15 minute read

Lead Story

Countries that trade with other parts of the world always excel tremendously in tourism. The Federal Republic of Nigeria is the 49th largest West African export economy in the world. Nigeria surrounded by countries like Benin, Chad, Cameroon and Niger, are making them the first point of call when it comes to trade and opportunities.

Exports of commodities (Oil and natural gas) are the main factor behind Nigeria’s growth, that accounts for more than 91% of total exports. In 2014, Europe countries and Asia were the country’s leading trade partners. The 43% of total sales to the European Union with 34% of imports in total; while 29% of complete shipment accounted went to Asia, which is 43% of total purchases. Nigeria enjoys a positive annual trade balance of $8.26 billion after deducting imports of $39.5 billion from its export total of $47.8 billion. The Federal Republic of Nigeria shipped US$52.9 billion worth of goods around the globe in 2018. That dollar amount reflects a -46.7% drop since 2014 but a 29.9% uptick from 2017 to 2018. However, the value of its exports has fallen sharply over the last five years, falling from $88.9 billion to $47 billion at an annualised rate of -11.9%. The GDP of Nigeria is $481 billion, which equates to a GDP per capita of $6,000.

Advertisement

Nigeria’s Top Five Commodity Exports:

Commodity Amount (Annually) Crude Petroleum $36.9 billion Gas $7.39 billion Refined Petroleum $603million Cocoa Beans $504 million Rough Wood $333 million

Nigeria’s Other Notable Exports Are:

Scrap Copper – $133 million Tanned Goat Hides – $106million Cocoa Butter – $76.1 million Rolled Tobacco – $65.1 million Rubber – $57.1 million.

The top exports destinations of Nigeria’s products are India ($9.1 billion), Spain ($4.63 billion), South Africa ($4.58 billion), Brazil ($4.14 billion) and the Netherlands ($3.37 billion). The latest available country-specific data for 2018 shows that importers bought 77.8 % of products exported from Nigeria in India (15.9% of the global total), Netherlands (10.7%), Spain (10.1%), France (7.9%), South Africa (6.4%), United States (6.1%), Indonesia (4.2%), Sweden (3.8%), United Kingdom (3.6%), Brazil (3.2%), Italy (3%) and Canada (2.8%). From a continental perspective, approaching one half (43.9%) of Nigerian exports was sent to European countries while 27.7% worth went sent to Asia. Another 13.2% to North America, 9.2% went to Africa, 4.9% arrived in Latin America excluding Mexico but including the Caribbean, with 0.4% shipped to Oceania (0.4%) led by Australia. In September 2019, nevertheless, Nigeria’s trade surplus widened sharply to NGN 1079 billion from NGN 772 billion in the same month of the previous year. It was the most comprehensive trade surplus since August 2014, as exports climbed 26.5 per cent to NGN 2,219 billion, boosted by manufactured products (3041 per cent). Shipments, however, fell for crude oil (-13.9 per cent); raw materials (-43.1%) and solid minerals (-73.6%) and energy goods (-56.6%). Imports advanced at a softer 16.1% to NGN 1,140 billion, mainly driven by purchases of machinery & transport equipment (111.9%); food & live animals (32 per cent); chemicals (61.5 per cent) and manufactured goods (7.4 per cent). From 1981 until 2019, Balance of Trade in Nigeria averaged 207010.69 NGN Millions, reaching an all-time high in October of 2011 of 2177553.08 NGN Millions and a record low of -622103.84 NGN Millions in August of 2018.

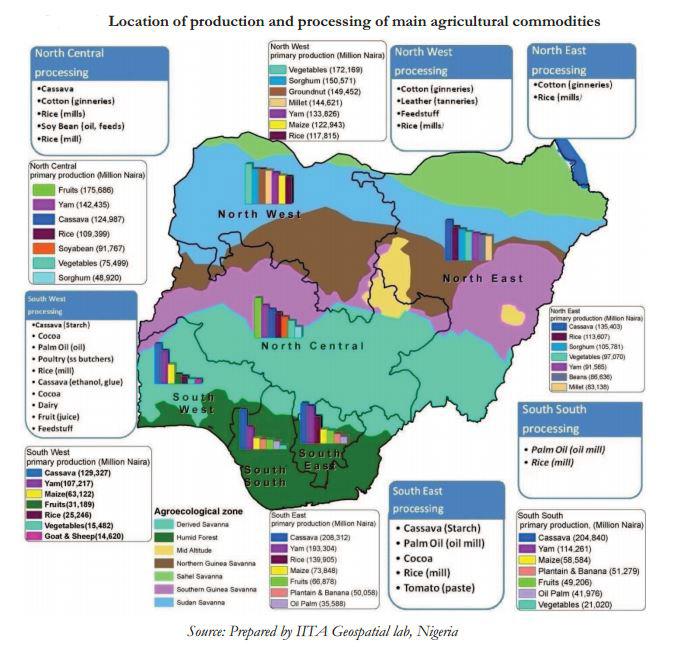

It is a fact that most often exported Nigerian product is Oil. But now, due to the crash of oil prices, the exportation of this “black gold” becomes less and less attractive. For this reason, a lot of people involved in export try to find some new ways and new products to export. According to statistics, the most popular non-oil products, which, Nigeria exported are cassava, cocoa, rubber, wool, cotton, palm oil, wood logs (Iroko or Mahogany) groundnut oil, cashew, garlic, as well as others. Nigeria mainly exports goods to Europe and Asia. Total profit is estimated to be about N682.5 billion.

Therefore, the Nigerian government recently announced that in future they want to focus more on agricultural products export because the prices on oil export decreased, and there is an increasing demand for non-oil products export. “Nigerian Export Promotion Council”, is a unique governmental body, launched by the Nigerian government; the council works to encourage Nigerian industrialists,

businessmen, and agriculturalists to export more non-oil products. So that the government can increase the export index, fight the unemployment issue, and stabilise Nigeria’s economy.

However, before the discovery of oil in Nigeria, the economy depended on the exportation of agricultural commodities. The oil sector in 1969 accounted for less than 3% of Gross Domestic Product (GDP), and a modest US$370 million in exports (42% of total exports) and the agricultural sector generated more than half of GDP. But the oil sector, by 1980, had come to account for nearly 30 per cent of GDP, and oil exports totalled US$25 billion (96 per cent of total exports) according to NCEMA (The National Emergency Crisis and Disaster Management Authority), 2008.

No doubt, the discovery of Oil gave Nigeria new opportunities to expand the economy. As more revenues flowed from the production of Oil, Nigeria began the importation of raw materials from other countries, thus improving trade with the rest of the world. The revenue derived led to the growth of the industrial sector, which hitherto was characterised by inactivity due to low demand for “made in Nigeria goods”. The oil boom of the Seventies led to importing substitution industrialisation and the establishment of new firms.

Hence; Nigerian economy since the 1970s has been a monoeconomy relying heavily on Oil as its primary source of foreign exchange earnings. The implication is that the economic dynamics of the country depends solely on the price of Oil, which, has been volatile. The oxygen that keeps Nigeria alive in Oil. At least statistics made available by the Central Bank of Nigeria (CBN) and National Bureau of Statistics (NBS) supports this claim. Data from both government institutions shows that the oil and gas sector, which currently accounts for less than 10 per cent of the nation’s Gross Domestic Product (GDP), contributes about 70% of government revenues and over 90% of export revenues.

The adverse consequences of over-dependency on oil trade heightened the need and call to diversify Nigerian economy away from Oil and towards the direction of non-oil export trade. It definitely will have high potentials to propel the Nigerian economy to the desired growth and development by implementing the value chain approach to agriculture with the possibilities to open up the economy and generate various activities. Such, are capable of creating jobs and enhancing industrialisation and thus make the non-oil sub-sector to hold access for future Nigerian sustainable high economic growth and development.

Going by the decline in oil price in recent years, the Nigerian economy seeks to diversify sources of revenue away from Oil. Therefore, the need to generate adequate revenue from other sources like non-oil export has become a matter of extreme urgency and importance. These further emphasise the need to diversify the Nigerian economy from its dependence on Oil through the promotion of non-oil exports as a significant source of foreign exchange earnings.

Furthermore, the role of non-oil exports can be more productive by enhancing export assistance and incentive programmes aimed at assisting exporters in expanding their volume and value of nonoil exports and thereby encourage a meaningful diversification of the economy.

All over the world, every country strives to achieve high economic growth and development, depending on the policies and strategies put in place. It is a fact that the economic development of any nation has some strong relationship with the export performance of the country. Thus, countries that adopt robust export policies can move their economies to a higher level of economic growth and development.

Most countries today are involved in the trade to gain from benefits that arise from the agreement that improves the balance of payment position, create employment and development of export-oriented industries in the manufacturing sector and enhance government revenue through taxes, levies and tariffs. Trade is not only to acquire foreign exchange reserves. But the benefits will eventually transform into better living condition for the nationals of the exporting economy since foreign exchange derived would contribute to meeting their needs for some essential goods and services. According to Mr Abubakar Abba Bello, the Managing Director/Chief Executive of Nigerian Export-Import Bank (NEXIM Bank), at the 2019 Annual Conference of the Financial Correspondents Association of Nigeria (FICAN) held on the 29th of September, 2019. The NEXIM Bank boss delivered a keynote address he titled, ‘Unlocking Opportunities in Nigeria’s Non-oil Export Sector’, he stated that with the collapse of the global oil price in 2015, the supply glut and weak economic growth primarily caused the nation’s economy to be impacted negatively in these three significant circumstances; *Lower government revenues with attendant budgetary pressures at all tiers of government. *Decline in export revenue, fell from $97.82 billion in 2013 to $82.95 billion in 2014 / $46.11 billion in 2015 and $34.70 billion in 2016 before recovering to $63.09 billion in 2018. *Destabilisation of macro-economic variables, naira exchange rate devaluation, rising inflation and high-interest rates.

As a result of the ripple effects of the fall in oil price in 2015 was that the Nigerian economy slipped into recession in 2016, recording five consecutive quarters of negative GDP growth before recovering in the second quarter of 2017, following improvements in international oil price and increased availability of foreign exchange in the country. He further states that “besides revenue volatility, the Dutch disease phenomenon is also associated with the oil sector, often manifesting in Naira exchange rate appreciation, which makes other products less competitive in the export market. I am sure that many of our farmers would bear testimony to the positive impact on the agricultural produce of the collapse of oil price in 2014-2015.

More significantly is the fact that the oil sector is an enclave that relied mostly on capital-intensive technology. The industry requires less employable opportunities, which makes the industry incapable of generating enough jobs that could address the growing challenge of unemployment in Nigeria, particularly amongst our youth. Hence; he called on the government to adequately move away from the dependence on oil by diversifying the economy to ensure sustainable growth and development.

At the moment, Nigeria’s non-oil exports sector, which comprises mainly of agricultural commodities and solid minerals, constitutes 97% of Nigeria’s exports. Crops like cotton, cocoa, palm oil, palm kernel, groundnut, and rubber were significant commodities for exports. However, between 1970 and 1974, non-oil exports dropped from 43% to 7% due to a rapid increase in the international oil price and Nigeria’s production. The circumstances led to the movement of resources out of the non-oil sector, contributing to its abandonment and lack of investments in the other export sectors, particularly value-added export. Nigeria observed the loss of more than $10 billion export opportunities in crops like cocoa, oil palm, cotton and groundnut alone. Despite the corrective measures over the years, the imbalance in the nation’s export trade has persisted with the non-oil sector now accounting for just about 5%-7% of Nigeria’s exports by value.

As enumerated above, currently the sector is characterised by a systemic drop in the contribution of total exports to GDP and figures from 2014 to 2017 have been below the global average of exports to GDP of about 30%, according to World Bank data. Other challenges of the sector are:

1. Few destinations for export, with the dominance of a few numbers of agro-allied commodities such as cocoa, rubber, leather, shrimps/ fish, sesame, cashew, and cotton, which account for over 60% of non-oil exports.

2. Minor contribution of the other agricultural sub-sectors like shea butter, ginger, cassava, yam, sweet potato, cowpeas and pineapple to export revenues. However, Nigeria remains one of the highest producers of these commodities, according to data from the Food and Agricultural Organisation (FAO).

3. Low export performance of the mining sector, which contributes less than 3% of total non-oil exports and one per cent of GDP annually, even though Nigeria has over 34 solid minerals in commercial quantities. 4. The inability of Nigeria to develop a significant footprint in services export, despite the dominance of services in the GDP.

The NEXIM Bank boss, Mr Bello, also identified inadequate funding from financial institutions, high cost of operations, quality standards, logistics issues and policy constraints on the part of the government as other substantial challenges bedevilling the non-oil sector. Therefore, Nigeria has recorded a significant rise in its non-oil export, with agricultural goods increasing the country’s foreign exchange earnings. The National Bureau of Statistics (NBS) recently reported that Nigeria recorded an export rise of 73.5 per cent in the second quarter (Q2) of 2019 compared to the same quarter the previous year.

Experts have attributed the rise to the diversification efforts of the Federal Government, with particular emphasis on non-oil exports. Speaking on the development, the Executive Director/CEO of the Nigerian Export Promotion Council (NEPC), Mr Olusegun Awolowo, said he is pleased with the positive trade balance recorded in the second quarter of 2017, which is as a result of the growth in exports. Awolowo said cashew nuts alone earned Nigeria N13.5 billion, primarily exported to Vietnam, India and Kazakhstan, while sesame earned N7.02 billion, exported mainly to Japan, India and Turkey.

Frozen shrimps and prawns earned over N2.83 billion, exported mainly to the Netherlands, Belgium, and the USA while flour and meals of soya bean made N2.31 billion, exported mostly to Ghana, Senegal and Spain. Ginger earned N633 million, exported mainly to Vietnam, Morocco and Sudan. In contrast, manufactured goods such as cigarettes containing Tobacco exported to Ivory Coast, Niger and Ghana contributed significantly to the surplus trade balance.

Other manufactured goods that showed good export outcome were Cocoa beans and its derivatives to several countries; cement exported to Niger and Chad Republics. He said although Oil continues to dominate exports with crude accounting for 42.57% and other oil products 21.86%, the outlook of the economy is beyond Oil as clearly laid out in the ‘Zero Oil Agenda’ which is central in the Nigerian Economic Recovery and Growth Plan (NERGP). “As observed from the report, there are remarkable increases in volumes and value in other sectors signifying efforts at diversifying the economy through a deliberate plan. Hence, raw materials, agriculture, solid minerals and manufactured goods are witnessing Year-on-Year growth,” he said. Businesses in the non-oil sector have benefited from the Federal Government’s initiatives and efforts. For instance, Trade Promotion and Facilitation activities of NEPC over the last three years working in partnership with USAID NEXTT and the cashew sector opened up a new market for cashew with Vietnam. Mr Awolowo stated that the ending of the suspension of the Export Expansion Grant (EEG) and the re-activation of the Export Development Fund (EDF), will further stimulate the growth of the non-oil export sector, thereby increasing the sector’s contribution to the nation’s GDP. The current Head of Department of Banking and Finance, Nasarawa State University, Keffi, told Daily Trust recently that, the solid minerals and agriculture sectors of the economy can contribute

in a large proportion to boosting Nigeria’s economy and serving as an alternative to oil products. Dr Uche Uwaleke explained that the second quarter of 2017 report on trade goods as released by the NBS recently suggest that crude Oil is still heavily relied upon as the major export and source of income to the country. “The composition of exports, in which crude oil has a disproportionate share, is still indicative of an economy that is dependent on a single product which is oil,” he said. Furthermore, he mentioned that agricultural products like ginger, soya beans, flour and meals have been generating a considerable amount of money for the country. There is, therefore, a need for these products to be judged in largescale production through funding and providing loans to farmers that can produce them in large proportion.

He further explained that developing the mineral sector could be designed to help serve as an alternative for Oil. Exportable minerals like sapphire, granite, marble, lead-zinc, coal, iron-ore among others sold to some parts of the world are not in large quantities. Still, it is crucial to expand and develop the mining sector to full capacity for a more profitable export base. He added that now that the country is out of recession, the Gross Domestic Product (GDP) has a positive of just 0.55 per cent and is driven basically by the oil sector which makes the economy still unbalanced. He said when we put in together, critical factors like agriculture and solid minerals, they will help contribute significantly to inclusive growth, which is essential to achieve sustained prosperity.

One of America’s respected, investigative journalists, Sam Hill, wrote a profound, well-researched article, to assure Nigerians that Nigeria is a great superpower being seeing in the international community as the ‘Black China of the world in the 21st century,’ beyond the shores of Africa.

In the articulated piece, Sam did not mince words as he demonstrates a more in-depth knowledge of all factors needed by the Nigerian economy to attain the enviable status in the comity of nations. Not wanting to depend on hearsay, the reporter was on the ground in Kano, and he compared, one of the busiest, most cosmopolitan city in West Africa with New York City in the United States of America. In a flowery article, he argues that a thousand years ago, Kano was one of the wealthiest cities in the world, the terminus of the crossSaharan trade that brought salt to exchange for slaves, gold and ivory. The palace has 5-foot thick walls, floor-to-ceiling bookshelves, stone pathways and ornamental mosaic domes.

All these further confirms that Nigeria is capable of developing trade that will bring more people of the world and increase the earning potentials of the country.