TAITTINGER, COMTES DE CHAMPAGNE 2013

‘STRONG BUY’ INVESTMENT GOLD DUST

98 points 30%

I am delighted to offer the latest vintage of Taittinger’s Comtes de Champagne, a true investment gem and with today’s pricing in mind a firm STRONG BUY recommendation given is very high score.

The 2013 vintage of Taittinger’s Comtes de Champagne is a total knock out, coming from the middle of a triptych of stellar vintages, with 2013 widely regarded as perhaps the finest ever for Chardonnay in the Côte de Blancs.

So remarkable was the vintage that the grapes were harvested in the early days of October, something not seen for two decades.

The result is a wine which has been heralded by leading critics as the joint best Comtes de Champagne of all time, hitting a huge 98 point score with Antonio Galloni who wrote:

“The 2013 Comtes de Champagne captures all the pedigree of this great vintage in its energy, depth and vibrancy. Lemon confit, dried flowers, chamomile, spice and crushed rocks all race across the palate. Passionfruit, ginger, marzipan and mint appear later, filling out the layers beautifully. Harvest took place in October in what has become the exception rather than the norm in Champagne”.

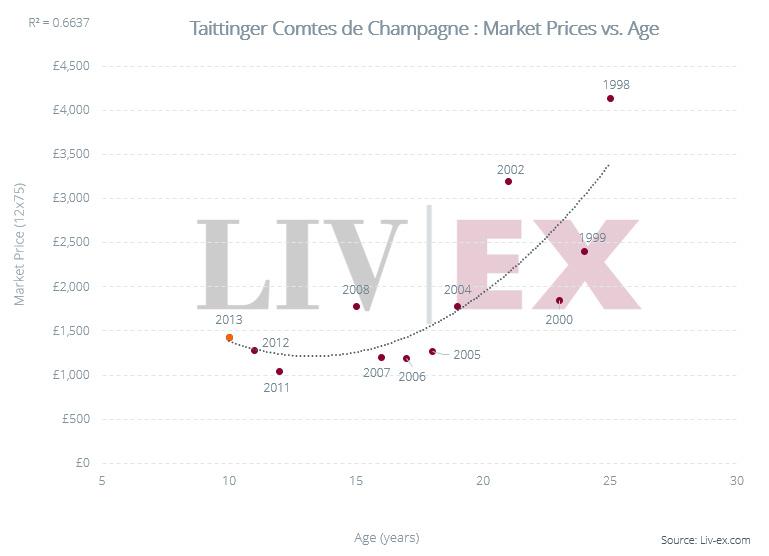

Comtes has been a wine which has delivered in the best vintages for Clos clients, with the 2008 vintage, also rated 98 Galloni points, appreciating at its peak to well over 70% in its three years since release. Even as the Champagne market was hit at the end of 2022 and dropped in value, the 2008 is still delivering 30% returns, or 10% per annum, and I have no doubt it will appreciate further in the coming two years.