9 minute read

Transform

As a Chamber member you have the power to influence key decision makers and play a leading role in tackling the issues that are preventing your business from reaching its potential, while an experienced team of lobbyists represents your interests in Whitehall.

AGM NOTICE

Advertisement

Notice is hereby given that the nineteenth Annual General Meeting of the Cambridgeshire Chamber of Commerce and Industry will be held at Clifford House, 2 Station Yard, Oakington, Cambridge CB24 3AH on Thursday 24 November 2022 at 9.30am for transaction of the following business: Ordinary Resolutions: • Approval of the report of the Directors and the financial statements for the year ended 31 March 2022 • Election of Directors; Stephen Dighton, Michael Greene and Andrew Silley who were co-opted to the Board of Directors in September 2022 offer themselves for election as Directors for an initial three year period until the November 2025 Annual General Meeting • Re-appointment of Azets Audit Services Limited as auditors of the company • Authorising the Directors to determine the auditors’ remuneration. Special Resolution; THAT revised Articles of Association of the Company be adopted. The Directors Report and Financial Statements for the year ended 31 March 2022 and the revised Articles of Association are available on the members’ section of the Chamber website. A proxy form can be downloaded from the members’ section of the website; this must be returned by email or post to the registered office, 48 hours before the meeting. By order of the Board

Michael Tolond

Company Secretary September 2022 Registered office: Clifford House, 2 Station Yard, Oakington, Cambridge CB24 3AH

Business confidence declines significantly

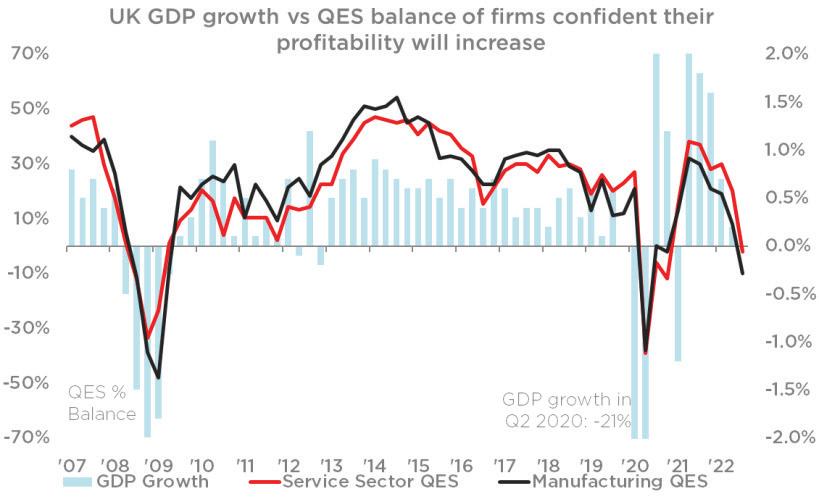

The BCC’s Quarterly Economic Survey (QES) for Q3 2022 shows a significant decline of key economic indicators, with weakening structural business conditions and confidence a cause for concern. The QES is the UK’s largest independent survey of business sentiment and a leading indicator of UK GDP growth. The survey took place between 22 August and 16 September, prior to the

Government’s energy support package for firms and the mini-budget announcement.

The survey of over 5,200 firms – 92 per cent of whom are SMEs – reveals there have been significant declines for indicators of business sales, cashflow, and profit expectations.

All indicators of business conditions and confidence have fallen significantly from Q2

More businesses are now seeing their cashflow decreasing, instead of increasing. One in three (32%) firms reported reduced cashflow over the last three months, while 23 per cent reported an increase. Indicators for business confidence have plummeted; less than half (44%) of firms expect their turnover to increase over the next 12 months, while 25 per cent expect a decrease. Those expecting an increase are down 10 percentage points from 54 per cent in Q2.

39% of businesses believe their profitability will reduce over the next 12 months

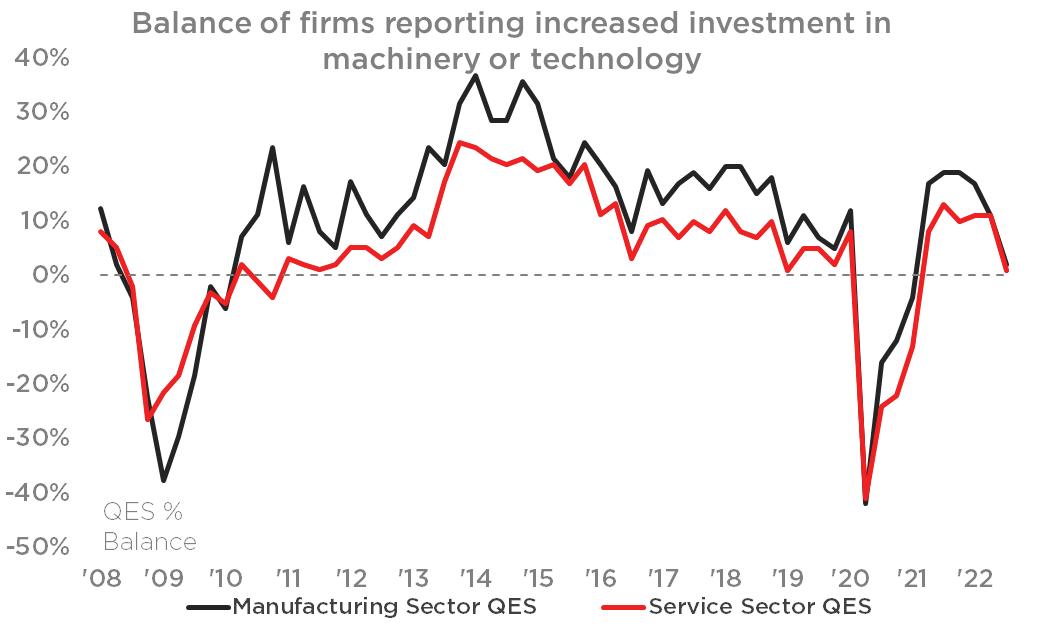

Profitability confidence has dropped to an even lower level; only one in three (33%) businesses believe their profits will increase over the coming year, while 39 per cent now expect a decrease. This is the lowest level since Q4 2020 at the height of the Covid crisis. Unsurprisingly, firms are not upping investment in their business. Only 22 per cent reported an increase to plant/equipment investment in the past three months, while 57 per cent reported no change, and 22 per cent reported a decrease.

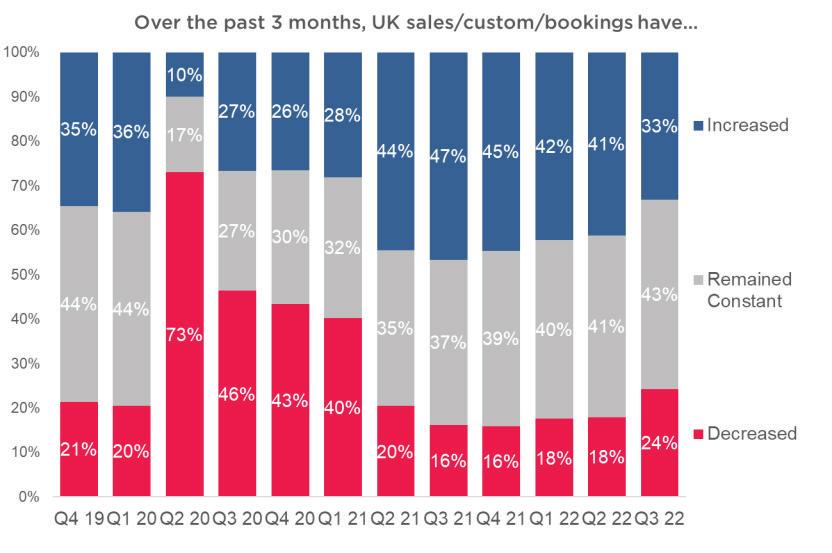

Business activity is taking a hit, with fewer firms reporting increased sales

Only 33 per cent of firms reported an increase in domestic sales over the past three months, a sharp decline from the Q2 level of 41 per cent. 24 per cent of firms reported a decrease in sales. The outlook is particularly bleak for the retail and wholesale sector. The sector is now in its second quarter of negative territory; with far more businesses reporting a decrease in sales rather than an increase. 25 per cent of retail/wholesale firms reported an increase in domestic sales, while 39 per cent reported a decrease. Alongside the retail and wholesale sector, other sectors are also struggling; almost three-quarters (71%) of hospitality businesses reported they are operating below capacity.

Fewer businesses are reporting increased sales; only 33% of firms reported increased domestic sales, down from 41% last quarter

Inflationary pressures are showing no signs of letting up

The percentage of firms expecting their prices to rise over the coming months (62%) remains close to last quarter’s record high. 84 per cent of firms also cite inflation as a growing concern to their business – by far the highest level on record. A rising proportion (37%) are also worried about interest rates. David Bharier, Head of Research at the British Chambers of Commerce (BCC), said: “This quarter’s results point to a significant decline in business confidence, with a clear shift downwards in many of the key indicators we track. Every sector has seen a falling proportion of firms reporting increased domestic sales, with the retail and wholesale sector particularly affected. “Diminishing sales coupled with soaring inflation is a toxic mix, and many firms are no longer looking to the future with optimism.

Profitability and turnover confidence for the next year have dipped significantly since last quarter. Both measures are heading towards levels not seen since the onset of the Covid crisis. “While the subsequent energy announcement will have alleviated immediate pressure on firms’ energy bills, confidence will have taken a further hit following the market reaction to the mini-budget. “Many firms are caught in the pincer movement of soaring inflation and rising interest rates. The devaluation of the pound has also added a huge cost base for businesses reliant on imports. “Businesses now desperately need to see economic stability in order to rebuild the confidence to invest.”

Measures for inflation remain at record highs as more than four in five (84%) firms say it is a growing concern for them

Responding to the findings, Director General of the British Chambers of Commerce, Shevaun Haviland, said: “This survey was concluded before the Government’s energy price package for businesses and the mini-budget. However, our findings paint a worrying picture of the state of affairs at many UK firms. Almost every key business indicator is trending downwards – sounding alarm bells across all sectors and regions. “Sales and cashflow are down, firms are operating below capacity, and the number of businesses expecting to see their profits increase is falling. “Unsurprisingly, inflation remains the top external factor of concern for businesses. Some firms are telling us that they have been forced to cancel otherwise viable projects, due to soaring costs. “In addition to the long-term structural challenges facing businesses, events over the last few weeks will have added to firms’ worries. The current volatility in the financial and currency markets must be speedily addressed to return stability to the economy and give business some certainty to plan. “We have welcomed the move from Government to reverse the National Insurance Contributions (NICs) increase, which will put money back into people’s pockets immediately; and the Annual Investment Allowance (AIA) now permanently set at £1m to help incentivise growth. “The six months energy package for businesses is a step in the right direction, but we need a longer-term plan if the government is serious about helping businesses during this energy crisis. Time is of the essence. “The Government must now rapidly present more detail on its fiscal policies and supply side reforms, particularly at a time when businesses are faced with rising interest rates and high inflation. “Businesses understand the economy will not fix itself overnight, but they do expect a long-term plan. We urge the Government to provide more certainty by bringing forward the publication of their Fiscal Plan. The sooner they do this, the sooner markets and businesses will understand what the long journey to stability will look like.”

As a Chamber member you have the power to influence key decision makers and play a leading role in tackling the issues that are preventing your business from reaching its potential, while an experienced team of lobbyists represents your interests in Whitehall.

Image by rawpixel.com on Freepik

5-point plan secured wins for business

The British Chambers of Commerce (BCC) proposed a comprehensive five-point plan to provide vital support to UK businesses including: 1. Ofgem to be given more power to strengthen regulation of the energy market for businesses 2. Temporary cut in VAT to five per cent to reduce energy costs for businesses 3. Covid-style support by introducing Government Emergency Energy Grant for SMEs 4. Temporarily reverse NICs and put money back into the pockets of businesses and workers 5. Government to immediately review and reform the Shortage Occupation List (SOL) to help bring down wage pressures and fill staffing vacancies

We asked for…

A temporary reverse to NICs and put money back into the pockets of businesses and workers. This would not only ease the immediate pressure on companies’ balance sheets, but it would also put money back into people’s pockets and increase consumer confidence.

What was the government’s response?

From 6 November 2022, the temporary 1.25 per cent increase in National Insurance rates is being reversed for the rest of the financial year.

The announcement to reverse the increase to National Insurance Contributions (NIC) is a big win for the British Chambers of Commerce and the business community. This is much needed support for companies during these difficult times.

We asked for…

• Ofgem to be given more power to strengthen regulation of the energy market for businesses • A temporary cut in VAT to five per cent to reduce energy costs for businesses • Covid-style support by introducing Government Emergency Energy Grant for SMEs. It was proposed that Ofgem ensure energy suppliers offer fixed-rate contracts to business customers, as they currently do to households, a VAT reduction would help give breathing space to all businesses and business grants administered through local authorities would also provide some support at this time of uncertainty.

What was the government’s response?

A new Energy Bill Relief Scheme will provide help with the cost of gas and electricity for all non-domestic customers, including all UK businesses and voluntary and public sector organisations. The scheme will apply to fixed contracts agreed on or after 1 April 2022, as well as to deemed, variable and flexible tariffs for energy usage from 1 October to 31 March.

For months The Chamber has been calling for Government intervention to help businesses with eye watering energy bills. This support package is significant and will ease the cost pressures that have been piling up on businesses.

We are currently (at the time of writing) awaiting a response to item 5 on our plan regarding the review and reform of the Shortage Occupation List (SOL) to help bring down wage pressures and fill staffing vacancies.