We are committed to fulfilling our clients’ real estate needs by utilizing our outstanding resources, specialized marketplace knowledge and analytical skills.

We pride ourselves in providing clients a seamless experience when navigating the real estate process, while exceeding their buying and selling expectations.

Our goal is to offer a personalized and professional approach with a commitment to our core values of exceptional service, unparalleled work ethic, reliability and integrity.

From the start, we go above and beyond to ensure our clients’ satisfaction.

Charles Fisher | RE/MAX Estate Properties Your Money Matters. Hire Experience You Can Trust.

With over 16 years of residential real estate expertise, Charles takes a highly dedicated approach to serving his clients throughout the Westside, Los Angeles and South Bay areas.

From starter condos to multi-unit investments, Charles provides creative and engineered solutions through each transaction. He epitomizes a relentless commitment to cultivating strong relationships with his clients and the real estate community. His extraordinary passion to connect clients with the right opportunities drive his daily desire to yield an outstanding level of client service.

RE/MAX Awards: Diamond, Platinum, Chairman & Title Club

RE/MAX Estate Properties is an independently owned and operated luxury real estate company spanning the coast of Southern California with 700+ exclusive agents.

Recently named one of LA County’s largest independently owned real estate brokerages

In annual sales volume with the most productive agents in the nation

Rated #1

In real estate sales volume in the South Bay every single year since 2010

Ranked in top 4

In sales volume for the Greater Los Angeles area year after year

Ranked #4

Largest RE/MAX brokerage nationwide

Ranked #5

Largest RE/MAX brokerage worldwide

Charles Fisher | RE/MAX Estate Properties

Our main competitive advantage is rooted in the following commitments to our family of clients:

A One-on-One Tailored Approach

Focused on protecting your interests and catering to your needs with a customized and careful approach to pricing, marketing and negotiation

A Transparent Methodology

Transparent communication with our clients about all details related to the transaction with their best interest in mind

Proactive Strategies

Anticipating shifts and proactively identifying potential issues while providing professional guidance throughout the process

A Commitment to Exceptional Quality

Committed to working within your goals while leveraging our top vendor relationships to ensure we showcase your property in the best light possible

Be Local, Think Global

Leveraging our local connections and the RE/MAX network with agents nationally and internationally

Charles Fisher | RE/MAX Estate PropertiesAssessing the value of your home is a vital part of the selling process which is dictated by current market value and influenced by several key factors:

• Supply and demand

• Economic conditions

• The selling and asking prices of comparable homes with similar criteria in your area

• Interior and exterior condition of the property

• Floor plan layout

• Buyer’s perception of your home

Our pricing approach considers each of the mentioned variables inclusive of our marketplace expertise and a goal to generate the highest level of engagement, interest and showings as soon as the property hits the market.

Those factors with minimal pricing influence to consider include the seller’s expected net proceeds, amount spent on improvements and the price the seller originally paid for the home.

Charles Fisher | RE/MAX Estate Properties“I found Charles’ real estate expertise to be top-notch. He’s been doing business and building connections for years. And he called on those connections to negotiate the best subcontractor prices and the highest quality work on my home.

I never expected this level of dedication from a selling agent. Charles could have backed off until the house was ready for sale. Instead, he became my advisor, my “project supervisor”. Charles helped me find subcontractors, worked with them and applied pressure when necessary to get things done in a timely manner. Charles brought in the roofers, landscapers and stagers and made everything come together for a beautiful presentation of a fabulously renovated product. Charles sold that house for a price that EVERYONE said couldn’t be achieved.”

-Sold a SFR

“If you are looking for a realtor, look no further! Charles makes magic happen! YOU WILL NOT FIND A BETTER REALTOR!!!

I cannot say enough good things about Charles Fisher and the service he provided in selling our parents home. My Mom passed away, this house was a family home for over 60 years. We lived about 400 miles away. We needed a full service realtor in the area, to minimize traveling to and from the property. Charles was fantastic in every way.

Unexpectedly, the house was full of Mom’s possessions. Charles took care of everything in a matter of 2 days! Having the house cleared up, cleaned up (inside and out),and sale ready in a matter of days. We never lifted a finger, or had to travel to the area. There were a few challenges during the sale, and I was appreciative of Charles knowledge of the market and advice. The house was in a trust and not having to worry about all the details was invaluable to us.

-Sold a SFR

I can’t thank Charles enough for all his help, advice and availability to us.”

Charles Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

Property Discovery

• Property Condition Assessment

• Repairs, Decluttering & Cleaning

Pre-Marketing

• Professional Photography

• Aerial Videos

• 360 Property Video

• Stunning Property Brochures

• Floor Plan Drawings

• Local Network Announcements(Largest in the Area)

• Local ‘Coming Soon’ Announcement (Digital & Print)

Internet Marketing

• Inclusion in MLS

• Customized Property Website

• integration within Dozens of Affiliated Websites & Feature Property Highlights

• SEO & Targeted Internet Ad

Media Marketing

• South Bay, Westside and LA Print Ads

• Targeted Social Media Marketing Reaching Over 65,000 People

Direct Marketing

• Targeted Mail Marketing

• Direct Informational Property Postcards

• Featured Property Spread in Direct Neighborhood Magazine Sent to Over 6,500 Properties

Charles Fisher | RE/MAX Estate Properties• Painting

• General Contractor

• Locksmiths

• Foundation Inspection

• Staging & Design

• Termite Inspection

• Roofing

• Carpet Installation

• Finance/Lending

• Title Services

• Real Estate Attorneys

• Carpentry

• Designers

• Insurance Services

• Handyman Services

• Moving Services

• Plumbing

• Electrical

• Landscaping

• HVAC & AC

• Windows & Blinds

• Flooring Solutions

• Professional Cleaning Services

• Real Estate Tax Accountants

• Stone & Granite

• Tile Installation

• General Home Inspection

• Declutter & Organization Consultant

• Pool Inspection

• 1031 Exchange (Accomodators)

• Sewer Line Inspection

• Architectural Engineering

Charles Fisher | RE/MAX Estate PropertiesGetting your home ready to sell is no small feat. A modified space can help you sell your home faster and turn a larger profit. Here are a list of several updates and repairs you can consider making on your property.

We provide an extensive list of trades and service providers who can assist every step of the way.

Kitchen

Start with the room where you spend most of your time: the kitchen. An updated kitchen is high on everyone’s list. And while some homebuyers are willing to renovate to mold it into their dream space, others are not. Homebuyers want a high-functioning, spacious, and organized cook space.

It might only take a few updates to freshen up the kitchen and attract buyers:

• Install new hardware

• Purchase shiny, new appliances

• Install updated and/or additional lighting

• Apply a fresh coat of paint to the walls (and maybe the cabinets, too)

Bathroom

Focus on these bathroom details:

• Replace old fixtures

• Install a new vanity

• Recaulk the shower

• Replace tiles

• Replace flooring

Charles Fisher | RE/MAX Estate PropertiesFreshening up your home’s curb appeal doesn’t have to break the bank. A handful of small projects can help grab the attention of potential home buyers.

Easy home exterior updates:

• Apply a fresh coat of paint

• Plant vibrant, healthy landscaping

• Replace broken railings

• Fix cracks in the cement

• Pressure wash the exterior of the home and pavement (driveway, sidewalk, porch)

• Fresh interior paint

• Clean or replace flooring

• Replace hardware

• Patch the walls

• Replace light bulbs

• Install new appliances

• Replace torn window screens

• Fix hidden issues

• Deep clean entire home

Charles Fisher | RE/MAX Estate Properties

25,000+ broker and agent websites

Social Ads

Monthly Newsletters

Personalized newsletter sent out twice a month to over 3,500 subscribers

Custom Property Sites

Sleek websites to showcase a detailed overview of properties.

Your listing reaches 155,000+ real estate professionals across California, including 110,000+ CRMLS users and 45,000 additional agents, brokers, appraisers, and more from data share partners.

But your exposure doesn’t have to end there.

Charles

25,000+ broker and agent websites

Fisher | RE/MAX Estate Properties

Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

Our listings get more exposure!

65,000

6,500 People reached via targeted social media ads Properties on our mailing list

Custom Targeted Mailings

Property Inclusion

maximizing exposure of your home across the South Bay, Westside and Los Angeles areas to increase visibility within a specified area within our newsletter to local subscribers

Charles Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

Seamlessly blending modern contemporary design with comfort and functional elegance, this fully remodeled home will have you falling in love the moment you enter. Walk past the spectacular front porch, through the Italian Porcelain tile floored hallway as you feel greeted by the abundance of natural light seeping throughout. The first bedroom, separate office nook and primary bedroom all sit at the front of the home each with engineered hardwood floors, ample storage space and large upgraded windows allowing for copious sunlight.

The enchanting remodeled bathroom is complete with calacatta quartz countertops and a Restoration Hardware vanity, adjacent to the barn doors opening to the side by side laundry area with hook ups. The sleek gourmet chef’s kitchen features a beautiful calacatta quartz 9 ½ foot countertop island, Italian high gloss white cabinets/pantry and Bertazzoni Italian appliance suite which includes a Gourmet 36” free standing range, 36” fridge, dishwasher and hood insert. Enjoy al fresco dining all Summer long with astounding black iron exterior doors leading out to the private backyard equipped with a 41”-4 burner built-in BBQ grill including an island, fridge, storage space and a custom patio cover with LED lighting. The salt water pool and spa, separate side synthetic turf area and outdoor rain shower make for a perfectly encompassing indoor-outdoor entertaining space that is pre-wired for tv hook up and outdoor speaker. Designer details elevate the home with additional features including forced air heating system with Nest thermostat control (A/C ready), LED recessed lights throughout, Coax/Cat 6 pre-wired in each bedroom/living area, pre-wired for cameras, new lighting fixtures and a 5.1 entertainment speaker system in living area. In the heart of everything, don’t miss this opportunity to enjoy beach living at its finest in this peaceful utopian sanctuary.

Charles Fisher | RE/MAX Estate Properties

Increase selling price, decrease selling time.

Home staging showcases your home in its best light, making all the difference when selling your property.

Charles Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

1.

2.

3.

4.

5.

6.

Charles Fisher | RE/MAX Estate Properties

Charles Fisher | RE/MAX Estate Properties

1.

2.

3.

4.

5.

6.

Welcome to this incredible location! This property boasts four units, each offering 1337 square feet of living space Inside, the units are beautifully designed with painted smooth walls and ceilings, along with some recessed lights throughout. The floors are a mix of tile, vinyl tile, engineered wood, and carpet, providing a comfortable and stylish living space for all residents The kitchen features, tile counters, wood cabinets, and recessed fluorescent lights, along with a dinette area perfect for enjoying meals The ground floor also features a guest bath and gas fireplace, creating a cozy and inviting atmosphere As you make your way to the second floor, you'll find carpeted stairs with a wood banister leading to a landing area with a laundry room. The master suites, feature a full bath with dual sinks, tile counters, a separate tub with a step-up tile seat, and a tile shower with a glass enclosure Two additional bedrooms share a full bath with one sink and a step-in tub/shower Walking distance to school, and parks

•

•

•

•

•

•

•

•

• Maintenance:

•

• Professional Management:

• Water/Sewer: $0

• Other Expense:

• Other Expense Description:

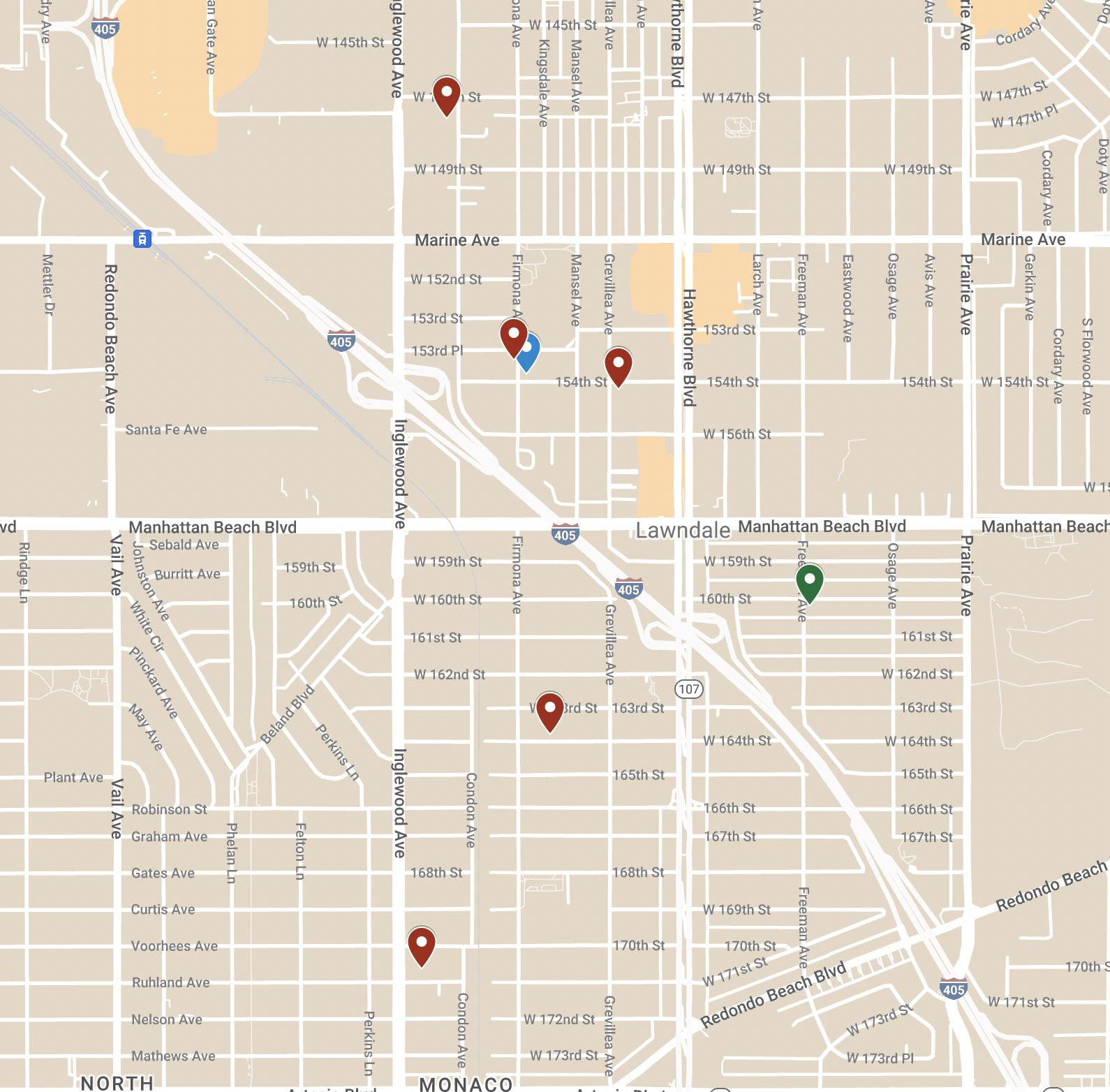

We are excited to offer this 4 unit property in the city of Lawndale The property contains four 3 bedroom/1 bathroom units with four 1 car garages There are three separate structures (front duplex, stand alone garage, and rear duplex) on a large 11,393 sqft lot that may have potential to add an additional unit The roofs were completely removed and replaced in 2016 with building permits Each unit has laundry hookups located inside the unit The rental income generated by the property is $9,750 per month as of June 2023

Facts & Features

• Sold On 07/24/2023

• Original List Price of $1,888,888

• 3 Buildings

• 4 Total parking spaces

• $0 (Seller)

• Laundry: Gas Dryer Hookup, Inside, Washer Hookup

• $117000 Gross Scheduled Income

• 4 electric meters available

• 4 gas meters available

• 1 water meters available

• Sewer: Public Sewer Annual Expenses

•

• Total Operating Expense: $0

• Electric:

•

• Furniture Replacement:

• Trash: $4,991

• Cable TV: 02081496

• Gardener: •

• Insurance: $2,731

• Maintenance:

• Workman's Comp:

• Professional Management:

• Water/Sewer: $3,600

• Other Expense:

• Other Expense Description:

Back on the market, and fully available This Beautiful Duplex features 2 Spacious 3 Bedrooms and 2 Bathrooms Units Both Units have been Extensively Remodeled! Downstairs Unit #A Kitchen has been totally remodeled approx 2 years ago Each Unit is over 1500 square feet and has its own washer and dryer hook ups Quarts Counter Tops throughout, Fans in Each Bedrooms, Down stairs Unit # A has enclosed Patio 12 X 24 with permits. There is one two Car Garage and One single Car Garage Easy access to Galleria shopping Mall, LAX , Manhattan, Redondo and Hermosa Beaches!!! BOTH UNITS ARE VACANT!!!!

Total Operating Expense: $0

• Electric: $0 00

• Gas: $0

• Furniture Replacement:

• Trash: $0

• Cable TV: 01264629

• Gardener:

• Licenses:

Unit Details

• Separate Electric:

• Gas Meters:

• Water Meters:

• Carpet:

• Dishwasher:

• Disposal:

• Insurance: $0

• Maintenance:

• Workman's Comp:

• Professional Management:

• Water/Sewer: $0

• Other Expense:

• Other Expense Description:

• Drapes:

• Patio:

• Ranges:

• Refrigerator:

• Wall AC:

Active • Duplex

$1,299,000 4176 W 160th St • Lawndale 90260

3 units • $433,000/unit • 3,087 sqft • 5,880 sqft lot

Built in 1953

• $420 80/sqft •

Manhattan Beach Blvd, South on Freeman. Corner of Freeman and 160th

19 days on the market

Listing ID: SB23082403

Great opportunity to own two homes on a lot with one house generating income. The front house is 3 bed, 1 bath with side yards currectly leased at $1600/mo from 3/23-3/24 and has off street parking in driveway The second two-story house: Upstairs, 3 bed, 2 bath, kitchen opens to wonderful vaulted ceiling main room with skylights which opens to a deck to entertain guests, cedar-lined walk-in closets, 3-car garage with bonus one-bedroom downstairs with separate and common entries with yard

Facts & Features

• Listed On 04/16/2023

• Original List Price of $1,299,000

• 2 Buildings

• Levels: One, Two

• 5 Total parking spaces

• Cooling: Whole House Fan

• $883 (Public Records)

Interior

• Rooms: Bonus Room, Den, Kitchen, Living Room, See Remarks, Walk-In Closet

Exterior

• Lot Features: Corner Lot, Front Yard, Landscaped

Annual Expenses

• Total Operating Expense: $4,093

• Electric: $640 20

• Gas: $0

• Furniture Replacement:

• Trash: $502

• Cable TV:

• Laundry: In Carport, Inside

• $98400 Gross Scheduled Income

• $94306 76 Net Operating Income

• 2 electric meters available

• 2 gas meters available

• 1 water meters available

• Sewer: Public Sewer

• Insurance: $2,119

• Maintenance:

• Workman's Comp:

• Professional Management:

• Water/Sewer: $832

• Other Expense:

• Gardener:

• Licenses:

• Other Expense Description: Unit Details

• Separate Electric: 2

• Gas Meters: 2

• Water Meters: 1

• Carpet:

• Dishwasher:

• Disposal:

• Drapes:

• Patio:

• Ranges:

• Refrigerator:

• Wall AC:

This is a great Investment property in one of the best areas in Lawndale. There are two very nice homes! The front house has 3 bedrooms 2 5 baths including a two car attached garage plus two extra parking spaces The back house has 4 bedrooms and 2 baths and three parking spaces Laundry is in the garage for the front house and laundry facility included in the back house. Both houses include central air and heating and security system. The front house was built in 2006 the back house was remodeled around the same time frame There is a private porch for each house that includes a storage shed property is close to freeways and very close to Del Amo shopping and 3 miles from the Beach This is a great investment option or a way to live in one house and rent the other house to help with monthly mortgage payments. Don't miss out on this great opportunity for an investment in a great area

Great 3 unit property on large corner lot Older home with tremendous character plus two homes with great rental potential 4452 W 154th st is 3 bedrooms with one bath 4450 W 154th has 2 bedrooms 1 bath and 15406 Grevillea has 2 bedrooms with a 3/4 bath Double garage on the property

• 3 electric meters available • 3 gas meters available •

available

• Workman's Comp:

• Professional Management:

The provided property valuation is an estimate based on available data, including comparable sales and the last MLS listing. It is not an official estimate and may change with additional information on the property's condition and upgrades. Market fluctuations can also impact its value.

Charles Fisher | RE/MAX Estate Properties• Understanding Living Trusts

• Life Of An Escrow

• Who Pays What?

• Closing Costs

• Understanding Title Insurance

• The Preliminary Report

• Understanding Home Warranty

• Terms

Estate planners often recommend “Living Trusts” as a viable option when contemplating the manner in which to hold title to real property. When a property is held in a Living Trust, title companies have particular requirements to facilitate the transaction. While not comprehensive, following are answers to many commonly asked questions. If you have questions that are not answered below, your title company representative may be able to assist you, however, one may wish to seek legal counsel.

Who are the Parties to a Trust?

A typical trust is the family trust in which the husband and wife are the trustees and, with their children, the beneficiaries. Those who establish the trust and transfer their property into it are known as trustors or settlors. The settlors usually appoint themselves as trustees and they are the primary beneficiaries during their lifetime. After their passing, their children and grandchildren usually become the primary beneficiaries if the trust is to survive, or the beneficiaries receive distributions directly from the trust if it is to close out.

Sometimes called an Inter-vivos Trust, the Living Trust is created during the lifetime of the settlors (as opposed to being created by their wills after death) and usually terminates after they die and the body of the trust is distributed to their beneficiaries.

No. The trustee holds the property on behalf of the trust.

Only your attorney or accountant can answer the question; some common reasons for holding property in a trust are to minimize or postpone death taxes, to avoid a time consuming probate, and to shield property from attack by certain unsecured creditors.

Married persons can usually exempt a significant part of their assets from taxation and may postpone taxes after the first of them to die passes. You should check with your attorney or accountant before taking any action.

Yes, if the property otherwise qualifies.

A trustee can take any action permitted by the terms of the trust, and the typical Trust Agreement does give the trustee the authority to borrow and encumber real property. However, not all lenders will lend on a property held in trust, so check with your lender first.

Some people who do not wish their names to show as titleholders make private arrangements with a third party trustee; however, such an arrangement may be illegal, and is always inadvisable because the trustee of record is the only one who is empowered to convey, or borrow against, the property, and a title insurer cannot protect you from a trustee who is not acting in accordance with your wishes despite the existence of a private agreement you have with the trustee.

The information contained in this flyer has been supplied by CLTA: www.clta.org

Gets pre-approval letter from Lender and provides to Real Estate Agent.

Makes offer to purchase. Upon acceptance, opens escrow and deposits earnest money.

Finalizes loan application with Lender. Receives a Loan Estimate from Lender.

Completes and returns opening package from First American Title.

Schedules inspections and evaluates findings. Reviews title commitment/ preliminary report.

Provides all requested paperwork to Lender (bank statements, tax returns, etc.)

All invoices and final approvals should be to the lender no later than 10 days prior to loan consummation.

Lender (or Escrow Of ficer) prepares CD and delivers to Buyer at least 3 days prior to loan consummation.

Escrow of ficer or real estate agent contacts the buyer to schedule signing appointment.

Buyer consummates loan, executes settlement documents, & deposits funds via wire transfer.

Documents are recorded and the keys are delivered!

Accepts Buyer’s offer to purchase.

Completes and returns opening package from First American Title, including information such as forwarding address, payoff lender contact information and loan numbers.

Orders any work for inspections and/or repairs to be done as required by the purchase agreement.

Escrow of ficer or real estate agent contacts the seller to schedule signing appointment.

Documents are recorded and all proceeds from sale are received.

Upon receipt of order and earnest money deposit, orders title examination.

Requests necessary information from buyers and sellers via opening packages.

Reviews title commitment / preliminary report.

Upon receipt of opening packages, orders demands for payoffs. Contacts buyer or seller when additional information is required for the title commitment/ preliminary report.

All demands, invoices, and fees must be collected and sent to lender at least 10 days prior to loan consummation.

Coordinates with lender on the preparation of the CD.

Reviews all documents, demands, and instructions and prepares settlement statements and any other required documents.

Schedules signing appointment and informs buyer of funds due at settlement.

Once loan is consummated, sends funding package to lender for review.

Prepares recording instructions and submits docs for recording.

Documents are recorded and funds are disbursed. Issues final settlement statement.

Accepts Buyer’s application and begins the qualification process. Provides Buyer with Loan Estimate.

Orders and reviews title commitment / preliminary report, property appraisal, credit report, employment and funds verification.

Collects information such as title commitment / preliminary report, appraisal, credit report, employment and funds verification. Reviews and requests additional information for final loan approval.

Underwriting reviews loan package for approval.

Coordinates with Escrow Of ficer on the preparation of the Closing Disclosure, which is delivered to Buyer at least 3 days prior to loan consummation.

Delivers loan documents to escrow.

Upon review of signed loan documents, authorizes loan funding.

Practices vary by state and are subject to local laws and customs.

ALTA Owners Title Insurance Policy (varies by county)

Escrow fee (varies by county)

Seller’s portion of sub-escrow fees

Notary fees

Document transfer tax ($1.10 per $1,000 of sales price)

Any loan fees required by buyer’s lender

Payoff of all loans in seller’s name (or existing loan balance if being assumed by buyer)

Interest accrued to payoff lender, statement fees, reconveyance fees and prepayment penalties

Any judgments, tax liens, etc., against the seller

Recording charges to clear all documents of record against the seller

Any and all delinquent taxes

Tax proration (for any taxes unpaid at the time of transfer of title)

Any unpaid homeowner’s dues

Escrow fee (varies by county)

Buyer’s portion of sub-escrow fees

Notary fees

Recording charges for all documents in buyers’ names

All new loan charges (except those required by lender for seller to pay)

Interest on new loan from date of funding to one month prior to first payment date

Assumption/change of records fees for takeover of existing loan

Beneficiary statement fee for assumption of existing loan

Tax-proration (from date of acquisition)

Homeowner’s transfer fee

Inspection fees (roofing, geological, property inspection, etc.)

Fire insurance premium for first year

CLOSING COSTS: WHO PAYS WHAT IN CALIFORNIA

These Closing Costs are reflective of current customary practices within the state of California and all items are subject to change without notice.

Prior to the development of the title industry in the late 1800s, a home-buyer received a grantor’s warranty, attorney’s title opinion, or abstractor’s certi cate as assurance of home ownership. The buyer relied on the nancial integrity of the grantor, attorney, or abstractor for protection. Today, home-buyers look primarily to title insurance to provide this protection. Title insurance companies are regulated by state statute. They are required to post nancial guarantees to ensure that any claims will be paid in a timely fashion. They also must maintain their own “title plants” which house duplicates of recorded deeds, mortgages, plats, and other pertinent county property records.

Title insurance provides coverage for certain losses due to defects in the title that, for the most part, occurred prior to your ownership. Title insurance protects against defects such as prior fraud or forgery that might go undetected until after closing and possibly jeopardize your ownership and investment.

Title insurance insures buyers against the risk that they did not acquire marketable title from the seller. It is primarily designed to reduce risk or loss caused by defects in title from the past. A loan policy of title insurance protects the interest of the mortgage lender, while an owner’s policy protects the equity of you, the buyer, for as long as you or your heirs (in certain policies) own the real property.

You pay for your owner’s title insurance policy only once, at the close of escrow. Who pays for the owner’s policy and loan policy varies depending on local customs.

Once you’ve opened escrow on a property, you will receive a preliminary report that describes the terms under which a title insurance policy will be issued for a specific parcel of land. It’s important to review this report so you understand any exceptions or exclusions from the title policy prior to completing your purchase.

A preliminary report shows the ownership of a specific parcel of land, together with the liens and encumbrances tied to the property that will not be covered under a subsequent title insurance policy.

While every property will have some exceptions, certain exceptions must be removed before a title policy can be issued. The preliminary report provides an opportunity for the parties to the real estate transaction and their agents to review and discuss items referenced in the report that are objectionable to the buyer prior to purchase.

Shortly after escrow opens, the title company will begin assembling and reviewing certain recorded matters related to the property and the parties to the transaction. This may include things like a deed of trust recorded against the property or a lien recorded against the buyer or seller for an unpaid court award or unpaid taxes. These recorded matters are then listed numerically as “exceptions” in the preliminary report.

You will be primarily interested in the extent of your ownership rights, so rst review the ownership interest in the property you will be buying. The name of the owner of record shown in the report should match the name of the seller on your transaction. If the names don’t match, contact your escrow or title of cer. You will also see the statement of vesting, which shows the form of the owner’s interest in the real property. “Fee” or “fee simple” is the highest type of ownership interest an owner can have. In some transactions, the interest might be a lease hold estate.

Next, you’ll see a reference to the legal description of the property, which is typically included in a separate schedule. There may also be a plat map or assessor’s map illustrating the location of the property.

Finally, the report will re ect the exceptions, or those matters that will not be covered by the title insurance policy. Any transfer or encumbrance of this property will be subject to these exceptions unless steps are taken to eliminate them. Common exceptions include:

Claims by creditors who have liens or liens for payment of taxes or assessments

Rules and regulations known as covenants, conditions and restrictions (CC&Rs) that must be followed by every homeowner in a covered community

Easements that give another party a right or interest in a property, such as providing a utility company access to install and maintain equipment or allowing a neighbor to cross over the property to gain access to their property

A deed of trust for any existing loan against the property

Every title insurance policy will also contain an exhibit that lists exclusions from coverage. While the exceptions above are generally related to the subject property, exclusions are preprinted limitations on coverage that are included in all policies of the same type. It’s important to review this section, as it sets forth matters that will not be covered by your title insurance policy but that you may wish to investigate, such as governmental laws or regulations governing building and zoning.

If you have questions about the preliminary report, contact your title representative or escrow of cer.

No. A preliminary report is simply a statement of terms and conditions of the offer to issue a title insurance policy; it is not a representation as to the condition of title. No contract or liability exists until the title insurance policy is issued.

A home warranty plan covers a variety of mechanical, electrical, and plumbing items, as well as some appliances. Optional coverage may be available for additional items such as air conditioners, refrigerators, pools, and spas.

The seller may purchase a home warranty plan prior to sale to protect against repairs needed during the listing period, and the buyer may be able to assume the plan at the close of escrow. Or the seller may offer to purchase a home warranty plan for the buyer. Offering a home warranty plan may provide these bene ts:

Increase the marketability of your home by reassuring potential buyers

Help sell your home faster and at a higher price

Ward off potential disputes after the sale for repair and/or replacement of covered items

Most home warranty plans can be paid for at the close of escrow. A copy of the invoice is presented to the escrow company.

If the buyer is securing a new loan to purchase your home, the buyer’s lender will require an appraisal to determine the fair market value of the property. A licensed appraiser will research nearby houses that have sold recently, usually in the last six months, and are similar to yours in size, age, construction, and amenities.

The appraiser will make an appointment to see your home and will take about 30 minutes to an hour to look over the property. He or she will measure your home, draw a representative oor plan, take photographs inside and out, and review the property’s condition, speci c improvements, and amenities.

The appraiser will provide a typed appraisal report to the buyer’s lender within a few days after visiting your property. You will be noti ed if the lender requires repairs before they will lend on your home. If repairs are required, the appraiser will have to return to review the repairs and a re-inspection fee may be charged.

An escrow is a process wherein the buyer and seller deposit written instructions, documents, and funds with a neutral third party until certain conditions are ful lled. It enables the parties to the escrow to deal with each other without risk, provides an accounting of all the funds deposited in the escrow, and provides the buyer and the seller with a settlement statement. In a real estate transaction, the buyer does not pay the seller directly for the property. The buyer deposits the funds to an escrow holder. The escrow holder, acting as a neutral third party, veri es that a title insurance policy can be issued pursuant to the terms of the contract. Then, the escrow holder arranges for the documents transferring title to the property to the buyer to be recorded, for the issuance of the title policy, pays any liens and all the costs associated with the sale that are chargeable to the buyer and seller, and disburses the sales proceeds to the seller. If the buyer gets a new loan, then the lender’s money is deposited into the escrow and the lender’s security documents are recorded at the same time as the deed.

One escrow transaction could involve more than 20 individuals, including real estate agents, buyers, sellers, attorneys, escrow of cer, escrow technician, title of cer, loan of cer, loan processor, loan underwriter, home inspector, termite inspector, insurance agent, home warranty representative, contractor, roofer, plumber, pool service, and so on. And often, one transaction depends on another. When you consider the number of people involved, you can imagine the opportunities for delays and mishaps. Your experienced escrow team can’t prevent unforeseen problems from arising; however, they can help smooth out the process.

An estimate of value of property resulting from analysis of facts about the property; an opinion of value.

The borrower’s costs of the loan term expressed as a rate. This is not their interest rate.

The recipient of benefi ts, often from a deed of trust; usually the lender.

Closing Disclosure form designed to provide disclosures that will be helpful to borrowers in understanding all of the costs of the transaction. This form will be given to the consumer three (3) business days before closing.

Generally the date the buyer becomes the legal owner and title insurance becomes effective.

Sales that have similar characteristics as the subject real property, used for analysis in the appraisal. Commonly called “comps.”

Occurs when the borrower becomes contractually obligated to the creditor on the loan, not, for example, when the borrower becomes contractually obligated to a seller on a real estate transaction. The point in time when a borrower becomes contractually obligated to the creditor on the loan depends on applicable State law. Consummation is not the same as close of escrow or settlement.

An instrument used in many states in place of a mortgage.

Limitations in the deed to a parcel of real property that dictate certain uses that may or may not be made of the real property.

The date the amounts are to be disbursed to a buyer and seller in a purchase transaction or the date funds are to be paid to the borrower or a third party in a transaction that is not a purchase transaction.

Down payment made by a purchaser of real property as evidence of good faith; a deposit or partial payment.

A right, privilege or interest limited to a specific purpose that one party has in the land of another.

As to a title insurance policy, a rider or attachment forming a part of the insurance policy expanding or limiting coverage.

Real estate insurance protecting against fire, some natural causes, vandalism, etc., depending upon the policy. Buyer often adds liability insurance and extended coverage for personal property.

A trust type of account established by lenders for the accumulation of borrower’s funds to meet periodic payments of taxes, mortgage insurance premiums and/or future insurance policy premiums, required to protect their security.

A description of land recognized by law, based on government surveys, spelling out the exact boundaries of the entire parcel of land. It should so thoroughly identify a parcel of land that it cannot be confused with any other.

A form of encumbrance that usually makes a specific parcel of real property the security for the payment of a debt or discharge of an obligation. For example, judgments, taxes, mortgages, deeds of trust.

Form designed to provide disclosures that will be helpful to borrowers in understanding the key features, costs and risks of the mortgage loan for which they are applying. Initial disclosure to be given to the borrower three (3) business days after application.

The instrument by which real property is pledged as security for repayment of a loan.

A payment that includes Principal, Interest, Taxes, and Insurance.

A written instrument whereby a principal gives authority to an agent. The agent acting under such a grant is sometimes called an “Attorney-in-Fact.”

Filing documents affecting real property with the appropriate government agency as a matter of public record.

Provides a complete breakdown of costs involved in a real estate transaction.

TILA-RESPA Integrated Disclosures