2 minute read

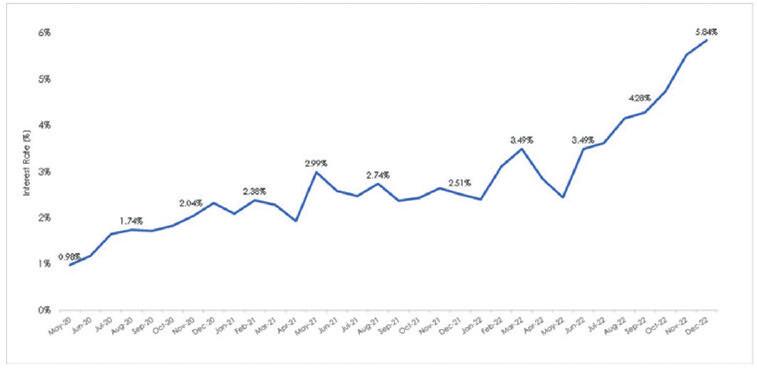

Interest Rates for SME Lending Have Now Increased Almost Sixfold from Pandemic Low

Small businesses face surging interest rates on lending, with the average rate on new bank loans written increasing fivefold from just 0 98% in May 2020 to 5 84%* in December 2022, says UHY Hacker Young, the national accountancy group

Many SMEs, due to the lack of collateral, will be unable to borrow from banks and will have to pay even higher interest rates from other non-bank funders

These rates are expected to continue to rise if the Bank of England increases its base rate again The central bank has pushed up its base rate nine consecutive times in the past year in a bid to control spiralling inflation

The higher cost of ser vicing debt means that SMEs will face fur ther financial stress with many already struggling to cope with rising inflation labour shor tages and surging costs

Alison Price Par tner at UHY Hacker Young says: “Rising rates on borrowing can have a major impact on small businesses Many small businesses are operating on tight margins so even a slight increase in borrowing costs can have a significant impact ”

These interest rates on bank lending are about the cheapest borrowing that SMEs can get The interest rates on non-bank lending for SMEs will be far higher ”

Says Alison Price: “For those SMEs who are already struggling with the cost-of-living increases, higher interest rates could mean serious financial trouble

The situation is unlikely to change for SMEs in the near future , with the Bank of England unlikely to bring rates down until its sees inflation fall substantially

Future lending to SMEs will also be harder to secure , with the Prudential Regulator y Authority (PRA) warning lenders to scrutinise applicants more thoroughly

Finalists Named in Pubaid Community Pub Hero Awards Pubs Recognised for Community and Charity Support in Competition Sponsored by Matthew Clark

Fifteen pubs have been named as finalists in the Community Pub Hero Awards, organised by PubAid and the All-Par ty Parliamentar y Beer Group (APPBG) and sponsored by Matthew Clark

The finalists all impressed the judges with their outstanding suppor t for their local communities or charities The competition, now in its four th year, has been expanded to offer two categories for pubs – Community Suppor t Hero or Charity Fundraising Hero and a new Community Regular Hero where pubs nominated a suppor tive customer The awards attracted a total of 200 entries, including 70 from MPs who nominated pubs in their constituencies

The finalists will now be judged and the overall winners announced in March at an event in London attended by shor tlisted licensees and their MPs PubAid co-founder Des O Flanagan said: Our hear tfelt congratulations go to our finalists, who have earned their place by going the extra mile and demonstrating, once again, that pubs are a force for good in their communities

“I was impressed by the stories from so many pubs, who have raised astonishing sums for charities, or provided incredible suppor t for local people , despite frequently facing uncer tainty themselves Choosing the 15 finalists was a real challenge and those who have reached the shor tlist should be ver y proud of their achievement ”

John Steele Trade Marketing Director Matthew Clark added: “We were delighted to suppor t this competition again and pleased to see an increase in the number of entries over last year It is wonderful to hear about the great work done by licensees and their teams and we re happy to be giving them well-deser ved recognition ”

The Rt Hon Alun Cairns MP, Chairman of the APPBG, said: To receive 70 nominations from MPs is an excellent result and shows how pubs are valued as hubs of charity and community suppor t in constituencies across the countr y All MPs with shor tlisted pubs in their constituency will join me in congratulating them on reaching the finals in a ver y tough competition ”