12 minute read

Creating Opportunities for Successful Adoption of BIM solutions for Estimators and Quantity Surveyors

Animesh Sourabh1

Account Manager (Construction) MagiCAD E-mail: 1animesh.sourabh@magicad.co.uk

Advertisement

Abstract The paper looks at three different groups of estimators and quantity surveyors in the UK & Ireland based on their use of BIM solutions. For those who currently use BIM solutions, we identify the type of solutions they use, explore reasons for investment and then offer ideas to facilitate expansion. For those who do not, we explore the problems they are trying to solve, understand key adoption barriers and suggest ways to overcome them. 'Improving productivity' and 'Reducing risk' come out as the top reasons for investment for the group already using a solution. ‘Cost’ and ‘No time to get up to speed’ are the main deterrents for those who have considered a BIM solution in the past. The third group is waiting for BIM models with cost relevant data to be more widely available before they decide on adopting a solution.

Keywords estimators, quantity surveyors, BIM, productivity, collaboration, risk

I INTRODUCTION The paper looks at a specific audience and where they are with BIM solutions (estimators and quantity surveyors in UK & Ireland). The objective wasto explore their opinions on benefits of BIM solutions as it relates to their work. If there are any adoption barriers, what are they?And, if that gives us insights into short and long terms options to overcome these barriers? The paper focuses on three different subgroups. • individuals who are currently using a BIM solution • individuals who don’t use a BIM solution but have considered using one in the past • Individuals who don’t use BIM and haven’t considered using one in the past For the first sub-group (referred to as ‘Use BIM’), we assess if they are satisfied with their BIM solution. For the second sub-group (referred to as ‘Have considered BIM’), we explore reasons for not investing in a solution. Also, if this group would consider a BIM solution in the future and the reasons behind it. For the third sub-group (referred to as ‘Have not considered BIM’), we try to understand what is required for them to consider one. a) Results

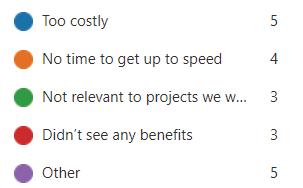

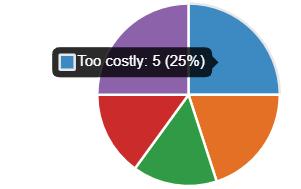

The results bring out the differences in motivations for BIM adoption for these sub-groups. The first sub-group is more aware of BIM solutions and their benefits because of the first-hand experience either within their department and/or a different department. The second sub-group lists ‘Cost’ and ‘No time to get up to speed’ as the main deterrents to investing in a BIM solution. However, it can proactively make a strong case in front of management as they understand the key problems they are trying to solve. The third sub-group is waiting for suitable BIM models with cost relevant data to be widely available and will benefit from an external push by the client.

II METHODOLOGY An online survey was sent out to estimators and quantity surveyors in UK & Ireland, which got 39 responses. There were a handful of responses from outside this region (3 of them). The survey was a mix of multiple-choice, rating scales and open-ended questions. The openended questions were included for respondents to offer explanations for their responses. About 87% identified themselves with the construction sector. A handful of other respondents

were from the Civil and MEP (mechanical, electrical and plumbing) sectors. About 4/5th had experience spanning 10 years or more, which makes the study biased towards experienced professionals. In terms of company size, just above 50% of them identified with companies having 200+ employees. Other company sizes were almost evenly represented (1-10 with 8 respondents; 11-50 with 6 respondents; 51-200 with 5 respondents).

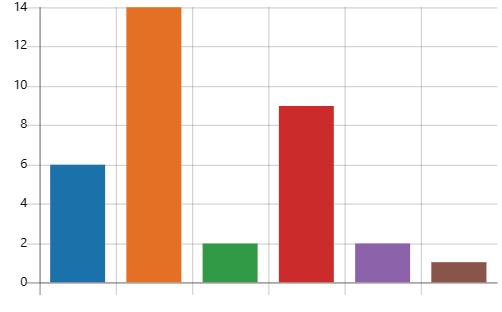

III DIAGRAMSAND TABLES Graph 1. Use BIM (reasons for investing) ‘Improving productivity’ and ‘Reducing risk’ come out as the top reasons for investing in a BIM solution for this group

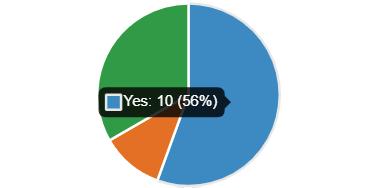

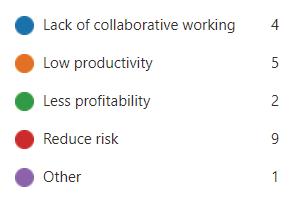

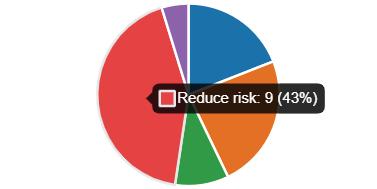

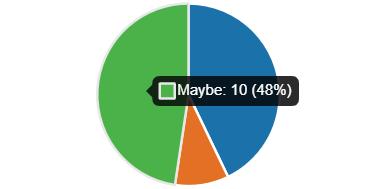

Graph 2. Use BIM (if it was your decision, would you continue with it?) The majority of users would choose to continue with the BIM solution if it was their decision Graph 3. Have considered BIM (problems to solve) ‘Reducing risk’ and ‘Low productivity’ are the top two problems this group wanted to solve through a BIM solution

Graph 4. Have considered BIM (reasons for not investing) Cost is the primary hurdle to investing in a BIM solution for this group

Graph 5. Have considered BIM (consider using a solution in the future) Most respondents are ambiguous about using a BIM solution in the future

IV RESULTS

a) Use BIM

BIM solutions related to take-off/estimating are mentioned the most, which is expected. Design solutions are mentioned next. This shows that the group feels that they are invested in BIM solutions even if they are not endusers. They may relate to the benefits of such solutions as they see other teams take advantage of them. In that case, they may be more open to using a work-specific BIM solution, if it is introduced to them.

‘Improving productivity’ is cited as the top reason for the management to invest in a BIM solution. The users can benefit from quantifying productivity figures for their teams. Hours saved per person/money saved per person are a couple of metrics they can track. With these numbers, they can better predict the resources required to complete a project or tender using the BIM solution. This will also help them build influence over their management in a couple of different situations - 1) for expanding the use of current BIM solutions for their team 2) purchasing new digital solutions in the future. It is no surprise that ‘reducing risk’ is cited as the second most important reason. The survey does not capture the types of risks. But, these may relate to a) risk of avoiding costly mistakes b) reputational damage or c) risk of regulatory non-compliance. The fallouts from any of these risks far outweigh the advantages ofimprovingproductivity or collaboration for a contractor. They can lose out on projects, suffer from poor margins, take years to recover from reputation loss or be blacklisted from tendering for certain projects. The estimators or quantity surveyors may lose their jobs. If they can build on the message of using BIM solutions to ‘reducing risk for the management’ and translate it to ‘reducing risk for the client’, they will be able to differentiate themselves. The management will also feel content about the return on investment (ROI) of digital technologies through access to new commercial assignments. The participants seem to be satisfied with their current BIM solution (average rating of 3.83 on a scale of 1-5 with 5 being most satisfied). Within this group of users, there are two sub-groups. Those who influenced the choice of BIM solutions and those who didn’t. Interestingly, they have slightly different levels of satisfaction – an average score of 4 for the ‘influencer’ group as compared to 3.72 for the ‘non-influencer group’. Users, when they join a new company, do not have a say in the choice of BIM solution/s. If they have had previous experience, it is easy for them to get up and running with the incumbent solution. If the new users do not have any experience, the existing users can help them with the uptake with a bespoke training and onboarding plan. This will ensure that they learn to use the BIM solution quickly. With regular use, they will also see the benefits for themselves and the company. And, develop similar satisfaction levels as their peers over a period of time. The response to the question”ifit was your decision, will they continue with it” is slightly titled towards YES (56%). Some users have said that they will not continue as they feel that there are better alternatives available. If that is the case, they should be proactive in getting their colleagues and management to think about using this alternative and its advantages. A trial or short-term subscription may be a suitable first step. The undecided users cite reasons like 1) not having a choice as it is client-driven 2) not sure if the overall team is satisfied with the use 3) current solution not able to interconnect 2D & 3D results. These users may influence their management to consider other BIM solutions by 1)

pointing out drawbacks with over-reliance on a single customer 2) taking an internal survey to understand the low satisfaction levels of the team and find ways to address them 3) explore solutions with better 2D –3D coordination through trial or short-term subscription.

b) Have considered BIM

The motivations for companies to use a BIM solution are similar to the ‘Use BIM’ group. But, for this group, ‘reducing risk’ takes the top slot. The paper has already highlighted the potential risks that contractors face and the related fallouts. Could it be the case that the groups’ employers have suffered in the past? Or, are they in a position where they may face an adverse outcome if they don’t manage a certain risk? If the group members can quantify the losses suffered or expected losses, they can make a strong case in front of their management for investment in a BIM solution. The solution will then pay for itself. The challenge here is that if the team does not have any previous experience with a solution, they will take time to build proficiency with a new system. To overcome this, in the first few months, they can use the services of an external party with the intention of building skills over a period of time or hire someone with the relevant technical skills. Although the members related to the company motivations either fully or partially, the management chose not to make an investment. ‘Cost’ and ‘No time to get up to speed’ are the main deterrents. Is it possible that the members were hesitant in making a strong case for the BIM solution in front of their management to justify the upfront cost? So, if the management approves it and the team is not able to invest enough time in learning the tool, they will be to blame. To overcome the ‘cost’ barrier, the members can quantify the benefits associated with reducing risk, improving productivity or improving collaboration. And, then pitch ‘cost’ as an ‘investment’ which will bear a positive return. ‘No time to get up to speed’ is a tricky problem. With the current workload, the members may struggle to learn a new solution from scratch. There are a couple of ways to deal with this. Either, strategically hire someone with the skills. Or, appoint an ‘internal BIM solution champion’. This champion can undergo training first and then train his/her colleagues to make the best use of the team’s time. This will also help the management to make investments in stages to align with the team’s training.

Some of the members highlighted that they are open to using a BIM solution in the future or recommending it to their management, if a) more BIM models became available b) BIM models had cost relevant data attached to them. If this group can get the management buyin and go ahead with a solution at a limited level, they can market themselves as a forward-thinking organisation. BIM savvy clients are sure to take notice and approach them in due time.

c) Have not considered BIM

This group has not considered a BIM solution in the past. However, they are open to adopting a BIM solution in the future if certain conditions are met. These conditions relate to a) tender requirements b) availability of BIM models c) cost relevant data within these BIM models Another interesting observation by this group was the problem upstream with design. If the designers do not factor in cost relevant data in their models, they become irrelevant to estimators and quantity surveyors down the line. Could clients play a pivotal role in this situation to improve BIM adoption? Firstly, by ensuring that their design team develops models including cost data. Secondly, by making these BIM models widely available to different contractors tendering for a project. Lastly, by giving the contractors an opportunity to have back and forth communication with their design team for any clarifications.

VCONCLUSIONS

a) Use BIM

This group is aware of the benefits of BIM solutions available to them. It can influence the management to expand the use of the existing solutions by quantifying the productivity benefits or developing a message around risk reduction for the clients. By having an onboarding and training plan for new users, they can ensure that these users develop the same satisfaction levels as existing ones. If the users feel that an alternative BIM system can offer better results, they should try to make a case for a trial or short-term subscription for this solution. An internal survey would help to establish if such an experiment is necessary.

b) Have considered BIM

This group appreciates the benefits that a BIM solution can bring to them and their employers. However, for them to get the nod from their management, they need to quantify the ‘risk reduction’ potential of this solution and pitch it as an investment.

They can show their commitment to using the solution through a new hire or an internal ‘BIM champion’, requesting investment in stages. By marketing their BIM credentials, they can attract new ‘BIM savvy’ customers.

b) Have not considered BIM

This group is sitting on the fence waiting for suitable conditions before considering investing in the appropriate BIM solution. An external push by the client may help this group get on the BIM ladder if not an internal one.

VISURVEY Link - https://bit.ly/3gTkTub

VIIREFERENCES [1] ANNUAL BIM REPORT, 10th ed. NBS, 2021, pp. 15-29.

[2] T. Dowd and D. Marsh, The future of BIM: Digital transformation in the UK construction and infrastructure sector. RICS, 2020, pp. 6-11.