Meet Harper!

The

The

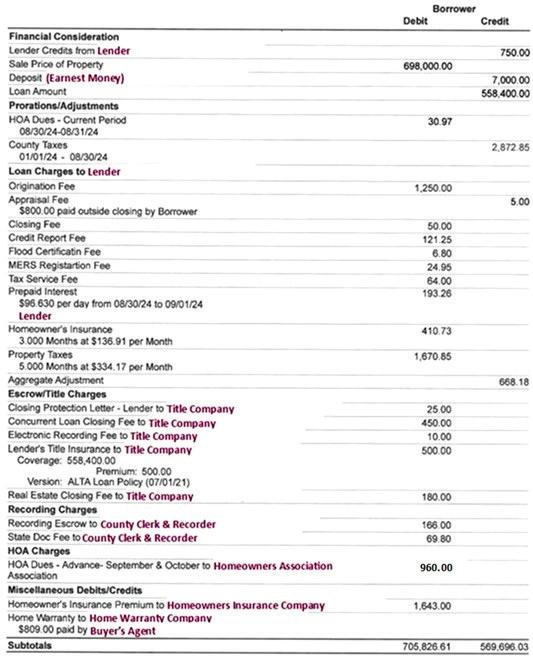

This is one article you’ll want to read at http://RealEstateToday.substack.com, where the buyer and seller settlement statements at right appear much larger on your computer screen. I have anonymized the actual closing statements from a property I sold for $698,000 this year which had an HOA, a seller loan to pay off, and a buyer loan to fund. This should cover most of the expenses that a buyer or seller might encounter when closing on a home sale or purchase.

We’re blessed in Colorado when it comes to the cost of buying and selling real estate. In many states, there are transfer taxes imposed by state or local jurisdictions, but not here by Colorado or in metro Denver. Also, in some states, both buyer and seller need to hire a lawyer, not just a real estate agent to complete a transaction. Long ago the State of Colorado passed a law giving licensed real estate brokers limited legal authority to explain state approved contracts, so it’s rare for a client to spend money on a lawyer. The exception is when a buyer purchases a new home, because builders have lawyers create their own contracts, and we would be practicing law without a license if we were to interpret those contracts and their provisions for our buyer.

ance renewal), but that escrow can't be credited on your closing. You’ll pay for the property taxes at closing and get a refund of your escrow balance from your lender 30 days or so after closing. On this seller’s settlement statement, the HOA dues are also pro-rated to the date of closing, and since the closing was on the 30th of August, the statement refunds two days’ worth of HOA dues, which the seller had paid on August 1st.

The biggest deductions for the seller (other than property taxes) are the real estate commissions and the title insurance policy. The purchase contract specifies whether the buyer or seller will pay for the buyer agent’s commission and the owner’s title insurance, but it is still common for the seller to pay both agents’ commissions plus the title policy, as in this case.

There are HOA fees which can also be paid by either party but are typically paid by the seller. Typically, the title company which is closing the transaction pays those fees (for status letter, documents, transfer fee, and more), so those fees are shown here as being reimbursed to the title company rather than paid to the HOA.

statement. If the buyer were paying cash, he or she would have very few expenses other than recording the deed for $10. The biggest costs associated with buying the home are related to the loan, especially if the seller has paid the buyer’s real estate agent and paid for the owner’s title policy.

So let’s look at the seller’s settlement statement first. Not all the debits on this statement are considered the cost of selling. For example, the property taxes for the current year, pro-rated to the date of sale, are not a cost of selling. Since property taxes are paid in arrears (not due until April of the following year), you’re always going to find that pro-ration of property taxes on the settlement statement. If selling in December, that’s almost an entire year’s tax bill. In January through April, if your taxes haven’t been paid, you will find the full year’s taxes plus a portion of the current year’s taxes deducted from your proceeds.

If you have a mortgage, your lender has probably been charging you each month to escrow for next year’s tax bill (and insur-

In addition to paying off the seller’s loan, based on payoff numbers the title company obtains directly from the lender, the closer will deduct a few extra days of interest to cover the time it takes to get the payoff to the lender. If that’s an overcharge, the seller will get a check for the surplus from the title company within a few weeks.

The title company will also escrow a few hundred dollars to pay the final water and sewer bill (unless water is included in the HOA dues), and will refund the excess after they pay the final water/sewer bill. This is the only utility which the title company pays and transfers on your behalf, because an unpaid water/sewer bill would result in a lien against the property, and the title company’s job is to assure the buyer that they are getting the home clear of any liens.

Now let’s look at the buyer’s settlement

At Golden Real Estate, we like to save you money wherever we can. For example, we have a handyman who can help you get your home ready to show or fix inspection issues at a client-only rate of $30/hour.

We also have a box truck which you can use prior to, during and after closing, not just for moving to your new home, but making those dump runs or runs to Goodwill for donating all that stuff you accumulated over the years!

packing material, including bubble wrap, so don’t buy any of those items yourself.

We’ve been offering the use of this truck since 2004. In fact, this is our second truck. It’s hard to estimate how much money this perk has saved both our buyers and sellers, but it must be several hundred thousands of dollars.

We also provide free moving boxes and

We also make the truck available free to non-profits and local organizations, such as Family Promise and BGoldN, which uses it to pick up food from Food Bank of the Rockies for their Golden food pantry.

Those loan costs are large and varied, as is detailed in the buyer’s settlement statement above. There’s the origination fee, from which the loan officer is paid. There is also the cost of appraising the home (in this case paid prior to closing), underwriting, credit report, flood certification, and a couple other lesser fees.

The buyer’s lender wants to be sure the home is insured, so you see that debit on the last line of the buyer’s settlement. (A cash buyer might choose not to insure.)

Not only does the buyer have to pay all those expenses, the buyer is charged for a title policy that covers the lender for the amount of the loan ($500 in this case) and a loan closing fee ($450). The lender will probably want to escrow for property taxes and insurance and will require a deposit for both those expenses that will vary depending on when in the calendar year the clos-

Each year, the FHA raises the limits on its federally guaranteed loans. The limits are based on the median sale price of homes in each county.

Because the Denver metro area’s median home price was calculated by FHA at $710,000, the loan limit for single-family homes was raised to $816,500 this year. That is the loan limit, not the purchase price, although FHA only requires a 3.5% down payment.

The loan limit for a duplex/2-family home was raised to $1,045,250. For a three-family home it was raised to $1,263,500, and for a four-plex, it was raised to $1,570,200.

Boulder County’s limits in each category are slightly higher, starting at $856,750 for a single-family home.

In the country’s lowest-cost counties, the loan limit is $498,257 for a single-family home, and in the highest-cost areas (Alaska, Hawaii and the U.S. Virgin Islands), the limit is $1,724,725, rising to $3,317,400 for a 4unit property. (Whether 1-unit or 4-units, the borrower has to live in the subject property.)

ing takes place. In this case the buyer is being debited for 3 months of insurance coverage and 5 months of property taxes. There is one big credit which the buyer receives from the seller. The funds which were deducted from the seller’s proceeds for the current year’s property taxes are credited to the buyer, not paid to the county. That’s because the buyer will paying the current year’s entire property tax bill when it becomes due. You see that credit — almost $3,000 — near the top of the above settlement statement.

There could also be a concession for repairs that the seller agreed to in the inspection resolution, although not in this case. Sometimes that concession takes the form of a price reduction, which does not appear as a line on the settlement statement.

Notice that the closing services (notary) fee of $360 is shared 50/50 in this case, as is commonly done, $180 for each party. As mentioned above, visit our blog for more readable copies of those documents and more discussion of transaction costs.

Non-FHA (“conventional”) loan limits are slightly lower for 2024. In most areas, the conforming conventional loan is limited to $766,550. Alaska, Hawaii and high-cost areas have a conforming conventional loan limit of $1,149,825 for a single-family home. FHA loans are attractive because they only require a 580 credit score (as low as 500 with a 10% down payment), and your debt-toincome ratio only needs to be below 57%.

The biggest negative of FHA loans is that they require a mortgage insurance premium (MIP) of 1.75% at closing, plus an annual premium which varies based on your loan-tovalue ratio. MIP is for the life of the loan, unless your downpayment is at least 10%, and remains in effect no matter how low the loan-to-value ratio falls (i.e., how much your equity increases). If your down payment was 10% or higher, the MIP goes away after 11 years. Otherwise, most 15- or 30-year FHA mortgages should be refinanced once the owner can qualify for a conventional loan, hopefully at a better interest rate, to get rid of the MIP.

Dental insurance from Physicians Mutual Insurance Company. Coverage for 400+ procedures.

dental insurance - not just a discount plan. Get your free Information Kit with details! 1-855-526-1060 www.dental50plus.com/ads #6258

Medical

Attention oxygen therapy users! Discover oxygen therapy that moves with you with Inogen Portable Oxygen Concentrators. Free information kit. 1-866-4779045

Miscellaneous

Replace your roof w/the best looking & longest lasting material steel from Erie Metal Roofs! 3 styles & multiple colors available. Guaranteed to last a lifetime! Limited Time Offer up to 50% off install + Additional 10% off install (military, health & 1st responders.) 1-833-370-1234

Aging Roof? New Homeowner? Got Storm Damage? You need a local expert provider that proudly stands behind their work. Fast, free estimate. Financing available. Call 1-888-878-9091

Safe Step. North America’s #1 Walk-in tub. Comprehensive lifetime warranty. Top-of-theline installation and service. Now featuring our free shower package & $1600 off - limited time! Financing available. 1-855417-1306

DIRECTV Stream - Carries the most local MLB Games! Choice Package $89.99/mo for 12 mos Stream on 20 devices at once. HBO Max included for 3 mos (w/ Choice Package or higher.) No contract or hidden fees! Some restrictions apply. Call IVS 1-866859-0405

American Log Homes DEVELOPER LIQUIDATION

SALE! Log Home kits selling for Balance Owed. Up to 50% off. Design plans can be modified! No time limit on delivery. Call 1-866-307-5491, M-F 9am–5pm ET. Prepare for power outages today with a Generac Home Standby Generator. Act now to receive a FREE 5-Year warranty with qualifying purchase* Call 1-855948-6176 today to schedule a free quote. It’s not just a generator. It’s a power move.

MobileHelp America’s premier mobile medical alert system. Whether you’re home or away. For safety & peace of mind. No long term contracts! Free brochure! Call 1-888-489-3936

Jacuzzi Bath Remodel can install a new, custom bath or shower in as little as one day. For a limited time, waving ALL installation costs! (Additional terms apply. Subject to change and vary by dealer. Offer ends 12/29/24.) Call 1-844-501-3208

Miscellaneous

Water damage cleanup: A small amount of water can cause major damage to your home. Our trusted professionals dry out wet areas & repair to protect your family & your home value! Call 24/7: 1-888-872-2809. Have zip code!

We buy houses for cash as is! No repairs. No fuss. Any condition. Easy three step process: Call, get cash offer & get paid. Get your fair cash offer today by calling Liz Buys Houses: 1-844-8775833

Eliminate gutter cleaning forever! LeafFilter, the most advanced debris -blocking gutter protection. Schedule free LeafFilter estimate today. 20% off Entire Purchase. 10% Senior & Military Discounts. Call 1-833610-1936

Become a published author We want to read your book! Dorrance Publishing trusted since 1920. Consultation, production, promotion & distribution. Call for free author`s guide 1-877-7294998 or visit dorranceinfo.com/ ads

Bath & shower updates in as little as 1 day! Affordable prices - No payments for 18 months! Lifetime warranty & professional installs. Senior & military discounts available. 1-877-5439189