5 minute read

Agero FOSTERING INNOVATION IN INSURANCE

From a consumer perspective, automotive insurance is about one thing: peace of mind in case something goes wrong. If it does, and you are there with a great claims experience, you have created a long tail of loyalty. Arguably, you have very likely made a customer for life.

The challenge is that claims happen infrequently, and the insurance policy is something consumers hope they never have to use. This creates a conundrum for providers: how do you engage the customer to build brand affinity and loyalty when a best-case scenario is to only interact once a year around policy renewal?

"This is one reason the automotive insurance market has gotten exceptionally competitive and, to a degree, commoditized," says Chetan Ghai, Chief Commercial Officer of Insurance for Agero. The market has been essentially flat for the past five years (declining 0.3% per year from 2018 and 2022, with a growth of 0.8% expected this year), and to the extent there is growth, it's with carriers who have been aggressive or sophisticated with pricing. Mr. Ghai adds, “Consumers have been left with the impression that there’s little value-add with insurance, and it’s best to just pay the least you can. For carriers, this becomes a race to the lowest price.”

While automotive accidents are, thankfully, only occasional, if not somewhat rare, anyone who’s owned a car knows that breakdowns can be maddeningly frequent. And when a breakdown does happen, it’s often at the worst time, making for an often times frustrating, stressful, and disruptive experience. Whether at home or on the side of the road, the result of a simple flat tire or something far more serious, car trouble is the bane of an owner’s existence. One company, Agero, has built a thriving business helping automotive insurers and manufacturers be there for the motorist during that time of need.

The Inception and the Journey

Agero was founded as Cross-Country Motor Club in 1972 by Sidney Wolk, who had previously worked as an agent for carriers, including Nationwide. Even back then, Mr. Wolk realized that forward-looking insurance and automotive companies would embrace the opportunity to sell value-add services such as roadside assistance. Agero grew out of that need to connect stranded motorists with willing service providers at any hour and across every zip code in the country.

As it has grown, Agero has also expanded into end-toend software-enabled driver safety services, covering key moments across the entire vehicle ownership experience, such as EV support, connected vehicle services, claims management, consumer affairs and more, all pushing the limits of big data to transform an industry. Today, Agero is the nation’s largest provider of white-label driver support services, working with seven of the ten largest insurance providers and more than a dozen of the largest automotive brands to cover 115 million vehicle owners in the U.S. while helping 33,000 drivers each day.

Making a Difference

“Delivering these capabilities is no easy feat, but it is our ability to do so that enables us to stand out in the industry,” says Mr. Ghai. The process of capturing service requests and delivering support is data-intensive, involving a complex chain of events among disparate parties—the customer, the service provider (tow operator), the program sponsor (such as the automaker or the insurer), and when needed for quality assurance, contact center agents. Mr. Ghai adds, “Seamless communication and coordination among these stakeholders, each needing to be armed with the right insights, is key to quickly and effectively helping a stranded policyholder.”

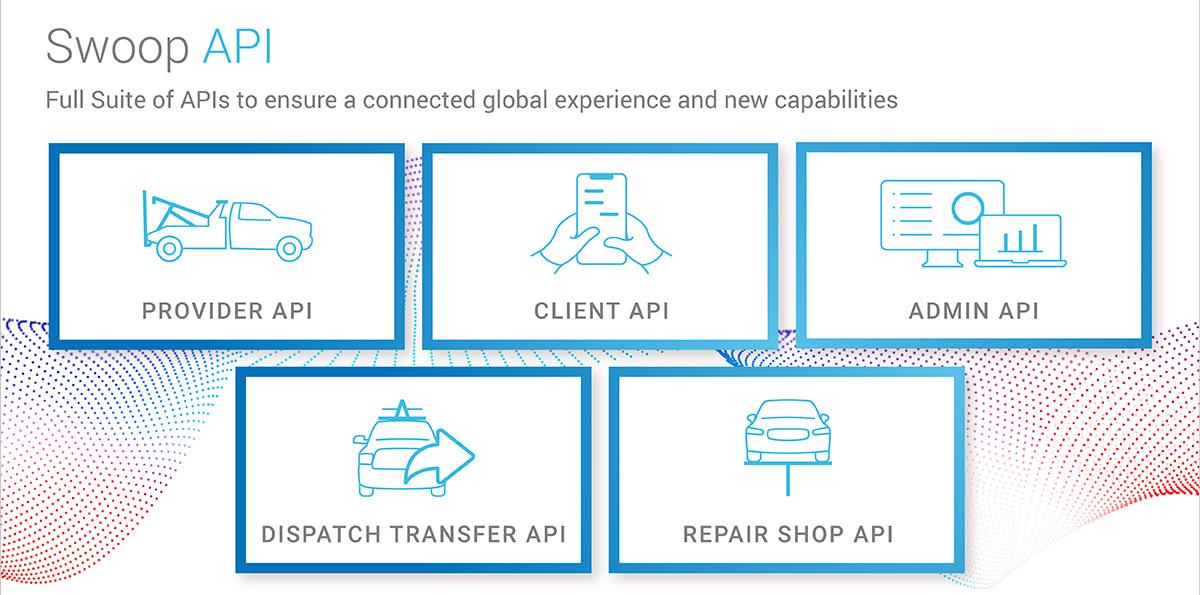

Agero's vertically integrated SaaS dispatch platform, Swoop Dispatch Management, tackles this complexity by providing transparency and clarity throughout the entire roadside or accident event. Swoop Dispatch Management modernizes and streamlines the complete breakdown experience for each stakeholder in the end-to-end service delivery chain. “This platform, combined with our award-winning people and our ability to deliver quality at scale, empower us to deliver unparalleled assistance to people in need: from intake to dispatching and servicing to monitoring and reporting,” explains Mr. Ghai.

Deliver the Right Help at the Right Time

Insurers embrace Agero’s white-label approach as it helps each provider deliver on its unique brand promise. “We do the hard work to maximize the insurer’s relationship, so they become the hero with policyholders during a stressful time,” pinpoints Mr. Ghai. Agero takes this role as an extension of the insurer’s brand seriously, bringing together its people, technology and scale to ensure that the company is getting these critical moments just right.

Armed with terabytes of event data to fuel service provider selection algorithms and event monitoring – and transparency for internal insurer reports and KPIs – the company is able to consistently and efficiently deliver the right help at just the right time to keep the insurer’s brand front and center.

Agero continues to extend these services to create multiple touchpoints between insurer and policyholder throughout the vehicle lifecycle. “One example is our partnership with Lyft, where the carrier is able to offer a ride from the disablement scene while their vehicle is being towed to the proper destination,” shares Mr. Ghai. Being able to integrate seamlessly with different providers in the transportation ecosystem can bring tremendous value to the consumer and help mitigate continued challenges.

One such challenge is the steady rise in vehicle repair and total loss costs and the resulting need for insurers to explore every possibility for reducing accident claim costs and cycle time. Agero’s data shows that issues such as delayed first notice of loss (FNOL), incomplete data and complex vehicle release requirements add an average of $700-$925 per claim, which can easily equate to millions of dollars in added insurer cost per year. The company’s records also show a 50% increase in the average fee paid by insurers for damaged vehicle towing and storage over the past three years. And, increasingly, backlogged body shops are even refusing vehicles outright.

“We are working with insurers to identify and combat these escalating costs through better accident claims management. For instance, research shows that only 9-13% of accidents are reported at the scene. This lack of on-scene FNOL might mean, for instance, that law enforcement is arranging an expensive (sometimes predatory) tow and impound instead of reflecting the insurer’s pre-negotiated transport and storage fees,” says Mr. Ghai. By facilitating the adoption of advancements like crash detection technology, mobile data gathering, digital Accident Management Dashboards and dedicated vehicle release management coordination, Agero is helping insurers alleviate the complexities that cause delays in accident management.

Facilitating the EV Revolution and More

Agero is looking forward to expanding its services to meet the evolving needs of insurance companies and policyholders. For instance, electric vehicles are an obvious industry growth market, yet EVs and their owners are very different from more traditional vehicles and motorists. Mr. Ghai shares, “It turns out that the vast majority of EV roadside assistance calls involve flat tires – for which most EVs don't have a spare in order to save weight and space. At the same time, this creates a great opportunity to offer motorists a needed service, that can quickly become expensive as each vehicle comes with a unique wheel and tire design, a quirk that translates to an inordinate volume of expensive tows. We are already experimenting with new programs and processes to address the issue.”

By the same token, compared to typical motorists, EV owners are considerably more involved and invested in understanding everything about their vehicles, including the vehicle’s connected capabilities. Among other things, this potentially creates an opportunity for insurers to integrate their mobile apps and motorist services more directly into the overall vehicle ownership experience, something Agero is hard at work solving.

Overall, Agero has leveraged its scale and experience to remain a leader in the insurer services space. During the past few years, the company completed the acquisition of a major competitor, Road America, and transitioned all existing and new Agero customers to an innovative cloud-based services platform. Agero continues to come to the aid of faltering programs for insurance and automotive partners nationally. The company has even helped the industry weather both literal and figurative storms with financial assistance, investments in tow provider training and education, massive scale-out for disaster support and continued partnership with industry consortiums researching vehicle advancements and motorist behavior.

Ultimately, Agero maintains a clear north star in all it does by recognizing that innovative services allow insurers to create a stronger, more frequent engagement with policyholders around a moment of truth. Every one of those touchpoints helps policyholders know the trust they put into their carrier is worth it.