6 minute read

All appropriate documents are recorded at the County

BEGINNING THE PRE-APPROVAL PROCESS.

Here are some of the current documents you'll need to provide your lender to get your pre-approval started:

income

· Current pay stubs, usually for the last two months · W-2s or 1099s, usually for the last two years · Tax returns, usually for the last two years

assets

· Bank statements · Investments/brokerage firm statements · Net worth of businesses owned (if applicable)

debts

· Credit card statements · Loan statements · Alimony/child support payments (if applicable)

GETTING STARTED

NEGOTIATING THE OFFER AND CONTRACT.

Many factors influence the asking price of a home. To help you decide how much you feel comfortable offering for a property, I will gather critical information for you regarding the factors that impact how much you should consider paying for the home, including:

· How long the home has been on the market.

· The history of the listing, including changes to the price and terms.

· The prices for other comparable homes in the area.

· If it is known whether there are multiple offers.

· Other items that might be included in the sale - furniture, hot tub, etc.

· The "list to sale price ratio", an indication of how competitive the market is for homes in this area.

You may make your offer subject to certain terms or contingencies, including the securing of financing or perhaps the sale of your current home. The purchase contract will also be subject to various inspections by both you and professional inspectors. Your contract will also include some standard provisions, such as property taxes that will be prorated between buyer and seller. Others will outline what happens if the property is damaged before closing, or if either party fails to go through with the sale.

I will review every aspect of your offer and contract with you. Together, we will plan a negotiating strategy to give you the best chance to secure the property at the most advantageous price and terms based upon your goals.

NAVIGATING THROUGH THE FINANCIAL PROCESS.

1. You submit the completed application and any required supporting documentation to the lender and the lender runs a credit report (when you are pre-approved this is done already).

2. The lender orders an appraisal of the property and begins verifying your employment and assets.

3. The lender provides a good faith estimate of closing and related costs, plus initial Truth in Lending disclosures.

4. The lender evaluates the loan package with all of your supporting documents, issues a loan approval and a list of conditions, if any.

5. You sign the closing loan documents and the loan is funded. The lender sends its funds to escrow.

6. All appropriate documents are recorded at the County Recorder's Office, the seller is paid, and the title to the home is transferred to you.

THE FINANCING PROCESS

Real estate contracts contain contingency clauses that allow buyers to inspect the property. It is very important that you hire a professional Home Inspector and conduct a home inspection to determine if the home has any defects that would affect the value or desirability of the home.

It is also important to order a Wood Destroying Pest and Organisms (termite) Inspection. This inspection identifies existing or potential pest, dry rot, fungus and other structurethreatening infestation or conditions. The initial inspection fee covers only those areas which are accessible to the inspector. These inspectors must be licensed and can give estimates to correct noted problems, can make the suggested repairs, and/or can certify that the work has been completed.

Once you have completed all of your desired inspections, you have the right to negotiate for the seller to make repairs based upon your determination of important issues found during your inspections. The seller will then have the right to agree, renegotiate, or refuse to make any repairs. In most cases, if the seller does not agree to make your requested repairs you can accept the seller's response, withdraw from the sale, or attempt to renegotiate.

I'll provide you with outstanding counsel and guidance. My streamlined process and superior customer service eliminate the stress, confusion and delays often associated with the sale of your home.

A title spells out who has the right of ownership for a property. It is considered “clear” if there are no claims or liens against it. In order to make sure nothing will prevent the transfer of the property to you, a title company will conduct a title search and prepare a preliminary report that indicates what recorded matters affect the title to the property, and if the title insurance company is willing to insure the title. At the close of escrow, the title company will issue an Owner’s Policy of Title Insurance to protect you against losses that might arise from covered claims on the title.

I'll provide you with outstanding counsel and guidance. My streamlined process and superior customer service eliminate the stress, confusion and delays often associated with the sale of your home.

HELPING YOU PREPARE FOR THE CLOSING PROCESS.

A home purchase is a complex transaction involving many parties and associated fees. In addition to your deposit and down payment, there are a variety of other costs incurred that are paid at the close of escrow. Some of these costs may include:

· Loan origination fees, appraisals and reports.

· Surveys and inspections.

· Mortgage insurance.

· Hazard insurance.

· Tax assessments.

· Title insurance, notary and escrow fees.

· Recording fees and stamps.

The escrow holder will provide an estimated closing statement that provides estimates of these costs prior to the close of escrow so you are aware of the amount of funds you will need to wire to escrow for your closing. You may contact escrow, your lender, or myself to answer any questions regarding your estimated closing costs.

THE CLOSING

WHY

Coldwell Banker Real Estate practically invented modernday real estate. Founded in 1906 on the principles of honesty, integrity and always putting the customer first, we changed the industry then and continue to do so today.

Coldwell Banker West started 10 years ago in one small office in Bonita. We now have over 900 agents with offices across San Diego County. We are the fastest growing franchise, within the brand, nationwide. We are continually growing and expanding, and our reach is limitless.

Our dominance over the San Diego real estate market is unmatched. With over 3,600 units sold in 2019, Coldwell Banker West is the #1 brokerage in San Diego.

Our full range of real estate services include; residential resale, commercial, mortgage, escrow and property management. We can help you with all your real estate needs.

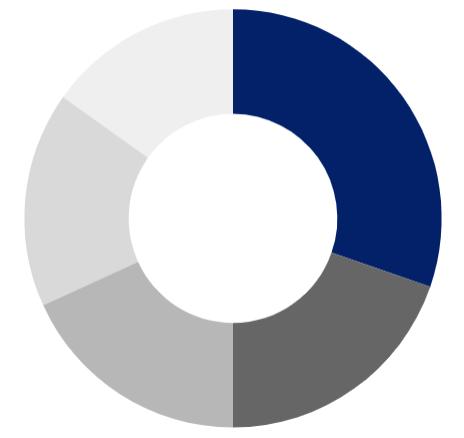

2. CB RESIDENTIAL (3453) 3. BIG BLOCK (3280) 4. PACIFIC SOTHEBY’S (3101.5) 5. COMPASS (3001.5 #1 COLDWELL BANKER WEST 3668.5

SAN DIEGO COUNTY MARKET SHARE BY BRAND: TOTAL UNITS SOLD

DATA PULLED FROM BROKER METRICS, CLOSED TRANSACTIONS ALL SAN DIEGO COUNTY BETWEEN NOVEMBER 2018 - OCTOBER 2019

Thank you

JERRY SOTO 619.572.7724 JERRYSOTO1@GMAIL.COM JERRY-SOTO.COM REALTOR® | DRE# 01233351