After four decades of dormancy, the newly renamed Cactus Project is ripe for redevelopment. Arizona Sonoran Copper Company, based in Tempe, AZ is setting the stage for the big new dig.

Written by Amy Milshtein

Produced by Stephen Marino

Written by Amy Milshtein

Produced by Stephen Marino

Everything old is new again at the Sacaton Mine located just west of Casa Grande, AZ.—starting with its name. Now known as the Cactus Project, this long-dormant mine is gearing up for productivity once more, thanks to new owner Arizona Sonoran Copper Company. (For those keeping count, Arizona Sonoran Copper Company is also new, in name at least. The change represents a rebrand of Elim Mining Incorporated.)

That is a lot of activity around a nearly 40-year-old open pit described as a “taxpayer liability in 2019” by Arizona Sonoran Copper Company COO Ian McMullan in an article in AZO Mining.

Much has turned around in the few short years since then. According to that AZO Mining story, an economic study based on the 2021 Preliminary Economic Assessment and as conducted by Rounds Consulting Group, the project’s 18-year operating life would result in an economic impact of more than $8.5 billion - the equivalent of a Super Bowl’s economic activity every other year for nearly two decades.

Not one to measure economic success by “Super Bowls,” Arizona Sonoran Copper Company president, CEO, and director

“

“The success of the project to date building an excellent team including Samuel Engineering and Stantec. been able to keep within our drilling industry cost per meter drilling with to Ruen Drilling. Last year we produced and Preliminary Economic Assessment both Samuel Engineering and economics on the Project. We completing a Pre-Feasibility Study are confident of producing highlighting the economics

- George Ogilvie, President,

date has been contingent upon including our partners Ruen Drilling, Stantec. On the drilling front we’ve drilling budget and have leading with great productivity thanks produced a maiden resource Assessment with the assistance of and Stantec that showed robust

We are now in the midst of Study with the same partners and producing a quality technical report economics of the Project.” President, CEO, and Director

George Ogilvie puts the numbers in more mining-friendly terms. “Based on the Cactus Project alone, our average annual production that’ll come out of the pre-feasibility study is probably going to be close to 35,000 short tons or 70 million lbs of copper cathode production, which is about a 15% improvement over and above what we had in the PEA at 56 million lbs.” (That 70 million lbs works out to around $273 million U.S. dollars in annual revenue at the current spot Copper price of $3.90.) The company has also discovered a nearly 3 billion pound deposit known as Parks Salyer within the project boundary, in addition to the 3.5 billion pounds at Cactus, which is currently being added into the pre-feasibility study due around year end.

Located at the convergence of three major geological zones in western Pinal County, the area’s mineral riches were originally discovered by the American Smelting and Refining Company (ASARCO) in 1961. ASARCO mined the sight from 1972 to 1984, processing 38 million tons of primary copper ore through a floatation mill. This produced 400 hundred million pounds of copper along with 759,000 ounces of silver and 27,000 ounces of gold.

INTELLIGENT APPROACH EQUALS A BETTER VALUE

PROJECT: Two Mile Project

LOCATION: Silver Valley, Idaho

RUEN was asked to drill a series of deep core holes beneath known mineral deposits in the Silver Valley mining district in order to confirm the existence and sxtent of deeper mineralization. Drilling proceeded on one of the holes to roughly 11,340 feet. Possibly the deepest core hole ever drilled in North America. Crews operated 24 hours a day, from start to fisish using V-wall lightweight drill rods. Special bits and an engineeered low solids polumer based drilling campaign with zero lost time accidents.

PROJECT: Geothermal Resource Evaluation

LOCATION: Near Fallon, Neveda

Geologic conditions and client’s needs require deep core recovery in a series of geothermal core holes. These were hubrid borings, pre-collared with casing ising a rotary drill rig, to top of the basement rock. Core holes completed to approximately 7,000 feet, drilling wire line core to TD. RUEN achieved accurate results for data collection to characterize the geothermal reservoir, and recovered core for additional exploration study at a cost savings to the client. With crews trained and experienced in geothermal hazards and nlowout prevention, this project was completed in a safe, timely manner.

PROJECT: Geotechnical Baseline Report

LOCATION: Oakland, California

Drilling results were the basis for a Geotechnical Baseline Report (GBR). Drilling included hortixontal and angle HQ3 core holes to depths of over 900 feet each. Geotechnical aspects of the rock including RQD, bedding, fracture patterns, presence and glow rate of the groundwater were reported. RUEN’s work on this project was designed to contribute t an accurate construction bid. In general, the more complete the characterization drilling program, the fewer change orders “changed ground conditions” will follow.

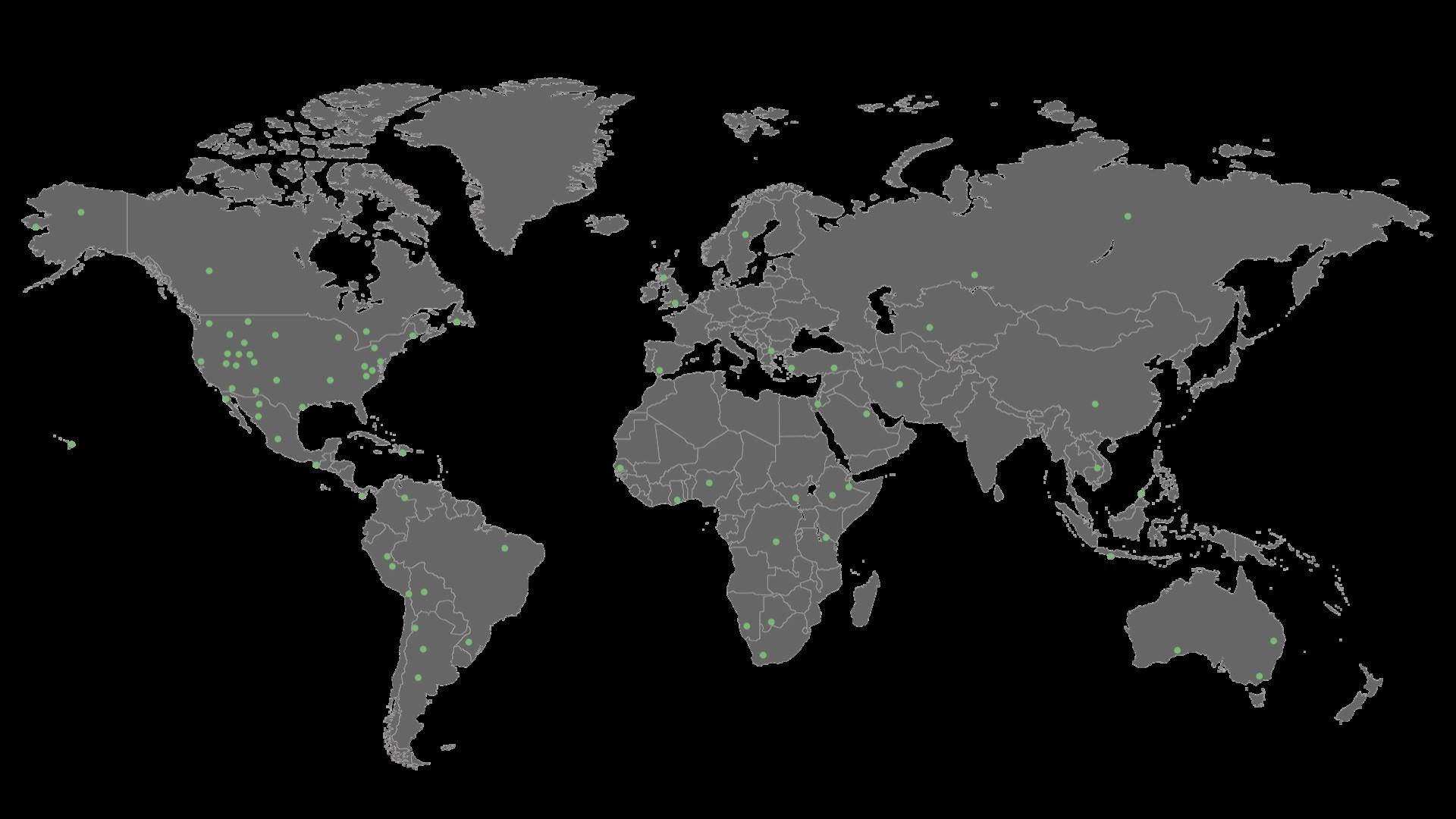

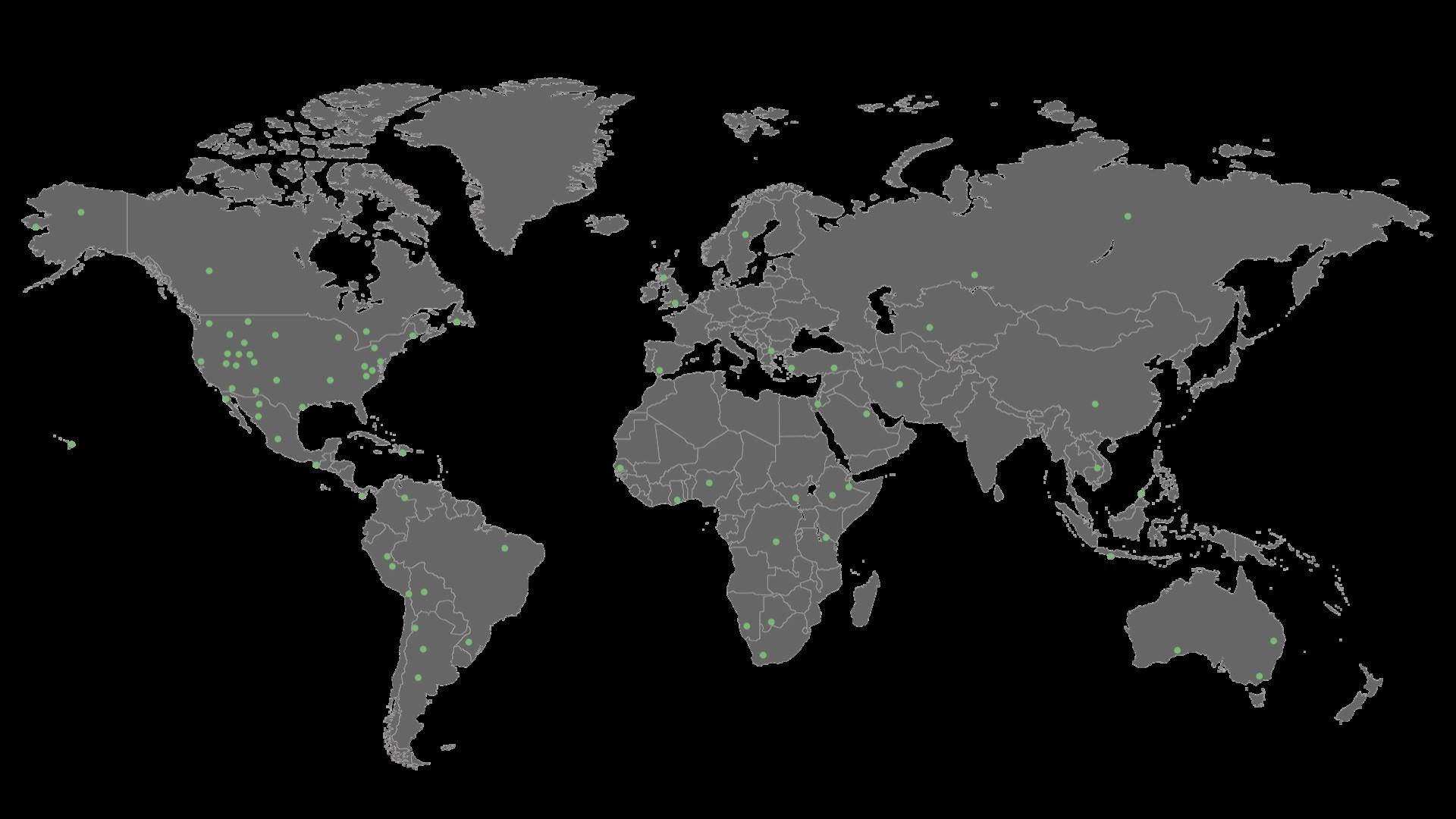

Ruen’s experience in the US, South America, and Asia

CLIENT: Kiewit Pacific Company

PROJECT: Rock Quarry Investigation / Core Drilling

LOCATION: Ensenada, Mexico

CLIENT: Minera Yanacocha S.A.

PROJECT: Exploration - Reserve Def. -Hydrological Investigation

LOCATION: Cajamarca, Perú

CLIENT: Geopractica, Inc.

PROJECT: PR-53 Mariani Tunnel Project

LOCATION: San Juan, Puerto Rico

CLIENT: GeoSal

PROJECT: Consulting

LOCATION Carajas, Brazil

CLIENT: Territory Development Dept

PROJECT: New Town Ground Investigation

LOCATION: Maunsell - Sha, China

CLIENT: Omolon Gold Corporation (Amax Gold, Inc.)

PROJECT: Kegali Exploration Core Drilling Project.

LOCATION: Kubaka Mine Site - Magadan Russia

CLIENT: Teck

PROJECT: Red Dog Mine

LOCATION: Kotzebue, Alaska, USA

CLIENT: Northern Star Resources

PROJECT: Pogo Gold Mine

LOCATION: Delta Junction, Alaska, USA

CLIENT: Nova Minerals

PROJECT: Estelle Gold Trend

LOCATION: Willow, Alaska, USA

From the Mariani Tunnel geotechnical investigation in Puerto Rico to the challenging markets of the Far East and Latin America. Its our personal attention, project passion, outstanding safety record and reputation that sets Ruen Drilling apart from the rest.

In 1982 construction began on a production shaft to a depth of 1,800 ft along with a headframe to the southwest to access higher-grade ore via underground mining methods. The projects were never completed. “The mine became uneconomical,” Ogilvie reveals. “There was significant mineralization in the ground at that point in time. But, you know, at $0.65 a pound for copper, they couldn’t really make money on that from an underground Mine.”

The mine officially closed in 1984 and ASARCO filed for Chapter 11 bankruptcy protections in 2004. After that the site was placed into an environmental trust and in 2019, $20 million worth of stabilization and reclamation work was completed. The trust also conducted valuable environmental analysis.

Elim Mining bought the mine in late 2019 for $6 million. They then renamed the site and subsequently rebranded as Arizona Sonoran Copper Company.

The Cactus Project already enjoys a head start, thanks in great part to being a brownfield project. That means that much of the infrastructure is already in place with a main power line running right through the property. There is an existing substation available to step power down and feed it to a core shed and security shack. An administrative building was also already on site, however, the offices are now housed within the typical mining double-wide trailer.

But advances in mining technology is what really makes this project

economically exciting. Arizona Sonoran Copper Company plans to use heap leaching to extract the copper. This requires just leaching pads and a solvent extraction electro-winning plant, according to Ogilvie, as opposed to a large, complex copper concentrator.

“Heap leach technology was in its infancy back in the 1970s when ASARCO mined the site,” he says. “So, when they initially were starting up the pit, they scraped back the overburden and then the oxide cap. But all of that oxide cap was regarded as waste and went to a surface stockpile. The same was true for any sulfide material below 0.3% copper which was the copper cut-off grade at the time.”

Ogilvie estimates that there is almost 80 million tons of material already drilled, blasted, and hauled

to the surface by ASARCO that is about 0.169% total copper. “If you calculate it out that’s about 224 million lbs (nearly $873 million) worth of copper sitting in a surface stockpile.”

Because the money has already been spent removing the rock, Ogilvie views the early work at the Cactus Project as a low-hanging fruit re-handling exercise to generate cash flow. “We just pick that material up, put it through a screen, onto a conveyor belt, agglomerate and then stack it onto a leaching pad,” he says. “With the application of just sulfuric acid we’re seeing a 90% recovery of copper from the oxide!”

This methodology allows Arizona Sonoran Copper Company the cash flow to reinvest in the project. This promises to minimize the

Samuel wishes to congratulate Arizona Sonoran on a successful project to date! We are grateful for our partnership throughout the feasibility study and NI 43-101 report effort and we look forward to the next phases of the project

Mineral processing expertise

Multi-discipline engineering

Full service procurement & expediting capabilities

Sophisticated Project Controls & Estimating

NI 43-101 and S-K 1300

Fabrication Construction

- Module fabrication & assembly

- Pipe spool and vessel fabrication

- Platework assembly - 40,000 sf of shop space - 4 acres of laydown and module assembly area

Onsite commissioning and startup team

Operational testing and operator training

Plant optimization

Debottlenecking

capital costs required to bring the mine into production.

It will also help speed up construction. “We have a prefeasibility study that’ll come out in late 2023/early 2024. We then move on to a bankable feasibility study which is produced in the late 2024,” reveals Ogilvie. “We would anticipate that we would have the project financing in place on the back of the bankable feasibility study and based on the current PEA schedule, it shows an 18-month construction and development period once the project financings are in place and the project is green lighted to first production. So, if we could execute

on that plan, we should see first copper cathode production being produced in late 2026.

The Arizona Sonoma Copper Company leaned heavily on several corporate partners to ensure the Cactus Project’s success. Ogilvie is not shy when talking about their importance. “The success of the project to date has been contingent upon building an excellent team including our partners Ruen Drilling, Samuel Engineering and Stantec,” he says.

Ogilvie continues. “On the drilling

front we’ve been able to keep within our drilling budget and have leading industry cost per meter drilling with great productivity thanks to Ruen Drilling. Last year we produced a maiden resource on Parks Salyer that will feed through to a re-scoped Pre-Feasibility Study in late 2024.”

Mining—the epitome of an extractive industry—is responsible for four to seven percent of greenhouse gas emission globally, according to McKinsey. Arizona Sonoran Copper Company, however, is committed to mining

sustainability. Their reclamation work already won the company the 2022 Award for Environmental Excellence by the American Exploration & Mining Association (“AEMA”), an award they share with the Arizona Department of Environmental Quality.

But that is just the start. Arizona Sonoran Copper Company is committed to operating in an environmentally responsible manner, which includes investing in low carbon and water efficient technologies. They also pledge to responsibly manage dust and tailings and to protect local air and water quality. Their ultimate goal is a Net Zero copper mine.

The extracted mineral will also help create a cleaner future for all. Copper, an excellent electricity conductor, is needed in many industries but it is critical for powering renewable energy sources. Solar, wind, geothermal, fuel cells, and other technologies need copper. Electric vehicles also require significant supplies of the mineral for construction.

As part of their sustainable framework, Arizona Sonoran Copper Company also considers social and community impacts. They pledge to create a positive work culture that prioritizes safety and well-being. The Company regularly meets with local community leaders and regional

level lawmakers, to share its plans in an effort to better understand community needs. Arizona Sonoran Copper Company also maintains a public hotline to encourage and solicit community partnerships and local procurement.

Mr. Ogilvie is a Professional Engineer, with 32 years of management, operations, and technical experience in the mining industry, both in Canada and internationally, according to an article in Businesswire. He has a track record of developing assets into commercial production

and turning businesses around resulting in significant shareholder appreciation.

The article notes that Ogilvie was previously the CEO of Battle North Gold (acquired by Evolution Mining) and Kirkland Lake Gold Inc. (acquired St. Andrew Goldfields), where he and his team optimized and improved operations, prior to major acquisitions.

Additionally, Mr. Ogilvie was the CEO of Rambler Metals and Mining, where he and his team guided the evolution of the company from grassroots exploration to a profitable junior producer.

Mr. Ogilvie began his mining career in 1989 with AngloGold in South Africa working in the ultra-deep, high-grade, gold mines in the Witwatersand Basin. From there, he moved to Northern Manitoba for HudBay Minerals’ Ruttan Mine as MineSuperintendent, followed by a term at Dynatec as Area Manager in Sudbury and McCreedy West Mine as Mine Manager.

Mr. Ogilvie received his B.Sc. (Hons.) in Mining and Petroleum Engineering from Strathclyde University in Glasgow, Scotland and holds his Mine Managers Certificate (South Africa), according to the piece. He is also a registered Professional Engineer in

Ontario, Canada.

Ogilvie has a reputation for success and turning ailing companies around. He is willing to share his secret to success. “Before joining Rambler, before joining Kirkland Lake, even before joining Rubicon (later re-named to Battle North Gold) and even this company, Arizona Sonoran. I’ve had the luxury of actually conducting weeks if not months of my own due diligence before signing on the bottom line,” he says. “That really is the secret. You can pick the winners even before the race has started.”

Company Name:

Arizona Sonoma Copper Company

Country: United States/Canada

Industry: Mining

Premier Services: Experts in the mining of copper

President: George Ogilvie

Website: www.arizonasonoran.com