26 minute read

Editorial summary: The real stress test

only 15 per cent of the building’s value. The condo corporation was unable to obtain any additional coverage due to its exposure to fires in the area and past claims. The owner paid $350,000 for the home several years ago but believed it was worth less than $200,000 in 2019 due to its insurability challenges. Typically, insurance companies will spread their risk by only insuring a portion of a building, with a policy being underwritten by as many as a dozen different insurance companies. With the number of insurance companies willing to insure condo buildings dwindling, this means that second quotes are near impossible to obtain.

In cases where strata owners are responsible for the building damage, deductible costs can be assessed directly against the owner. Deductibles have now increased from typically about $10,000 to as much as $100,000, with some even hitting the $250,000 mark. This means many insurance claims will not be pursued by the strata/condo corporation as repair costs may fall below the deductible payment. For instance, a leaking toilet or a triggered fire sprinkler causing water damage to multiple units below might easily result in repair costs of $80,000. However, if the building’s insurance deductible is $100,000, the strata/condo corporation could elect not to make an insurance claim and might instead seek compensation from the responsible owner. If the cost of repair was $120,000, the strata/ condo corporation might opt to utilize the building’s insurance coverage and then assess the $100,000 deductible cost against the responsible condo unit.

Condo owners are therefore being urged to ensure that they have their own insurance policy to cover either the cost of repairs incurred by their condo corporations or the insurance deductibles for instances where they may be found responsible. At this juncture though, it is not entirely clear whether owners are currently able to obtain such insurance coverage at an affordable cost. The same challenges in obtaining insurance coverage that condo buildings experience also apply to individuals. Without insurance coverage, being hit with a sizable insurance deductible or repair bill can readily zap an owner’s equity and undermine a lender’s security in its mortgage loan.

Problems faced by condo corporations in obtaining building coverage challenge our current concepts of insurance. Insurance is intended to be a means of hedging against contingent, uncertain financial losses, while an insurance deductible generally has two purposes.

One is to reduce the number of smaller claims, which keeps premiums affordable. A second purpose is to reduce instances of fraud or ‘moral hazard,’ which is where insureds fail to mitigate risks with the expectation of an easy insurance payout. However, when the insurance policy loads the risk of financial loss onto individual owners through exorbitant deductibles, these rationales no longer make sense.

Unaffordable deductibles may weed out most claims, and not just those of a nuisance or fraudulent nature. Insurance policies might seldom be triggered and reserved for only the most catastrophic events, while the financial risk of lesser events is borne by the individual owner or owners – surely this is not a scenario intended by the authors of the various provincial condominium statutes that mandate insurance coverage for the full replacement value of buildings. What is the real purpose of statutory mandatory insurance requirements

DIMITRI KOSTUROS Chief Operating O cer dimitri@vwrcapital.com

PAULA HUTTON BDM - Prairies paula@vwrcapital.com Email lender notes, application, and credit bureaus to: deals@vwrcapital.com

NOW YOU’RE IN THE DRIVER’S SEAT.

With uDrive, you’re in control. As an alternative MIC mortgage lender, we focus on being a good business partner to our mortgage broker community. We work diligently to find creative solutions for your clients who don’t qualify for traditional financing.

• uDrive: No Fee or Lower Rate

• Residential 1 st and 2 nd mortgages

• Fully open options available • Lending in BC, AB, MB and ON • One or two year terms available • Maximum LTV of 75%

INVEST. LEND. GROW.

threepointcapital.ca uDrive@threepointcapital.ca | 1.800.979.2911

when the insurance is too expensive to be useful or is simply unattainable, as in the case of the Fort McMurray building?

We are advised by most insurance experts that insurance costs are determined in part by catastrophic, worldwide events, which are increasing in frequency. A solution to the insurance affordability problem, therefore, does not seem evident. In Ontario and British Columbia, recommendations for legislative reform focus on making rules around the assessment of deductible costs against individual owners less muddy.

In B.C., strata corporation insurance deductibles are common expenses, which are ultimately paid for by all owners, but an owner who is responsible for damage can be sued by the strata corporation to recover the deductible expense. The challenge for the strata corporation is that lawsuits require considerable litigation funds with no guarantee of success in an unpredictable court process, which requires proving that the owner was ‘negligent.’ Some strata corporations have sought to work around this challenge

with indemnity bylaws that assign liability to responsible owners and use a different standard of liability than that ascribed by the common law of negligence. These bylaws have created further uncertainty.

Provinces such as Ontario have adopted proposals to amend relevant legislation by expressly providing that owners are responsible for repair costs or the insurance deductible, whichever is lower, as a result of damage to other units or common property caused by the unit owner’s acts or omissions. The goal here is to create greater certainty and consistency by eliminating the obligation on a strata corporation to sue an owner to recover the deductible expense. The BC Law Institute has recommended that B.C. adopt this course.

Clearly these reforms do nothing to solve the insurance affordability problem, which requires a more in-depth review. In the interim, condo owners and their mortgage lenders should continue to ensure that owners have sufficient deductible insurance to cover all potential claims.

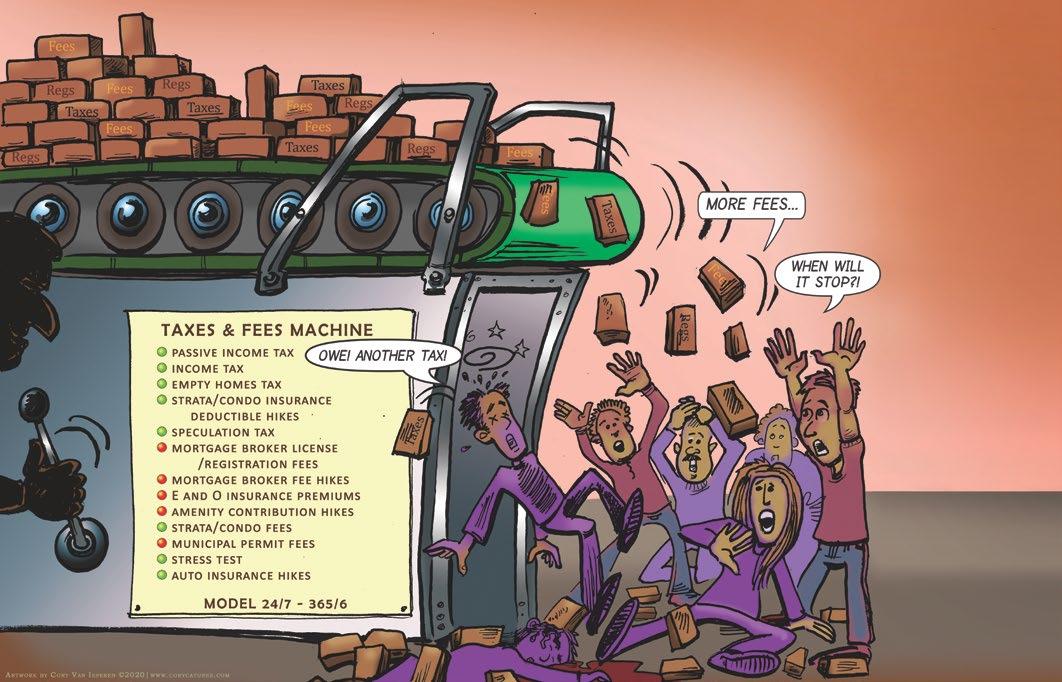

After years of the federal government tinkering with housing demand (the mortgage stress-test, the First-Time Home Buyer Incentive and other stick-andcarrot approaches to how people can purchase homes), it’s clear that housing affordability remains a top issue in many Canadian cities from Victoria to Charlottetown.

Of course, this is because housing demand is only half the equation. To really get at the root of this issue, it’s painfully clear we must also talk about supply.

The thing is, the most important policy levers influencing the supply of housing are local and provincial – not federal. So what, if anything, can Canada’s next federal government do to help tackle housing shortage by boosting supply? Again, the feds may not control the thicket of local land-use regulations that hamstring homebuilding, but they do control billions of dollars transferred every year to municipalities all across Canada, aimed either at everyday operating costs or infrastructure projects.

For example, the federal government recently committed $1.37 billion to two major rapid transit projects in Metro Vancouver, and another $1.3 billion to extend Montreal’s metro system. In fact, more than two-thirds of direct federal-municipal grants relate to infrastructure, representing hundreds of millions of dollars every year, and this doesn’t include the billions transferred annually from the federal gas tax or federal funding funnelled through provinces and advocacy groups such as the Federation of Canadian Municipalities.

In short, the feds don’t control how long or complicated it may be for homebuilders to obtain a building permit, but they hold the purse strings for billions in transfer funding. By attaching expedited homebuilding as a condition for funds, Ottawa can encourage a growing housing supply. Conditionality for federal funding is nothing new, and after all, if Ottawa is going to disburse billions of tax dollars to fund major transit or roadway projects, it only makes sense that those projects benefit the greatest number of Canadians possible. There’s no point extending a subway line to serve a low-density neighbourhood, only for that neighbourhood to remain low-density and the new line under-utilized. Otherwise why undertake the project in the first place?

Ultimately, restoring broad affordability to Canada’s most expensive cities and towns requires addressing both sides of the homeprice equation – demand and supply. So far, most governments in Canada have either ignored the supply side or only started to consider it after years of lacklustre results following demand-side interventions.

If the next federal government is serious about tackling the chronic shortage of homes in the country’s least-affordable regions (Toronto, Vancouver, etc.), it should attach supply-friendly conditions to the billions it sends to junior levels of government every year. How Ottawa can tackle the housing shortage Restoring broad affordability to Canada’s most expensive cities and towns requires addressing both sides of the home-price equation – demand and supply BY JOSEF FILIPOWICZ

Josef Filipowicz is a senior policy analyst in the Centre for Municipal Studies at the Fraser Institute. This article originally appeared in Fraser Forum, the Fraser Institute blog. More at fraserinstitute.org

Mortgage lending with rates your borrower will say YES to!

• Residential 1st and 2nd Mortgages • Lending in BC, ON, AB and MB • Loyal to our Brokers - you retain your client

BC: 604-467-6449 Toll Free: 1-888-467-6449 information & guidelines visit www.armadamortgage.com email: sales@armadamortgage.com

BRIDGING THE GAP

RESIDENTIAL MORTGAGE LENDING CRITERIA

Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rates Starting at

Single Family + Condo 65% $500K - $5 M 6.50%

Luxury Condos 60% $500K - $5 M

Rentals/Vacation 60% $500K - $5 M 6.50%

6.50%

Sam Fogell - Commercial sfogell@lanyardgroup.com Christine Perkins - Residential cperkins@lanyardgroup.com COMMERCIAL MORTGAGE LENDING CRITERIA

Mortgage Type Loan to Value (up to) Loan Amount Range Interest Rates Starting at

Retail/Office/Industrial 75% $1 M - $20 M 7.25% Land (urban infill) 65% $1 M - $20 M 7.75%

Apartments 75% $1 M - $20 M 6.50%

Res. Condo Inventory 65% $1 M - $20 M 7.25%

Phone 604.688.5388 www.lanyardgroup.com

TIME FOR NEW RULES ONTARIO PROPOSES CHANGES TO MODERNIZE REGULATION OF PROVINCIAL MORTGAGE BUSINESSES

If adopted, the seven key recommendations to increase accessibility to the mortgage market will usher in significant changes BY MENA BELLOFIORE, DAWN JETTEN AND KATIE PATTERSON

The Ministry of Finance recently released Protecting and Modernizing Ontario’s Mortgage Broker Industry, a report on the legislated five-year review of the Mortgage Brokerages, Lenders and Administrators Act, 2006 (MBLAA) led by Attorney General of Ontario Doug Downey and Parliamentary Assistant to the Minister of Finance Stan Cho. The review first launched in November 2018 with a view to improve efficiencies and reduce regulatory burden, objectives that are closely aligned with the Ontario government’s commitment to reducing regulatory requirements by 25 per cent by 2020.*

The report, which follows an extensive open consultation process, provides an overview of the issues raised and input received from 35 different stakeholders representing a variety of financial services sectors, including feedback received from these industry participants through detailed written submissions, roundtable discussions as well as many one-on-one meetings.

According to the report, the seven key recommendations are “aimed at modernizing and streamlining the MBLAA to increase accessibility to the mortgage market, reduce regulatory burden, and improve consumer and investor protection.” Interestingly, the report comes shortly after the establishment of the Financial Services Regulatory Authority of Ontario (FSRA). On June 8, 2019, FSRA replaced the Financial Services Commission of Ontario as the regulator for mortgage brokers, insurance, credit unions, loan and trust companies and pensions. If adopted, the recommendations will usher in significant changes to the MBLAA.

RECOMMENDATIONS Of the seven key recommendations, the first four recommendations (Recommendations 1, 2, 3 and 4) are aimed at reducing regu

latory burden for lenders and brokers and increasing access to the housing market for homeowners and investors and the last three recommendations (Recommendations, 5, 6 and 7) are intended to strengthen consumer protection and anti-money laundering oversight. 1 RECOMMENDATION Reducing red tape for commercial mortgage transactions The report recommends that the Ministry of Finance and FSRA work together to “reduce the regulatory burden on commercial mortgage transactions between sophisticated entities, such as large companies and financial institutions.” This recommendation flows from the fact that, currently, the MBLAA applies the same regulatory framework to both residential and commercial mortgages. The report recognizes that commercial mortgages are unnecessarily

subject to consumer and investor protection regulation and recommends removing the red tape by exempting sophisticated entities from these requirements when they are dealing in commercial transactions. 2 RECOMMENDATION Reducing regulatory burden by establishing new classes of licensing The report recommends that the Ministry of Finance work with FSRA and the industry to develop different licensing schemes to better reflect the specifics of different segments of the mortgage market. This recommendation stems from the understanding that various types of mortgages are accompanied by different sets of risks and the current “one size fits all” approach to licensing does not ensure that mortgage brokers and agents have the appropriate competencies and skills required to best serve their clients.

3RECOMMENDATION Reducing regulatory burden in guidance, bulletins and forms The report recommends that FSRA consult with industry participants in its efforts to simplify and streamline guidance, rules, bulletins as well as forms and accompanying disclosures provided to consumers. This recommendation emphasizes the need for these documents to be written in plain language in order to enhance industry and consumer readability and understanding while simultaneously striving to reduce regulatory burden and duplication. 4 RECOMMENDATION Maintaining current licensing exemptions The report acknowledges the importance of maintaining the current licensing exemptions for simple referrals, lawyers and employees of financial institutions but

recommends that FSRA and the Law Society of Ontario cooperate to ensure protocols are put in place to allow for the timely sharing of information in circumstances where either regulator takes enforcement action involving a licensee that is subject to regulation by the other. The report also recommends that the Ministry of Finance work with the Financial Consumer Agency of Canada to ensure consumers are treated consistently regardless of “whether they receive their mortgage from a provinciallyregulated mortgage broker/agent or from a federally-regulated bank employee.” 5 RECOMMENDATION Raising and streamlining educational and professional standards for agents and brokers The report recommends that FSRA work with industry and mortgage licensing education providers to improve the mandatory education requirements, including licensing Canada’s housing market (including, rising housing prices, stricter underwriting rules and federally mandated stress tests for uninsured loans) have contributed to an increase in the use of private lenders in recent years.

According to the report, “although private lenders represent a relatively small portion of mortgages currently outstanding in the overall $132 billion mortgage brokerage market in Ontario, the market share of this segment has grown in recent years.” Nonetheless, despite this growth, because private lenders who work through a licensed mortgage brokerage qualify for an exemption from the licensing requirement under the MBLAA, the report highlights the difficultly in determining the extent of their market participation under the existing mortgage broker regime. It also notes the recent reports in British Columbia that have identified private lending in Canada’s real estate market as being “particularly vulnerable to the risk of money laundering.”

education courses by, among other things, expanding both the content of such courses and the types of courses offered in coordination with the new licensing regime described in Recommendation 2. This recommendation recognizes that “right-sized” education for mortgage brokers and agents should be focused on teaching the skills necessary to properly prepare agents and brokers for their careers in the mortgage industry. 6 RECOMMENDATION Incentivising registration for private lenders The report makes several important observations as it relates to private lending in Canada’s real estate market. It notes that significant changes in

In an effort to better understand and quantify the continued growth of the private mortgage lending sector and to combat fraud, the report recommends that the Ministry of Finance and FSRA create “a registration regime for private/unregulated lenders that meet certain monetary or activity thresholds” and which could also invite entities that do not meet the prescribed thresholds to voluntarily register. Under the proposed registration regime, registered private lenders that lend to sophisticated entities “would be able to carry out mortgage lending activities without the need for licensing under the MBLAA, and without the requirement to work through a licensed brokerage” which according to the report would operate to “significantly reduce regulatory burden” for private lenders. The report also recommends that registered private lenders “should be required to report periodically to FSRA on their lending activities”, thereby providing FSRA with valuable data to bridge the existing information gap related to private lender activities and market share in the Canadian real estate market. 7 RECOMMENDATION Strengthening the administrative monetary penalty framework The report recommends that the Ministry of Finance and FSRA review the administrative monetary penalty (AMP) maximums currently imposed under the MBLAA to ensure they appropriately deter non-compliance with the legislation. This recommendation is in response to stakeholder feedback indicating that current AMP levels are not high enough and often result in non-compliance with the MBLAA being a more cost-effective option than compliance.

NEXT STEPS With respect to the implementation of these recommendations, neither the report nor the Ministry of Finance announcement specify next steps. However, in light of the extensive public consultation process and industry participation, it is expected that the seven recommendations we discussed will likely be presented in the form of draft regulations, but nothing has been published at this point. Given the government’s self-stated goal of reducing the number of regulatory requirements affecting business by 25 per cent overall by 2020, and the fact that modernizing and streamlining the MBLAA in accordance with the recommendations in the report represent, in large part, changes proposed by industry participants that would be a welcome change, it’s possible that draft regulations could be released in short order.

This article was first published by Blake, Cassels & Graydon LLP (blakes.com). Blakes retains all rights to the article.

*For more information on the consultation, please see Blakes’ December 2018 Bulletin (blakesbusinessclass.com)

Spectrum-Canada offers institutional service to Private Lending! 3 Flexible open terms for your clients 3 Quick, easy, & professional service 3 1sts starting at 5.99% 3 2nds starting at 7.99% 3 Lend in BC, Ontario & Alberta

Call or email us today!

BC DEALS CONTACT: James Pell 1(877) 909-6263 James.Pell@spectrum-canada.com

ONTARIO & AB DEALS CONTACT: James Christopherson 1(877) 909-6266 Jamesc@spectrum-canada.com

A BEACON OF LIGHT FOR MORTGAGE BROKERS NAVIGATING THE CHALLENGING WATERS OFLENDING.

WE UNDERSTAND YOUR CHALLENGES.

SOMETIMES YOUR CLIENTS JUST DON’T FIT INTO THE TYPICAL MOLD. OUR EQUITY LENDERS SEE THE BIGGER PICTURE THROUGH EQUITY BASED SOLUTIONS.

IF THERE IS EQUITY IN A PROPERTY, CHANCES ARE WE CAN FIND A LENDER THAT WILL CONSIDER YOUR LOAN.

85% L O A N - T O - V A L U E WHY CHOOSE US?

T 1.888.554.9075 F 1.888.240.9087 awcapital.ca

MORTGAGE BROKERAGE LICENCE 12633 MORTGAGE ADMIN LICENCE 12634

We now have boots on the ground in:

VANCOUVER · VICTORIA · OKANAGAN PEACE REGION · CALGARY

Equitable Bank AWC CMBABCad_Jan2020.indd 1 2020-01-14 9:19 AM

Mortgage Solutions

Prime mortgage solutions

Our EQB Evolution Suite ® is designed to provide prime mortgage solutions that will appeal to borrowers who are salaried, salaried with commission, as well as selfemployed individuals looking to purchase a residential property.

CONTACT YOUR RBM TODAY

EQUITABLEBANK.CA

Alternative mortgage solutions

Equitable Bank’s alternative mortgage solutions can be customized to fit the circumstances of your clients. Whether your client is self-employed, a newcomer to Canada, currently rebuilding their credit, or an investor, we offer solutions to help them reach their homeownership goals.

Managing director of FBAA and IMBF chair Peter White (centre) with Brokers Ireland’s national president Duncan Duke and Rachel McGovern, director of financial services.

Call for mortgage broking industry to be innovative and better informed about global market practices BY SAMANTHA GALE

The Irish industry association Brokers Ireland has joined the International Mortgage Brokers Federation (IMBF) as the newly formed federation continues to expand into more nations. The Finance Brokers Association of Australia (FBAA) managing director Peter White, who was in Ireland recently, says Brokers Ireland understood the benefits of standing together and learning from one another in an increasingly globalized market.

“The recent banking royal commission (in Australia) highlighted just how governments and regulators are looking at overseas models for guidance on how to tackle [mortgage broker] issues, so we must be ahead of the curve, learning about other markets so we can understand what is working and what isn’t,” explains White, who currently serves as chair of the IMBF. The IMBF is an international organization for national mortgage broker and mortgage finance associations to share ideas, client referrals, market intelligence, trends, regulatory matters and best practices. It serves as the leading global forum for bringing the international mortgage brokering community and its suppliers together to collaborate on shaping market practices, while influencing regulation and legislation through global advocacy.

The federation was formed last year by associations from Canada (CMBA), U.S.A. (National Association of Mortgage Brokers), New Zealand, U.K. (Association of Mortgage

Intermediaries) and Australia (FBAA).

White also revealed that the Netherlands was a part of the IMBF as an associate, an important step given recent publicity around the ‘Netherlands model,’ a consumer-pays approach.

“During the coverage of the royal commission (in Australia), the Netherlands model was brought up in questions by the media, and some people in our industry had no idea what it was. This is unacceptable if we are to represent our industry to government.”

Changes and trends impacting the mortgage broker industry in one country can affect any number of other countries.

“Now more than ever before, it is vital for the industry to be innovative,” says White, adding “the IMBF works together and is reviewing best-practice procedures to bring a global focus to the benefits of mortgage and finance brokers across the globe.”

KEEPING PROSPERITY IN PERSPECTIVE

Defining the middle class is complicated, but indications are this demographic in Canada is doing better BY VINCENT GELOSO

After Prime Minister Justin Trudeau introduced the men and women who will serve in his new cabinet, much attention has been dedicated to Mona Fortier, the new ‘minister for middle-class prosperity.’

To name a minister in charge of the prosperity of the middle class suggests that the middle class has had a tough time recently. This is only the latest iteration of a recurrent myth in Canadian politics peddled by members of all parties – that the middle class is stagnating.

But is it really? The main problem here is ‘defining’ the middle is a complicated task. Fortier herself actually claimed to use a loose definition of the term. Some like to use the average income of the middle 20 per cent of the population (when ranked by income). Others use a certain absolute income threshold. However, the most often-used measure (even if there are debates over it) is the median income – the income of the person in the middle of the population that cuts the remaining population into two equal shares.

By that measure, there appears to be very small improvements since the mid1970s. However, this is misleading. Impressions of stagnation of the median are mathematical illusions caused by changing demographics, which create a situation where, when comparing different income statistics from year-to-year, you compare apples with oranges and then apples with bananas. These situations are known as ‘composition biases.’

Consider the following thought experiment. A group of 50 Canadians, all with incomes that go from $100 to $5,000, experience a 10 per cent increase in income. Accordingly, all statistics should go up 10 per cent – the median, the average income for the middle 20 per cent, the average for everyone. However,

0.25

0.2

0.15

0.5

0.05

0

Real median income (2002$) gains during each 5-year periods, 1982-2017

1982 to 1987 1983 to 1988 1984 to 1989 1985 to 1990 1986 to 1991 1987 to 1992 1988 to 1993 1989 to 1994 1990 to 1995 1991 to 1996 1992 to 1997 1993 to 1998 1994 to 1999 1995 to 2000 1996 to 2001 1997 to 2002 1998 to 2003 1999 to 2004 2000 to 2005 2001 to 2006 2002 to 2007 2003 to 2008 2004 to 2009 2005 to 2010 2006 to 2011 2007 to 2012 2008 to 2013 2009 to 2014 2010 to 2015 2011 to 2016 2012 to 2017

if an extra 10 people with incomes of $100 enter the group, then all of these statistics will fall, despite the fact that everyone else gained 10 per cent extra income. This is because a key factor is not held equal between the two points – the composition of the population.

Is there a similar process at play in Canada? Yes! Take the example of immigration. When immigrants enter a given country (while they often enjoy massive income gains relative to incomes in their countries of origin), their incomes tend to be inferior to the native population. The addition of immigrants is thus equivalent to the example above. But as long as the immigrant population remains steady, there’s no creeping composition bias. From the 1950s to the mid-1980s, the share of foreign-born Canadians remained steady at around 7 per cent. However, starting in the mid-1980s, the share began to increase and exceeded the 10 per cent mark. This means immigrants are dragging down the distribution. It does not mean that people were becoming poorer. The same applies to other demographic changes. For example, an aging population will cause the same effect. Older people tend to have lower earnings because they are consuming their savings. Because seniors are growing more numerous in Canada, the median income will be pushed down even

if no one experiences a decline in living standards.

Both examples illustrate the problem caused by changes in demographic composition, which may cause some people to make false judgments about the living standards of certain populations. The best way to see this is to track the same people over time. The type of data needed to provide this portrait is known as ‘longitudinal data.’ By tracking the same individuals over time, longitudinal data circumvent composition bias, where the apples of 1985 are compared with oranges from 2019. We simply evaluate how the apples of 1985 fare later on.

Statistics Canada has such data, which track individuals over five-year periods between 1982 and 2017. What happened to the median income for the same people over each five-year period? With the exception of 1988 to 1996, the real median market income of the same people tracked over each five-year period increased by around 15 per cent (see chart above).

If you track people over a longer period of time, the gains are even clearer. The main limitation with the Statistics Canada data mentioned above is that they’re subsequent sets of longitudinal groups over five years. This is a relatively short period of time, which could lead skeptics to shrug at the evidence above. However, the Fraser Institute produced a study that covered the years from 1993 and 2019. The 20 per cent of the population in the middle of the income distribution in 1993 had – by 2012 – enjoyed real income gains of 70 per cent (and this is a conservative estimate of the gains because only wages and salaries are included – adding other sources of income will only add to these gains). Moreover, that study also finds that the poorest 20 per cent of the population enjoyed income gains equal to 781 per cent. This means that many of the poorest of 1993 had propelled themselves into the middle class (and above) by 2012.

Do such gains indicate stagnation? Clearly not. Rather, everything indicates that the middle class in Canada is doing better. Could things have improved at a faster pace? Obviously. However, it’s better not to peddle inaccurate depictions of the situation when constructing public policy. Let’s hope our new federal minister for middle-class prosperity keeps this in mind.

Vincent Geloso, senior fellow of the Fraser Institute, is an assistant professor of economics at King’s University College, Western University Canada. This article originally appeared in Fraser Forum, the Fraser Institute blog. More at fraserinstitute.org

FROM FUNDING TO DISCHARGE SYNDi Mortgage Managerdoes itall.

Syndicated Mortgages

Investor Disclosure Statements Broker Commissions

Investor for new deals Fixed and Variable Rate Mortgages InterestDirect Deposits and Preauthorized Payments through EFT Borrower and Investor Statements Pop-up Reminders and e-mails Built-in Timeand Inquiries Ability to define unlimited number

Can be interfaced with Sage 300 ERP User Rights and Security Built-in Audit Trail: Who did what, when?

Are you running a MIC? Let us see if SYNDi Fund Manager can help You.

BALANCING ACT A case involving a vulnerable 89-year-old borrower illustrates the need for lenders to be reasonable THE