IRB-Brasil Re 2004

DEMONSTRAgOES FINANCEIRAS

FINANCIAL

STATEMENTS

BibI FE oteda NAsi: Lu z M G :nd( n?a

Senhores Acionistas, Submetemos a apreciacao e aprovacao de V.Sas. o Retaforio do iRB-Brasil Resseguros SA, com os principals fatos e realizacoes ocorridos no exerci'cio encerrado em 31 de dezembro de 2004, com as respectivas dem'onstracoes contabeis.

A economia mundial teve um.bom desempenho em 2004, com urn crescimento estimado medio de 4,9%.sendo que os paises em desenvolvimento e os de economia avancada cresceram 6,5% e 3.6%, respectivamente [Fonte: World Economic Outlook, FMI - setembro de 20041.

No mercado internacional, as seguradoras enfrenlaram em 2004 pedidos de indenizacao que atingiram a cifra de US$ 25 bilhdes, por causa das quatro grandes tormentas ocorridas no ano, o que provavelmente tornara 2004 o ano com o maior volume de dispendios em toda a historia dos seguros contra furacoes. Esses sinistros deverao prejudicar o resultado das empresas e ter impacto nos preqos de resseguro para o ano de 2005.

Os lucros dessas seguradoras subiram em 2003 e 2004, depois dos prejuizos recordes de 2002. 0 setor se beneficiou de tres anos de aumento das taxas, as quais agora comecam a se reduzir em algumas linhas. Os ganhos atuais estariam mais diretamente relacionados a urn possivel maior grau de exposicao e a maior demanda decorrente da atual recuperaqao economica'

A projecao do indice combinado, que e a proporcao entre premios e despesas. e de 100% para 2004, isto e, houve pouca mudanca em relacao aos 100,1% atingidos em 2003. De qualquer modo, a projecao signifies grande melhora, tendo em vista 0 resultado de 115,7% em 2001, ano afetado pelo impacto do atentado terrorists de 11 de setembro. Caso o indice combinado em 2004 fique abaixo de 100%. marcara o primeiro tucro operacional no setor de seguros patrimoniais, no mer cado americano, desde 1978.

0 IRB-Brasil Re, conforme dados-e-indicadores a seguir apresentados. demonstra estabilidade no perfil e na qualtdade de suas carteiras de negocios. evidenciando sua capacitacao e determinacao para a manutenqao do equilibrio economico-financeiro do mercado segurador nacional, com reflexos positivos para a sociedade brasileira.

CENARIO ECONOMICO E MERCADO SEGURADOR NACIONAL

A economia brasileira comemora, no encerramento da prestacao de contas do exercicio de 2004, a preservacao da estabilidade economica, refletida na solidez de suas contas fiscais e externas e no controie da inflacao.0 valor da divida publica, comparado ao PiB, vem caindo de forma sustentada. Com 0 grande aumento nas exportacoes, o saldo da balanca comercial vem crescendo, tambem de for ma sustentada. A esse contexto, associa-se a queda da inflacao. proporcionando condicbes de consisten-

cia economica e ambiente favoravel ao crescimento e a novos investimentos.

Esse ciclo de expansao trouxe reflexos positives para o mercado de seguros, com melhores riscos associados a novos clientes e consequente reducao de sinistros.

0 setor de seguros cresceu 20.82%. arrecadando R$45,09? bilhoes de janeiro a dezembro de 2004,sem considerar a receita referente aos negocios de Previdencia ComplementarAberta e de Capitalizacao.

0 ramo Vida permanece liderando esse crescimen to. com uma expansao de 37,39% em relacao a 2003,alcancando 36.76% de participaqao no merca<^0 e arrecadando R$ 16,577 bilhoes em 2004.

0 ramo Automovel apresenlou arrecadacao de R$ 10.531 bilhoes e o ramo Saude de R$ 7,611 bilhoes.

No conjunto. estes tres ramos responderam por um faturamento de R$ 34.719 bilhoes. ou cerca de 77% da arrecadacao total do mercado. significando uma variacao nominal de 26.38% em relacao ao exercicio de 2003, com elevacao de 3,30 pontos percentuais na composicao de concentracao desses negocios.

Nos tres ramos supramenctonados, as operacoes de resseguro no IRB-Brasil Re registram R$ 196,882 milhoes, ou 0.57% desses negocios.

No consolidado dos demais ramos, o mercado apresentou faturamento de R$ 10.380 bilhoes (R$ 9,854 bilhoes em 2003], com crescimento anual de 5,36%.

Desse consolidado, o resseguro junto ao IRB-Brasil Re foi de R$ 2.638 bilhoes, ou 25,41% desses nego cios 128.96% em 20031.

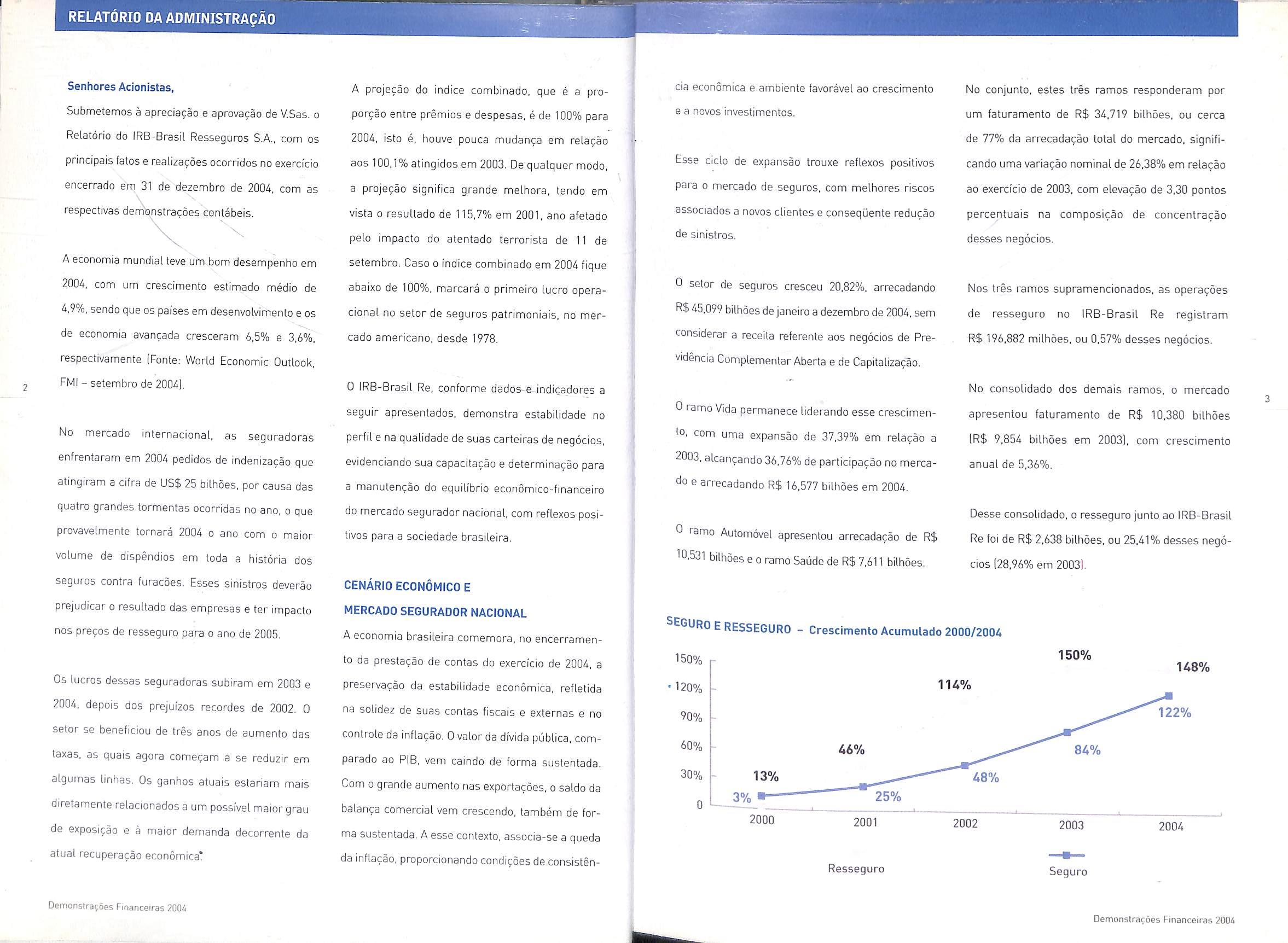

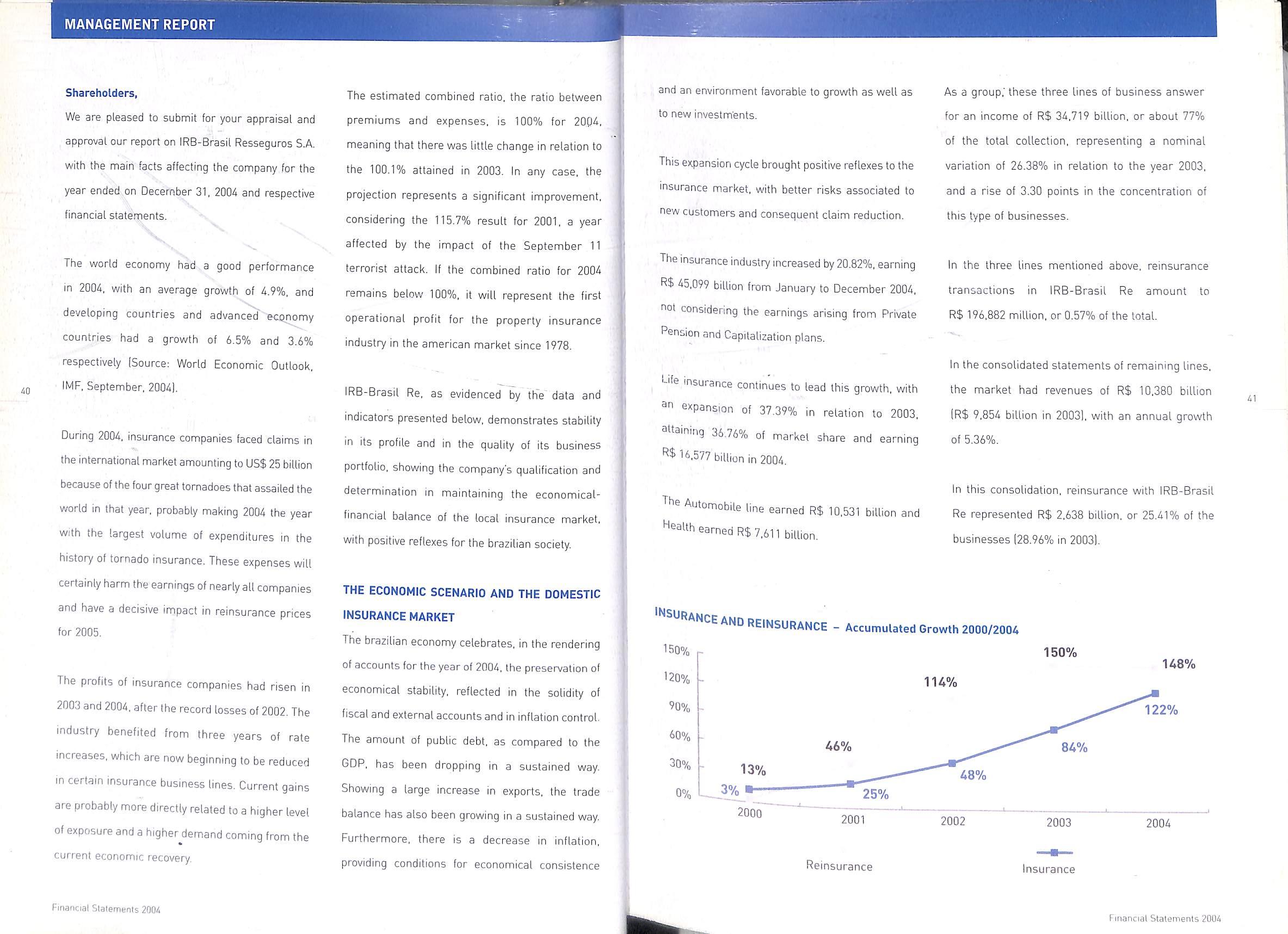

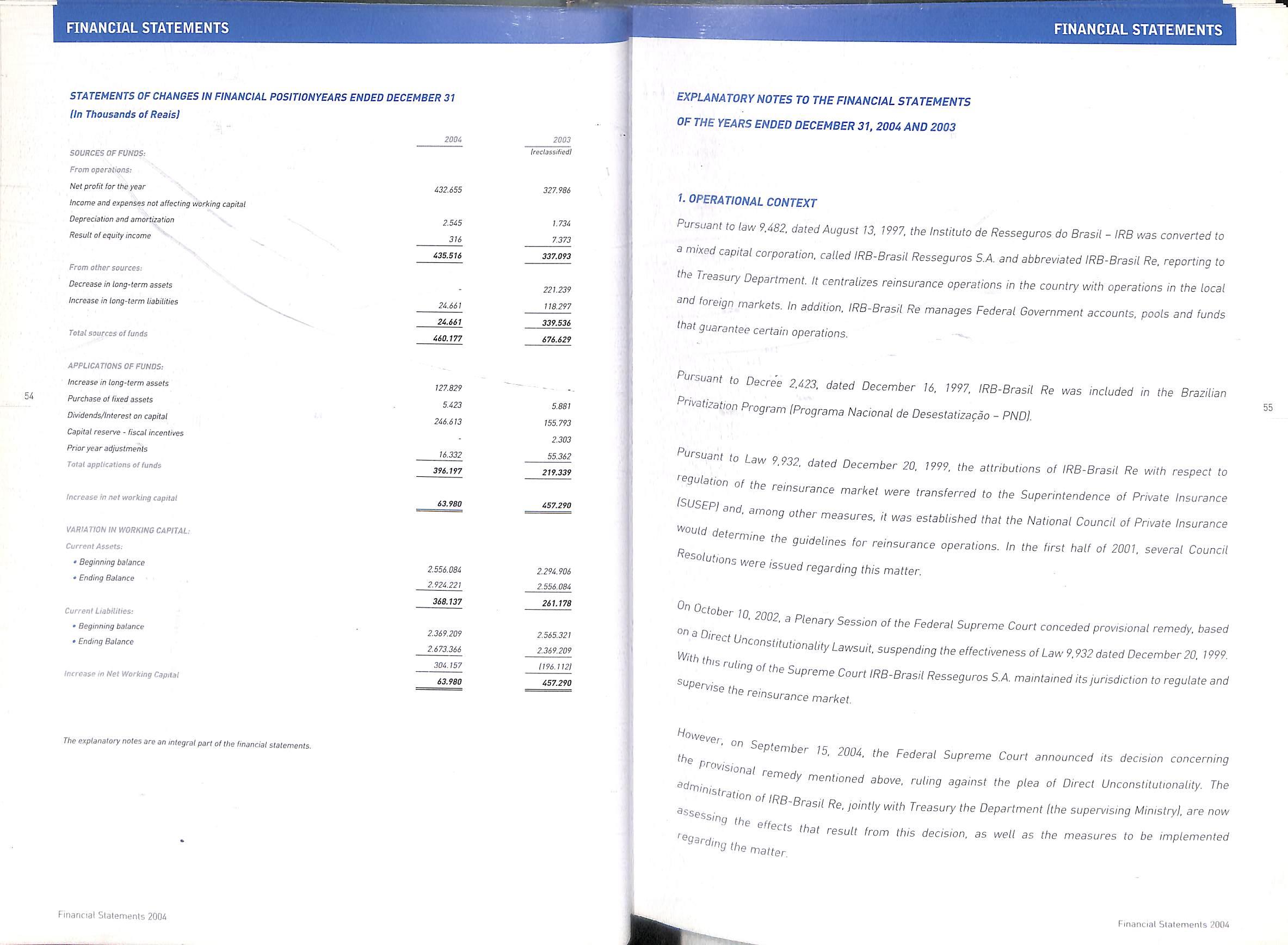

EGURo E RESSEGURO - Crescimento Acumulado 200D/2004

RELATORIO DA ADMINISTRApAO

Demonstraccies Fingnceiras 2004

150% •120% L 1U% 90% 60% 30% 0 150% U8% 122% 2000 2001 Resseguro 2002 2003 Seguro 2004 Demonstracoes Financeiras 2004

DESEMPENHO OPERACIONAL

0 IRB-Brasil Re registrou R$ 2.853 bilhoes em premios totals de resseguro, praticamente o mesmo nivel de 2003 (R$ 2,877 bilhoesl, correspondendo a 6,30% da arrecadacao do mercado (7,68% em X003).

\Contrapondo a reducao da participacao relativa no mercado, o percentual de premios cedidos para o exterior, no montante de R$ 1,410 bilhao, apresenta reducao de 11,88% em relacao ao ano de 2003 [R$ 1,600 bilhao], implicando aumento de 6,03 pontos percentuais no I'ndice de retencao de resseguro no Pals, que atingiu 50,07% do premie total auferido pela empresa [44,04% em 2003).

Dessa forma, o total de premios ganhos foi de R$ 1,394 bilhao em 2004, com um crescimento de 11,64% em relacao a 2003(R$ 1,248 bilhao],

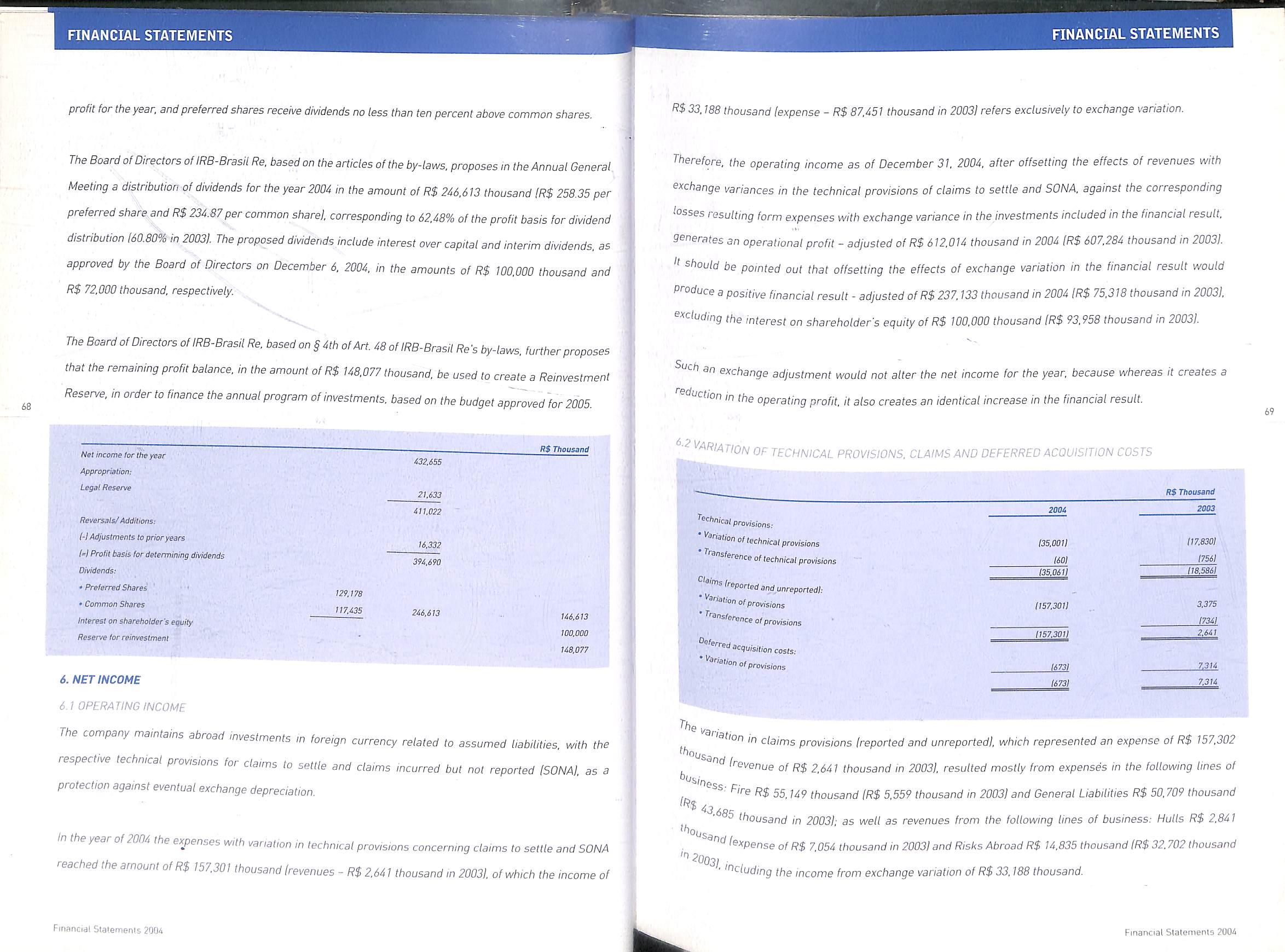

A maior arrecadacao esteve, mais uma vez, por conta do ramo Incendio, no valor de R$ 517 milhoes(R$ 468 milhoes em 2003], seguido pelos ramos R.C.Geral, com R$ 139 milhoes (R$ 136 milhoes em 2003), Garantia, com R$ 106 milhoes [R$ 75 milhoes em 2003] e Transportes tnternacionais, com R$ 80 milhoes|R$ 75 milhoes em 2003], que respondem, em conjunto, porcerca de 60% do premie retido da empresa.

As despesas com sinistros, no montante de R$ 655 milhoes em 2004, apreseiXaram aumento de

PREMIO RETIDO 2004

junto ao mercado externo, permitindo disponibilizar ao mercado segurador capacidades de ate US$ 212 milhoes e US$ 35 milhoes, respectivamente;

objetivo de tornar os processes internes mais seguros, eficazes e transparentes, tem relevo as seguintes iniciativas;

• renovacao do contrato de RC Diretores e Administradores [D&Oj, com aumento da capacidade de US$ 15 milhoes para US$ 25 milhoes e da participacao do IRB-Brasil Re de 25% para 30%, para cobertura ao mercado interno;

32,91% em comparacao a 2003 1R$ 492 milhoes), alavancado por significative incremento na variacao da provlsao de sinistros a liquidar, porem, refletindo baixo fndice de sinistralidade: 46,98%, ante 67,01% apurado pelo mercado em 2004.

0 resultado operacional, assim como ocorreu com a sinistralidade, teve um desempenho positivo no exerclcio de 2004, atingindo a cifra de R$ 645 milhoes, contra R$ 695 milhoes em 2003.

0 Indice combinado apresentou, em 2004, tambem um bom resultado, atingindo 0,72 [0,62 em 2003).

No ambito das acoes do IRB-Brasil Re em favor da dinamica e do desenvolvimento do mercado national de seguros, no ano de 2004, destacam-se as seguintes:

■ renovacao dos programas de resseguro das carteiras de Propriedade e Responsabilidade Civil

■ novos contratos de resseguro diferenciado para o segmento dos muLtirriscos;

■ novos contratos de resseguro diferenciado e renovacao de contratos para tarifas proprias das seguradoras para RD Equipamentos;

■ implantacao de nova rotina de subscricao para aeronaves agrlcolas, atendendo demanda do mer cado e permitindo a pratica de taxas mais competitivas nesse segmento;

■ desenvolvimento de piano operacional para a aceilacaode resseguropara previdenciacomplementar;e

■ renovacao dos programas de retrocessao em '^elhores condicoes de maneira geral, disponibi^izando as seguradoras ampla capacidade automatica, maior agilidade nas contratacoes e li^'Jidez nos pagamentos.

are o desenvolvimento das operacoes, com o

■ continuidade no processo de implantacao do Sistema Integrado de Negocios-SIN, integrando as areas de subscricao e contas tecnicas, em plataforma WEB;

■ criacao de grupo de trabalho para revisar as Fptinas operacionais do IRB-Brasil Re, com otimizacao e adequacao ao novo Sistema Integrado de Negocios;

■ ampliacao da cultura interna de pluralidade na tomada de decisao, com a reativacao do Comite de Investimentos, criacao do Comite de Security (ambos com a participacao do mercado], bem como do Comite de Planejamento e Orcamento e do Comite de Colocacao de Excedentes;

■ edicao de regulamento de diretrizes e normas para a Polltica de Colocapao de Excedentes, precedido de consulta publica ao mercado;

■ ampliacao do numero de reguladores e peritos, atraves da abertura de novo cadastro, assumindo as regulacoes de sinistros em que o resseguro tem participacao majontaria;

■ celebracao de convenio IRB-Brasil Re-UFRJ para desenvolvimento de sistema de apoio a decisao de

RELATORIO DA ADMlNlSTRApAO

Demonstracoes Financeiras ?G04

7% 1% 12% 51% 24% ■ PROPRIEDADE ■ TRANSPORTES ■ FINANCEIROS □ GOVERNO ■ PESSOAIS ■ RETROCESSAO

Demonslrafoes Financeiras 200i

retencoes proprias, otimizando a capacidade operacional; e

■ elaboracao de pfano de acao, com identificacao de oportunidades de negocios.

Ainda no contexto opej;^cional, esta- em curso contratacao de consultoria especializada para efetuar a reavaliacao atuahal da carteira em run off das operafoes aceitas no exterior nos anos 80.

DESEMPENHO FINANCEIRO

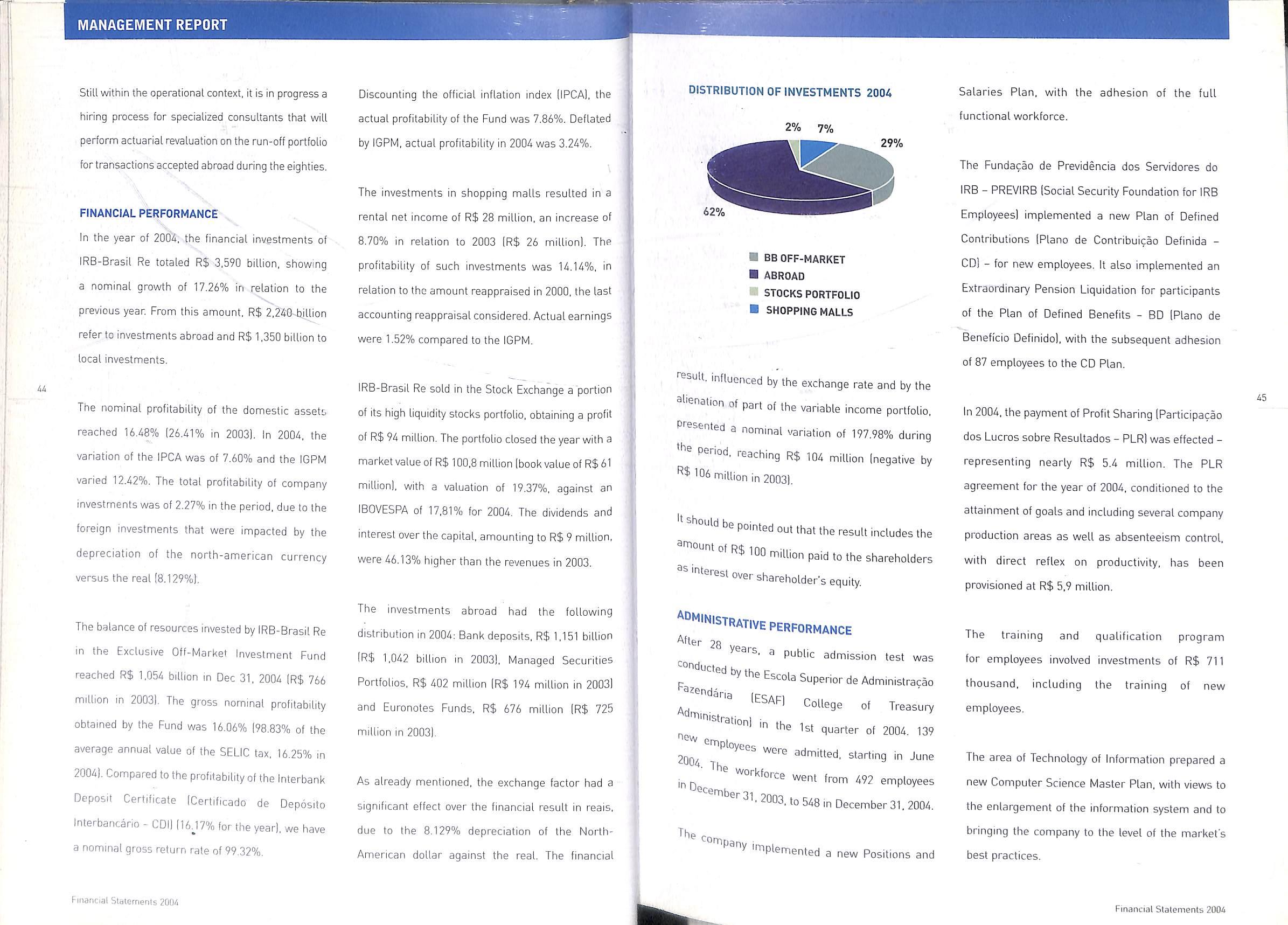

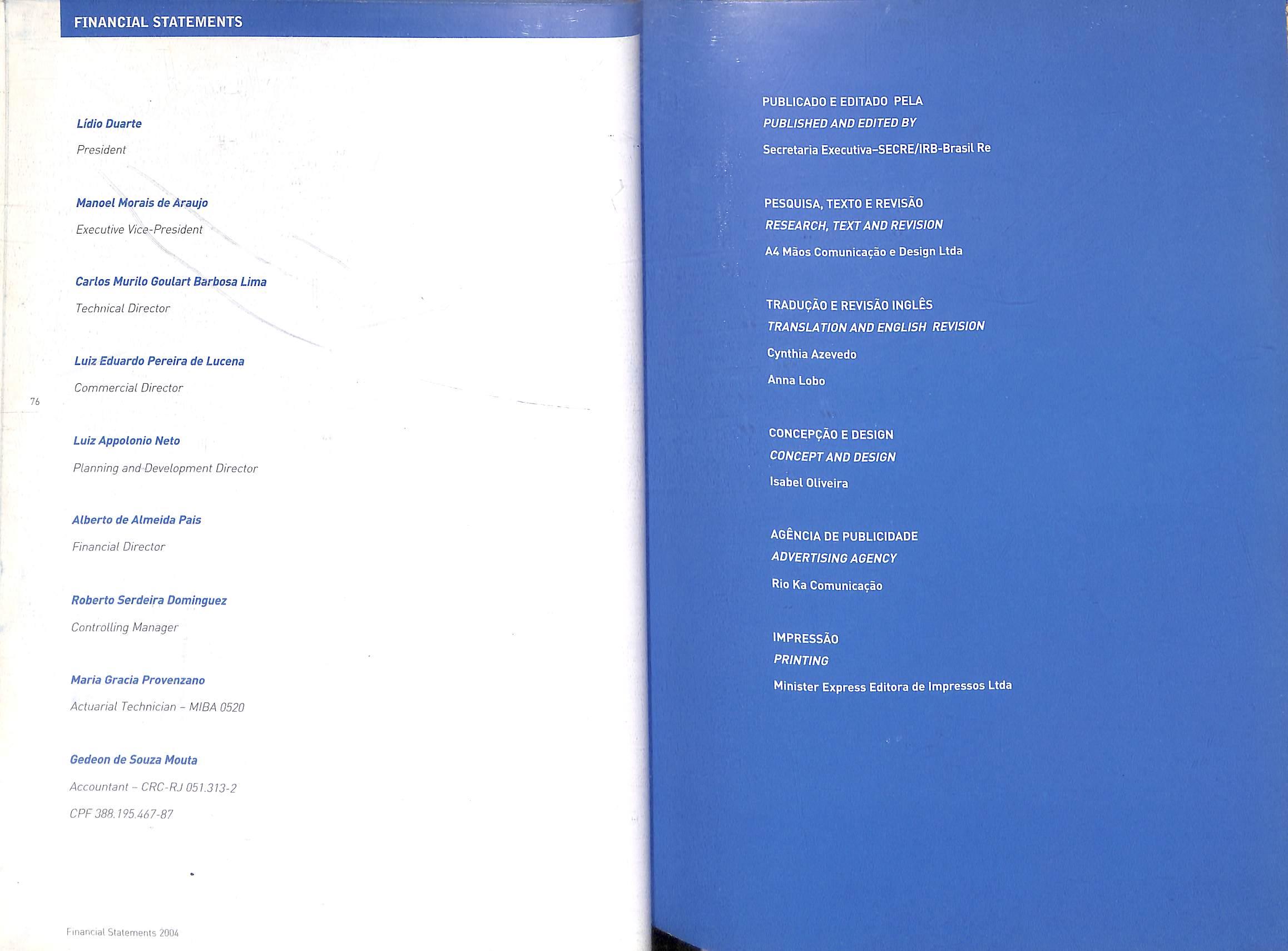

No exercicio de 2004, os investimentos e aplicacoes financeiras do IRB-Brasil Re totalizaram R$ 3,590 bilhoes, apresentando urn crescimento nominal de 17,26% em relacao ao exercicio anterior. Desse total, R$ 2,240 bilhoes referem-se a investimentos no exterior e R$ 1,350 bilhao a aplicacoes no Pats.

A rentabilidade nominal dos ativos no Pais alcancou 16,48% 126,41% em 20031. No ano de 2004, a variacao do IPCA foi de 7,60% e do IGPM de 12.42%. A rentabilidade total dos investimentos da empresa foi de 2,27% no periodo, por influencia dos investimentos no exterior, impactados pela desvalorizacao da moeda norte-americana frente ao Real (8,129%!.

0 satdo de recursos aplicados pelo IRB-Brasil Re no Fundo de Invesfimento Extramercado Exclusivo atingiu R$ 1,054 bilhao, em 31.12.2004 [R$ 766 milhoes em 2003). A rentabiMade bruta nominal

obtida no Fundo foi de 16,06%(98,83% do valor anual medio da taxa SELIC, de 16,25% em 20041. Comparada a rentabilidade do Certificado de Deposito Interbancario-CDI (16,17% no exercicio), temos uma taxa bruta de retorno nominal de 99,32%.

Descontada pelo indice oficial de inflacao [IPCAl, a rentabilidade real do Fundo foi de 7,86%. Deflacionada pelo IGPM, a rentabilidade real em 2004 ficou em 3,24%.

tribuicao em 2004: Depositos Bancarios, R$ 1,151 bilhao 1R$ 1,042 bilhao em 2003), Carteiras Administradas de Titulos, R$ 402 milhoes (R$ 194 milhoes em 2003) e Fundos Euronotes, R$ 676 milhoes lR$ 725 milhoes em 2003).

DESEMPENHO ADMINISTRATIVO

Os investimentos em Shopping Centers resultaram em uma receita liquida de alugu% de R$ 28 milhoes, com urn crescimento de 8,70% em relacao a 2003 (R$ 26 milhoes). A rentabilidade desses investimentos foi de 14,14% em relacao ao valor reavaliado no ano de 2000, ultima avaliacao considerada contabilmente. 0 ganho real foi de 1,52%, comparado ao IGPM.

0 IRB-Brasil Re vendeu. em Bolsa de Valores, parte da carteira de acoes de alta liquidez, auferipdo lucro de R$ 94 milhoes. A carteira encerrou o exercicio com valor de mercado em R$ 100,8 milhoes [valor contabil de R$ 61 milhoes), com valorizacao de 19,37%, contra o IBOVESPA de 17,81% em 2004. Os dividendos e juros sobre

0 capital recebidos, no montante de R$ 9 milhoes, foram 46,13% superiores aos rendimentos de 2003.

Os investimentos no exterior tem a seguinte dis-

Como ja mencionado, o fator cambial teve efeito sobre o resultado financeiro em Reais, face a des valorizacao de 8.129% da moeda norte-americana frente ao Real. 0 resultado financeiro, influenciado pelo cambio e pela alienacao de parte da carteira de renda variavel, apresenta variacao nominal de 197,98% no periodo,'atingindo o valor R$ 104 milhoes (negattvo de R$ 106 milhoes em 2003).

E relevante registrar que esse resultado embute o valor de R$ 100 milhoes pago aos acionistas a titulo de juros sobre o capital proprio.

Depois de 28 anos, foi realizado concurso publico, atraves da Escola Superior de Administracao Fazendaria (E5AF), no 1° trimestre de 2004. Foram admitidos 139 novos empregados. a partir de junho de 2004.0 quadro proprio de pessoal da empresa evoluiu de 492 empregados. em 31.12.2003, para 548, em 31.12,2004.

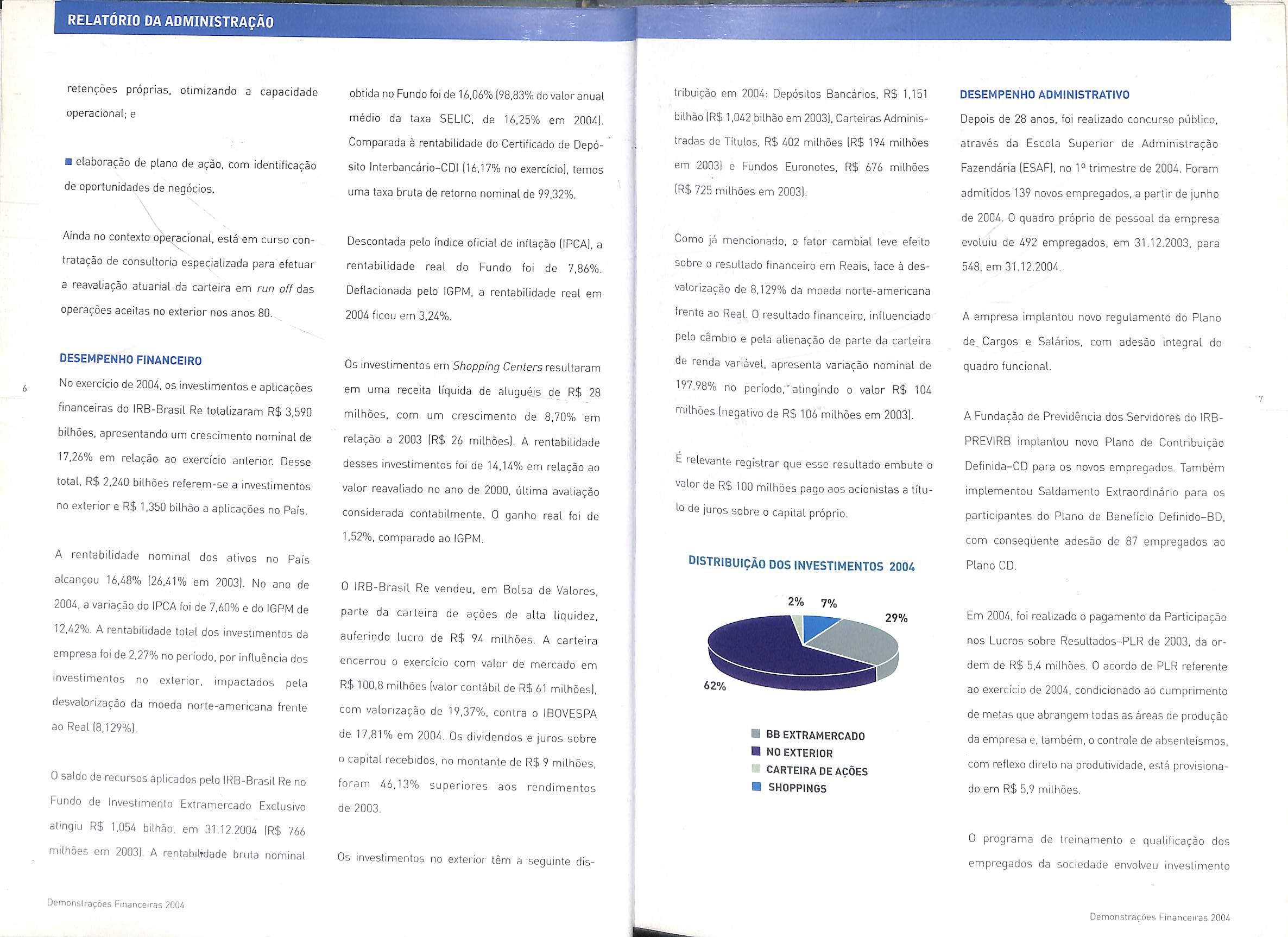

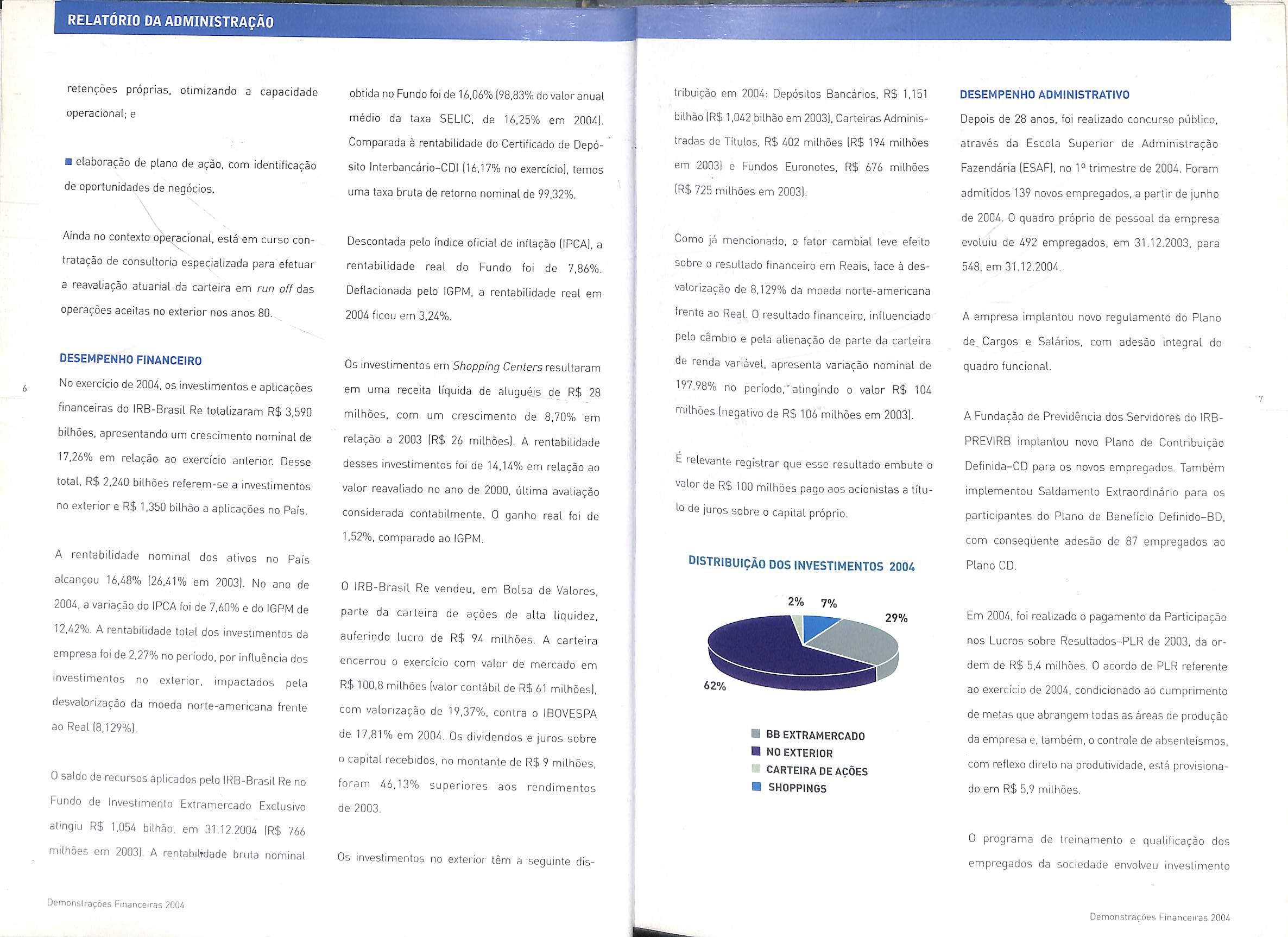

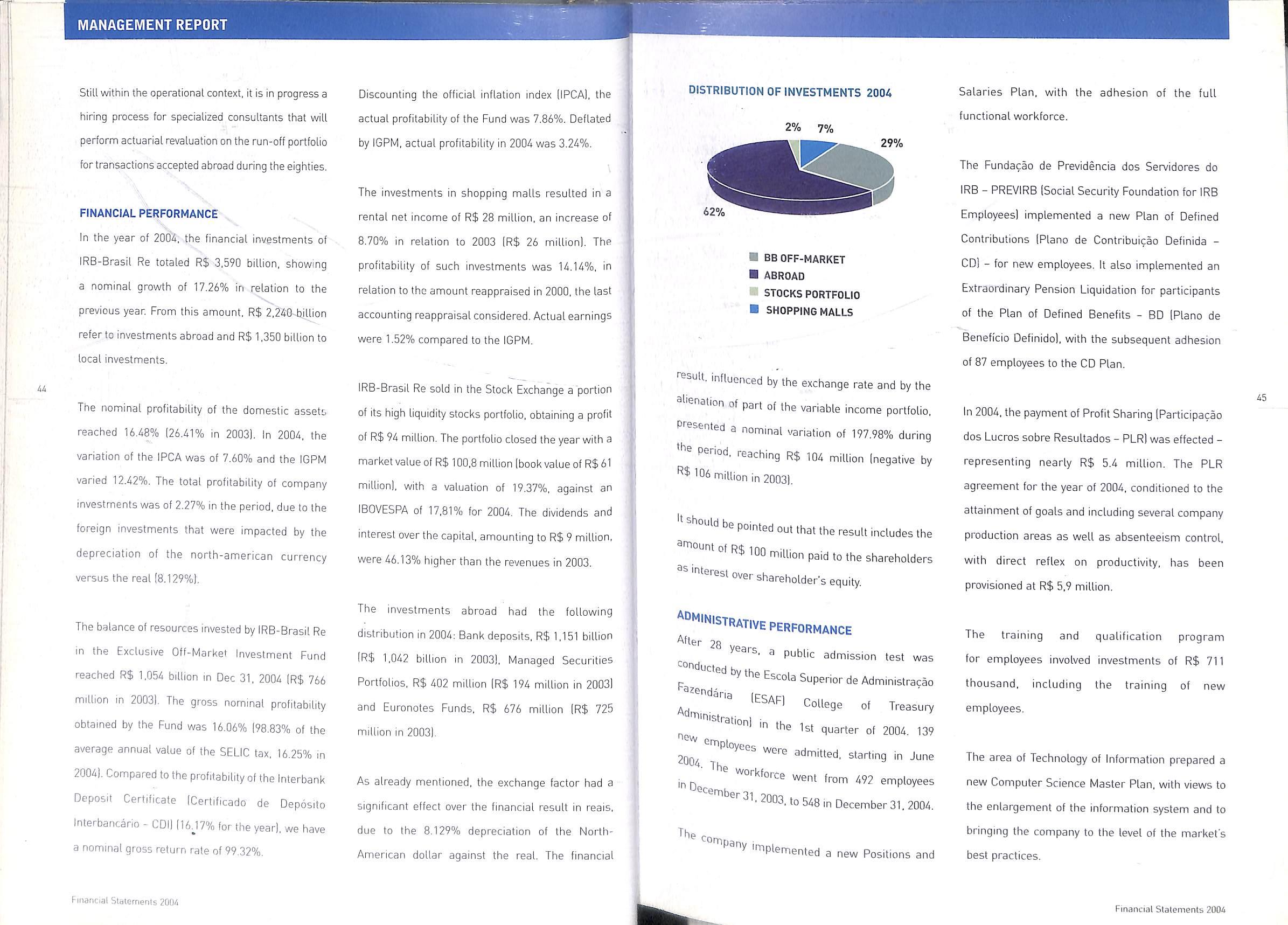

DISTRIBUICAO DOS INVESTIMENTOS 2004

A empresa implantou novo regulamento do Piano de.. Cargos e Salaries, com adesao integral do quadro funcional.

A Fundacao de Previdencia dos Servidores do IRBPREVIRB implantou novo Piano de Contribuicao Definida-CD para os novos empregados. Tambem implementou Saldamento Extraordinario para os participantes do Piano de Beneficio Definido-BD, com consequente adesao de 87 empregados ao Piano CD.

Em 2004, foi realizado o pagamento da Participacao nos Lucros sobre Resultados-PLR de 2003, da ordem de R$ 5,4 milhoes. 0 acordo de PLR referente ao exercicio de 2004, condicionado ao cumprimento de metas que abrangem todas as areas de producao da empresa e, tambem,o controle de absenteismos, com reflexo direto na produtividade, esta provisionado em R$ 5,9 milhoes.

0 programa de treinamento e quaiificacao dos empregados da sociedade envolveu investimento

RELATORIO DA ADMINISTf^f'

Demonstra?6es Financeiras 2004

2% 7% 29% 62% BBEXTRAMERCADO NO EXTERIOR CARTEIRA DE ACOES SHOPPINGS

DemonstracSes Financeiras 2004

de R$ 711 mil, incluindo o treinamento dos novos empregados,

A area de Tecnologia da Informacao elaborou novo Piano Diretor de Informatica, com vistas a ampliacao do sistema^^fie informacao da empresa e seu nivelamento as meB5_^res praticas do mercado.

0 novo Sistema Integrado de Negocios-SIN, importante marco no processo de modernizacao do IRB-Brasil Re, ja em operacao, implementa a incorporacao de diversos outros ramos. Tambem ja se encontram definidos e em processo de contratacao para desenvolvimento os projetos SIN Vida e de Cotacao.

A empresa implementou o envio de importantes movimentos pperacionais com o mercado segurador, via internet, iniciando processo de desativacao da antiga Rede da Comunidade de Seguros-RECOMS.

Destacam-se dentre os programas sociais a continuidade do Programa de Iniciacao ao Trabalho, em parceria com a Associacao Beneficente Sao Martinho, que teve, em 2004, 30 adolescentes, em media, exercendo atividades de mensageiro ou de servicos gerais administrativos. com gastos de R$ 269 mil.

Em 2004, 0 IRB-Brasil Re contou com a mao-deobra de 37 deficientes auditivos, em atividades de digitacao. auxiliar administrative, higienizacao de documentos e analise de sistemas, per intermedio da Federacao Nacional de Educacao e Integracao dos Surdos-FENEIS, com gastos de_R$ 710 mil.

No ambito do Programa de Estagiarios de 2° e 3° graus,feito em parceria com a Fundacao Movimento Universitario de Desenvolvimento Economico e Social-MUDES, a empresa ofereceu oportunidade de complementacao academica a 34 estagiarios de 2° grau e 57 de 3°, com carga horaria media de 5hs/dia, totalizando gastos de R$ 621 mil.

I R$ Receita Bruta por Empregado

I R$ Faturamento Bruto por Empregado

desempenhogeral

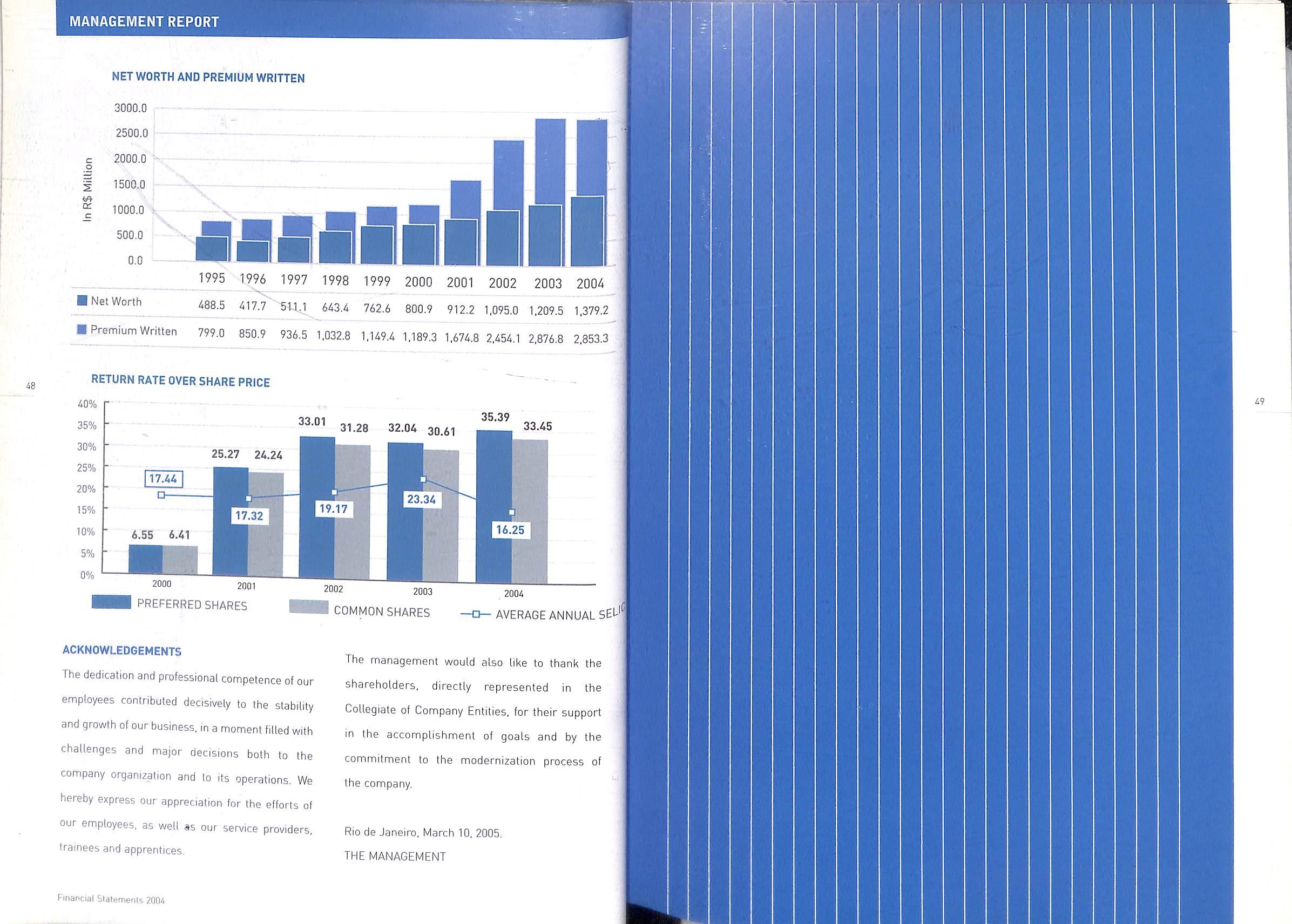

0 IRB-Brasil Re encerrou o exercicio de 2004 com um lucro liquido de R$ 433 milhoes, com crescirnento nominal de 32% em relacao ao exercicio anterior. 0 patrimonio liquido atingiu o valor de R$ 1,379 bilhao,com uma evolucao nominalde 14%.

A rentabilidade do patrimonio liquido inicial ajustado atingiu o percentual de 36,26%.

Diversos sistemas financeiros, administrativos e de seguranca foram aprimorados ou impiementados, com resultados positives para a melhoria dos processos envolvidos.

A empresa segue enfatizando sua atuapao na area da responsabilidade social. Em 2004 foi elaborado e divulgado o primeiro Balance Social - 2003, com selo de certificacao fornecido pelo IBASE.

0 papel social da organizacao foi enfatizado, tambem, por acoes de voluntariado do seu quadro funcional, beneficiando instituicoes, despertando a solidariedade, promovendo a cultura e o clima organizacional.

As despesas administrativas, no montante de R$ 182 milhoes, apresentaram aumento de 9,69% em relaqao a 2003[R$ 166 milhoes], decorrente, principalmente, da elevaqao do seu quadro funcional e de despesas com provisoes para passives contingentes.

Os dividendos propostos, de R$ 247 milhoes

258,35 por acao preferencial e R$ 234,87 por ordinariaj. correspondem a 62,48% do lucrobase para distribuiqao. Esse valor inclui a parcela de juros sobre o capital proprio e de dividendos ante'pados, aprovada pelo Conselho de Administracao

06.12.2004, nos monlantes de R$ 100 milhoes e 72 milhoes, respeclivamente.

RELATORIO DA ADMlNlSTRApAO

PRODUTIVIDADE

- 1,00 DC 0 "O 1/1 01 lO 2000 2001 2002 2003

DA MAO-DE-OBRA

2004 Demonstracoes Fmanceiras 200i Demonslragoes Fmanceiras 200i

A competencia profissional e a dedicapao de nossos empregados contribuiram decisivamente para a manutencao da estabilidade e crescimento de nossos negocios, em momento de grandes desafios e de importantes definicoes para a organizacao e 0 funcionamento da empresa, Expressamos nosso reconhecimento e agradecemos o empenho do corpo funcional, bem como de nossos prestado-

res de servicos, estagiarios e menores aprendizes.

A administracao expressa, tambem, seu reconhecimento aos acicnistas, represenlados diretamente pelos Orgaos Societarios Colegiados, pelo apoio no atingimento das metas e pelo compromisso com o processo de modernizacao da empresa.

Rio de Janeiro, 10 de marco de 2005

A ADMINISTRACAO

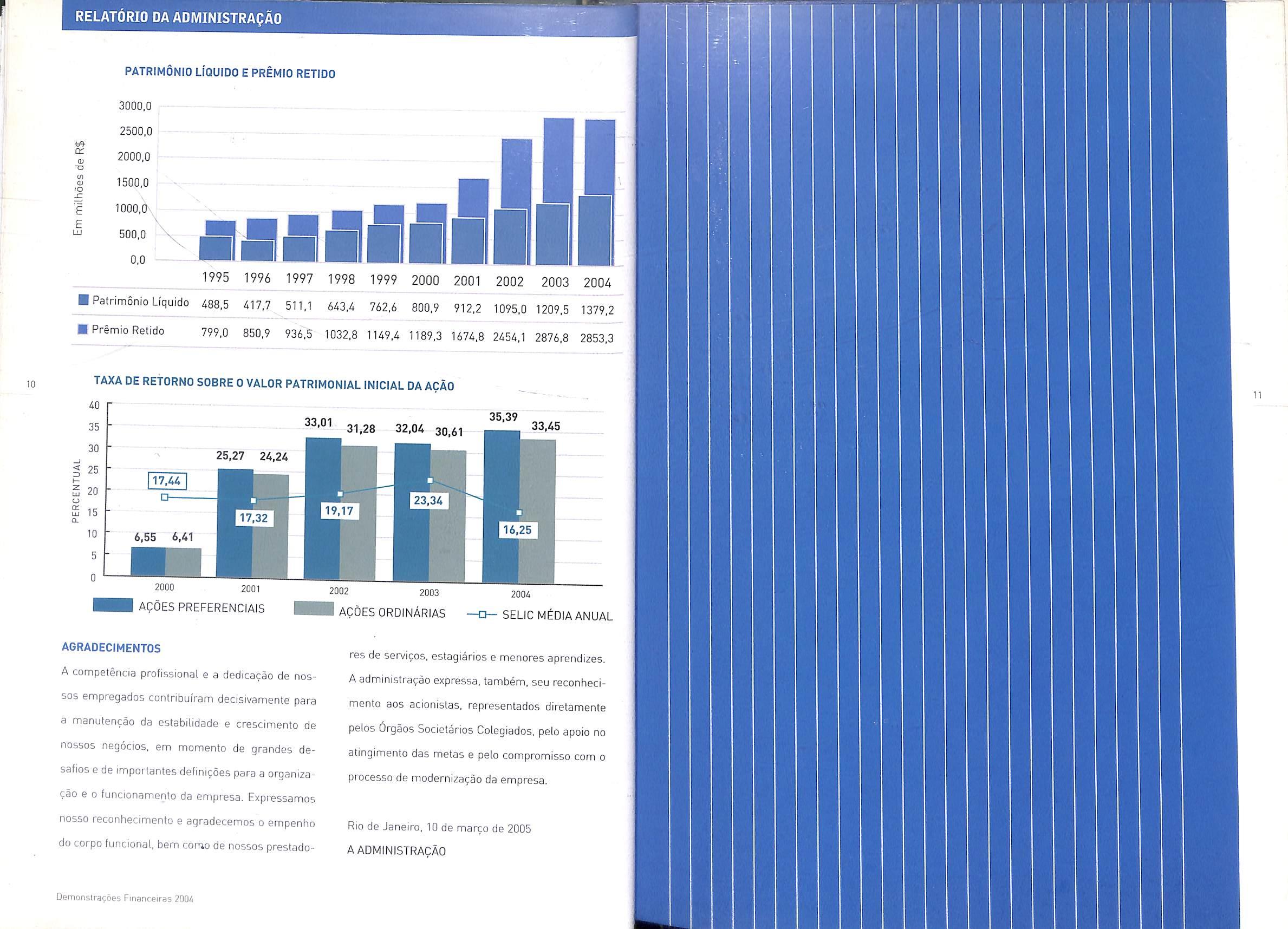

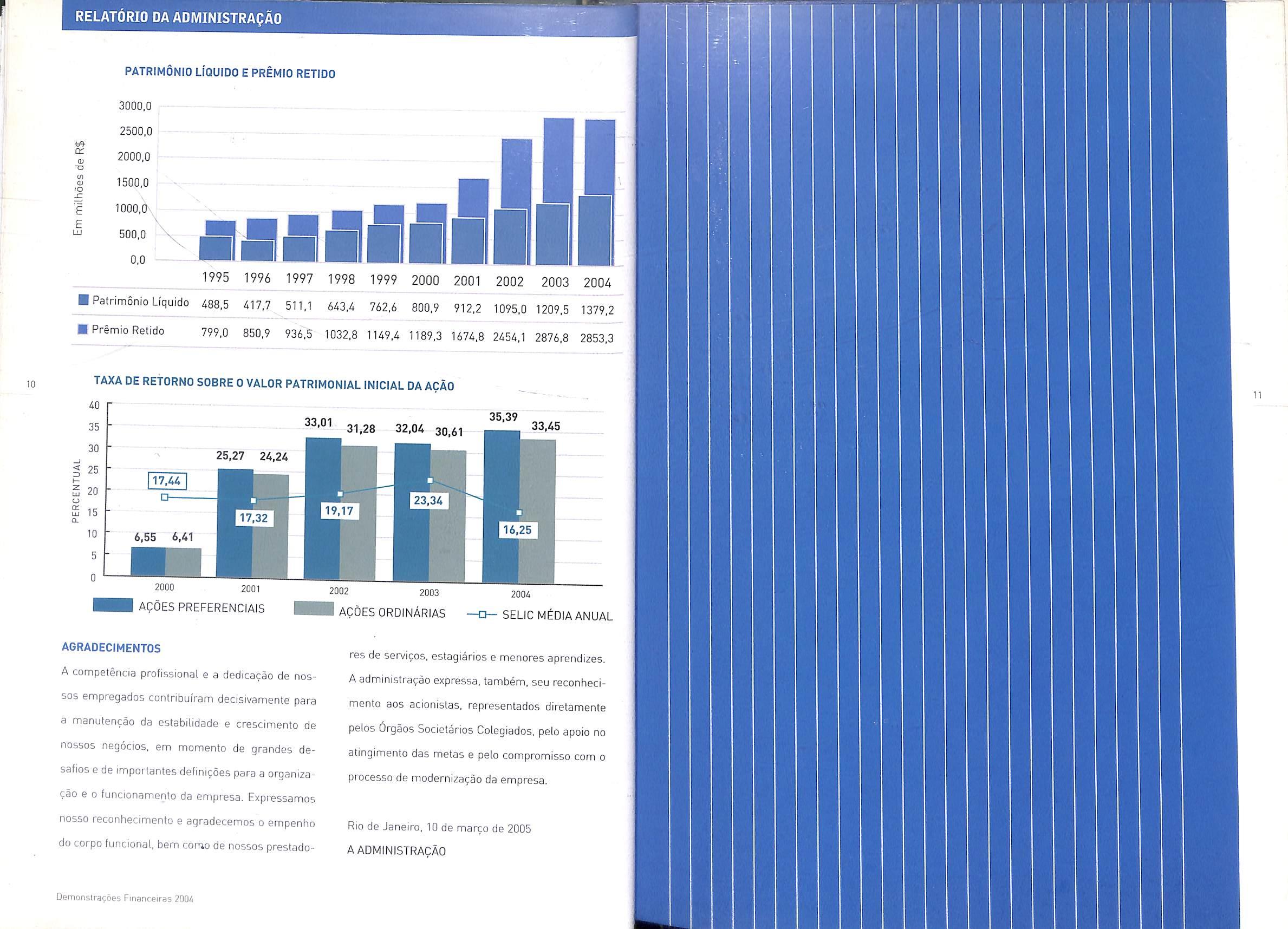

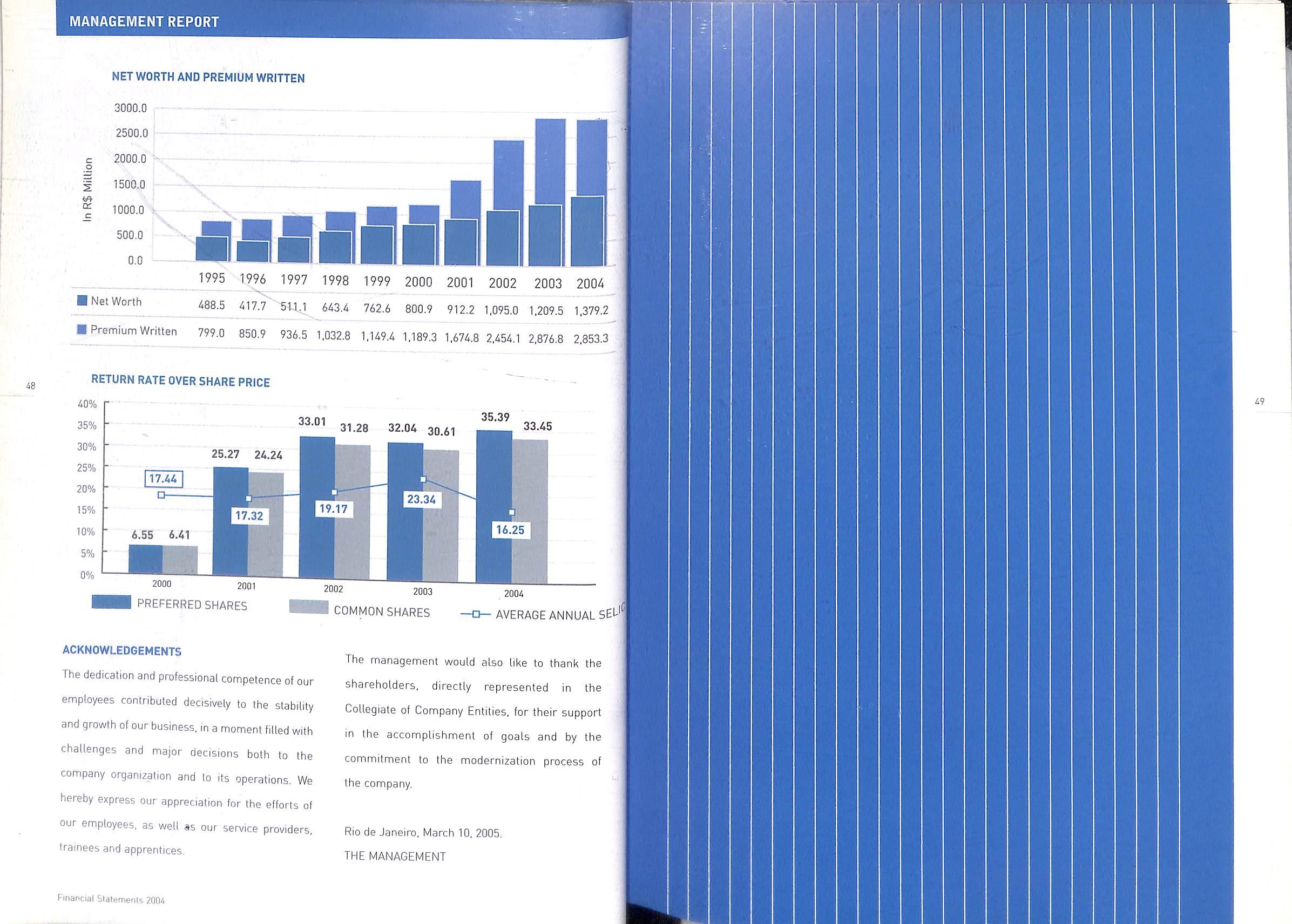

RELATORIO DA ADMINISTRApAO «• q: 01 "O to tu iO £ LU PATRIMONIO LIQUIDO E PREMIO RETIDO 3000,0 2500,0 2000,0 1500,0 1000,^, 500,0 0.0 ■llllll 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 M Patrimonio U'quido 488,5 417,7 511,1 643,4 762,6 800,9 912,2 1095,0 1209,5 1379,2 ■ Premio Retido 799,0 850,9 936,5 1032,8 1149,4 1189,3 1674,8 2454,1 2876,8 2853,3 10 TAXA DE REtORNO SOBRE 0VALOR PATRIMONIAL INICIAL DAACAO 40 35 30 < 25 33,01 31,28 32,0A 30.61 35,39 33,45 UJ u 01 6,55 6.41 20 15 Q. 10 5 0 2000 2001 AC0E5PREFERENCIAIS AGRADECIMENTOS

2002 2003

ACOESORDINARIAS 2004 SELICM^DIA ANUAL

I

Demonsirafoes Financeiras 2Q04

BALANCO PATRIMONIAL EM 31 DE DEZEMBRO (Em milhares de reals)

ATIVO

CIRCULANTE

Oisponlbilidades

Apllcsfoes financeiras:

• Moeda nacional:

• Operacoes exlramercado

• Carteira de apoes

• Provisao para desvaionzacio de acoes

• Moeda estrangeira; \

• Deposilos a prazo fixo no exterior

• Recursos administrados por instilui?oes tmanceiras apticados em renda fixa e variavel

• Provisao para perdas

Deposilos bancarios vincolados a carlas de credilo no exterior

Seguradoras, por operapdes em geral

• Provisao para credilos de liquidapio duvidosa

Outras comas a receber

Creditos tributarios

Adiartamentos ao Escritdrio de Londres

Despesas de oomercializapao diferidas

Oulros creditos

REALIZAVEL A LONGO PRAZO

Aplicacbes financeiras

• Moeda estrangeira:

• Recursos administrados por instiluicoes financeiras apticados em renda fixa e varjavel

• Provisao para perdas

Creditos tributarios

Deposilos judiciais

Oulros devedores

• Provisao para credilos de iiquidapao duvidosa

PERMANENTE

BAUN^O PATRIMONIAL EM 31 DE DEZEMBRO (Em milhares de reals)

PASSIVO E PATRIMONIO LIQUIDO CIRCULANTE

Provisoes tecnicas:

• Premios naoganhos

• Riscos deporridos

Provisoes de sinistros a liquidar:

Sede:

• Avisados

< Nao avisados

• Catastrole automoveis

Escritdrio de Londres:

• Avisados

• Nao avisados

Seguradoras, por operapoes em geral

Seguradora, porretencdes de provisoes tdcnicas

Pundos, consdrcios e contas

Comas de despesasa pagarou provisionadas;

• Provisao para imposto de renda c cdnlribuigao social

• Parlicipacao nos lucres

• Encargos trabalhlstas e previdenciarios

• Provisao para contingencias trihutarias

• Outras contas a pagar

Dividendos/Juros sobre o capital prdprio

EXIOiVELA LONGO PRAZO

^undos. consdrcios e contas

FrovisSo para beneficios previdencidrios

'''•ovisao para contingenciastrabalhistaseprevidenciarias

Provisao para contingencias tributarias

PATRIMONIO LIOUIDO

Capital realizado alualizado

de lucres

As explicaiivassaoparteinlegrantredasdemonslragdesconlabeis.

DEMONSTRAPOES HNANCEIRAS "■■•' '•VR-iNj 12

Inveslimenlos • Provisao para desvalorizapao Imobitizado: • Terrenes e imoveis • Maquinas e equipamentos • Outros • Depreciapao acumulada Diferido Amortizapao TOTAL

200A 2003 120.260 1.054,038 57.231 (2.3551 1.151.712 256.468 (152.9271 2.366.167 3.295 367.707 1103.005) 10.779 124.670 3 28.221 6.124 437.794 2.924.221 1-143.084 1161.5691 981.515 170.471 7.985 86.622 174.5751 190.503 1.172.018 318.704 (59.100) 259.604 31.709 10.184 5.929 117.734] 30.088 412 317 290.009 4.386.248 (recldssificado) 109.057 765.561 83.576 (2.3S5) 1.041.736 228.655 (153.885) 1.963.288 6.994 403.640 176.9521 13.379 101.800 J.225 28.893 4.760 483.739 2.556.084 1.042.234 (189.6541 852.580 172.789 7,460 86.674 175.314) 191.609 1.044.189 318.623 (58.2861 260.337 31.110 9.019 2-548 115.567) 27.110 267.447 3.887.720 Oemonstrapoes Financeiras 2004

Reserva

total 2004 2D03

Posorva de capital Paserva de reavaliaclo

296.080 13.946 310.026 1.104.830 206.979 4-297 131.602 144.637 1.S92.345 329,704 19.195 65.264 27.920 6.095 48.259 25.520 9.097 239.941 2.673.366 673. 163.624 71.325 98.035 333.657 750.000 29.520 21.075 578.630 1.379.225 4.386.248 266.417 8.608 275.025 946.577 208.139 4.090 158.523 184.733 1.502.062 315.011 21.657 65.699 74.576 5.359 43.490 3.513 62.817 2.369.209 710 147.895 69.809 90.582 308.996 750.000 29,520 21.075 408,920 1.209.515 3.887.720 13 Demonslragoes Financeiras 2004

DEMONSTRAQOES FINANCEIRAS

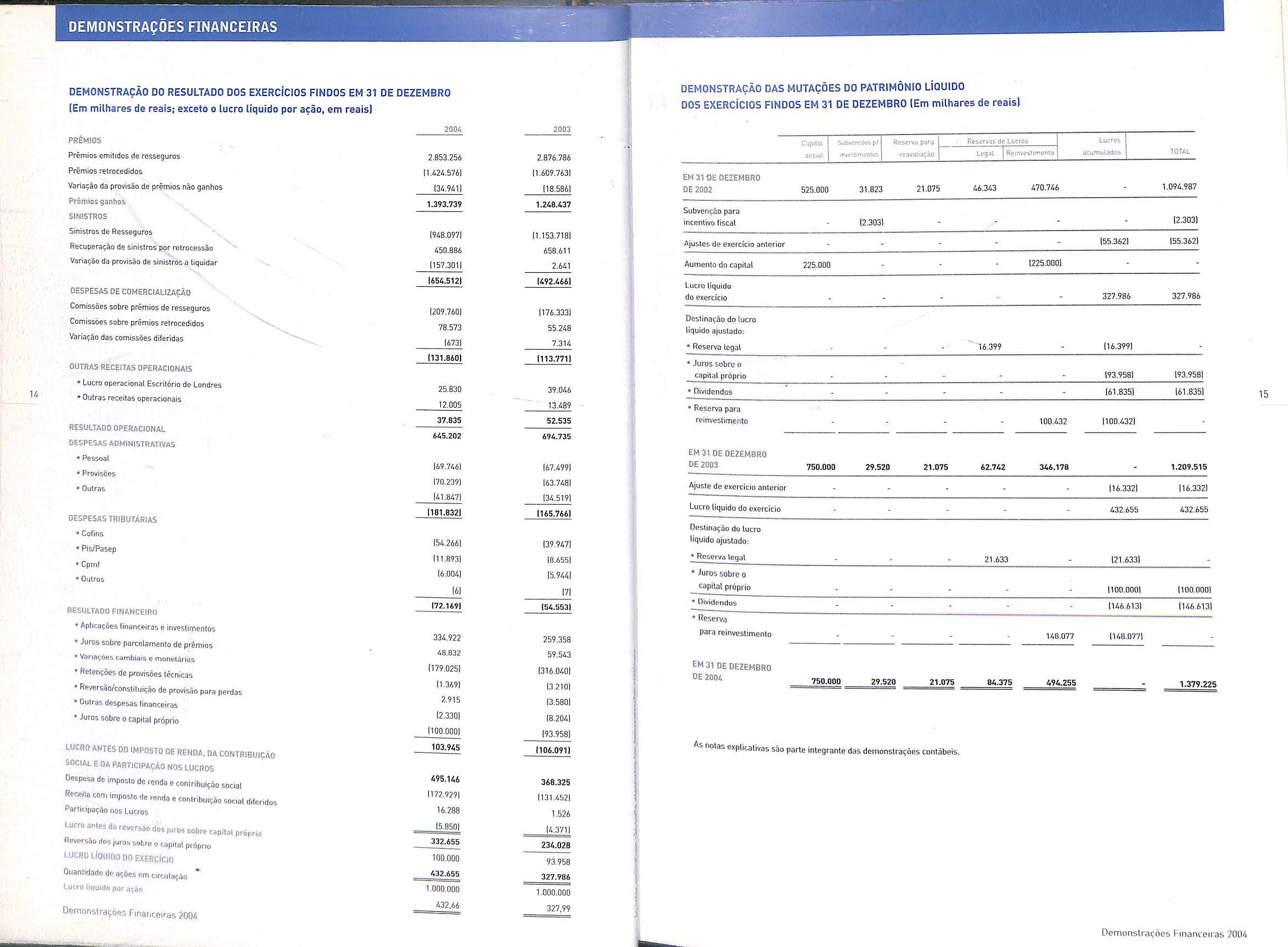

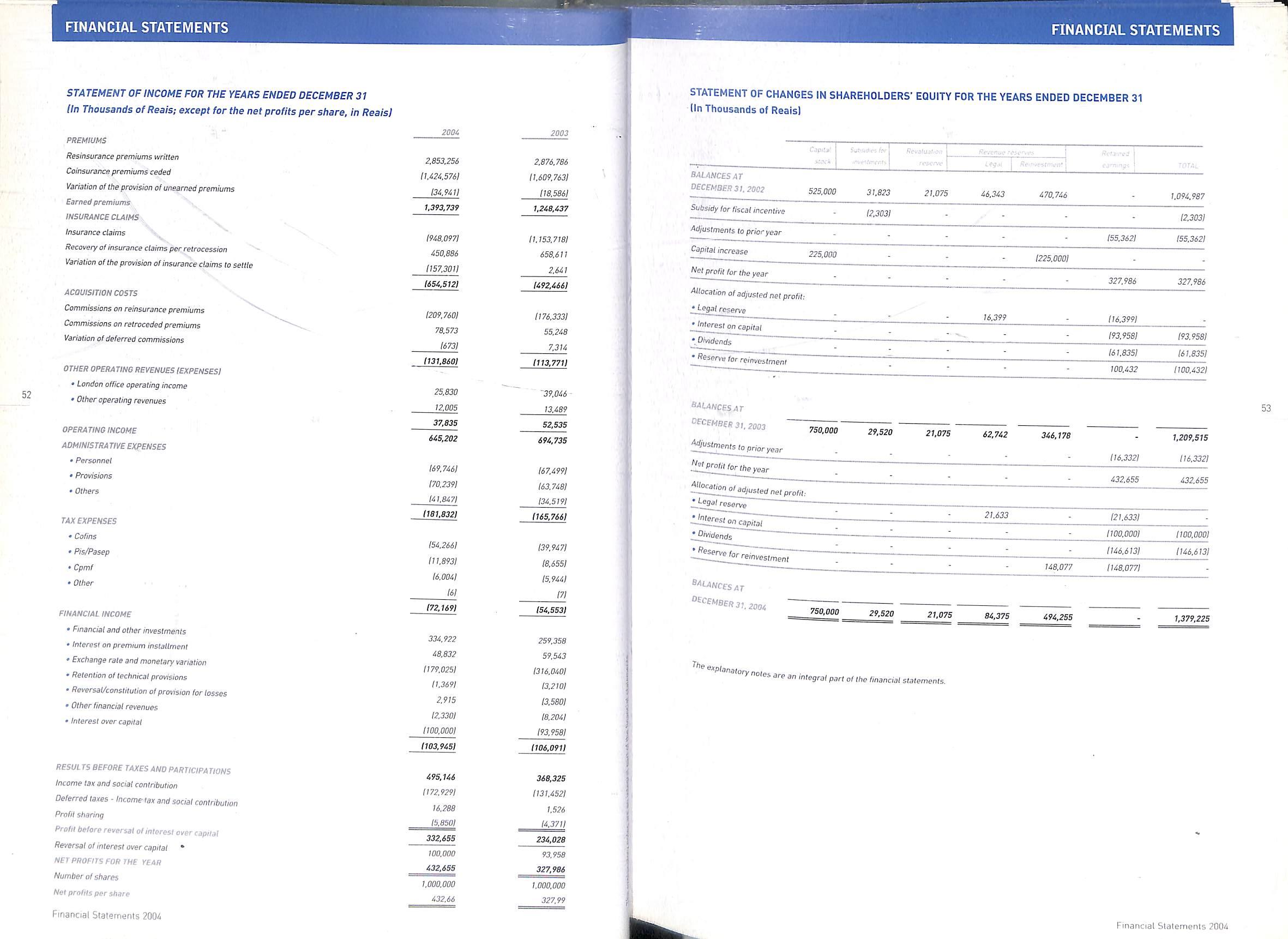

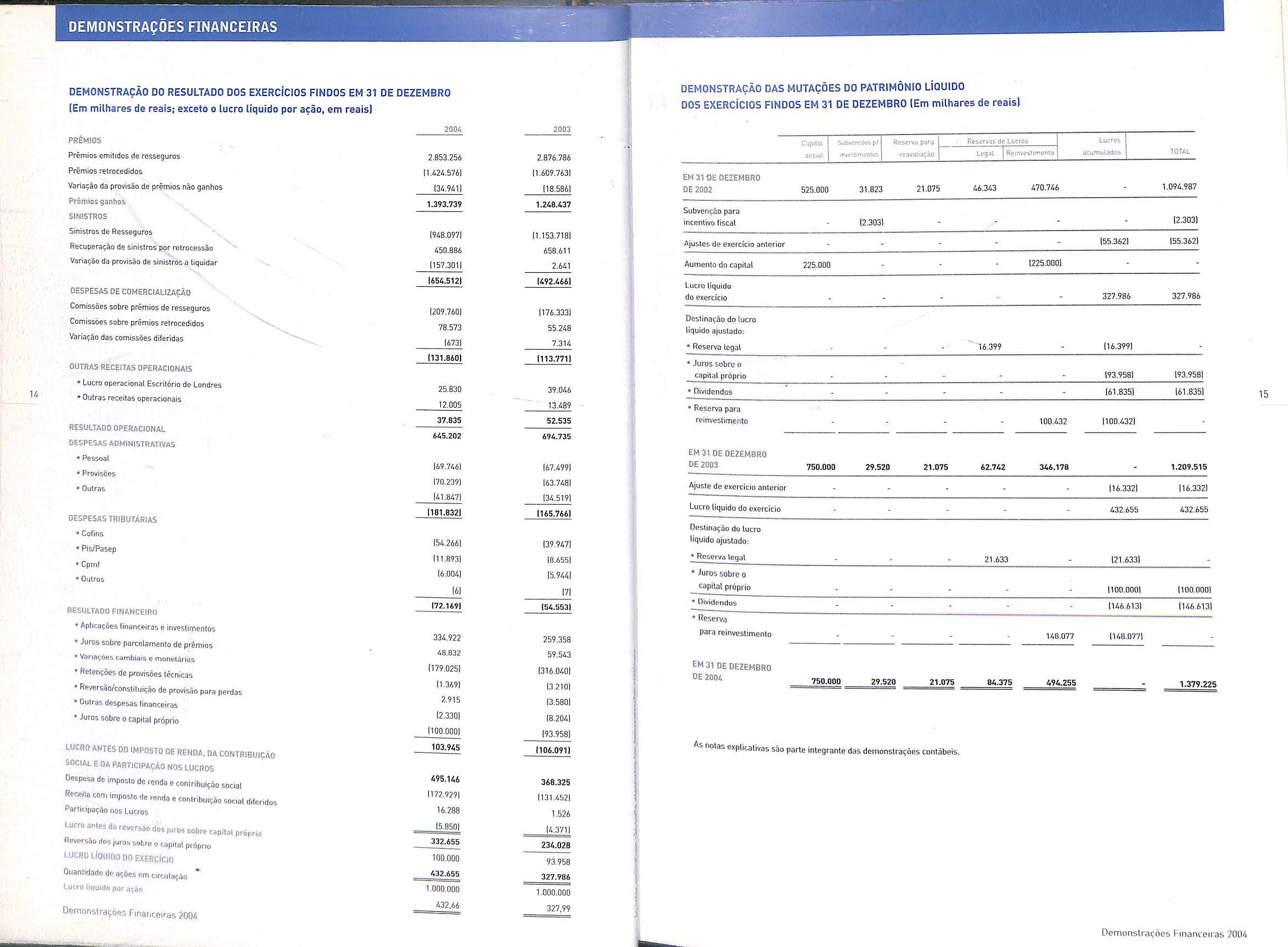

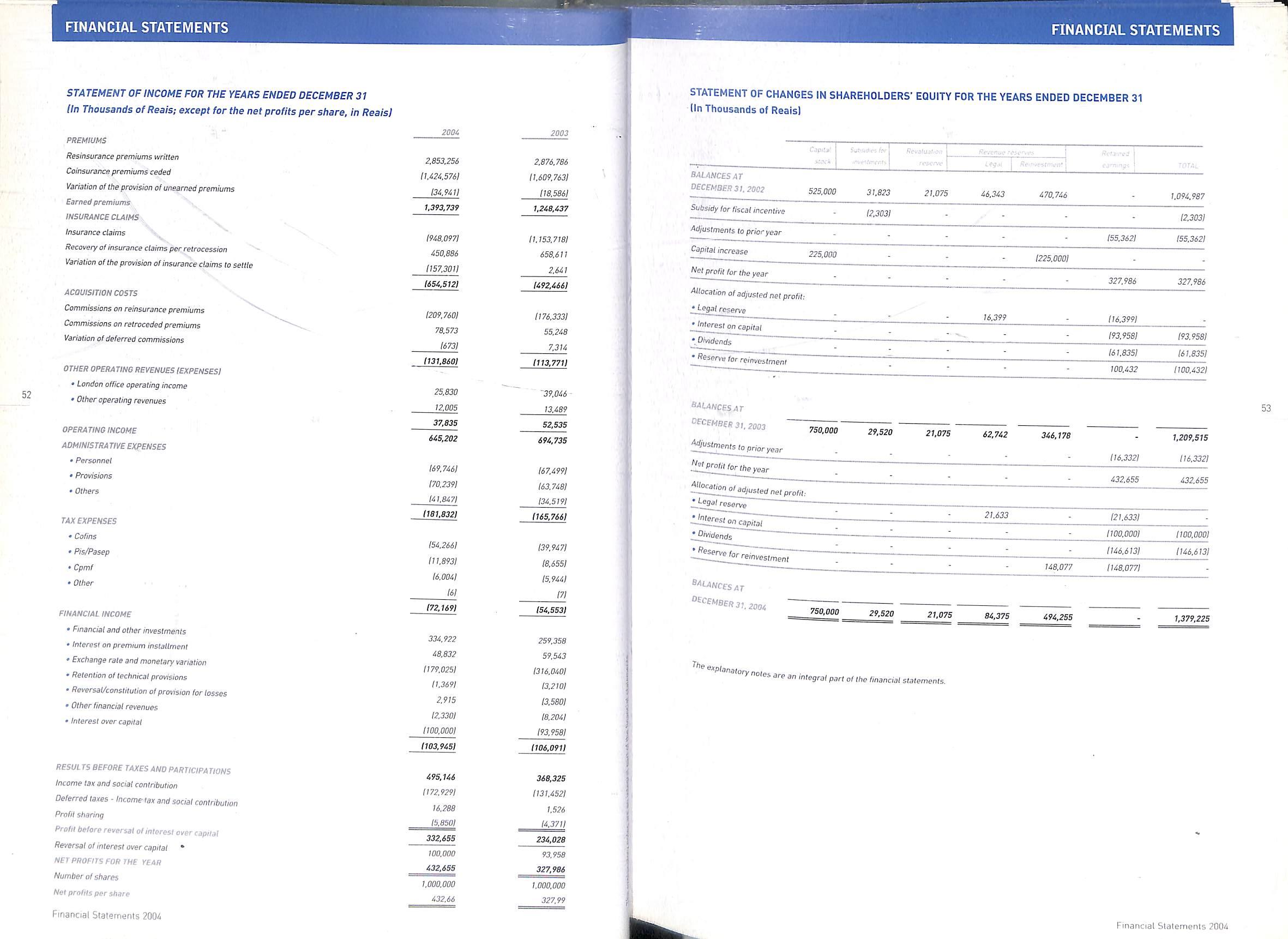

DEMONSTRACAO DO RESULTAOO DOS EXERCICIOS FINOOS EM 31 DE DEZEMBRO

(Em milhares de reals; exceto o lucro Uquldo por acao, em reals)

Pf^EMIOS

Premios emilidos cle resseguros

Premios retroceflidos

Variagao da provisao de premios nio ganhos

Premios ganhos

SINISTROS

Sinistros de Resseguros

Recjperacao de sinistros por retrocessio

Variatao da provisao de sinistros a liquidar

DESPESAS DE COMERCIALIZACAO

Comissoes sodre premios de resseguros

Comissoessobre premios relrocedidos

Variatao das comissoes dileridas

OUTRAS RECEITAS OPERACIONAIS

•Lucro operational Escritorio de Londres

•Outras receitas operacionais

RESULTADO OPERACIONAL

DESPESAS AOMINISTRATIVAS

• Pessoal

•Provisoes

•Outras

DESPESAS TRIBUTARIAS

•Cofins

• Pis/Pasep

•Cpmf

• Oulros

RESULTADO FINANCEIRO

• Aplicagoes financeiras e investimentos

•Juros sobre parcelamento de premios

• Variances cambiais o monetdrias

• Retencoes de provisoes tecnicas

•Reversao/constiluicao de provisao para perdas

• Outras despesas(inanceiras

•Juros sobre o capital prbprio

LUCRO ANTES 00 IMPOSTO DE RENOA.DA CONTRIBUiCAO SOCIAL E OA PARTICIPACAO NOS LUCROS

Despesa de imposio de lenda e coniribuicio social

Receita com imposto de renda e contribu.gao social diferidos

Participagao nos Lucres

Uicro antes da reversao dosjuros sobre capital prdpho

Rovorsao clos Juros sobre o capital prdprio

LUCRO LlOUlOO DO EXERCiCIO

Quantidade de a?6es em circulapbo

Lucro Uquldo por a;3o

DEMONSTRACAO DAS MUTACOES DO PATRIMONIO UQUIDO DOS EXERCiCIOS FINDOS EM 31 DE DEZEMBRO(Em milhares de reals)

As notas e*plicativas sao parte integranle das demonslracoes conlabeis.

u

Demonstrafoes Financeiras 2004 200A 2003 2.853.256 2.876.786 (1.424.5761 (1.609.7631 (34.9411 118.5861 1.393.739 1.248.437 (948.0971 11.153.7181 450.886 658.611 (157.3011 2.641 (654.5121 (492.466) I2O9.760I (176.3331 78.573 55.248 (673! 7JU 1131.860) (113.7711 25.830 39,046 12.005 13.489 37.835 52.535 645.202 694.735 (69.7461 (67.4991 (70.2391 (63.7481 (41.8471 134.5191 1181.8321 (165.766) (54.2661 139.947) (11.893! 18.655) (6.004) 15.944) (61 (71 172.1691 (54.5531 334.922 259.358 48.832 59.543 (179.0251 1316.040) (1.369) 13.210) 2.915 (3.580) 12.3301 (8.2041 (100.0001 (93.9581 103.945 1106.091) 495.146 368.325 (172.929) (131.4521 16.288 1.526 (5.850) 14.371! 332.655 234.028 100.000 93.958 432.655 327.986 l.OOO.OOO 1.000.000 432,66 327.99

C-ipilol %0C\A\ Subxoncyss p/ Roserva pars rcbvalidCdO Keservaf dc Lucres Legal Reinvesiimenlp Lucres acurnuUdos

TQTAl. EH 31 DE DEZEMBRO DE 2002 525.000 31-823 21.075 46.343 470.746 1.094.987 Subvenpso para incentive fiscal 12.303) - - (2.3031 AJustes de exercicio anterior - - -155.3621 155.362) Aumento do capital 225.000-(225.000) -Lucro Uquldo do exercicio 327.986 327.986 Destinaqao do lucro Uquldo ajuslado: • Reserva legal " "16.399 (16.399) •Juros sobre o capital proprio(93.9581 (93.9581 < Oividendos - - - - - (61.8351 (61.8351 • Resorva para rcinveslimento - - - - 100.432 (100.432)EM 31 OE DEZEMBRO OE20Q3 750.000 29.520 21.07B 62.742 346.178 1.209.515 Ajuste de exercicio anterior - - - - - (16.332) (16.332) Lucro liquido do exercicio - - - - - 432.655 432.655 Oestinagao do lucro liquido ajuslado: • Resorva legal 21.633 (21.633) • Juros sobre o capital proprio 1100.0001 (100.0001 • Dividendos - - - - - (146.613) I14&.613I • Reserva para reinvestimenlo 148.077 (148.077) EM 31 DE DEZEMBRO DE 2004 7SO.OOO 29.520 21.075 84.375 494.255 1.379.225 15 OemonslFa?6es Fiaan^eiras 2004

DEMONSTRAQOES FINANCEIRAS

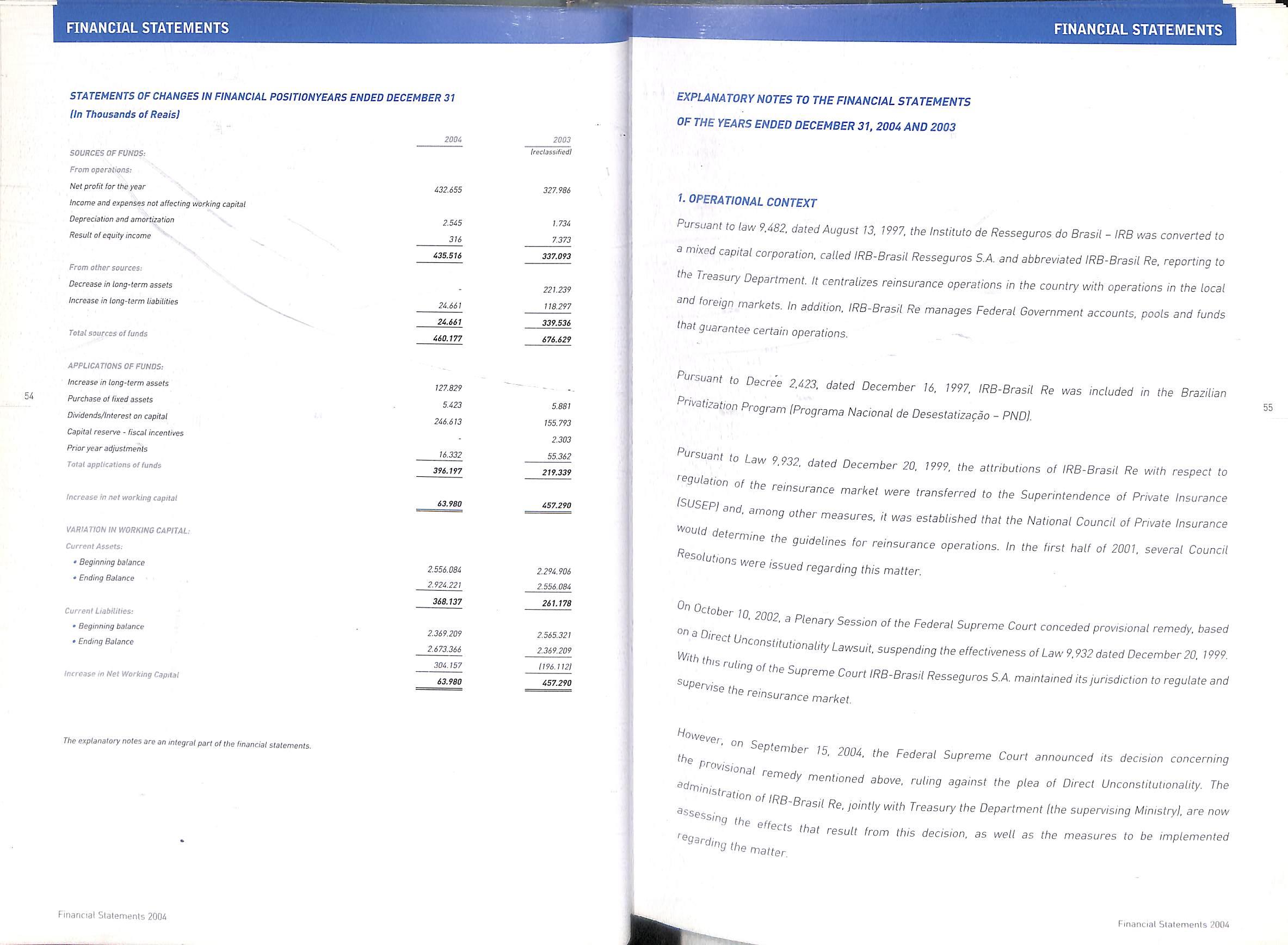

DEMONSTRACAO DAS ORIGENS E APLICACOES DE RECURSOS DOS EXERCICIOS FINDOS

EM 31 DE DEZEMBRO[Em milhares de reals]

ORIGENS DEBECUR50S:

Das opera^Dcsr

LLcro iiquido do exercicio

Receilas e despesas qje nio atetam o capital circulanle:

Deprecisfoes e amonizafoes

Resullado de equtvaieocla patrimonial

De oufrasfonles:

Redu^lo do realljavet a tongo praao

. Aumento do exigi'vel a longo prazo

Total das origens de recorsos

APLICACOES DE RECURSOS:

Aumento do realizaxel a longo prazo

16 Aumenta do atlvo permanente

Dividendos/Juros sobi¥ o capital proprio

Reserva de capital - incentivos tiscais

Ajustes de exercicios anteriores

Tolal das aplicacoesdo

Aumento do ceprtat

NOTAS EXPLICATIVAS AS DEMONSTRACDES C0NTABE1S

DOS EXERCiCIOS FINDOS EM 31 DE DEZEMBRD DE 200A E DE 2003

1 CONTEXTO OPERACIONAL

Com base na Lei n° 9.482, de 13 de agosto de 1997. o Institute de Resseguros do Brasil-IRB foi transformado em sociedade anonima de economia mista, denominada IRB-Brasil Resseguros S.A., com abreviatura de IRB-Brasil Re, vinculada ao Ministerio da Farenda. Centraliza as operacoes de resseguro no Rats, com atuacao nos mercados interne e externo. Complementarmente, o IRB-Brasil Re administra contas do Governo Federal, consorcios e fundos destinados a garantia de determinadas operacoes.

Peio Decreto n° 2.423,.de 16 de dezembro de 1997, o IRB-Brasil Re foi incluido no Programa Nacional de Desestatizacao-PND.

Pela Lei n° 9.932, de 20 de dezembro de 1999, foram transferidas para a Superintendencia de Seguros Privados-SUSEP alribuicoes do IRB-Brasil Re relativas as atividades de orgao regulador do mercado de resseguros e, entre oulras providencias. determinado que o Conselho Nacional de Seguros Privados estabelecesse as diretrizes para as operacoes de resseguros,sendo editadas, no primeiro semestre de 2001, diversas resolucoes daquele Conselho sobre a materia.

Ern 10 de outubro de 2002, o Plenario do Supremo Tribunal Federal deferiu medida cautelar,em sede de Acao Direta de Inconstitucionaiidade,suspendendo a efickia da Lei n° 9.932, de 20 de dezembro de 1999. Com a decisao do Supremo,o IRB-Brasil Resseguros S.A. permaneceu com a competencia de regular e fiscalizar o "mercado de resseguros.

Em 15 de setembro de 2004, loi publicada decisao do Supremo Tribunal Federal a supracitada medida

^'Jtelar, manifestando-se pelo prejuizo do pleilo formulado na Acao Direta de Inconstitucionaiidade. A

f^rninistracao do IRB-Brasil Re, em conjunto com o Ministerio da Fazenda (Ministerio Supervisor), esta ndo Ob efeiios decorrenles dessa decisao, bem como das providencias a serem implementadss "esse contexto,

recursos

circutante VABIACAO NO CAPITAL CIRCULANTE: Alive circutanloNo inicio do exercicio No lim do exercicio Paseivo circutante: No inicio do exercicio No fim do exercicio Aumemo do rapuai circutanlo 200A 432.655 2.545 316 435.516 24.661 24.661 460.177 127:829 5.423 246.613 16.332 396.197 63.980 2.556.084 2.924.221 366.137 2.369.209 2.673.366 304.157 63.980 2003 (rectassiiicadol 327.986 1.734 7.373 337.093 221.239 118.297 339.536 676.629 '5S81 155.793 2.303 55.362 219,339 4S7.290 2.296.906 2.556.084 261.170 2.565.321 2.369.209 (196.1121 457.290

17 As notas expbcativas sso parte integrante

DefTionstragdea Flnanceiras 2004

das demonstra^o oes contabeis.

Demonstragoes Flnanceiras 2004

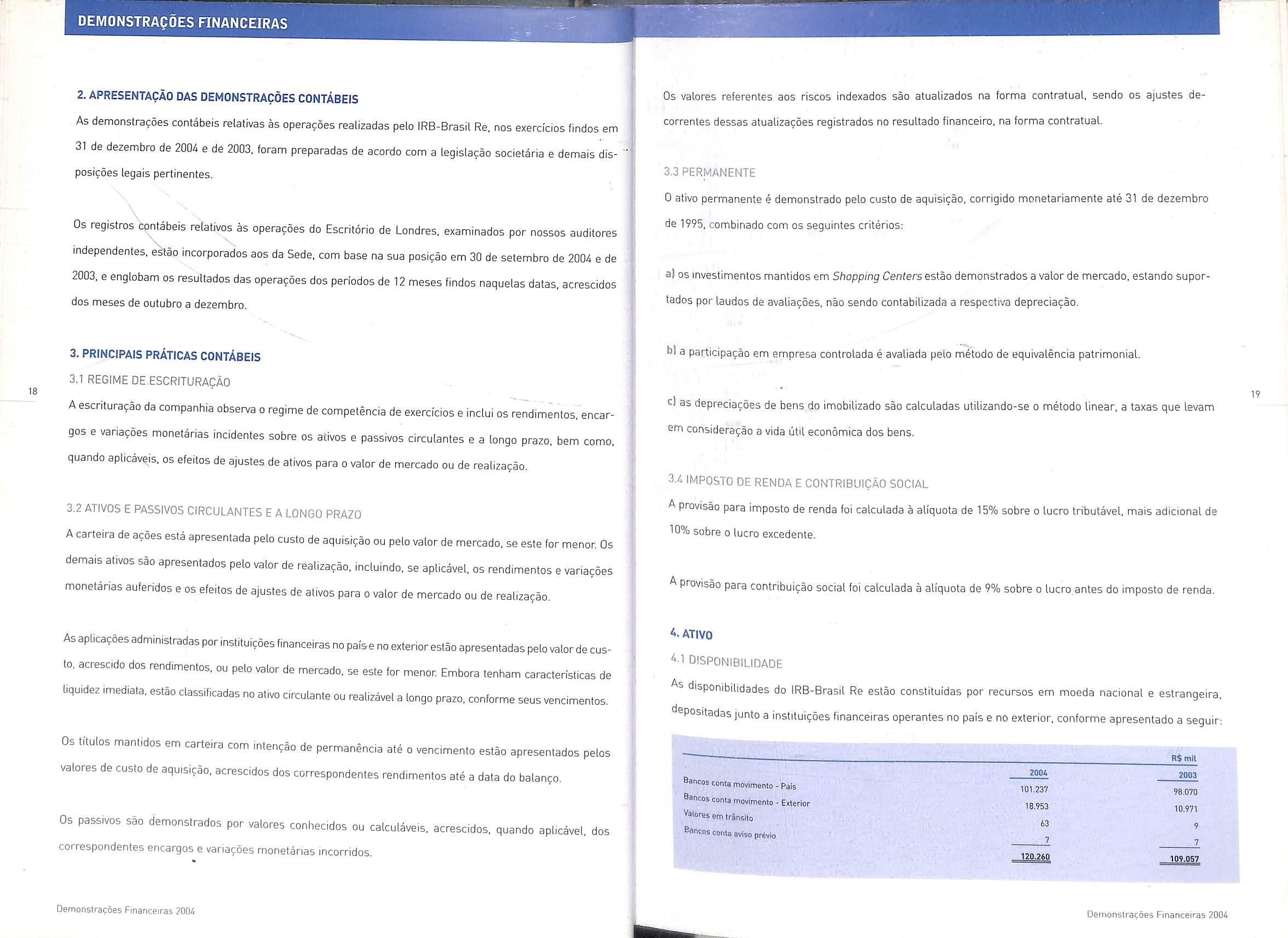

2. APRESENTACAO DAS DEMONSTRACOES CONTABEIS

As demonstracoes contabeis relativas as operacoes realizadas pelo IRB-Brasil Re. nos exercicios findos em 31 de dezembro de 2004 e 2003, foram preparadas de acordo com a legislacao societaria e demais disposicoes legais pertinentes.

Os registros Gpntabeis retabVos as operacoes do Escritorio de Londres, examinados por nossos auditores independentes.e^o incorporados aos da Sede, com base na sua posicao em 30 de setembro de 2004 e de 2003,0 englobam os resuttados das operacoes dos penodos de 12 meses findos naquelas datas. acrescidos dos meses de outubro a dezembro.

3.PRINCIPAfS PRATICAS CONTABEIS

3.1

REGIME DEESCRITURACAO

A escrituracao da companhia observa o regime de competencia de exercicios e inclui os rendimentos. encargos e variacoes monetarias incidentes sobre os ativos e passives circulantes e a longo prazo, bem como. quando aplicaveis. os efeitos de ajustes de ativos para o valor de mercado ou de realizacao.

3.2 ATIVOS E PASSIVOS CIRCULANTES E A LONGO PRAZO

A carteira de acoes esta apresentada pelo custo de aquisicao ou pelo valor de mercado.se este for menor, Os demais ativos sao apresentados pelo valor de realizacao. incluindo, se aplicavel, os rendimentos e variacoes monetarias auferidos e os efeitos de ajustes de ativos para o valor de mercado ou de realizacao.

Asaplicacoes administradas por instituicdes financeiras no pafee no exteriorestao apmsentadas pelo valorde cus to, acrescido dos rendimentos, ou pelo valor de mercado. se este for menor Embora tenham caracteristicas de Itquidez imediata. estao classificadas no ativo circulante ou realizavel a longo prazo.conforme seus vencimentos.

Os titulos mantidos em carteira com intencao de permanencia ate o vencimento estao apresentados pelos valores de custo de aquisicao. acrescidos dos correspondentes rendimentos ate a data do balance.

Os passives sao demonstrados por valores conhecidos ou catculaveis, acrescidos, quando aplicavel, dos correspondentes encargos e variacoes monetarias incorndos.

Os valores referentes aos riscos indexados sao atualizados na forma contratual, sendo os ajustes decorrentes dessas atualizacoes registrados no resultado financeiro, na forma contratual.

3.3 PERMANENTE

0 ativo permanente e demonstrado pelo custo de aquisicao, corrigido monetariamente ate 31 de dezembro de 1995. combinado com os seguintes criterios:

a)OS investimenlos mantidos em Shopping Centers estao demonstrados a valor de mercado, estando suportados por laudos de avaliacdes, nao sendo contabilizada a respectiva depreciacao.

bl a participacao em empresa controlada e avaliada pelo metodo de equivalencia patrimonial.

c) as depreciacbes de bens do imobilizado sao calculadas utilizando-se o metodo linear, a taxas que levam em consideragao a vida util economica dos bens.

3.4 IMPOSTO OE RENDA E CONTRIBUICAG SOCIAL

A provisao para imposto de renda foi calculada a aliquota de 15% sobre o lucro tributavel, mais adicional de 10% sobre o lucro excedenle.

A provisao para contribuicao social foi calculada a aliquota de 9% sobre o lucro antes do imposto de renda.

A. ATIVO

A1 DISPONIBILIDAOE

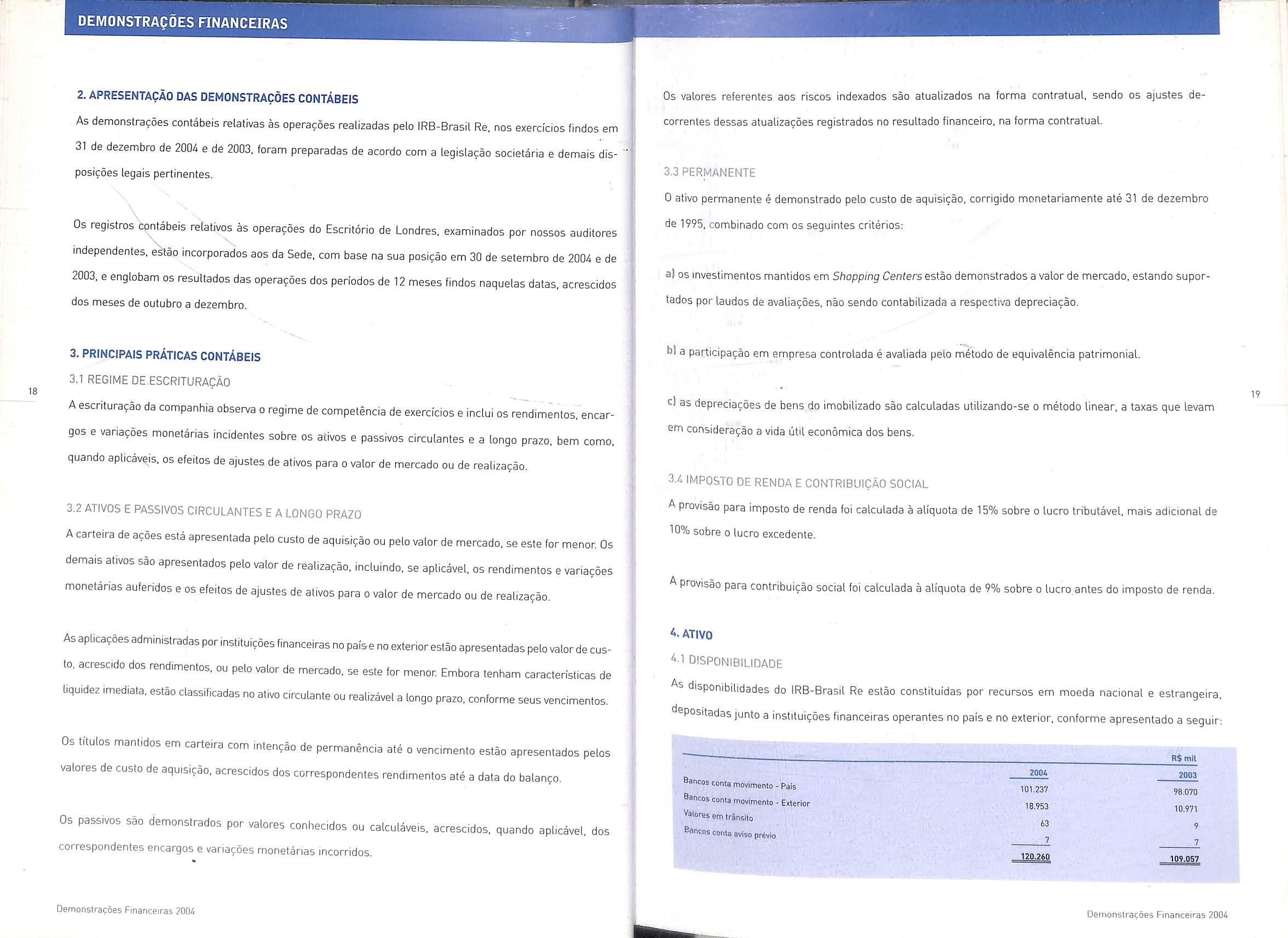

As disponibilidades do IRB-Brasil Re estao constituidas per recursos em moeda nacional e estrangeira, '^^Positadas junto a instituicoes financeiras operantes no pals e no exterior, conforme apresentado a seguin

18 DEMONSTRApdES

RNANCEIRAS

Demonstracoes Financeiras 2004

R$ mil Bancos 2004 ronta movimento - Pals Bancos conta movimento - Exterior Valore'■s em Iransito Bancos conta aviso prtvio 101.237 18.953 63 7 120.260 2003 96,070 10.971 9 7 109.057 19 Demonstracoes Financeiras 2004

1*2 APLICACOES FiNANCElRAS - OPERACOES EXTRAMERCADO

Deacordo com a Resolucao r.° 2.917, de 19 de dezembro de 2001, do Conselho Monetario Nacional, asaplicacoes financeiras estao representadas por quotas do Fundo de Investimento Extramercado mantido juntoao Banco do Brasil S.A.

A.3 DEPOSIYoS A PRAZOFIXO NO EXTERIOR

Representam a>t<ac6es no eiderior em Time Deposit(renda fixa), com vencimento variando entre 30 e 180 dias, com taxas de remuneracao entre 2.1025% a 2,43% ao ano e estao apresentadas pelo valor de custo acrescidos dos rendimentos e variacao camfaial.

4.4 RECURSOS ADMINISTRAD05 POR INSTlTUiCOES FINANCEIRAS APLICADOS

EM RENDA FIXA E VARIAVEL - CURTO E LONGO PRAZO

As aplicacoes financeiras realiaadas em moeda eslrangeira induem ativos de renda fea e variaeel emit;dos no mercado externo por empresas bras.leiras IBrazdian Bondsl e estrangeiras, sendo administrados pelos

BB Security Ltda., Goldman Sachs,Salomon Brothers e Dean Witter.

No mes de oatubro de 2002,com base no relatdrio 'Estrategia de Alocacao de Invest,mentos", elaborado pela consultorla contratada Hampton Consults, o montante de R$ 874.172 mil[US$ 240 milhoesi fol realocado para tres fundos de investimentos exclus.vos,sob as administracbes do Socle,e Generate CSGI,do The Royal Bank of Scotland pLc e do Bayensche Landesbank AG, na proporpao de 50%,25% e 25%,respectivamente, OS correspondentes satdos em 3, de dezembro de 2003foram rectassificados do aOvo drculante para o reatizavet a longo prazo,tendo em vista a intencao da adm,n,stracao de resgatar sous valores somente a partir dos sous venc.men.os, pertodo no goal so tera d.reito a ren.abibdade integral aufenda por este investimento.

Em 31 de dezembro de 2004, considerando gue os referidos reoursos encontram-se apticados em fundos multiadmipistrado e multies.rategia e tem oomo caraoteris.ica a protecao do vator do principal nas dates de vencimento de 15 de outubro e 5 de novembro de 2007, estao sendo apresentados no ativo realizavel peto valor da aplicaoao, acrescido de variacao cambial e dos rendimentos incorridos, correspondendo ao mon tante de R$ 675,855 mil/ US$ 254,694 mil(R$ 725.225 mil / USS 251,082 mil em 20031,

4.5 SEGURAD0RA5 POR OPERACOES EM GERAL

A conta de seguradoras por operacoes em geral esta representada pelos saldos a receber e a pagar resultantes dos movimentos operacionais das companhias de seguros do pals e exterior para com o IRB-Brasil

Re.acrescidos dos premios emilidos a receber e a pagar; das respectivas comissoes; das despesas de sinistros a atribuir e dos creditos e debitos decorrentes dos negocios realizados pelo Escritorio de Londres. Em 31 de dezembro essas contas estao compostas conforme a seguir;

Alivo

Seguradoras no pa!s

Seguradoras no exterior

Premios a receber •''

Indeniza^oes desinistros a alrihuir

Segtjradoras no exterior -.Pnndres

Provtslo para credito de realizagloduvidosa

Passive

Seguradoras no pais

Seguradoras no exterior

Premios de seguros em moeda eslrangeira a atribuir

Salvados e ressarcimentos de sinislros a atribuir

Seguradoras no exterior - Londres

Comissoes sobre premios a pagar(receberl - liquido

^■6 CREDITOS TRibuTARIOS

Clrculante

Impostode rendae coniribuigaosociala recuperar

OulroscreditostributariosICofins/Pasep)

impostodererda econlribuigaosocialdiferidos:

* diferengastemporarias

"ealiz^VBl a longo prazo

POsto de renda e contribuigao social diferidos;

"^obtB diferengas temporSrias

DEMONSTRApdES FINANCEIRAS 20 i 1

2004 147.402 175.624 •• 28.784 10.071 5.826 367.707 1103.0051 264.702 49.066 149.991 124.174 628 12.052 (6.207) 329.704 ".It'III* ,1 2004 2.631 1.715 120,324 124.670 170.471 170.471 R$mil 2003 135.743 222.329 32.954 5.369 7.245 403.640 176.9521 326.688 54.737 173.379 80-329 349 14.297 18.0801 315.011 R$ mil 2003 40 101.760 101.800 172.789 172.789 21 Demonslragoes Financeiras 2004 Demonslracoes Financeiras 2004

0 IRB-Brasil Re procedeu a constituicio de creditos tributaries, representades, basicamente, pelo imposto de reeda e contribuicae social diferidos,sebre diferertcas temporarias decerrentes, principalmente, do registro das provtsdes para desvalonzacao da carteira de in.estimento, das provisoes para contingencies a dosbeneficios complementares pds-emprego.0 efeito liquido da constituicao dos citados creditos Iributanos, no evercicio findo em 31 de dezembro de 2004, no valor de R$ 22.552 mil, foi registrado em contrapartida ao resultado dd,„e^dcio e ao.paWmonio liquido na ruhrica de Ajustes de Everoicios Anteriores, nos valores de R$ 16,288 mil^5,750 mil,'^5spectivamente,tendo side compensado o valor de R$ 1.486 mil.

OS referidos creditos estao sustentados pela expectativa de resultados futures e, ainda, pelo fato de serem considerados. pela atual legislacao, como urn direito do IRB-Brasil Re.

4,7INVESTtMENTOS

ntrolada United Americas Holding Corporation [UAHI e sediada em Nova York, Estados Unidos da America, e detem o controle integral da United Americas Insurance Co. lUAICI, empresa seguradora regida pelas ieis do Estado de Nova York e da UA Service Corporation. A participacao do IRB-Brasil Re no capital da UAH e de 99,75% e a avaliacao do investimento foi reafizada com base em demons.rapdes oontabeis preliminares de 31 de dezembro de 2004.0 pa.nmonio liguide da empresa con.rolada lUAHl, em 31 de dezembm de 2004 e de 2003, e de, respectivamente, US$ 9.227 mil IR$ 24,485 mill e US$ 8,587 mil(R$ 24.803 mil)e o lucre e o preioizo do exercicio,conforme essas mesmas demons,ragoes,e de,respec.ivamen.e, USS 875 mil |R$ 2.322 mil) e de U5$ 514 mil(R$ 1.484 mil).

A UAIC esta com suas operacoes de aceitacao interrompidas desde 1984 e vem administrando a carteira em run-off. decorrente de riscos assumidos no mercado americano ate aquele ano. 0 IRB-Brasil Re assumiu a responsabilidade pela liquidacao dessas operacoes, constiluindo provisao, cujo saldo em 31 de dezembro de 2004 e tJe2003,e de, respectivamente. US$ 13,590 mil(R$ 36.062 mill e USS 14,075 mil[R$ 40.654 mil], registrada na conta de sinistros a liquidar.

Os investimentos em Shopping Centers constituem-se dos seguintes centres comerciais, todos em operacao: Casa Shopping - Rio de Janeiro - RJ 120%); Park Shopping - Brasilia - DF(20%); Iguatemi - Campinas -SP 15%); Barra -Salvador - BA (20%); West Plaza - Sao Paulo - SP [25%]; Iguatemi - Sao Paulo - SP [7%);

Iguatemi - Maceio - AL 120%!; Amazonas - Manaus - AM (34,79% s/ lojas-ancoras e 11,9128% s/ lojassatelitesl; Esplanada - Sorocaba - SP (15%|; Praia de Betas - Porto Alegre - RS(20%) e Minas ShoppingBelo Horizonte - MG (19,13%).

Em 2004 e em 2003, as receitas auferidas com as participacoes nesses centres comerciais totalizaram

R$ 32.522 mil e R$ 25.806 mil, respectivamente.

5. PASSIVO

5-1 provisoes CONSTITUiDAS

5.1.1 Provisoes tecnicas e despesas de comercializacao diferidas

As provisoes para premios nao ganhos e riscos decorridos - constituidas para cobrir riscos de contratos em vigor e correspondentes a parcels de premie relative ao periodo de riscos ainda nao de corridos -e as despesas de comercializacao diferidas sao estabelecidas com base no criterio de diferif^ento linear dos premios e comissoes, ao longo do prazo de vigencia das ap6lices. Para aplicacao desse criterio, considera-se a vigencia-padrao de 12 meses e que as operacoes de seguro sejam infor^adas ao IRB-Brasil Re,em media, no 4° mes de vigencia.

A partir do exercicio findo em 31 de dezembro de 2003, o IRB-Brasil Re reconheceu a variacao cambial ralativa ao saldo da provisao para premios nao ganhos-PPNG para os riscos indexados em moeda estrangeira, bem como para as correspondentes parcelas diferidas.

OEMONSTRApOES FINANCEIRAS 22

(. R$mfl Psrticipafoes societlrias; United Americas Holding Corporation Investimentos minoritSrios em ootras empresas Provisao pars desvaloriza^ao Investimentos em Shopping Centers; Cuslo corrigido reavalisdo Prowslo para desvalorizaflo 20M 24.425 2.629 (2.629) 24.425 294.279 (59.100) 235.179 259.604 2003 24.741 2.629 (2.629) 24.741 293.882 (58.2861 235.596 260.337

23 Oemonstra9oes Financeiras 2004 Demonstracoes Financeiras 2004

5.1.2 Provisao de sinistros a fiquidar e provisao para sinistros ocorridos e nao avisados

A prowsao para sinistros a liquidar e constituida em funcao das notificacoes de sinistros recebidas das sociedades seguradoras e vaiorada em montantes nao inferiores as responsabilidades do IRB-BrasilRe. quando por este regulados.

Ate 31 <Mezembro de 2003. nas operacdes com o exterior, a provisao para sinistros ocorridos e nao avisados eVpnstitufda. para os riscos assumidos pela Sede, par criterio interne, a razao de 130% da respect,va provisao de sinistros avisados a liquidar com riscos ambientais e danos causados por amianto, e de 30% nos demais casos. No exercicio de 200i, a citada provisao passou a ser constituida com bases em premissas atuariais definidas em nqta tecnica, montando o saldo de R$ i6.893 mil(US$ 17.672].

Com relafao as operacoes realizadas no pais, a provisao para sinistros ocorridos e nao avisados e constituida com base na Resolucao CNSP n° 89/02.

As provisoes relatives as operacoes contratadas pelo Escritono de Londres sap constituidas com fundamento nas informacdes das cedentes e consubstanciadas por avaliacao estatistica atuarial.

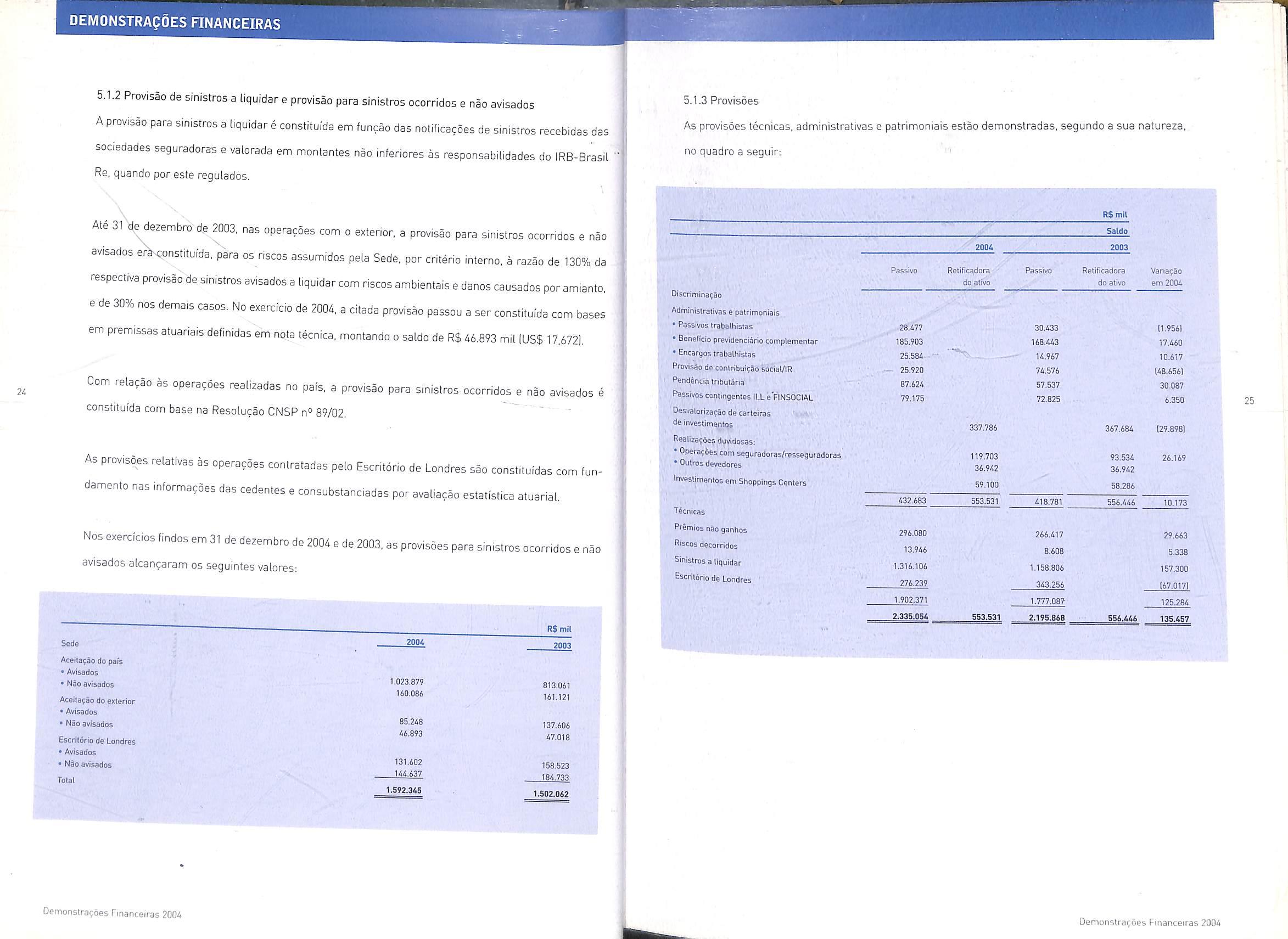

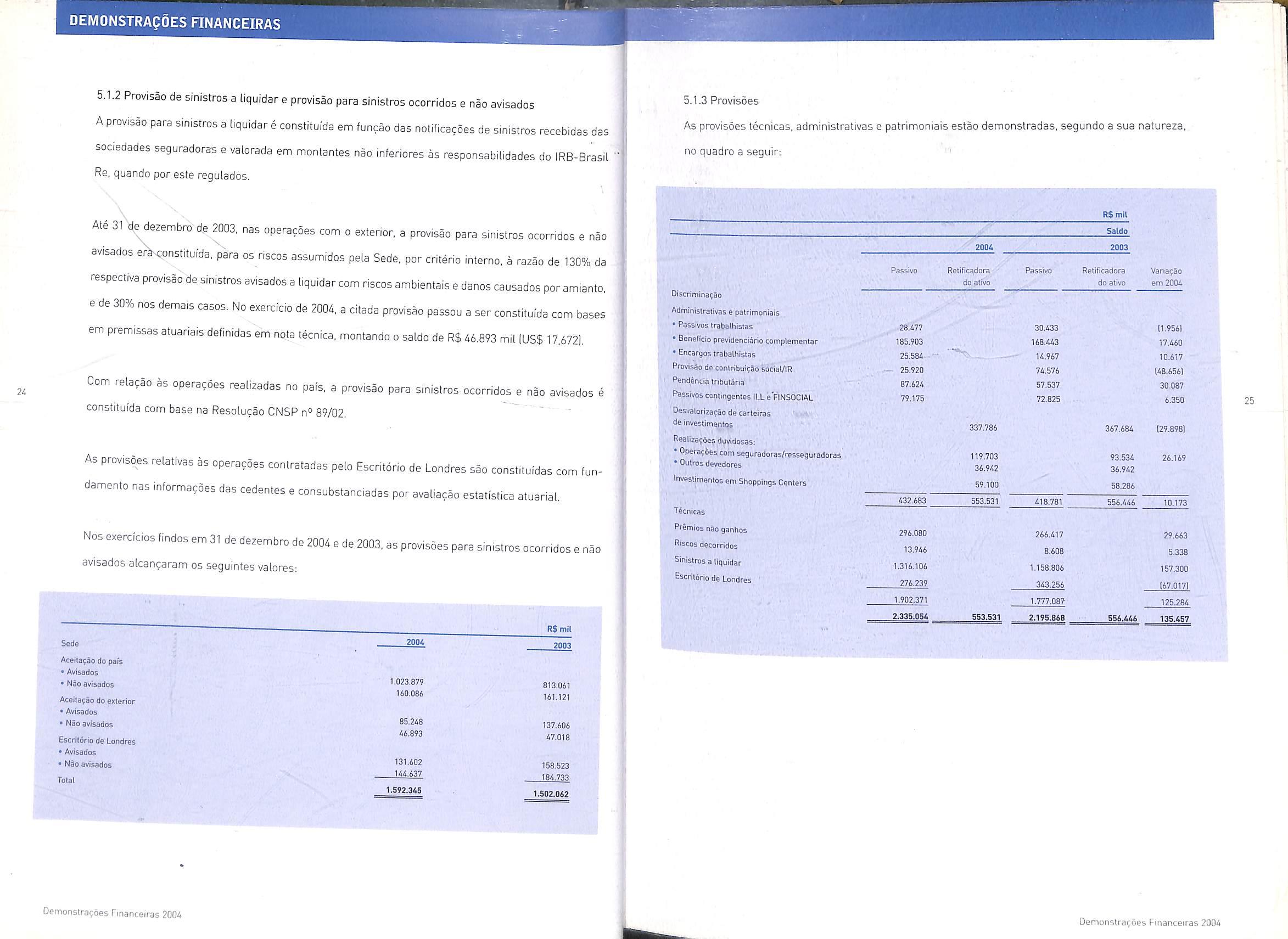

Nos exercicios findos em 31 de dezembro de 2004 e de 2003,as provisoes para sinistros ocorridos e nao avisados alcancaram os seguintes valores;

5.1.3 Provisoes

As provisoes tecnicas, administrativas e patrimoniais estac demonstradas, segundo a sua natureza,

2i DEMONSTRAgOE'S FINANCEIRAS •n.

IrMHjnr' V.L Sede Aceitaflo do pals •Avisados • Nao avisados Aceita?io do exteiior •Avisados • Nao avisados Escrildrio de Londres •Avisados • Nao avisados Tolal R$ mil 200A 1.023.879 U0.086 85.2^8 46.893 131.602 144.637 1.592.345 2003 813.061 161.121 137.606 47.018 158-523 184.733 1.502.062

no quadro a seguif: • 1 ji R$ mil Saldo 2004 2003 Passive Raliticqdoi^ Passive Retificadora Vahagao do alivo do alivo em 2004 Discrlmina?ao Administrativas e patrimoniais • Passives trabalhistas 28.477 30.433 [1.9561 • Beneflcio previdenciario coinplementar 185.903 168.443 17.460 • Encargos trabaltiistas 25.584 •• - 14.967 10.617 Provisao dp contribuifSo social/IR •• 25.920 74.576 (48.6561 Pendlncia trlbutaria 87.624 57.537 30.087 Pass'tvosconlingentes il.LeFINSOClAL 79.175 72.825 6.350 Desvalorijacao de carteiras de investimentos 337.786 367.684 [29,8981 RealizajSes dyvidosas: • Operagoes com seguradoras/resseguiadoras 119.703 93.534 26.169 • Outrosdevedores 36.942 36.942 Investimentos em Stioppings Centers 59.100 58.286 432.683 553.631 418.781 556.446 10.173 Tecnicas Premios nao ganhos 296.080 266.417 29.663 Riscos decorrldos 13.946 8.608 5.338 Sinistros a liquidar 1.316.106 1.158.806 157.300 Escritorio de Londres 276.239 343.256 167.0171 1.902.371 1.777.087 125.284 2.33S.054 553.531 2.195.868 556.446 135.457 25 Oerrwnstragdes Financeiras 2004 Demonslra^oes Financeiras 2004

5.2 FUNDOS, CONSORCIOS E CONTAS SOB ADMINfSTRACAO DO IRB-BRASIL RE

Fundos,c^orclos e contas^ob

administrafad^iRB-BrasilRe \

Fundodee5labUi^<^doSe9uro Rui^ FESR(21

Credllo a Exportagao - SCE(1)e(2)

ValoraReceberdo Valor do Superavit Valora Receberdo Valor do Superavil lapagaraol (deficit) (apagaraol (deficit)

(II As demgnstragoes contabeis sao audiladas pelos auditores independentes do iRB-Brasil Re. (21 As demonstragoes contabeis sao objelo de prestagoes de contas apresenladas anualmenle ao Tribunal de Conlas da Uniao - TCU.

5,3 PLANO DE APOSENTADORIA E PENSOES E OUTROS BENEFICIOS POS-EMPREGO

5.3.1 Fundacao de Previdencia dos Servidores do Inst-ifuto de Resseguros do Brasil-PREVIRB

0IRB-Brasil Re e patrocinedor da PREVIRB,quo assegura aos seus participantes e dependenfes beneficros complementares aos da previdencia oficial basica. 0 ptano oferecido atraves da PREVIRB e o de beneficio definido. sendo o regime de capitalizacao adotado nas reavaliacdes atuariais. As contribuipoes feitas pelo IRB-Brasil Re a Fundapao de Previdencia de seus empregados (PREVIRB), no exercicio de 200A, totalizaram R$ 3.8A1 mil|R$ 3.424 mil em 2003).

Seguindo os criterios determinados pela Deliberacao CVM n° 371, de 13 de dezembro de 2000, foi realizada, em 31 de^dezembro de 2004, avaliacao atuarial por atuarios independentes,apurando um

superavil tecnico de R$ 90.196 mil, que. a teor da alinea "f" do item 49 da citada Deliberacao CVM, nao reslou contabilizado na patrocinadora.

5.3.2 Complementacao de aposenladoria epensoes-empregados admitidos ate 31 dedezembro de 1968

0 IRB-Brasil Re custeia integralmente os beneficios de complementacao de aposenladoria e de peculio pormorte.em relacao aos servidores admitidos ate 31 de dezembro de 1968, de melhioria de complemen tacao de aposenladoria em relacao aos servidores que tenham adquirido a aposenladoria ate 28 de fevereiro de 1975 e de melhoria de pensao em relacao aos beneficiario? dos servidores falecidos ate 28 de fevereiro de 1975.

Q IRB Brasil Re constitui provisao tecnica para lazer face as obi igacoes relativas aos beneficios supramencionados, que abrangem 497 assistidos com media de idade de 75 anos.

Em 31 de dezembro de 2004, a provisao para beneficios previdenciarios, suportada em calculo atuarial realizado por atuarios pertencentes ao corpo funcional do IRB-Brasil Re. alcancou o montante de R$ 146.406 mil 1R$ 128.325 mil no exigivel a longo prazoj. Em 31 de dezembro de 2003, esta pro visao matematica.suportada por avaliacao atuarial, realizada por atuarios independentes, alcancava o montante de R$ 137.906 mil IR$ 120.880 mil no exigivel a longo prazo).

5.3.3 Outros beneficios p6s-emprego

0 IRB-Brasil Resseguros S.A. oferece. ainda, beneficios assistenciais de Assistencia Medica e Odontologica aos aposentados, pensionistas e dependentes, de Seguro de Vida em Grupo e Coletivo de Acidentes Pessoais e de Auxilio Funeral, Consoante disposipoes contidas na Deliberacao CVM 371,o IRB-Brasil Re,suportado em calculo atu arial procedido em 31 de dezembro de 2Q03, optou por reconhecer o passivo atuarial no prazo de quatro anos, correspondentes aos exercicios de 2002 a 2005. Sendo assim, a parcels relativa ao exercicio findo arn 31 de dezembro de 2002foi reconhecida como ajustes de exercicios anteriores e a parcels correspondente ao exercicio findo em 31 de dezembro de 2003foi diretamente registrada no resultado. No balance patrimonial de 31 de dezembro de 2004,baseado em novo calculo atuarial procedido para essa data-base, esses beneficios encontram-se apresentados como segue:

DEMONSTRApOES RNANCEIRAS g,

26 R$ mil2004 2003

acumulado irb acumulado

Excedente Onico de Risc<i5.ExtraordinarlosEURE(l)ei2) ^ • Seguro de

Consorcio Brasileiro

Outras contas Fundo de Equalizagao de Sinistralidade da ApoUce de Seguros do Sist^ma Financeiro Habitapao - FESA Consorcio para Regularijapao do Mercado Segurador-CRMS Outros Curio Praao Longo Prazo 279 296 (n2) 59.439 141.790 386.226 (238.650) 34.210 (2.273) 62.705 118.738 341.880 (363.377) 34.611 7.763 12.299) 571 7.625 (2.299) 651 65.937 65.264 673 66.409 65.699 710

de Riscos Nucleares - C0RN (1)

27 Demonstragoes Financeiras 2004 Demonslracoes Financeiras 2004

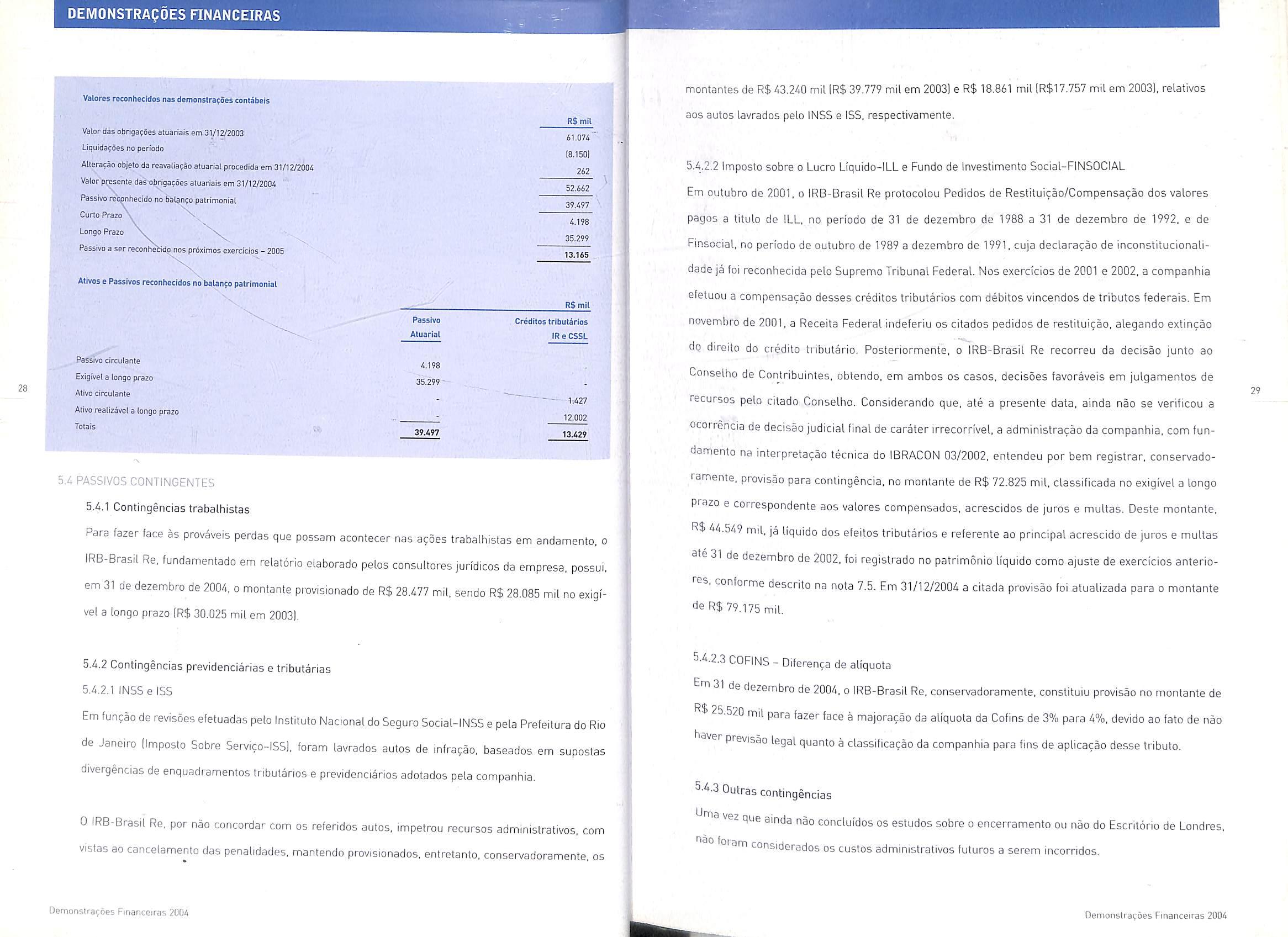

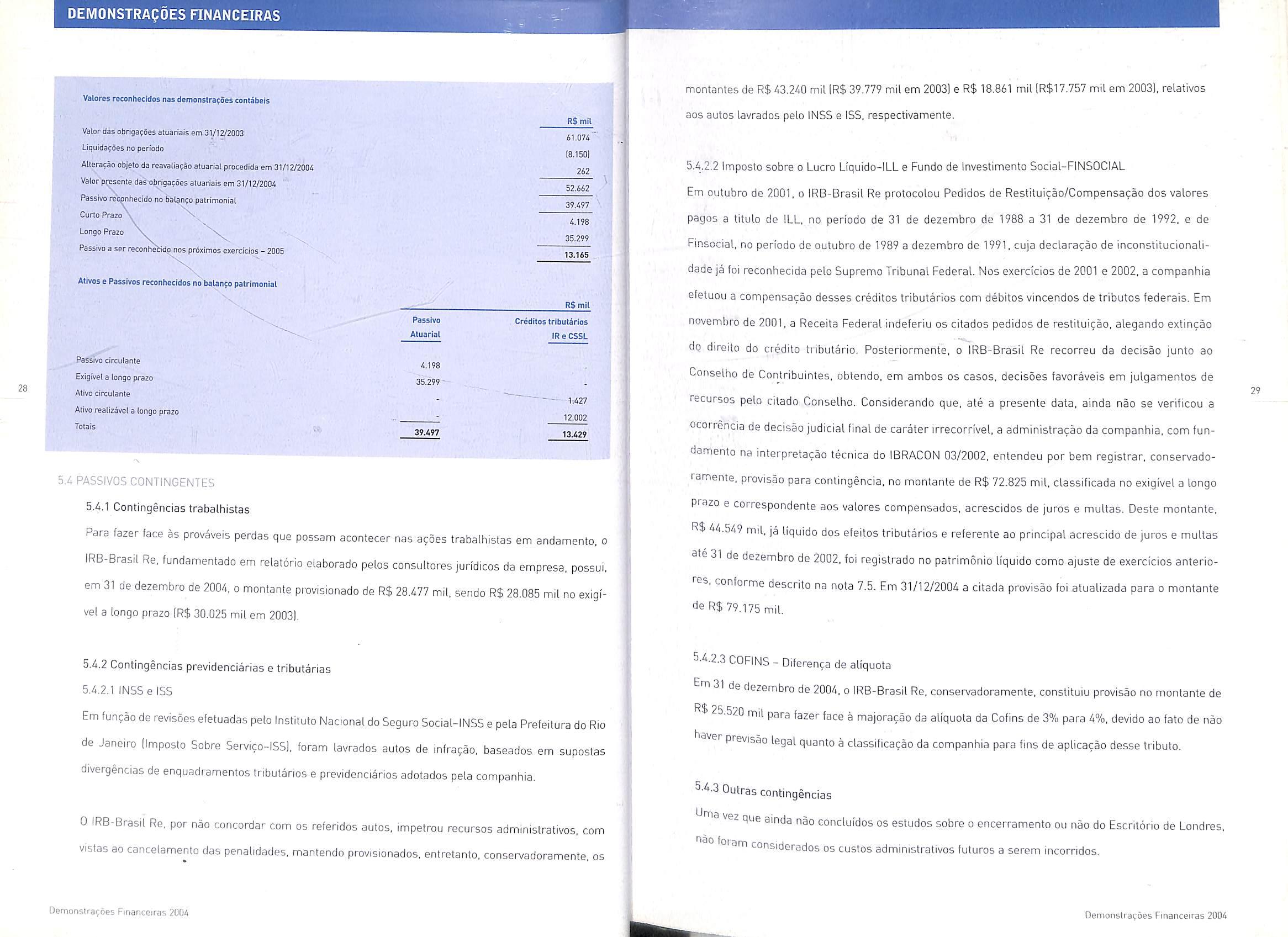

Valores reconhecitfos nas demonstra?5es contabeis

Valordas obrigafoes atuariais em 31/12/2003

Uquids^oes no periods

Aiteraclo objeto da reavaliaflo atjarial procedida em 31/12/200i

Valor presents das obrigapoes aluariais em 31/12/2004

Passive respnhecido no balanco patrimonial

a ser reconti^p nos prdximos exercicjps-2005

5.A PASSIV05 CONTINGENTES

5.4.1 Contingencias trabalhistas

Para fazer face as provaveis perdas que possam acontecer nas acoes trabalhistas em andamento. o IRB-Brasil Re. fundamentado em relatorio elaborado pelos consultores jurfdicos da empresa, possui, em 31 de dezembro de 2004, o montante provisionado de R$ 28.477 mil, sendo R$ 28.085 mil no exigi vel a longo prazo(R$ 30.025 mil em 2003).

5.4.2 Contingencias previdenciarias e tributarias

5.4.2.1 INSSeISS

Em funpao de revisoes efetuadas peto Instituto Nacional do Seguro Social-INSS e pela Prefeitura do Rio de Janeiro llmposto Sobre Servico-lSSi, foram lavrados autos de infracao, baseados em supostas divergencias de enquadramentos tributarios e previdenciarios adotados pela companhia.

0(RB-Brasil Re, por nao concordar com os refehdos autos, impetrou recursos administrativos. com vistas ao cancelamento das penalidades, mantendo provlsionados, entretanto, conservadoramente, os

montantes de R$ 43.240 mil(R$ 39.779 mil em 20031 e R$ 18.861 mil IR$17.757 mil em 20031, relativos aos autos lavrados peto INSS e iSS. respectivamente.

5.4.2.2 Imposto sobre o Lucro Uquido-ILL e Fundo de Investimento Social-FINSOCIAL

Em outubro de 2001, o IRB-Brasil Re protocolou Pedidos de Restituicao/Compensacao dos valores pagos a titulo de ILL. no pen'odo de 31 de dezembro de 1988 a 31 de dezembro de 1992. e de Finsocial, no periodo de outubro de 1989 a dezembro de 1991, cuja declaracao de inconstitucionalidade ja foi reconhecida peto Supremo Tribunal Federal, Nos exercicios de 2001 e 2002, a companhia efetuou a compensacao desses credilos tributarios com debitos vincendos de tributes federals. Em novembro de 2001, a Receita Federal indeferiu os citados pedidos de restituicao, alegando extincao dp direito do credito ti ibutario. Posteriormente. o IRB-Brasil Re recorreu da decisao junto ao Conselho de Contribuintes, obtendo, em ambos os casos. decisoes favoraveis em julgamentos de recursos peto citado Conselho, Considerando que, ate a presente data, ainda nao se verificou a ocorrencia de decisao judicial final de carater irrecorrivel, a administracao da companhia. com fundamento na interpretacao tecnica do IBRACON 03/2002, entendeu por bem registrar, conservado ramente. provisao para contingencia, no montante de R$ 72.825 mil, classificada no exigivel a longo prazo e correspondente aos valores compensados, acrescidos de juros e multas. Deste montante, R$ 44.549 mil.ja llquido dos efeitos tributarios e referente ao principal acrescido de juros e multas ate 31 de dezembro de 2002,foi registrado no patrimonio llquido como ajuste de exercicios anterio6s, conforme descrito na note 7.5. Em 31/12/2004 a citada provisao foi atualizada para o montante de R$ 79.175 mil.

5.4,2.3 COFINS - Diferenca de aliquota

Ti 31 de dezembro de 2004, o IRB-Brasil Re. conservadoramente, constituiu provisao no montante de ^ 25.520 mil para fazer face a majoracao da aliquota da Cofins de 3% para 4%.devido ao fato de nao ver previsao legal quanto a classificacao da companhia para fins de aplicacao desse tributo,

5.4.3 Outras contingencias

3 vez que ainda nao concluidos os estudos sobre o encerramento ou nao do Escritbrio de Londres, 'oram considerados os custos administrativos futuros a serem incorridos.

DEMONSTRAQOES FINANCEIRAS 28

Curto

Longo Prazo

Ativos

Passives

R$ mil 61.074 (8.1501 262 52,662 39.497 4.198 35.299 13.16S R$ mil Passivo circulante Exigivel a longo prazo Ativo circulante Alivo realizavel a longo prazo Totals Passivo Atuarial 4.198 35.29939.497 Credilos tributarios IR e CSSL 1:427 12-002 13.629

Prazo

Passivo

e

reconhecidos no balan?o patrimonial

Demonstra?6es Financeiras 20D4

Oemonslrafoes Financeiras 2004 29

5.5 DESTINACAO DO LUCRO LiQUIDO DO EXERCICIO

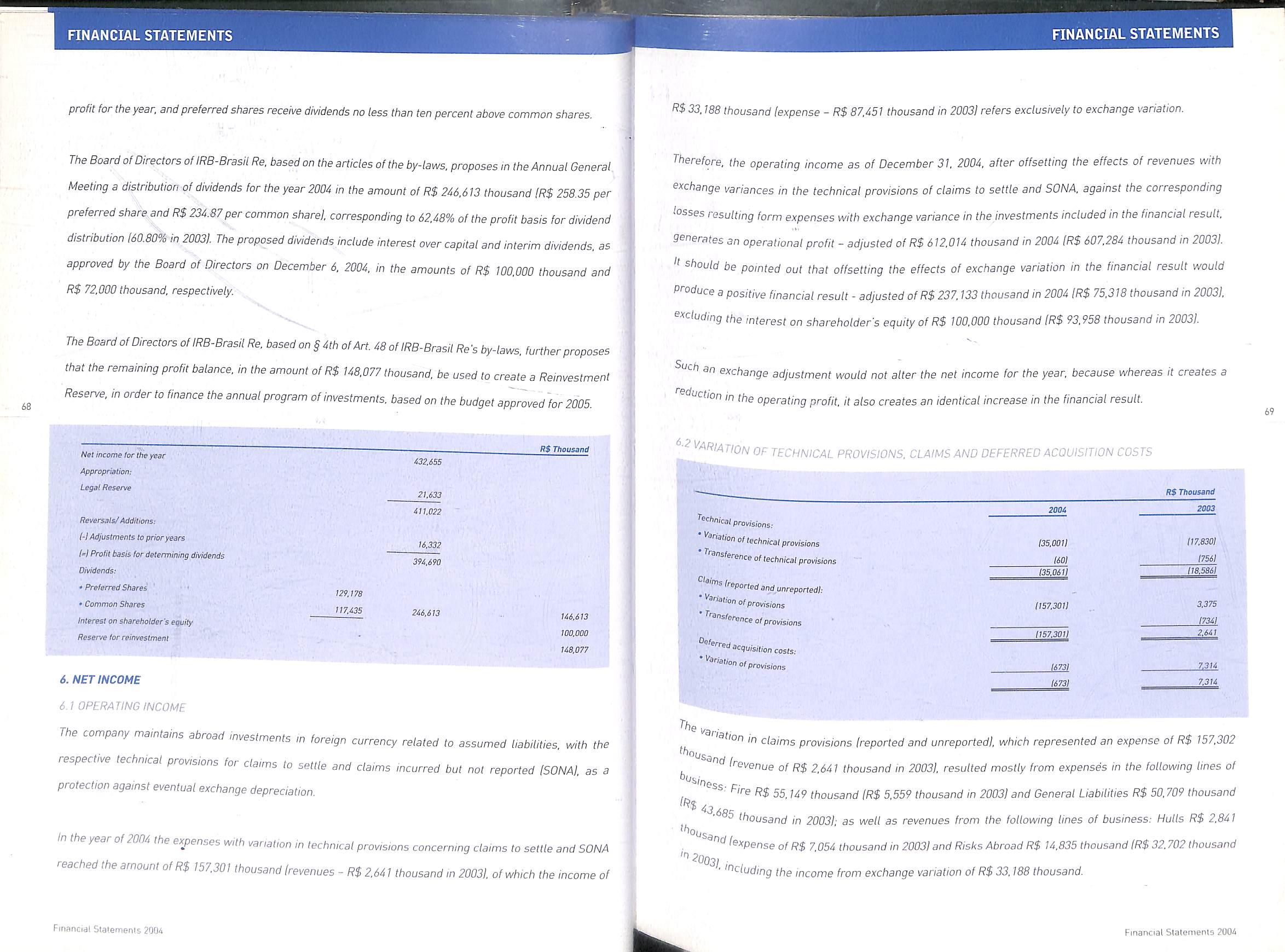

0 dividendo mfnimo anual,como determinado no estatuto da companhia,e calculado a razao de 25% do lucro liquido ajustado do exercfcio, sando que as acoes preferenciais gozam, ainda, da prloridade de receber dividendos, no minimo. dez por cento maiores que os atribuidos as acoes ordinarias.

0Conselho de^inistrac^ do IRB-Brasil Re,com base nas disposicoes estetutarias, propoe a Assembteia Geral Ordinana ^stribuicao de dividendos relatives ao exercicio de 2004 no montante de R$ 246.613 mil [R$ 258,35 por acao preferencial e R$ 234,87 por acao ordinaria), correspondendo a 62,48% do [ucm-base para a distribuicao de d,videndos|60,80% em 2D03j. Gs dividendos propostos incluem a parcela de juros sobre

0 capital prdprio e de dividendos antecipados. aprovado pelo Conselho de Administracao em 06 de dezembro de 2004, nos montantes de R$ 100.000 mil e R$ 72.000 mil, respectivamente.

0 Conselho de Administracao do IRB-Brasil Re, com base no § 4= do Art. 48 do estatuto do IRB-Brasil Re, propoe, ainda. que o saldo remanescente dos lucros, no montante de R$ 148.077 mil, seja utilizado na constituicao de Reserva para Reinvest,mento, para atender ao programs anual de investimentos, com base no orcamento de capital aprovado para 2005.

estrangeira, com as provisoes tecnicas de sinistros a liquidar e sinistros ocorridos e nao avisados-SONA, constituindo protecao contra eventuais desvalorizacoes cambiais.

No exercicio de 2004, as despesas com vartacoes das provisoes tecnicas de sinistros a liquidar e SONA alcancaram o montante de R$ 157.301 mil (receitas - R$ 2.641 mil em 20031. do qual a receita de R$ 33,188 mil Idespesa - R$ 87.451 mil em 2003) se refere, exclusivamente, a oscilacao cambial.

Nessascondicoes,o resultadooperacionalapuradoem31 dedezembrode2004, compensando-seosefeitos dasreceitascom variacoescambiais nas provisoestecnicasdesinistro a liquidareSONA. contra as correspondentes perdas advindas das despesas com oscilacoes cambiais dos investimentos alocados no resulta dofinapceiro,ensejariaumlucrooperacional-ajustadodeR$612.014milem2004(R$607.284milem20031, stralivo alentar-se que, compensando-se esses mesmos efeitos das variacoes cambiais no resultado inanceiro, ensejaria, ainda. um resultado financeiro positivo - ajustado de R$ 237.133 mil em 2004 $25.318milem2003),excluidososjurossobrecapitalpropriodeR$100.000mil(R$93.958milem2003).

ajuslecambialnaoalterariaolucroliquidodoexercicio,vistoqueaotempoemqueprovocaumareducao resultadooperacional.provoca, nosentidoinverso. umaumentodeigualvalornoresultadofinanceiro.

6.2VARIACOESDASPROVISOESTECNICAS, DESINISTROS EDEdespesasdeCOMERCIALIZACAO DIFERIDAS

IPiWiseesWcnlcas:

'Vanagao da provisiol6cnica

Transferenciade provisoestecnicas

Si"istn,s(avisadosenaoavlsados):

* Variagaode pro«sao

• Transferenciadeprovisoes

Despesasdecomercialiaafaodtferidast

' Variagao de provlsio

RESULTADO OPERACIONAL

companhia manlem investimentos no exterior atrelados as responsabilidades assumidas, em moeda

DEMONSTRApdES FINANCEIRAS r 30

R$ mil Lucro liquido do exerdcio 432.655 Apropn'acao: Reserva Lega 21.633 ReversSes/Adlfoes: (-1 Ajustes de exercicios anteriores (=■) Lucro bisico para determinapaodo dividendo Dividendos: • Afoes preferenciais • Afoes ordinarias Juros sobre o capital proprio Reserva para reinvestimerto 411,022 16.332 394.690 129.178 117.435 246.613 146.613 100.000 148.077 A.

6

RESULTADO DO EXERCICIO

1

A

2004 135.001) 160) (35.061) Tiini R$mtl117.830) (18.586) 1157.301) 1157.3011 3.375 17341 2.641 1673] 7.314 7J14 31 Demonstracoes Financeiras 2004 Dernonstracoes Financeiras 2004

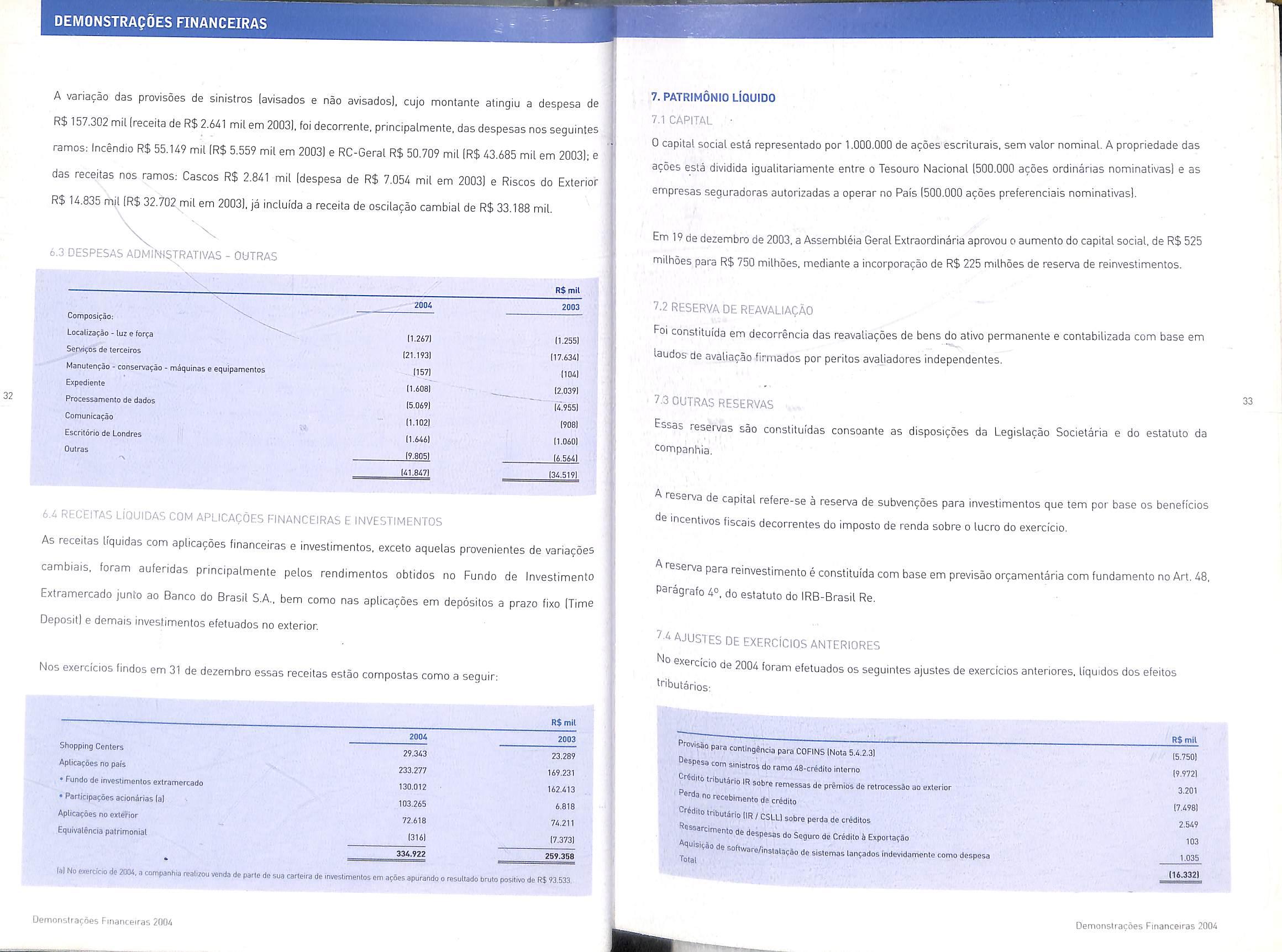

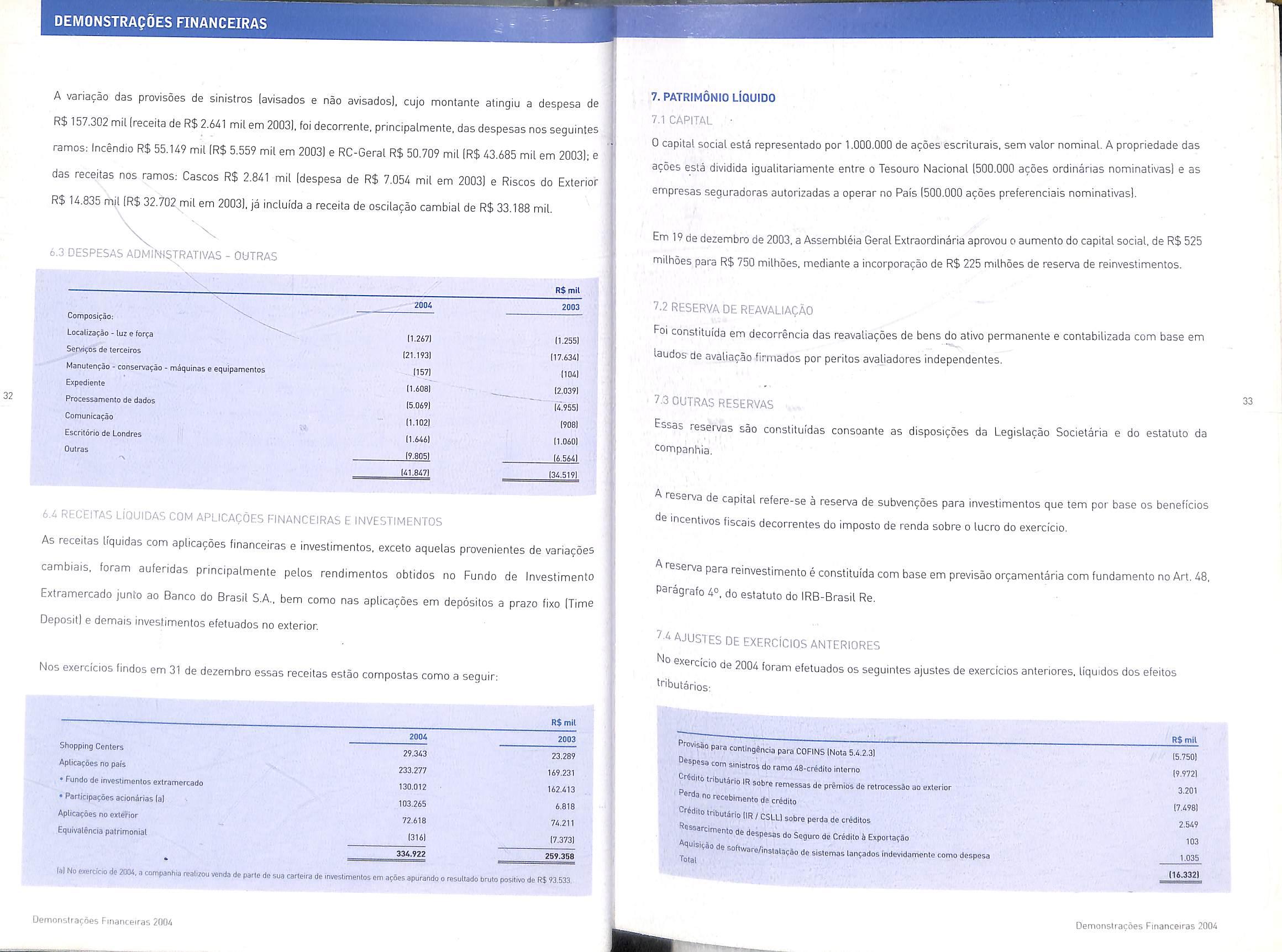

A vanacao das provisoes de sinistros (avisados e nao avisados), cujo montante atingiu a despesa de R$ 157.302 mil[receita de R$ 2.641 mil em 2003],foi decorrente, principalmente,das despesas nos seguintes ramos: Incendio R$ 55.M9 mil|R$ 5.559 mil em 20031 e RC-Geral R$ 50.709 mil 1R$ 43.685 mil em 2003); e das receitas nos ramos; Cascos R$ 2.841 mil Idespesa de R$ 7.054 mil em 2003) e Riscos do Exterior R$ 14.835 mil(R$ 32.702 mil em 2003),ja incluida a receita de oscilacao cambial de R$ 33.188 mil.

6.3 DESPESAS ADMlMt^TRATIVAS - OUTRAS

- conserva^ao - maquinas e equipatnentos

6.4 RECEITAS LIQUIDAS COIv] APLICACOES RNANCEiRAS E INVESTIMENT05

As receitas liquidas com apUcacoes financeiras e investimentos, exceto aquelas provenientes de variacoes cambiais, foram auferidas principalmente pelos rendimentos obtidos no Fundo de Investimento Extramercado junto ao Banco do Brasil S.A., bem como nas aplicacoes em depositos a prazo fixo iTime Deposit) e demais investimentos efetuados no exterior.

Nos exercicios findos em 31 de dezembro essas receitas estao compostas como a seguir:

7.PATRIM6nIO LtQUIDO

7.1 CAPITAL •

0 capital social esta representado por 1.000.000 de acoes escriturais, sem valor nominal A propriedade das acoes esta dividida igualitariamente entre o Tesouro Nacional (500.000 acoes ordinarias nominativas) e as empresas seguradoras autorizadas a operar no Pais (500.000 acoes preferenctais nominativas).

Em 19 de dezembro de 2003,a Assembleia Geral Extraordinaria aprovou o aumento do capital social, de R$ 525 milhoes para R$ 750 milhoes, mediante a incorporaqao de R$ 225 milhoes de reserva de reinvestimentos.

7-2 RESERVA DE REAVALIACAO

Foi constitulda em decorrencia das reavaliacoes de bens do ativo permanente e contabilizada com base em laudosde avaliacao firmados por peritos avaliadores independentes.

7.3 OUTRAS RE5ERVAS

Essas reserves sao constituidas consoante as disposicoes da Legislacao Societaria e do estatuto da companhia,

neserva de capital refere-se a reserva de subvencoes para investimentos que tern por base os beneficios de incentivos fiscais decorrentes do imposto de renda sobre o lucro do exerclcio.

para reinvestimento e constltuida com base em previsao orcamentaria com fundamento no Art, 48, Paragrafo 4°. do estatuto do IRB-Brasil Re.

7-4 AJUS1ES DE EXERCICIOS ANTERIORES

No xencicio de 2004 foram efetuados os seguintes ajustes de exercicios anteriores, llquidos dos efeitos ^'"ibutarios;

Provlsao pars cantlnglncia para COFINS iNota 5.4.2.3)

Sespesa com sinistros do ramo 48-credito inlerno butario IR sobre remessas de pr§mibs de retrocesslo so exterior

«"la norecebitnentode credito

irihutario(IR / CSLL)sobre perda de creditos

EquiValSncia patrimonial

(a)No exeroico de 2004,a companhia reeDzou venda de par.e de sua carteira de investimentos em apces apurendo o resullado bruto positive de R$ 93.533.

^ . .. 6espesas do Seguro de Credito 5 ExportaqSo

de sistemas lanjados indevidamente como despesa

DEMONSTRAQOES RNANCEIRAS

\ Composicao: Locallzafao

for^ Servi?os de terceiros Manutercio

Expedlente Processamento de dados Comunlcapao Escrltorio de Londres Omras R$mil 2004 2003 (1.2671 (21.1931 (1571 (1.608) (5.069) [1,1021 (1.666) (9.8051 (1.255) (17.634) (106) (2.039) (4.955) (908) (1.060) (6.564) 141.847) (34.519)

- luz e

t.

33 R$ mil Shopping Centers Aplicapoes no pais •Fundo de investlmenlos e*tramereado •Parficlpaqoes acionarias(a) Aplicaqoes no exteTlor

2004 29.343 233.277 130.012 103.265 72.618 (316) 334.922 2003 23.289 169.231 162.413 6.818 74.211 (7,373) 259.358

''^st^/inslalaqao

RSmll (5.7501 (9.972) 3.201 (7.498) 2.549 103 1.035 (16.332) Demonstra?6es Financeiras 2004 Demonstracoes Financeiras 2004

8. ATIVOS E PASStVOS EM MOEOA ESTRAN6EIRA

Apresentamos a seguir os saldos das contas ativas e passives indexados ou contratados em moeda estrangeira;

9. PREMIOS GANHOS POR RAMOS DE ATUACAO

Apresentamos a segem ps premios ganhos dps principals ramos de atuacao da companhia:

DEMONSTRACAO 00 VALOR ADICIONADO

Apresentamos a demonstracao de VaLor Adicionado, com empress para geragao da riqueza nacional, e explicitar a neracao do trabalho. governo e acionista.

PeHONSTRApAO DO VALOR AOICIONADO ^

1 - RECEITA COM ACEITApAO DE RISCOS

2 - CESSAO DE RISCOS A TERCEIROS

0 - VALOR AOICIONADO BRUTO

4-SINISTROS.

- SINISTROS INOENIZAOOS

4.2 - SItdlSTROS RECUPERADOS

5 ■ COMISSOSS £ PARTICtPACbES EM LUCROS

5.1 - COMISSOES sobre prEmios EMITIDOS

5.2 - cqmissOes sobre prEmios retroceoioos

5.3 - PARTlCIPAQbES EM LUCROS CONCEOIDAS

5.4 - PARTlCIPAGbES EM LUCROS AUFERIDAS

5 MATERiais,ENERGIA,SERVICOS DE TERCEIROS E OUTROS

VALOR AOICIONADO LlQUlOO

8- VALOR AOICIONADO fiECEBIDO POR TRANSFERSNCIA

8.1-RESULTAOO FINANCEIRO

VALOR GLOBAL ADICIONADO AOS NEObCIOS OA EMPRESA

'0-RetenpQes

'"•'-PROVISOES TECNICAS

'"•2 - provisoes ADMINlSTRATiVAS

'03- PROVISOES econOmico-financeiras

•^ REDUpAo PATRIMONIAL- AJUSTES DE EXERC.ANTERIORES

'"•5 - DEPRECIApio

VALOR FINAL ADICIONADO AOS NEGbCIOS DA EMPRESA

-^^^S!HH1£A0Do VALOR ADICIONann

PESSOAL E encargos

objelivo de mensurar o valor distribuicao para a sociedade

da contribuicao da na forma de remu-

empregados E DIRIGENTES NDS LUCROS

;^LDEPESS0ALEENCARG0S

POSTQS,TAXAS E CONTRIBUIOOES

10. REMUNERAPAO

ADMINISTRADORES ores maximos, medas e minimos da remuneracao mensal paga pelo IRB-Brasil Re a seus emprega. Oos e admintstradores em 31 de desembro de 2004,sao cs seguintes

Demonslrsfoes Finsnceiras 2004

DIvTI^ RECURSOS deTERCEIROS

"ALOR AOICIONADO DISTRIbuIdo

DEMONSTRApOES FINANCEIRAS 34

R$ mil 2004 Ativos em moeda estrange»ra OisponlbiUdades Aplicafoes financeiras Seguradoras poroperagoes em geral fnvestlmentos permanenles • Total Passlvos em moeda estrangeira Provisao para premio nao ganho Provisoes de sinistros a liquidar Provisao tecnica - SONA Seguradoras por operagoes em geral Conta corrente - CBRN Outros passlvos em moeda estrangeira Provisoes tecnicas - Londres Total Ativos liquldos em moeda estrangeira

80.972 2.240.069 145.620 24.425 2.491.086 68.315 284,540 77.119 301.291 59.439 2.933 276.239 1.069.876 1.421.210 2003 102.811 1.976.087 261.695 24.741 2.365.334 74.693 313.627 75,798 276.445 62.705 343.256 1.146.524 1.218.810 RAMO Incendio Responsabilldade CIvli Oeral Transportes Inlernaclonals Garantia de Obrig. Contraluals VIda em Grupo RIsco de Engentiaria Aeroniutico Habltacional Outros Total Primio ganho 511.975 138,260 75.579 101.404 75.287 26.433 68.791 46.910 349,100 2004 indlcede sinlstralidade 52.0 5-1,5 27.7 26.8 53.1 52,3 46.8 41,0 47,0 fndlce de comrssionamento 1.0 13,8 20.2 41,4 0,3 6.S 5.8 19.1 14.1 2003 PrSmio ganho 448.722 136.999 74.186 72.947 65.598 62.588 48.012 40,735 29S.6S0 1.248.437 Indies de sinlstralldsde 55,5 41.9 10,31 20.7 27.8 64,8 30.1 33.2 (3,5) indice de comlssionamento 2,1 15,5 19.1 38.4 0,6 0,5 a 17,9 11.5 39,4 9,7

PAGA A EMPREGADOS E

EmR$ Remuneragao bruta MIxime Minima Media Empregados 12-270.61 325,00 5.334,59

EM DEZEMflRO Administradores 13.507,75 13.507.75 13.507,75

Valores em R$ mil 2004 % 2003 % 2.853.256 100,00 2.876.787 100,00 1.424.576 49,93 1.609.763 55.96 1.428.68D 50,07 1.267,024 U,04 497.211 17,43 495.107 17.21 948.097 33,23 1.153,718 40.10 1450.886) i 15,80) [658.6111 (22.89) 93.352 3.27 68.551 2,38 209.760- 7,35 176,333 6,13 178,573) 12,75] 155.2481 [1,92) 9.966 0,35 25,980 0,90 147.801] 11,681 [78.514] (2.73) 41.365 1.45 38.492 1,34 796.752 27,92 664.874 23,11 204.944 7,18 15.149) (0.18) 204.944 7.18 15.149] 10,18) 1.001.696 35,11 659.725 22.93 264.340 9,78 116.681 4,06 192.915 6.76 8.631 0,30 55.463 2,46 47.375 1,65 12.915] IO.10) 3.579 0,12 16.332 0,57 55.362 1,92 2.545 0,09 1.734 0.06 737.356 25,32 543.044 18.88 2004 % 2003 % 96.897 13,14 91.978 16,94 5.850 0.79 5.359 0.99 10? 747 13.9.3 97.137 17.92 216.917 29.42 169.873 31,28 1,369 0,18 3.210 0,59 246,613 33.45 155.793 28,69 169 7in 23.07 116R31 21 51 737.356 100,00 543.044 nriiiiii 100.00 35 Denion5tra(;6es Financeiras 2004

PARECER DOS AUDiTORES INDEPENDENTES

Ao ConseLho de Administracao e Acionistas

IRB-Brasil Resseguros SA

1. Examinamos o balance patrimonial do IRBBrasil Resseguros SA., levantado em 31 de dezembro de 200A, e as respectivas demonstracoes do resultado, das mutacoes do patrimonio liquido e das origens e aplicacoes de recursos correspondentes ao exercicio findo naquela data-,-..elaborados sob a responsabilidade de sua administT^ao. Nossa responsabilidade e expressar uma opiniao sobre essas demonstracoes contabeis.

2. Nosso exame foi conduzido de acordo com as normas de auditoria aplicaveis no Brasil e compreendeu:(a|o planejamento dos trabalhos, considerando a relevancia dos saldos, o volume de transacoes e os sistemas contabil e de controles internos do IRBBrasil Resseguros S.A,; lb) a constatacao, com base em testes, das evidencias e dos registros que suportam OS valores e informacoes contabeis divulgados; e Id a avaliagao das praticas e das estimativas con tabeis mats representativas adotadas pela adminis tracao do IRB-Brasil Resseguros S.A., bem como da apresentagao das demonstragoes contabeis tomadas em conjunto.

3. Em nossa opiniao, as demonstracoes contabeis refendas no paragrafo 1 representam adequadamente, em todps os aspectos relevantes, a posigao patrimonial e financeira do IRB-Brasil Resseguros S A. em 31 de dezembro de 2004, o resultado de suas operagoes, as mutacoes de seu

patrimonio liquido e as origens e aplicacoes de seus recursos correspondentes ao exercicio findo naquela data, de acordo com as praticas con tabeis adotadas no Brasil.

4. As demonstracoes contabeis do exercicio findo em 31 de dezembro de 2003, apresentadas para fins de comparacao, foram por nos examinadas e o nosso parecer emitido em 30 de Janeiro de 2004, sem ressalvas, apresentava enfase referente as incertezas existentes quanto a determinacao da provisao para sinistros ocorridos e nao avisados assumidos no exterior, pela Sede.

Rio de Janeiro. 31 de Janeiro de 2005

No tocante a destinacao do lucro liquido do exerci cio de 2004, oConselhio aprovou a proposta de distribuicao de dividendos no montante de R$246.613.583.30 (R$285,35 por acao preferential e R$234,87 por acao ordinarial, correspondendo a 62,48% do lucro-base para distribuicao de dividen dos. nestes inclutdas as parcelas de juros sobre o capital proprio e de dividendos antecipados, aprovados por este Conselho em 06.12.2004, nos montantes de R$100.000.000,00 e R$72.000,000,00, respectivamente.

0Colegiado registrou.tambem, quetodaa documenlacao apresentada esta em ordem, permitindo que seja convocada a Assembleia GeraldeAcionistas.

Janeiro iRJj. ig dg marco de 2005

PARECER DO CONSELHO FISCAL

0 CONSELHO FISCAL DO IRB-BRASIL RESSE

GUROS S.A., no USD de suas atribuicoes legais e estatutarias. havendo procedido ao exame do Relatorio da Administracao, do Balance Patrimo nial e demais demonstracoes contabeis acompanhadas das respectivas Notas Explicativas, do IRB-Brasil Re, relatives ao exercicio findo em 31 de dezembro de 2004, aprovados pelo Conselho de Administracao, em reuniao de 18 de marco de ,2005, com base nesse exame e a luz do Parecer dos Auditores Independentes, TREVISAN - AUDI TORES INDEPENDENTES, de 31 de Janeiro de 2005, e de opiniao que os referidos documentos refletem adequadamente a situacao financeira e patrimonial do IRB-Brasil Re.

Jose Luiz de

Souza Gurgel Socio-contador

CRC RJ-087339/O-4

Trevisan Auditores Independentes

CRC 2SP013439/O-5"S" RJ

PATIECER DO CONSELHO DE ADMINISTRACAO

0 Conselfio de Administracao do IRB-Brasil

Resseguros S.A., em cumprimento ao disposto no artigo 142, incise V, da Lei n° 6.404/76 e no artigo 24, inciso V, do Estatuto Social, considerando os Pareceres da Auditoria Interna e dos Auditores Independentes, aprovou, por unanimidade, as Demonstracoes Contabeis referentes ao exercicio encerrado em 31 de dezembro de 2004, o Relatorio da Administracao e a Proposta de Orcamento de Capital para o exercicio de 2005.

Marcos de Barros Lisboa

I^Fesidente

Lidio Duarte

^ice-Preside^tg

^tacilio Caldeira Junior

ConsGlheiro

■^"nselheiro

Rio de Janeiro. 18 de marco de 2005

Pedro Wilson Carrano Albuquerque

Presidente

Pedro Camara Raposo Lopes

Conselheiro

Amaury Patrick Gremaud

Conselheiro

Filho

Henrique de Jesus Coelho

Conselheiro Suplente

Jon9® Hitario GouveaVieira

^"i^selhe iro

Lucio Antonio Marques

Conselheiro Suplente

36 RELATORIO DA ADMINISTRAQAO

Demonslrdcoes Financeiras 2004 •■I

""'W^QuintilianodaSilva

^'^Tavares Pereira

^°"selheiro

Demonslracoes Financeiras 2004

Lidio Duarte

Presidente

Manoel Morals de Araujo

Vice-Presidente Executive

Carlos Murilo Goulart Barbosa Lima

DiretorTecnico

Luiz Eduardo Pereira de Lucena

Diretor Comercial

LuIz Appolonio Neto

Diretor de Planejamento e Desenvoivimento

Alberto de Almeida Pals

Diretor Financeiro

Roberto Serdeira Dominguez

• Gerente de Controle

Maria Gracia Provenzano

Atuaria-MIBA 0520

Gedeon de Souza Mouta

Contador - CRC-RJ 051.313-2

CPF 388.195.467-87

RELATORIO DA ADMINISTRAQAO 38

Oemonstrafoes Financeiras 2004 'H

Shareholders,

We are pleased to submit for your appraisal and approval our report on IR8-Brasil Resseguros S.A. with the main facts affecting the company for the year ended on December 31, 2004 and respective financial statements.

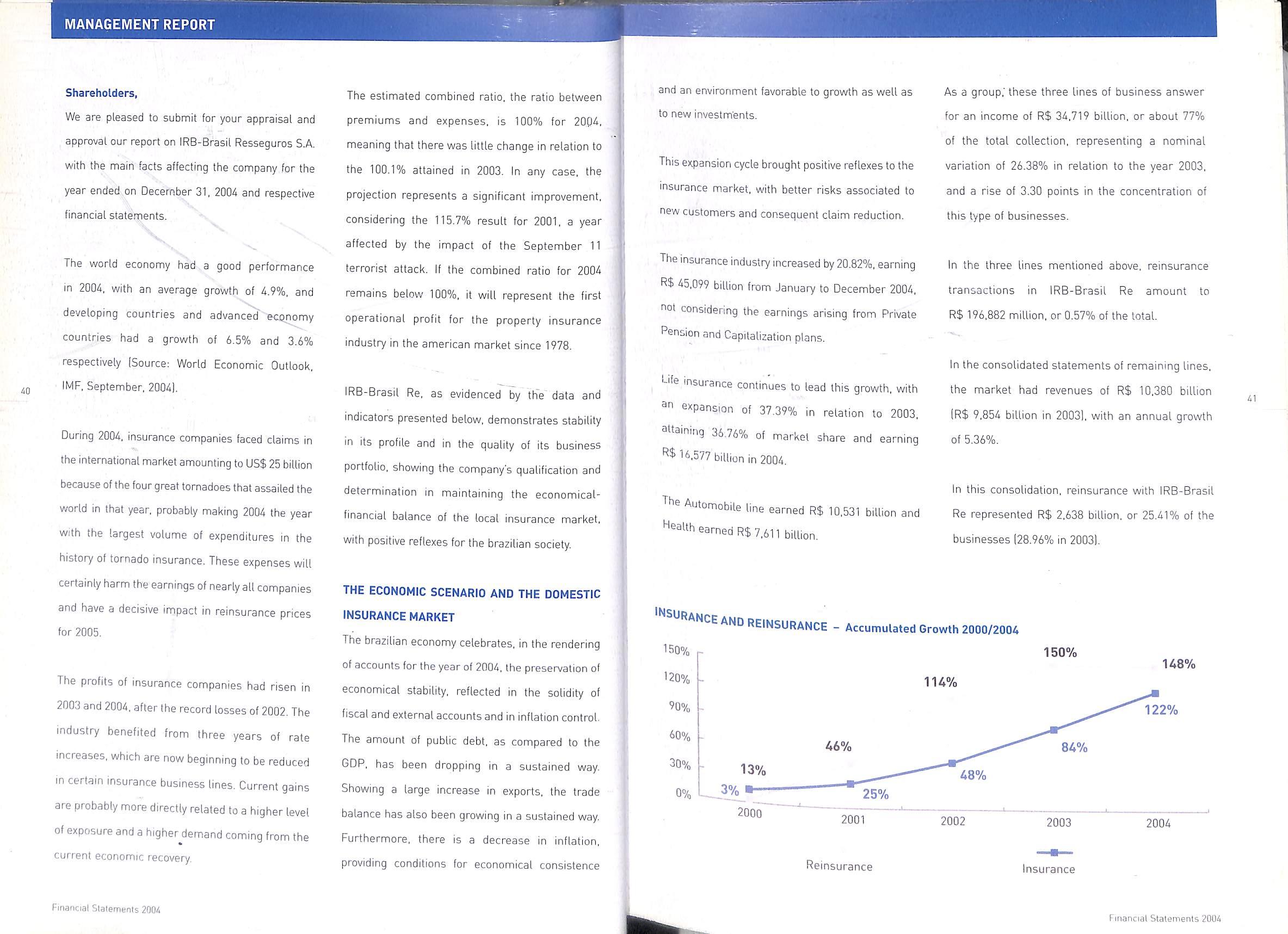

The world economy had a good performance in 2004. with an average growth of 4.9%, and developing countries and advanced economy countries had a growth of 6.5% and 3.6% respectively (Source: World Economic Outlook, IMF, September, 2004).

During 2004, insurance companies faced claims in the international market amounting to US$ 25 billion because of the four great tornadoes that assailed the world in that year, probably making 2004 the year With the largest volume of expenditures in the history of tornado insurance. These expenses will certainly harm the earnings of nearly all companies and have a decisive impact in reinsurance prices for 2005,

The profits of insurance companies had risen in 2003 and 2004, after the record losses of 2002. The industry benefited from three years of rate increases, which are now beginning to be reduced in certain insurance business lines. Current gains are probably more directly related to a higher level of exposure and a higher^demand coming from the current economic recovery.

The estimated combined ratio, the ratio between premiums and expenses, is 100% for 2004, meaning that there was little change in relation to the 100.1% attained in 2003. In any case, the projection represents a significant improvement, considering the 115.7% result for 2001, a year affected by the impact of the September 11 terrorist attack. If the combined ratio for 2004 remains below 100%, it will represent the first operational profit for the property insurance industry in the american market since 1978.

IRB-Brasil Re, as evidenced by the data and indicators presented below, demonstrates stability in its profile and in the quality of its business portfolio, showing the company's qualification and determination in maintaining the economicalfinancial balance of the local insurance market, with positive reflexes for the brazilian society.

THE ECONOMIC SCENARIO AND THE DOMESTIC INSURANCE MARKET

The brazilian economy celebrates, in the rendering of accounts for the year of 2004, the preservation of economical stability, reflected in the solidity of fiscal and external accounts and in inflation control. The amount of public debt, as compared to the GDP, has been dropping in a sustained way. Showing a large increase in exports, the trade balance has also been growing in a sustained way. Furthermore, there is a decrease in inflation, providing conditions for economical consistence

and an environment favorable to growth as well as to new investments.

This expansion cycle brought positive reflexes to the insurance market, with better risks associated to new customers and consequent claim reduction.

The insurance industry increased by 20.82%,earning R$ 45.099 billion from January to December 2004, not considering the earnings arising from Private Pension and Capitalization plans.

Life insurance continues to lead this growth, with expansion of 37.39% m relation to 2003, Reining 36.76% of market share and earning 14.577 billion in 2004.

Automobile line earned R$ 10,531 billion and earned R$ 7,611 billion.

As a group," these three lines of business answer for an income of R$ 34.719 billion, or about 77% of the total collection, representing a nominal variation of 26.38% in relation to the year 2003, and a rise of 3.30 points in the concentration of this type of businesses.

In the three lines mentioned above, reinsurance transactions in IRB-Brasil Re amount to R$ 196,882 million, or 0.57% of the total.

In the consolidated statements of remaining lines, the market had revenues of R$ 10,380 billion 1R$ 9,854 billion in 2003), with an annual growth of 5.36%.

In this consolidation, reinsurance with IRB-Brasil Re represented R$ 2,638 billion, or 25,41% of the businesses(28.96% in 2003).

MANAGEMENT REPORT LJ_ 40

Financial Stalements 2004

150%'20% 90%60%30%0% 150% U8% 1U% 122% A6% 8A% 13% A8% 3% 25% 2000 2001 Reinsurance 2002 2003 Insurance 2004 41 Financial Sfalements 2004

OPERATIONAL PERFORMANCE

IRB-Brasil Re recorded R$ 2,853 billion in total reinsurance premiums, practically the same level of 2003(R$ 2,877 billion), corresponding to 6.30% of the market 17.68% in 2003).

In opposition to the decrease in market share, the percentage of premiums transferred abroad, in the amount of R$ 1,410 billion, represents a decrease of 11,88% in relation to 2003 IR$ 1,60Ch-bii,lionl. implying an increase of 6.03 points in the ratio of reinsurance retention in the country, or 50.07% of ^2 the total premium earned by the company [44.04% in 2003).

Therefore, the total premium earned was R$ 1,394 billion in 2004, representing an increase of 11.64% in relation to 2003[R$ 1,248 billion).

The highest volume was, once again, in the Fire product line, in the amount of R$ 517 million (R$ 468 million in 2003), followed by the lines General Liability, with R$ 139 million 1R$ 136 million in 2003), Guarantees, with R$ 106 million 1R$ 75 million in 20031 and International Transports with R$ 80 million iR$ 75 million in 2003], which altogether represent close to 60% of the premium retained by the company.

Claims expenses, in the amount of R$ 655 million in 2004, increased by^32.91% as compared to 2003 [R$ 492 million), leveraged by a significant

increment in the variation of the provision of claims to settle, but reflecting, nevertheless, a lovv claim rate; 46.98%, as compared to 67.01% calculated by the market in 2004.

The operating profit, similarly to claims, had a positive performance in 2004, totaling R$ 645 million against R$ 695 million in 2003.

The combined ratio also presented a good result in 2004, reaching 0.72 [0.62 in 2003).

Concerning IRB-Brasil Re's actions in 2004 in favor of the dynamics and development of the national insurance market, the following actions stand out:

■ Renewal of the Real Property and Liabilities portfolios in foreign market reinsurance programs, making available to the insurance market capacities of up to US$ 212 million and US$ 35 million, respectively;

■ Renewal of Directors and Managers liabilities policies (D&O); increasing capacity from US$ 15 million to US$ 25 million and increasing IRB-Brasil Re s participation from 25% to 30% for coverage in the local market;

■ New differentiated reinsurance contracts for the multi-risk segment;

■ New differentiated reinsurance contracts and renewal of contracts using insurance companies' own tariffs for RD Equipment;

mplementation of a new subscription routine for 9 culture aircrafts, addressing market demand flowing for the practice of more competitive tariffs in the segment;

^'olopment of an operational plan for oe acceptance for supplementary pension Pl-^ns; and

® f^enewal nf fk e retrocession programs, usually better conditions, making available to the companies wider automatic capacity, higher c - P fid in recruiting and better liquidity payments.

Cq ^ of operations with the making internal processes safer, more and "^ibativec i^ore transparent, the following should be noted:

■ Continuity in the process of implementation of SIN - (Sistema Integrado de Negociosl, or Integrated Business System, which integrates subscription areas and technical accounts in a WEB platform;

■ Creation of a Workgroup to review IRB-Brasil Re's operational routines, including the optimization and adaptation to the new Integrated Business System;

■ Enlargement of the internal culture of plurality in decision-making, with the reactivation of the Investment Committee, creation of a Security Committee [both committees with the participation of the market), as well as a Planning and Budget Committee and a Surplus Placement Committee;

■ issuing guidelines and standards for the Surplus Placement Committee, preceded by public consultation to the market;

■ Increase of the number of regulators and experts, through the opening of a new list, for the regulation of those claims where reinsurance has a majority participation;

■ Execution of an agreement between IRB-Brazil Re and UFRJ for the development of a support system for deciding our own retentions, thus optimizing the operational capacity: and

■ Preparation of an action plan to identify business opportunities.

MANAGEMENT REPORT

RETAINED PREMIUM 2004 7% 1% 12% PROPERTY TRANSPORTS FINANCIAL GOVERNMENT PERSONAL RETROCESSION

43 Financial Statements 2004 Financial Statements 2004