2022 | D ays On Market

The average Days On Market for the 56 markets evaluated in 2022 was 299 days, a 14% decrease from the 349 days in 2021.

2015 2016 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET 1,000 750 500 250 0 180 DOM Market with average DOM >180 Market with average DOM ≤180 All markets

Just under half of the top sales evaluated in 2022 were on the market more than 180 days. The average for the 51.55% of properties listed for 180 days or less was only 86 days, on par with the last four consecutive years. By comparison, for the 48.45% listed more than 180 days, average Days On Market jumps to a startling 519 days.

Hot vs Cold

The lowest average Days On Market were in Duval and St. Johns Counties, FL and Boston, MA at 114 days and 123 days, respectively. By contrast, the highest were in Fairfield County, CT and Aspen, CO, at 754 and 731 days. 1

Top Ten Highest Top Ten Lowest

29 | LUXURY HOMES INDEX

ID

Vineyard, MA

Dallas, TX

Kona, HI

Rhode Island

Duval

St.

FL 2 Boston, MA 3 Palm Beach, FL 4 Vero Beach, FL 5 Phoenix, AZ 6 Sonoma County, CA 7 Palo Alto, CA 8 Boca Raton/Del Ray, FL 9 Westchester County, NY 10 Atlanta, GA

Fairfield County, CT 2 Aspen, CO 3 Oahu, HI 4 Vermont 5 Kauai, HI 6 Sun Valley,

7 Martha’s

8

9

10

1

+

Johns,

Vero Beach, Florida

The fourth lowest of all 56 markets, Days On Market in 2022 dropped to 143, setting a new low record for the market since 2015.

2015 2016 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET 1,200 900 600 300 0

DAYS ON MARKET: HOT

Maui, Hawaii

After a 69% drop in 2021, Maui continues to remain steady, reaching 215 Days On Market in 2022.

31 | LUXURY HOMES INDEX

1,000 750 500 250 0 2015 2016 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET

DAYS

MARKET: HOT

ON

Palm Beach, Florida

DAYS

Days On Market have been on the decline since 2020, reaching a new all-time low for Palm Beach in

2015 2016 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET 800 600 400 200 0

2022.

ON MARKET: HOT

33 | LUXURY HOMES INDEX 2015 2016 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET 800 600 400 200 0 Another all-time low for the market, Phoenix has experienced a 69% drop in Days On Market since 2021. Phoenix, Arizona DAYS ON MARKET: HOT

After a steady decline since 2017, Days On Market began to track upward after an all-time low in 2020, reaching 754 in 2022, the highest of all Days On Market.

800 600 400 200 0 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET

Fairfield County, CT

DAYS ON MARKET: COLD

Kauai, Hawaii

After a drop in Days On Market from 2020 to 2021, the 2022 average increased over 92%, ranking the fifth highest of all 56 markets.

35 | LUXURY HOMES INDEX

2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET 1,000 750 500 250 0

DAYS ON MARKET: COLD

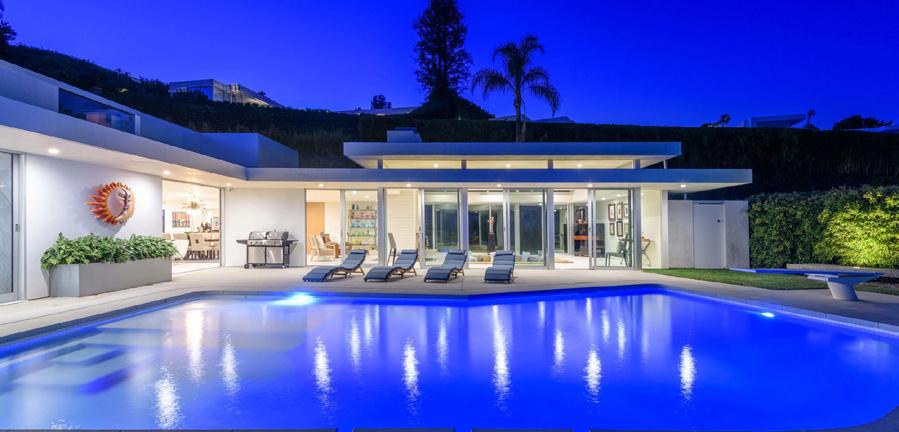

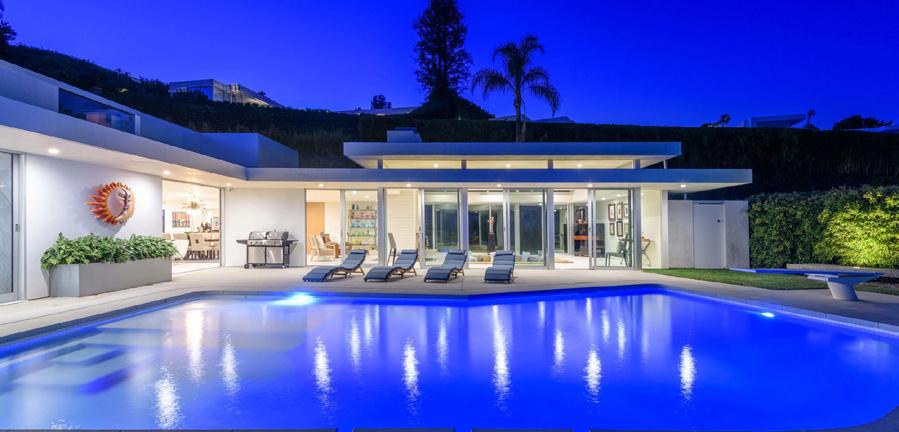

Brentwood, California DAYS ON MARKET: COLD

Average Days On Market reaches new high with a 151% increase over 2021.

2015 2016 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET 400 300 200 100 0

After a steady climb from 2018 to 2020, Chicago reached an all-time low Days On Market in 2021, and in 2022 increased by 128% to 468.

37 | LUXURY HOMES INDEX 800 600 400 200 0 2017 2018 2019 2020 202 1 202 2 AVERAGE DAYS ON MARKET

DAYS ON MARKET: COLD

Chicago, Illinois

CHAPTER 3

Percent of List Price

39 | LUXURY HOMES INDEX

2022 | Percent of List Price

The average percent of Original List Price achieved for the 56 luxury U.S. markets evaluated in 2022 was 89.7%.

2015 2016 2017 2018 2019 2020 202 1 202 2 AVERAGE % OLP TO SP 100% 90% 80% 70% 60% Market with average DOM >180 Market with average DOM ≤180 All markets

The properties that sold within 180 days achieved 92.61% of their Original List Price. By contrast, those that took longer than 180 days to sell achieved just 86.85%. This nearly 6% difference can be substantial when dealing with multi-million dollar properties and does not include carry costs, property taxes, or other expenditures of both time and money.

Hot vs Cold

Top Ten Highest

Top Ten Lowest

The lowest average percent of Original List Price achieved for top sales in 2022 were in Beverly Hills, CA, at 72.71%, followed by Houston, TX, at 73.83%. Conversely, properties in Telluride, CO achieved over asking price and the highest percent of Original List Price, at 121.21%, followed by Palo Alto at 103.04%. 1

41 | LUXURY HOMES INDEX

Nantucket, CT 4 Vermont

Kona, HI 6 Dallas, TX 7 Westlake Village, CA 8 Duval + St. Johns, FL 9 Park City, UT 10 Naples, FL

Air, CA 4 Brentwood, CA 5 Kauai, HI 6 Malibu, CA 7 Chicago, IL 8 San Francisco County, CA 9 Las Vegas, NV 10 Oahu, HI

Telluride, CO 2 Palo Alto, CA 3

5

1 Beverly Hills, CA 2 Houston, TX 3 Holmby Hills/Bel

Telluride, Colorado

At 121%, the top sales achieved the highest percent of Original List Price of all markets analyzed; an anomaly, of the 40% that took longer than 180 days to sell, the price achieved was more than 162% above the Original List Price.

2015 2016 2017 2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

OLP: HOT

%

Palo Alto, California

Although it slightly declined from 2021, top sales in 2022 in Palo Alto achieved the second highest percentage in final sale price to Original List Price of all markets, at 103%.

43 | LUXURY HOMES INDEX 2016 2017 2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

OLP: HOT

%

Nantucket, Massachusetts

% OLP: HOT

Fluctuating since 2018, Nantucket is the third highest of all markets at 103%. Top sales in less than 180 days achieved 95%, while those that lingered longer and sold after being listed more than 180 days achieved only 66%, on average.

2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

Park City, Utah

Steadily rising overall since 2017, top sales in Park City achieved nearly all of their original ask, at 97%. Not as impacted by longer Days On Market, the market remained strong for those listed more than 180 days, also at 97%.

45 | LUXURY HOMES INDEX 2017 2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

Beverly Hills, California

Steadily declining since 2019, while top sales in Beverly Hills continue to garner some of the highest prices, when compared to Original List Price, it is the coldest of all markets with the lowest achievement, at just under 73%.

2015 2016 2017 2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

OLP: COLD

%

A sharp decline in 2022, Houston ranks the second lowest for final sale price to Original List Price achieved, at just under 74%—top sales listed less than 180 days achieved 92% of their Original List Price; by contrast, those listed longer dropped to just 66%.

47 | LUXURY HOMES INDEX 2017 2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

% OLP: COLD

Houston, Texas

Las Vegas, Nevada

Dipping slightly from 2021, top sales in Las Vegas achieved an average of 85% of their Original List Price.

2017 2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

OLP: COLD

%

San Francisco, California

Steady since 2019, San Francisco sees an average of 85% of Original List Price achieved for top sales; with one of the largest contrasts of Days On Market impact—top sales on the market less than 180 days achieved over 95%, while those on the market for more dropped to just over 72%.

49 | LUXURY HOMES INDEX 2015 2016 2017 2018 2019 2020 202 1 202 2 110% 100% 90% 80% 70% AVERAGE % OF LIST PRICE

% OLP: COLD

CHAPTER 4

Top Sales

51 | LUXURY HOMES INDEX

Highest Priced Sales in Top U.S. Luxury Markets 2015-2022

Top Sales

West

Aspen

Beverly Hills

Brentwood

Denver

Holmby/Bel Air

Lake Tahoe

Las Vegas

Malibu

Orange County

Pacific Palisades

Palo Alto

Park City

Phoenix

Rancho Santa Fe

San Diego

San Francisco

Santa Barbara

Seattle

Sonoma

Sun Valley

Telluride

Vail

Westlake Village

Hawaii

Kauai

Kona

Maui

Oahu

North

Boston

Cape Cod

Chicago

Fairfield County

Greenwich

Hamptons

Martha’s Vineyard

Morristown/Essex

Nantucket

New Hampshire

New York

Philadelphia

Rhode Island

Vermont

Westchester

South

Atlanta

Boca Raton

Broward County

Dallas

Duval/St Johns

Fairfax

Houston

Miami Naples

Nashville

Palm Beach

Sarasota

Tampa

Vero Beach

53 | LUXURY HOMES INDEX

Top Sales: Highest Priced Sales in 56 U.S. Luxury Markets

Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Lake Tahoe Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Santa Barbara Sonoma County Westlake Village Aspen Denver Telluride Vail Sun Valley Las Vegas Park City Seattle WEST MARKET AVERAGE $15,804,500 $40,010,000 $19,668,800 $47,786,500 $15,301,440 $46,065,000 $23,374,500 $25,155,495 $11,602,700 $14,157,500 $17,937,500 $13,897,500 $31,584,500 $5,703,775 $7,663,421 $45,750,691 $7,180,000 $13,395,000 $18,646,000 $10,074,500 $12,755,000 $16,435,611 $8,129,200 $20,341,267 143 391 369 261 198 339 350 211 167 237 239 250 322 147 355 731 287 320 255 458 241 262 384 293 78% 20% 63% 60% 70% 30% 67% 60% 88% 50% 40% 56% 33% 63% 67% 0% 43% 60% 44% 60% 57% 44% 44% 50.48% 22% 80% 37% 40% 30% 70% 33% 40% 12% 50% 60% 44% 67% 37% 33% 100% 57% 40% 56% 40% 43% 56% 56% 47.52% 94 102 68 95 80 111 109 68 50 86 85 75 138 44 53 N/A 70 120 118 32 63 88 34 81 315 463 870 511 474 437 832 426 985 388 341 470 414 318 959 731 449 620 365 1,098 479 401 664 549 91.21% 84.23% 88.33% 81.07% 95.77% 86.63% 87.44% 94.13% 105.2% 87.81% 87.92% 95.02% 83.52% 98.39% 97.31% N/A 92.88% 93.94% 93.65% 100.38% 94.27% 99.07% 98.96% 92.6% 99.59% 69.83% 58.05% 68.32% 87.16% 79.23% 80.69% 86.47% 87.88% 90.61% 87.47% 71.74% 98.91% 92.64% 107% 86.51% 89.09% 162.1% 89.11% 75.04% 72% 96.86% 88.58% 88.03% AZ CA CA CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO ID NV UT WA

2022 ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

55 | LUXURY HOMES INDEX Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Martha’s Vineyard Nantucket New Hampshire Morristown + Essex Hamptons New York Westchester County Philadelphia Rhode Island Vermont NORTH MARKET AVERAGE $19,551,000 $20,092,500 $19,402,895 $15,704,889 $18,687,821 $9,181,250 $8,754,000 $6,651,651 $13,202,500 $11,467,500 $10,202,500 $21,175,000 $9,365,000 $4,308,800 $19,930,000 $64,080,000 $11,005,250 $4,580,731 $10,064,850 $6,005,800 $13,998,322 468 417 215 644 436 754 344 400 123 257 423 211 238 300 229 N/A 187 308 406 495 334 29% 50% 56% 29% 40.68% 30% 40% 33% 71% 40% 60% 60% 70% 44% 71% N/A 70% 33% 25% 44% 49.53% 71% 50% 44% 71% 59.33% 70% 60% 67% 29% 60% 40% 40% 30% 56% 29% N/A 30% 67% 75% 56% 50.47% 150 90 68 116 106 64 83 103 94 95 85 112 75 88 107 N/A 106 34 136 99 92 596 744 399 855 649 1,049 519 549 197 365 930 360 618 470 537 N/A 376 444 496 812 552 83.01% 87.62% 92.28% 96.08% 89.75% 113.05% 92.86% 96.2% 89.98% 92.94% 91.57% 95.07% 99.9% 100.07% 91.88% N/A 96.67% 92.29% 100% 95.04% 96.25% 79.69% 109.45% 92.59% 80.63% 90.59% 77.5% 89.13% 75.34% 90.77% 84.06% 79.11% 65.85% 83.49% 89.23% 104.06% N/A 77.21% 88.06% 86.76% 102.65% 85.23% HI HI HI HI CT CT IL MA MA MA MA NH NJ NY NY NY PA RI VT ST MARKET HAWAII NORTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

2022

COLDEST

Beach Broward County

+ St. Johns Counties Miami Naples Palm Beach (Proper) Sarasota + Manatee Counties Tampa Vero Beach Atlanta Nashville Dallas Houston Fairfax SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE $21,557,200 $21,466,954 $8,457,790 $66,961,863 $31,820,207 $37,803,750 $11,922,500 $9,567,900 $10,854,500 $5,259,765 $10,128,300 $9,887,500 $11,230,500 $10,487,444 $19,100,441 $18,213,954 176 380 114 238 226 142 217 241 143 195 238 423 344 227 236 299 70% 40% 80% 50% 50% 80% 67% 56% 70% 50% 43% 30% 30% 57% 55.16% 51.55% 30% 60% 20% 50% 50% 20% 33% 44% 30% 50% 57% 70% 70% 43% 44.84% 48.45% 73 88 75 60 85 98 86 80 87 70 81 89 111 68 82 86 417 574 270 357 367 317 479 444 272 321 356 566 444 438 402 519 88.37% 91.36% 95.7% 42.78% 99.48% 91.18% 93.06% 97.68% 92.69% 94.59% 95.08% 88.92% 92.45% 94.03% 89.81% 92.61% 102.76% 90.55% 106.73% 92.68% 94.08% 94.88% 89.37% 90.21% 83.06% 87.78% 88.72% 102.11% 65.45% 90.19% 91.35% 86.85% FL FL FL FL FL FL FL FL FL GA TN TX

Boca RatonDelray BeachHighland

Duval

TX VA

Top Sales: Continued HOTTEST

ST MARKET SOUTH UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

Fewer than 10 sales were used for some markets because public data was incomplete. † Lake Tahoe: Combined NV and CA

Top Sales: Highest Priced Sales in 56 U.S. Luxury Markets

57 | LUXURY HOMES INDEX Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Lake Tahoe Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Santa Barbara Sonoma County Westlake Village Aspen Denver Telluride Vail Sun Valley Las Vegas Park City Seattle WEST MARKET AVERAGE $15,035,000 $40,530,000 $31,120,350 $41,907,175 $35,130,000 $26,264,615 $29,166,848 $20,146,567 $27,325,000 $14,762,000 $19,867,000 $18,855,000 $20,634,828 $8,604,500 $7,007,500 $38,474,500 $5,875,000 $18,541,696 $21,281,250 $9,423,500 $12,579,000 $14,604,650 $18,567,600 $21,552,330 468 607 147 530 161 300 647 158 143 490 443 375 149 525 413 410 268 249 260 263 278 764 209 359 57% 20% 75% 57% 86% 40% 50% 60% 75% 67% 36% 56% 80% 67% 33% 17% 38% 57% 50% 75% 67% 20% 50% 53.61% 43% 80% 25% 43% 14% 60% 50% 40% 25% 33% 64% 44% 20% 33% 67% 83% 62% 43% 50% 25% 33% 80% 50% 46.39% 85 47 78 63 57 107 86 75 49 66 54 61 76 72 75 29 63 91 111 82 65 14 77 69 979 747 352 1,154 781 428 1,349 283 425 1,479 638 768 440 1,432 582 487 392 461 409 806 702 856 341 708 89.04% 88.42% 90.1% 84.55% 93.89% 81.39% 90.78% 92.33% 98.32% 94.46% 94.7% 96.42% 91.55% 107.05% 92.22% 93.13% 100.08% 94.47% 90.06% 94.61% 93.21% 98.43% 88.98% 92.96% 84.28% 65.8% 77.83% 84.29% 115.45% 75.8% 85.01% 84.17% 78.79% 67.37% 76.06% 67.38% 84.93% 76.47% 85.59% 101.59% 91.32% 91.12% 96.7% 91.41% 89.26% 90.34% 87.56% 84.72% AZ CA CA CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO ID NV UT WA

2021 ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

2021

Top Sales: Continued

Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Martha’s Vineyard Nantucket New Hampshire Morristown + Essex Hamptons New York Westchester County Philadelphia Rhode Island Vermont NORTH MARKET AVERAGE $22,919,900 $23,478,200 $21,960,000 $11,257,050 $19,903,788 $14,630,000 $21,578,800 $7,080,000 $5,579,000 $12,175,000 $14,118,438 $23,338,500 $5,959,345 $4,787,800 $63,550,000 $49,917,000 $10,015,000 $4,409,900 $16,986,164 $8,192,332 $17,487,819 243 270 235 352 275 577 357 176 181 277 221 533 104 174 198 N/A 687 165 256 N/A 300 20% 20% 70% 40% 37.5% 50% 38% 67% 80% 50% 50% 0% 78% 50% 67% N/A 30% 60% 62% N/A 52.46% 80% 80% 30% 60% 62.5% 50% 62% 33% 20% 50% 50% 100% 22% 50% 33% N/A 70% 40% 38% N/A 47.54% 67 143 87 86 96 1 135 103 71 106 127 N/A 55 114 126 N/A 106 100 88 N/A 94 287 301 581 530 425 1,152 491 320 620 449 315 533 278 235 341 N/A 936 263 451 N/A 491 86.95% 80.93% 93.99% 104.23% 91.53% 98.25% 95.49% 92.2% 93.74% 85.03% 94.18% N/A 104.27% 96.92% 97.16% N/A 100% 93.87% 90.68% N/A 95.15% 90.04% 91.18% 77.27% 82.66% 85.29% 62.81% 80.86% 85.47% 87.24% 91.68% 85.02% 88.85% 90.04% 88.17% 90.91% N/A 75.6% 91.44% 76.16% N/A 84.17% HI HI HI HI CT CT IL MA MA MA MA NH NJ NY NY NY PA RI VT ST MARKET HAWAII NORTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

Boca RatonDelray BeachHighland Beach

Fewer than 10 sales were used for some markets because public data was incomplete. † Lake Tahoe: Combined NV and CA

59 | LUXURY HOMES INDEX

Broward County

Johns Counties Miami Naples

Sarasota

Counties Tampa Vero Beach Atlanta Nashville Dallas Houston Fairfax SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE $58,063,500 $19,363,500 $8,140,816 $38,775,000 $22,404,750 $63,734,255 $11,380,725 $12,646,620 $12,876,300 $6,753,053 $13,781,000 $11,025,000 $8,040,800 $12,099,901 $21,363,230 $20,298,593 195 389 133 681 283 296 305 513 779 362 204 880 255 308 399 349 33% 45% 70% 44% 25% 44% 75% 25% 43% 38% 60% 20% 50% 33% 43.21% 49.44% 67% 55% 30% 56% 75% 56% 25% 75% 57% 62% 40% 80% 50% 67% 56.79% 50.56% 88 116 58 61 126 113 70 37 80 116 159 91 94 67 91 83 248 571 307 1,177 335 442 1,010 672 1,303 510 272 1,077 415 429 626 614 90.26% 87.82% 95.38% 96.8% 97.33% 88.57% 89.76% 100% 102.11% 85.62% 93.46% 94.73% 94.17% 91.57% 93.4% 93.47% 90.63% 73.23% 83.83% 78.28% 89.73% 95.81% 78.45% 78.78% 72.64% 83.35% 81.27% 72.16% 91.13% 90.35% 82.83% 84.14% FL FL FL FL FL FL FL FL FL GA TN TX TX VA ST MARKET SOUTH UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES HOTTEST COLDEST

Duval + St.

Palm Beach (Proper)

+ Manatee

ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS

AZ CA CA CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO ID NV UT WA

2020 712 415 288 508 400 644 433 374 207 533 589 173 627 86 547 787 119 270 658 525 542 379 329 441

AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Lake Tahoe Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Santa Barbara Sonoma County Westlake Village Aspen Denver Telluride Vail Sun Valley Las Vegas Park City Seattle WEST MARKET AVERAGE

33% 10% 11% 20% 43% 40% 44% 33% 67% 40% 30% 71% 67% 86% 50% 33% 86% 67% 11% 50% 12% 25% 50% 42.57%

37 153 107 107 28 78 97 104 66 67 116 75 62 52 42 115 94 84 47 82 23 84 47 77

96.57% 94.23% 91.86% 91.87% 97.08% 88.02% 92.27% 95% 89.84% 91.22% 92.74% 92.54% 88.87% 93.36% 99.45% 92.46% 93.17% 93.76% 91.67% 95.76% 94.87% 89.59% 94.84% 93.09%

67% 90% 89% 80% 57% 60% 56% 67% 33% 60% 70% 29% 33% 14% 50% 67% 14% 33% 89% 50% 88% 75% 50% 57.43%

937 444 379 608 678 1,022 701 508 489 844 792 416 1,756 294 1,051 1,124 268 643 735 968 616 478 612 711

85.28% 66.26% 71.45% 67.44% 92.28% 74.81% 81.13% 77.3% 67.4% 67.82% 68.34% 72.72% 77.84% 88.3% 59.53% 80.18% 94.05% 86.38% 84.83% 90.81% 77.28% 98.69% 77.39% 78.59%

Top Sales: Highest Priced Sales in 56 U.S. Luxury Markets $13,412,500 $33,685,000 $21,766,550 $27,470,000 $20,125,000 $19,671,800 $25,126,800 $12,037,031 $12,338,000 $11,743,750 $20,100,000 $17,458,000 $29,728,325 $6,747,900 $6,108,300 $27,892,964 $4,721,900 $8,343,875 $19,495,000 $5,448,300 $9,029,500 $12,800,000 $19,686,300 $16,736,382

61 | LUXURY HOMES INDEX $14,480,700 $8,400,191 $12,722,554 $8,078,500 $10,920,486 $10,267,500 $18,761,000 $5,811,786 $10,263,000 $10,447,778 $10,639,500 $18,032,500 $6,147,083 $2,530,000 $41,635,573 $65,561,281 $7,108,500 $2,033,600 $9,797,700 $7,253,736 $15,086,036 1,081 638 773 447 735 377 611 768 379 332 784 420 260 283 887 N/A 618 267 762 249 500 0% 12% 0% 14% 6.5% 56% 17% 12% 25% 50% 0% 20% 50% 50% 0% N/A 30% 44% 12% 50% 29.71% 100% 88% 100% 86% 93.5% 44% 83% 88% 75% 50% 100% 80% 50% 50% 100% N/A 70% 56% 88% 57% 72.6% N/A 111 N/A 49 80 85 169 67 29 103 N/A 69 56 92 N/A N/A 87 72 31 121 82 1,081 713 773 496 767 741 699 868 496 560 784 508 464 475 887 N/A 845 424 866 377 642 N/A 97.28% N/A 93.47% 95.38% 93.78% 87.51% 98.91% 85.46% 94.32% N/A 86.71% 95.98% 81.69% N/A N/A 97.19% 100.53% 98.74% 98.99% 93.41% 72.26% 81.86% 84.98% 92.87% 82.99% 85.24% 73.35% 75.34% 83.48% 86.17% 74.38% 124.08% 77.4% 82.45% 60.03% N/A 75.99% 94.08% 73.2% 96.02% 82.94% Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Martha’s Vineyard Nantucket New Hampshire Morristown + Essex Hamptons New York Westchester County Philadelphia Rhode Island Vermont NORTH MARKET AVERAGE HI HI HI HI CT CT IL MA MA MA MA NH NJ NY NY NY PA RI VT ST MARKET HAWAII NORTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

Boca RatonDelray BeachHighland Beach

Broward County

Duval + St. Johns Counties

Miami Naples

2020 534 382 378 493 639 546 522 425 698 639 399 546 289 430 494 491

Palm Beach (Proper)

Fewer than 10 sales were used for some markets because public data was incomplete. † Lake Tahoe: Combined NV and CA

14% 30% 30% 20% 20% 67% 20% 50% 12% 40% 50% 10% 50% 25% 31.29% 33.8%

7 63 98 72 116 172 109 54 19 116 68 118 85 63 83 80

92.94% 68.2% 95.97% 85.72% 96.76% 85.86% 90.33% 90.83% 93.75% 98.68% 96.36% 93.35% 92.88% 99.8% 91.53% 92.83%

86% 70% 70% 80% 80% 33% 80% 50% 88% 60% 50% 90% 50% 75% 68.71% 66.79%

622 519 498 598 770 1,293 625 796 795 987 731 593 493 552 705 696

92.6% 74.75% 79.06% 74.69% 80.59% 95.76% 79.65% 72.82% 72.49% 81.55% 83.12% 81.68% 85.53% 84.74% 81.36% 80.72%

OVERALL MARKET AVERAGE FL FL FL FL FL FL FL FL FL GA TN TX TX VA ST MARKET SOUTH UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES HOTTEST COLDEST

Top Sales: Continued $15,828,600 $15,250,685 $6,964,200 $27,265,000 $14,845,000 $48,294,758 $10,522,500 $7,765,980 $7,630,000 $9,664,000 $6,372,500 $8,192,380 $7,080,250 $7,582,813 $13,804,190 $15,145,856

Atlanta Nashville Dallas Houston Fairfax SOUTH MARKET

Sarasota + Manatee Counties Tampa Vero Beach

AVERAGE

Top Sales: Highest Priced Sales in 56 U.S. Luxury Markets

63 | LUXURY HOMES INDEX $11,333,000 $31,689,958 $20,359,089 $63,225,000 $10,354,500 $26,252,000 $25,246,500 $11,937,367 $9,537,500 $7,543,967 $15,010,000 $15,370,000 $17,335,000 $9,309,500 $2,397,170 $18,829,500 $6,322,349 $6,647,450 $14,697,400 $5,536,300 $6,940,075 $11,906,208 $10,720,500 $15,586,971 340 372 173 269 390 315 333 247 184 335 366 182 281 162 168 535 522 584 285 488 463 850 205 350 50% 30% 78% 33% 33% 40% 44% 30% 75% 30% 33% 70% 50% 60% 70% 25% 14% 0% 44% 40% 10% 20% 60% 40.83% 50% 70% 22% 67% 67% 60% 56% 70% 25% 70% 67% 30% 50% 40% 30% 75% 86% 100% 56% 60% 90% 80% 40% 59.17% 111 121 84 61 48 74 104 90 75 112 64 61 58 103 67 137 100 N/A 39 84 89 74 40 82 569 479 485 373 562 475 516 315 511 430 518 425 505 250 401 668 593 584 482 757 505 1,043 454 517 87.44% 87.59% 90.69% 87.84% 97.77% 93.08% 80.76% 96.6% 88.21% 95.19% 88.68% 96.56% 95.02% 98.75% 96.56% 91.69% 87.60% N/A 90.42% 97.18% 78.13% 92.24% 95.66% 91.53% 84.67% 77.08% 76.36% 73.62% 89.57% 80.73% 70.41% 79.83% 80.22% 77.66% 76.73% 79.77% 72.94% 88.46% 81.70% 82.27% 83.01% 87.34% 86.61% 86.18% 68.61% 96.43% 79.63% 80.86%

2019 ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Lake Tahoe Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Santa Barbara Sonoma County Westlake Village Aspen Denver Telluride Vail Sun Valley Las Vegas Park City Seattle WEST MARKET AVERAGE AZ CA CA CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO ID NV UT WA

2019

Top Sales: Continued

$6,694,542 $13,067,000 $10,776,214 $10,956,681 $10,373,609 $5,077,443 $18,179,000 $4,978,367 $11,944,692 $10,250,000 $13,803,350 $13,380,335 $4,407,525 $4,105,000 $25,804,398 $65,371,204 $6,218,540 $4,495,180 $6,951,000 $2,792,100 $13,183,876 603 568 922 560 663 538 615 468 259 921 553 406 545 445 847 1,218 358 244 474 455 556 0% 57% 0% 33% 22.5% 11% 17% 30% 33% 20% 12% 17% 40% 20% 0% N/A 30% 44% 44% 43% 25.79% 100% 43% 100% 67% 77.5% 89% 83% 70% 67% 80% 88% 83% 60% 80% 100% N/A 70% 56% 56% 57% 74.21% N/A 145 N/A 60 102 45 61 81 89 127 135 104 103 120 N/A N/A 88 84 136 134 101 603 709 922 811 761 600 726 633 344 1,119 612 466 840 526 847 N/A 474 372 744 696 643 N/A 88.16% N/A 90.74% 89.45% 120.54% 94.18% 96.29% 100.87% 95.01% 89.66% 97% 95.39% 95.32% N/A N/A 88.65% 87.95% 89.31% 95.92% 95.85% 81.46% 86.93% 85.85% 91.77% 86.5% 58.4% 73.78% 79.3% 88.14% 76.71% 69.51% 84.39% 76% 78.44% 72.61% N/A 77.43% 89.05% 110.1% 68.9% 78.77% Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Martha’s Vineyard Nantucket New Hampshire Morristown + Essex Hamptons New York Westchester County Philadelphia Rhode Island Vermont NORTH MARKET AVERAGE HI HI HI HI CT CT IL MA MA MA MA NH NJ NY NY NY PA RI VT ST MARKET HAWAII NORTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

Boca RatonDelray BeachHighland Beach

Broward County

Duval + St. Johns Counties

Miami

Naples

Palm Beach (Proper)

Sarasota + Manatee Counties Tampa Vero

Fewer than 10 sales were used for some markets because public data was incomplete. † Lake Tahoe: Combined NV and CA

65 | LUXURY HOMES INDEX $12,813,300 $10,896,503 $5,630,200 $23,938,500 $19,715,000 $25,031,345 $8,517,500 $4,868,500 $5,922,000 $6,971,526 $7,185,000 $7,251,000 $5,835,400 $6,072,771 $10,760,610 $13,364,312 542 490 408 429 477 703 724 227 1,190 394 464 317 367 405 510 468 30% 20% 44% 22% 33% 0% 25% 63% 10% 30% 33% 40% 50% 40% 31.43% 33.27% 70% 80% 56% 78% 67% 100% 75% 38% 90% 70% 67% 60% 50% 60% 68.64% 66.75% 94 114 33 109 80 N/A 69 96 167 74 37 73 71 43 82 87 734 584 708 521 676 703 942 445 1,304 531 677 480 663 646 687 610 92.96% 84.93% 96.85% 66.85% 94.03% N/A 95.44% 93.88% 84.62% 95.5% 92.35% 92.02% 87.88% 101.66% 90.69% 92.35% 96% 73.29% 78.13% 76.75% 82.07% 70.73% 65.94% 73.84% 64.57% 82.78% 81.32% 81.45% 88.79% 84.11% 78.56% 80.15%

Beach Atlanta Nashville Dallas Houston Fairfax SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE FL FL FL FL FL FL FL FL FL GA TN TX TX VA ST MARKET SOUTH UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES HOTTEST

COLDEST

ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS

AZ CA CA CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO ID NV UT WA

2018 720 361 163 226 541 490 528 395 86 660 787 116 589 244 282 400 201 804 559 705 1,133 449 466 474

AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Lake Tahoe Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Santa Barbara Sonoma County Westlake Village Aspen Denver Telluride Vail Sun Valley Las Vegas Park City Seattle WEST MARKET AVERAGE

22% 50% 60% 60% 44% 30% 30% 50% 90% 50% 20% 89% 10% 60% 60% 50% 70% 30% 33% 0% 20% 30% 50% 43.83%

84 79 94 72 123 137 112 77 80 70 55 92 92 91 72 83 57 91 69 N/A 92 84 66 85

98.28% 87.09% 93% 88.95% 93.23% 80.73% 94.87% 96.65% 94.44% 86.33% 95.86% 89.6% 88.02% 95.69% 94.37% 93.42% 80.01% 84.47% 90.53% N/A 123.81% 91.39% 96.32% 92.59%

78% 50% 40% 40% 56% 70% 70% 50% 10% 50% 80% 11% 90% 40% 40% 50% 30% 70% 67% 100% 80% 70% 50% 56.17%

902 586 268 458 791 642 706 712 217 1,250 970 281 645 473 597 717 537 1,110 804 705 1,263 606 866 700

63.65% 73.37% 77.6% 74.12% 78.15% 75.96% 76.84% 81.62% 94.14% 70.8% 78.18% 65.17% 78.74% 81.29% 81.8% 77.64% 81.85% 76.27% 85.03% 91.35% 59.62% 86.27% 81.33% 77.86%

Top Sales: Highest Priced Sales in 56 U.S. Luxury Markets $9,177,500 $22,852,600 $18,585,175 $27,227,250 $21,021,054 $21,042,500 $26,294,500 $15,398,567 $12,313,000 $8,866,296 $16,684,500 $15,880,000 $12,403,745 $6,301,250 $5,317,500 $16,596,574 $6,190,883 $6,027,550 $14,934,000 $6,161,790 $8,050,000 $8,011,750 $13,353,450 $13,856,149

67 | LUXURY HOMES INDEX $14,232,940 $11,430,800 $11,957,500 $16,434,675 $13,513,979 $3,556,000 $12,842,500 $8,066,363 $4,572,914 $10,070,000 $9,407,185 $9,441,000 $3,942,873 $4,343,100 $24,556,612 $41,470,830 $13,340,000 $4,692,500 $5,554,400 $3,593,500 $10,629,985 640 290 674 981 646 702 679 245 303 663 572 438 1,054 692 707 426 343 411 639 560 562 10% 60% 20% 22% 28% 20% 40% 60% 50% 20% 57% 22% 20% 22% 14% N/A 50% 30% 25% 40% 33.57% 90% 40% 80% 78% 72% 80% 60% 40% 50% 80% 43% 78% 80% 78% 86% N/A 50% 70% 75% 60% 66.43% 1 39 122 52 54 123 129 75 60 138 56 136 170 74 167 N/A 138 110 153 87 115 711 478 812 1,246 812 846 862 457 400 795 1,088 481 1,164 868 797 N/A 547 540 801 876 752 96% 93.49% 96.97% 97.22% 95.92% 96.07% 84.13% 87.78% 100% 89.89% 88.29% 100% 95.52% 84.05% 87.44% N/A 105.47% 98.19% 66.58% 95.49% 91.35% 78% 87.2% 79.18% 79.05% 80.86% 67.78% 79.17% 83.15% 85.87% 83.6% 69% 88.13% 72.68% 69.34% 60.65% N/A 84.32% 80.18% 75.03% 66.36% 76.09% Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Martha’s Vineyard Nantucket New Hampshire Morristown + Essex Hamptons New York Westchester County Philadelphia Rhode Island Vermont NORTH MARKET AVERAGE HI HI HI HI CT CT IL MA MA MA MA NH NJ NY NY NY PA RI VT ST MARKET HAWAII NORTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

Top Sales:

Fewer than 10 sales were used for some markets because public data was incomplete. † Lake Tahoe: Combined NV and CA

$13,094,116 $8,971,462 $5,087,500 $20,540,000 $18,026,362 $25,673,308 $6,141,500 $6,199,900 $6,009,750 $5,745,500 $4,642,399 $13,842,712 $6,423,156 $11,670,000 $10,861,976 $12,219,014 657 605 344 502 534 575 1,109 445 337 473 425 641 275 369 521 516 22% 20% 80% 22% 33% 10% 40% 40% 44% 20% 60% 30% 70% 0% 35.07% 37.84% 78% 80% 20% 78% 67% 90% 60% 60% 56% 80% 40% 70% 30% 100% 64.93% 62.16% 139 41 104 67 99 155 78 61 55 80 90 79 124 N/A 90 92 806 746 1,186 627 752 621 1,796 638 562 571 950 881 626 369 795 746 81.76% 79.77% 92.99% 65.51% 94.85% 80.79% 89.5% 91.33% 78.77% 97.21% 92.91% 91.7% 90.38% N/A 86.73% 91.96% 82.59% 82.37% 81.32% 71.54% 83.48% 72.72% 76.14% 78.45% 88.07% 80.01% 82.60% 63.18% 85.06% 79.32% 79.06% 77.93%

Beach

Beach Atlanta Nashville Dallas Houston Fairfax

MARKET

OVERALL MARKET

FL FL FL FL FL FL FL FL FL GA TN TX TX VA ST MARKET SOUTH UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES HOTTEST COLDEST

Continued 2018 Boca RatonDelray BeachHighland

Broward County Duval + St. Johns Counties Miami Naples Palm Beach (Proper) Sarasota + Manatee Counties Tampa Vero

SOUTH

AVERAGE

AVERAGE

69 | LUXURY HOMES INDEX

Top Sales: Highest Priced Sales in 40 U.S. Luxury Markets

Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Sonoma County Westlake Village Aspen Denver Telluride Vail Las Vegas Park City Seattle WEST MARKET AVERAGE $6,212,650 $24,352,500 $15,200,000 $24,418,500 $19,120,095 $20,981,200 $15,199,500 $9,796,900 $6,585,000 $4,499,700 $12,892,500 $5,923,150 $5,347,400 $21,991,100 $5,152,500 $4,802,182 $12,466,000 $4,938,900 $9,630,300 $11,516,850 $12,051,346 632 347 154 251 480 589 398 180 481 614 78 408 597 630 371 563 472 379 1,039 398 453 10% 30% 80% 20% 30% 20% 30% 60% 10% 10% 100% 40% 30% 10% 40% 33% 20% 30% 0% 40% 32.15% 90% 70% 20% 80% 70% 80% 70% 40% 90% 90% 0% 60% 70% 90% 60% 67% 80% 70% 100% 60% 67.85% 6 139 114 73 89 102 77 63 151 137 55 64 126 77 67 64 79 52 N/A 60 84 701 436 317 296 647 711 536 355 518 667 N/A 581 732 692 573 812 570 520 1,039 567 593 97.01% 79.81% 85.5% 79.84% 96.2% 93.99% 99.59% 95.63% 85.62% 92.87% 100.13% 93.71% 83.18% 98.18% 93.16% 93.82% 100% 94.35% N/A 96.35% 92.58% 80.4% 74.8% 72.83% 70.47% 75.36% 71.93% 79.32% 92.17% 73.66% 68.09% N/A 72.38% 66.2% 85.42% 86.83% 87.08% 80.09% 77.98% 84.51% 79.42% 77.84% AZ CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO NV UT WA ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

2017

Fewer than 10 sales were used for some markets because public data was incomplete. †

71 | LUXURY HOMES INDEX Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Westchester County Philadelphia NORTH MARKET AVERAGE Miami Naples Palm Beach (Proper) Tampa Vero Beach Atlanta Nashville Dallas Houston SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE $7,887,000 $11,650,000 $10,985,000 $8,082,800 $9,651,200 $7,573,500 $16,629,200 $6,555,800 $5,861,000 $9,840,900 $8,701,335 $4,958,977 $8,588,673 $22,871,100 $14,045,000 $28,362,528 $5,698,925 $6,222,600 $5,557,582 $5,312,364 $8,459,500 $8,503,500 $11,670,344 $11,119,638 357 315 698 737 527 757 478 322 241 982 798 771 621 608 410 476 457 926 953 1,062 416 395 634 530 50% 30% 10% 20% 27.5% 40% 30% 30% 50% 20% 30% 0% 28.57% 0% 20% 20% 40% 20% 10% 40% 20% 40% 23.33% 29.08% 50% 70% 90% 80% 72.5% 60% 70% 70% 50% 80% 70% 100% 71.43% 100% 80% 80% 60% 80% 90% 60% 80% 60% 76.67% 70.93% 102 66 30 60 64.5 48 91 44 90 87 80 N/A 73 N/A 79 128 64 169 133 97 121 77 109 85 612 422 773 906 678 1,229 644 441 392 1,206 1,106 771 827 608 493 563 719 1,115 1,044 1,704 490 606 816 695 83.99% 94.91% 100% 95% 93.48% 95.97% 88.14% 96.78% 95.35% 103.13% 100.89% N/A 96.71% N/A 79.63% 82.54% 94.3% 86.14% 91% 94.11% 81.54% 95.9% 88.15% 92.39% 74.95% 76.56% 74.92% 71.39% 74.46% 72.08% 68.58% 90.33% 84.12% 75.26% 62.3% 77.48% 75.74% 68.1% 73.08% 69.78% 76.55% 65.4% 64.53% 72.4% 79.96% 66.03% 70.65% 75.45% HI HI HI HI CT CT IL MA MA NY PA FL FL FL FL FL GA TN TX TX HAWAII UNDER 180 DAYS OVER 180 DAYS ST MARKET AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES SOUTH NORTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS HOTTEST COLDEST

Lake Tahoe: Combined NV and CA

ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS

AZ CA CA CA CA CA CA CA CA CA CA CA CO CO CO NV WA

2016 $7,393,000 $19,730,000 $12,349,600 $32,741,600 $17,205,400 $19,182,258 $12,779,406 $6,215,000 $14,544,250 $14,011,111 $10,320,700 $4,543,650 $13,774,000 $5,963,750 $7,867,388 $5,262,000 $7,744,743 $12,448,697

AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

690 417 345 860 489 525 256 434 372 355 811 572 383 1,057 702 398 569 543

20% 60% 50% 10% 30% 20% 50% 40% 60% 60% 20% 30% 60% 20% 30% 40% 50% 38.24%

97 106 87 1 81 132 85 95 49 76 85 77 122 76 85 150 78 87

85.26% 92.75% 95.34% 100% 94.51% 82.52% 89.49% 91.99% 110.66% 88.88% 87.42% 95.56% 92.58% 97.98% 84.64% 91.82% 94.31% 92.69%

80% 40% 50% 90% 70% 80% 50% 60% 40% 40% 80% 70% 40% 80% 70% 60% 50% 61.76%

838 805 603 955 664 623 427 661 856 705 992 784 645 1,303 967 564 1,060 791

83.51% 67.08% 79.24% 76.02% 85.28% 72.15% 78.59% 72.88% 79.33% 84.94% 70.2% 81.25% 83.51% 77.59% 80.16% 73.4% 90.15% 78.55%

Top Sales: Highest Priced Sales in 27 U.S. Luxury Markets Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Malibu Orange County Pacific Palisades Rancho Santa Fe San Francisco County San Diego County Sonoma County Westlake Village Aspen Telluride Vail Las Vegas Seattle WEST MARKET AVERAGE

Fewer than 10 sales were used for some markets because public data was incomplete. † Lake Tahoe: Combined NV and CA

73 | LUXURY HOMES INDEX $10,472,000 $8,076,969 $9,274,485 $11,447,888 $5,108,000 $8,277,944 $14,998,960 $24,894,801 $6,412,000 $5,832,800 $3,388,400 $8,090,200 $10,602,860 $11,494,440 438 428 433 665 287 476 552 451 807 532 585 724 609 545 20% 20% 20% 22% 40% 31% 40% 50% 20% 40% 40% 10% 33.33% 35.26% 80% 80% 80% 78% 60% 69% 60% 50% 80% 60% 60% 90% 66.67% 64.74% 41 64 53 131 99 115 66 76 97 115 47 63 77 84 537 520 529 818 413 616 794 827 984 811 944 797 860 774 100% 89.59% 94.8% 96.67% 95.75% 96.21% 85.22% 91.17% 95.34% 90.71% 97.82% 98.16% 93.07% 93.19% 71.95% 78.79% 75.37% 66.11% 85.57% 75.84% 64.64% 84.24% 72.75% 69.64% 87.15% 74.62% 75.51% 77.43% Maui Oahu HAWAII MARKET AVERAGE Greenwich Boston NORTH MARKET AVERAGE HI HI CT MA Miami Palm Beach (Proper) Vero Beach Atlanta Nashville Dallas SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE FL FL FL GA TN TX HAWAII NORTH SOUTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS UNDER 180 DAYS OVER 180 DAYS ST MARKET AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES HOTTEST COLDEST

ST MARKET WEST UNDER 180 DAYS OVER 180 DAYS

AZ CA CA CA CA CA CA CA CA CA CA CA CO CO CO NV WA

2015 $7,344,769 $25,117,000 $13,381,166 $24,536,155 $14,862,222 $16,730,489 $12,383,946 $7,525,500 $12,032,000 $16,082,500 $10,814,800 $5,685,944 $22,450,981 $6,137,195 $11,609,250 $6,081,000 $8,552,500 $13,019,260

AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES

604 188 173 683 577 435 494 1,155 852 579 432 875 857 1,085 735 606 739 651

20% 80% 60% 30% 33% 30% 40% 40% 20% 60% 60% 30% 33% 30% 30% 70% 50% 42.12%

69 86 82 123 57 129 86 115 114 62 106 124 170 89 39 103 84 96

88.45% 87.85% 94.67% 83.4% 95.32% 72.31% 94.69% 93.25% 91.37% 92.12% 93.71% 93.37% 86.41% 92.53% 84.13% 87.40% 95.07% 89.77%

80% 20% 40% 70% 67% 70% 60% 60% 80% 40% 40% 70% 67% 70% 70% 30% 50% 57.88%

738 598 310 922 837 478 767 1,675 1,037 1,353 922 1,197 972 1,370 909 1,778 1,395 1,015

82.69% 63.97% 84.53% 76.23% 78.68% 78.32% 76.75% 62.89% 71.93% 71.63% 71.91% 70.98% 76.06% 80.91% 88.08% 53.43% 73.27% 74.25%

Top Sales: Highest Priced Sales in 27 U.S. Luxury Markets Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Malibu Orange County Pacific Palisades Rancho Santa Fe San Diego County San Francisco County Sonoma County Westlake Village Aspen Telluride Vail Las Vegas Seattle WEST MARKET AVERAGE

Fewer than 10 sales were used for some markets because public data was incomplete. † Lake Tahoe: Combined NV and CA

75 | LUXURY HOMES INDEX NORTH SOUTH UNDER 180 DAYS UNDER 180 DAYS OVER 180 DAYS OVER 180 DAYS $10,899,500 $12,037,600 $11,468,550 $9,976,667 $8,244,500 $9,110,584 $20,820,011 $22,415,410 $7,241,375 $4,248,160 $3,662,400 $9,122,222 $11,251,596 $12,222,047 522 293 408 940 412 676 559 428 571 467 852 479 559 615 40% 50% 45% 0% 60% 30% 33% 30% 30% 50% 30% 44% 36.17% 40.11% 60% 50% 55% 100% 40% 70% 67% 70% 70% 50% 70% 56% 63.83% 59.89% 113 88 101 N/A 76 76 61 122 112 106 53 150 101 97 795 499 647 940 917 929 725 513 767 828 1,194 742 795 933 91.38% 88.92% 90.15% N/A 92.81% 92.81% 89.91% 88.91% 85.75% 90.58% 98.33% 80.67% 89.03% 89.74% 81.99% 69.05% 75.52% 80.96% 85.53% 83.25% 77.63% 84.88% 76.85% 78.39% 71.63% 82.78% 78.69% 76% Maui Oahu HAWAII MARKET AVERAGE Greenwich Boston NORTH MARKET AVERAGE HI HI CT MA Miami Palm Beach (Proper) Vero Beach Atlanta Nashville Dallas SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE FL FL FL GA TN TX ST MARKET HAWAII UNDER 180 DAYS OVER 180 DAYS AVG SALE PRICE AVG DOM % OF SALES AVG DOM AVG DOM AVG SP/OLP AVG SP/OLP % OF SALES HOTTEST

COLDEST

CHAPTER 5 —

Annual Change

77 | LUXURY HOMES INDEX

2015-2022

Annual Change: Highest Priced Sales in U.S. Luxury Markets

Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Lake Tahoe Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Santa Barbara Sonoma County Westlake Village Aspen Denver Telluride Vail Sun Valley Las Vegas Park City Seattle WEST MARKET AVERAGE 0.66% -21.45% -7.71% 33.44% N/A 15.77% 14.65% 3.19% N/A -17.41% 16.45% -9.56% N/A -4.57% -20.09% -38.65% N/A -2.83% -32.23% N/A -13.47% N/A -9.44% -5.49% -15.97% 23.43% 23.08% -25.42% N/A 11.13% 9.38% 18.94% N/A 5.95% -67.65% -11.36% N/A -42.61% 17.69% 59.66% N/A -19.48% 58.45% N/A -6.14% N/A 48.71% 5.16% 18.3% 6.3% 6.9% -56.6% 94.4% -25.1% -0.5% 0.8% 29.4% 55.7% 33.9% 13.6% 71.5% -27.5% 154.8% 48.1% -25.3% 25.5% 32.6% -1.6% 30.1% 7.5% 83.6% 25.06% 47.72% -6.16% 22.27% 11.5% N/A 10.05% 25.32% 1.31% 25.68% 34.64% 270.79% 23.17% N/A 6.38% -0.56% -24.53% 20.15% 25.52% 19.8% N/A 62.99% -16.81% 15.95% 28.76% 12.1% 20.3% 43% 52.6% 74.6% 33.5% 16.1% 67.4% 121.5% 25.7% -1.2% 8% -30.6% 27.5% 14.7% 37.9% 24.4% 122.2% 9.2% 73% 39.3% 14.1% -5.7% 34.77% 23.49% 38.67% 9.54% 132.21% -50.74% 24.76% -3.99% -22.48% -22.54% -14.91% -10.04% -3.21% 39.76% 47.74% -54.92% 13.45% 2.12% 10.28% -1.58% -10.15% -10.15% 48.61% -19.72% 7.23% 5.12% -1.28% -36.8% 14.03% -56.44% 75.39% -19.86% 24.86% -57.54% -4.09% -9.71% -26.29% 53.06% -33.71% 6.08% 18.91% 22.21% -27.76% -12.38% 6.91% 1.4% 12.54% -56.22% -4.42% 115.18% 59.29% 46.99% 94.76% N/A 209.95% 39.71% 103.13% N/A 88.13% 49.08% -13.59% N/A -47.26% 30.73% 103.78% N/A 118.26% 60.61% N/A 109.75% N/A -4.95% 68.44% AZ CA CA CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO ID NV UT WA ST MARKET WEST % CHANGE AVERAGE SALE PRICE 2015–2016 2016–2017 2017–2018 2020–2021 2018–2019 2021–2022 2015–2022 2019–2020

79 | LUXURY HOMES INDEX Phoenix Beverly Hills Brentwood Holmby Hills + Bel Air Lake Tahoe Malibu Orange County Pacific Palisades Palo Alto Rancho Santa Fe San Diego County San Francisco County Santa Barbara Sonoma County Westlake Village Aspen Denver Telluride Vail Sun Valley Las Vegas Park City Seattle WEST MARKET AVERAGE 14.24% 121.81% 99.42% 25.92% N/A -15.25% 20.69% -48.18% N/A -62.42% -58.33% -35.75% N/A 87.73% -34.63% -55.31% N/A -2.58% -4.49% N/A -34.32% N/A -23% -0.26% -8.41% -16.79% -55.36% -70.81% N/A -1.84% 12.19% 55.47% N/A 10.83% 72.96% -79.03% N/A -49.69% 4.37% 64.49% N/A -46.74% -32.76% N/A -4.77% N/A -30.05% -10.35% 109.4% 11.6% 66.5% 88.8% 2.6% 104.4% 30% 51.4% 12.5% 59.1% 60.9% -4.95% 123.1% -46.9% 225.6% 47.1% -77.2% -53.8% 130.9% 7.6% 17.1% -55.4% 60.5% 42.21% 13.92% 4.03% 5.84% -9.84% N/A 2.08% -10.36% -0.75% -47.22% 37.21% 28.19% 48.72% N/A -40.2% -52.76% -36.51% -45.85% 42.81% 18.46% N/A 198.94% -56.76% 17.09% 5.85% -34.27% 46.2% -49.1% 4.4% -59.9% -53.4% 49.5% -52.9% -30.9% -8.1% -24.7% 116.9% -76.3% 510.5% -24.5% -47.9% 125.21% -7.7% -60.5% -49.9% -48.71% 101.58% -36.4% 12.57% -52.83% 3.05% 6.13% 19.03% -27.91% -35.71% -36.99% -37.33% 93.68% -49.24% -53.46% 56.9% -52.29% -33.61% -40.43% 33.75% 159.97% -27.35% -49.05% -30.83% -59.14% 89.07% -55.96% -7.85% -69.44% 35.58% 151.02% -50.75% 22.98% 13% -45.9% 33.54% 16.78% -51.63% -46.05% -33.33% 116.11% -72% -58.35% 78.29% 7.09% 28.51% -1.92% 74.14% -13.31% -65.71% 83.73% 3.53% -76.32% 107.98% 113.29% -61.79% N/A -41.25% -19.54% -57.29% N/A -79.48% -71.95% -56.82% N/A -65.97% -80.34% -14.7% N/A -70.51% -65.31% N/A -60.23% N/A -48.04% -38.13% AZ CA CA CA CA CA CA CA CA CA CA CA CA CA CA CO CO CO CO ID NV UT WA ST MARKET WEST % CHANGE AVERAGE DAYS ON MARKET 2015–2016 2016–2017 2017–2018 2020–2021 2018–2019 2021–2022 2015–2022 2019–2020

NORTH % CHANGE AVERAGE SALE PRICE Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Martha’s Vineyard Nantucket New Hampshire Morristown + Essex Hamptons New York Westchester County Philadelphia Rhode Island Vermont NORTH MARKET AVERAGE N/A N/A -3.92% -32.9% -18.41% N/A 14.75% N/A -38.04% N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A -11.65% N/A N/A 4.9% 0.07% 2.49% N/A 45.26% N/A 14.74% N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 30% 116.3% -35.7% 18.1% -26.3% 18.1% 102.2% 3.2% 16.7% -14.1% 1.9% -22.9% 34.8% 39.5% -38.4% 61.4% 0.3% 14.3% -54.8% 41% 159.8% 22.99% 80.46% -1.88% 8.85% 103.33% 47.69% -53.05% -22.77% 23.04% -21.98% 2.33% N/A N/A N/A N/A N/A N/A 53.31% -5.37% N/A N/A -3.5% 58.3% 179.5% 72.6% 39.3% 87.43% 42.5% 15% 21.8% -45.6% 16.5% 32.7% 29.4% -3.1% 89.2% 52.6% -23.9% 40.9% 116.9% 73.4% 12.9% 31.41% -52.96% 14.31% -9.88% -33.33% -20.47% 42.79% 41.55% -38.28% 161.21% 1.79% 46.73% 41.73% 11.78% -5.48% 5.08% 57.63% -53.38% -4.21% 25.14% -22.3% 20.79% -14.7% -14.42% -11.64% 39.51% -0.31% N/A N/A 78.02% 30.47% 54.24% -37.24% -59.43% -6.05% 136.65% -5.81% -27.74% -9.27% 57.15% -10% -68.64% 28.37% 9.89% 3.87% -40.75% -26.69% -3.71% N/A -12.26% N/A 60.14% N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A 23.94% HI HI HI HI CT CT IL MA MA MA MA NH NJ NY NY NY PA RI VT HAWAII % CHANGE AVERAGE SALE PRICE

ST MARKET 2015–2016 2016–2017 2017–2018 2020–2021 2018–2019 2021–2022 2015–2022 2019–2020

Annual Change: Continued 2015-2022

HAWAII % CHANGE AVERAGE DAYS ON MARKET

81 | LUXURY HOMES INDEX Kauai Kona Maui Oahu HAWAII MARKET AVERAGE Fairfield County Greenwich Chicago Boston Cape Cod Martha’s Vineyard Nantucket New Hampshire Morristown + Essex Hamptons New York Westchester County Philadelphia Rhode Island Vermont NORTH MARKET AVERAGE HI HI HI HI CT CT IL MA MA MA MA NH NJ NY NY NY PA RI VT NORTH % CHANGE AVERAGE DAYS ON MARKET N/A N/A -16.09% 46.08% 15% N/A -29.26% N/A -30.34% N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A -29.8% N/A N/A 59.36% 72.2% 65.78% N/A -28.12% N/A -16.03% N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A -22.08% 79.3% 12.32% -16.2% -20.18% 13.81% -29.93% -0.7% 64.1% 46.3% -64% 41.8% 3.4% -52.29% -36.4% 4.7% N/A 72.6% 9.4% 60.8% -45.3% 5.32% 79.19% -7.94% -3.47% 33.05% 25.21% -7.27% 42.05% -23.91% 25.73% -32.47% N/A N/A N/A N/A N/A N/A -57.06% -46.69% N/A N/A -14.23% -77.52% -57.68% -69.6% -21.25% -56.51% 53.05% -41.5% -77.1% -52.3% -16.4% -71.8% 26.8% -60% -38.4% -77.7% N/A 11.2% -38.2% -66.4% -5.6% -32.45% -5.8% 95.86% 36.87% -42.86% 21.02% -23.36% -9.43 91.02% -14.52% 38.83% -3.32% -7.31% -48.29% -35.71% 19.82% 185.98% 4.37% -40.72% -25.80% -18.79% -54.72% 92.59% 54.44% -8.51% 82.95% 55.37% N/A N/A -58.81% 119.8% 30.49% 30.68% -3.64% 127.27% -32.04% -7.22% 91.4% -60.41% 128.85% 72.41% 15.66% N/A -72.78% 86.67% 58.59% N/A 33.49% N/A -63.4% N/A -70.15% N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A -66.77%

ST MARKET 2015–2016 2016–2017 2017–2018 2020–2021 2018–2019 2021–2022 2015–2022 2019–2020

2015-2022

Boca RatonDelrayBeachHighlandBeach

Broward County

Duval + St. Johns Counties

Miami

Naples

Palm Beach (Proper)

Sarasota + Manatee Counties

Tampa Vero Beach Atlanta Nashville Dallas Houston Fairfax SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE N/A N/A N/A -27.96% N/A 11.06% N/A N/A -11.45% 37.30% -7.48% -11.31% N/A N/A -1.64% -5.63% N/A N/A N/A 52.48% N/A 13.93% N/A N/A 3.28% -4.72% 56.78% 4.56% N/A N/A 21.05% 9.62% 23.5% 40% 23.7% 13.9% -24.7% 97.84% 23.5% 59.5% 28.8% 38.6% -11.3% 13% 21.3% 24.9% 26.61% 24.4% N/A N/A N/A -10.19% 28.35% -9.48% N/A 8.79% -9.25% 3.38% -12.61% 63.64% -24.46% N/A 4.24% 19.49% 266.8% 27% 16.9% 42.2% 50.9% 28.7% 8.2% 62.8% 68.8% -30.1% 116.3% 34.6% 13.6% 59.6% 54.74% 42.62% -2.14% 21.46% 10.67% 16.55% 9.37% -2.5% 38.69% -21.47% -1.46% 21.34% 54.77% -47.62% -9.15% -47.96% 2.9% 7.8% -62.87% 10.86% 3.89% 72.69% 42.02% -40.69% 4.76% -24.34% -15.7% -22.11% -26.51% -10.32% 39.67% -13.33% -3% -3.58% N/A N/A N/A 221.62% N/A 68.85% N/A N/A 49.9% 23.81% 176.55% 8.39% N/A N/A 91.49% 73.37% FL FL FL FL FL FL FL FL FL GA TN TX TX VA SOUTH % CHANGE AVERAGE SALE PRICE

Annual Change: Continued ST MARKET 2015–2016 2016–2017 2017–2018 2020–2021 2018–2019 2021–2022 2015–2022 2019–2020

Boca RatonDelray BeachHighland Beach

Broward County

Duval + St. Johns Counties

Miami

Naples

Palm Beach (Proper)

Sarasota + Manatee Counties Tampa

Vero Beach

83 | LUXURY HOMES INDEX

Atlanta Nashville Dallas Houston Fairfax SOUTH MARKET AVERAGE OVERALL MARKET AVERAGE N/A N/A N/A -1.25% N/A 13.89% N/A N/A 41.33% 13.92% -31.34% 51.15% N/A N/A 14.62% 1.99% N/A N/A N/A 10.14% N/A 5.54% N/A N/A 14.75% 79.14% 81.54% -42.54% N/A N/A 24.76% 2.22% -1.5% -22% -7.4% 14.9% 34% -22.3% -27.9% 87.2% -41.3% 62.2% -14% 72.2% -21.3% 6.2% 8.5% 22.17% N/A N/A N/A -17.38% 30.67% 20.71% N/A -2.63% -63.64% -50.37% -55.56% 54.09% -30.3% N/A -12.71% 0.1% -63.5% 1.8% -64.9% 38.1% -55.8% 71.9% -41.6% 20.71% 11.5% -43.3% -48.87% 61.1% -11.9% -28.37% -10.94% -9.9% -17.51% -19.05% 18.6% -14.53% -10.71% 22.33% -34.71% -48.99% 253.5% -16.72% -1.69% -50.55% 33.61% 9.71% 8.81% -14.18% -9.74% -2.31% -14.29% -65.05% -20.14% -52.03% -28.85% -53.02% -81.64% -46.13% 16.67% -51.93% 34.9% -26.3% -28.56% 6.26% N/A N/A N/A -57.42% N/A -66.82% N/A N/A -74.96% -58.24% -72.07% -11.69% N/A N/A -56.87% -38.33% FL FL FL FL FL FL FL FL FL GA TN TX TX VA SOUTH % CHANGE AVERAGE DAYS ON MARKET ST MARKET 2015–2016 2016–2017 2017–2018 2020–2021 2018–2019 2015–2022 2021–2022 2019–2020