samantha Reynolds, Catherine Manning and Beverly Flaxington The Collaborative

• Training Solution (US) Winner

all of our proven core content and offering it more widely to large RIAs and platform providers. We already have custodial and asset management relationships where our learning programs are being used across advisor platforms, but we hope to help other large firms implement in their customized environments.

What sort of challenges did you surmount to reach this level and how have you been able to succeed in such fast-moving circumstances?

Our clients are busy and working alongside them to ensure we are respectful of all they are trying to accomplish with their teams, combined with implementing forward-thinking and marketingleading programs is an ongoing challenge. One of our large clients, an international investment banking and wealth management firm, rolled out a world-wide proprietary program to accelerate their sales. They are also undergoing cultural change, have new leadership and we worked with their internal L & D to respect all of the changes but also create a customized program their team members would benefit from and that was action-oriented. In partnership with them we rolled this out across the globe to great results and accolades from those who attended. These programs challenge us to do our best work while keeping up with our clients and their ever-changing environments.

Where do you see the wealth management industry and your part of it going in the next five years?

Consolidation, competition, and change. The big three C’s! Firms are going to have to stay ahead in technology while partnering this with the human touch investors are desperately seeking. Knowing when to merge and/or sell and acquire will continue to be important however even with this understanding the human element will be key.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 35

PERSONALIZED INVESTING AT SCALE ®

An

enhanced suite of personalization capabilities

and services that can be deployed in a flexible way to fit your business.

Learn more about how Vestmark VAST can help you provide personalized investing and tax management at scale. Contact Us: Email: vast@vestmark.com

www.VestmarkVAST.com

Vestmark Advisory Solutions, Inc. (“VAS”), a wholly-owned subsidiary of Vestmark, Inc., is an investment advisor registered with the U.S. Securities and Exchange Commission (“SEC”). VAS acts as a paid sub-advisor and/or overlay portfolio manager offering VAST and tax optimization services. Registration does not imply a certain level of skill or training. VAS has its principal place of business in Wakefield, MA. Investing involves risk. The value of an investment will fluctuate over time, and an investor may gain or lose money. Past performance is no guarantee of future returns and individual investor results will vary. Please consult our full disclosure document for a discussion of risks related to the services provided by VAS, at www.vestmark.com/vast-disclosure.

©2024 Vestmark, Inc. All Rights Reserved. Reproduction in whole or in part in any form or medium without express written permission is prohibited. Vestmark, VAST, and the Vestmark icon are registered trademarks. Other trademarks contained herein are the property of their respective owners. Vestmark believes that the information in this publication is accurate as of its publication date; such information is subject to change without notice.

Personalized Investing At Scale

Robert Battista, CFA Head of Advisory Solutions Vestmark

• Innovative Solution (US) Winner

How has Vestmark achieved excellence and recognition in its industry?

Since its inception in 2001, Vestmark has gained recognition by pioneering innovative portfolio management and trading solutions for financial institutions and their advisors. Supporting over $1.5 trillion in assets and 5.5 million accounts, Vestmark is a partner to some of the largest and most respected wealth management firms.

The company's flagship technology platform, VestmarkONE®, empowers firms and advisors to efficiently manage and trade customized client portfolios at scale. By leveraging automated workflows and time-saving features, Vestmark enables advisors to focus on building truly individualized relationships with each client.

Vestmark's commitment to innovation is evident in the introduction of VAST, an outsourced portfolio management solution that delivers personalized investing at scale. Vestmark VAST® empowers advisors to create highly customized portfolios aligned with each client's unique investment preferences and tax situations. By offering active tax overlay across entire portfolios and combining multiple asset classes, VAST aims to simplify the advisor-client interaction and save time for both parties.

How will your leading solutions, such as the award-winning VAST, adapt to evolving market conditions?

In 2024, VAST is poised to sustain its competitive edge and adapt to evolving market conditions through its innovative approach to portfolio management and tax optimization. With VAST, advisors can enhance the level of personalization they offer to clients while also cutting down time spent on manual, time-consuming activities. Our intuitive user interface is designed to simplify the process for advisors, allowing them to deliver federally and state tax-informed capital gains budget data tailored to each client's needs.

Furthermore, Vestmark's comprehensive technology and services enable seamless transitions of assets, whether moving between firms, advisors, or from legacy offerings to tax-managed ones.

What is the advantage of independent tech providers in the wealth management space, and how does technology enable customization and innovation for investors?

Independent tech providers like Vestmark are not constrained by legacy systems or proprietary platforms, allowing them to offer more flexible and customizable solutions. We can adapt our technology to meet the specific needs of advisors and investors, incorporating personalized features and functionalities that align with their preferences and goals.

Firms like Vestmark also have the freedom to innovate and develop cutting-edge solutions without being tied to the limitations of larger institutions. We can leverage the latest technologies and industry best practices to create innovative products that address the evolving needs of the market and solve the issue of scale for advisors and firms, whether they have hundreds of accounts or hundreds of thousands.

Looking ahead, what is your focus, and how do you envision the future?

One notable development planned for 2024 is optimizing tax benefits at the household level, moving beyond the account level to reflect the industry trend of viewing the entire household for personalized portfolio management. We remain committed to continuous innovation, client collaboration, and staying at the forefront of advancements.

Investment Services offered by Vestmark Advisory Solutions, Inc. an investment advisor registered with the U.S. Securities and Exchange Commission (“SEC”). Investment strategies that seek to enhance after-tax performance may be unable to fully realize strategic gains or harvest losses.

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 37

Turn compliance into a strategic advantage.

Today’s market volatility and regulatory headwinds re-enforce the importance of compliance as a core pillar for growth.

InvestorCOM.com

The Third Annual WealthBriefing

ACCLAIM | WEALTHBRIEFING RECOGNISES LEADERS ACROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY 39

Artificial Intelligence (AI) Application Bill Pay WINNER Client Accounting Client Communication Solution or Tool WINNER Client/Consolidated Reporting WINNER Client Marketing and Prospecting WINNER Cyber and Network Security WINNER WINNER WINNER US - GENERAL WEALTHTECH CRM Provider WINNER Data Management and Analysis WINNER Data Aggregation Family Office Solution WINNER WINNER Data, Information or Business Intelligence Provider WINNER

WealthTech Americas Awards Winners 2024

AWARDS NEWS EVENTS

RESEARCH

WEALTHBRIEFING - ALWAYS AT THE CENTRE OF YOUR 360° VIEW ON THE WEALTH MANAGEMENT LANDSCAPE

With 60,000 global subscribers, WealthBriefing is the world’s largest subscription news and thought-leadership network for the wealth management sector

Register for a free trial www.wealthbriefing.com

WINNER

WINNER